How to long or short crypto assets

Dear Bankless Nation,

There’s so many money verbs in DeFi these days.

Lend, borrow, swap, hedge, long, short…

Even just one specific verb—like “going long” or “going short” on an asset—there’s literally dozens of ways to do it at this point.

We had William help break down the three main ways to go long or short on an asset in DeFi using leverage. (Careful with leverage folks…see my warning below! ⚠️)

Here’s what he found.

- RSA

Tactic Tuesday

Guest Writer: William M. Peaster, writer of Metaversal

How to long and short crypto assets

Bankless Writer: William M. Peaster, Editor and Writer of Metaversal

Want to long or short crypto?

With the total value locked (TVL) in DeFi now over $35B, the bankless revolution is taking off. But things are still early. You still have time to dive into these protocols and learn to make the most of them while DeFi is blooming.

One of the most powerful things you can do in DeFi today is going long and short on different crypto assets using some leverage. The cool thing about DeFi is that you don’t have to be a professional trader or accredited investor to execute longs or shorts—you really only need an internet connection and a basic understanding of Ethereum!

In this tactic, we’re going to briefly walk you through all the primary ways you can long and short assets in DeFi:

- Goal: Familiarize yourself with popular ways to long and short assets in DeFi.

- Skill: Advanced (only because this is leverage!)

- Effort: 20 minutes

- ROI: Depends on how your longs and shorts fare!

Different ways to go long or short in DeFi

It’s hard to discern how to value a cryptocurrency at any given time with accuracy.

The good news about levered bets in DeFi is that there’s plenty of ways to do it.

You can use lending protocols like Maker to go levered long on ETH or use Synthetix’s “Inverse Synths” to short specific assets, and there’s plenty of alternatives in between. I’ll break down the possibilities by category so you can readily get a sense of all the most popular choices today.

⚠️ Warning before we begin—leverage increases your game-over risk!

Game-over means losing the majority of your crypto. This is the one thing you want to avoid. I’ve seen this happen to many savvy crypto investors—they think their collateral value can never drop beyond a certain liquidation level, but when the cycle turns violently they’re forced to feed more and more collateral into their position…until they have nothing left and they get liquidated anyway. That’s game over.

If you’re not comfortable sustaining a 95% drop in the value of your collateral…if you feel yourself taking irrational positions due to FOMO….if you have any shadow of concern about risk…don’t take on leverage! Live a simple life. Get rich slowly. Crypto volatile enough already. No need to juice your upside.

TLDR; don’t take leverage unless you’re a multi-cycle veteran…read this first.

- RSA

1. Use an Interest Rate Protocol

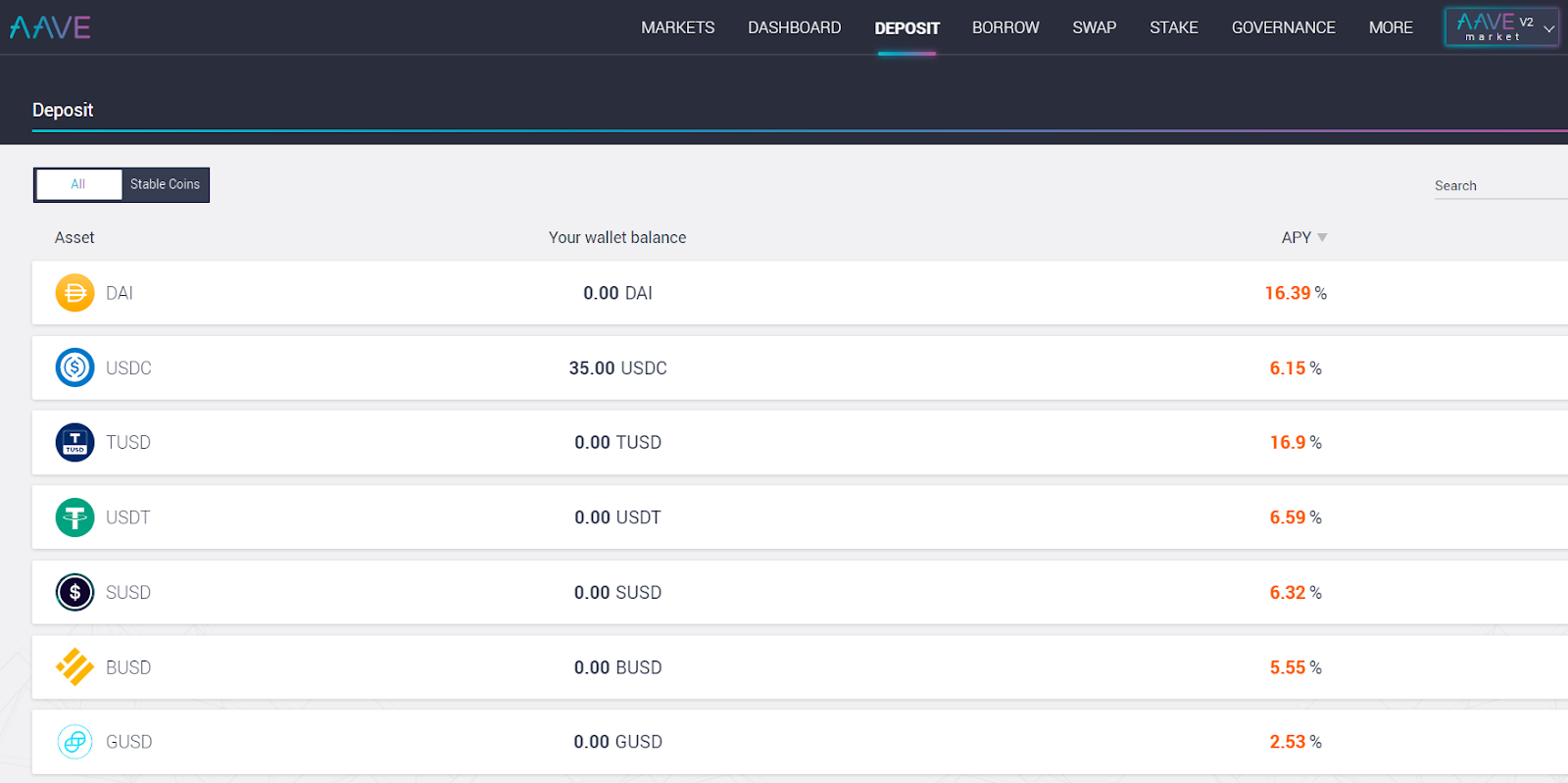

Three of DeFi’s top 5 protocols per TVL presently—Maker, Aave, and Compound—are borrowing and lending protocols. These projects allow anyone to take out loans by putting up collateral first (e.g. ETH).

This borrowing function makes these protocols popular avenues for longing assets.

Here’s the idea: to go leveraged long you deposit an asset (let’s say ETH) as collateral and then draw out a loan in cryptodollars (let’s say DAI) against the value of the deposit—usually around 25%-60% of the deposit’s value.

After this, you then sell the borrowed capital for more ETH, making you long on ETH. Let’s say the price of ETH rises, you can then pay back your debt with less ETH (since its value increased), leaving you with the remaining amount of ETH, your collateral, and no debt.

Of course, this position adds risk! If the price of the collateral drops below a certain value (called the liquidation price) your entire collateral position gets liquidated. This can happen quicker than you anticipate so be careful! (See the warning note above.)

Note that Maker handles its lending “Vaults” through its Oasis app, while Aave and Compound have dedicated front-end deposit dashboards. All of these avenues are unique in their own ways, but for longing generally works the the same across all three:

You connect your wallet, deposit your collateral of choice, and then draw out a loan and use it to buy more of your asset of choice.

Pro-tip: You can use dashboard services like DeFi Saver or smart wallets like Instadapp to easily manage and even migrate your DeFi lending positions.

Bankless Guides on using DeFi protocols:

2. Use an Options Protocol

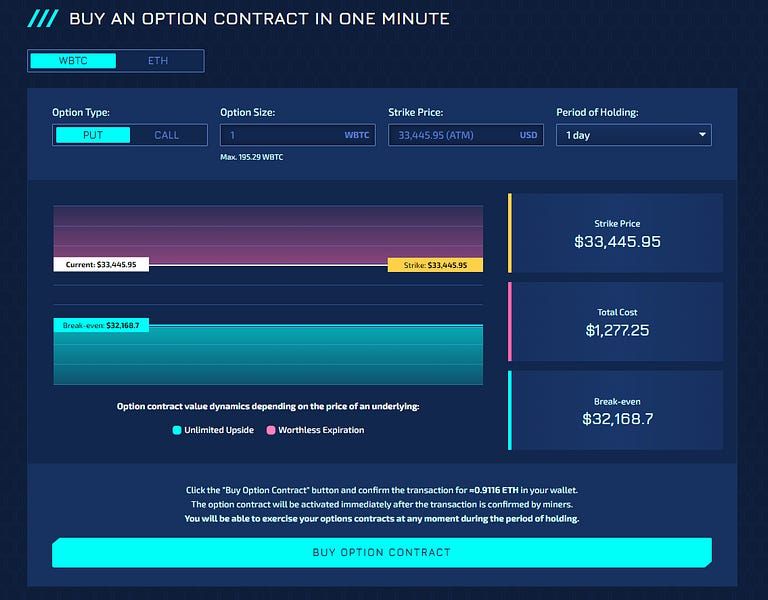

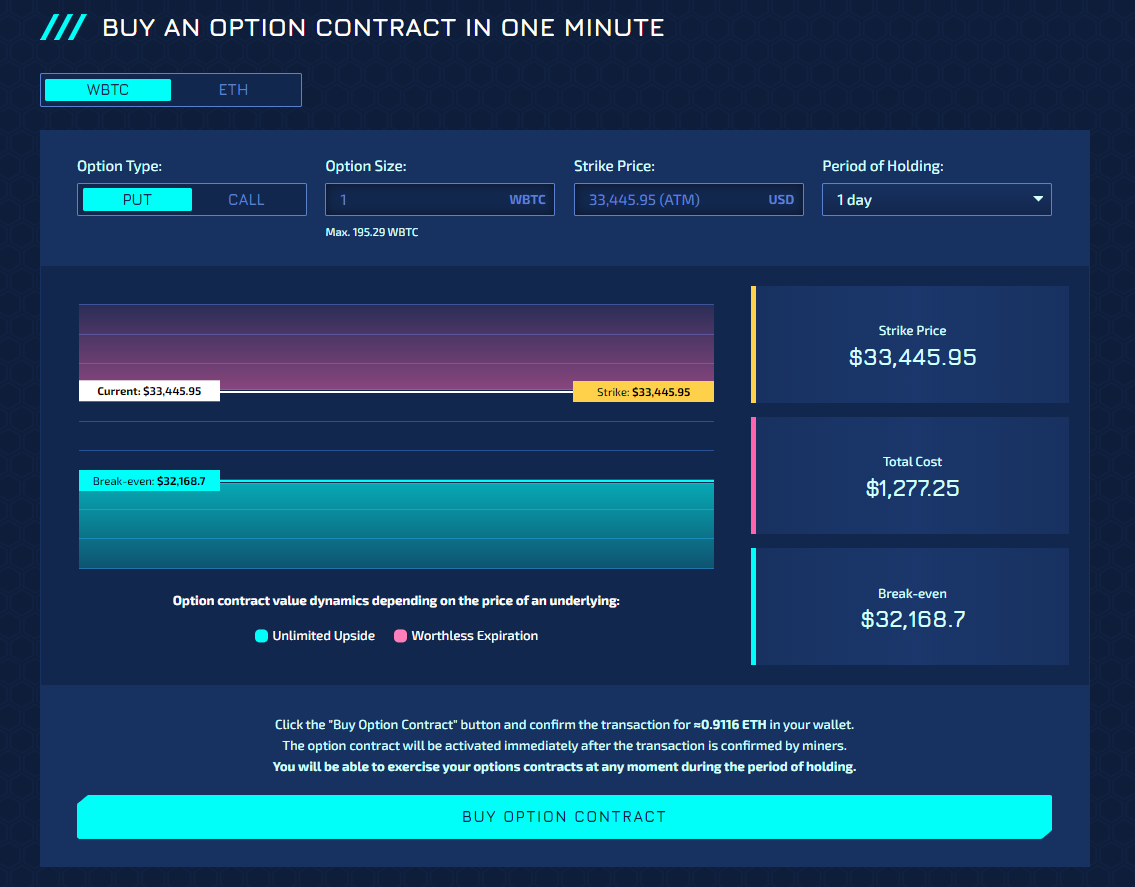

Options are a popular variety of derivatives that are starting to gain traction in DeFI. The early trailblazers in this sector, Opyn and Hegic, let traders speculate or hedge their portfolios by taking out on-chain puts (i.e. shorts) and calls (i.e. longs) on major assets like ETH and BTC.

While it’s still early for these protocols, they’re showing promise within their respective sectors. Opyn recently launched V2 while Hegic has grown from nothing to millions in months.

If you’re interested in going long or short via options to get a leveraged position, then check out protocols like Opyn or Hegic. Connect your wallet and get trading!

Pick the asset you want to buy a put or call on (popular choices are, you guessed it, ETH and WBTC), choose the setup that’s best for you, and then fire off a purchase transaction.

Need some help on using option protocols? We got you covered:

- 📄 How to trade ETH and BTC options with Hegic

- 📄 How to protect your ETH with Opyn

- 📄 How to make money selling ETH options

3. Use a Derivatives Platform

DeFi’s ecosystem of derivatives protocols is starting to come together, and it’s this sector where you’ll find interesting and growing varieties of ways to go both long and short on a range of crypto assets.

For example, perpetuals—which are like futures contracts with no settlement dates — are one of the most popular traded derivatives in crypto. If you’re looking into perpetuals, you can go to more veteran projects like dYdX (which has done pioneering work around ETH Perpetuals and BTC Perpetuals) or newer DeFi oncomers like Perpetual Protocol and Futureswap.

As with most of DeFi, platforms like Perpetual Protocol offer liquidity mining incentives for participating while others like dYdX remain untokenized (when DYDX token??).

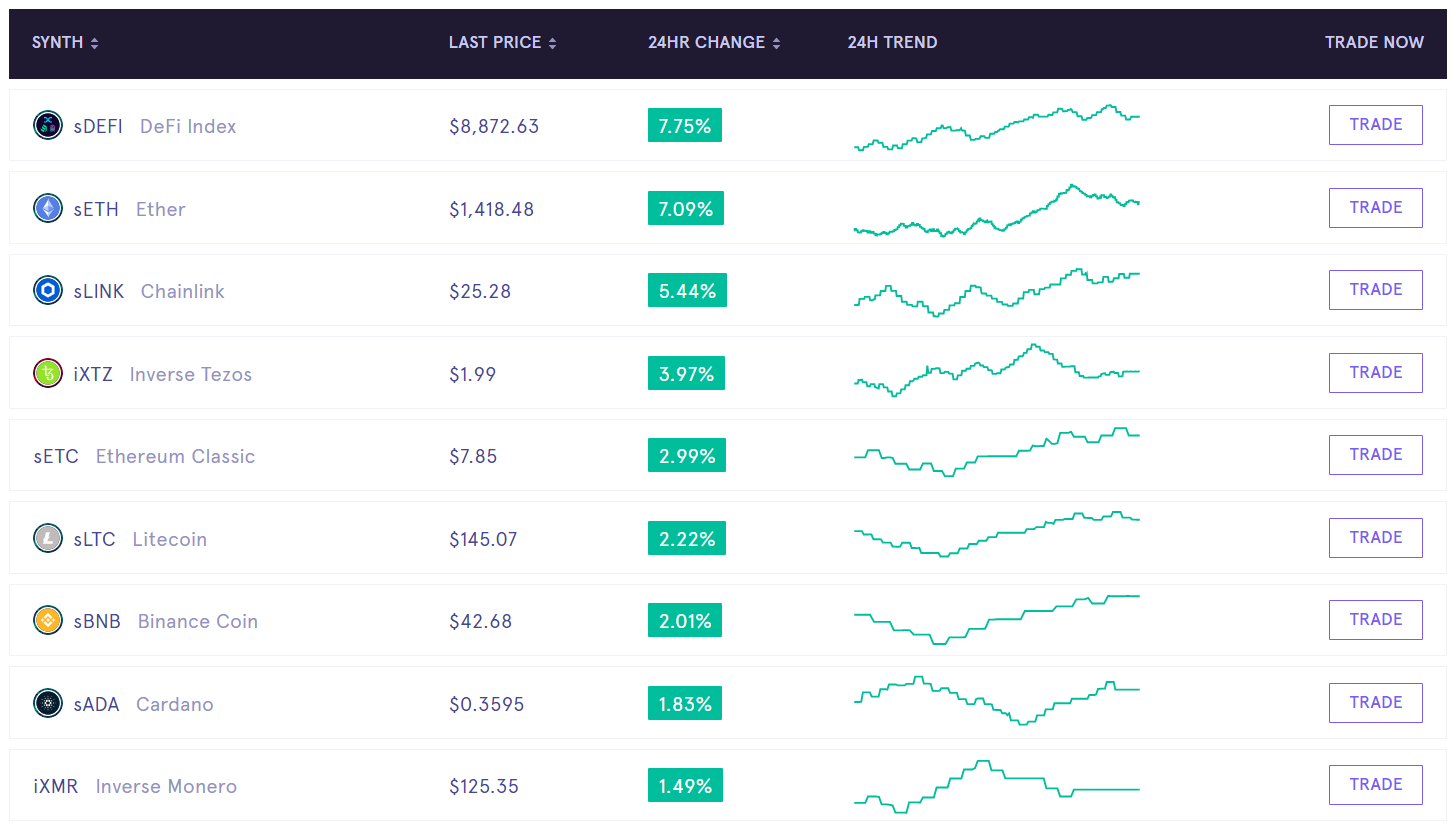

Another solid option is to use decentralized derivative exchanges like Synthetix, a DeFi protocol that’s building out a suite of synthetic assets (increasingly on Layer 2).

How would this work? Say you wanted to long an asset like the euro.

You can go the Synthetix’s exchange interface and buy sEUR, giving you exposure to the euro. If you’re interested in shorting for any reason, Synthetix also offers ‘Inverse Synths’. Inverse Synths, like iETH or iBTC, allow traders to short assets because they gain in value when the underlying asset depreciate in value.

Some guides on how to use derivatives protocols:

- 📄 How to speculate on DeFi tokens with binary options

- 📄 How to trade derivatives on Kwenta

- 📄 How to trade YFI perps on Perpetual Protocol

- 📄How to trade the ETH perpetual on dYdX 🔥

- 📄 How to trade the BTC perpetual on dYdX

- 📄 How to trade the ETH perpetual on MCDEX

- 📺 How to trade the ETH perpetual on dYdX

Wrapping Up

When it comes to longing and shorting with leverage you’ve have three main paths in DeFi: lending protocols, options protocols, and derivatives platforms. It’s up to you to decide which format suits your needs best.

Careful though—leverage is a dangerous tool, especially given the insane volatility of crypto. Best to use it sparingly or not at all.

Action steps

- Try out Maker, Aave, or Compound

- Trade options protocols like Opyn or Hegic

- Check out derivatives protocols like Synthetix, Perpetual Protocol, and dYdX