How to trade ETH perpetual on MCDEX

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Margin is risky—you know this from Tactic #43 and #35. So keep in mind that today’s tactic is another for our advanced traders. Layered on to that margin risk is this—MCDEX is a new protocol. New means more risk. Yes, even despite audits.

But here’s why Bankless traders should know about MCDEX…

This is the first:

- ETH perpetual I’ve seen in DeFi—no USDC, just pure ETH

- DeFi options protocol starting yield farming—MCB tokens to incent liquidity

- Referral pool—MCB tokens go to Bankless badge holders when you use MCDEX

Yeah. Three firsts.

It’s all here in Tactic #45.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Btw, we just released episode 4 of our new Tuesday video show—State of the Nation!

📺Watch State of the Nation #4: HUNGRY - special guest Luke Martin!

Buying the Eth Narrative, $2B in DeFi, and the DeFi Vortex

TACTICS TUESDAY:

Tactic #45: How to trade ETH Perpetual Futures on MCDEX (MCDEX ETH trade)

Guess Post: Jean Miao, co-founder of MCDEX

Anyone who trades crypto assets has likely come across the phrase “Perpetual Swaps”. (RSA—We talked about them in tactic #43)! Today, trading perpetual swaps are the primary financial instrument for risk-seeking investors and traders to access leverage on their favorite crypto assets. In this tactic, we shed light on how MCDEX’s decentralized perpetual contracts work and how you can trade the ETH perpetual on MCDEX.

- Goal: Learn how to trade ETH perpetual on MCDEX

- Skill: Intermediate

- Effort: less than 2 minutes (if you have an Ethereum wallet)

- ROI: positive/negative (depending on your judgment of the market)

EARN 5% IN MCB TOKENS

Use this link and 5% of your MCDEX trading fees go to Bankless Badge holders 🚀

Here’s how it works:

- Use the link when you set up your MCDEX account

- 5% of trading fees will be set aside in a Bankless referral pool

- In July the fees accrue in stablecoins

- In August & September, the fees accrue in MCB tokens 🔥 (MCDEX’s token)

- Referral pool pays out to Bankless token holders monthly starting September

That’s it! Use the MCDEX link when you trade and you’ll seed Bankless Badge holders with MCB governance tokens. (Bankless members—claim your badge if you haven’t!)

⚠️ MCDEX is a new decentralized exchange powered by the Mai Protocol smart contracts. Please be cautious and understand the risk associated with using new DeFi products and recognize the potential to lose any (or all) of your capital, especially when using leverage.

While the Mai Protocol Contracts have been audited by Open Zeppelin, ConsenSys, and Chain Security that does not MCDEX is free of technical & economic risk!

What is MCDEX?

MCDEX is a decentralized trading platform for perpetual swaps and futures on Ethereum. The mission is to make investing in DeFi more accessible by providing financial services for users with different risk appetites.

Currently, the ETH perpetual contract is live on main net using an on-chain AMM and off-chain order book hybrid model.

With MCDEX, traders can long and short ETH with up to 10x leverage without taking custody of other assets, only ETH.

To read more about MCDEX, read up on the MCDEX whitepaper.

AMM / Order book Hybrid Model

The most unique and innovative part about MCDEX’s ETH-PERP contract is the introduction of the AMM (Automated Market Maker), which generates the funding rate, provides on-chain liquidity, and ensures complete decentralization.

The AMM acts as a money lego for smart contracts to trade with MCDEX’s on-chain perpetual contracts, enabling them to arbitrage, speculate, and manage their portfolios.

Since the AMM has higher slippage than traditional CeFi exchanges, MCDEX has also introduced an off-chain order book for liquidity-sensitive users. The order book, which provides better liquidity than the AMM, is used as the main entry point for trading perpetual contracts.

⚠️MCDEX recommends that users trade with the order book and smart contracts to trade using the AMM. So if you’re human trade with the order book!

Liquidity Mining & MCB

In a nutshell, users can get MCB, MCDEX’s native token, by providing liquidity to the AMM pool.

The MCB token will allow key stakeholders of the MCDEX platform, i.e takers, liquidity providers, contributors of trading strategies, DeFi developers, etc, to participate in the governance to achieve sustainable and robust development.

For details, refer to this guide.

Review of Perpetual Markets

A perpetual contract is a futures-like product but without an expiration date.

Since its inception, perpetuals have become one of the most popular instruments for crypto trading. Its trading price is anchored to the underlying asset price index through a funding payment mechanism (called the funding rate).

The funding payment balances out between long and short positions by charging between them. While CeFi platforms hold customer deposits and control the overall functioning of the platforms, DeFi platforms like MCDEX are non-custodial.

This is the primary reason why trading a perpetual contract on a decentralized exchange is far more beneficial than trading on a centralized exchange such as BitMEX. The fact that decentralized exchanges have no control over your funds, it’s much safer to trade on decentralized exchanges.

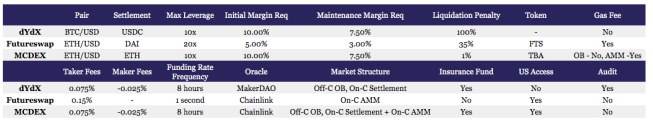

MCDEX vs. dYdX vs. FutureSwap

While MCDEX, dYdX, and FutureSwap offer similar products, each DEX has taken a different design approach with both their contract specifications and infrastructure.

Here’s a concise overview of each exchange and their respective perpetual swap products:

Source: The Block

How to trade ETH Perpetual on MCDEX

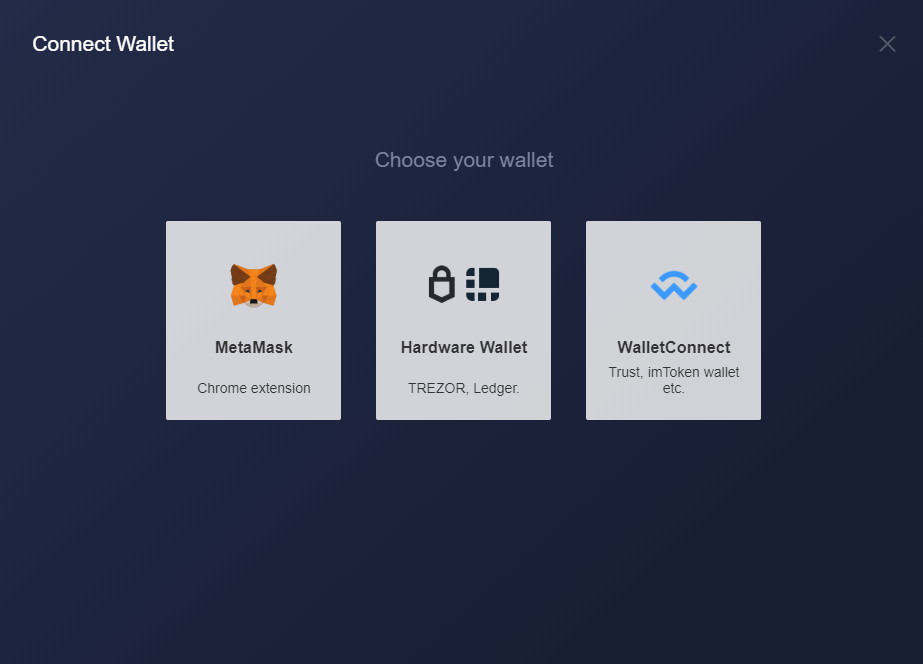

Step 1: Connect your wallet.

Visit MCDEX on your favorite web browser, Click the “Connect Wallet” button at the top right of the page, and connect your wallet.

MCDEX supports Metamask, Trezor, Ledger, imToken, Trust, etc.

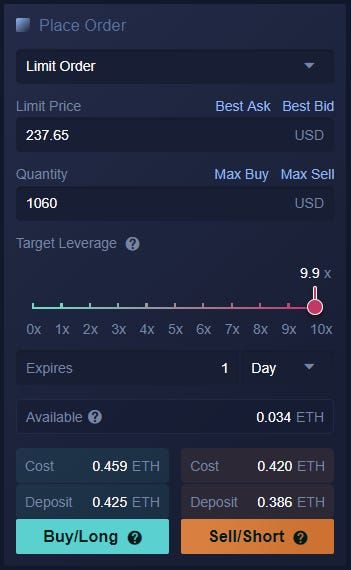

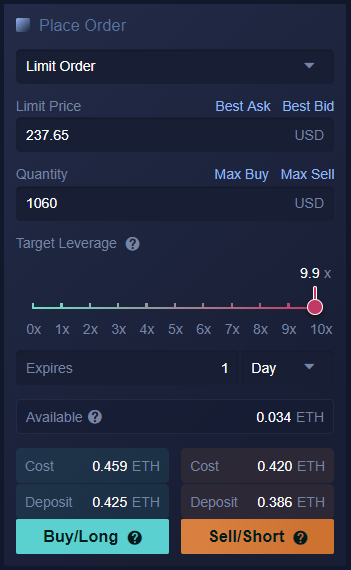

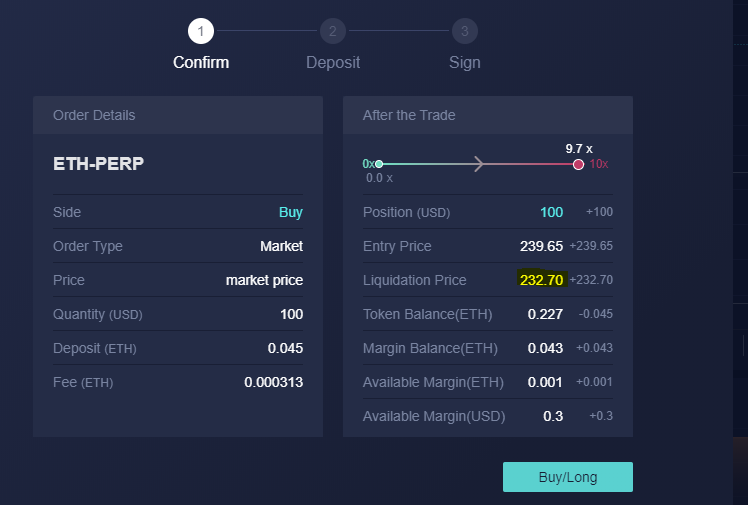

Step 2: Create a market/limit order

Fill in the order information including quantity (in USD) to buy/sell, target leverage (up to 10x), and expiry time.

Then click the Buy/Sell button to submit your order.

📔 Note: 1 ETH-PERP = ~0.001 ETH

Step 3: Verify details and confirm transaction

Verify your purchase quantity, deposit amount, entry price, and liquidation price are correct.

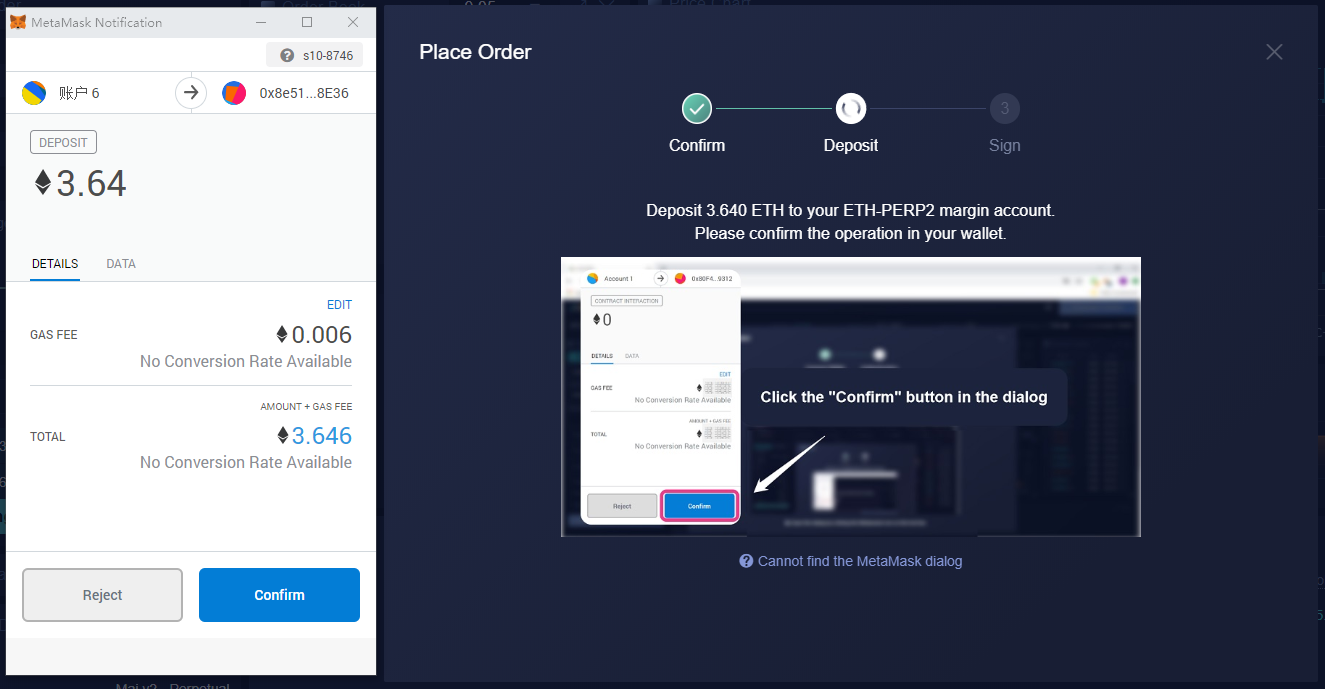

Step 4: Deposit ETH

Confirm in your wallet to deposit ETH in your margin balance and wait for the order confirmed to on-chain.

📔 Note: Transaction fees on Ethereum will range from $1-2. We recommend using the “fast” setting on Metamask to ensure your transaction always goes through!

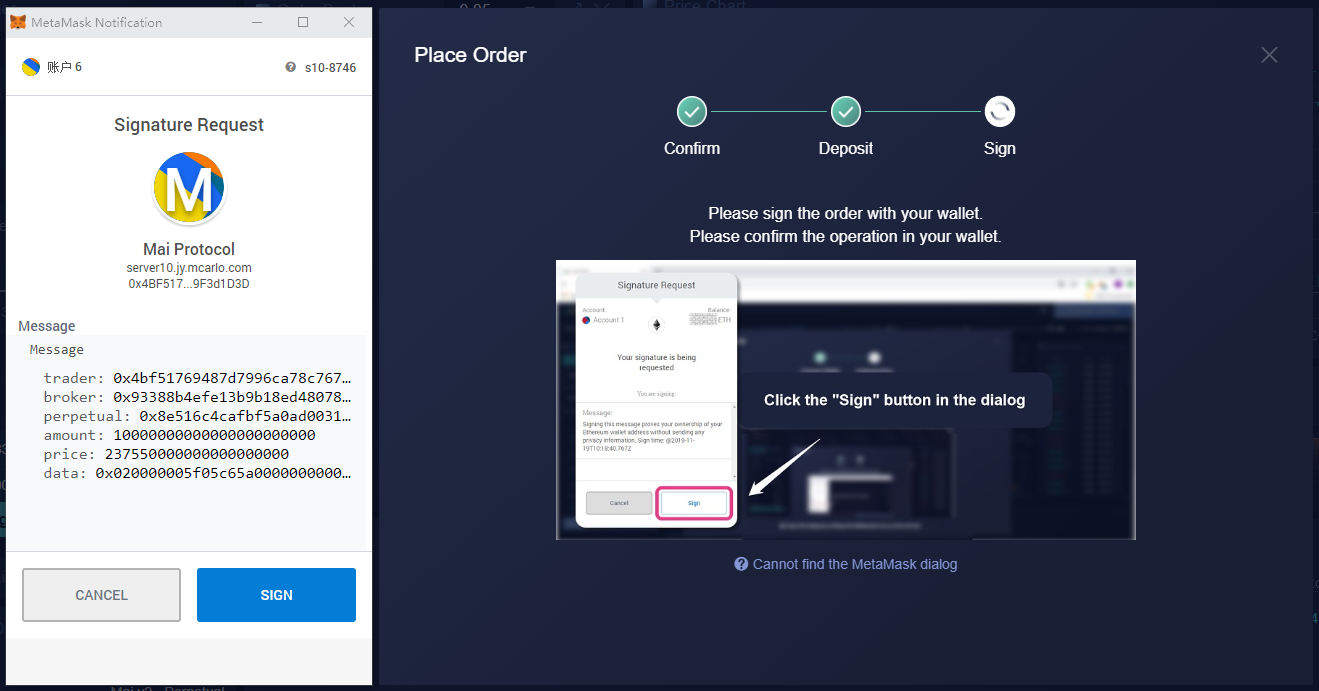

Step 5: Sign the order

Sign the order in your wallet to allow MCDEX to your match orders!

Once the transaction has been signed, your orders will be shown here:

Step 6: Wait for your order to be filled

Orders can be partially/fully filled depending on the size.

When filled, the position will be shown here:

Step 7: Close your position

Once you’re ready to close your position (hopefully in the green!), click on the close button and sign the order in your wallet.

Once the transaction has been confirmed, you should see ETH show up in your wallet.

And there you have it! You’ve traded perpetual swaps on MCDEX. It was completely permissionless and non-custodial. No banks. No KYC. Just Bankless.

Happy trading!

Author bio

Jean Miao is the Co-Founder of Monte Carlo DEX (MCDEX), a decentralized derivatives exchange built on the Mai Protocol for trading perpetual swaps and futures contracts.

Action steps:

- Open an ETH-PERP position on MCDEX (Warning: High Risk!)

- Learn about the Mai Protocol

- Reserve your Bankless Badge and earn 5% of MCDEX trading fees

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.