How to trade the ETH perpetual on dYdX

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Yesterday I said the bull market’s back. Time to shift the mindset.

Perfect timing for freshly launched ETH perpetual swap from dYdX?

I think so.

This is a power tool for ETH bulls. It’s an inverse perpetual, meaning all the collateral is ETH based, not USDC. Using ETH as collateral means leveraged exposure to ETH.

Not the kind of stuff you’re likely to see at BitMex.

Quick note—like our BTC perpetual tactic, this is advanced stuff so don’t enter this lightly. Trading with leverage can be dangerous. Be careful.

Because it’s DeFi you keep custody of your assets. You can verify the house isn’t betting against you. No shady banker black box.

Bye-bye BitMex.

Your services are no longer needed.

We’re going bankless.

-RSA

P.S. We’ll be sending out a special email later today announcing something big (and this week’s State of the Nation!).

P.P.S. Get up to 55% off dYdX ETH perp trading fees this week...just add bankless code! 🔥

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

How to trade the ETH perpetual on dYdX. (Available to non-US residents only).

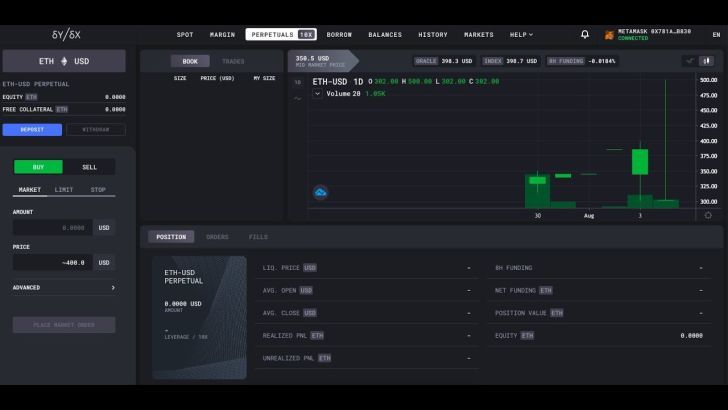

dYdX is one of the first decentralized ETH perpetual market built on Ethereum—the first was MCDEX. For ETH holders, perpetuals are convenient as they provide efficient price exposure, allow you to deposit ETH as collateral, and enables you to trade up to 10X leverage.

This is basically today’s tactic in video form! 🔥

DeFi Dad walks us through the following:

1️⃣ Why a decentralized ETH perpetual market is important and how it works.

2️⃣ What is the Oracle Price, Index Price, Mid Market Price, and 8H Funding Rate

3️⃣ How to open a position

4️⃣ Recap of risks

👉Check out Bankless YouTube for & tactics by DeFiDad!

👉Check out DeFiDad’s YouTube channel for extended tactics

TACTICS TUESDAY:

Tactic #49: How to trade the ETH Perpetual on dYdX trading platform

Guest Post: Corey Miller, Senior Growth Associate at dYdX

If you’re reading this, you probably own ETH. And you’ve probably asked yourself what are the easiest ways to access leverage on it.

While there are plenty of ways to do that in DeFi (primarily by using your ETH as collateral to borrow another asset such as a stablecoin), existing solutions are often both cumbersome and severely restrict the amount of leverage you can obtain. On dYdX, a decentralized exchange for spot, margin, and perpetuals, you can now obtain up to 10x leverage on your ETH without ever touching another token.

In this tactic, we’ll go over the basics of perpetual markets and how to open an ETH-USD perpetual market position using dYdX. By the end of the post, you will be able to obtain up to 10x leverage on your ETH in a few simple steps.

- Goal: Learn how to open, close, and set up a stop for an ETH-USD Perpetual

- Skill: Beginner/Intermediate

- Effort: 10 minutes

- ROI: Variable -- depends on how well you trade!

🤑 As a launch promotion, dYdX is offering 50% off trading fees for all ETH perp users in the first week!

⚠️ Disclaimer: Leverage trading is risky and not recommended for beginner traders. Please rationally judge your investment ability and make decisions prudently once you’re well informed about how Perpetuals work. dYdX Perpetual Markets are not available in the US.

Want more than 50% off? Add another 10% discount to your wallet!

Before you start! dYdX has trading fees but Bankless readers can get 10% off dYdX fees by adding the Bankless code to their wallet.

You can add it here.

Don’t know how to add the code? Watch this video 👇

What is dYdX?

dYdX is an open, permissionless protocol to trade, borrow, and lend crypto-assets. It offers spot and margin markets across ETH, USDC, and DAI pairs as well as perpetual markets for BTC and ETH. Although dYdX is decentralized, the experience of trading on dYdX is very similar to trading on a centralized exchange. It offers professional trading tools and orders, fast trade execution due to its off-chain order books, as well as pays all gas fees for its users once on the platform.

Perpetual Markets

Perpetuals have been popularized by a number of centralized exchanges over the last few years — allowing users to get synthetic exposure to crypto assets without an expiration date. Perpetuals are the most widely traded crypto product with daily trade volume in the billions of dollars, eclipsing spot trading volume in 2019 as the most popular way to gain crypto price exposure.

dYdX’s ETH perpetual functions as an “inverse perpetual,” which means that it is collateralized, margined, and settled in ETH, while all orders are calculated in USD.

That means for all users who already have ETH, it is one of the most efficient ways to obtain leverage on ETH in DeFi.

Key terms to know:

- Oracle: The Oracle Price is an aggregate price calculated using on-chain price oracles. Collateralization and liquidations on dYdX are determined using the oracle prices of each asset.

- Index Price: The Index Price is an aggregate price based on price data from multiple exchanges and is used to trigger stop orders. To provide optimal performance, the index price is managed off-chain to ensure minimal delay and slippage in stop order triggering.

- Mid-Market Price: The Mid Market Price is determined by the order book and is simply the midpoint or average between the lowest ask (sell price) and the highest bid (buy price) on the order book.

- Funding Rate: Funding rate is the fee paid between longs and shorts for each perpetual market. Longs would pay shorts if the funding rate is positive and vice versa. The funding rate is a mechanism to keep the mid-market price close to the Oracle and Index price.

For more information on perpetuals, see our in-depth article on The Integral.

How to open an ETH perpetual

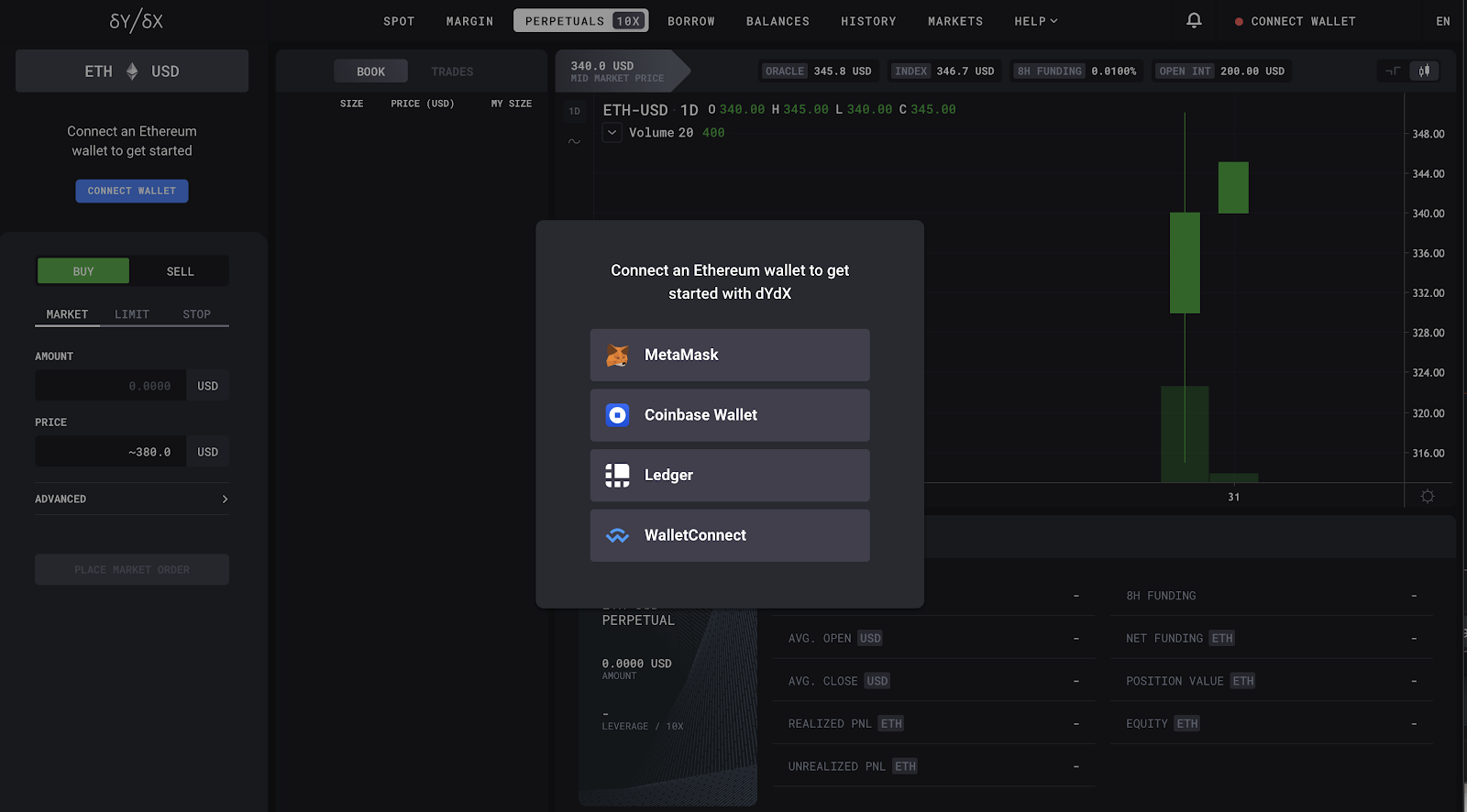

- Head to dYdX ETH-USD Perpetual Contract Market and connect wallet using MetaMask, Coinbase Wallet, Ledger, or Wallet Connect.

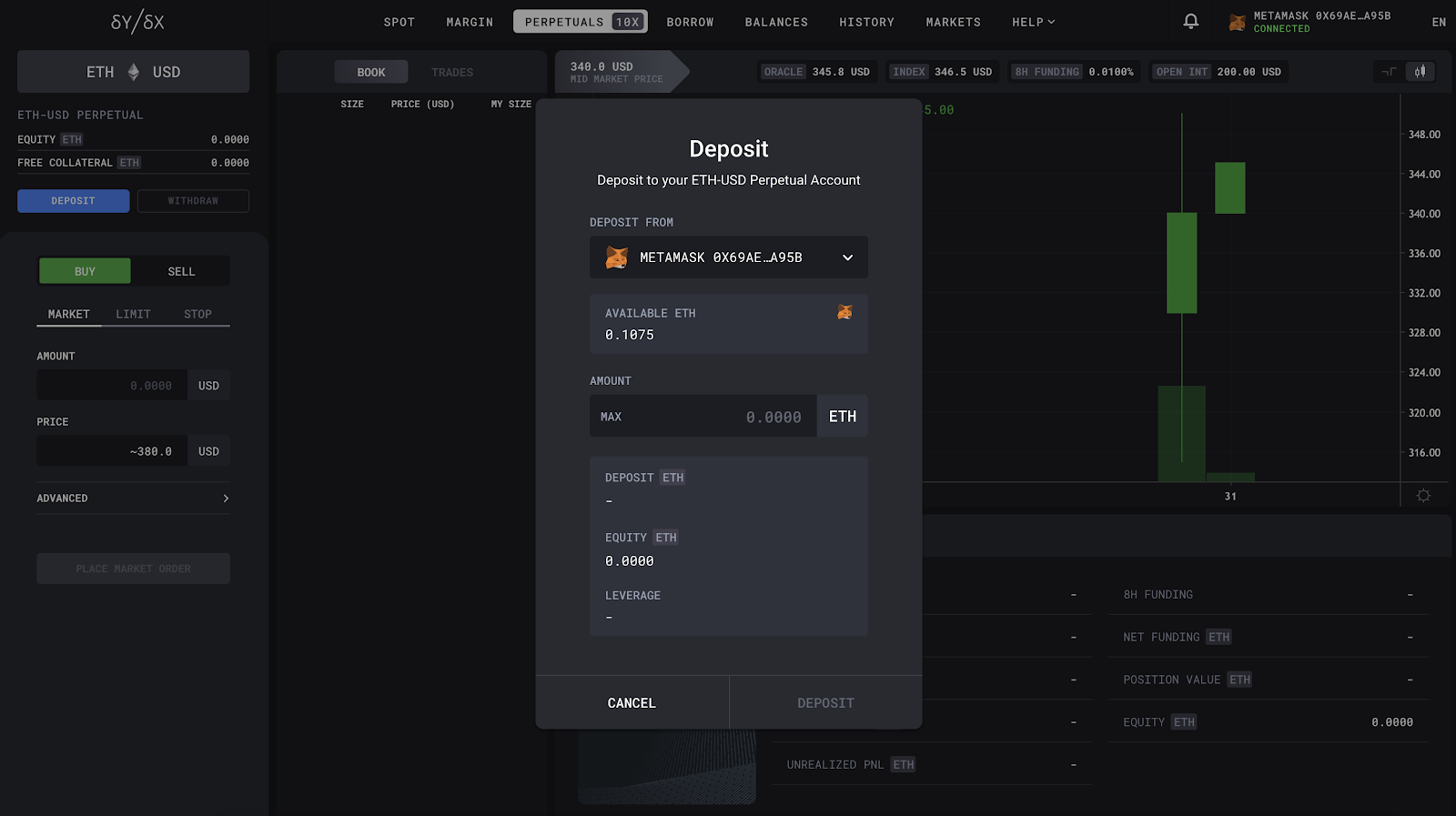

- Click deposit and determine how much ETH you would like to deposit and trade.

👉 Note: Minimum trade size is $200 in ETH! There’s no minimum deposit size but make sure you’re trading with at least $200 in order to access the ETH Perp.

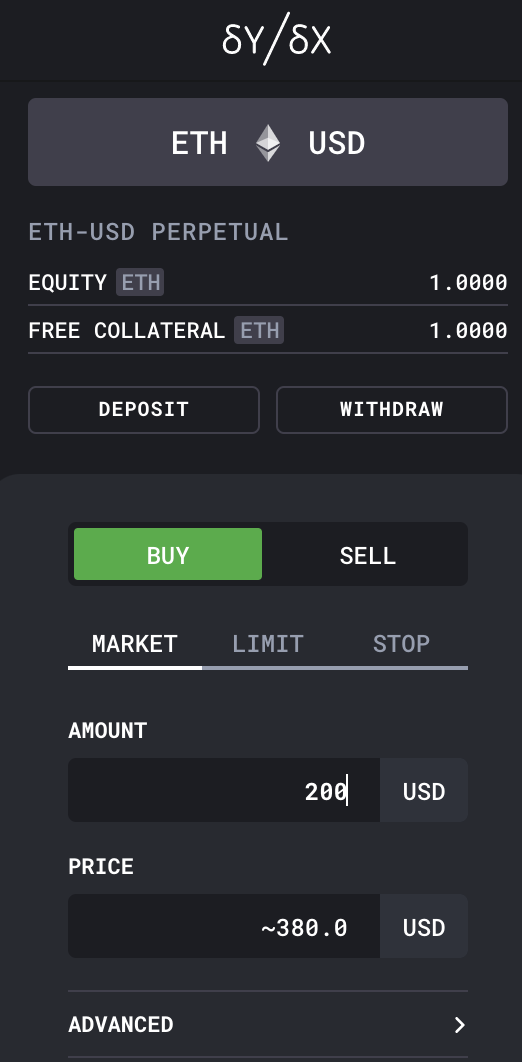

- Create a buy or sell order. This can be a market or limit order. Leverage is applied automatically and depends on how much collateral you have in your account. For instance, let’s assume you have 1 ETH in your account and the price of ETH is $500, meaning the total value in your account is $500. Let’s also assume you want to buy ETH with 5x leverage. You would simply buy $2,500. Leverage is applied automatically using the ETH in your account.

- Sign message to open the order

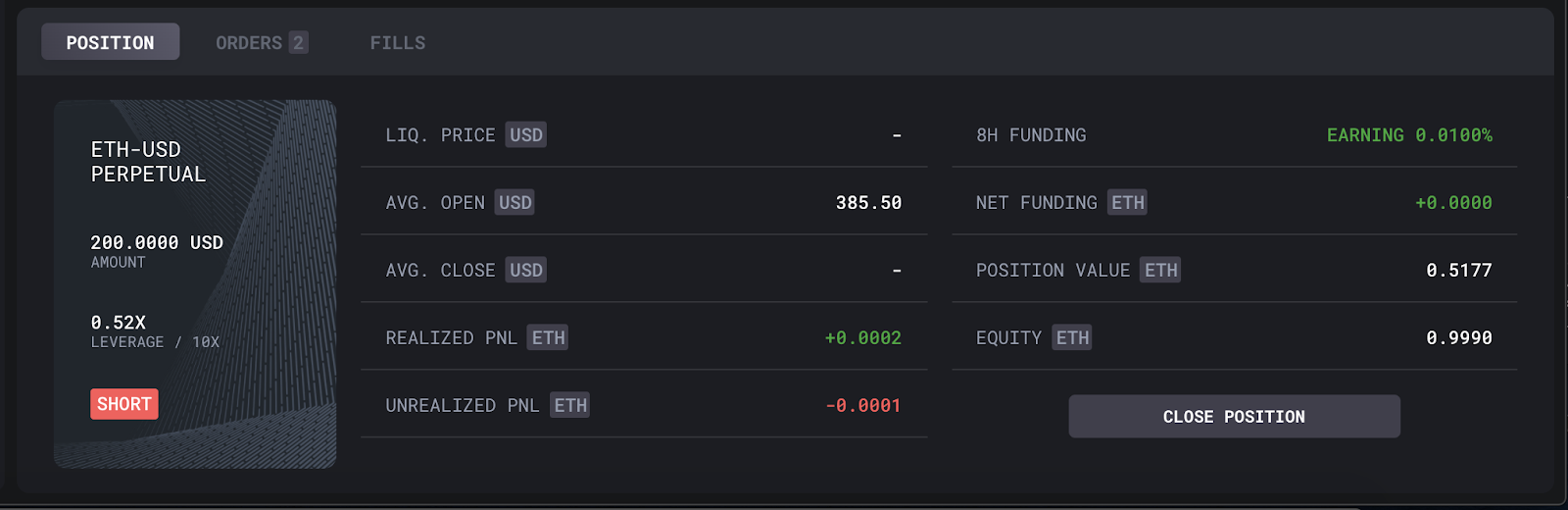

👉 Note: The interface on the right side of the screen will indicate metrics such as your liquidation price, leverage, PNL, and funding rate.

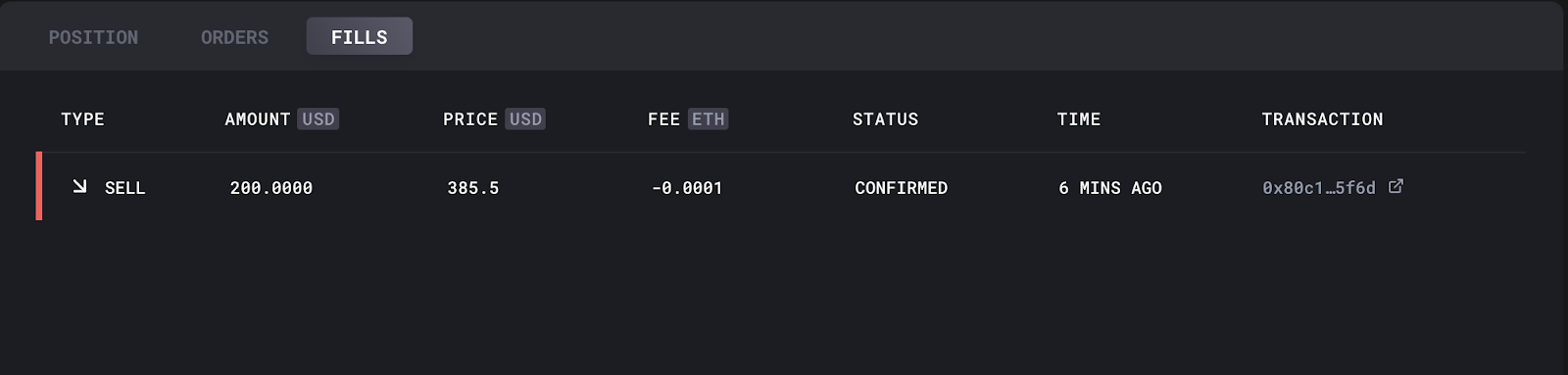

- To confirm your order was filled, click the “FILLS” tab on the bottom right-hand corner of the screen. Once the status is “confirmed,” the trade is finalized and can be viewed on Etherscan by clicking the “TRANSACTION” link.

Close a position

- Once a long or short position is open, you can view it in the “position” tab in the bottom right-hand corner of the screen

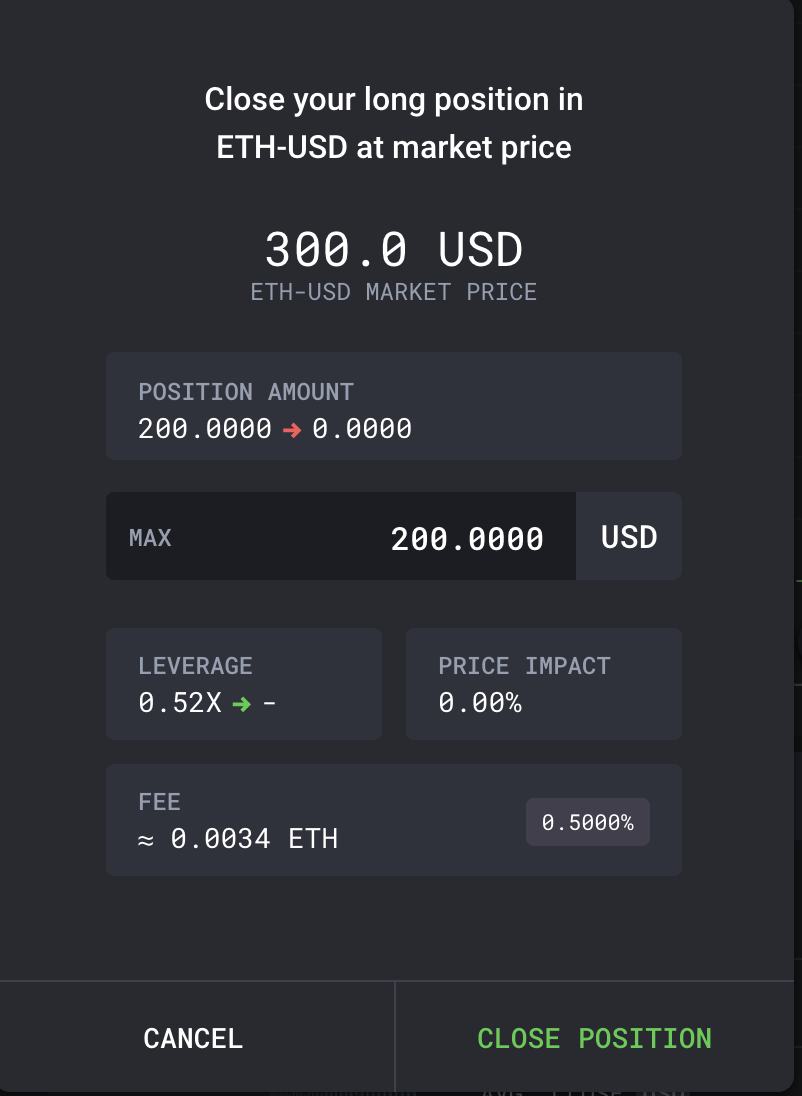

- To close the position, simply click “Close Position” and confirm the amount of the position you want to close. To close your whole position, click “MAX” after clicking “Close Position.”

- Sign message to close the order

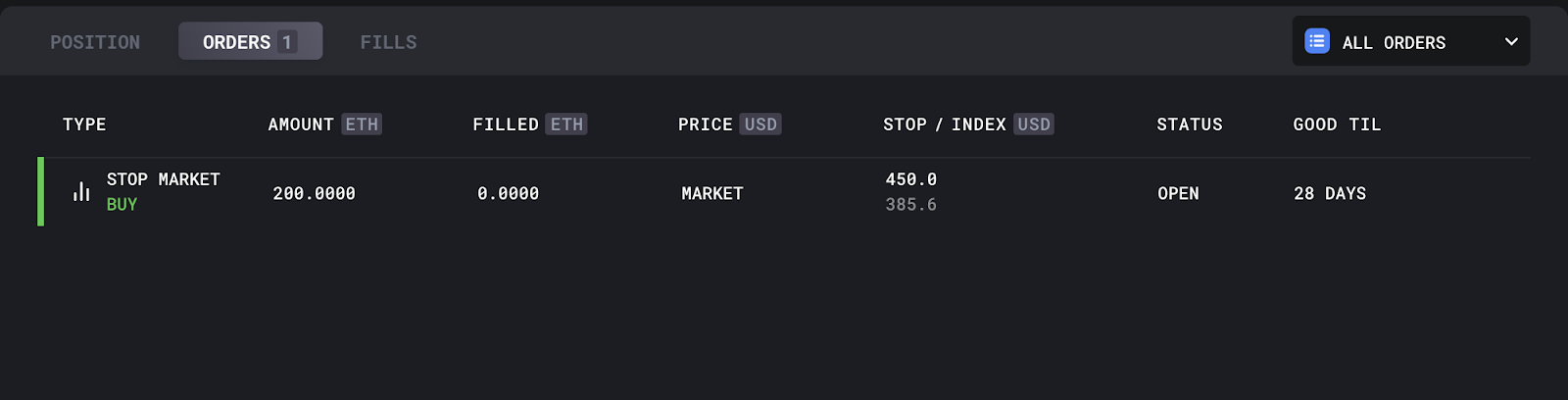

Set a Stop

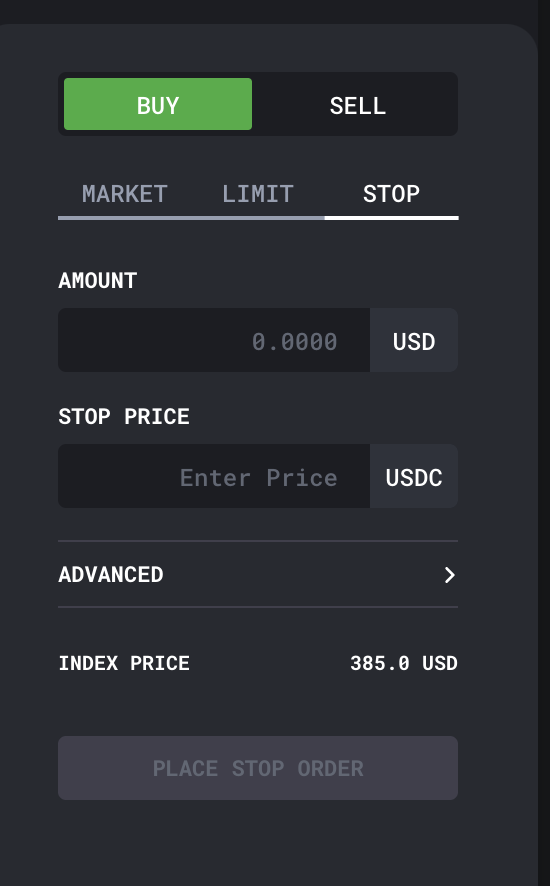

A Stop order is used to execute a market order once a certain Index Price has been hit (also known as Trigger Price). This is commonly used to automatically lock in a certain amount of profit or loss once a target price has been hit.

- To set a Stop, click the “STOP” tab on the left side of the screen

- Determine the amount of ETH you want to buy/sell once the trigger price is hit. Click “Place Stop Order” and sign the message.

- Your Stop order can be viewed in the “ORDERS” tab on the right side of the screen.

- To cancel the order, simply hover over the order and click “CANCEL” and sign the message.

That’s it! You can now trade dYdX’s new ETH perpetual product.

If you’re interested in learning more about dYdX and their margin trading platform, make sure to follow the team on Twitter or read up on their trading blog, The Integral.

Author bio

Corey Miller is a Senior Growth Associate at dYdX. He previously worked at BlockTower Capital and ScoutVentures, an investment fund providing seed-stage companies with capital and strategic growth. He’s also an Alumnus from the University of Pennsylvania.

Action steps:

Go long or short with the ETH perp on dYdX (get a 10% off trading fees)

Complete the weekly assignment: How to use the new ETH Perp on dYdX

Try out our previous tactics on options/derivatives/perpetual swaps:

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.