How to earn token airdrops

Dear Bankless Nation,

People are making bank going bankless.

I’m not talking about investing here. You can make money by using DeFi.

If you followed this tactic from a year ago, you made at least $1,200 in UNI tokens.

If you had followed this one, you could have earned over $1,000 from 1inch tokens.

If you had followed this video, you may have earned a nice stack of CRV this summer.

Why? Because DeFi protocols are starting to reward their most loyal users with retroactive airdrops. This is the ultimate fair launch. Don’t be surprised if 2021 is filled with more of these lucrative airdrops for past users.

And as we always say, we’re here to help you front run these opportunities.

So we had William take a look at the market and speculate on a few DeFi projects that aren’t currently tokenized, but could be in the future. It might be worth using these protocols—even once.

Imagine if the first Uber riders had the chance to get free Uber shares.

This is like that only for DeFi.

- RSA

This year, high profile DeFi projects like Uniswap, Curve, and 1inch released governance tokens with distribution schemes that heavily rewarded the protocols’ past users. The tl;dr?

The more you used these protocols and supported them through their earliest days, the more tokens you earned in the projects’ retroactive token airdrops.

This new DeFi distribution paradigm has led to some Ethereum users joking that they’ve earned multiple “DeFi stimulus checks” in 2020. It’s also understandably kicked off a frenzy of speculation as to which protocols may launch retroactive token distributions next.

In this article, we’ll cover a range of DeFi and Ethereum-based projects that are currently untokenized and could launch a retroactive distribution to their users in the future.

To be clear: you’ll have to actually use the following projects to qualify for any potential airdrops, and the projects I mention have zero inside knowledge and zero liaison with any team members involved.

These are simply apps that haven’t released tokens yet and could leverage this emerging distribution mechanism in 2021 or beyond!

- Goal: Identify untokenized protocols to capitalize on potential future airdrops

- Skill: Beginner

- Effort: Medium

- ROI: Variable depending on protocol!

9 DeFi Projects that might have a Future Airdrop

Here’s our list of successful DeFi projects with some likelihood of launching a token and doing a retrospective airdrop in the future. (We have no idea if they will or not)

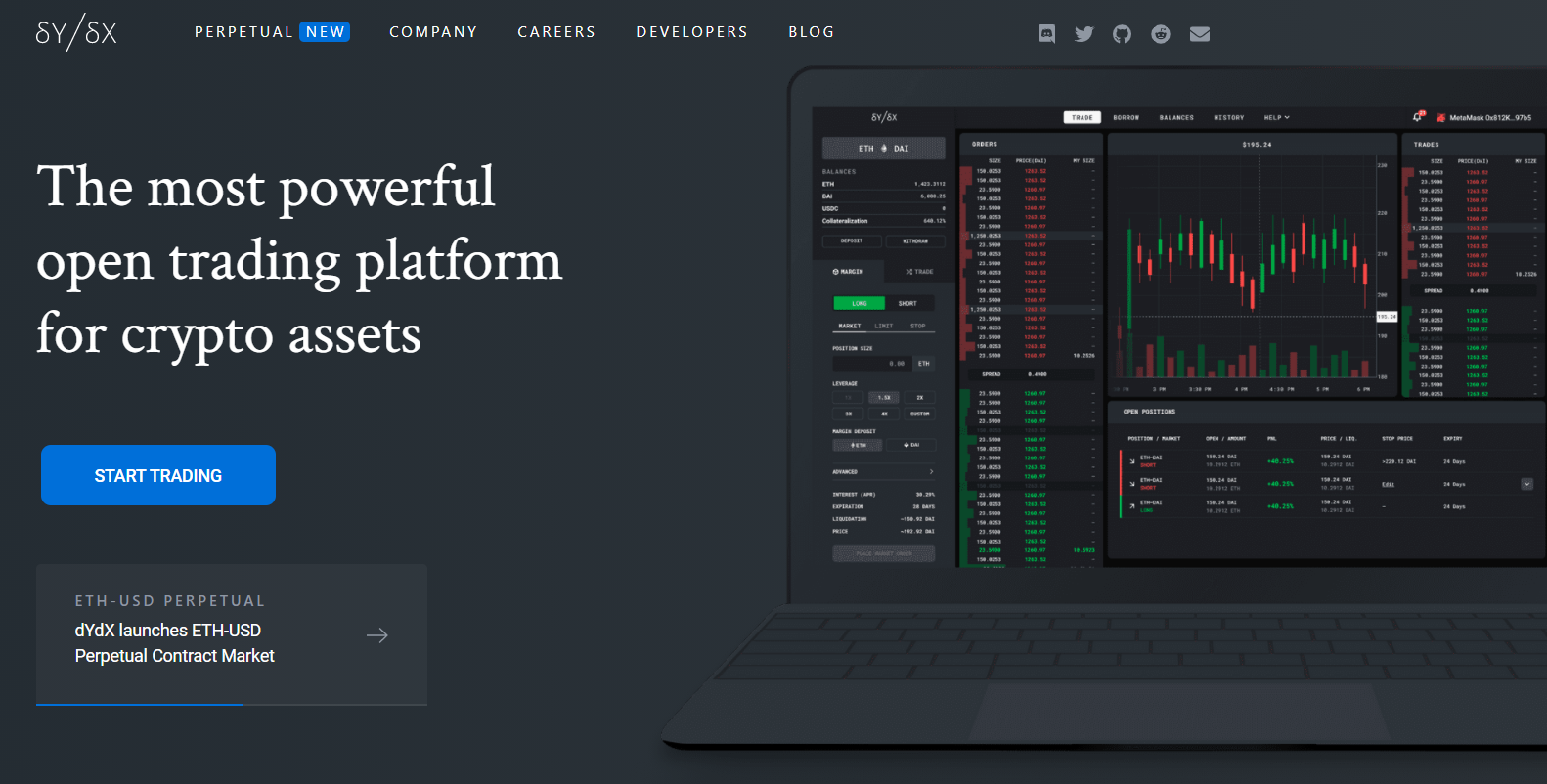

1. dYdX

dYdX is one of Ethereum’s foremost decentralized margin trading protocols that’s also surged in popularity this year thanks to its native support for flash loans. Accordingly, dYdX is a highly composable “money lego” that makes it straightforward to place leveraged bets on crypto prices, e.g. ETH’s price or WBTC’s price.

Considering dYdX’s status as one of DeFi’s most popular projects to date, the protocol’s lack of a native token is growing more and more conspicuous. It seems like a prime candidate for an eventual retroactive token airdrop as such.

When we talked to Antonio back in August, he did tease the fact that dYdX is exploring a token, making it a strong contender for a retroactive distribution.

👉 Bankless resources on dYdX:

- 📄 How to trade the ETH perpetual on dYdX

- 📄 How to trade the BTC perpetual on dYdX

- 📺 How to trade the ETH perpetual on dYdX

- 📺 How to get 10% off dYdX trading fees

2. Opyn

Decentralized options are an emerging DeFi sector that’s seen considerable growth this year. And Opyn is one of the interesting projects tackling this area.

Since its original main net launch in June 2020, Opyn has shown there’s significant demand for decentralized options in the fledgling DeFi arena.

But even with the launch of V2 last week, Opyn hasn’t said much on the possibility of a native token in the future. There were some light hints in their V2 announcement post that kind of indicate a potential one in the future like allowing anyone to list new options if it’s whitelisted (who decides which assets are whitelisted?) and that they’ll be setting up incentives for market makers in the future (what kind of incentives?).

However, there was nothing overly concrete.

Regardless, seeing as how the project’s main competitor Hegic has already launched HEGIC with success, there’s reason to believe Opyn could follow a similar path in the future.

👉 Bankless resources on Opyn:

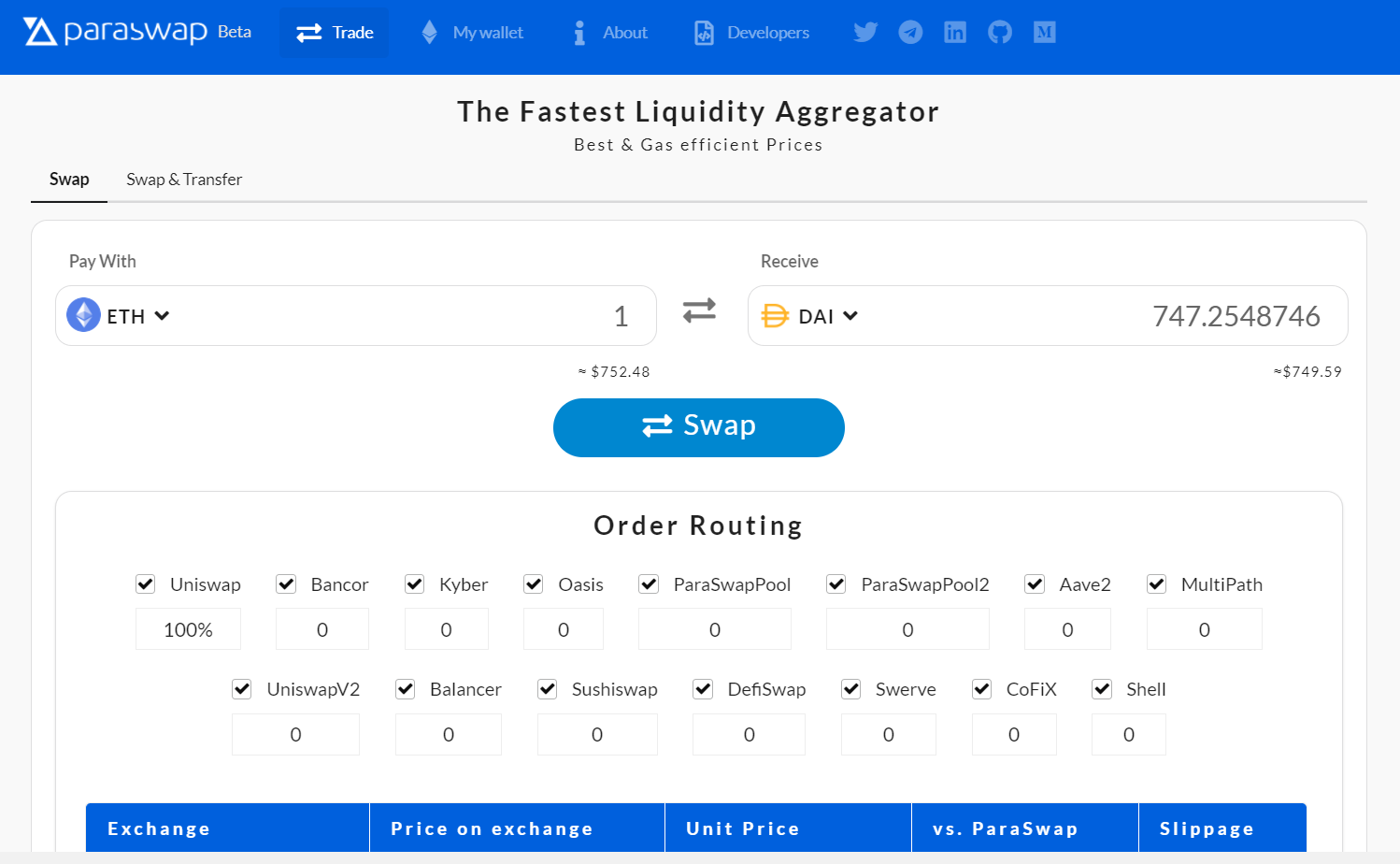

3. Paraswap

Remember Ryan mentioning Uniswap, Curve, and 1inch in the intro?

Each of these are decentralized exchanges, suggesting DEXes are low-hanging fruit in this new retroactive token distribution paradigm.

On that point, Paraswap is a DEX that hasn’t released its own token yet. As such, it seems like a natural contender to do so in the months ahead.

It’s no secret that Uniswap is the most popular decentralized trading protocol right now and that some traders don’t see the need to trade anywhere else. But if you’re interested in trialing a promising project while also potentially getting on the slate for free governance tokens in the future, Paraswap is certainly a DEX to consider.

NFT Marketplaces

4. OpenSea

OpenSea is one of Ethereum’s premier NFT hubs. The platform makes it easy to mint your own NFTs or trade NFTs from other projects on the secondary marketplace.

One of the reasons OpenSea stands out is its robust community. This fall, the platform reached the 25,000+ user milestone—which is more users than many DeFi protocols currently have!

As a result, if OpenSea opted to decentralize the control over the platform with a token, this NFT marketplace certainly would have no shortage of on-chain activity to snapshot and reward its historical users.

Take a look around the project, and maybe buy some NFTs. At worst, you’ll have fun and have some new digital assets to play with.

At best, you’ll get these benefits and earn some free OpenSea tokens in the future!

👉 Bankless resources on OpenSea:

5. SuperRare

SuperRare is Ethereum’s leading crypto art marketplace. Both artists and collectors have made millions of dollars’ worth of ETH in sales this year even though the NFT space is still young. The sky seems like the limit from here.

This early success is interesting, of course, but we’re also interested because SuperRare’s team has all but admitted they’re looking to decentralize the project sometime in the future. In August, the team wrote:

“Going forward, we believe a digital art marketplace like SuperRare should ultimately be owned and operated by the community. As the first step towards that, we’re building an advisory board made up of community members to advise and partner on resolution management and our overall strategy.”

Accordingly, it seems there’s a decent chance SuperRare will eventually seek to accomplish this mission via a governance token airdrop to its past users.

👉 Bankless resources on SuperRare:

6. NiftyGateway

Nifty Gateway has taken the NFT ecosystem by storm this year with their featured drops from acclaimed artists like Beeple, Pak, and Trevor Jones.

Why? There’s a lot to love about Nifty Gateway’s style. Its “drops” format funnels an incredible amount of attention to artists’ works, and the project’s team has also made the marketplace among one of the most user-friendly NFT platforms around.

All that said, Nifty Gateway is quite promising and the project could choose to decentralize control to its diverse group users in the future. The possibility of this seems less clear compared to OpenSea and SuperRare, as Nifty Gateway is owned by the Gemini crypto exchange whose leadership is cautious and won’t give willy-nilly approval to a DeFi token launch.

Still, though, that reality hardly rules out a Nifty Gateway token release down the road, so we say keep this platform on your radar for now.

Our hunch is that a Nifty Gateway token would become more likely if the above two platforms (OpenSea and SuperRare) tokenized and start eating up their marketshare as collectors and artists capitalize on the token incentives on other marketplaces.

Asset Managers

7. Zerion

Zerion is an all-in-one DeFi dashboard that makes a range of DeFi activities, like borrowing, lending, and trading easy and manageable from a single interface.

As the DeFi sector has gone through a boom year in 2020, these kinds of dashboards — and their growing list of services — have become increasingly pivotal.

As one of the most popular DeFi wallet management platforms in the game today, Zerion might choose to “exit to community” and pass off its governance to a DAO one day via a retroactive token release.

If that happens, having made a few transactions through Zerion will surely prove to have been worth your time.

👉 Bankless resources on Zerion:

8. Zapper

Like Zerion, Zapper is one of DeFi’s premier dashboard services right now.

The project made a name for itself with its signature “Zaps,” which let users jump right into DeFi like liquidity pools or yield farms with a single transaction. And it’s these zaps and beyond that may just earn traders Zapper tokens in the future if the project ever opts for a token release.

For example, let’s say there’s a yield farm you’ve been eyeing but haven’t pulled the trigger on yet. If you do decide to move on it, try joining the farm through Zapper.

It could pay dividends later!

👉 Bankless resources on Zapper:

9. Argent

Argent is an Ethereum smart wallet that makes it simple and secure to participate in a variety of different activities in DeFi and on Ethereum.

Given its more advanced capabilities compared to regular wallets, Argent has grown popular with an increasing number of users this year and this trend seems set to continue for the foreseeable future.

With all its promise, then, Argent may decide to foster further growth around the project by releasing a governance token to its early users. Seeing as how Argent is so useful anyways, it certainly wouldn’t hurt to use the wallet some and get your foot in the door just in case.

👉 Bankless resources on Argent:

- 📄 How to get your first DeFi wallet

- 📄 How to maximize your Argent wallet

- 📺 How to lend with Aave on Argent

- 📺 How to become a Uniswap LP with Argent

- 📺 How to buy & sell TokenSets in Argent

- 📺 How to play PoolTogether in Argent

Closing Thoughts

This list wasn’t comprehensive, but it will absolutely get you started on a handful of leads if you’re in the hunt for free DeFi tokens in the future.

But remember: there are no guarantees that any of these projects will release their own native tokens or that they’ll execute a retroactive distribution.

You won’t want to ape into them simply because they haven’t released tokens yet, this is just a really fundamental factor to take into consideration.

If you have some ETH laying around though and you’re in the mood for experimenting, trying out some of the above projects might really pay off later.

Only time will tell for now!

Action steps

- Use any of the above protocols to get a chance to earn free tokens in the future

- Check out Guide #3: Tactics and Tools for more tutorials and deep dives