How to trade BTC perpetual on dYdX

How cool would it be to have Bankless in video format? That’s where I want to go next. But I need your help! If you want the Bankless program in video give 1 DAI & let’s make it happen!

Dear Bankless Nation,

I have no love for BitMex.

Why?

Because I came to crypto to escape the BitMexes. I don’t want to trust Arthur Hayes and friends any more than I want to trust Jamie Dimon and friends. Replacing bankers with bankers? No thanks.

But BitMex, Binance, and friends are the kings of the BTC perpetual, and since futures volumes are 10x spot that makes them the kings of liquidity.

The thing about kings is there’s only one way to reign them in. A bigger king. That means nation state regulation, then cronyism, and then pretty soon we’re back to the system we just escaped.

But we don’t need kings.

Now there’s a way to do BTC perpetual swaps without the bankers.

You can keep custody of your assets. You can see onchain that the house isn’t betting against you. You can replace the bankers with a protocol.

Today we’re going to show you how to gain Bitcoin exposure (with leverage) using a DeFi protocol. No bank necessary.

Like our margin trading tactic this is advanced stuff so bon’t enter this lightly.

So let’s do BTC futures—the bankless way.

Bye Bye Bitmex.

-RSA

P.S. Since it’s yield farming week we’ve included a farming bonus for you at the end of the article. (A neat way to do up to 18% APY on USD.)

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Btw, we just release episode 2 of our new Tuesday video show—State of the Nation!

Watch SotN #2 - CHURNING ETH bears wrong, Venmo loves crypto, Gas fees good

TACTICS TUESDAY:

Tactic #43: How to trade BTC Perpetual on dYdX

Guess Post: Sid Ramesh, consultant and advisor to early-stage crypto teams

If you’ve ever wondered how to gain short exposure on Bitcoin or trade crypto with leverage, you may have run into the term ‘Perpetual Swaps’ or found yourself trading BTC on crypto derivatives exchanges such as BitMEX. Perpetual Markets long been one of the most popular instruments to trade Bitcoin.

In this tactic, we’re going to learn how Perpetuals work and how you can trade the Bitcoin Perpetual on dYdX while keeping custody of your funds.

- Goal: Learn the basics of trading BTC perpetuals through dYdX

- Skill: Intermediate / Advanced

- Effort: 15 minutes

- ROI: Positive ROI if perpetual trade (long / short) follows BTC market movement

⚠️ Disclaimer: Leverage trading on crypto is risky and not recommended for beginner traders. Please rationally judge your investment ability and make decisions prudently once you’re well informed about how Perpetuals work. dYdX Perpetual Markets are not available in the US.

Background on dYdX and Perpetuals

dYdX is the most powerful decentralized exchange for crypto assets with spot, margin, and perpetual markets. Founded in 2017, there has been over $1.5B transacted on dYdX so far.

What are Perpetual Markets?

In a nutshell, a Perpetual is a type of crypto derivative contract that allows you to gain long or short exposure on a certain crypto asset without needing to hold the underlying asset.

Perpetual Markets fall under the umbrella of futures contracts, but the key difference is that they never expire.

Introduced by derivatives exchange BitMEX in 2016, Perpetual Markets now facilitate billions of dollars in trading volume across the largest crypto exchanges in the world.

📚 If you’re interested in taking a deep dive into perpetual contracts, here’s an article highlighting everything you’d need to know!

How do Perpetual Markets work?

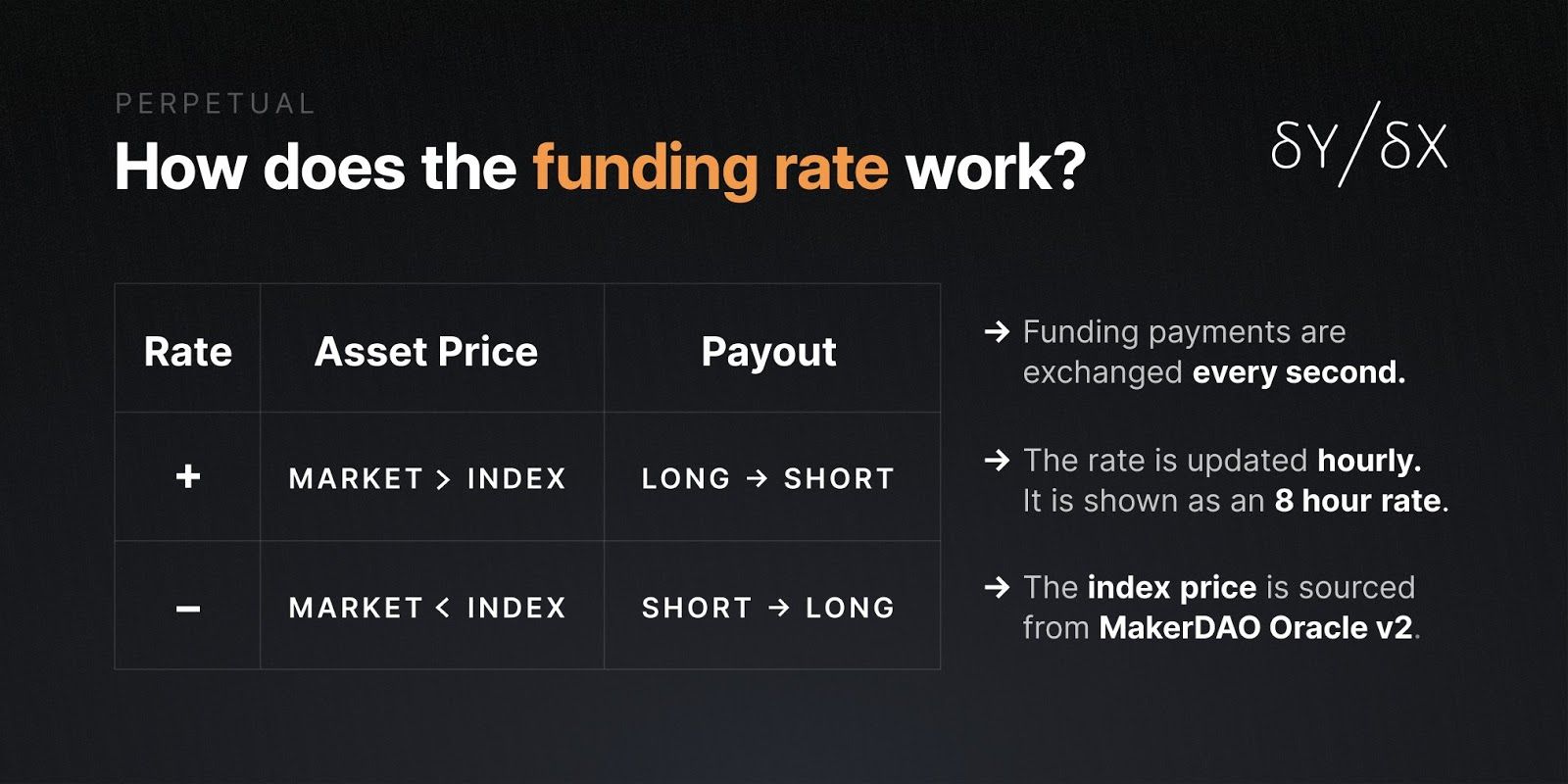

The underlying mechanism that enables Perpetual Markets is the funding rate. With Perpetual Markets, one side, either longs or shorts, pays the other side over a specified time window. The amount paid is a reflection of both how much leverage each side is employing as well as the delta between the index price and the price of the perpetual market. It mimics interest payments between long and short positions on spot margin trading.

🧠 The “delta” is the ratio of the change in the price of the derivative to the change in the price of the underlying asset. As an example, a delta of 0.50 means that for every $1.00 the underlying asset move, the price of the derivatives contract moves $0.50.

Given this structure, the traders on perpetual markets have an incentive to open or close certain positions to bring the market price close to the index price using interest payments transferred between the longs and shorts.

To learn more about how funding works on dYdX, check out their documentation here.

What’s special about DeFi Perpetuals?

DeFi-based perpetual markets make a lot of sense given the very nature of what a derivative instrument is — you don’t need the underlying asset to transact, you just need a reference to its value. The DeFi ecosystem is home to robust oracle solutions including MakerDAO and Chainlink’s price feeds which are improving every day. Therefore, Perpetual Markets virtually allow any non-ERC20 asset to be tradeable on Ethereum, so long as there is a reliable price feed to act as the system’s reference point.

Additionally, DeFi is already home to growing capital markets powered by stablecoins, so capital can flow significantly less friction than in the traditional world.

Finally, there are two bankless benefits to DeFi Perpetuals vs their centralized counterparts:

- Traders retain custody of funds at all times. Funds are held in a non-custodial smart contract. At no point in the position’s lifecycle do funds have to be exposed to a third party.

- Transparency into the liquidation process and operation of the insurance fund. On dYdX’s BTC Perpetual, all liquidations are executed on the blockchain, allowing full transparency into the amount of collateral that was liquidated, the price at which the position went into default, and the price at which the position was closed.

👉 RSA Note: In the words of my favorite anonymous trader CryptoCat “The non-custodial aspect is very important for me coupled with the fact that I know the house is not actively playing against me.”

Add 10% Discount to your Wallet before you start.

dYdX has trading fees but Bankless readers can get 10% off dYdX fees by adding the Bankless code to their wallet. Add it here.

Don’t know how to add the code? Watch this video 👇

How to trade the dYdX BTC Perpetual

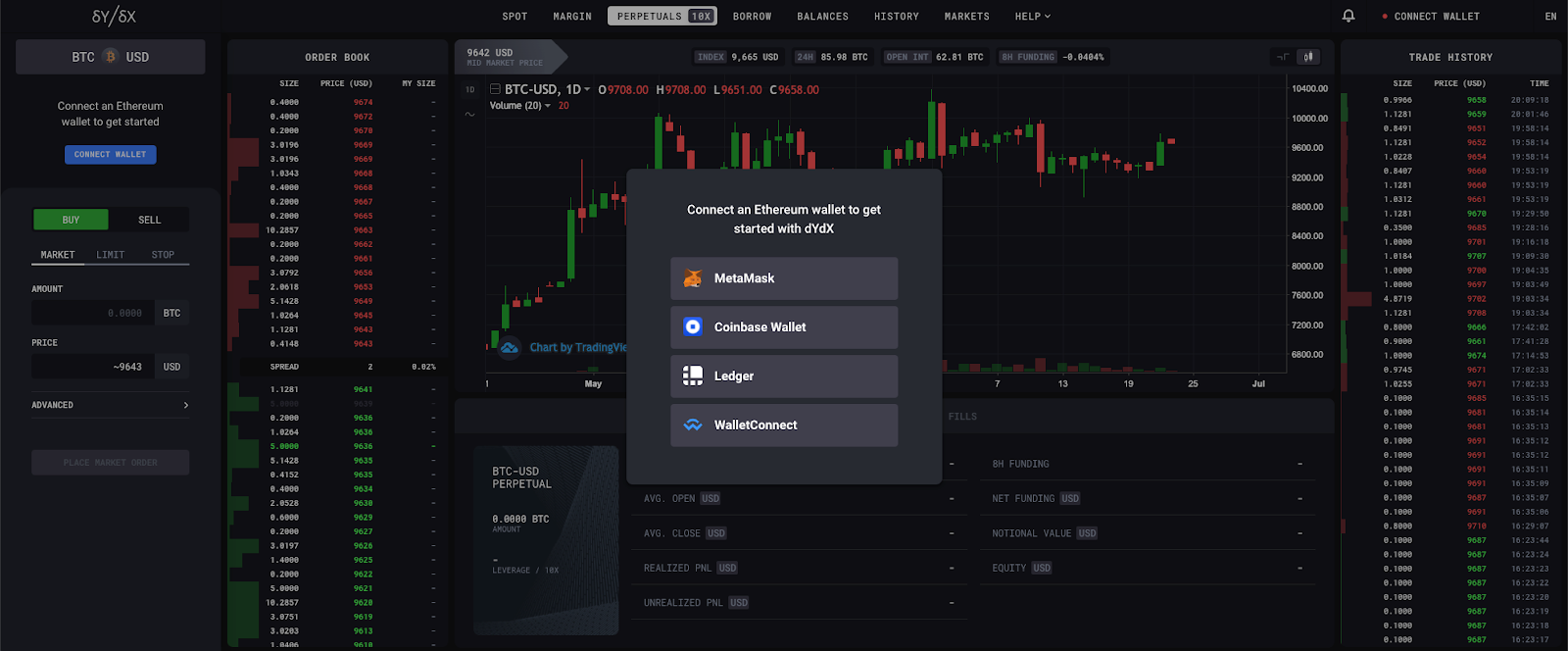

1. Connect your ETH wallet on dYdX to get started

Visit trade.dydx.exchange, head to the Perpetuals tab and connect your favorite Ethereum Wallet. MetaMask, WalletConnect, Ledger, etc are all supported.

⚠️ Note: Perpetual Markets on dYdX are not available in the United States. No KYC and no sign-ups if you’re in a non-US country

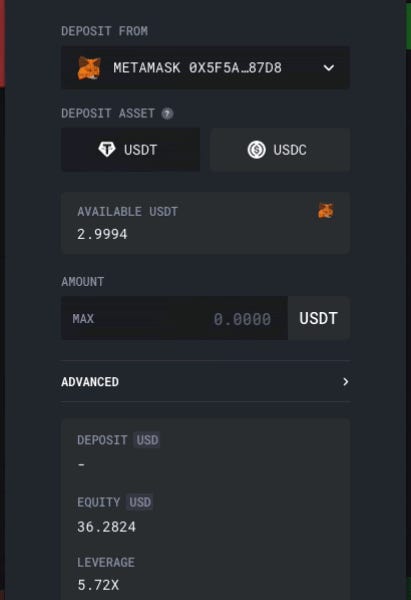

2. Make your first deposit to the BTC Perpetual

It’s important to note that the margin and settlement collateral of the dYdX BTC Perpetual is USDC, so all perpetual positions on dYdX are backed by USDC.

dYdX currently supports USDT and USDC stablecoin deposits for the BTC Perpetual.

Once you’re ready with the funds, choose the stablecoin you would like to deposit into the BTC-USD Perpetual account. You may need to “enable” the particular stablecoin asset before making a deposit, which basically means you’re granting token allowance on the deposits/withdrawals.

RSA Note—I have no love for USDT so they way they auto-convert USDT to USDC is cool! Also, you can’t deposit actual BTC into dYdX (yet) so make sure to have stablecoins (USDC or USDT) in your wallet.

3. Enter your BTC long/short position via a market or limit order

Once you’ve deposited the USD stablecoin into your perpetual account, you’re all set to start trading on the Perpetual market. The USD stablecoin you’ve deposited will serve as the ‘collateral’ for all your trades.

To open a position, you can either choose to use a market order or set a limit order with your desired price point (earn a rebate when filled!).

For this step, all you need to do is sign a transaction on your wallet corresponding to the desired trade. The gas fees and trade execution on-chain is handled by dYdX!

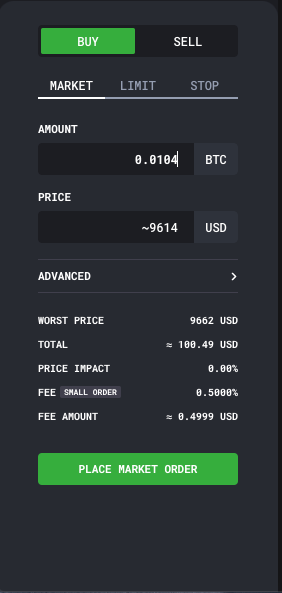

Here’s an example of a 1x long on BTC-USD using a market order:

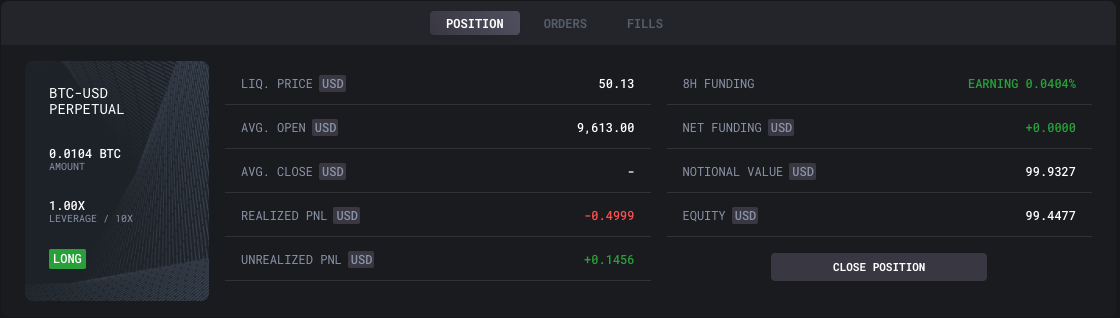

4. Monitor your position via the trade dashboard

Once your trade gets filled, you will notice that the bottom panel of your trade dashboard will start to light up with important information regarding your open position.

The information enclosed includes details about your liquidation price, PnL, net funding, and the notional value of your entire position among other sources of information.

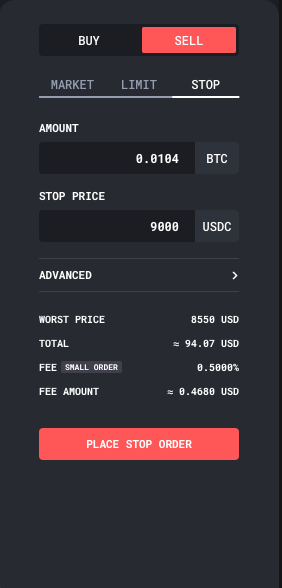

5. Setting stop-loss orders for risk management

Stop losses prevent you from completely losing all your capital from a sudden drop (for longs) or sudden spike (for shorts) in price action.

Once a stop loss trigger has been hit, your trade initiates the stop loss ‘limit’ price. Once this limit price has been reached, you exit out of the trade. This will ensure that your loss is minimized.

In order to place a stop-loss order on dYdX, hover to the left trade entry panel and select the ‘Stop’ section. You will need to input the trade amount and a stop ‘limit price.

Here’s an example of a stop loss for the 1x long BTC-USD position we opened in the previous steps:

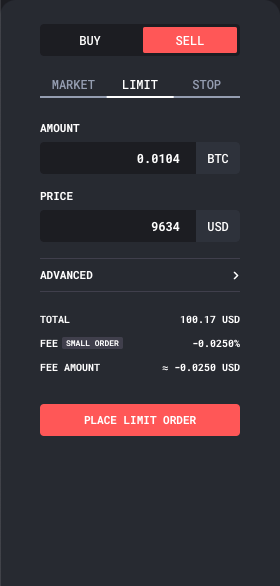

6. Close position when it’s time to complete the trade

If you find yourself ready to close out your position to take out any profits/losses, then you will need to close the open position. You can either use a market or limit order to complete this step.

Example using a limit order to close a 1x long on BTC-USD:

Note that the reverse (i.e. short sell) was used in order to close the long position that was previously opened.

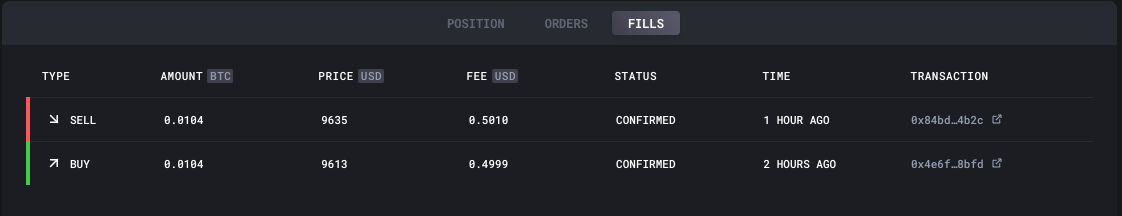

7. Viewing your trade history

There are two places where you can view trade history, namely the trading dashboard as well as a dedicated trade ‘History’ page.

For a quick access to your recent trade history, just hover on the ‘Fills’ tab of the bottom panel on your trade dashboard.

📜 For a longer trade history and for downloading .CSV exports, jump to the dedicated trade ‘History’ page!

Bonus : How to earn yield farm on the BTC Perpetual (Advanced)

You’ve had a glimpse into the world of BTC perpetuals trading through dYdX, but maybe you want to dive deeper and explore further opportunities?

This bonus action is for the yield farmers who know the ins/outs of staying hedged and want to chase USD yield on the BTC Perpetual through a trade strategy known as ‘cash-and-carry’. So far annualized USD yields have been as high ast 18%.

To accomplish this you must take the side that’s collecting funding on the Perpetual and hedge that position on a spot exchange with a BTC-USD cross.

Author bio

Sid Ramesh is a consultant and advisor to early stage teams in crypto. He lives and breathes Bitcoin derivatives, Crypto Dollarization, and DeFi. Learn more about Sid’s background.

Action steps

- Add the dydx discount to your trading wallet

- Go long or short on dYdX with BTC Perpetuals (non-US only!)

- Bonus: learn how to yield farm with BTC perpetuals

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.