How to trade BTC and ETH options

Become a full member and access the Inner Circle private community chat! Level up your crypto finance game with insights and knowledge from other seasoned Bankless members.

Dear Bankless Nation,

In June we started to explore the potential for options in DeFi (like this, and this, and this). These assets open up a wide range of opportunities for crypto investors.

In traditional finance, option contracts drive a significant amount of volume for the derivatives market as a whole—we’re talking trillions. They will in DeFi too.

But options in DeFi haven’t fully taken off yet. There’s no Uniswap for options.

Hegic is one of the new players on the block looking to tackle this massive market. They recently relaunched a few months ago with ETH and BTC options. Since then, the protocol has accumulated roughly $80M in value locked. Impressive right?

Today we brought in a hegician to show us how to use this financial primitive to our advantage.

Time to level up on options.

- RSA

P.S. Ethereum 2 launched today—watch the live stream from the launch! 🚀

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

We just released episode 25 of State of the Nation!

📺 Watch State of the Nation #25: Road to Eth2 w/ @RyanWatkins + @WilsonWithiam

The analysts behind Messari Crypto on Ethereum 2.0 and ETH as a triple point asset

We’re now live streaming State of the Nation—join us at 2pm EST every Tuesday!

TACTICS TUESDAY

Tactic #68: How to trade BTC and ETH Options

Guest Writer: Tempted, Hegician at Hegic Protocol

Over the past few years, DeFi has significantly improved the flexibility and potential strategies for any crypto investor. The introduction of decentralized peer-to-pool exchanges, decentralized lending and borrowing, automated money management strategies, synthetic assets and yield farming have all created new tools that traders can utilize as part of their strategy.

Hegic is a decentralized peer-to-pool options protocol that can be utilized by crypto asset holders to create new investment strategies and manage their crypto exposure to optimize their risk/reward profiles.

Here’s how to use ETH and BTC options to your advantage.

- Goal: Learn how to trade ETH and WBTC options on Hegic

- Skill: Beginner/Intermediate

- Effort: Low

- ROI: Market/strategy dependent

An Important Financial Primitive

Option contracts began trading in traditional capital markets around 1973 to provide investors with additional tools to hedge their market exposure or develop new investment strategies that spot markets could not provide.

While they’ve become massively popular in traditional capital markets, DeFi has largely failed to create a vibrant options market despite the interest and growth in the asset class.

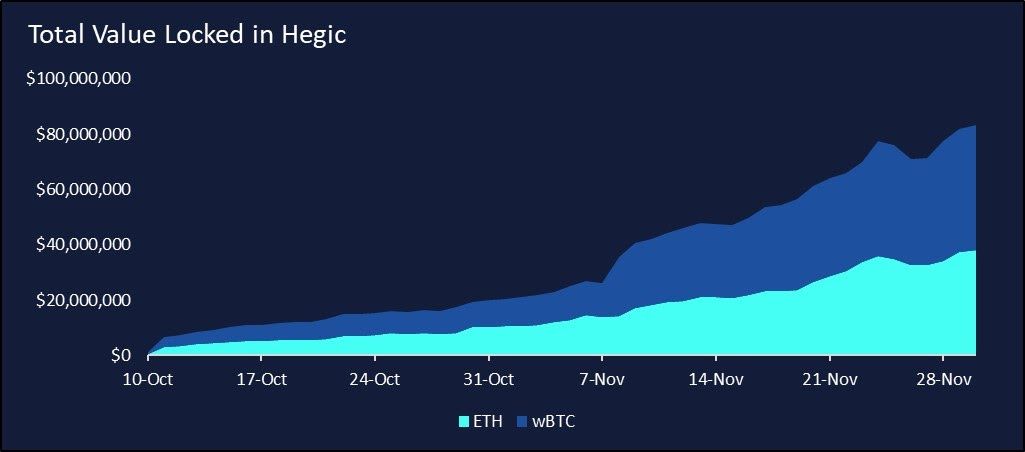

Hegic relaunched in October with a new and innovative design: bi-directional option liquidity pools. The two pools (ETH and WBTC) have attracted over $80m in capital since the launch less than two months ago, giving traders a fair amount of depth in option liquidity.

What’s an option?

Options are a financial instrument that provide users with exposure to the price of the underlying asset while limiting their downside exposure. Hegic offers buyers the opportunity to go long (call option) or short (put option) on either WBTC or ETH.

For those new to option contracts:

- Put options represent a right, but not the obligation, to sell an asset at a predefined price within a specific period of time. This gives you “short” exposure as if the price of the underlying asset goes down, you retain the right to sell the asset at a higher price (called a strike price) and earn a profit.

- Call options represent a right, not obligation, for the holder to buy an asset at a predefined price within a specific period of time. This gives you “long” exposure as if the price of the underlying asset increases, you retain the right to buy the asset at a lower price and earn a profit.

🧠 Hegic options are cash settled, meaning that they only pay out the value above/below the strike price for a call/put. In other words, the user does not need the capital to buy (call) or sell (put) the underlying if their trade is successful.

What can you do with options?

Options open up a host of opportunities and investment strategies for DeFi investors and traders:

Hold a lot of ETH and want to hedge against the risk of ETH volatility?

- You can purchase a put option for capital efficient downside exposure.

Want to protect your Maker CDP or Aave Health Factor from liquidation risk?

- Consider purchasing a Put Option which becomes profitable if markets take a downturn.

Want to farm with stablecoins but not reduce your long crypto exposure?

- You can sell your crypto assets and use the remaining 5-10% to purchase a Call Option that provides you with long exposure for 28 days.

Want to farm a ETH or WBTC stablecoin pair on Uniswap or Sushiswap but are worried about Impermanent Loss (IL)?

- Purchase a Put Option to protect you against IL if the price of ETH/WBTC falls. Or purchase a Call Option to prevent a reduction in your non-stablecoin asset if price rises. You could even buy both to protect against both scenarios (this is called a straddle).

Bi-directional Liquidity Pools

Perhaps Hegic’s most innovative and experimental aspect are its bidirectional liquidity pools for ETH and WBTC. Both the ETH pool and the WBTC pool act as liquidity that can be utilized by buyers to purchase BOTH puts and calls of any size (as long as there is liquidity), at any strike, and for one of five durations (1d, 7d, 14d, 21d, 28d).

This design overcomes liquidity fragmentation issues that order book options protocols encounter as they’re required to spread liquidity across numerous strike prices, across puts and call contracts, and over expiration dates.

As an example, order book option platforms might allow you to sell a 10 ETH put with a 7 day duration at a strike of $500, but a buyer that wants a 5 ETH call with a 14 day duration and a strike of $650 cannot purchase against my position/liquidity.

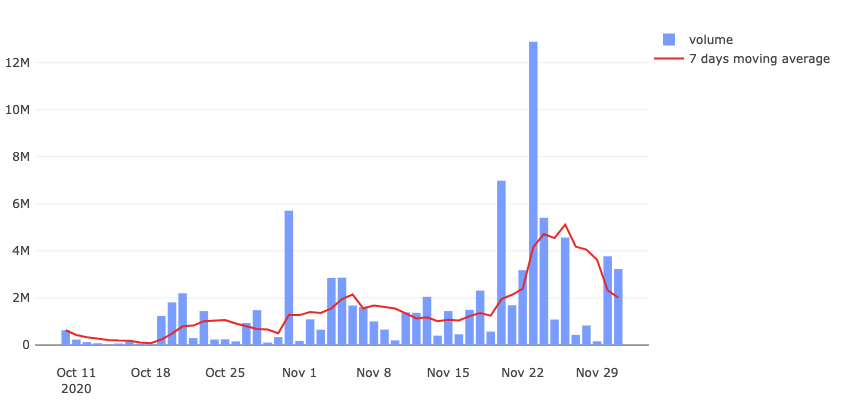

That in mind, Hegic’s design overcomes this capital efficiency issue and as a result has amassed over $80m volume over the past 7 weeks.

The HEGIC token

Hegic’s native token (HEGIC) represents a claim on all fees generated from the protocol.

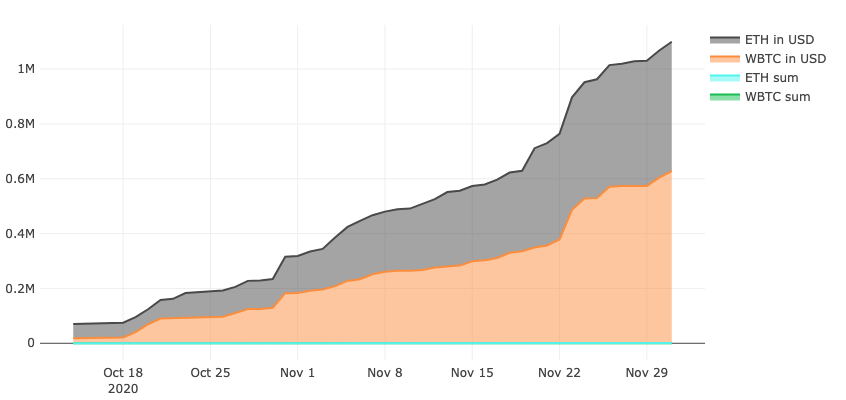

Under the current parameters, all ETH options purchased incur a 1% fee (paid in ETH) which is distributed to ETH Staking Lots evenly. Similarly, WBTC options incur a 1% fee paid in WBTC that is distributed evenly to WBTC Staking Lots.

Since the launch in October, Hegic has amassed over $1M in fees paid to stakers across both the ETH and WBTC pools.

To obtain a staking lot and have access to a share in protocol fees, users need to acquire 888,000 HEGIC. However, there are currently two live staking lot pool services that allow users with less than 888,000 HEGIC to participate in a share of the protocol fees as well. These solutions are HegicStaking and zLOT.

Yearn also has HEGIC vault strategy in the pipeline that has been tested and is awaiting the launch of v2 vaults.

How to buy put and call options on Hegic

1. Getting Setup

Head over to Hegic’s website, connect your wallet and navigate to the “holders” tab. Hegic currently supports Metamask, WalletConnect, Authereum and a few other Ethereum wallets!

Once you’re connected and looking at the “Holders” page, scroll down to the section “Buy an option contract in one minute” and select the underlying asset you wish to trade. This could be either ETH or BTC options!

2. Design your customized option to best suit your crypto trading strategy

- Select the option type you wish to enter in. This could be either a Put or Call.

- Choose the size of the option denoted in the underlying asset (i.e. ETH or WBTC).

- Select the strike price you wish for the option to have. The default strike value is set to current Chainlink oracle price of the underlying asset.

- Select the duration you wish for the option to have: 1 day, 7 days, 14 days, 21 days or 28 days.

The pricing of your option will be displayed in USD value as outlined in the yellow box in the image below. You will also notice that the strike price and the break-even of your option are displayed through the UI on the dynamic charting.

3. Purchase your option

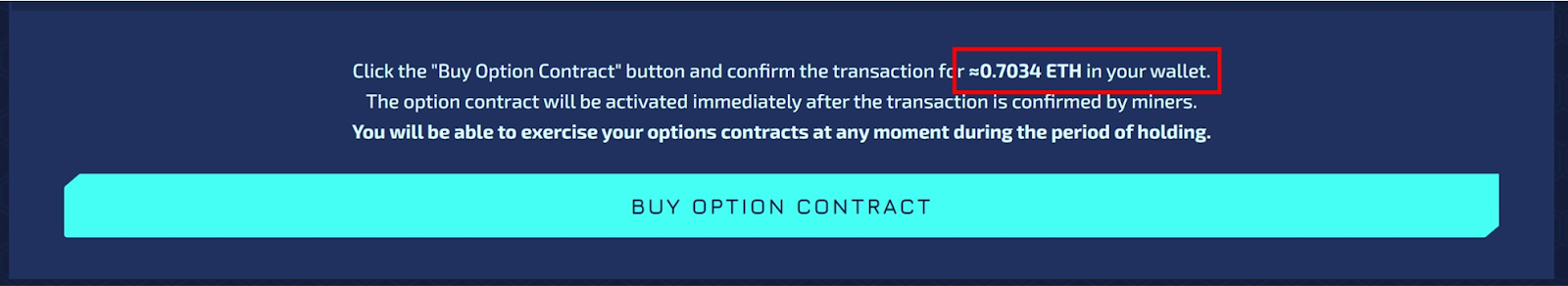

Below the charting tool, you will notice a text box where the cost of the option is denominated in ETH. All options are payable in ETH regardless of the option's underlying asset. You must ensure that this amount of ETH is in you wallet in order for the transaction to process and for the option to be purchased.

Once you’re ready, hit the “buy option contract” button and approve the transaction.

Once confirmed on-chain, you are now the owner of your first Hegic options contract!

4. Observe progress and exercise your option

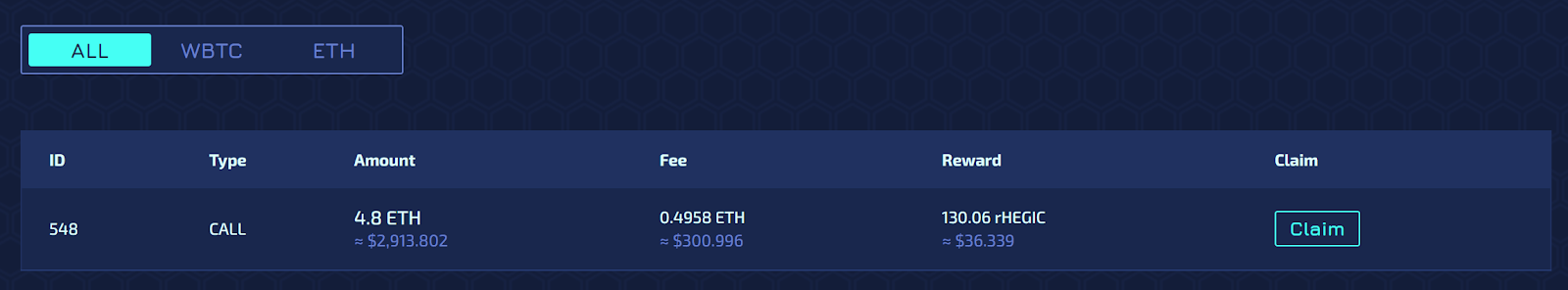

In order to see your contract track it’s performance, you may have to refresh your browser first. You can observe your contracts over at the top of the “Holder” tab under “Your Options Contracts”.

Here you will be able to exercise your call option(s) for value if the current price of the asset is in the money. This could mean it’s above the strike price for a call option or below the strike price for put options! You will only ‘break even’ if the value of the option exceeds the cost of the option.

👉 In order to realize your gains, you MUST exercise your options contract before the expiry date. If they expire in the money or profitable you will receive NOTHING and miss out on receiving value.

Secondary markets for trading the options contract are not yet available. Coming soon!

BONUS: Earning rHEGIC

As an early participant of Hegic, users that buy options will receive a reward in the form of rHEGIC, a tokenized asset convertible 1:1 for HEGIC at a later defined date. The current estimations are said to be sometime in 2021 but keep an eye out on the Discord for more information.

The amount of rHEGIC is relative to the size and duration of your option. Users can claim their rHEGIC on the “Token Holders” tab under “Liquidity Utilization Rewards”.

Conclusion

The DeFi ecosystem is just starting to see the growth of more robust options markets. But it’s still early in the game.

With Hegic, you can currently only purchase and exercise options. Secondary markets that allow for trading of existing options is still being developed. Regardless, given that option markets represent trillions in volume in traditional finance, there’s still a long road ahead.

Hegic only launched on mainnet a few months ago after all!

For those that want to learn more about Hegic, check out the Gitbook for more information or hop into the Discord if you have any questions.

Action steps:

Understand how you can use ETH and BTC options to your advantage

Try trading ETH or BTC options—you can go long or short!

Read our previous pieces on DeFi options:

Author Bio

Tempted is a Hegician at Hegic Protocol, a decentralized protocol for options contracts.

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.