How to make money selling ETH options

How cool would it be to have Bankless in video format? That’s where I want to go next. But I need your help! If you want the Bankless program in video give 1 DAI & let’s make it happen!

Dear Bankless Nation,

If we’re right about ETH you won’t have to sell ETH for money.

ETH will become money.

What I mean is…

You won’t have to sell ETH to do your banking—your banking will be built on ETH.

Seem far-fetched?

Price volatility aside there’s already less reason to sell ETH than there was a few years ago. Today you can use ETH to mint stablecoins for payment, as a trading pair, as a collateral for lending, and soon—you’ll be able to stake ETH as a bond to secure the Ethereum protocol.

Banking is being built on ETH.

If you see this future then long ETH is your default position.

And if you’re already long ETH then why not earn some extra ETH by protecting others against short-term ETH volatility? You can do this by selling ETH put options on Opyn.

This means you deposit USDC as collateral, you get paid in ETH up-front, and worst case if ETH price drops you just have to buy more ETH at the lower strike price. (More ETH at a lower price—not a bad deal for an ETH bull!)

Sounds interesting right? Then let’s dig in!

-RSA

P.S. I said “worst case” but the worst case in using DeFi is always loss of your entire collateral due to technical or economic risk we’ve discussed previously—so be careful!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Btw, we just released episode 3 of our new Tuesday video show—State of the Nation!

Watch State of the Nation #3 - GROWING

The Flippening is Back, India Banning China, DEXs going parabolic

TACTICS TUESDAY:

Tactic #44: How to make money on ETH options

Guess Post: Aparna Krishnan, Co-Founder of Opyn

This tactic builds off Tactic #40—How to protect your ETH with Opyn. Skim through that tactic before you dive into this one.

This tactic is for those of you who are long ETH and aren’t afraid of the ETH volatility. This is for the risk-seeking. Those of you who’ve decided to double down on the ETH volatility risks to make some money. Those of you who aren’t happy with that USDC return on Curve or USDC interest on Compound and are willing to take a riskier bet on your ETH long. Here’s how to make money by selling ETH put options with Opyn.

- Goal: Earn a premium by selling protection on ETH volatility using Opyn

- Skill: Intermediate / Advanced

- Effort: 5 minutes

- ROI: 100-400% annualized ROI (if you’re never exercised on)

⚠️ Please note that if someone exercises your option, you may lose some or all of your collateral! As mentioned, this tactic is risky but can pay off if executed properly!

What is Opyn?

Opyn is built on a generalized options protocol called the Convexity Protocol.

📜 RSA Note: Before you begin this advanced tactic, make sure you understand what Opyn is and how options contracts work —we cover it in detail in Tactic #40!

Selling Put Options

By selling a put option on ETH, you are selling someone the “right but not the obligation to sell you ETH at a pre-specified price”.

If the price of ETH remains above the strike price, then the seller of the option keeps the premium they earned for selling the option and is able to withdraw their USDC upon the option expiring.

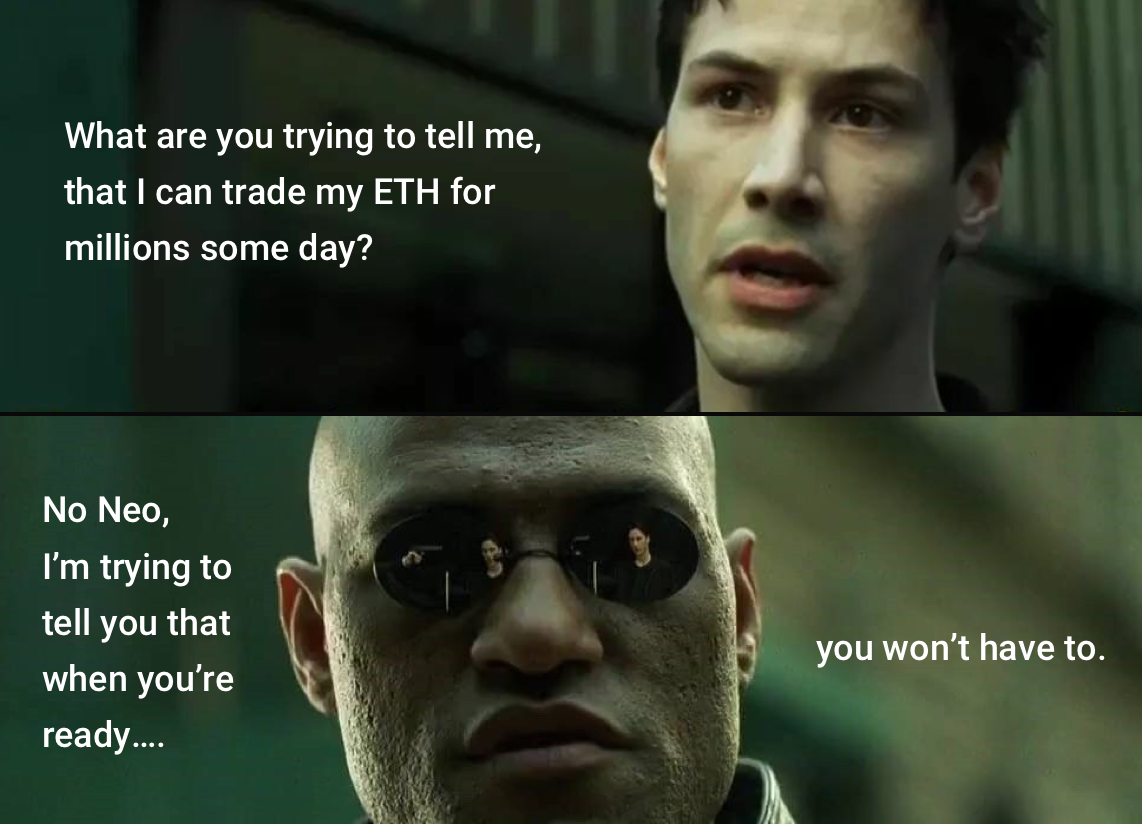

If the price of ETH falls below the strike price, then the seller of the option may be obligated to buy ETH at the strike price (which could be higher than the market price of ETH). The image below demonstrates the payoff for a seller of a $200 Strike Put option on ETH.

How to use Opyn to provide ETH protection to other users

Requirements: The following section only works on a desktop browser. You will need your computer and MetaMask for the following to work.

You will also need some USDC and ETH (for gas) in your wallet.

👉 Note: Gas is very expensive these days. In order to make a positive ROI by selling ETH options on Opyn, you’ll need a fair amount of capital to get started. We’re recommending at least $500+.

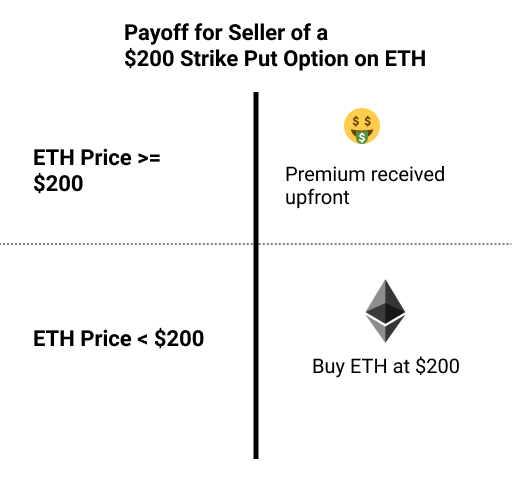

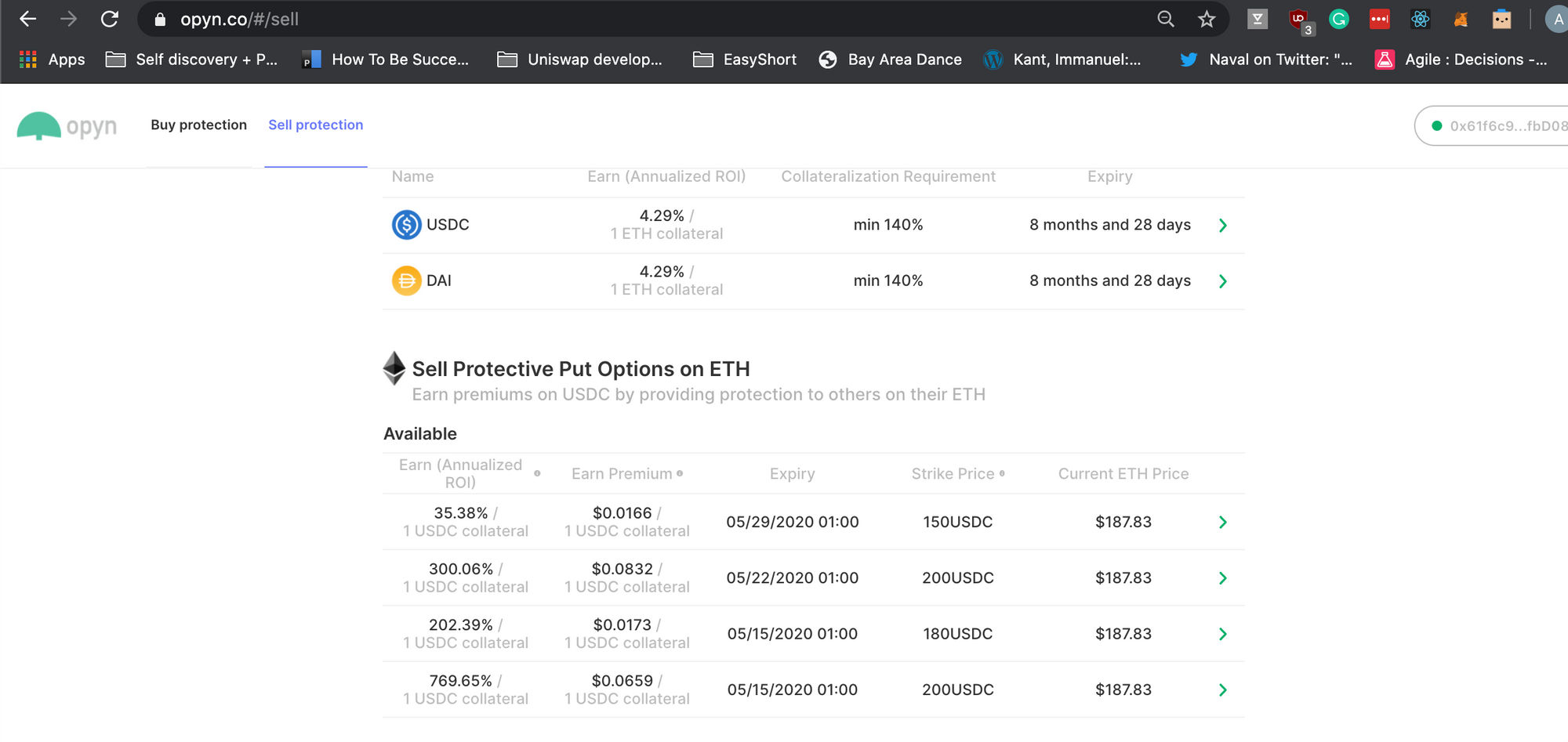

- Go to https://opyn.co/#/sell

- Connect your wallet by clicking the “Connect Wallet Button” on the top right corner. You should then see a page similar to the one below:

Scroll down to the “Sell Protective Put Options on ETH Section”.

The expiry is the date that your protection will expire on. You are providing protection until that date.

Strike Price is the pre-specified price that you are agreeing to buy ETH at if ETH falls in price. You are effectively selling someone “the right but not the obligation to sell you their ETH at that price (the strike price)”.

The earned premium is how much you could make upfront per 1 USDC that you lock up as collateral.

The Annualized ROI is what your returns over the course of a year could look like if you continued to earn the current rate of premiums.

Choose the parameters that work best for you and click on that specific row.

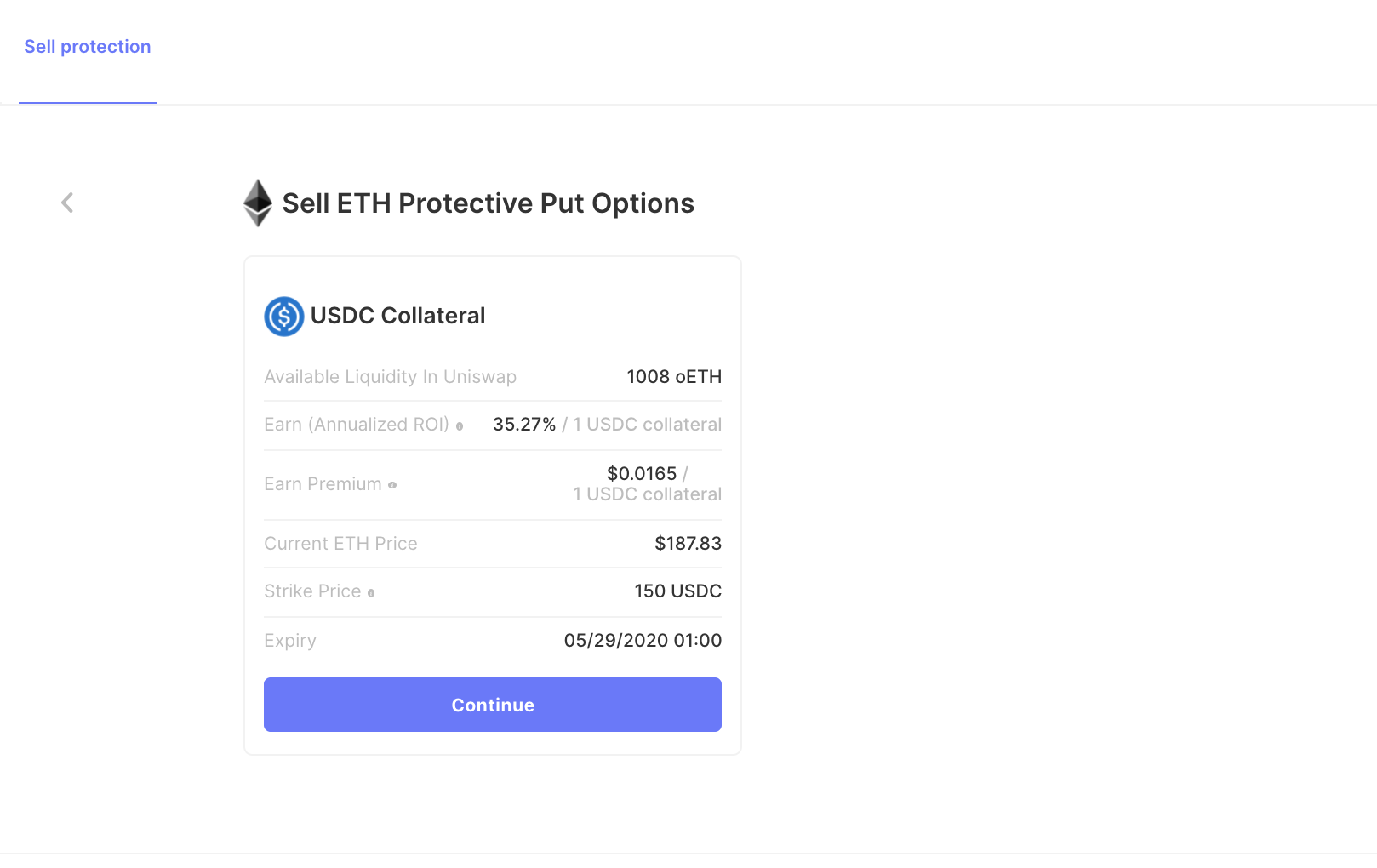

You should see the page below. Click on the continue button if the strike price, expiry, earn premium all look good to you.

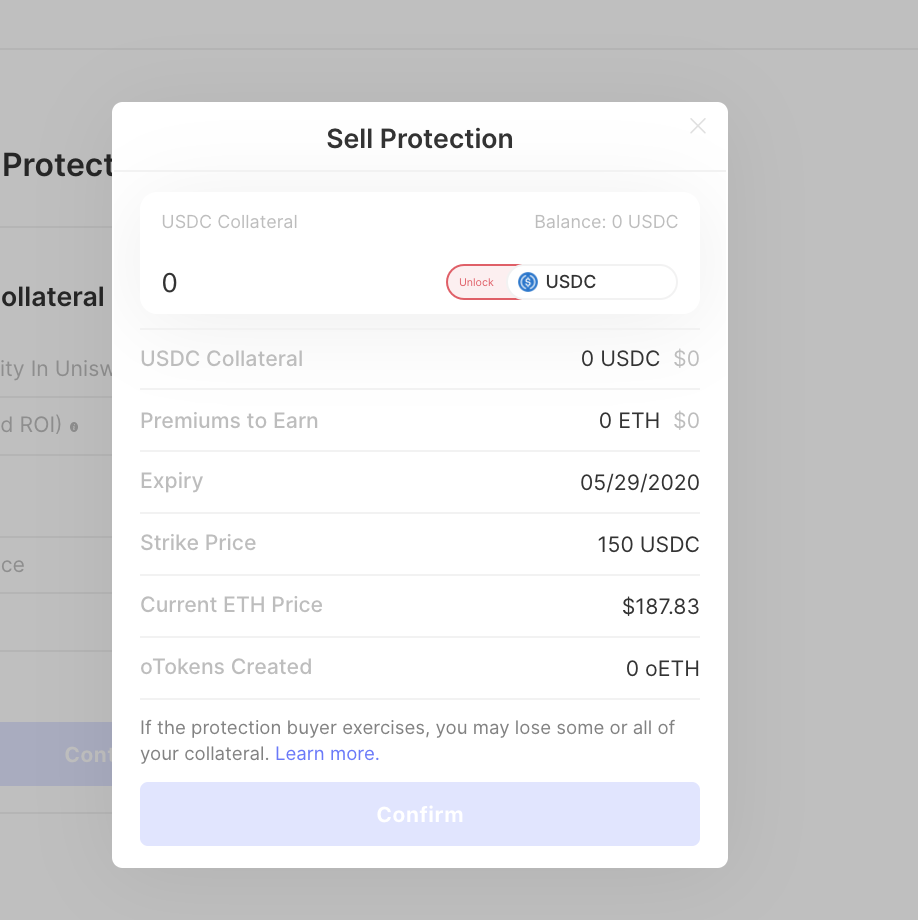

- Unlock the modal that you see below to allow the contract to spend your USDC.

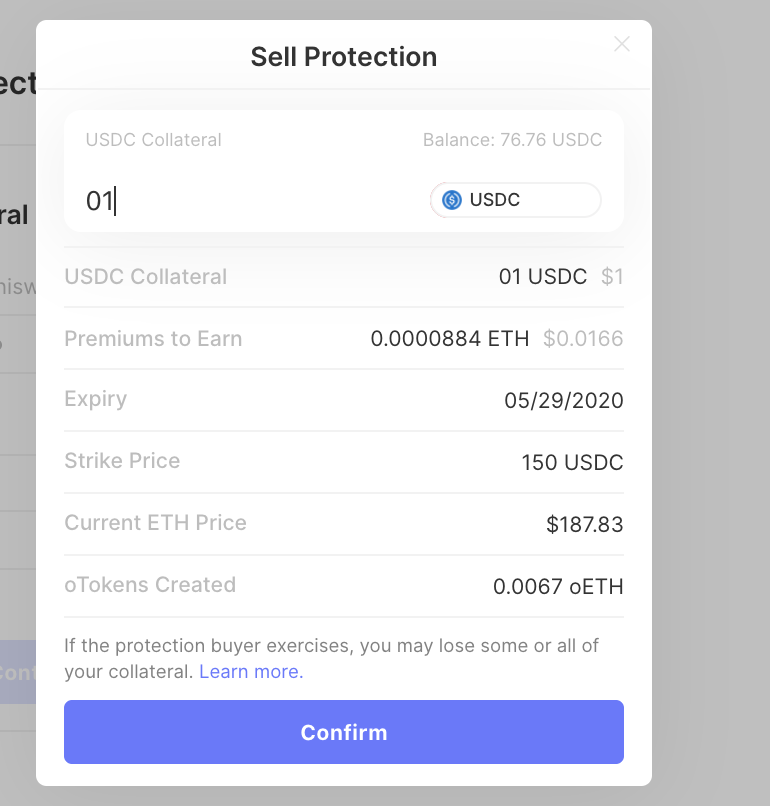

- Enter the amount of USDC that you want to put down as collateral

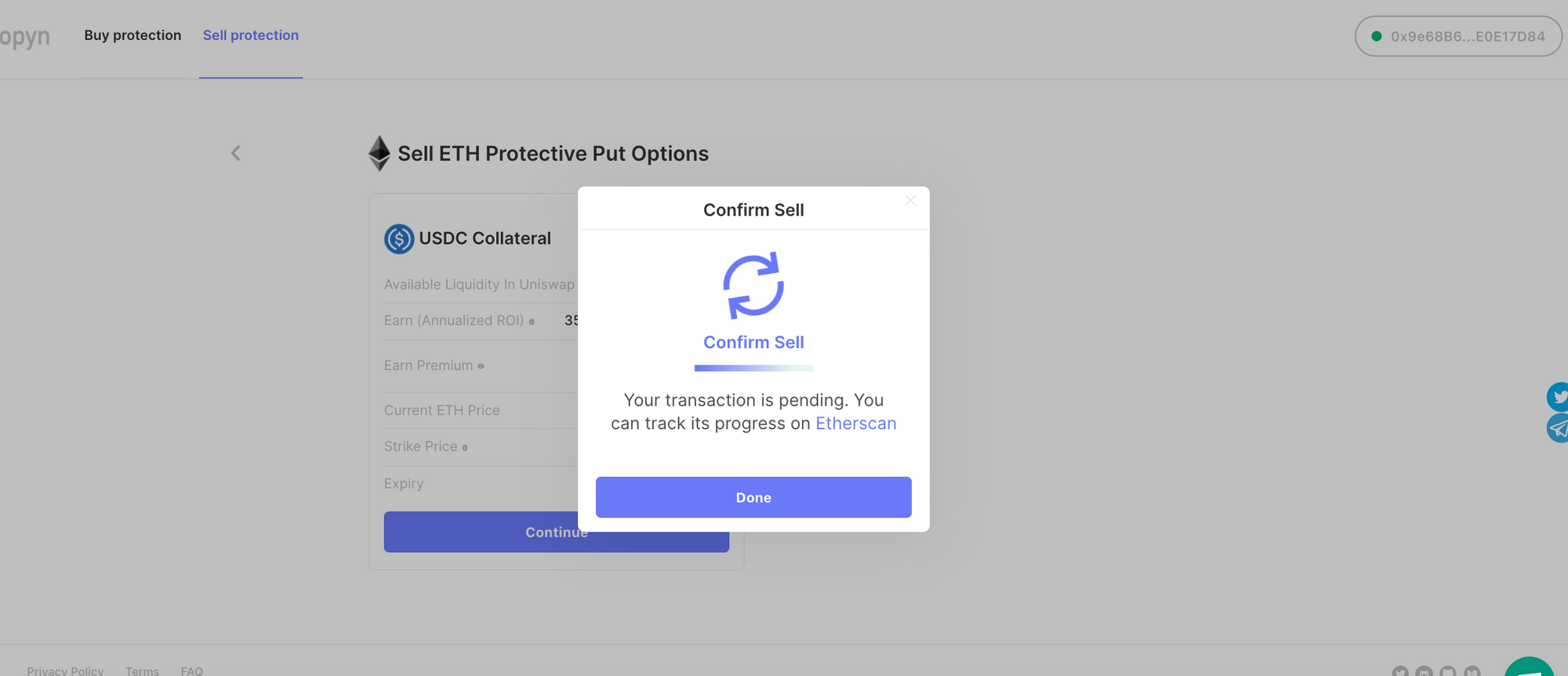

- Click “confirm” and approve the transaction through MetaMask. Once that is done, you should see a screen like this

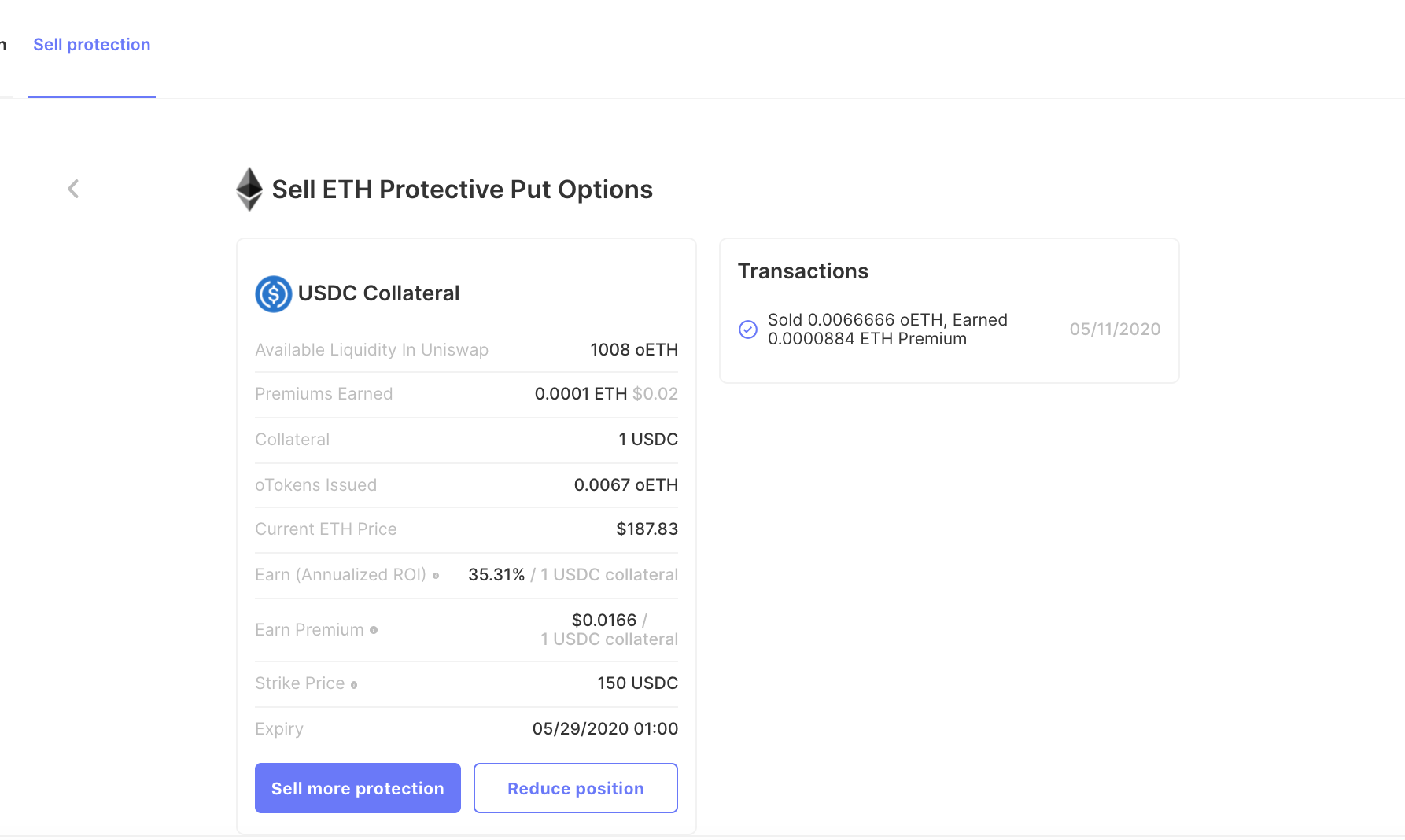

- Once the transaction has been confirmed on Ethereum, you should be able to see your position on this page. Refresh the page to see the new view.

And that is it! You have earned a premium by selling a put option. You should see the ETH in your wallet.

What happens now? If ETH falls below the strike price, you might get exercised on. In other words, someone might sell you their ETH for the USDC that you have locked in the vault.

⚠️Note that your USDC is locked in the smart contract until the expiry date. Once the option expires (and no one exercised it), you can collect your USDC back. If someone exercised your put option, you will see some ETH in your vault which you can collect instead (it’ll be less than the value of your collateral).

You can sell more protection now if you wish to!

You also have the ability to close out your position early and take out your USDC before the expiry. If you want to close out your position earlier, you will have to

Buyback the oETH tokens from the respective Uniswap pool

Burn the oETH tokens from this front end

Remove your collateral from this front end

If you want to learn more about options or run into any trouble, join the Opyn Discord!

Further Resources to learn more about options

Author bio

Aparna Krishnan co-founded Opyn, a DeFi protection and risk management platform. Aparna joined the Thiel Fellowship after attending UC Berkley where she was an active member of Cal Blockchain - one of the leading student blockchain organizations in the US.

Action steps:

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.