How to speculate on DeFi tokens with binary options

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

0 or 1.

Win or lose.

All or nothing.

Either SNX is > $6 on September 30th 2020 and you win. Or it’s not and you lose.

That’s a binary option. Pretty simple right?

That’s the beauty of them. Binary options are simple. They’re flexible.

And now…you can don’t need a bank to use them.

Use them for fun. Use them as a way to hedge against the volatility of markets.

Let’s learn how to bet on DeFi tokens with binary options.

-RSA

P.S. The three risks of using DeFi certainly apply…careful!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Btw, we just released episode 6 of our new Tuesday video show—State of the Nation!

📺 Watch State of the Nation #6 - EXPONENTIAL w/ Special Guest: LUCAS CAMPBELL (DEFI TOKENS, ETH PUMPING GOOD, TOKENS VS ETH)

TACTICS TUESDAY:

Tactic #47: How to speculate on DeFi tokens with binary options

Guest Post: Deniz Yilmaz, Product & Community manager at Opium

If you’re part of the Bankless community, you know that DeFi markets can get very hot, very fast. Can binary options help you catch upside on these asset moves?

Decentralized finance has proven its potential over the past few years, but with the introduction of liquidity mining and Compound’s recent face-melting $COMP token valuation, we have effectively entered a new phase of explosive growth in DeFi.

For those early adopters who are willing to educate themselves and take on the risk, there’s opportunity to profit from the growth in the sector. In this tactic, we’ll dive into speculating on DeFi tokens using a special type of derivative: binary options.

- Goal: Earn alpha by speculating on DeFi token valuations via binary options

- Skill: Intermediate

- Effort: 15 minutes

- ROI: Variable (payout is fixed but options contract price determined by market)

Binary options 101

Let’s start with the basics.

Just like other cash-settled financial derivatives, options are financial products that provide exposure to future price movements of an underlying asset without actually owning the underlying asset.

In traditional finance, there are a lot of option types available. Some examples are vanilla options that are physically-settled (ie. forces you to actually buy or sell the underlying asset) and cash-settled options with fixed initial margin (ie. potential payout in cash is known upfront). The payoff of these options are depending on the actual price of the underlying asset at the expiry of the option.

The higher or lower the price of the underlying asset, the higher or lower the payoff for the counterparty that was right.

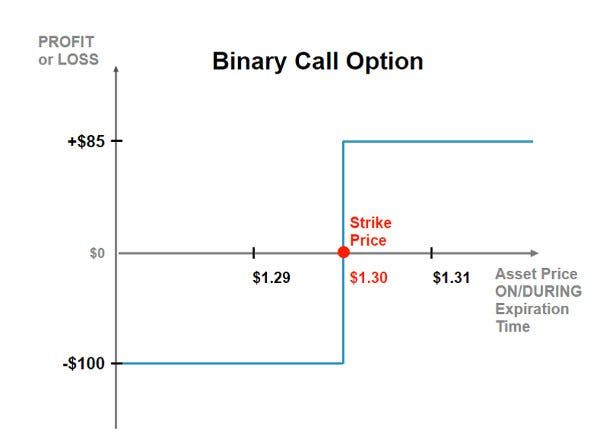

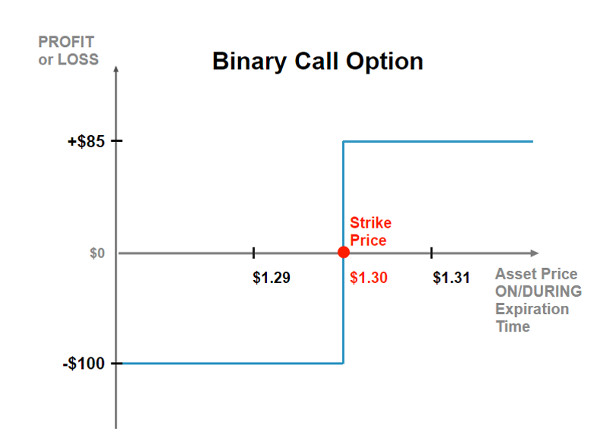

Binary options are different because of their steep payoff function. A binary options trader either wins the full margin locked in the option contract or loses it.

Winner-take-all. There is no in-between.

This simple dynamic makes binary options very easy to understand and therefore a good introduction to trading derivatives. However, professional traders will prefer other types of options contracts as they offer more advanced trading strategies.

Above — payoff chart of an example binary option

How do binary options work?

In this tactic, we will consider two implementations of binary options in DeFi: Synthetix and Opium.

The Synthetix implementation of binary options is based on so-called “Pari-mutuel markets”, which means that the payout of winners to losers is determined by the relative capital pool size of longs and shorts.

🧠 Pari-Mutuel = Bet Together. This means all bets go into one pool so the price of any given contract reflects the opinions of market participants. In other words, you are competing against other participants, not the house.

Every binary options market on Synthetix has a “bidding phase” in which traders can place bids for long and short positions.

After a fixed time period, the bidding phase is closed and the payouts are fixed based on the spread between long and short bids. Traders can then either trade their positions on secondary markets or wait until maturity. At maturity, the winning traders can exercise their options for the previously determined payout. Traders can specify how much margin they want to lock upfront, however, their potential payoff is unknown until a later stage.

On Opium, binary options are implemented based on a fixed initial margin which means that the maximum payoff of losers to winners is known upfront and therefore risk is mitigated. Professional traders who use options to hedge their trading risks generally prefer this implementation of decentralized derivatives. Traders can get the desired price exposure through buying a certain volume of long or short contracts for the right price (eg. a trader buys 3 binary options contracts on Opium with $50 margin each to have a total of $150 invested).

In comparison, Synthetix currently offers more markets and guaranteed execution. Binary options on Opium are more predictable and therefore more suitable for traders that want to hedge risks, however, execution of trades is depending on liquidity.

Why are binary options useful in DeFi?

Options can be used to speculate on both price drops and price increases of a DeFi token without owning the token itself, which mitigates risk and requires less capital.

Because of this simple fact, trading options are an effective method for speculating on the valuation of DeFi tokens without participating in the spot market. It also makes for an excellent option (pun intended) for hedging trading risk when you’re also trading spot markets (e.g. buying $COMP on Uniswap).

The above applies to options in general, but what about binary options?

Professional traders sometimes refer to binary options trading as “gambling” because the payoffs are either very high or zero. However, given the fact that volatility and valuations in DeFi can get real hot, real quick, traders might want to express their opinion about the market in a ‘binary’ fashion’ In other words, Binary options are a simple way of expressing strong optimism or pessimism on the value of a DeFi token.

Binary options are also relatively easy to understand and therefore serve a bigger audience.

How to trade binary options in DeFi?

Although this tactic considers two implementations of binary options in DeFi: Synthetix and Opium, let’s focus on Synthetix for now.

Requirements:

Trading binary options are best done using a desktop browser with MetaMask.

📚 Note: Make sure you have some sUSD in your wallet for placing bids (this can be bought on Uniswap) and a sufficient amount ETH to cover gas costs (it can get expensive!).

Step 1: Go to https://synthetix.exchange/#/options

Step 2: Connect your wallet using the top-right wallet icon, select MetaMask, and follow instructions in MetaMask.

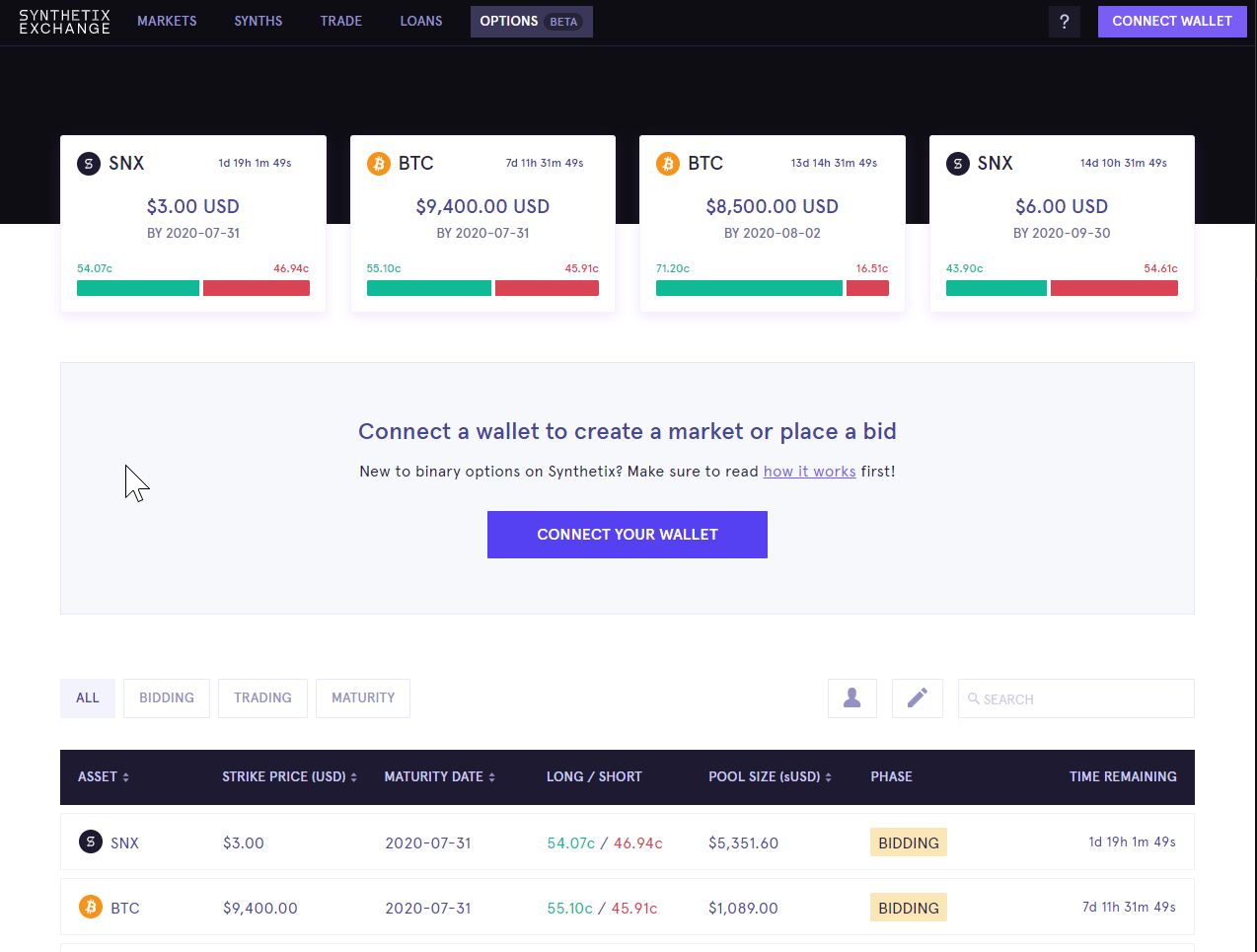

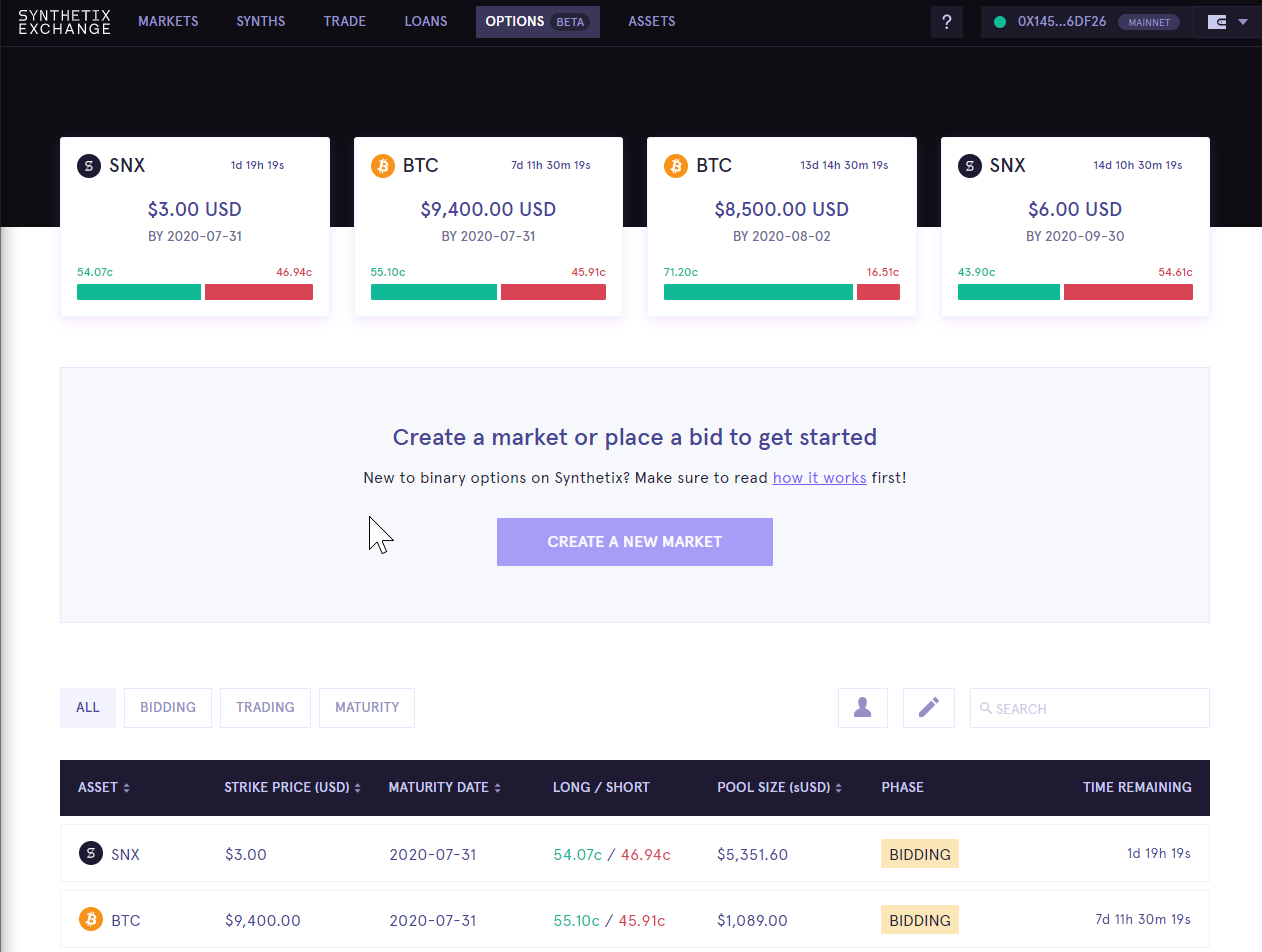

Once connected, you should see this screen which contains a table of all active markets. Synthetix also allows you to create your own markets.

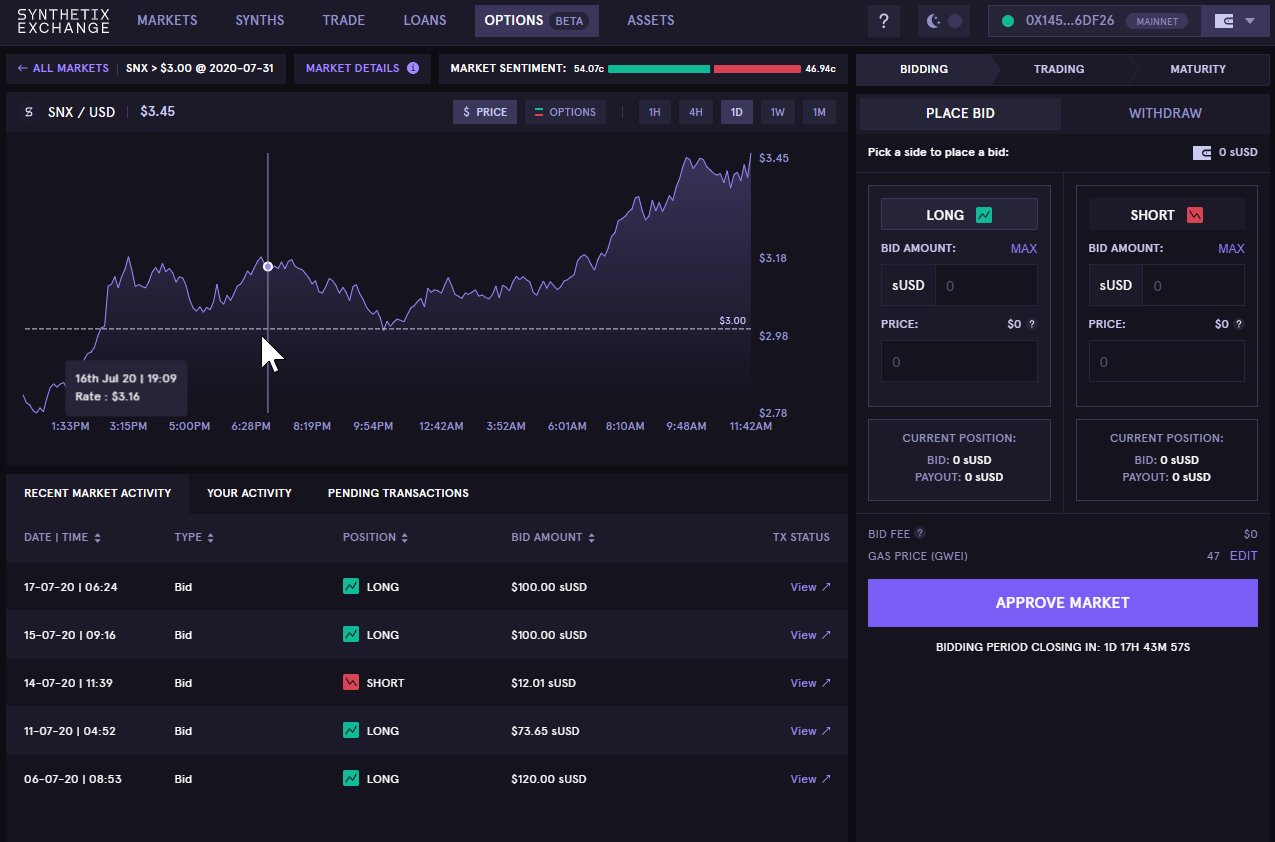

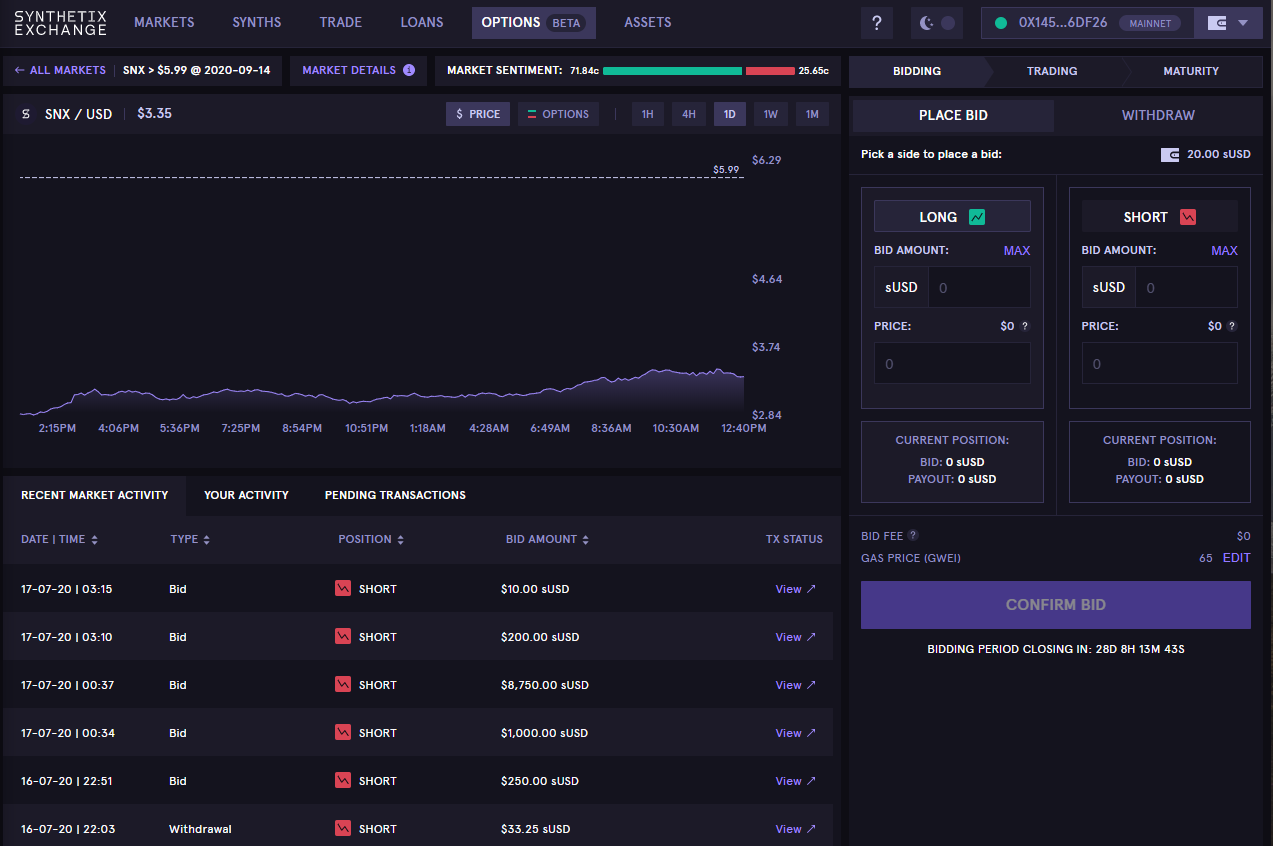

Step 3: For this Tactic, let’s select the SNX/USD market with a strike price of $5.99 and a maturity date of September 14th, 2020 which is currently open for bidding.

To elaborate — taking a long position in this market means speculating on the price of SNX being $6 or higher by the maturity date (September 14th). Taking a short position in this market means speculating on the price being lower than $6.

As explained before; the payouts for each side will be set based on the spread of long/short bids at the end of the bidding phase.

Find this particular market in the table by sorting on Pool Size (sUSD); it’s one of the most liquid markets currently available.

Click on the market and we will be redirected to the trading interface which looks like this.

Step 4: Click the “approve market” button to allow Synthetix.Exchange to spend your sUSD. Approve the transaction in MetaMask (make sure you set the gas price high enough to avoid a stuck transaction!).

Once the transaction is confirmed, you will be able to place bids on this binary options market.

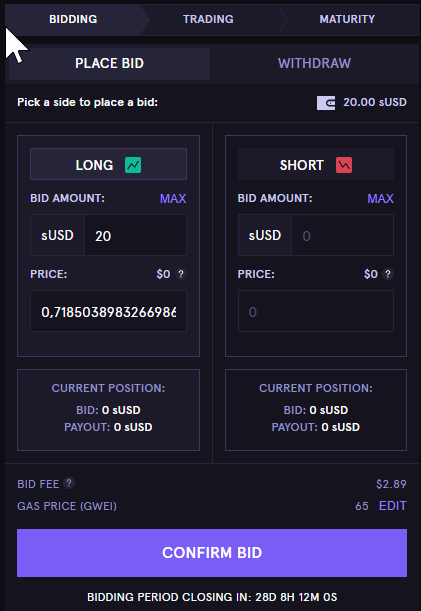

Step 5: Place a LONG or SHORT bid on the market by specifying the amount of sUSD you want to invest.

Remember, LONG means you’re betting that the price will be above $6 while SHORT means you’re betting that the price will be below $6.

The price of the LONG or SHORT position will automatically be calculated based on the spread of long/short bids. Take note of the bid fee and make sure the gas price is set high enough before confirming the bid.

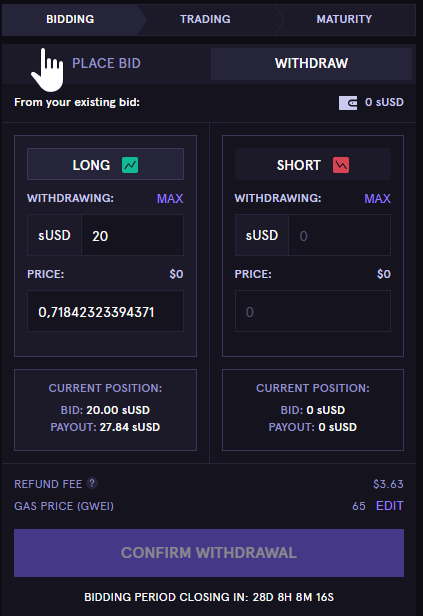

Step 6: Your bid will be visible in the interface once your transaction has been confirmed. You are allowed to withdraw your bid anytime during the bidding phase of this market, but you will pay a small fee for doing so.

Step 7: The bidding phase for this particular market ends on August 14th, 2020, after which you will be able to mint an ERC-20 token that represents your binary options. This ERC-20 can then be traded on secondary markets.

📚 Note: this only applies to advanced traders that want to trade their options via OTC or AMM markets. Most binary options traders will want to exercise their options at maturity, in which case you don’t have to do anything in the trading phase of the market.

Step 8: At the maturity date of September 14th 2020, you will be able to exercise any winning options that you own, which will award you with the payout in sUSD determined at the start of the trading phase. Done!

You now have speculated on the SNX price using a binary option. In our example, an SNX price of $6 or higher on September 14th, 2020 will award you with a payout of 27.84 sUSD based on a 20 sUSD bid (a nice ~40% return!).

Closing words

Was this your very first plunge into options trading? '

Then don’t stop here!

There are many types of options out there and option trading strategies are incredibly powerful. Derivatives in DeFi are still in the early stage, but it’s one of the biggest markets in traditional finance.

Get comfortable with options, level up, and get ready for the wave of decentralized derivatives! Look at the action steps below for a few other Bankless derivative tactics!

Author bio

Deniz Yilmaz is Product & Community Manager at Opium; a universal and open-source protocol for creating, trading, and settling any type of financial derivative on Ethereum. Deniz has been involved in the crypto space since early 2017 and has extensive experience in enterprise blockchain consulting, managing concept & product development projects for large multinationals.

Check out Opium Exchange to trade derivatives on DeFi tokens and hedge your risks in DeFi.

Action steps:

Try binary options on Synthetix for fun or to hedge a position

Learn about the flavors of options and their use cases with these other tactics:

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.