I developed a model to help us on our weekly journey to level up your open finance game. Simple and effective.

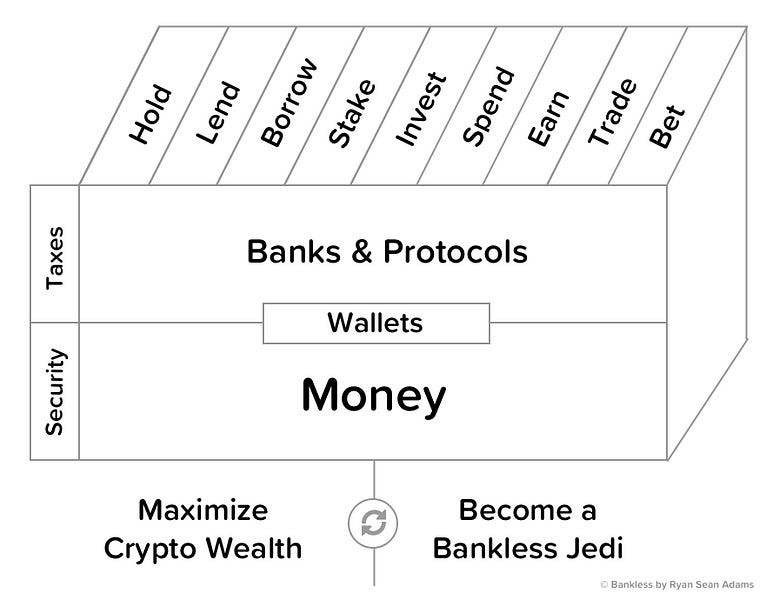

The Bankless Skill Cube.

We’ll refer to it during the program. It’s both a model for the crypto money system and a map of the skills you need to develop. Most of the tactics and strategies in the program fit in one of the boxes.

I’ll explain—let’s start with the objectives under the bottom of the cube.

Crypto wealth and mastery

Bankless is for those who believe crypto money is future money. For the believers like us, the objectives are two-fold:

- To maximize your crypto wealth

- To get good at being Bankless (like a Jedi)

Notice I said maximizing your crypto wealth. This means your wealth is denominated in crypto money, not denominated in fiat. So, increasing the amount of ETH and BTC you have -- not necessarily increasing your USD. We’re low-time preference people.

Second, becoming a Bankless Jedi means gaining mastery of each box in the cube. Everyone has different reasons for wanting mastery. Maybe you believe in a better system for the world. Maybe you’re here for the tech. Maybe you want things you can’t have in legacy finance. Maybe you see an opportunity. Any reason is fine.

Your reasons are why you’re putting in the work. They underlie everything else.

The crypto money system

The base layer of the cube is money. A layer up is Banks & Protocols. Wallets sit between them. The banks & protocols provide the money system its verbs: holding, lending—things you do with money. Together, this is the crypto money system.

It operates in parallel to legacy finance. A separate system.

Let’s walk through it.

- Money. The money layer forms the value store of the crypto money system. The reserve currencies. The liquidity. For us, the most important assets in this layer are non-central bank commodity monies like BTC and ETH rather than fiat-backed stablecoins like USDT or USDC, but both types are included here.

- Banks. The banks are the centralized financial institutions in crypto that provide the money verbs on top of the money. I call these crypto banks. They’re fiat ramps. They’re structured like traditional banking companies and FinTechs. Coinbase, BitMex, BlockFi, Binance are among these.

- Protocols. The money protocols are a new innovation, mostly available on Ethereum. Like the banks, they also provide money verbs but do so through code, not custody. They replace banking functions with protocols. They are permissionless, decentralized public goods. Maximally bankless. Maker, Uniswap, Compound, and Set are among these.

Between these layers are the Wallets that hold the money and help you interact with banks and protocols to do something. That brings us to the verbs.

The money verbs

The money verbs are the things the crypto money system helps you do with your money. Like legacy finance, you may want to:

- Hold—custody and secure your money for saving

- Lend—generate returns by lending your money to protocols or banks

- Borrow—pay funds to borrow money from protocols and banks

- Stake—special case of lending—lend money to a protocol to generate returns

- Spend—use your money to pay for something

- Earn—do something of value to get additional money

- Trade—exchange your money for something of value

- Bet—risk and earn money by making a bet (shorting/longing included)

In crypto, there’s generally a way to do each verb either via crypto bank or money protocol. We’ll cover both.

And we’ll work to achieve mastery of these verbs. The open finance skills you develop here may pay dividends down the road as the world adopts crypto—like learning computers in the early 90s before everyone else.

There’s one last area we’ll work on in the program.

Security and Tax Skills

Security and taxes are routine maintenance. The stuff you have to do. Like brushing your teeth. Good hygiene here will save you thousands, so we don’t skip it.

Security in crypto comes down to key management. Sounds simple. But if you’re new, there’s a lot to do before taking custody of your crypto. The good news is that security is a learnable skill, and the tools are getting better.

On taxes. First rule: we pay them. Always. This is not a program for tax evasion. Second rule: we avoid them. Whenever possible. If you’re a long-term holder, you have tax optimization options the traders don’t. Understanding tax ramifications helps you make smart decisions that optimize your crypto wealth.

Summary

The skill cube is our map.

The objective: to maximize crypto wealth and become a bankless jedi.

The model: develop tactics and strategies for this parallel money system. A system that has crypto money at its base and crypto banks & money protocols that allow us to accomplish things with our money.