Why Pomp is wrong about ETH

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

In 2015 people said Blockchain not Bitcoin.

In 2020 people said Ethereum not Ether.

Both wrong.

Lucas explains why ether the asset must grow with Ethereum the network. Not wild speculation—the data makes the case.

I suppose you can ignore the data. Dismiss the arguments. Resort to maximalism.

Maybe they’re right.

Or maybe ETH is money is the greatest alpha leak of this cycle.

Place your bets.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Guest Post: Lucas Campbell, Analyst for Bankless & Growth at DeFi Rate

The argument against Pomp’s stance on ETH

“Ethereum, the network, is going to empower an incredible amount of innovation over the coming years. It is going to be one of the core pieces of infrastructure for building a decentralized world.”

-Anthony “Pomp” Pompliano

The past few weeks in crypto has been filled with a fair amount of tribalism. What sparked with the ETH Supply Gate has now resulted in multiple debates within the broader crypto community.

A few ETH vs BTC examples:

- “ETH doesn’t know its supply” tweet (SOTN reply with Vitalik)

- Vitalik vs Samson Mow on WBD? (RSA + David comment 🌶️)

- So many endless tweet threads…even satire!

The issue, while it has been solved, brought a lot of controversy to the Ethereum ecosystem. Simply put, there was a discrepancy in ETH’s circulating supply across major data providers. What came from the argument was that reporting ETH’s total supply is more nuanced than most originally thought. Especially in the eyes of the Bitcoin community where the “there’s only 21M BTC” meme reigns supreme.

In response to Supply Gate, prominent Bitcoiner Anthony Pompliano recorded a podcast with his partner Jason Williams at Morgan Creek Digital—a crypto-focused investment fund. The podcast kicked off with discussing this issue while diving into Pomp’s stance on Ethereum, ETH as an asset, and the divergence between the two.

While there were a lot of valid arguments as well as some surprising comments from Pomp, there were also a handful of misconceptions that I felt the need to point out and respond to.

So here it is. The argument against Pomp’s stance on ETH. You can listen to his argument here (starts at 4:45 mins in):

Ethereum will succeed but ETH won’t accrue any of that value

This is the core piece of the argument that drove me nuts. Despite the fact that Pomp believes Ethereum will succeed in the future, he doesn’t think any of the value will accrue to ETH beyond pure investor speculation.

I’ll caveat this recognizing that he did say there was some serious mental gymnastics on his thought process.

But in short, Pomp’s argument draws a parallel between Ethereum (the network) and ETH (the asset) with Ripple (the company) and XRP (the asset).

Ripple is a software company for banks. They sell financial software to banks and the company prints money—both literally and figuratively. Everyone would love to be an investor in Ripple the software company given its success. The problem is that retail investors generally believe that the adoption of Ripple software and the success of the company drives value to XRP, the digital asset.

Where that falls off, according to Pomp, is that there’s no value accrual mechanism that links the success between Ripple and XRP.

No comment on this as I don’t know enough about XRP to make an argument for or against it.

Why ETH accrues value

Three reasons. I’ll keep it simple.

1) A demand for Ethereum’s blockspace makes ETH valuable today

If there’s demand for blockspace on Ethereum, there’s demand for ETH. Any transaction that leverages Ethereum as a settlement layer must pay a fee denominated in ETH (which is very expensive these days btw).

This means that anytime someone wants to lend or borrow an asset from Aave, provide liquidity to Uniswap, or bet on some future event with Polymarket, it demands ETH in some respect. Not to mention anytime someone transacts with any of the $500M+ BTC or the $13B+ in crypto dollars circulating the Ethereum economy. Or anytime developers want to deploy a new smart contract. Or even when an avid community deploys a DAO for efficient social coordination on a digital scale.

There’s virtually an endless amount of use cases for Ethereum’s blockspace. All of it drives a tiny demand for ether.

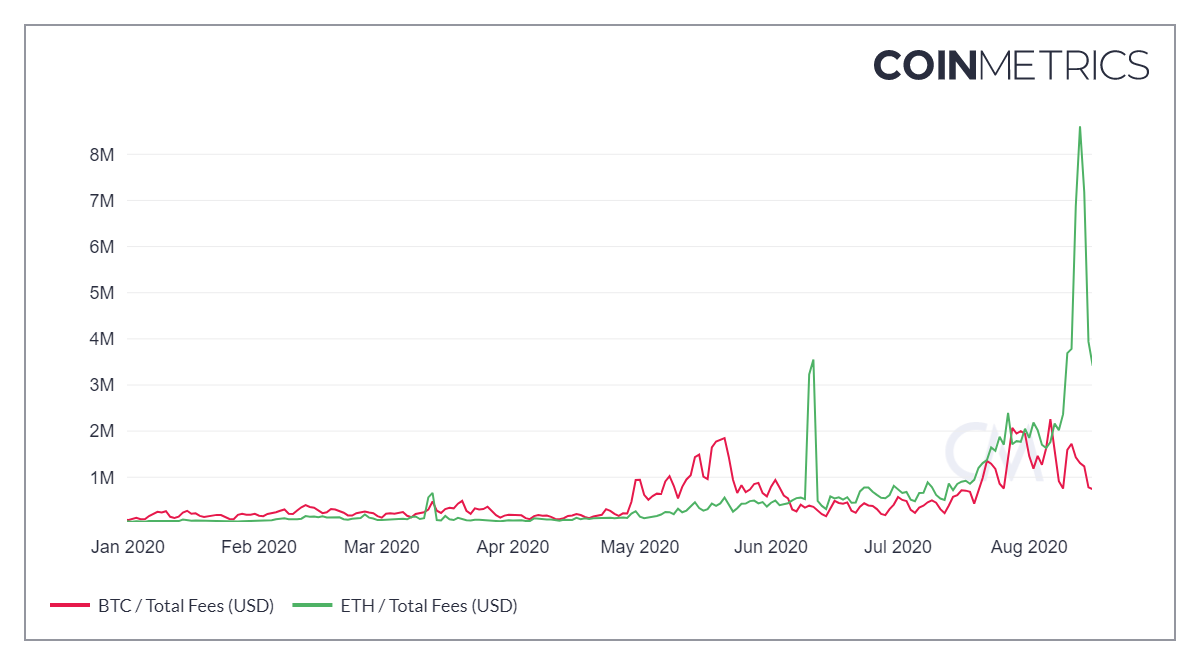

As a matter of fact, this number has recently reached all time highs as Ethereum miners were paid over $8M in fees in a single day - over 6x more than Bitcoin in the same time period.

Above — transaction fees paid on Bitcoin vs. Ethereum. Data via CoinMetrics

With that said, I will concede that this correlation isn’t perfect. Transaction fees on Ethereum are reaching new levels while ETH still sits well-below previous all time highs.

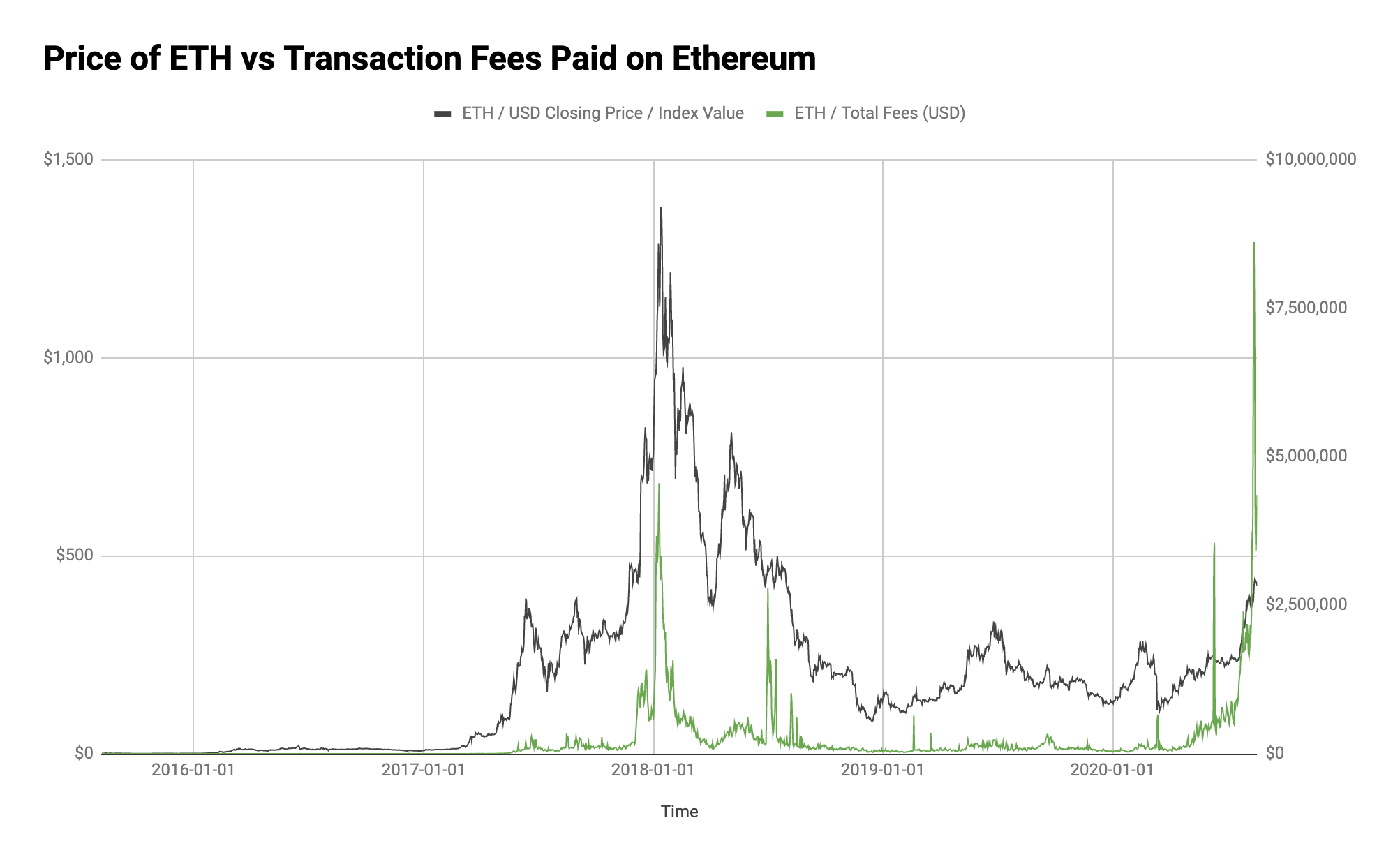

Above — Ethereum price vs. transaction fees paid on the network. Data via CoinMetrics

2) ETH as trust-minimized collateral makes ETH valuable today

Paying transaction fees in ETH is only part of the story today.

The other part comes from the proliferation of decentralized finance (DeFi) and the need for trust-minimized collateral. Regardless of which side of the aisle you stand, the core ethos and long term goal of crypto is trust-minimized money & finance. A separation between state and money.

No one should have to trust or rely a single entity, institution or individual for access to financial assets and services. It should happen for anyone, anywhere, at any time. Whether it’s holding onto a non-sovereign, fixed supply digital store of value (Bitcoin) or accessing permissionless financial applications, the goal of crypto is always trust minimization.

DeFi attempts to become a critical movement towards this mission. It aligns perfectly with the ethos of crypto as Ethereum’s money protocols are early-stage, open-source financial software striving for trust-minimization.

Many of these open protocols require users to lock up capital in order to access said financial services. Want to mint your own dollar? Lock up capital into Maker and print yourself a few Dai (which you’ll have to pay interest on).

And guess what? Many of these protocols drive a demand for ETH as the primary source of capital to fuel these protocols.

Why? Because ETH is the most trust-minimized asset on Ethereum. Any other asset on Ethereum requires some other protocol or custodian to exist, forcing a higher degree of trust than the network’s native asset. Ether as a source of capital holds priority in the Ethereum economy.

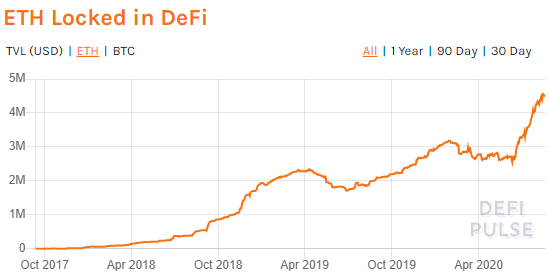

This demand for ETH from DeFi is apparent in the data too. There’s now over 4.5 million ETH locked up in Ethereum financial protocols—valued at nearly $2B. This means that roughly 1 in every 25 ETH in circulation is locked up in DeFi right now.

Above — ETH locked in DeFi. Data via DeFi Pulse

At the beginning of the year, it was only 1 out of every 38 ETH. In 2019, it was 1/58.

The growth is there. If this trend continues, eventually the demand for ETH as trust-minimized collateral for open finance will soak up enough ETH to drive fundamental value to the asset.

What happens when this number increases from 4% to 10%? Or even 20% of all ETH?

The laws of supply and demand will eventually take over. God forbid Ethereum undergoes another block reward reduction or finds another value-added use case.

But wait. There’s more.

3) Ether’s future value proposition as a productive asset

Why are we talking about ETH’s value proposition today? People invest in the future.

You don’t invest in Tesla for what they’re doing today. You invest in them for what they’re going to do and what they’re going to become. Because the real money is made by the people who see the future before anyone else.

And while fees don't accrue to ETH holders today, they will in the future. Ether represents the right to Ethereum’s future cash flows. A productive asset! And those cash flows are hitting all time highs as we speak.

Equally important, ether has rights to Ethereum’s cash flows via both active participation (validation) and passive participation (holding). This is done through two mechanisms:

- ETH becomes a productive asset via Proof of Stake in Ethereum 2.0. Users deposit ETH in order to secure the network and in return receive a claim to its cash flows. Ether effectively becomes a crypto bond.

- EIP 1559 introduces a burn whenever there’s a significant demand for Ethereum. What results is a universal dividend to all ETH holders as everyone’s percentage share of the network rises equally. In theory, if Ethereum is used enough, EIP 1559 can actually create a deflationary environment despite ETH having perpetual issuance and no supply cap.

Whether or not you elect to become a validator in Ethereum 2.0, anyone that holds ETH today has the right to the network’s future cash flows. That could be incredibly valuable one day.

Yes, Ethereum 2.0 is not here today. It’s actually going to be awhile before it launches in full production. But as mentioned, the real money is made by those who are willing to take that bet before anyone else. If Eth2 launches and succeeds, those that took the risk today will be rewarded handsomely in the future.

To wrap up this correlation:

If someone believes that Ethereum will act as a core piece of infrastructure for the decentralized future, there’s a demand for Ethereum’s blockspace. If there’s a demand for Ethereum’s blockspace, there are cash flows. And since ETH represents the future right to those cash flows, its value is directly tied the success of Ethereum (the network).

No mental gymnastics needed.

Closing Thoughts

When we tie all of this together, there’s a rather compelling investment case for ETH as an asset and causal path for ETH value accrual as Ethereum grows.

To summarize: If Ethereum as a network is successful, ETH will accrue value because:

- A demand for blockspace drives a demand for ETH to pay transaction fees (today)

- A demand for DeFi drives a demand for ETH as trust-minimized collateral (today)

- ETH represents the right to the network’s transaction fees (future)

If Ethereum is successful as a global settlement layer, ETH must accrue value.

When looking at the fundamental growth of the network in its first five years in existence, it’s undeniable that there’s tangible value being built on the network. People are paying millions of dollars per day to miners right now in return for the network’s blockspace. All of it is paid in ETH.

Ethereum is becoming an invaluable global settlement layer for the internet of value. When you understand how ETH accrues value from that success, it actually becomes irresponsible to not have any exposure to that asset.

Even if it’s only a few hundred basis points.

Rapid Fire Counterpoints

- What about supply gate? - Two key takeaways from the ETH supply gate. (1) It’s harder to verify ETH’s circulating supply as it updates frequently and (2) no Ethereum clients offer this native functionality at the moment (but they can if they want to). You can also verify 99.8% of ETH’s current supply in real time from any major data provider at any time. It’s also verifiable by 100% if needed, it just takes a bit more work. While it’s not perfect, this is still a massive improvement over both gold and fiat currencies.

- BTC is a *better* money though - Not here to argue whether one asset is money or not. Or if one is better money than the other. As stated, they’re both technically money as money is largely a socially coordinated belief system. It simply depends on what you’re optimizing for. Pomp says good money should at least protect your wealth. There’s not an extensive amount of historical data on this compared to gold and other assets but using this argument, both BTC & ETH have done far more than protect holders' wealth since their respective geneses.

- People have sold and moved less BTC than ETH - BTC’s money game is to buy it and hold it. You just let it sit there in your wallet and its value goes up over time - elegant in its own respect. ETH has more “money games” as its network enables ways for you to lend, borrow, bet, and dozens of other money verbs with it. Simply put, there’s more to do with ETH so it’s not a very fair measure given it’s apples to oranges (which are both fruit btw).

- ETH is identical to fiat currency - ETH’s issuance schedule is not completely programmatic—true. However, it is transparent and verifiable (although, as we learned, it’s not as easily verifiable as Bitcoin). Moreover, Ethereum is open-source software. If people don’t like an issuance change or loophole that prints 25M ETH to a single holder, it can always be forked. You always retain the right to opt-out. Again, it’s a substantial improvement over a fiat currency despite the “no supply cap” meme. Besides…are you sure fixed cap security issuance is sustainable?

Action steps

Read these pieces on ETH’s value accrual:

Author Bio

Lucas Campbell is an Analyst for Bankless and leads Growth at DeFi Rate. He also engages in token economic & DAO advisory with 🔥_🔥

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.