The Moneyness of Bitcoin and Ethereum

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

I think the author of today’s post would consider himself open but also somewhat skeptical of the idea that ETH is good money—Ethereum has to prove it.

Perfect.

Good thought-pieces should test our assumptions. Groupthink is boring.

And it’s clear Bitcoin and Ethereum are taking different paths to moneyness.

Hardness vs. utility?

Meme vs. economy?

Banked vs. bankless?

Scarcity vs. security?

Calcification vs. evolution?

There are many lens to compare these monetary experiments. Josef gives us his.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

The Moneyness of Bitcoin and Ethereum

Guest post by: Josef Tětek, analyst at TopMonks

The past two years have been a period of healthy crypto cleansing. Most of the altcoins fell from grace and their ATHs by more than 90%. Bitcoin has gradually reclaimed its throne with 60%+ in market cap dominance. For some, this is a clear sign of Bitcoin slowly becoming the best contender for the role of global non-fiat money. On the other hand, the fast-moving Ethereum DeFi development is nothing to be scoffed at.

In this text I’d like to analyze two approaches to achieve moneyness:

- Bitcoin’s approach is to focus on solidifying the foundation of monetary base; further aggregates may come later and only on 2nd layers/sidechains

- Ethereum’s approach is to aim at further monetary aggregates: lending, borrowing, derivatives; monetary base is a dynamic tool that shouldn’t stay in the way of developing the aggregates

Monetary aggregates

The fundamental difference between Bitcoin and Ethereum lies in their quite opposite understanding of what constitutes money. In today’s fiat currency world, money isn’t actually one definite thing. Usually we talk about money in context of various monetary aggregates, where the individual aggregates have various levels of liquidity and counterparty risk.

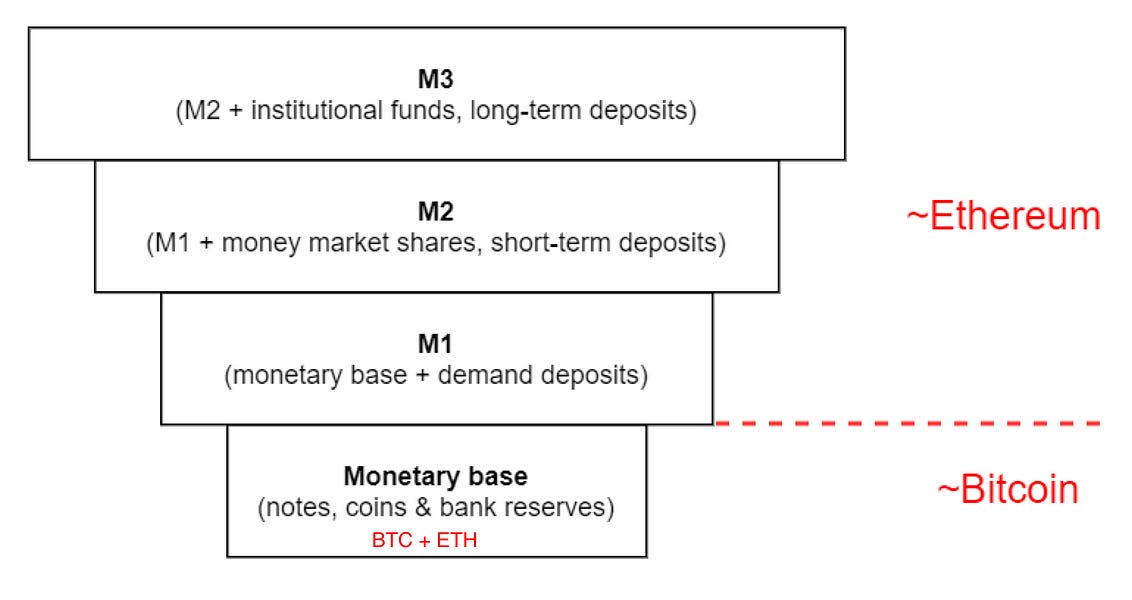

It’s useful to view today’s money as an inverse layered pyramid:

(Above) Bitcoin community focuses mostly on the base money qualities, while Ethereum as a community focuses more on the further aggregates.

At the bottom of the inverse pyramid lies the Monetary base—this is the cash we carry around in our wallets, plus reserves of commercial banks held at the central bank. Monetary base is the narrowest definition of money, as it’s the ultimate clearing instrument: if you hold cash as a citizen or reserve at central bank as a bank, there is no risk of counterparty failure.

On the other hand, if you hold a deposit at your bank (as a citizen) or an overnight deposit (as a bank), there is a slight counterparty risk—the depository institution can go insolvent or bankrupt. This is one of the reasons why American commercial banks started to hoard excess reserves after the financial crisis, as the trust between the banks evaporated (the other main reason for the sustained high level of excess reserves is the fact Fed started paying an interest on the reserves).

The reason for the shape of an inverse pyramid lies in the nature of a fractional reserve system—banks are able to issue loans in multiples of the held reserves, and further aggregates like M2 are mostly based on trust and credit rating of the issuing institutions. The further you move up the aggregate pyramid, the more trust is required and the less liquid (immediately exchangeable for the lesser levels of the pyramid) the assets are.

(Fun fact: Ethereum’s aggregates’ pyramid would be in an opposite shape, due to overcollateralization. But this may change in the future if a model of money markets without overcollateralization is developed.)

The M1 and further aggregates are what we actually handle most of the transactions with. All over the world, people and businesses handle more and more of the payments via wire transfers and credit/debit cards and less with physical cash.

Let’s summarize this section and move on the implications for Bitcoin and Ethereum. We’ve learned that:

- today’s money has no single definition: it’s a spectrum with various levels of trust and liquidity across individual layers

- while monetary base has least trust assumptions and is the most liquid of the aggregates, M1-M3 is where the monetary utility lies

Want an overview of base money and M1-M3?

🎙️Listen to “Ether the triple point asset” Episode #4 of the Bankless Podcast

Bitcoin’s path to moneyness

As I indicated on the monetary aggregates diagram, Bitcoin is mostly focusing on having the solid monetary base first and foremost. Let’s go through the evidence briefly:

- prevailing hard money narrative and broad popularity of Plan B’s Stock to flow model (which is just an applied version of the hard money narrative); halving is one of Bitcoin’s sacred days (others: Pizza day, White paper day, Genesis block day)

- strong focus and historical success of decentralized governance (UASF and No2X grassroots initiatives)

- continuing discussion and analysis of Bitcoin’s future security budget (as written on by Nic Carter, Dan Held, Hasu and yours truly)

- payments scalability: startups building on Bitcoin tech stack focus mainly on payments scalability and fungibility improvements (Samourai, Wasabi, Strike, Lightning Labs, Square Lightning SDK)

- social scalability: Bitcoin’s focus on store of value and payments aspects may be seen as unambitious, but this focus ensures Bitcoin’s position as a natural Schelling point of global non-fiat money; since only soft forks are used to include changes in the protocol, there is little need to pay attention to ongoing governance discussions (with headaches like in what language should the discussions take place?)

- decentralization scalability: Bitcoin full nodes can be run on general consumer hardware and the blocksize limit has been kept low to ensure users with average internet connections can sync and keep up with the blockchain size; there is an increasing selection of node-in-a-box solutions (check the overview by Bitcoin Magazine)

- conservative approach to protocol upgrades: softfork activations only, and rigorous peer-review process; even relative “no-brainers” like Schnorr signatures take years to implement

All in all, the Bitcoin community has adopted a very conservative and transparent approach towards its protocol development, mostly out of concern of damaging the broad consensus and Bitcoin’s Schelling point attributes. The solid monetary base foundation is the priority—further aggregates can be developed on second or third layers (Lightning, Liquid, Debnk etc). Store of value utility arising from a clear and reliable monetary policy seems to be the main driver of global adoption in the past years.

This has of course elicited some critique from those that don’t see the point in such conservatism and has lead to various forks (mostly money-grabs like BCH/BSV), new projects (Ethereum) and a good measure of memes.

(Above) Meme author Fiskantes

Parker Lewis from Unchained capital provides a good summary of Bitcoin’s path to moneyness in his “Bitcoin obsoletes all other money”:

But remember that scarcity for scarcity sake is not the goal of any money. Instead, the money that provides the greatest constant will facilitate exchange most effectively. The monetary good with the greatest relative scarcity will best preserve value between present and future exchanges over time. Relative price and relative value of all other goods is the information actually desired from the coordination function of money, and in every exchange, each individual is incentivized to maximize present value into the future. Finite scarcity in bitcoin provides the greatest assurance that value exchanged in the present will be preserved into the future, and as more and more individuals collectively identify that bitcoin is the monetary good with the greatest relative scarcity, stability in its price will become an emergent property.

Ethereum’s path to moneyness

In contrast to Bitcoin, Ethereum takes an opposing approach to moneyness—that is if we take the DeFi movement as Ethereum’s best and lasting product-market fit. Let’s go through the evidence briefly:

- focus seems to be mainly on the utility side of moneyness—not SoV or payments as such, but actually using the native token (ETH) as the “economic bandwidth” within the decentralized ecosystem

- Ethereum’s monetary policy is fluid and focused on maximizing chain security (instead of predictable inflation); this is why there is no hard cap and no clear inflation curve for the future—instead, we have a “minimum necessary issuance” social contract

- HW and bandwidth-heavy nodes—running and syncing full ETH node from scratch is notoriously hard and about 70% of the nodes are run in hosted cloud services such as AWS; on the other hand, it seems this is being addressed with dedicated node-in-a-box solutions, in a similar fashion to Bitcoin; also noteworthy is experimentation with economic incentives for node runners (eg. Pocket Network) (RSA note: Eric Wall’s tweet linked above is him syncing and replaying all Ethereum transactions from scratch which is unnecessary imo—using fast sync is practically just as secure and takes 1 day—see details on this)

- as David Hoffman explains, there are/will be 3 ways how ETH engineers scarcity: DeFi, staking, and fee burns; this reinforces the thesis that Ethereum’s path to moneyness is an iterative work in progress (2 out of 3 mentioned mechanisms are not in existence yet)

- in the same article, David Hoffman points out that the concept of money has historically been heavily intertwined with debt (citing Graeber’s Debt: The First 5000 Years), and DeFi protocols bring about precisely this feature to make ETH money—ETH as a standard of deferred payment

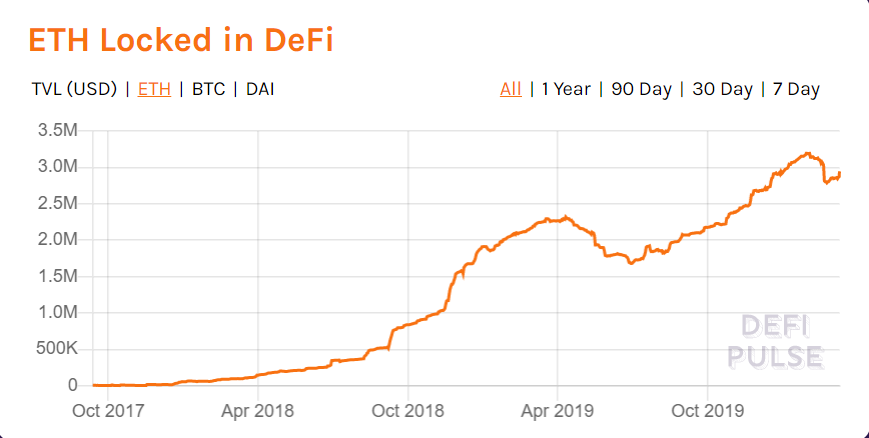

Ethereum has always operated in a “move fast and break things” fashion, where multiple use cases are tried in parallel and what sticks is then iterated upon. DeFi seems to be a thing that has stuck so far, and various DeFi services have attracted a sustained inflow of ETH as their “economic bandwidth”:

Above source: DeFi Pulse

DeFi services are usually praised for their permissionless nature (at least some of them) and composability (the possibility of mutual interaction and synergy).

My opinion is that the real game-changers that DeFi services bring to the table are the transparency and auditability. As Ryan Sean Adams points out in the recent discussion in Ivan on Tech podcast, we cannot audit the collateral and internal operations of Coinbase or Kraken—but we can do that with MakerDAO or Compound. The speed with which the bZx exploit audits came about is a cause for celebration, not for condemnation of the vulnerable protocols. Mt. Gox had been insolvent for 2+ years and no-one knew. bZx got exploited and everybody knew within hours.

DeFi as a source of moneyness for ETH has a strong ally on its side: the absurd state of the modern financial system that is anything but open, borderless and inclusive. Even centralized “crypto banks” have to conform: Kraken’s futures trading is prohibited in 36 countries—including United States, even though Kraken is a US-based company! Moreover, the risk of keeping assets like BTC or ETH with custodians may prove to be an ultimate Achilles’ heel of the monetary revolution—the establishment can simply confiscate the asset, as happened in the 1930s with gold.

On the other hand, DeFi still has a lot of work ahead to truly turn ETH into money.

First, there will always be a trade-off between functionality and decentralization. Simple protocols like Uniswap can work as complete contracts, but is that true for advanced stuff like money markets? With governance and admin keys, there will always be a risk of regulatory action or governance attack.

Second, the composability and protocol interplay bring about both new opportunities and headaches. Nobody saw the flash loans attacks coming. Many more sophisticated attacks are coming as the DeFi space keeps on innovating. The features of transparency and permissionless interaction also introduce a huge honey pot. While insurance protection through Nexus or Opyn may help a bit, the premiums are going to be huge if the attacks happen regularly. So the teams need to be sure they attract exploiters through bounties, not honey pots.

Third, DeFi is still a niche and may be a thing of the inner circle of sophisticated Ethereans. There are multiple reasons to think this: Maker, Compound and other services have most of the value locked by a handful of whales; when the ETH price rises, the ETH locked-in-DeFi metric falls (summer 2019 and Feb 2020); the ETH locked-in-DeFi doesn’t grow exponentially over time, as usually happens with startup-like trends—the growth is +3000% for 2018, but only +52% for 2019 and falling so far in 2020. At this point, DeFi has attracted 2.6% of all ETH in circulation. Nice, but still a niche.

Summary

Both Bitcoin and Ethereum have a strong chance to become world’s first digital money without any government involvement. Both have to overcome their potential weaknesses in the coming 5 years:

- Bitcoin has to survive its hard-coded monetary policy: 2 halvings in the next 5 years will show how that works out. Increasing the “transaction density” through heavy economic activity on sidechains and 2nd layers is critical. Auctioning of future blockspace through futures contracts would help as well (if there is demand for predictable future settlement).

- Ethereum has to prove it can achieve moneyness on a constantly shifting monetary base. If the shift to Eth2 works out as envisioned, the focus on governance eradication and monetary policy automation should follow. There should be no strong leaders in decentralized money protocol, no matter how charismatic.

Both Bitcoin and Ethereum also need to create pockets of circular economies, without a dependence on the fiat on/off-ramps. This is especially true for Bitcoin—in order to establish itself as a future monetary base, its users need to start thinking in bitcoins/satoshis as a natural unit of account.

Outside of the scope of this article are various interoperability plays, that might bring joint success of both Ethereum and Bitcoin as money. One of the possible futures is that Bitcoin is the natural monetary base, while Ethereum provides the monetary aggregates and utilizes Bitcoin via trust-minimized pegs like tBTC and renBTC. As we saw in the recent weeks, the future is quite unpredictable and often very wild. Recent developments point to mankind entering a new era, both in global markets and social dynamics. Hopefully there will be a demand for global non-fiat money in this brave new world.

Post scriptum: This text was written in large part before the massive Bitcoin and Ethereum sell-off in mid-March 2020. While those events don’t change any of my viewpoints expressed in the article, I concede that current DeFi services (mainly MakerDAO) have shown their fragility, as they are susceptible to failure in the event of a black swan event (namely a failure of the incentivization model in the face of network congestion and market sell-off). However, in this space every failure is also a learning opportunity and if the current class of DeFi services collapse, better ones will stand on top of their shoulders.

Author bio

Josef Tětek is an analyst at TopMonks—a software development house and startup incubator. He’s active on Twitter and Hacker Noon. He’s written some excellent Bankless articles including “Rise of the Cryptodollar”.

Action steps

Consider: what are the different paths to money for BTC vs ETH?

Related articles:

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

New to the Bankless program? Start here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.