Ether: The Birth of the Digital Bond

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

ETH staking is like a bond offering for a new type of digital nation.

Staked ETH is like a crypto T-bill.

People haven’t wrapped their heads around ETH as a digital bond. Certainly institutional investors haven’t. Understandable—it’s not yet here.

But Stefan Coolican sees the future. He’s the president of Ether Capital, a publicly traded company with the foresight to keep ETH on its balance sheet under this thesis: ETH is turning into a productive asset and the world doesn’t yet appreciate it—but they will.

He's doing what we do. He’s front-running the opportunity.

This is how he explains Ethereum’s Digital Bond. 🔥

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Guest Post: Stefan Coolican, President @ Ether Capital

Understanding ETH as a Productive Asset

Later this year, when Ethereum transitions to staking, $26 billion of Ether will immediately be convertible into yield-bearing instruments.

When staked, the Ether you hold isn’t a virtual commodity anymore. It is more like a financial asset on which you’re paid dividends or interest.

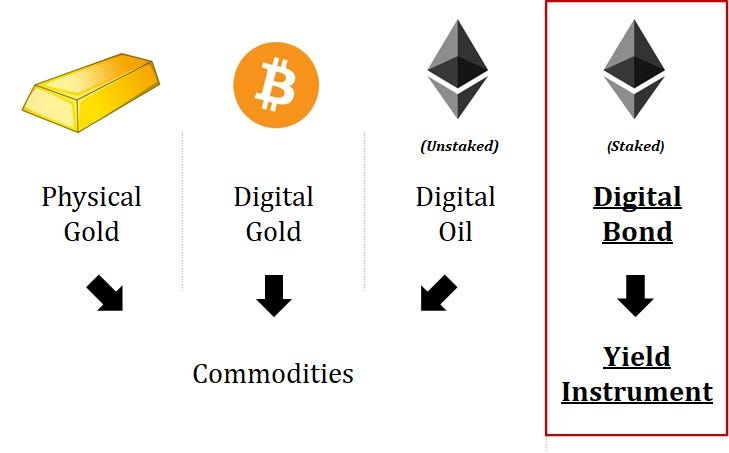

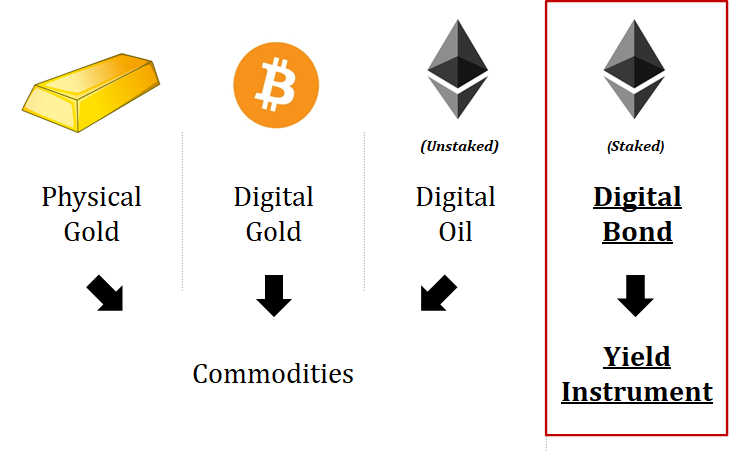

If bitcoin is digital gold and ETH is digital oil, staked ETH is a digital bond.

Staked ETH is unique. Unlike a conventional bond, it has no counterparty risk – there is only protocol risk. Staked ETH gives you yield at the protocol level and not via a counterparty. Staked ETH is therefore an intrinsic yield instrument.

For the first time ever you can compound your ETH holdings organically without assuming any counterparty risk.

Now, you might think the introduction of yield would be an Aha! moment for traditional finance. But just as traditional finance missed Bitcoin’s “big bang” moment in the early 2010s, the same is happening with staking today.

In this piece, I’ll provide some thoughts on the economics of staking, why it brings a unique yield instrument to crypto, what staking means for ETH returns and why traditional finance will inevitably need to pay attention.

Staking – The What and The Why

We all know that blockchains need honest validators.

One way to incentivize this is via proof of work mining. In mining, the incentive to be honest stems from energy-intensive calculations. This is Bitcoin’s model and is currently Ethereum’s model as well.

Another way to incentivize is via proof of stake, which is the model for Ethereum’s transition later this year. In staking, the incentive comes from locking up one’s tokens as a performance bond.

Compared to mining, staking aims to be not only more environmentally friendly but also more efficient, more secure, and more performant than hardware mining.

Only Staking Creates an Intrinsic Yield Instrument

Both mining and staking are ways to provide security to a blockchain, but only staking creates an intrinsic yield instrument. Why? Because both the capital at risk and the rewards are internal to the protocol.

Think of staking as security-as-a-service incentivized by yield.

Let’s unpack this.

Staking on Ethereum will be fairly simple. The steps are:

- You have ETH 💰

- You deposit ETH into the staking contract 👨💻

- You run staking software honestly ☑️

- You earn more ETH (yay!) 💵

In staking, the staker puts capital at risk in the protocol’s native units. In other words, the ETH that I stake is my investment.

Mining differs because while mining rewards are internal to the protocol, the investments – ASIC chips and electricity – are external.

Asset Lending is Not an Intrinsic Yield Instrument

You might think this is semantics. Can’t I generate yield with bitcoin?

Of course you can. You can lend it to someone (or in the case of DeFi, a pool governed by a smart contract). But this entails additional counterparty risk, which effectively decouples the yield from the risk of the protocol.

Where staking differs from ordinary asset lending is that there is no counterparty risk – the risk profile is internal to the protocol itself.

This makes staked ETH an intrinsic yield instrument, while other proof of work cryptocurrencies like bitcoin are mere commodities. It also means that tokenized lending on Ethereum (e.g., Compound’s cTokens) creates digital bonds but ones that are not intrinsic yield instruments.

Staking and Traditional Finance

Traditional finance understands yield. It understands interest and dividends. It understands cash flow and compound growth.

It does not understand staking!

Why? Investment professionals, bankers, and economists are still just getting used to the concept of Bitcoin. A few years ago, it was routinely dismissed as a fraud and as being used only by drug dealers and money launderers. Now, the conceptual tide has turned somewhat and a popular finance narrative has emerged as a higher risk/reward analog to gold.

And yet, digital gold isn’t enough.

Warren Buffet, one of the greatest investors in history, once said that he’d prefer all the farmland in the U.S. to all the gold in the world. Why?

Simply put, farmland is an asset with compound growth potential. You can generate cash flow and re-invest it, increasing your wealth. Meanwhile, gold is a commodity you can only hold in the hopes of the price going higher.

But here’s where staking changes the game. With staking, you can make cash off your holdings organically without disposing of your original capital base or incurring additional risk.

Staking is what moves crypto from digital gold to an asset with compound growth potential. Staked ETH is more farmland than gold.

Staking – What Happens to Price and Yields?

I consistently get asked by Ether Capital’s investors – what will staking do to the price of ETH and what will my yield be? These are difficult questions to answer.

Prices incorporate a myriad of factors, including those pesky animal spirits that we can’t explain. Yields are a function of total ETH staked which we won’t know until launch. Still, here are a few thoughts on both issues.

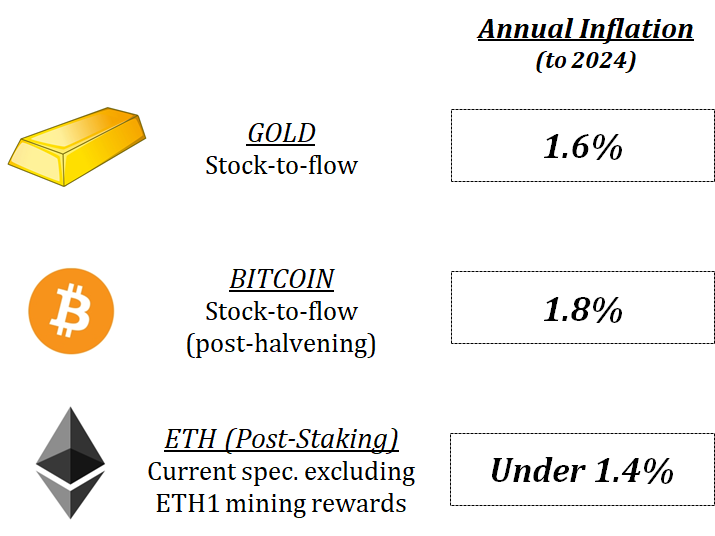

First, on price: post-staking, ETH will be scarcer than gold and bitcoin in terms of supply issuance.

Sources: Kraken Intelligence, Consensys’ ETH2.0 Calculator

Ethereum’s total inflation depends on how much ETH is staked, but the maximum annual figure is only 1.4%. Realistically, we might expect an inflation rate under 1.0%. Note that I have excluded Ethereum’s proof of work mining rewards over the period, reflecting their eventual discontinuation in the context of staking.

I realize, of course, that price isn’t determined uniquely by supply factors. Very simply put, if ETH can retain the demand side of the equation, ETH’s issuance scarcity is likely very bullish for its price.

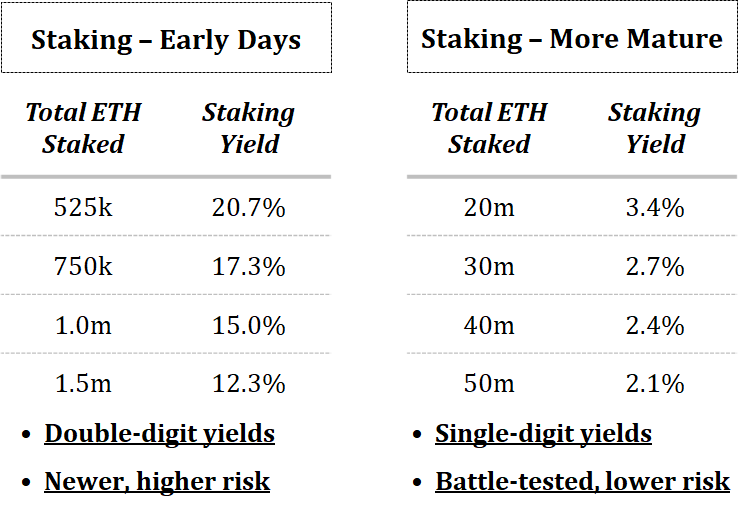

Second, on staking yield: we might end up seeing double-digit staking rewards in the early days and lower single-digit gross yields as staking becomes more common.

Assume early on that relatively few ETH are staked due to it being new (i.e., higher risk) and initially non-transferrable. Let’s also assume that when Ethereum 2.0 is in full production in a couple of years, the number of ETH staked is much higher.

Source: Consensys’ ETH2.0 Calculator

In the early days staking could be very lucrative – while after some time it could be more akin to inflation protection, plus a margin (still a better return than your negative interest rate bank account).

The Future of Ethereum’s Digital Bond

Ethereum’s digital bond promises to be a crucial milestone for crypto as an asset class.

Think back to Bitcoin’s white paper in 2008.

Imagine predicting Bitcoin’s global recognition only a few years after launch. Imagine predicting that bitcoin would be a mainstay on CNBC’s ticker tape. Imagine having a $40 billion AUM fund manager extoll the merits of bitcoin in an update to his investors. Those predictions would have been considered outlandish. Yet here we are.

In the same vein, I would argue that staking yield opens the door to similarly fanciful predictions.

Maybe we are not as far away from the days when the Financial Times compares staking yields to yields in treasuries, bonds, and dividend stocks.

Maybe we are not that far away from ETH’s staking yield serving as a reference for financial products in the same way LIBOR does today.

Maybe we are not that far away from smart contracts like Maker, Compound, Uniswap and Augur powering next-generation financial infrastructure for the world, all secured by ETH.

Inevitably, even if a small number of these predictions come true, traditional finance will have to take a much more serious look into crypto.

This will include having to grapple with the novel concept of intrinsic yield — protocol risk without counterparty risk, among other things.

With crypto creating a new digital paradigm for a yield instrument, doing your homework now may literally pay dividends in the future.

Action steps

Study the implications of Proof of Stake for ETH.

Get prepared for ETH 2.0 Staking—it’s coming!

Author Bio

Stefan Coolican is President of Ether Capital Corporation (NEO:ETHC). Ether Capital is an Ethereum ecosystem investor. Previously, Stefan worked as a Director in the investment banking group at Cormark Securities.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.