ETH's monetary policy is underrated

Reminder: if you’re not a paid subscriber this is your second last Thursday on the program! Subscribe now & get 20% off forever.

Dear Crypto Natives,

Last week I published BTC's monetary policy is overrated.

This is what I said in part 1:

- Monetary policy is issuance policy is security policy

- Block rewards & transaction fees together are the security budget

- The block reward part of the budget increases with BTC demand but transaction fees only increase with Bitcoin blockspace demand—separate markets

- Almost all of Bitcoin’s security budget is paid by block rewards—BTC demand

- BTC’s monetary policy makes a perilous switch from paying for security through BTC demand to paying for it through blockspace demand—it’s likely that Bitcoin must either: lose its throne as the highest security chain or it change monetary policy to add inflation

Think fixed supply is perfect? It’s not! Every halving is a security halving. There’s two slides to the coin:

BUY NOW! There’s only 3m BTC left—and they ain’t makin more!

is also…

OMG! There’s only 3m BTC left to subsidize security—what are we gonna do?

If you’re ignoring both sides of the coin you’re overrating BTC’s monetary policy.

Ethereum is taking a different approach. One that’s still underrated by many. Let’s explore today in part 2.

Level up!

- RSA

THURSDAY THOUGHT

ETH’s monetary policy is underrated

Fixed cap supply with diminishing block rewards is Bitcoin’s design. But is it the only design for a non-sovereign money? Is it even the best design?

Remember the primary goal of crypto monetary policy is to maximally secure the network. It’s not to achieve the highest scarcity, or to be the most unchanging, or to be the most predictable—those are means to an end. The end is security.

What alternative path is Ethereum taking?

Extended: Is maximum security the only monetary policy goal?

Had a good convo with Hasu. He believes the goal of a crypto monetary policy is to 1) incentivize sufficient security 2) at a price users will pay 3) while minimizing free riders. I agree, though I’d say to maximally secure the network at the lowest cost is similar, just short-hand. Since price and security are tied together through block rewards and since price defines what users will pay for an asset given its issuance, maximally securing the network at the lowest cost encompasses the points above.

Minimum Necessary Issuance

The path of Ethereum is minimum necessary issuance (MNI). Specifically, Ethereum’s monetary policy is to decrease issuance to only the minimum necessary amount of block rewards to achieve the security of the Ethereum network.

Not fixed cap—MNI.

The problem with fixed cap is that it also means fixed security budget. It ultimately depends solely on user fees generated by blockspace demand.

MNI doesn’t have this problem. With MNI, there’s always enough security revenue minted by the network to meet security requirements. As improvements to the network are made and security budget increases, issuance is adjusted downward.

We can divide the MNI policy of ETH into two eras:

- Proof-of-Work Era—Launch to Present Day 👈we are here

- Proof-of-Stake Era—ETH 2 launch and Beyond

Through both eras the same MNI principle holds. Ethereum’s move to Proof-of-stake is can be seen as the ultimate manifestation of MNI—a technology improvement to provide higher network security at lower issuance cost.

Let’s take a look at the history of ETH issuance to see how MNI’s played out so far.

MNI under Proof-of-Work (Launch—Present Day)

At launch in 2015, Ethereum’s block reward was set to 5 ETH per block. Under this monetary policy, 18m ETH per year would be minted in perpetuity. No scheduled halvings. Each year, this newly minted ETH would comprise less as a proportion of the total amount of ETH and thus would ensure decreasing annual issuance rates.

An early post on ETH monetary policy projected something like:

- year 1—22% issuance

- year 2—18% issuance

- year 10—7% issuance

- year 64—1% issuance (and so on.)

5 ETH in perpetuity. More conservative than BTC. No block reward reductions.

These projections didn’t become reality.

For reasons related to speed of block times, actual ETH issuance at launch started at 18%, then dropped to 13%-14% in the first year. By mid-2017, issuance had decreased to 8% due to a built in mechanism that temporarily slowed block times even further—this difficulty bomb was put in place to incentivize frequent protocol updates.

The Ethereum community made this lower issuance more permanent by decreasing block rewards to 3 ETH through a hard fork in October 2017. A similar process in early 2019 further decreased block rewards to 2 ETH.

The actual history of ETH block reward is as follows:

- 2015/2016: 5 ETH per lock (18% issuance down to 13%)

- 2017/2018: 3 ETH per block (13% issuance down to 6%)

- 2019/Today: 2 ETH per block (6% issuance down to 4.6%) 👈we are here

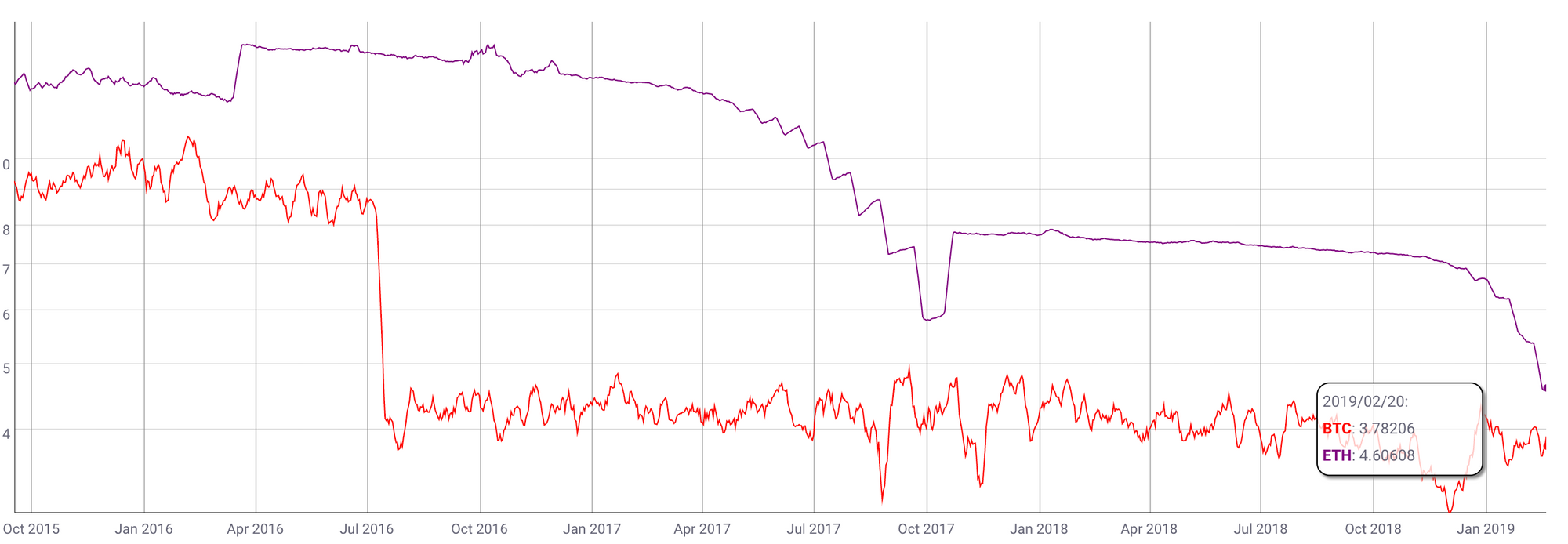

👉Graph Eric Conner put together on ETH issuance

As you can see, instead of keeping block rewards at 5 ETH in perpetuity per the original post, Ethereum has actually decreased its block rewards by 40%. (In contrast, a 5 ETH perpetual issuance would have taken over 20 years to get to 4.6% issuance!).

Why was issuance reduced? Because the network was overpaying. Fewer block rewards were needed to subsidize network security given the increase in ETH price and transaction fees. The protocol developers encoded the issuance reduction and community accepted it by updating their nodes. There were no competing forks, since the change honored the social contract and was not contentious.

This is MNI in action.

A brief pause for questions

Let’s pause to answer a few question that must be stirring in your mind:

This sounds like a central bank—arbitrary changes to monetary policy. Recall from last week, the monetary mandate of a central bank vs. a crypto money are completely different. Central banks must turn knobs and dials to achieve the economic and political goals of a nation state—unemployment, GDP. There’s an incentive to inflate supply. Not so for Ethereum. The goal of a crypto monetary policy is to maximally secure the network at the lowest cost—an incentive to reduce issuance, not increase it.

What’s to prevent insiders from printing money for themselves? Forks chiefly. But this is why I’m also against block rewards going to developers and onchain governance for money systems. There’s simply too much incentive for cronies and plutocrats to corrupt the system and print money for themselves. Neither ETH nor BTC are going in this direction fortunatly.

Minimum necessary? You said the goal was to be maximally secure. Aren’t these at odds? If the protocol remains block reward funded, I actually think maximal security can only be achieved with the low issuance—the intersection of the curves. A money system can’t simply increase security by increasing block rewards by 5x—that would damage it’s monetary premium and lead to devaluation of the asset, resulting in lower security revenue overall.

MNI under Proof-of-Stake (2020—Beyond)

Ethereum’s ETH 2 upgrade will allow it to reduce issuance further. Increasing security per unit of capital is a design goal of Ethereum’s proof-of-stake. And when less capital is needed to secure the network, less issuance is needed to pay for it.

While it’s difficult to project ETH’s future issuance schedule under proof-of-stake, I feel very good about projecting the direction: downward.

Here are a two downward catalysts I expect in ETH 2:

1. ETH issuance after Proof-of-Stake decreases to between .3% to 1%

This depends on the amount staked, but at a high range—say 30m ETH staked—ETH issuance would decrease to less than a percent. The exact % of issuance will be algorithmically determined based on staking supply and demand.

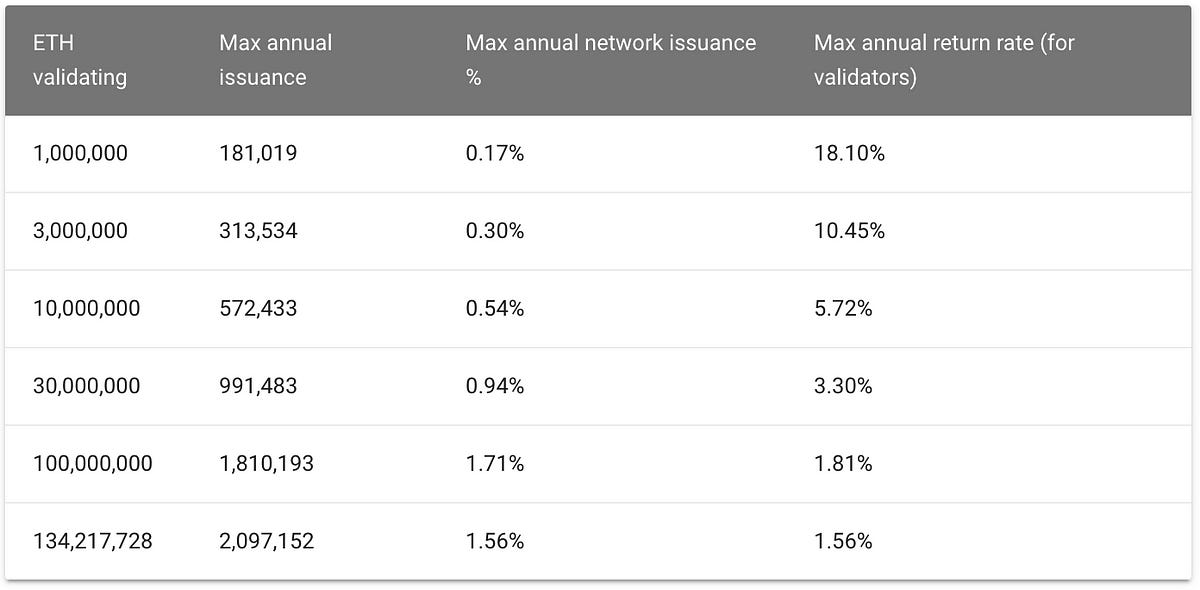

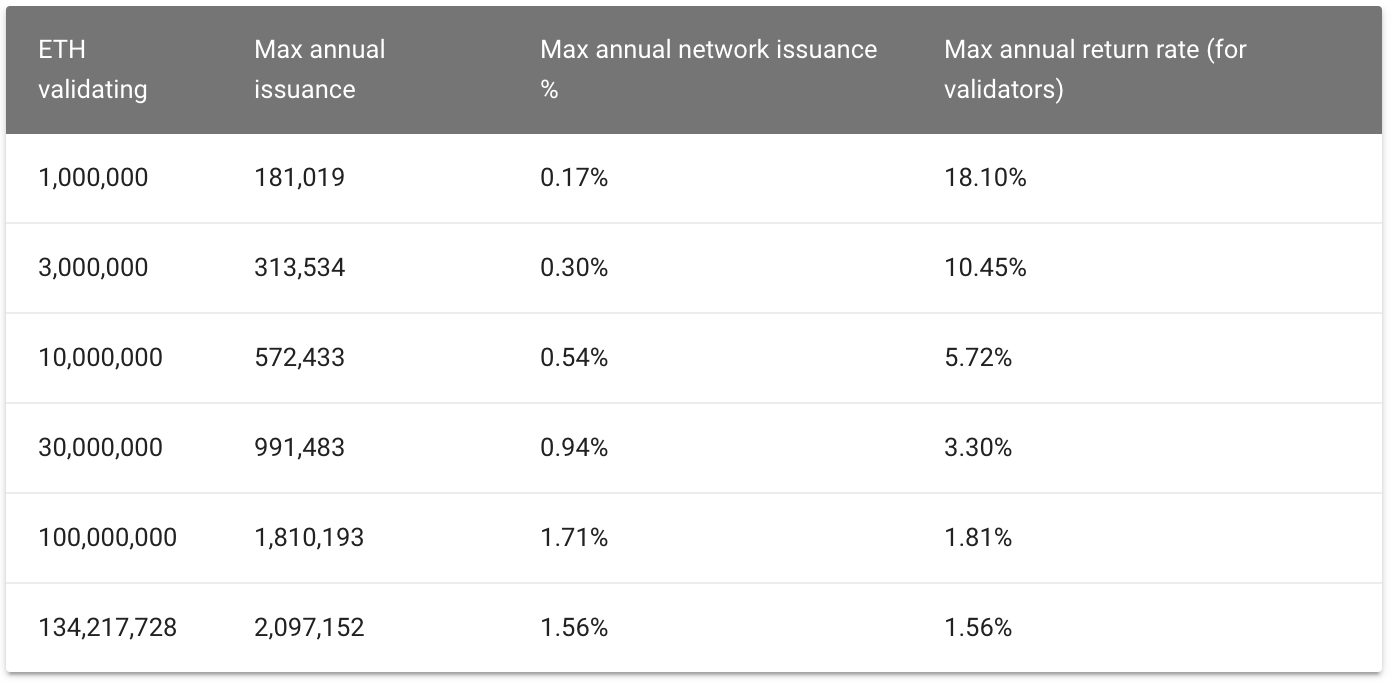

Above is the ETH 2 issuance schedule based on recent spec per ETHHub

2. Adding an EIP-1559-like transaction fee burning mechanism

A mechanism that burns the majority of the ETH spent in each transaction fee is being considered for Ethereum today and will certainly be implemented in Ethereum’s Proof-of-Stake upgrade. David Hoffman wrote about this here.

While it’s difficult to determine how much this would burn each year, if we just took current total transaction fees, about $250k per day, and multiplied it by 10x (not crazy—transaction fees on ETH have grown 1000x in the past 3 years), then we’d be burning close to $1B worth of ETH per year. That’s a 1% burn if the network is worth $100B.

When will this happen?

This issuance reduction won’t happen overnight. When ETH 2 launches, it’s likely issuance will temporarily increase by .3% or so, at least until the tech is in place to allow ETH 2 to finalize the ETH 1 chain.

But if the plan works, an issuance schedule like this could be in the cards:

- 2020: 4.9% issuance (up from 4.6% with ETH 2 chain launched)

- 2021: 2-4% issuance (down as ETH 2 chain partially finalizes ETH 1)

- 2022: 1-2% issuance (down as ETH 2 chain fully finalizes ETH 1)

- 2023: .5%-1.5% issuance (down as some ETH is burned)

- 2024 & beyond: .5%-1% issuance (down as more ETH is burned)

For comparison, BTC’s annual issuance is currently 3.8%. It will be about 1.9% in 2020 after its next halving and remain at this rate until 2024.

Fixed cap vs MNI

Take a look at ETH vs BTC issuance in this graph:

ETH’s issuance rate is catching up to BTC’s. Not through the unyielding power of a halving algorithm, but through an MNI policy implemented by code and enforced by social contract.

I’d put good odds on ETH issuance dropping below BTC issuance by 2024.

Does this make ETH’s monetary policy better?

BTC has a clear advantage in scarcity narrative and simplicity—this has given it an early lead. ETH has an advantage in security by block reward subsidy—it can use its own monetary premium to secure itself, while Bitcoin must jettison the security provided by its monetary premium and depend on transaction fees.

ETH’s ability to adjust its monetary policy might be captured. But then again, who knows what chaos might happen if BTC needs to adjust its monetary policy to add inflation at some point.

ETH’s future monetary policy feels uncertain, but has a history of issuance reductions and ambitions to further decrease issuance. BTC’s future monetary policy feels certain, but will it feel as certain when the block reward subsidies decrease?

So it’s too early to say which one is better. They both make tradeoffs.

But I will say this—if you think fixed supply is the only path for a crypto money, well, you’re greatly underrating ETH’s monetary policy.

There’s two horses in this race.

Action steps

- Consider: what are the strengths and weaknesses of Ethereum’s monetary policy?

- Review Ethereum’s Monetary Policy on ETHHub

Continue leveling up. $12 per month. 20% off if you subscribe before November 1.

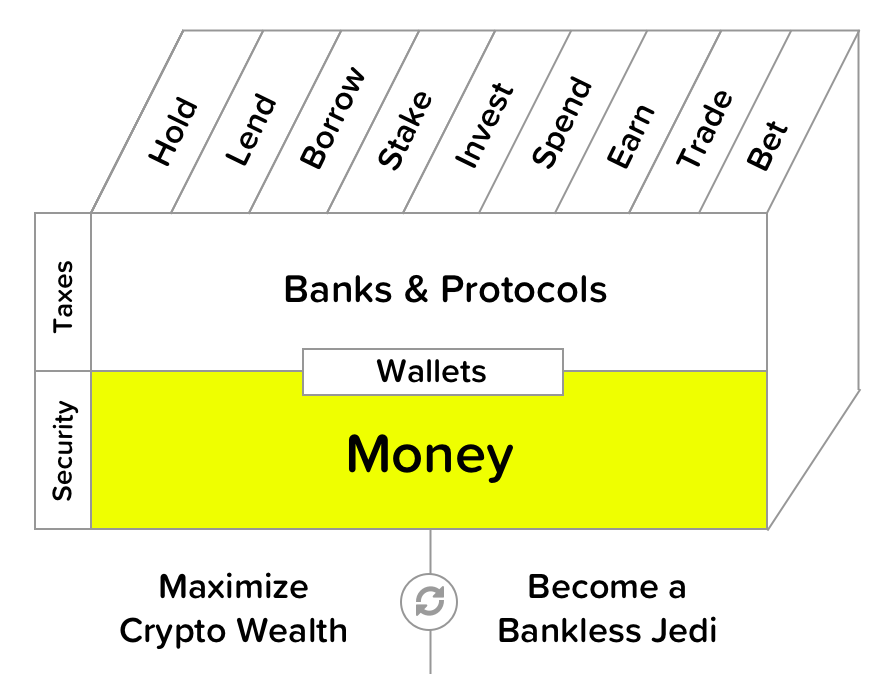

Filling out the skill cube

By understanding BTC and ETH’s monetary policy you’re leveling up on the money layer of the skill cube. The money layer is the foundation for everything else.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.