The Fundamental Value Proposition for Ether

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

David writes some of the most imaginative long-form posts in the space. He’s doing something different in this one. Today’s post is a concise and succinct analysis on the investment thesis behind Ether.

Read it. Then use it as a cheat-sheet to help explain the value of Ether to others!

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WRITERS CORNER

By Bankless writer: David Hoffman, Bankless podcast & POV Crypto

The fundamental value proposition for Ether is scarcity.

All activity on the Ethereum blockchain results in the generalized scarcity of Ether. The privileged role that Ether has as the native asset of Ethereum creates an inextricable link between the economic activity of all assets and financial applications on Ethereum, and the scarcity of Ether. As a result of this link, the health of the Ethereum economy is reflected in, and impacted by, the value of Ether. This link is created by the generalized demand, and therefore scarcity, that Ethereum places on Ether for the operation of economic activity recorded to the blockchain.

Ethereum has 3 core pillars that are crucial to its operation as an ecosystem, and each represents a core mechanism of the Ethereum blockchain that also results in the scarcity and demand of Ether:

- ETH in DeFi: The amount of Ether that is deposited as collateral in Ethereum applications

- Staked ETH: The amount of Ether that is being staked to the network

- Burnt ETH: The amount and rate of Ether that has been/is being burnt in transaction fees.

These three pillars represent the foundations of the Ethereum protocol and economy, and establish the privileged relationship between Ether the asset and Ethereum the protocol. The outcome of these three pillars is the generalized scarcity and demand for Ether.

1. ETH in DeFi

The applications on Ethereum that have found product/market fit are applications that allow you to deposit assets in order to access some sort of financial product or service. Theoretically, these applications can support any asset found on Ethereum, however the native asset of every blockchain is always given a privileged position inside its own internal ecosystem.

Strong trustlessness and censorship resistance are requisites in an M0 settlement currency. As the native asset to Ethereum, Ether will always have the strong settlement guarantees compared to all the assets on Ethereum. It is impossible for any asset that is issued or deployed to Ethereum to be able to match Ether’s level of trustlessness or censorship resistance, and therefore cannot match Ether’s assurance of settlement. Strong trustlessness and censorship resistance are requisites in an M0 settlement currency, and represent a core characteristic of Ether as an asset inside of Ethereum’s financial application ecosystem (called ‘DeFi’)

For these reasons, the various financial applications found on Ethereum will likely always have a bias towards ETH as ‘good collateral’. The establishment of Ether as ‘good collateral’ in Ethereum applications has been a driving force for increasing both Ether demand and Ether liquidity. As a result of the demand for the asset with the strongest settlement guarantees, Ether has become the most liquid asset inside of Ethereum, which further contributes to nature as ‘good collateral’.

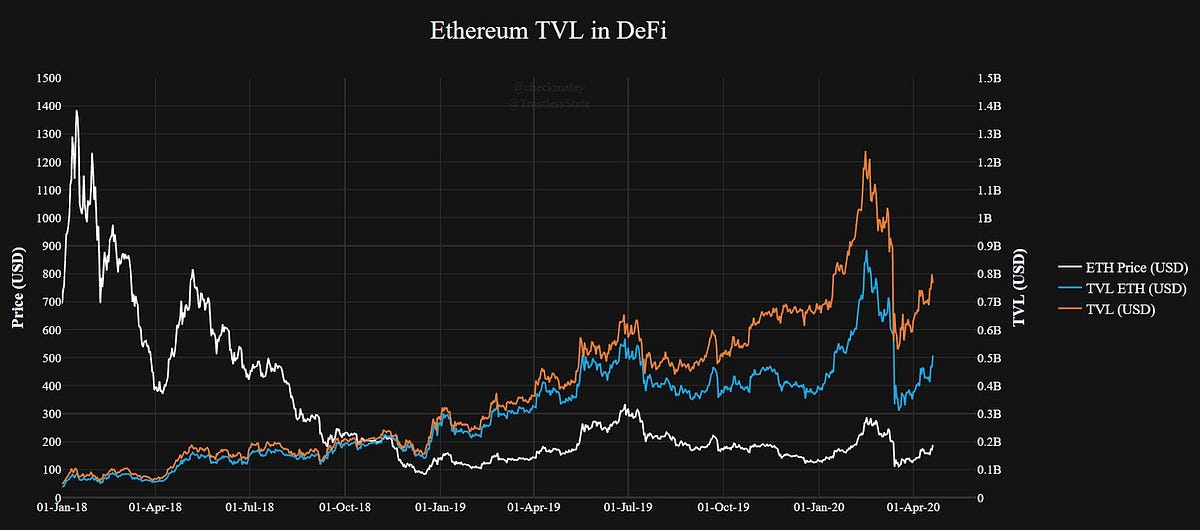

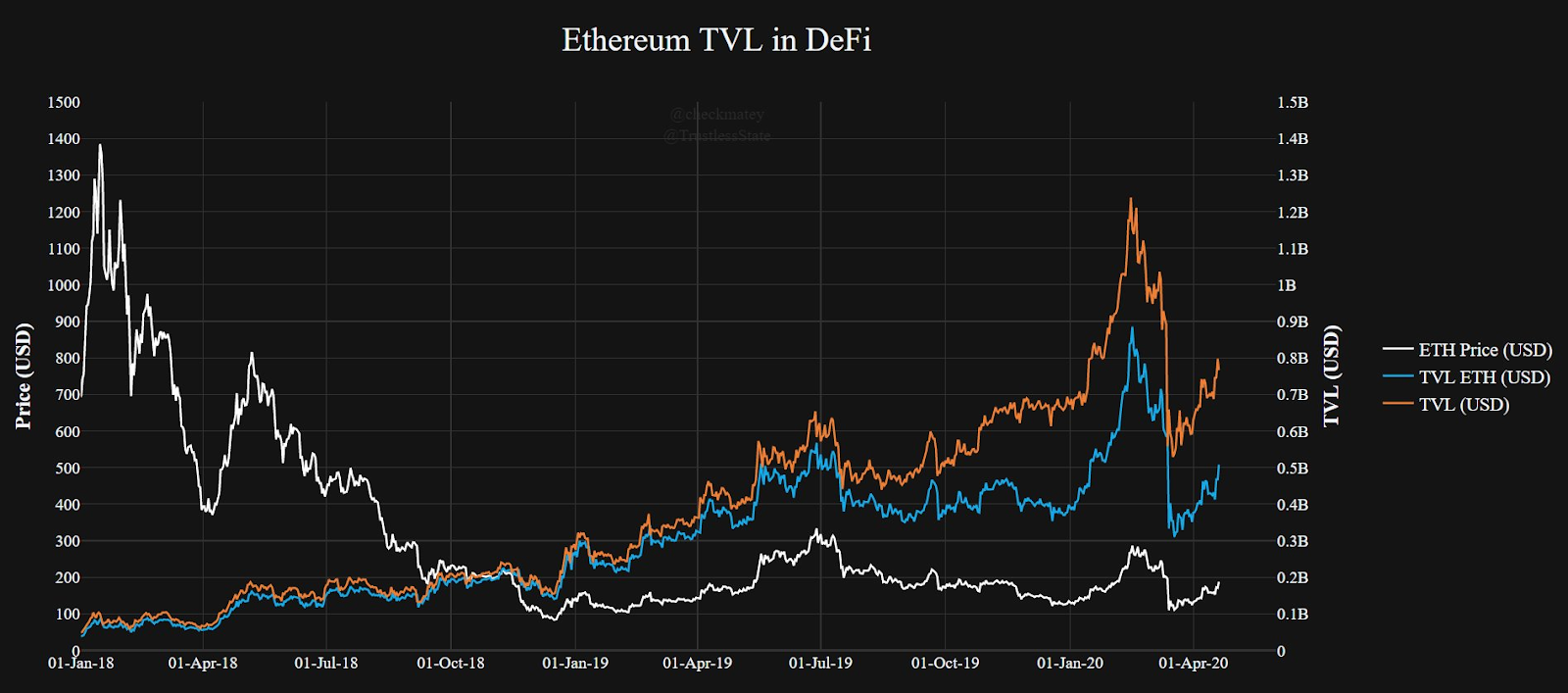

You can see this in the dominance of Ether collateral vs other assets inside of Ethereum’s financial applications.

(h/t to Checkmate for help on the above graphic)

Ethereum is a platform for hosting financial applications. All applications on Ethereum are financial in nature, as all crypto-economic systems like Bitcoin and Ethereum are economic in nature.

Currently, there are 2.7M ETH deposited into various DeFi applications, which represents just 2.5% of the total supply of ETH. The scarcity of Ether grows commensurately to the number of financial applications on Ethereum, as all financial applications require assets to be deposited in order to use them, and Ether has consistently been the collateral of choice for users of these Ethereum applications. Further, the growing number of financial applications on Ethereum increases the total addressable market (TAM) for Ethereum at large. Not only does the growth in Ethereum applications increase generalized demand for Ether, but the addition of new users increases the capital inflows that these applications are exposed to.

While new entrants to Ethereum are not guaranteed to use Ether as their asset of choice, the privileged nature of Ether inside of Ethereum always offers a carrot.

The growing number of useful Ethereum applications and the growing number of users using Ether inside those Ethereum applications directly contributes to the scarcity of Ether at large. The more people deposit Ether into Ethereum applications, the more scarce Ether becomes.

The fundamental value proposition for DeFi is that it incents the depositing of a large percentage of the total supply of Ether, via the various individual products and services created by each application on Ethereum.

2. Burnt ETH

(this section assumes EIP1559 is active. It is not currently active)

Economic activity on Ethereum results in the burning of ETH. In order to make a transaction (any transaction) on Ethereum, you must burn a small amount of ETH. In addition to this, you may also chose to ‘tip’ the validators of Ethereum, in order to allow you to ‘jump the line’; a carrot for validators for including your transaction earlier than others.

The mechanism behind the burning of ETH is described here (short technical description) and here (longer narrative version). In short, burning ETH is a good way to measure one’s desire to have their transaction included, and is also a good way to increase the security of Ethereum in the long term. Because Ethereum issues new ETH via block-rewards to validators, the transaction fee does not need to be paid to the validators, and burning it provides a good game theoretically-safe mechanism of returning value to the ecosystem, by increasing the scarcity of all remaining ETH.

Economic Activity

Because every transaction on Ethereum burns a small amount of ETH, the scarcity of ETH becomes a function of the economic activity on Ethereum. The growth in the economic activity on Ethereum increases the ETH Burn Rate, which contributes to the scarcity of ETH over time.

As a credibly-neutral internet based asset-settlement network, Ethereum offers a compelling place to host economic activity. Economic activity always has two parts: assets, and financial logic. On Ethereum, these are called ‘tokens’ and ‘applications’. The establishment and growth of these on Ethereum creates a feedback loop of usefulness, as Ethereum itself becomes more useful as these things proliferate.

The more applications that are available on Ethereum, the larger the possible kinds of economic activity there are. Derivative markets, prediction markets, lending and borrowing, and capital coordination all are enabled via Ethereum applications, and any asset on Ethereum can be leveraged inside these applications. The more total assets on Ethereum also enable further kinds of economic activity as well, as there are more assets available for applications to leverage.

Simply put, more total assets, and more total financial applications on Ethereum contribute to a larger body of economic activity. This economic activity denotes the rate of ETH Burn and removal from supply, ultimately resulting in increasing ETH scarcity.

Sharding

Included in the Ethereum roadmap is Sharding. Sharding is Ethereum’s main path towards scaling, or, increasing the total transactional bandwidth of the Ethereum blockchain. Adding new data to a blockchain is inherently bottlenecked by the global distribution of nodes that make up the network. Sharding splices up a blockchain into 64 individual smaller blockchains, each with their own separate bandwidth constraints. The shards are ultimately composed together into a single blockchain.

Sharding means more capacity. Because of sharding, Ethereum is able to host more total economic activity. Sharding allows Ethereum to serve 64x as many customers simultaneously, increasing Ethereum’s ability to generate revenue from fees. All revenue generated from fees is burnt.

However, sharding also increases the supply of available blockspace for purchase. The bidding war that all transactions participate in is competing for 64x more supply, reducing the price that is ultimately paid. While this may result in reduced short term revenue, it may ultimately increase Ethereum’s ability to host more total economic activity at large.

Currently, the Ethereum 1.x blockchain is ‘at capacity’, which results in the increased costs of transacting. Increased transaction costs reduces the viability of complex and expensive transactions, and limits the viability of many kinds of otherwise useful economic activity.

With increased capacity brings lower fees per transaction, which enables a more complex set of possible transactions to be viable on Ethereum. More people will be willing to engage in more, and more complex, economic activity. As a result of the reduction in fees per transaction, a more vibrant economic ecosystem may emerge.

The increased net size of the economic activity on Ethereum contributes to a greater rate of ETH Burn. The ETH Burn Rate is a measure of the rate at which ETH is becoming more scarce over time. As the economy of Ethereum progresses, the total amount of ETH burnt may represent a significant portion of the total supply of ETH, ultimately increasing ETH’s scarcity.

3. Staked ETH

Ethereum achieves its security through proof-of-stake, a mechanism that forces all Ethereum Validators to have skin-in-the-game, or ‘stake’ in order to validate. If you want to be a validator on Ethereum (and earn validation rewards), you must purchase ETH as stake, and ‘stake it’ to the Ethereum protocol on the promise that you will not falsify a transaction. If you do falsify a transaction, you get your ETH ‘slashed’ (deleted).

Stakers are compensated with ETH rewards from block-issuance, as well as any tips that were included in transactions. This represents the incentive to stake: returns on your Ether, paid in Ether.

Current ETH 2 projections estimate roughly 10%-30% of the total supply of ETH participating in staking. If these projections are accurate, the proof-of-stake mechanism is responsible for making 10%-30% of the total supply of ETH inaccessible to the secondary market. In other words, staking makes ETH more scarce.

The value of Ether is the force that protects Ethereum in Proof of Stake. The Proof-of-Stake consensus mechanism creates a “wall of value” against would-be attackers, and the size and strength of this wall comes from the amount and value of Ether that makes up this wall.

In order to create this wall, Ethereum issues new Ether as the incentive for Ether stakers to stake their ETH. The creation of the value-wall that protects Ethereum is doubly-effective, as the supply of Ether that is used to build the wall reduces the remaining Ether available to the rest of the Ethereum ecosystem, making Ether less available for malicious attackers.

If 30% of all ETH is staked, then there is only 70% of ETH remaining that is available to a would-be malicious attacker. If a malicious attacker were to attempt to attack Ethereum, it would need 30.1% of the total supply of ETH, which is 43% of the supply of all ETH that is not already staked. Purchasing 43% of all remaining available ETH is likely to be an extremely costly endeavor, as pursuing this effort is likely to increase the price of ETH on the secondary market to prohibitively expensive levels.

Increased levels of security means that Ethereum is able to reduce new ETH issuance. The sole purpose of ETH issuance is to secure the Ethereum blockchain, and Ethereum has adopted the position of “Minimal Necessary Issuance” (MNI). If Ethereum is deemed to be overly secure with the current rate of issuance, the community may rally behind a reduction in issuance. It remains to be seen how Ethereum and the Ethereum community can effectively measure security, and coordinate around an appropriate change in issuance.

Metrics

The beauty of blockchain systems is that they are maximally transparent. All possible information is freely available. The scarcity mechanisms illustrated above can be observed and verified in real time. Moving forward into the future, we will be able to measure ETH scarcity in real time, using the following metrics:

- ETH Locked in DeFi

The amount of ETH that has been deposited into Ethereum applications - Staked ETH

The amount of ETH that has been deposited for staking - ETH Stake Rate

The ETH-denominated returns being paid to Ether stakers, representing the strength of the incentive to stake ETH. - ETH Issuance Rate

The rate of issuance of new ETH paid to ETH stakers - ETH Burn Rate

The rate of ETH burn from the transaction fees on Ethereum - ETH Issuance:Burn Ratio

The ratio of the ETH Issuance Rate to the ETH Burn Rate

These represent the six verifiable, on-chain metrics that provide a way to measure the level of scarcity for Ether.

Quality long term fundamental analysis on Ether’s valuation must account for these six variables. These metrics cohere into a holistic view as to the state of the relationship between Ether, Ethereum, and the economy on-top of it.

Ether Value; Ethereum Health

Ethereum leverages the value in its native asset, Ether, both as a means of protection and proliferation of the Ethereum economy. Ether offers Ethereum the protection it needs from would-be attackers, while simultaneously acts as a valuable asset for the financial applications on Ethereum.

This creates a duality between the security and utility of Ethereum, which converges upon the value inside ETH.

Ether allows Ethereum to leverage its value for security, in return for its primacy as an asset in the Ethereum economy. Ether’s primacy as an asset gives it the highest possible settlement guarantee you can give it. Ether’s first-class status on Ethereum inextricably ties the value of Ethereum as a network to the value of Ether as an asset. The value of the Ethereum network is instantiated in the price of Ether.

As a result of this relationship, the growth and health of the Ethereum economy results in, and is promoted by, the scarcity/demand of Ether. As the Ethereum ecosystem grows, the core mechanisms of Ethereum that drive ETH scarcity grow stronger, which further instantiates the Ethereum economy into the world around it.

Action steps

- Learn the three pillars of ETH scarcity & the six metrics that measure it

- Listen to Episode #7 of Bankless podcast where the three pillars are discussed

Author Blurb

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his talk on how ETH accrues value and this accompanying post.

Want to dive deeper on Ether’s Scarcity Mechanisms?

Listen to episode 7—Ether’s Value Mechanisms on iTunes | Spotify | YouTube

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.