How Does Cryptocurrency Gain Value?

I’m sending this Economic Bandwidth piece to everyone including free subscribers. I think it’s that important! If you’d like to receive future Thursday pieces and start going bankless at warp speed subscribe now & support the program as a paying member. (Here’s what you get)

Dear Crypto Natives,

This thought-piece has been on my mind for a while now. Here’s a synopsis:

The concept of economic bandwidth is way under appreciated. When we talk about scaling blockchains we always talk about transactions per second (TPS). But that’s only a measure of scale for the networks of blockchains.

What about scaling the base money?

Let’s level up on economic bandwidth.

- RSA

P.S. Subscribe to the full program so you don’t miss David Hoffman’s killer new piece next wk. I’m also going to introduce subscribers to an incredible new money protocol on Tuesday. 🔥

THURSDAY THOUGHT

ETH and BTC are Economic Bandwidth

I have three things to say here:

- The asset is not the network

- Value is economic bandwidth

- Crypto is a social technology

The asset is not the network

First thing.

ETH is an asset. Ethereum is a network.

BTC is an asset. Bitcoin is a network.

We need this drilled into our heads because we forget so often. We can easily get caught in the crypto meme bubbles others have crammed into our brains without even realizing it.

For instance, how many times have you heard something like this?

“Bitcoin is a digital gold and Ethereum is a smart-contract platform”

There’s something off in that statement. Did you catch it? It’s comparing two separate things: Bitcoin the asset vs Ethereum the smart-contract platform.

This makes no sense—it’s like comparing Euros to FedWire.

If you want to compare the two networks doesn’t it make more sense to say, “Bitcoin is a transaction network for Bitcoin and Ethereum is a smart-contract platform”

And if you’re comparing the assets, well, they’re both a commodity store-of-value like gold, they’re both a currency for paying for blockspace, and they’re both crypto money.

But people miss this distinction. They default to the silly memes that tell them the important thing about Bitcoin is BTC the asset and the important thing about ETH is Ethereum the network. These memes are wrong.

Another story

I was talking to some people in the Ethereum community recently about marketing. Their focus—Ethereum as a blockchain platform. Ethereum as a decentralized internet. Ethereum as the home for DeFi.

“What about ETH the asset?” I asked.

“Oh, we don’t talk about price stuff” was the reply. “Bitcoin has the digital gold narrative and Ethereum needs a good narrative too.”

Again, see what just happened? Same mistake. They’re comparing Bitcoin the asset to Ethereum the network. Apples meet oranges. These people aren’t maximalists, but somehow they’re subconsciously buying into silly maximalist memes—that ETH doesn’t matter (just Ethereum!), that Bitcoin is the only “digital gold”.

The network is not the asset.

Value is economic bandwidth

Second thing.

There’s an obsession with improving crypto scalability by network metrics—TPS. Transactions per second. Some people make the mistake of thinking all TPS is equal. No. What we’re really after in crypto is trustless transactions per second. If you’re giving up decentralization for higher TPS you’re just a cloud provider.

But even trustless TPS is a limited definition of scalability. Don’t get me wrong. It’s a decent scalability metric for the network parts of blockchains. But it doesn’t measure the economic parts of blockchains. It can measure the scalability of Ethereum the network, but it doesn’t measure the scalability of ETH the asset.

It’s not enough to improve TPS. We also need to improve economic scalability. We need to increase the scalability of the cryptoassets themselves.

Trustless liquid value

You can measure cryptoasset scalability by the amount of liquid value available in the asset—the liquid market cap. High value, high liquidity assets can be sold with little impact on asset price. Dollars, Euros, T-bills, gold—these are the high value, high liquidity assets that provide economic bandwidth to the traditional financial system.

Want to see cryptoasset scalability live? Go to Messari now and peak at liquid value to see. Sort by “Liquid Marketcap” and look at “Real Volume” for a rough proxy.

Liquid value stores aren’t new to crypto. There are many real-world assets that are more liquid and higher value outside crypto. The revolution of crypto is that these cryptoassets can have trustless liquid value—value that isn’t backed by a central authority. Value that settles completely onchain. No sovereign, no court system, no threat-of-violence—purely crypto native.

This is why USDC can’t replace ETH

You can get liquid value on a crypto network really easily. Just use existing sources of trusted value. Import fiat stablecoins like USDC. Use tokenized T-bills. Tokenize gold. Some people think these will replace cryptonative assets as a store of value. But all of themm require a trusted third-party—banks, vaults, and legal systems. All of them settle natively on the legal system, not on the chain. They’re all useful, but limited. They’re foreign.

Trustless value is only present in crypto native assets. The high value, high liquidity trustless assets like BTC and ETH are the kings here. These settle onchain—no legal system, no banks, no meatspace, no trusted third-party. Tether, or USDC, or tokenized T-bills might beat BTC and ETH in liquidity and marketcap for a time but they can never beat them on the dimension of trustlessness.

USDC can never replace ETH on Ethereum.

Value is economic bandwidth

Trustless value is important because its economic bandwidth for a trustless economy.

With low bandwidth we have low capacity for trustless money applications. We’re dependent on the trusted systems we hoped to replace. With high economic bandwidth we can build an entire economy. A parallel money system.

We don’t have to wait. We can see this playing out now.

DAI is maximally trustless because it’s backed by a trustless value source—ETH as economic bandwidth. Uniswap also uses ETH for its economic bandwidth, but imagine if it used USDC? The protocol would be one OFAC mishap from being perma-frozen by Coinbase. (Yeah, Coinbase can freeze USDC at will). Hardly permissionless. Same as the old system.

These money protocols only exist due to the economic bandwidth of ETH.

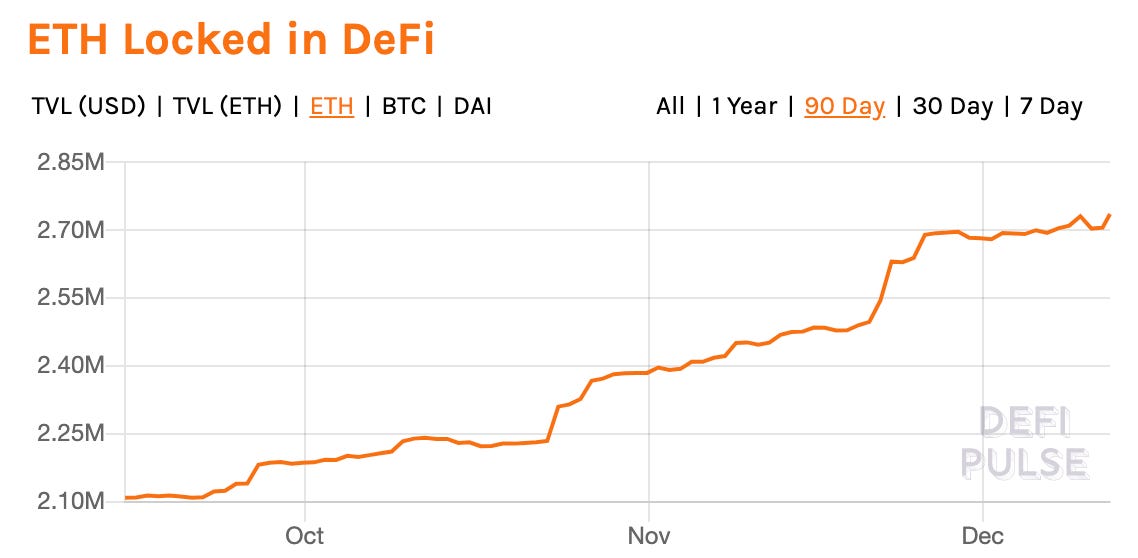

(Above) This is a graph of $400m worth of ETH base money being used as economic bandwidth for the Ethereum economy

The Ethereum economy needs ETH bandwidth to thrive

The community discussion in Synthetix is fascinating these days. They’re debating whether they should add ETH as collateral to back their growing ecosystem of decentralized synthetic assets.

Their problem? Right now the $24m or so of all synths are self-referentially backed by the value of SNX, which itself derives value from the net present value of future Synthetix exchange fees (they’ve made $3.1m on exchange volume so far). A low liquidity, low value SNX gives them the economic bandwidth of a 56k modem. To generate more snyths in order to grow their ecosystem and generate more exchange fees you know what they need? A bandwidth upgrade.

So early next year they plan to add ETH as a collateral option for Synthetix. This will give them broadband—call it a 78x upgrade on their current economic bandwidth (78x is the difference between SNX and ETH market cap). And probably more than 78x since ETH collateralization can be 600% less than SNX due to ETH’s higher liquidity.

Money protocols in the Ethereum economy like SNX need high economic bandwidth—so they need a high value ETH. And they’re using ETH’s bandwidth to grow. Scaling Ethereum isn’t just scaling the TPS of the network. It’s scaling the economic bandwidth of ETH.

Crypto is a social technology

Last thing.

All of this makes more sense if you think of Ethereum and Bitcoin more as a social tech like money or law and less as a hard tech like relational databases or programming languages.

You don’t necessarily scale a social tech through better software alone. Software plays an important role, but it’s not sufficient. How do you scale a social tech—how do you scale economic bandwidth?

The engineers among you may not like the answer to this question because it doesn’t have a technical solution. It’s soft, it’s squishy, it’s human. It requires things like:

- Sticky narratives and memes

- An intolerant minority of true believers

- A predictable and easy-to-explain issuance policy

- A social movement with a clear vision for a better world

And the VCs who’ve invested in ETH-killers won’t like this next part. Because the reality is their early involvement in base chains can permanently stunt the future economic bandwidth of their investments by:

- Limiting coin distribution to accredited investors and backroom deals

- Stifling the organic growth of early communities

- Removing the upside for early crypto natives

- Corporatizing the social movement

Indeed, in today’s environment of regulatory scrutiny is the type of open, public, low-value “immaculate ICO” that Ethereum had even possible?

Is the type of non-whale influenced proof-of-work coin distribution to cipher punks and true believers that Bitcoin had even possible when Wall Street and Sandhill are watching?

I have my ideas, but no one knows for sure how it’ll play out.

I do know this: economic bandwidth scales on the social layer.

And without economic bandwidth our crypto systems aren’t truly scalable.

Trillions in trustless economic activity will require trillions in economic bandwidth.

Money, store-of-value assets, reserve assets, whatever you want to call them—the high powered collateral assets like ETH and BTC are essential. They have to grow massively in value for this whole open finance thing to work.

Let’s pay more attention to our economic bandwidth. Let’s fire up the bandwidth memes.

Actions

- Consider: how does the economic bandwidth of crypto systems scale?

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

👉Send Bankless a DAI tip for today’s issue

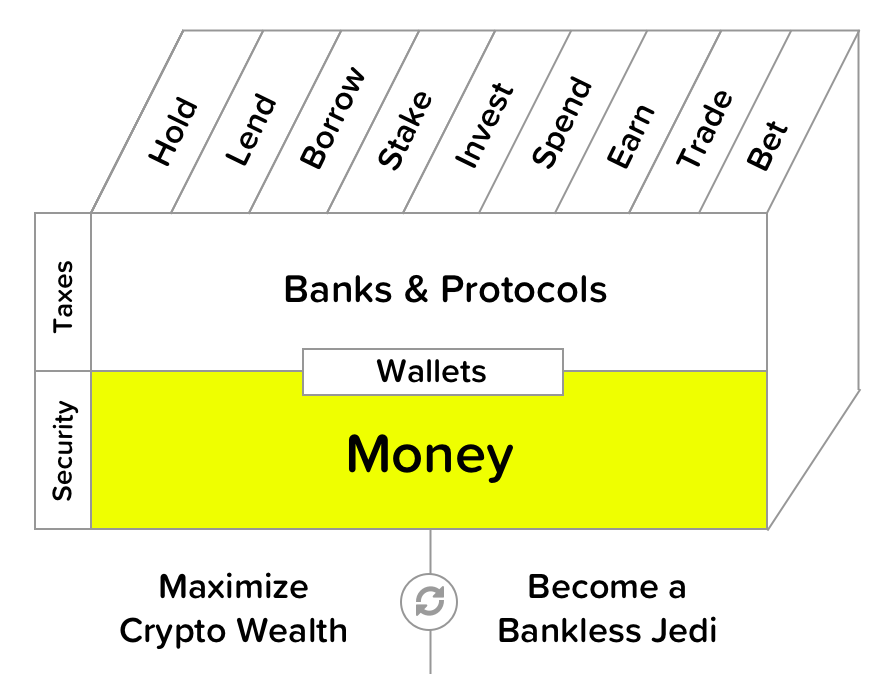

Filling out the skill cube

The concept of economic bandwidth is in the money layer of the skill cube. The assets in this layer comprise the biggest portion of a typical crypto money portfolio.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.