Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Economic bandwidth is the new fat protocol thesis.

Read this and this for a primer.

But why can’t we use something other than ETH for economic bandwidth in DeFi?

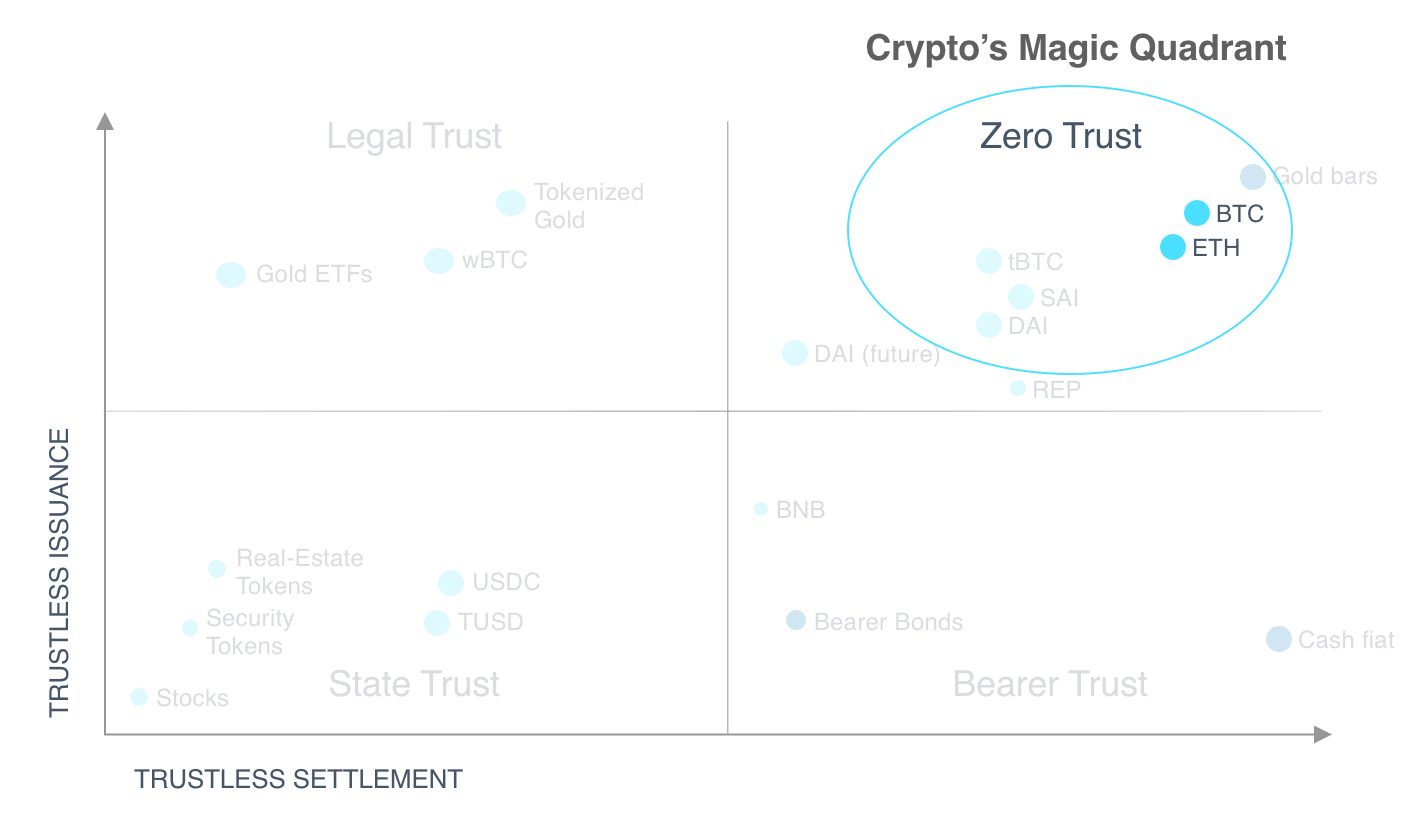

This article answers that question. Along the way, we create a taxonomy for economic bandwidth and map crypto assets in one of four trust quadrants.

This is the mental model you need to understand economic bandwidth.

This is why I think ETH is irreplaceable.

This is the magic quadrant for crypto.

Let’s level up.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

A Taxonomy for Economic Bandwidth

Written by: Ryan Sean Adams and Lucas Campbell

Economic bandwidth is the fuel for powering open, decentralized financial applications. In Eth2, economic bandwidth also serves to secure Ethereum as a global settlement layer. The more economic bandwidth on a network, the higher the capacity for financial applications and security of the network at large.

In order to fuel a decentralized, permissionless financial economy, Ethereum will require trillions in economic bandwidth. But where will it come from?

Yes, economic bandwidth comes from the total value of the network’s assets.

But we need more specificity…because not all economic bandwidth is created equal.

Trustless Economic Bandwidth

Today Ethereum’s native currency, Ether (ETH), serves as the primary reserve asset supplying economic bandwidth for its money protocols and financial applications.

Importantly, Ether supplies the most valuable form of bandwidth—trustless economic bandwidth. Ether is trustless value supplying economic bandwidth for Ethereum’s permissionless money protocols.

In order to build a trustless economy, we need trustless value. Imagine if USDC were the main reserve asset for Ethereum. The entire system would be subject to the whims of Coinbase, Silvergate, and the Fed. Not decentralized. Same system as today.

Trustless value is only possible with fully decentralized crypto-native assets that settle on-chain with no central backing like BTC and ETH.

The aggregate liquid value of trustless assets on a network is the network’s trustless economic bandwidth. Total trustless economic bandwidth of Ethereum in USD terms is the liquid market cap of the network’s trustless assets—the market cap of Ether.

But can Ethereum tokens also be a source of trustless economic bandwidth?

Tokenized Assets as Economic Bandwidth

Though tokenized assets on Ethereum supply economic bandwidth it is not necessarily trustless economic bandwidth.

An example:

Synthetix is a synthetic asset issuance protocol built on Ethereum with a value accrual asset called SNX. While Synthetix introduced ETH-based collateral, a move which will drastically increase the economic bandwidth for Synths, today its synthetics almost entirely relies on economic bandwidth supplied from SNX.

Could other DeFi protocols use SNX as economic bandwidth?

Yes, but they’d have to trust Synthetix.

Even though SNX has proven itself as a form of economic bandwidth within the Synthetix ecosystem, it’s lacking the most important characteristic when it comes to economic bandwidth for a broader permissionless economy: it’s not trustless. While SNX settles onchain, the Synthetix team has enough control to tinker with issuance (see SNX issuance changes here and here).

SNX has trustless settlement because it settles on Ethereum but not trustless issuance because its supply can be manipulated by a self-interested third-party. SNX is not as trustless as ETH.

It seems there’s a spectrum of trust across the axises of issuance and settlement. Can we apply this to a broader taxonomy of assets?

Quadrants of Trust

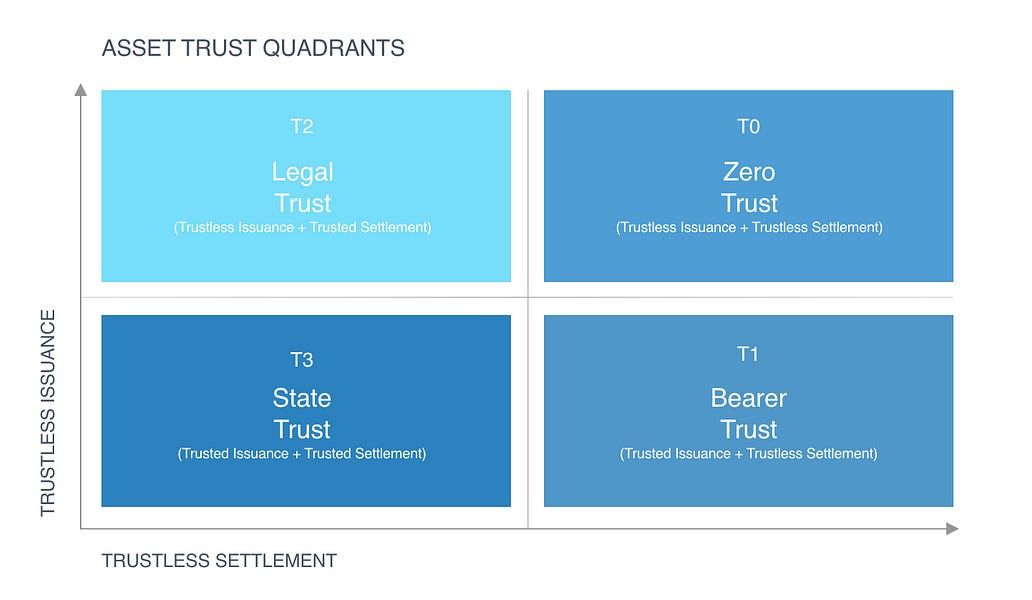

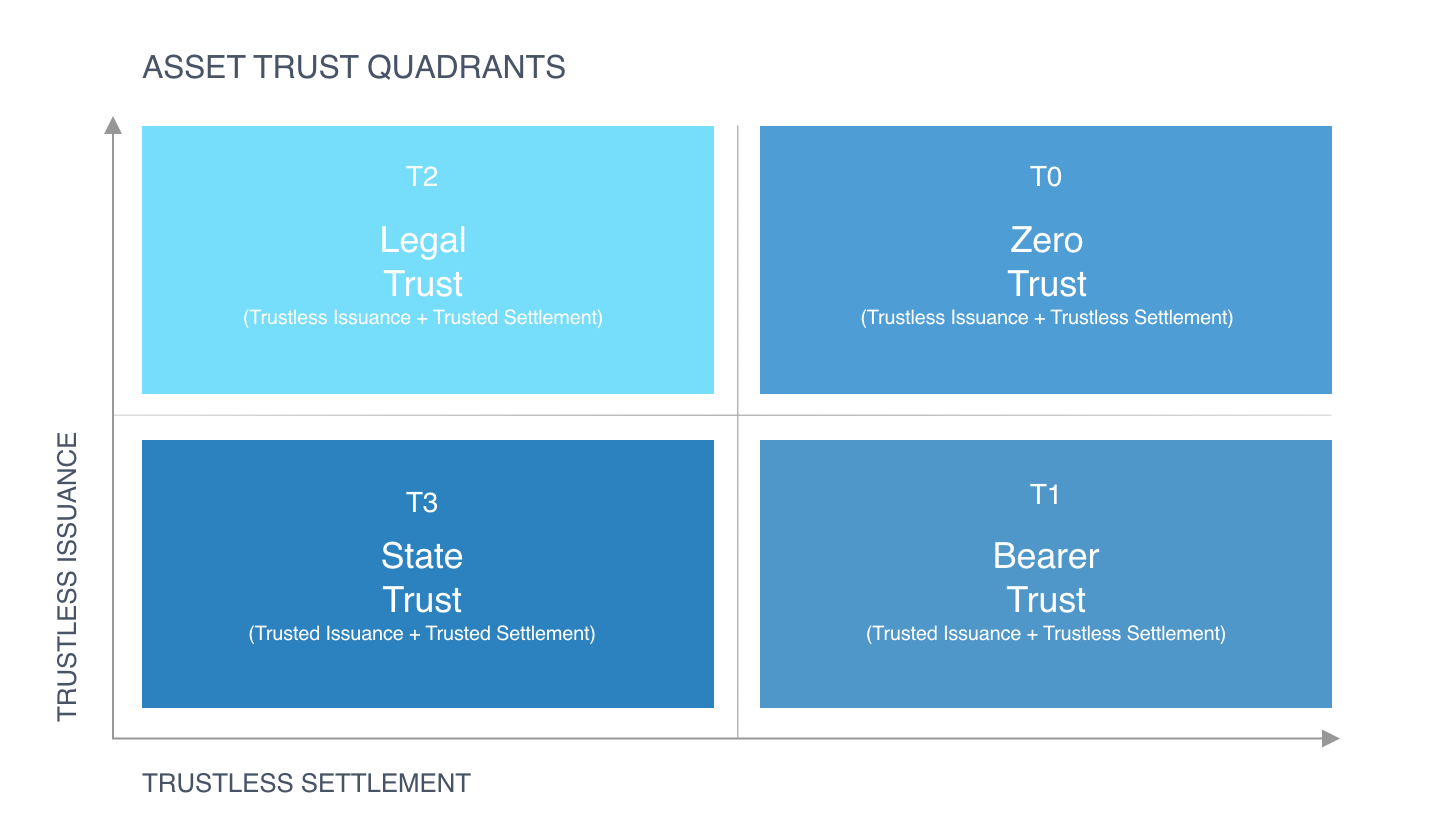

Let’s define the degree of trust associated with an asset by these two components: trustless issuance and trustless settlement.

- Trustless issuance means the asset’s issuance policy isn’t dependent on and can’t be manipulated by a self-interested third-party

- Trustless settlement means the asset’s transaction finality isn’t dependent on and can’t be manipulated by a self-interested third-party.

An asset with trustless issuance combined with trustless settlement is the optimal form of economic bandwidth for a decentralized system. Zero Trust assets are those in the upper right quadrant.

- Zero Trust Assets (T0)—trustless issuance & trustless settlement

Let’s look at the other quadrants:

- Bearer Trust Assets (T1): trusted issuance & trustless settlement

- Legal Trust Assets (T2): trustless issuance & trustled settlement

- State Trust (T3): trusted issuance & trusted settlement

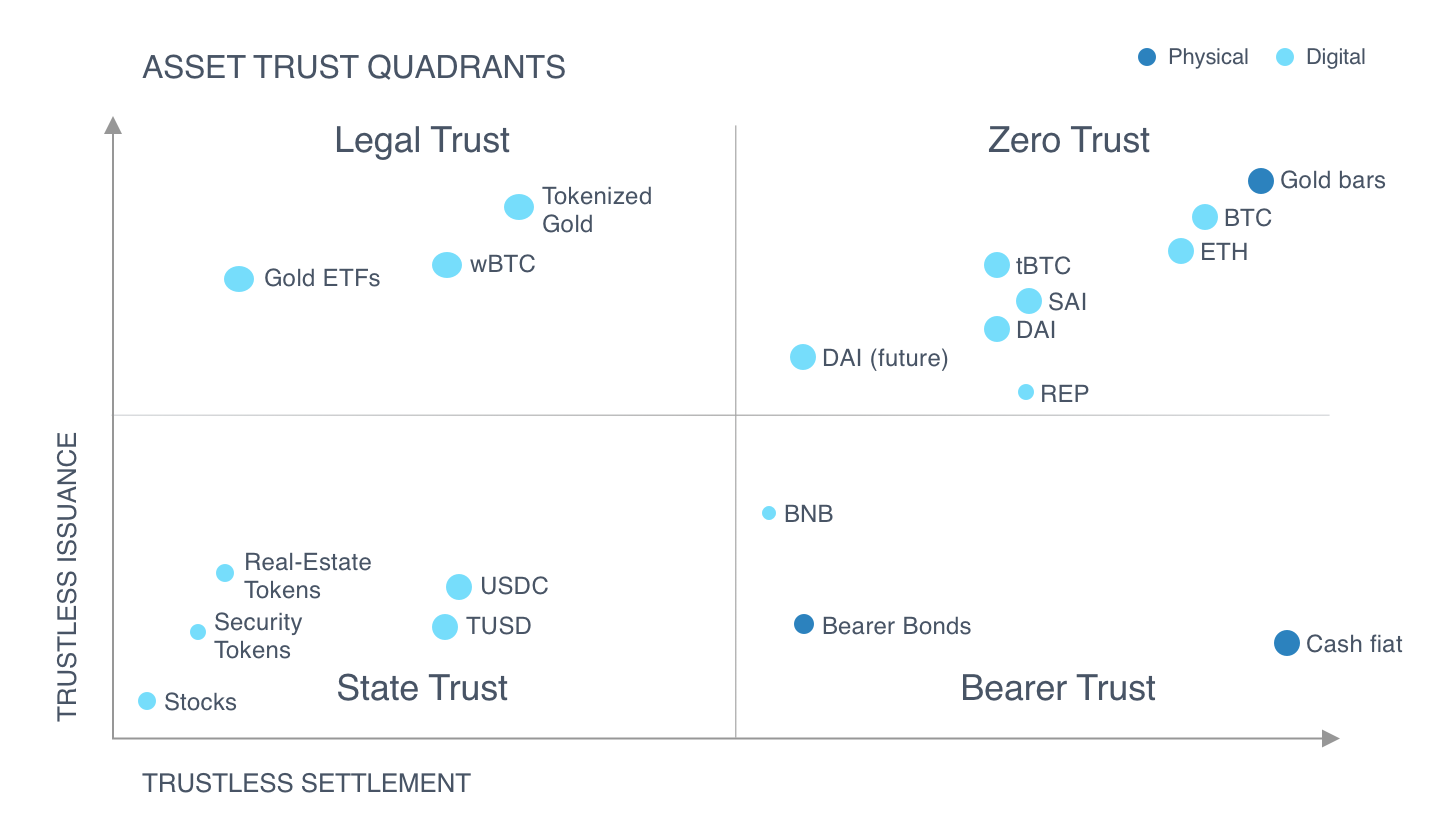

ETH, BTC, and gold are some of the three most trustless forms of economic bandwidth in existence today. Unfortunately, since trustless-ness of gold is limited to its physical form, it’s less useful bandwidth in a digitally-native economy.

Here’s how we’d map these assets:

Let’s run through our reasoning—first Zero Trust assets:

- BTC: a zero trust asset when settled on the Bitcoin network

- ETH: similar to BTC, issuance & settlement slightly less trustless that BTC

- DAI: backed by ETH, but oracle & governance makes it less trustless than ETH

- DAI (future): if trusted assets are added to DAI as collateral DAI drifts left

Bearer Trust assets are about possession:

- Cash fiat: settlement by possession, but issuance requires trust of US gov

Legal Trust assets are often neutral issuance assets wrapped in legal guarantees:

- Tokenized gold: gold issuance can’t be manipulated—but if the gold in the vault backing PAXG disappears your only recourse is legal system

- wBTC: a Bitcoin coupon custodied by a legal entity—settlement by legal system

State Trust assets comprise almost everything else in our traditional financial system:

- Stocks: issuance increase by shareholder vote, settlement by corporate law

- USDC: not really settled on Ethereum, dollars settled in bank system

- T-bills, derivatives, bonds, CDs: all these are state trust assets

Maybe you’d change the placement of some of these assets in the graph, but are you seeing how the model works? Stuff in the left and bottom quadrants requires guns and governments. Stuff in the top right doesn’t.

❓Why are gold bars Zero Trust? Gold’s issuance is set by physics. Gold’s above ground supply is costly to increase (barring tech leaps in sea or asteroid mining). Gold’s settlement is also trustless—finality occurs when a unit of gold is transferred from one person’s physical possession to another. Possession is finality.

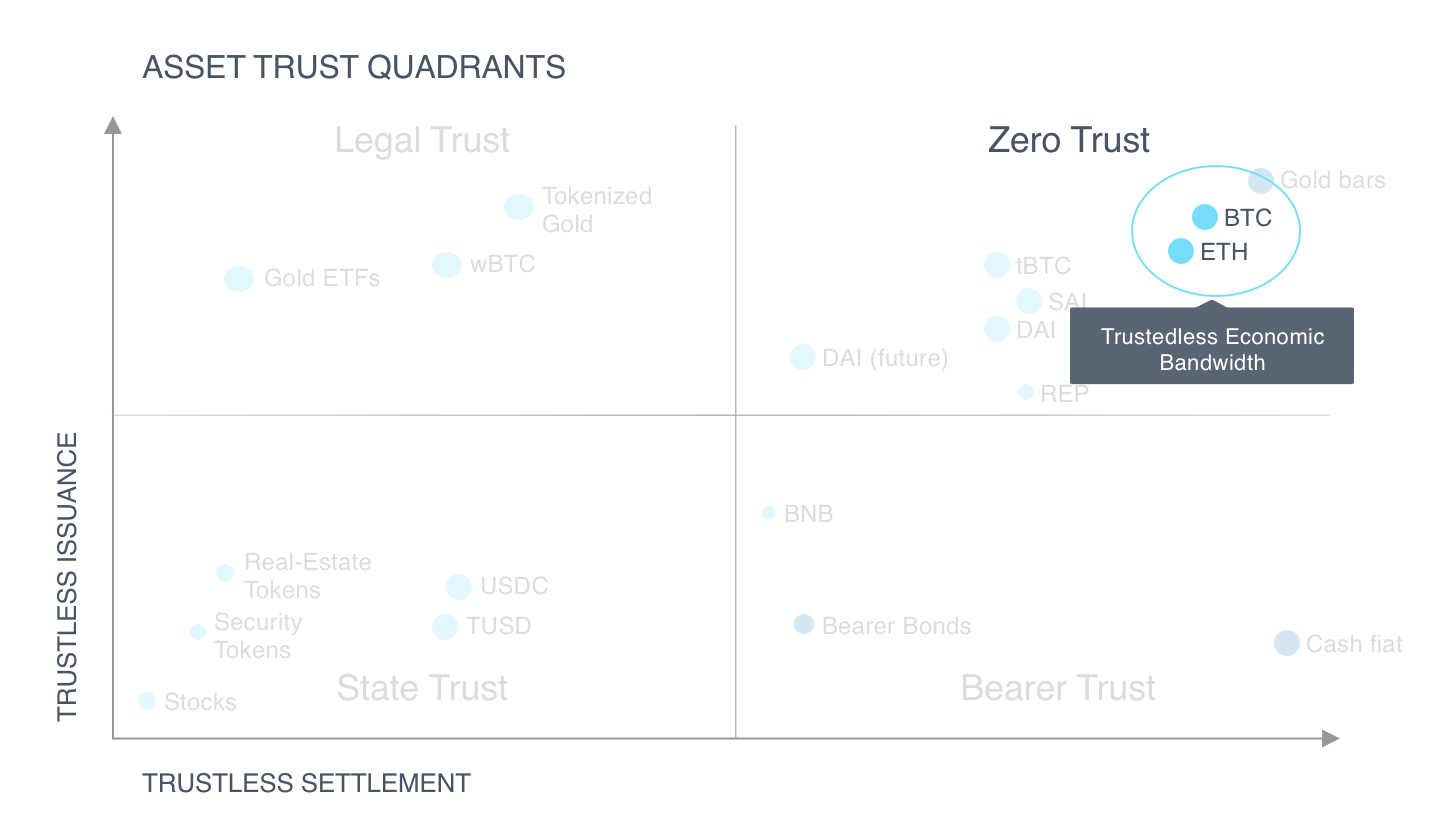

ETH and BTC are the only multi-billion dollar digital assets that have ever occupied the Zero Trust quadrant. DAI, tBTC—only possible because of ETH and BTC. That’s why crypto money is a such a big deal.

But here’s the problem with Bitcoin.

BTC is settled trustlessly on its respective network, but if deposited in Coinbase, settlement now depends on a third-party. BTC moves from a Zero Trust asset to a Legal Trust asset.

Since Bitcoin is limited by the functionality of its network it serves more as a network for peer-to-peer value transfer rather than a network for programmable money. Most of Bitcoin’s money verbs require a trusted crypto bank.

That’s why ETH is so important. The expressivity of Ethereum means we can create an entire money system inside the Zero Trust quadrant.

That’s why ETH is irreplaceable.

(Above: you’ve heard of Gartner’s magic quadrant? Top right is crypto’s magic quadrant too.)

Ethereum’s Economic Bandwidth by Type

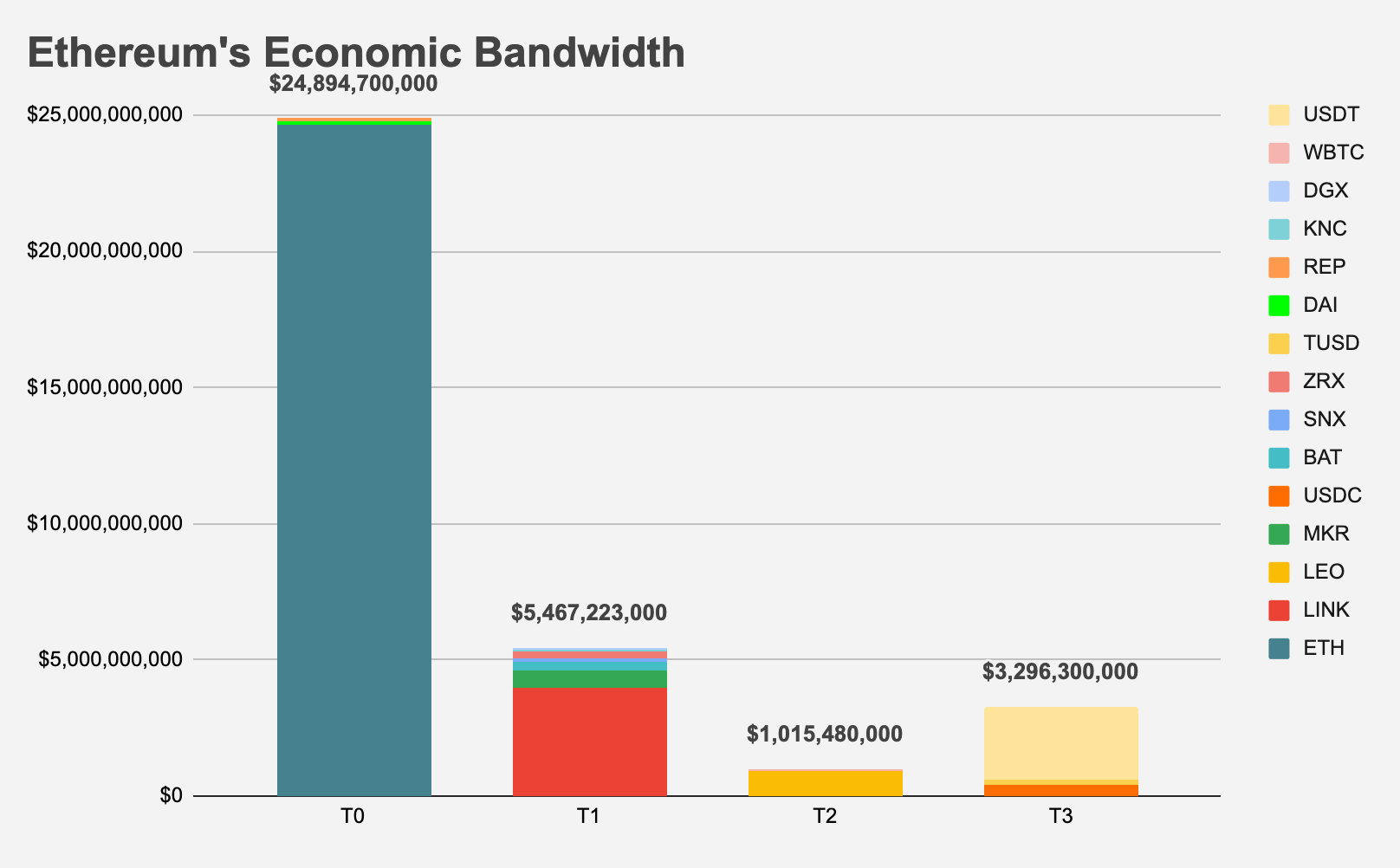

Let’s run some numbers. What’s the available Zero Trust (T0) economic bandwidth versus other forms on Ethereum today?

As expected, Ether is the largest supplier of T0 economic bandwidth by far—providing over $24.6B in bandwidth to Ethereum. Other forms of trustless economic bandwidth include DAI and REP.

T1 economic bandwidth forms $5.4B in total available bandwidth as it includes a majority of token projects like LINK, SNX, BAT and others. These are liquid assets with trustless settlement but trusted issuance. Trusted issuance because their respective teams have enough control over the protocols to change issuance.

That said, it is entirely possible for many of these T1 tokens to become trustless economic bandwidth in the future if they’re able to minimize the influence of single entities and individuals within the ecosystem—there was a time when BTC was in the T1 quadrant too!

Economic bandwidth T2 and T3 supply a little over $1B and $3.2B, respectively. Recall that T2 assets have trustless issuance but trusted forms of settlement—wBTC and tokenized gold are examples.

T3 assets include USDC, TUSD and USDT—fiat-backed stablecoins with trusted settlement and issuance, making them largely rely on the legacy financial system to succeed. UDST provides the highest amount of T3 economic bandwidth at over $2.7B of the reported $4.3B in circulating supply is now tokenized on Ethereum.

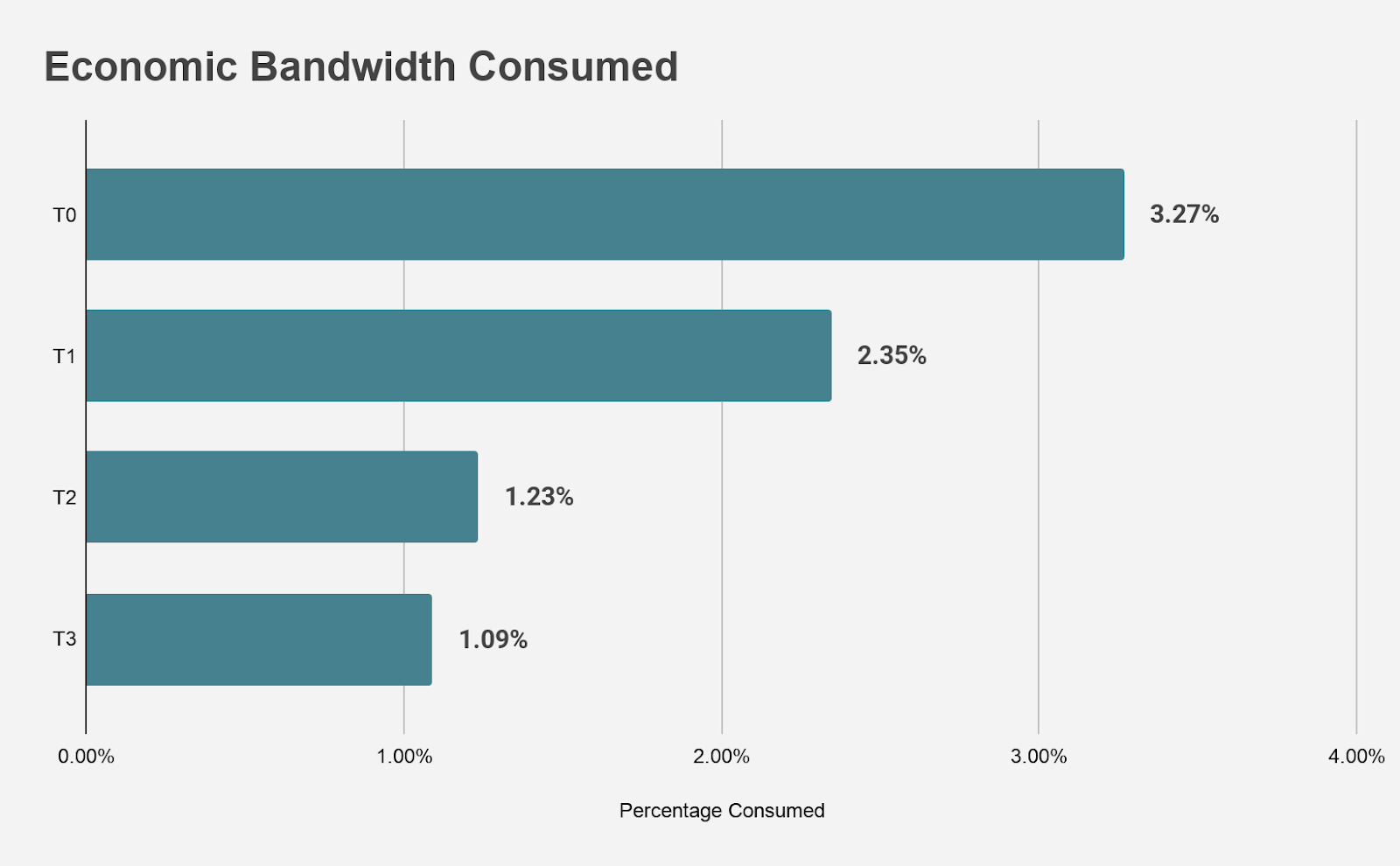

Economic Bandwidth Consumed by DeFi

We also can measure economic bandwidth consumed by DeFi protocols. Over 3.27% of available T0 economic bandwidth is being consumed by Ethereum’s DeFi today. This is some of the most decentralized DeFi activity on Ethereum.

But of course DeFi protocols like Compound, Uniswap, and Maker are not limited strictly to trustless economic bandwidth. Compound for example, has permissionless lending markets for a range of Ethereum-based assets, including USDC.

Even though USDC has a relatively high usage rate within DeFi, T3 bandwidth consumption is low overall due to the lack of DeFi’s adoption of Tether—USDT is the biggest supplier of T3 bandwidth in our data set.

Ultimately, we can see that Ethereum’s money protocols are consuming more than just trustless economic bandwidth. It is entirely possible for liquid, non-trustless assets to serve as economic bandwidth for the broader ecosystem.

Eyes on the Prize

While DeFi protocols can leverage trusted forms of economic bandwidth to improve financial products, it is vital that we remain focused on the core mission of open finance: trust-minimization.

Trustless economic bandwidth is trust-minimized fuel for an open economy. Combine this with permissionless money protocols and it’s an unstoppable force for money and finance at large.

Unless our goal is to simply reconstruct the same old financial system, we need trustless economic bandwidth. That is the most important thing to remember as we pioneer through this financial revolution.

Closing thoughts

The goal of this article was to propose a taxonomy for economic bandwidth. By analyzing assets on the trust quadrant, we established a framework for understanding the importance of trustless assets to decentralized finance.

There are two core components for trustless economic bandwidth (1) trustless issuance and (2) trustless settlement. Assets like ETH in the Zero Trust quadrant have both of these attributes and form the basis of a trust-minimized crypto money system—they cannot be replaced by assets from other quadrant.

Of course any tokenized asset can leverage the permissionless, programmable, and open nature of Ethereum’s financial system and benefit from settlement on Ethereum. Tokenization is good for crypto and good for the world. But we should remember, only Zero Trust bandwidth can contribute to the decentralization and security of Ethereum.

A trustless economy will require trillions in trustless economic bandwidth.

ETH is irreplaceable economic bandwidth.

Action steps

- ETH is irreplaceable as economic bandwidth—do you agree?

- Review: what are the four types of economic bandwidth?

- Where would you map assets on the Trust Quadrant?

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

New to the Bankless program? Start here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.