How to make money with Balancer

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Balancer is what you’d get if Uniswap and Set had a baby.

It’s like Set because it can be used to bundle any group of assets into a single ERC20 token—say an index fund token composed of 50% ETH + 20% MKR + 30% DAI—and it auto-balances to always maintain the same proportion.

And it’s also like Uniswap because it’s an automated-market maker that can be used as as liquidity infrastructure for the entire DeFi economy

Today we’ll hit the basics: how to use it to trade, how to supply liquidity to get returns.

But we don’t stop there.

At the end of this tactic I’ve added a Bonus Tactic that actually shows you how to create your own Balancer index fund and liquidity pool. 🔥

Maximum level-ups today.

This is one of the coolest money legos I’ve seen.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #33: How to make money with Balancer. The Balancer Guide.

If you have some ETH or ERC20 tokens lying around you've probably already asked the question: how should I put these to work? With DeFi there are a multitude for you to earn money with your idle assets: from lending money to Compound (tactic #23), opening a Maker vault, to being a Uniswap liquidity provider (tactic #15).

Now there’s Balancer—a new option for providing liquidity. Balancer allows pools with different combinations of tokens (think token ETFs or index funds). With Balancer, any liquidity provider can customize their exposure while earning trading fees from the protocol.

- Goal: Provide liquidity to a Balancer pool & earn fees (add-on: create your own pool!)

- Skill: Beginner/Intermediate

- Effort: 15 minutes (1h for the add-on of creating a Balancer pool yourself)

- ROI: Variable. Usually ranging -5% to 20% APR. (See recent ROI here)

What is Balancer?

Guest post: Fernando, co-founder Balancer Labs & Nodar, co-founder DeFiZap

Balancer is an AMM protocol that allows anyone to provide liquidity to existing Balancer pools or create one themselves. Each Balancer pool is composed of 2 to 8 tokens. Each of the tokens makes up a percentage of the total pool value: these are the token weights that are chosen at the moment of pool creation. The mathematical properties of Balancer protocol ensure that the value percentage of each token in a pool will stick closely to the weight even as the market prices of the tokens themselves vary.

A Balancer Pool is a self-balancing index fund

This means that each Balancer pool is a self-balancing index fund itself. But it gets better. In a conventional index fund the investor has to pay a fee for the rebalancing service, but in a Balancer pool the liquidity provider is actually rewarded for their service of providing liquidity to the protocol. They earn fees while their index funds are continuously rebalanced for them.

Why Balancer is a magical money lego

Balancer pools can be one of two kinds:

- shared (i.e. finalized)

- private (i.e. controlled)

Shared pools have fixed parameters (they cannot be changed even by the pool creator) so that anyone can add liquidity to them. This is necessary since the pool creator could indirectly steal money from other liquidity providers in their pool if they could, for example by adding a new token they control all the supply of.

Private pools are as flexible as it gets: tokens can be removed/added, weights can be changed and even the swap fee can be adjusted. However the only address that can provide liquidity to it is the pool creator. This is great for big index funds that manage funds of third parties for example.

But private pools get really interesting with smart pools.

Smart pools are private pools that are owned by smart contracts. These smart contracts can be used as a gateway for external users to add liquidity to pools under known conditions. Some great examples are:

- PieDAO BTC++: the BTC++ pool is currently comprised of 4 different types of ERC-20 BTC synthetics. Through governance, PieDAO can change the weights of each of these types of tokenized BTC, add new types in the futures and even pause trading if one of the tokens has problems and loses its peg.

- RealT index fund: instead of having fragmented liquidity in many Uniswap Pools, RealT tokenized properties can all live in the same Balancer pool, effectively creating a RealT index fund. By using a smart pool, RealT can keep the possibility of adding new properties in the future, as well as changing the weights of existing ones (say for example one of them is refurbished and doubles in market value).

- Bootstrapping liquidity pools: projects that are seeking to both make their native token liquid and also distribute tokens in a sale can use the concept of a smart pool that gradually flips the weights of its underlying tokens. This is an effective way of killing two birds with a stone: provide liquidity for your token at the same time as you exchange it for ETH or DAI to fund your project development.

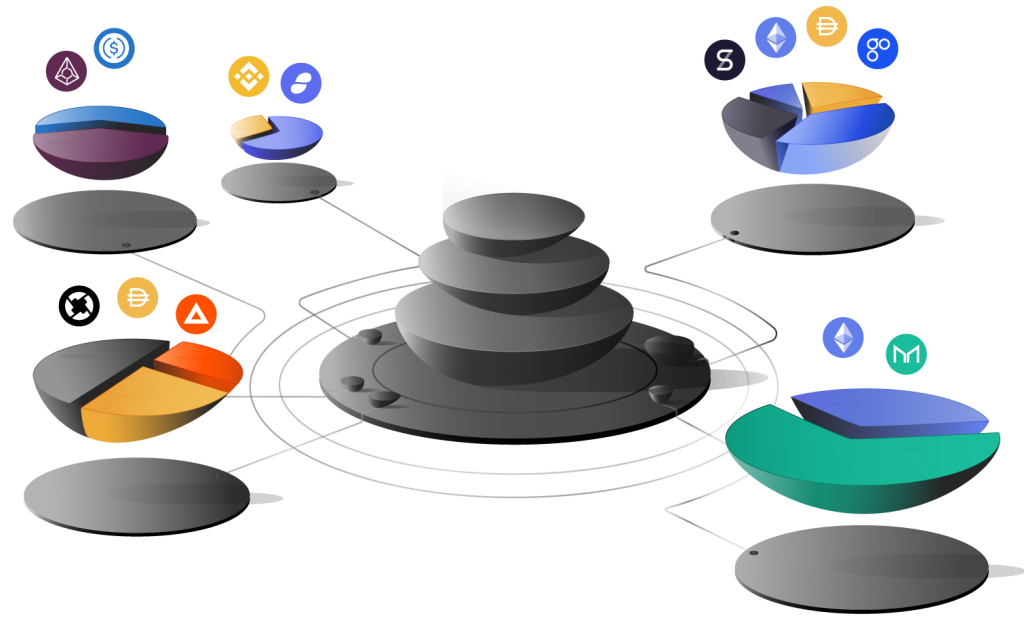

Pools in pools

All Balancer pools are themselves represented by ERC-20 tokens, allowing the composability feature of creating Balancer pools of Balancer pools. Many BTC++, which are Balancer Pool Tokens themselves, are pooled in another Balancer pool with ETH. So if you want to trade one of the flavors of BTC in BTC++ like wBTC, you can get BTC++ with ETH and then from BTC++ pool tokens you can withdraw pool liquidity with wBTC alone.

As RealT grows, they could create pools with 8 properties located in the same city, and then create Balancer pools with these Balancer pool tokens for properties in a state, and so on.

Buying a Balancer index fund asset

Of course you don’t have to be a liquidity provider or pool creator to gain exposure to a Balancer index fund asset. If you want to get exposure to BTC++ for instance you can buy the BTC++ token from a secondary exchange or mint BTC++ in Balancer by providing the underlying tokens.

Many end-users of Balancer in the future will probably be the holders and traders of the thousands of Balancer index pool assets that will inevitably be created using the protocol.

How to use Balancer

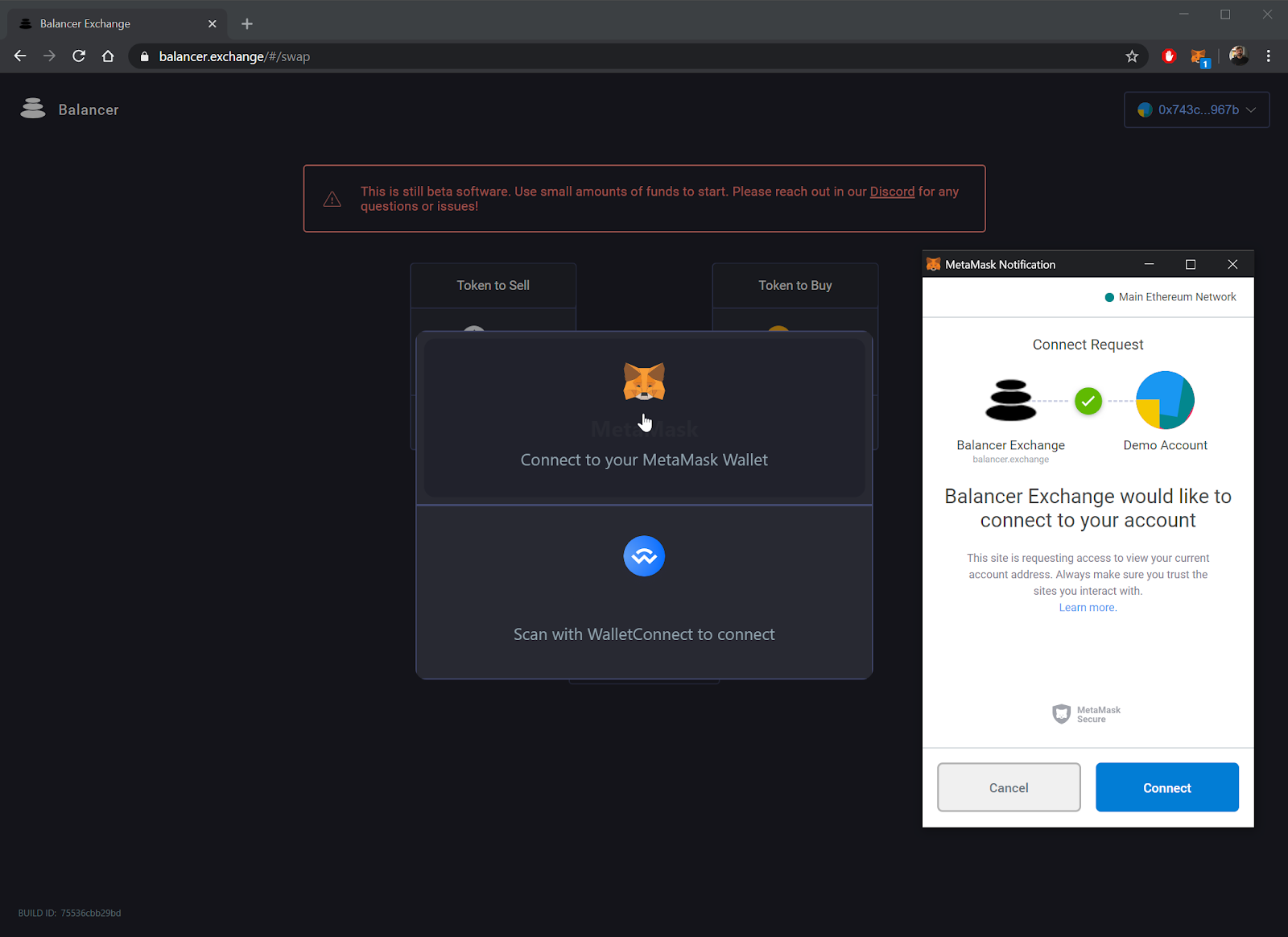

Trading using Balancer

- Visit Balancer exchange and connect to your MetaMask Wallet or use WalletConnect.

No signups. No kyc. We’re bankless, remember?

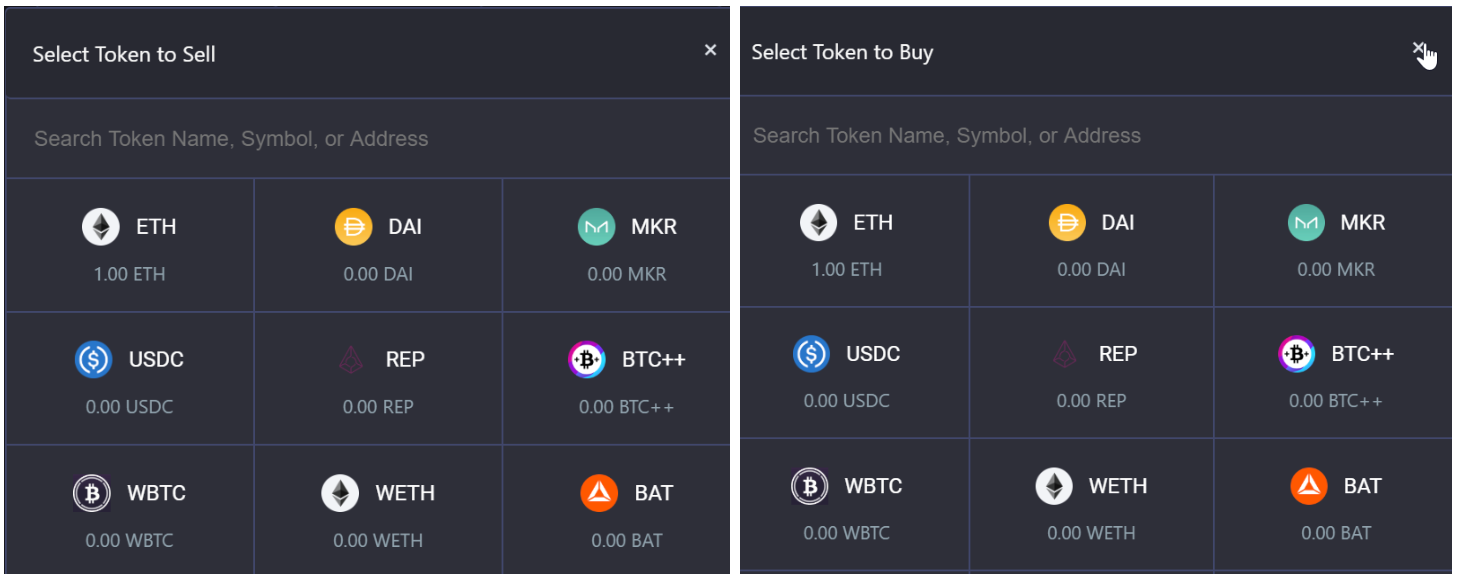

- Choose which token you would like to sell and which to buy from a dropdown list of available assets or by entering Token Name, Symbol, or Address.

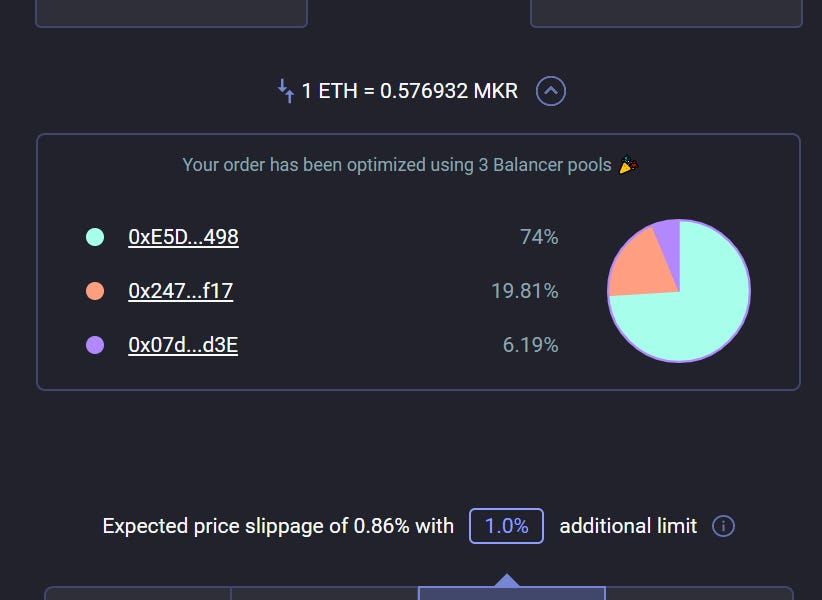

- As you start entering your ‘Token to Sell’ amount, Balancer will filter through applicable pools containing your requested tokens and spread your order using the most efficient allocation to provide the best possible price.

It’s important to note that the bigger your swap amount, the more liquidity you are requesting from available pools ultimately resulting in higher and higher price paid for the asset your are buying—aka slippage. To control this, after finalizing your input amount you will notice a summary of your expected price slippage and there’s an option to set an additional limit.

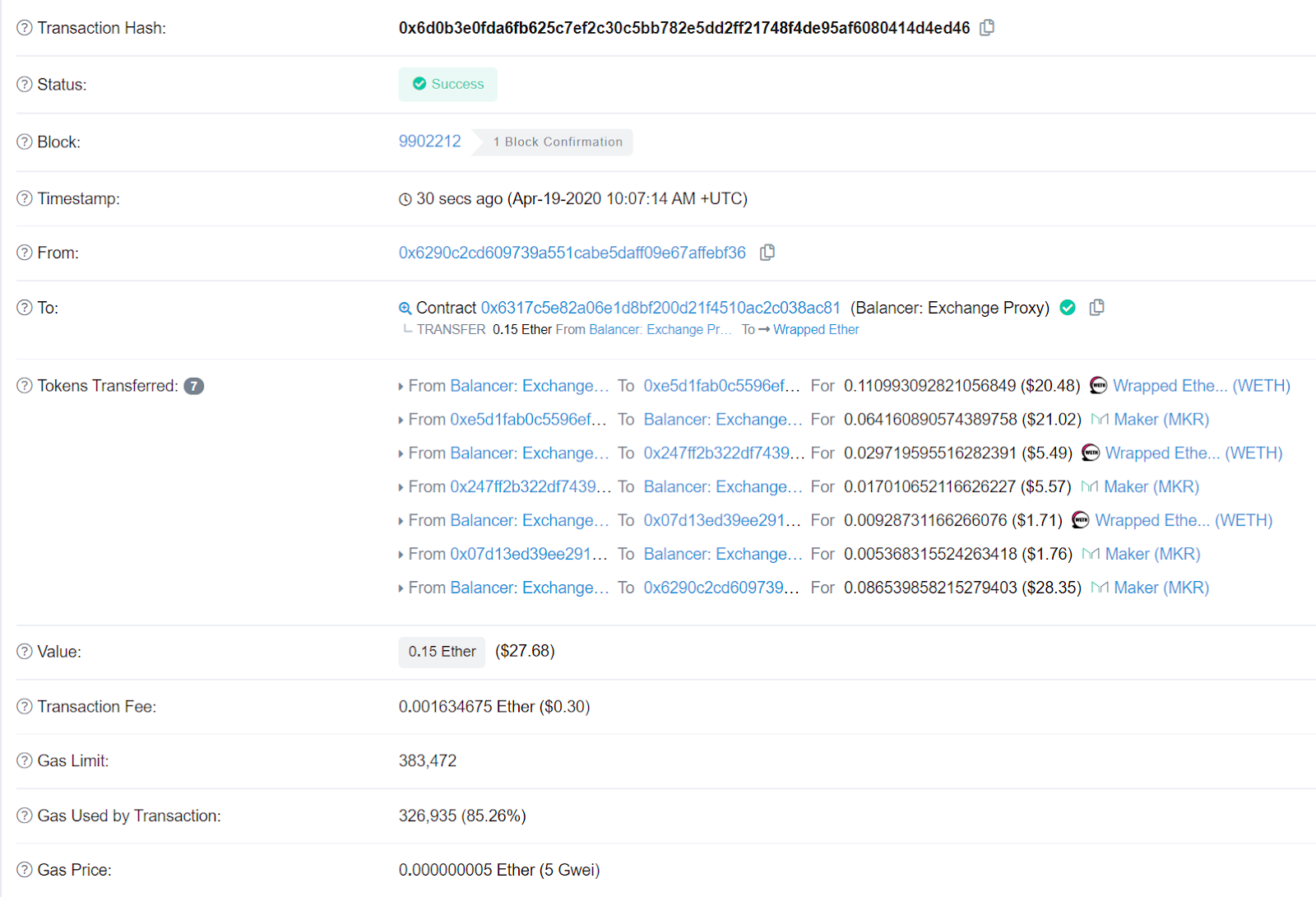

Click ‘Swap’ and Confirm the transaction on on your Metamask (or WalletConnect). Here’s an example of ETH to MKR swap.

Tx hash: see here

Adding liquidity using Balancer

Note: You need to know the concept of impermanent losses from tactic #15—it applies here too

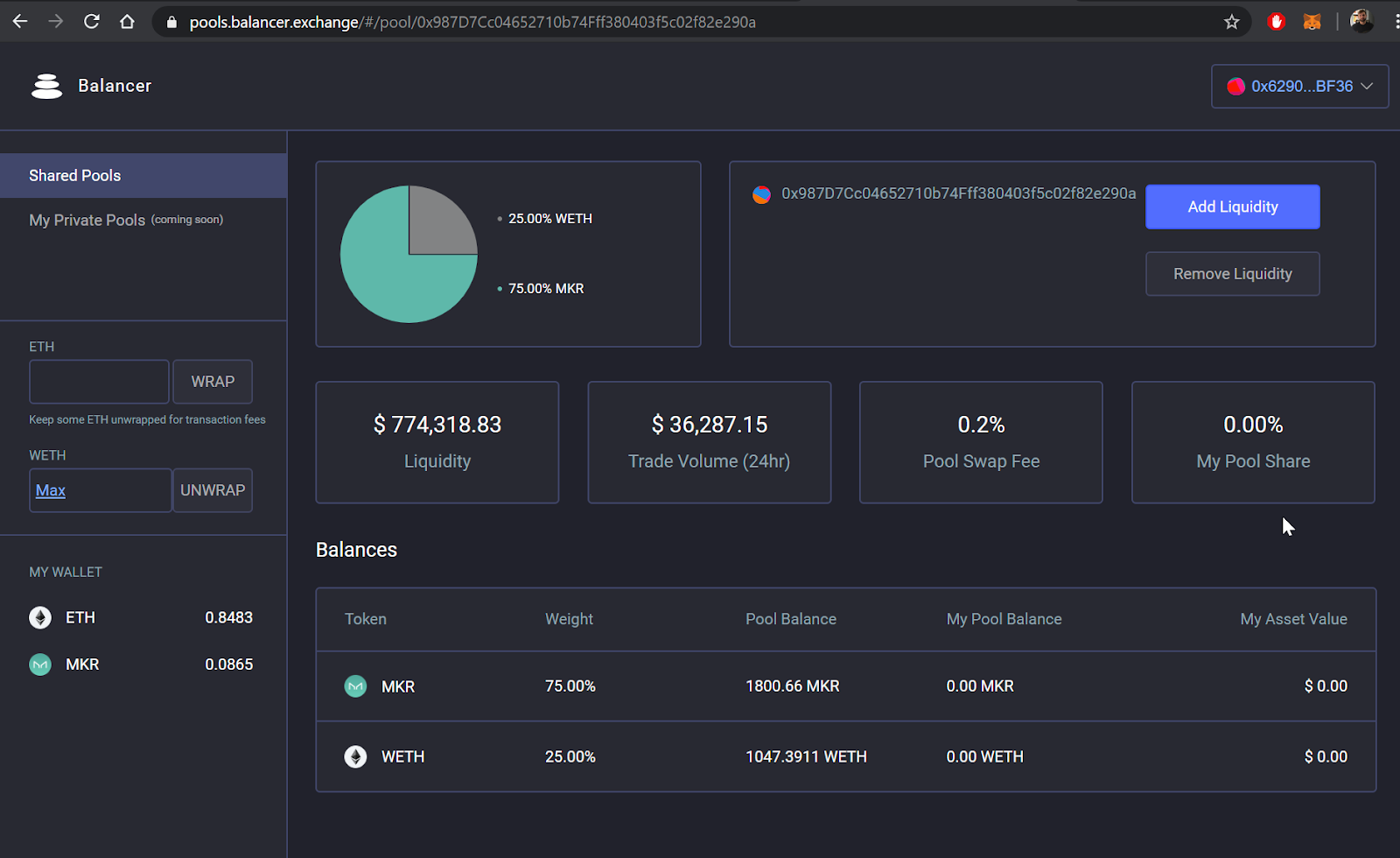

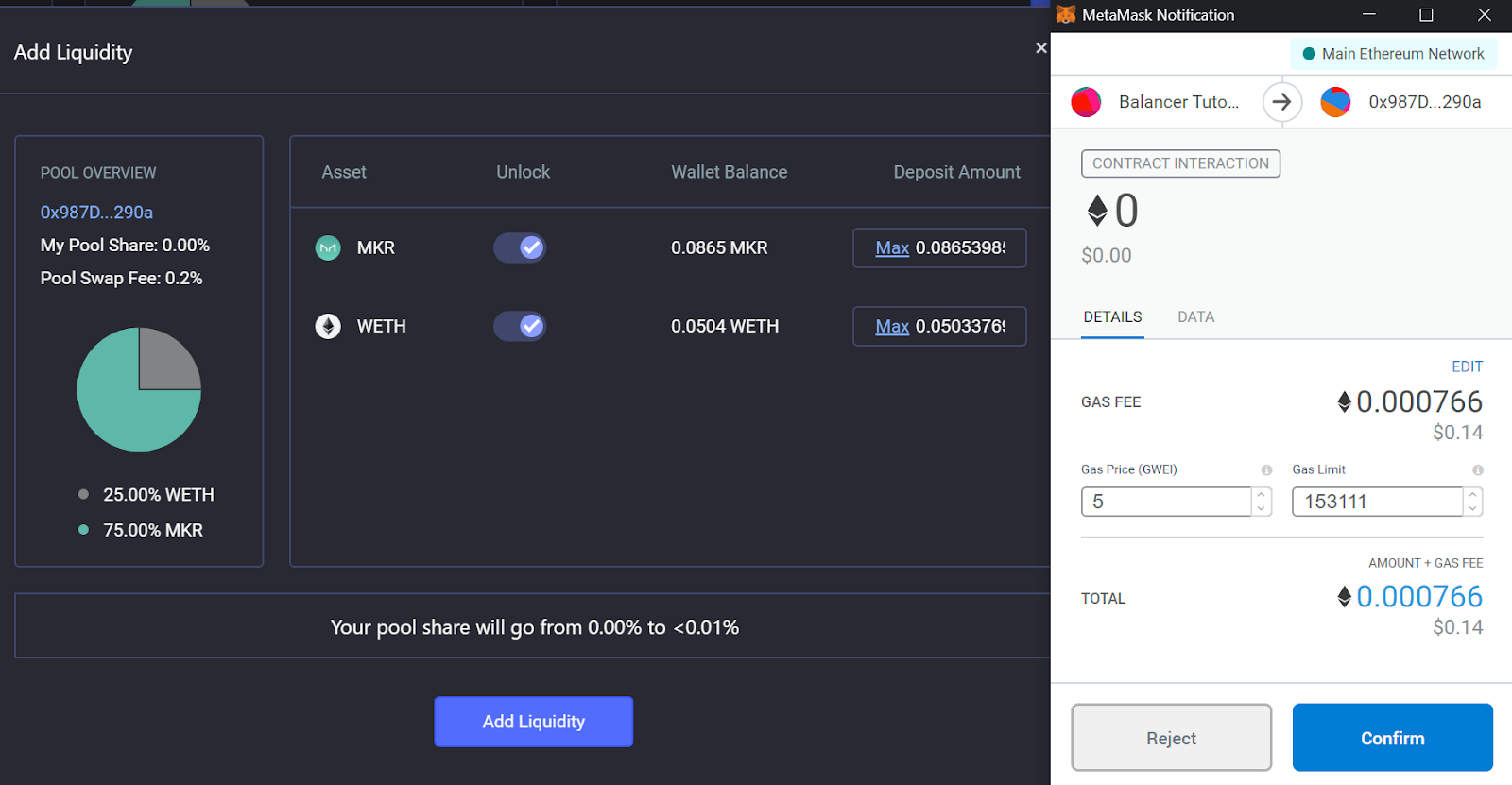

- Visit Balancer Pools and connect MetaMask Wallet or use WalletConnect. View available pools and choose which one you would like to add liquidity to. We will add liquidity to 75% WETH / 25% MKR Pool

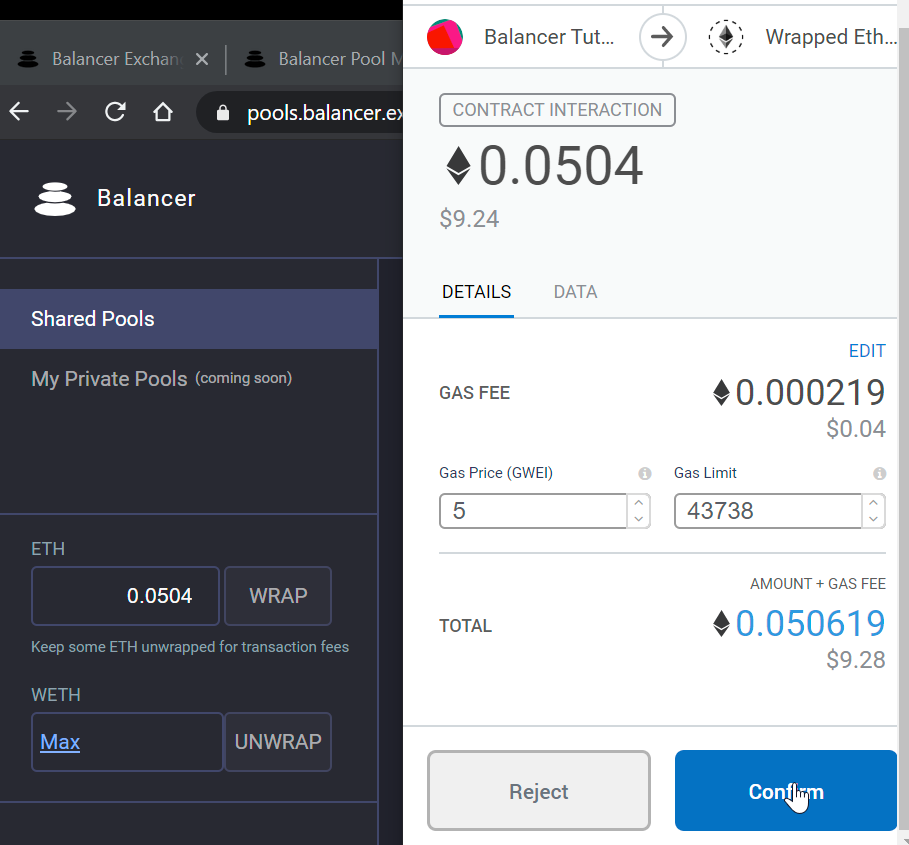

Click Add Liquidity and Unlock both MKR + WETH. What you are doing here is approving the Balancer pool contract to use your deposited MKR + WETH tokens. Each one of these approvals is a separate on-chain transaction but each one will only cost 45K in gas or $0.05 (assuming 6 gwei gas rates).

MKR approval tx here.

WETH approval tx here.

- Make sure you have appropriate proportions of underlying tokens required to enter your chosen Balancer pool. In our case we will be adding MKR tokens we received from our swap example (~0.0865 MKR). Since this pool is 75% MKR + 25% WETH we need to match our MKR tokens with ~0.0503 WETH tokens. Keep in mind, these are WETH tokens so if you have ETH, you will first need to wrap it into WETH. Again, this would be a separate transaction with gas cost ~45K.

Wrapping ETH in WETH tx here.

- Choose how much MKR+ETH Liquidity you would like to deposit and confirm the transaction on your Metamask.

Adding liquidity tx here.

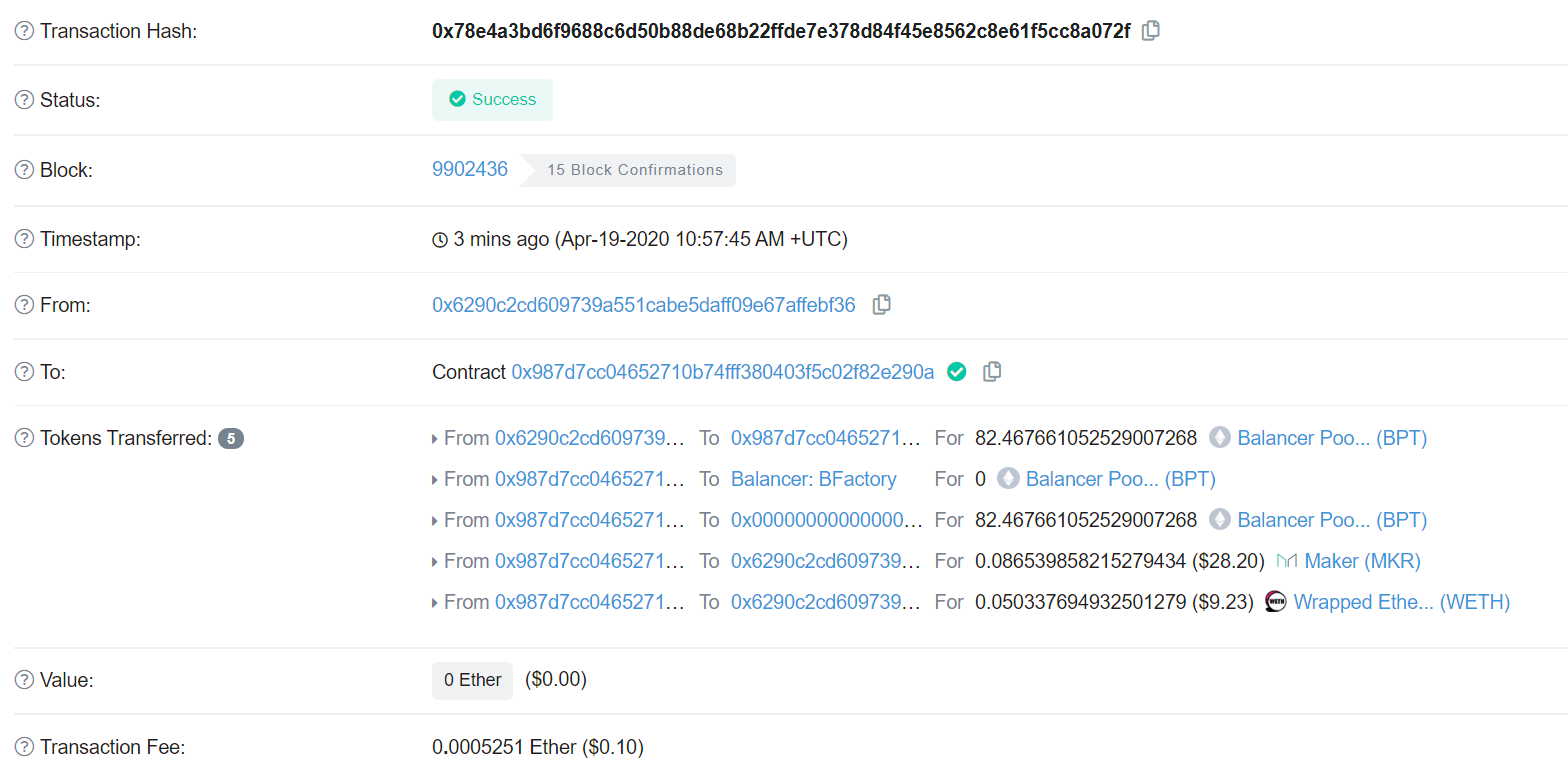

Removing liquidity via Balancer

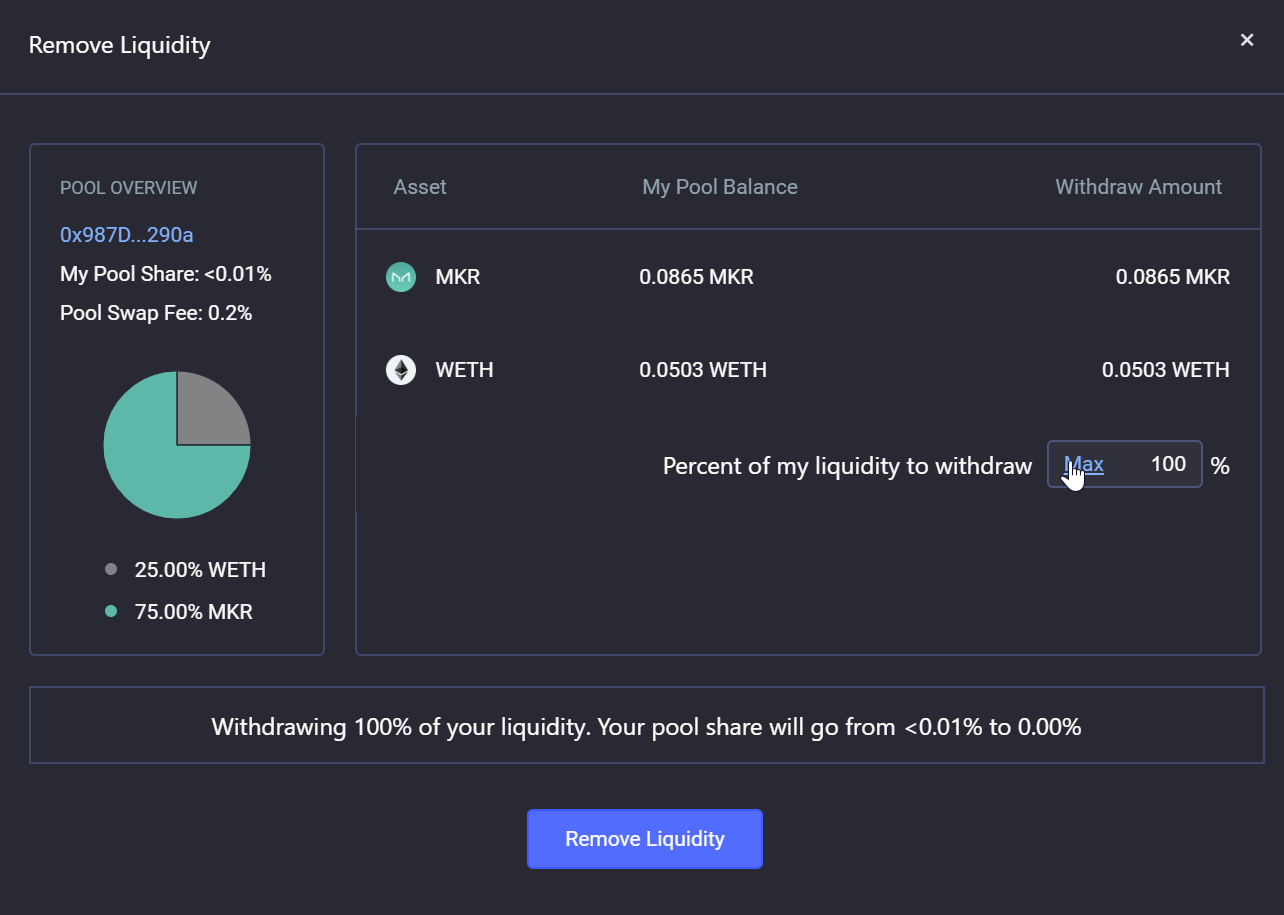

- Removing liquidity from Balancer Pools is extremely simple. Just visit your pool page, in our case it’s here.

- Click ‘Remove Liquidity’, choose how much you would like to withdraw as % of total, and confirm with your Metamask.

Note: As you can see, in return you will receive both MKR + ETH in similar proportions + any earned swap fees.

⚠️Making this one-click. Zaps will soon be available to make tasks like supplying and withdrawing liquidity one-click. See tactic #25 for our how-to on Zaps and stay tuned to DeFiZap for more.

Bonus tactic:

How to Create your own Balancer pool

You’ve had a taste of Balancer but maybe you want to create your own Balancer index fund asset and liquidity pool. Maybe some Balancer liquidity mining? In today’s bonus tactic we show you how.

This bonus tactic is for the trailblazers. Is that you?

Author blurbs

Fernando is the idealizer of Balancer Protocol, CEO and co-founder of Balancer Labs.

Nodar Janashia is the co-founder of DeFiZap. He also makes DeFi Tutorials to highlight best use-cases & risks involved when using Open Finance tools.

Action steps

- Trade using Balancer and add liquidity to a pool

- If you’re advanced—do our bonus tactic and create your own Balancer pool

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.