How to make money on Uniswap

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

The best money protocols eat money and spit out something valuable.

Maker eats ETH and spits out stability.

Compound eats ETH and spits out interest.

Uniswap eats ETH and spits out liquidity.

Before money protocols only the banks performed these functions. And they required executives, offices, and accountants to do it—the overhead of a firm. Uniswap was built by an unemployed 20-something between gigs as his first programming project.

But you’d be mistaken to underestimate it.

A year after launch Uniswap is doing $22m per week in volume and pooling over $26m in value—over half of which is ETH. It’s beating a $150m competitor, is the highest volume DEX, and showing impressive hockey stick growth.

For the first time in the world anyone with an internet connection can:

- Trade (exchange one asset for another)

- Earn (by risking assets as liquidity)

- List (create a new market by listing an asset)

No permission required.

And since it’s a protocol on Ethereum, it’s global, it talks to other money robots, and it can’t be stopped.

You know the craziest thing? No one outside our bold little community of mega users yet realizes how big this is. This stuff is Steve Jobs in his Los Altos garage big. It’s Zuckerberg in his Harvard dorm room (but, ya know w/o the evil stuff).

We’re playing ahead of the game. It’s our asymmetrical advantage.

So today let’s level up on the Earn function of Uniswap and figure out how to make money by feeding it money. That’s how this little liquidity robot incents us to make it bigger.

- RSA

TACTICS TUESDAY:

Tactic #15:

How to make money on Uniswap

Prepared with help from: Caleb Sheridan of Blocklytics

You can earn money on Uniswap by providing liquidity through a pair of assets like ETH and DAI. Uniswap uses these assets as liquidity for traders. In return, it shares the trading fees with you.

Note: Providing assets to Uniswap is not like lending on Compound. As a liquidity provider you take unique risks—the returns aren’t guaranteed and you could lose a portion of your principle relative to holding. So don’t add serious liquidity to until you fully understand these risks. Start small—it takes time to wrap your head around this.

- Goal: Learn the risks of using Uniswap and how you can earn money

- Skill: Beginner

- Effort: 30-60 minutes

- ROI: Varies—a range of -30% to +30% is not uncommon

Anyone can provide liquidity to Uniswap

Uniswap allows users to swap tokens and ETH by trading against a pool of assets held in a smart contract. There are no order books on Uniswap that set the exchange rate. Instead, the rate is based on the ratio of ether and tokens held in each pool. And the depth of each pool determines how much trading it can facilitate. Deeper pools enable bigger trades and more trading.

These pools are not filled by a company entity like Uniswap, Inc. Instead, anyone can add assets to a pool and earn a share of its trading fees. Liquidity providers earn fees in tokens and ether, based on their ownership of the pool. Fees are collected after each and every trade and liquidity providers have immediate access to their earnings.

This model creates a virtuous cycle for tokens with demand—as more liquidity is added to a pool, the pool facilitates more trades, collects more fees and attracts more liquidity.

Gains and Impermanent Losses

Each pool in Uniswap is a pair of assets. To be a liquidity provider and earn a return, you must provide both sides of the pair—to invest $100 in the ETH/SAI pair requires $50 worth of ETH and $50 worth of DAI.

Your return for contributing to the pool grows as trading volume grows. It costs traders a 0.3% fee each trade. You earn this fee. It’s allocated to you proportional to the amount you added to the pool.

More trading equals more gains. Make sense so far?

Here’s the tricky part. You lose money as the % change between the assets increases—the change could be in either direction, up or down doesn’t matter. Any price ratio change between when you add the assets to the pool to when you withdraw results in an impermanent loss:

- 1.25x price change is a .6% loss

- 1.50x price change is a 2.0% loss

- 3x price change is a 13.4% loss

- 5x price change is a 25.5% loss

It’s called impermanent because if the ratio returns to where it started when you first added the assets the loss isn’t realized. More on this here.

Your net gains are the trading fees minus the impermanent loss when you withdraw.

You make the highest returns when there’s high trading volume and low price change between the pair (e.g. ETH $150 when you start and $152 when you withdraw). Or when price is volatile but goes back to the ratio you started with. You make the least returns when there’s low trading volume and high price change.

This is tricky enough to reason through in the ETH/DAI pair where ETH tends to fluctuate but DAI remains stable. It’s even harder when providing liquidity to pairs like ETH/MKR which are both highly volatile.

🔨Pools.fyi is a useful tool for seeing net returns over time. Here’s ETH/SAI for example. The Pool return tab shows you returns vs holding the 50/50 pair. The ETH returns shows you returns vs holding 100% ETH. Look at 7, 30, and 90 day returns.

Time in the pool gives you more time to accrue fees to compensate against impermanent loss. If ETH 5x’s from $150 today to $750 in 12 months you might have a 25.5% impermanent loss—but if you gained 40% on fees, you’d still net 14.5%.

In the short-term the returns are all over the place but in the longer term these pools tend to do pretty well—they become a bet on trading volume more than price change. And given growth so far it would not be surprising if trading volume grew by 5x to 10x in some of the larger Uniswap pools in a year or so.

Generating returns on your ETH

An additional consideration—if you’re following the crypto money portfolio you might be denominating your returns in ETH. So providing liquidity on an ETH/DAI pair could require you to trade half your ETH exposure for DAI in order to participate.

Is it worth exiting 50% of an ETH position to enter a DAI pool?

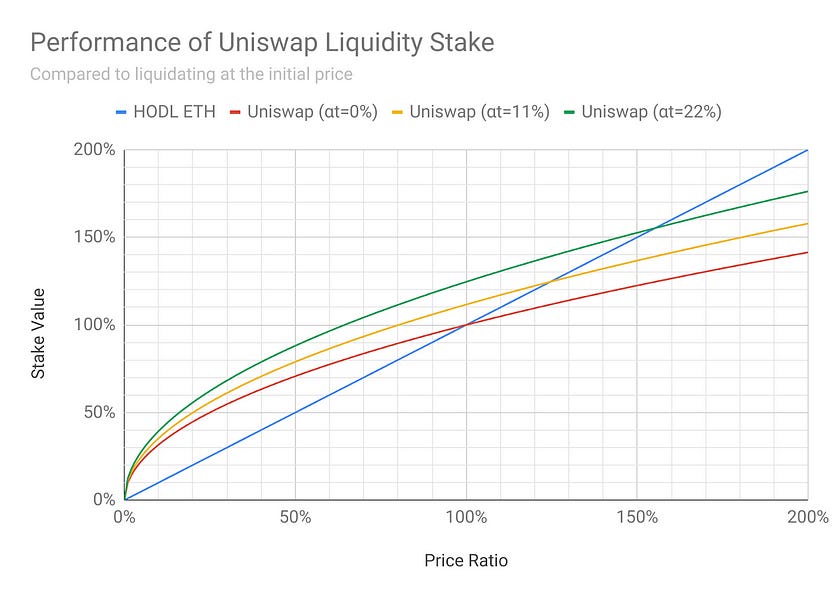

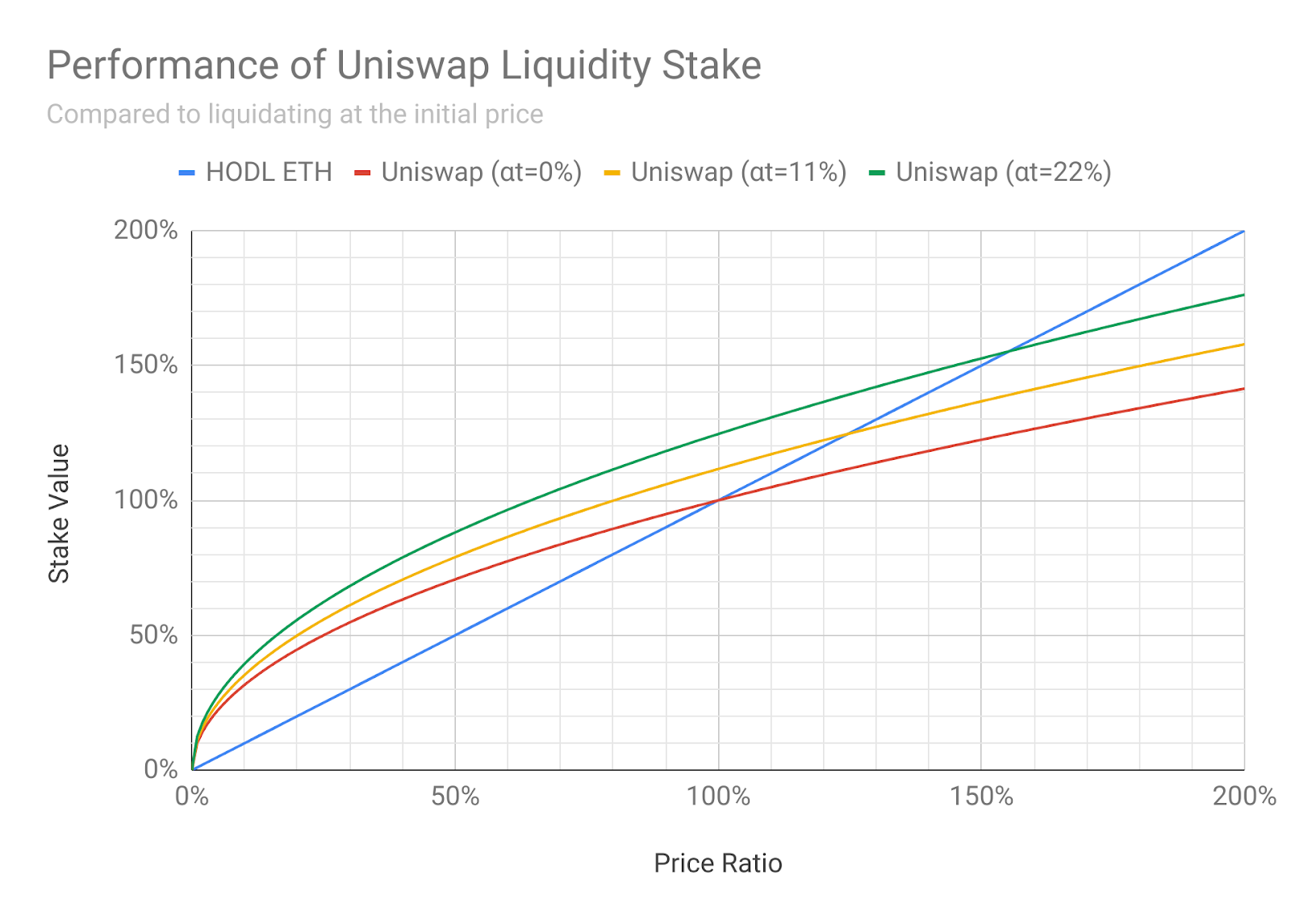

The bet here is that pool growth from trading fees will outweigh your reduced exposure to ETH. The chart below from Understanding Uniswap Returns provides a tidy visualization of different growth scenarios on the ETH/DAI pool vs holding ether.

(Above) Holding ETH vs. using the ETH to supply an ETH/DAI liquidity pool

Let’s walkthrough the above graph—say you have 1 ETH that you’re considering depositing to an ETH/DAI liquidity pool. Your alternative to depositing to the pool is to hold the ETH, but you’re wondering if the pool might provide a return on your ETH vs. holding—ignoring impermanent losses.

Let’s see.

The blue line represents holding ETH. You can see it grows and decreases linearly with price as expected. If ETH increases in price by 50%, you have 150% in value. If it decreases in price by 50%, you have 50% less and so on.

Taking your 1 ETH and contributing it to the ETH/DAI liquidity pool requires converting 50% of it to DAI. This is an opportunity cost—you’re losing upside potential on part of your ETH vs just holding it. It cuts both ways—you’re also avoiding ETH downside risk.

The red line represents a hypothetical ETH/DAI liquidity pool that’s not growing at all. The effect of ETH price increases and decreases are dampened here. Slop increases in blue line if returns amount to 11% and in the green line if they’re 22%.

Effectively, using ETH only to fund the ETH/DAI pool reduces your exposure to ETH while earning you liquidity fee income—a good tactic if you’re feeling less bullish on ETH. (Make sure you consider taxes and trading fees as you analyze this approach.)

Choosing a pool

We’ve used examples from the ETH/DAI pool, but Uniswap has many pools you can try out. Broadly speaking, there are three types of pools to consider:

Stable pools

- Low risk/ low reward

- e.g. ETH-sETH

- These pools are for tokens pegged to ETH, meaning you maintain full exposure to ETH while collecting trading fees. There is risk in a peg collapse and historically these pools do not generate a great deal in fees.

Stablecoin pools

- High risk/ high reward

- e.g. ETH-SAI

- These pools are historically popular with traders and often generate a good deal in fees. There is risk of missing out on ETH returns should its price break significantly upwards.

Standard token pools

- For existing token holders

- e.g. ETH-MKR

- If you’re already exposed to tokens and rebalancing, there is little harm in supplying liquidity to established pools.

If you’re just starting out as a liquidity provider, try sticking with established pools that have deep liquidity, high trading volume and lots of other liquidity providers.

Avoid low liquidity pools. There is no reasonable expectation of profit starting a new pool or contributing to low liquidity pools as an individual.

Also use caution interacting with pools whose tokens are highly specialized. For example, deflationary token supply mechanisms may severely impact returns.

👉Get started—the best way to learn how to earn on Uniswap is to try it. Just a small amount first. Takes less than 10 minutes. Complete the Weekly Assignment from Market Monday and Zap some liquidity to Uniswap

Final Thoughts

Earning on Uniswap is a different form of risk and reward than long-ETH folks are used to taking. In the short to medium term its more a bet that there won’t be permanent changes in the price ratio of the pair. In the longer term it’s more a bet on trading volume of the Uniswap pool itself.

Selecting the right pools, understanding impermanent losses, and measuring your returns—these are the first steps to making money on Uniswap.

Action steps

- Compare Uniswap pool returns on pools.fyi and select a pool to try

- Complete weekly assignment: Zap liquidity to Uniswap

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

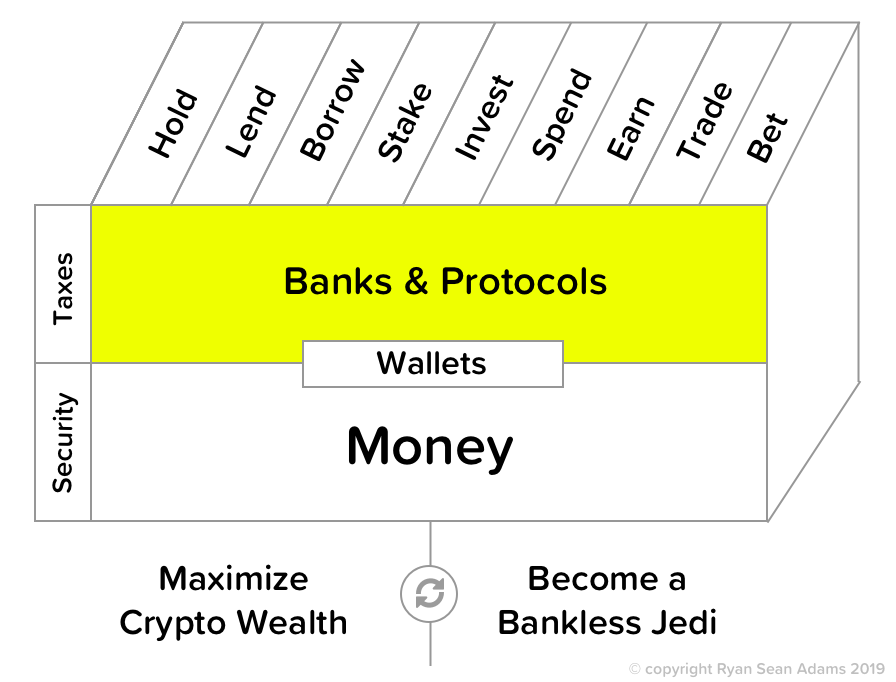

Filling out the skill cube

Uniswap is one of the most interesting liquidity money protocols we’ve yet seen. Today you leveled up on the protocols layer of skill cube. Nice work.

👉Send us a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.