Rise of the Liquidity Robots 🤖

⚠️Hey it’s been a tumultuous day for crypto & DeFi—more thoughts in the days ahead. Want info faster? Become a full subscriber & join almost 500 other Bankless members in the Inner Circle Discord channel. It’s here to help during times like this.

Dear Crypto Natives,

We’ve talked about money robots before. But the liquidity robots are a special kind.

They can operate without human intervention, providing trading, liquidity, and price information according to a pre-set formula called a bonding curve.

And we’re only starting to unlock their potential. Another branch in the tech tree.

I’ve asked Ric to explain them to us today. 🔥

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Rise of the Liquidity Robots

Written by: Richard Burton, Designer and DeFi Investor

How markets work

The relationship between supply & demand is something that economists have studied for a long time. It emerges over time as people buy & sell things to one another.

In the stock market, market makers are responsible for connecting buyers & sellers to facilitate trades. These people make money by charging a spread. This is the gap between the price of the asset when it leaves one person & is bought by another.

How Automated Market Makers work

Automated Market Makers have existed in the traditional financial system for a while. They allow financiers to set up price relationships that must be followed. If an asset hits a certain price, a specified amount can be bought.

In traditional finance, automated market makers are operated by humans. Humans deploy them, control them, turn them on, turn them off. They operate on centralized exchanges which are also controlled by humans.

On Ethereum, this human control can be minimized. Humans still create market making robots, but then we can set them free to run on their own like an economic lifeform. With the right design, they can be as autonomous & unstoppable as the Ethereum protocol itself.

Not just automated, but autonomous.

Uniswap was one the one of the first of this kind of market making robot on Ethereum (Bancor was first). I had the pleasure of watching the Uniswap robot get built in my office in 2018.

To understand how AMM robots like Uniswap work, let’s start with core concepts:

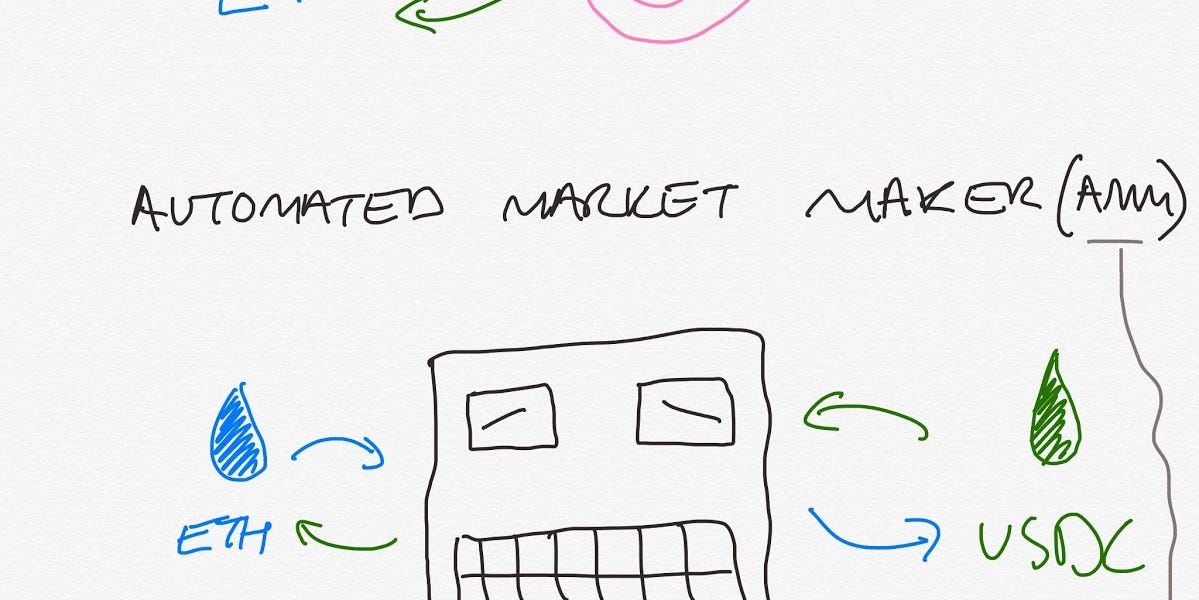

📊 Market Makers

Fleshy humans who make trades to make markets.

🤖 Automated Market Makers (AMMs)

Robots made of smart contract code who do this job.

🦄 Fixed Product AMMs

Robots that use a bonding curve to determine what price they will execute a trade at and then just do it.

What do we mean by curves?

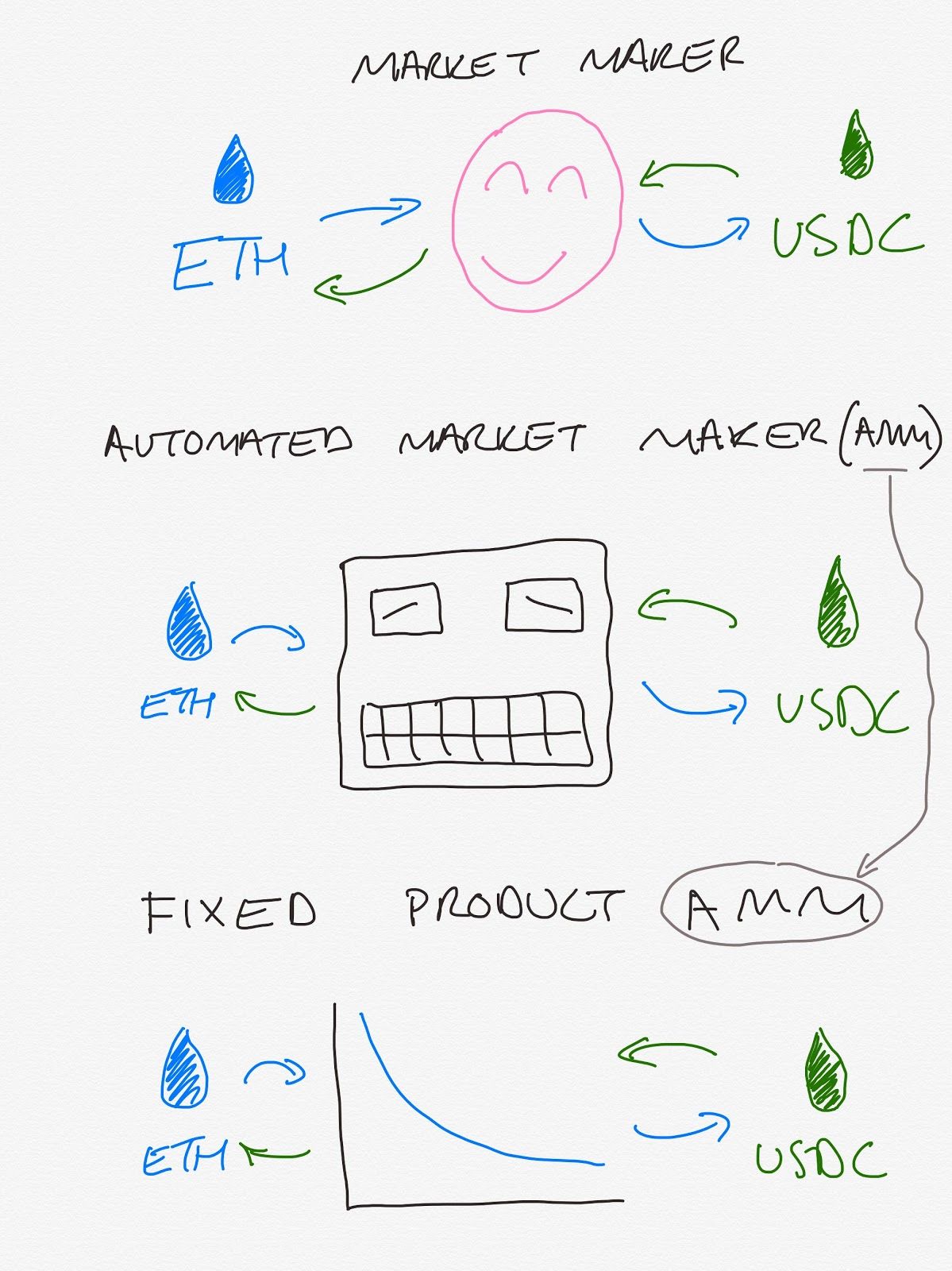

📈 Supply Curve

A graph plotting the relationship between the cost of something and the quantity supplied. The curve emerges after observing the data.

📉 Bonding Curve

A relationship between a token’s price and its supply that is defined by a mathematical curve.

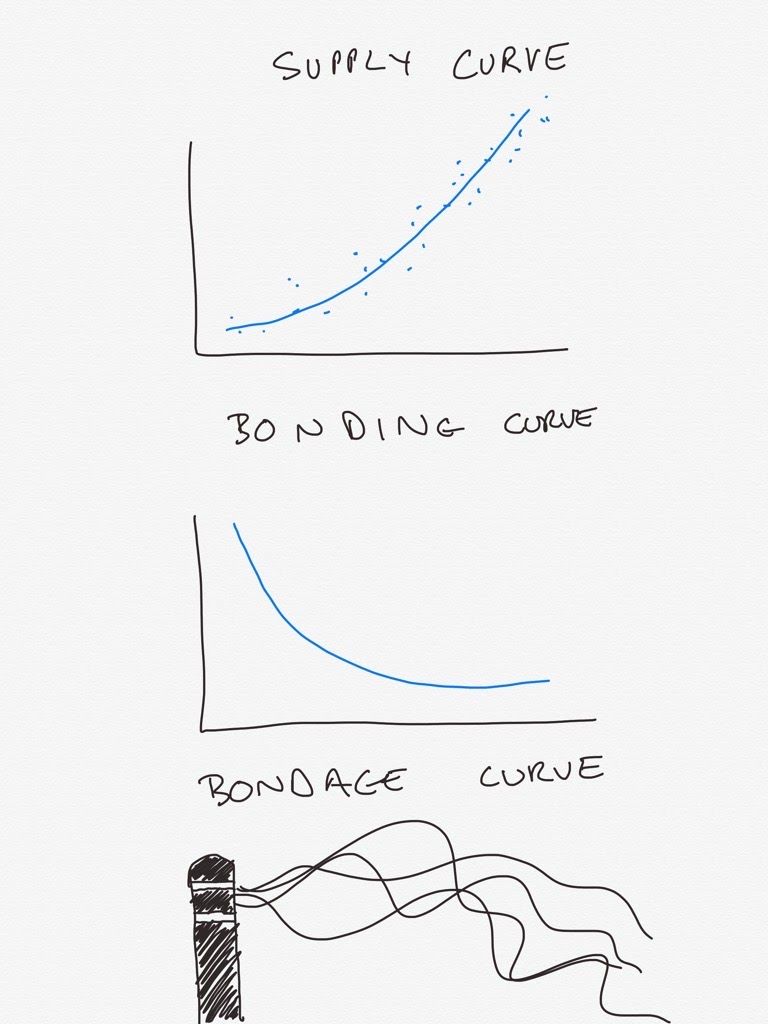

The asset supply is collected in liquidity pools:

🏊♂️ Liquidity Pool

A smart contract that is storing tokens that are ready to be traded.

⚖️ Arbitrage

Where a trader will take advantage of price differences or imbalances in the supply of liquidity.

🔁 Exchange

Where one token is exchanged for another using the curve & pool.

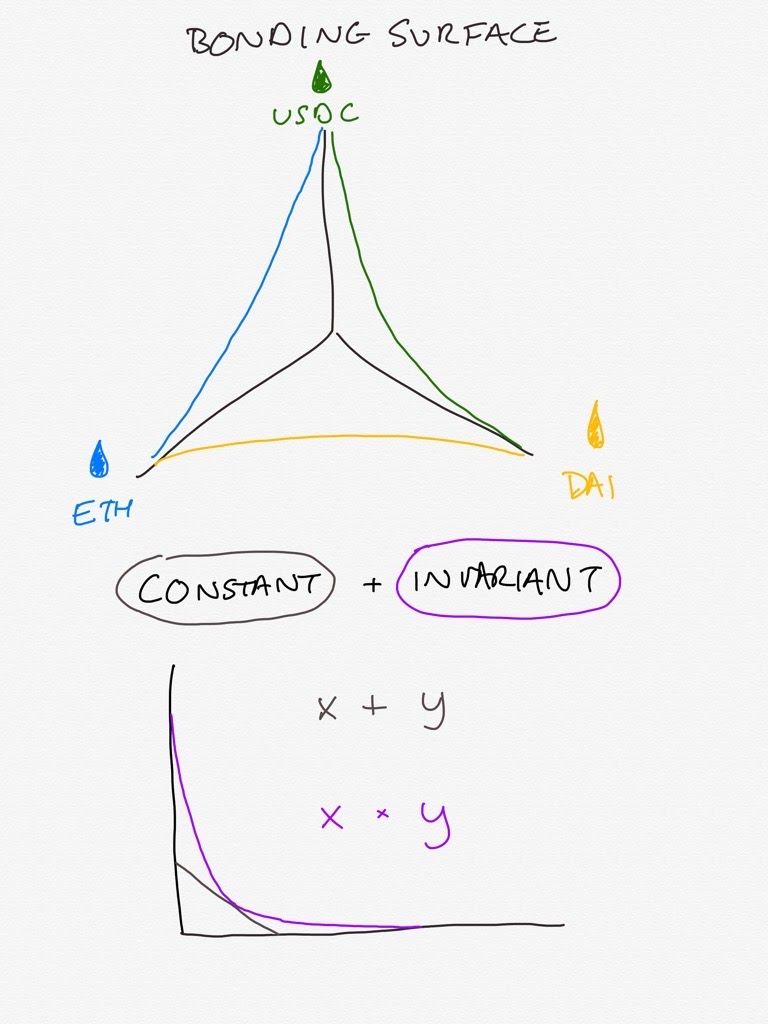

All this leads to the concept of a bonding surface:

🌏 Bonding Surface

A multi-dimensional price & supply relationship between 3 or more tokens. These can facilitate trades that occur between lots of assets simultaneously.

📐Constant & Invariant

These are types of mathematical functions that can define the curves on a graph.

There you go! Those are the core elements of an Ethereum AMM.

What projects are working on AMMs?

There are lots of new projects emerging in the Automated Market Making space. You can check out this history of inspiration behind Uniswap here to see the lineage.

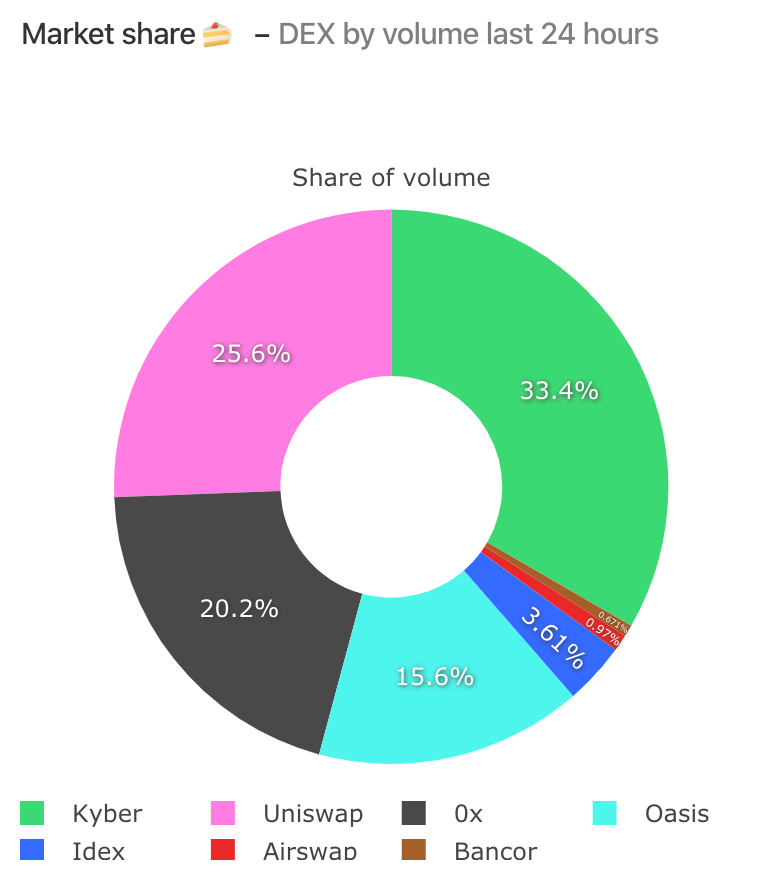

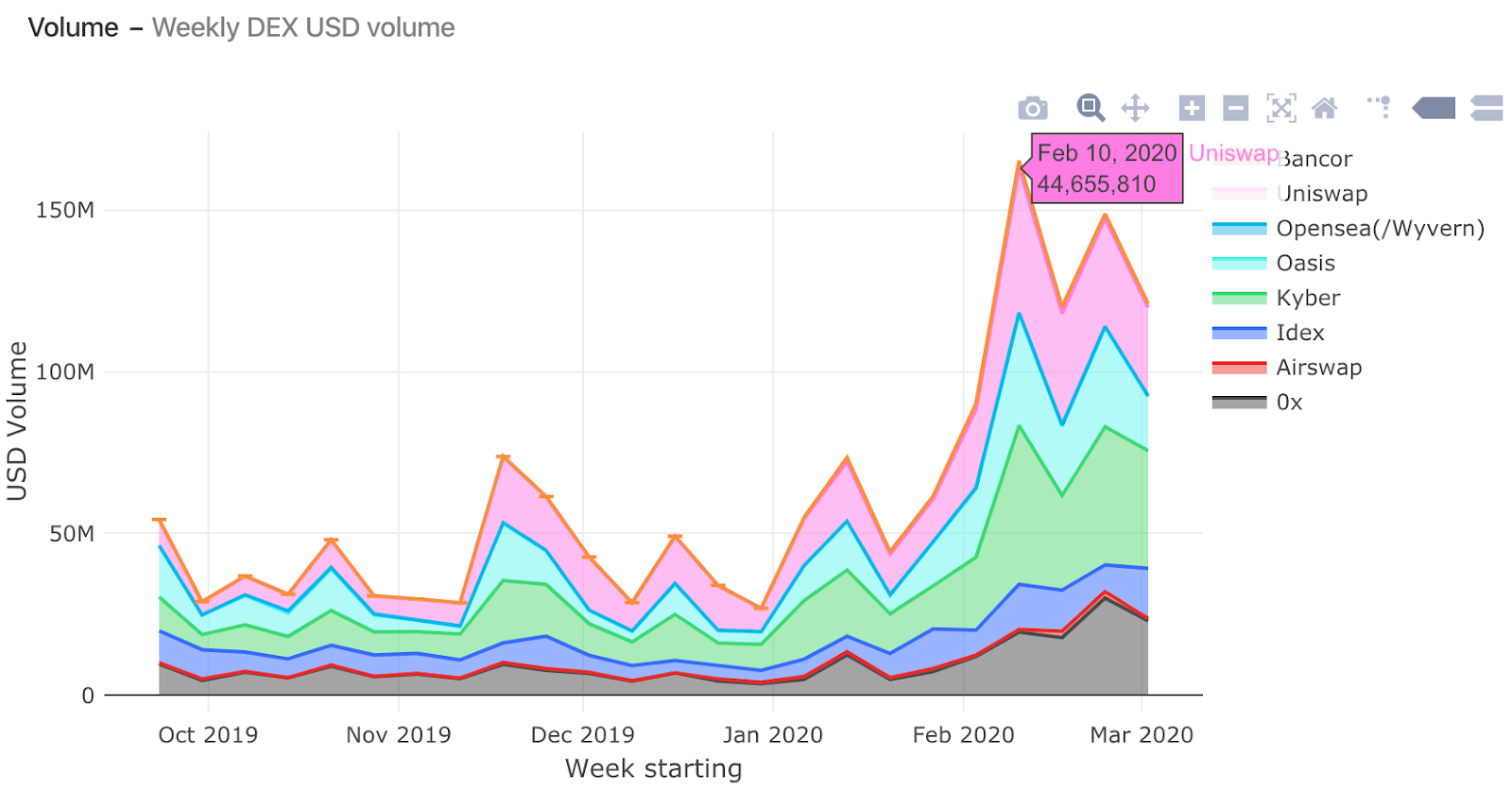

In 2018, Uniswap was up against Kyber, 0x, & Bancor, who had raised over $200m. With a few grants & loans, Hayden Adams (the primary developer behind Uniswap) launched the system & completely blew past the competition. The other AMM robots were too complex & hard to use. Uniswap just worked.

(Above) Decentralized exchange marketshare, Uniswap & Bancor are the AMMs

Let’s go through the big AMM projects on Ethereum today:

Bancor - 2017

- First major smart contract AMM out in the wild

- Pioneered some key design patterns

- Used a bonding curve to calculate prices

- Used a bonding curve to track liquidity provider contributions

- Connected multiple pools through a hub-spoke model

- Unfortunately used $BNT token as the hub currency (rather than Ether)

Uniswap - 2018

- Main goal: a decentralized protocol for token liquidity

- Simpler bonding curve than Bancor

- Used Ether as a hub currency

- Very gas efficient

- Not very capital efficient

- Over all, extremely well crafted (see Hayden’s launch tweet from Nov 2018)

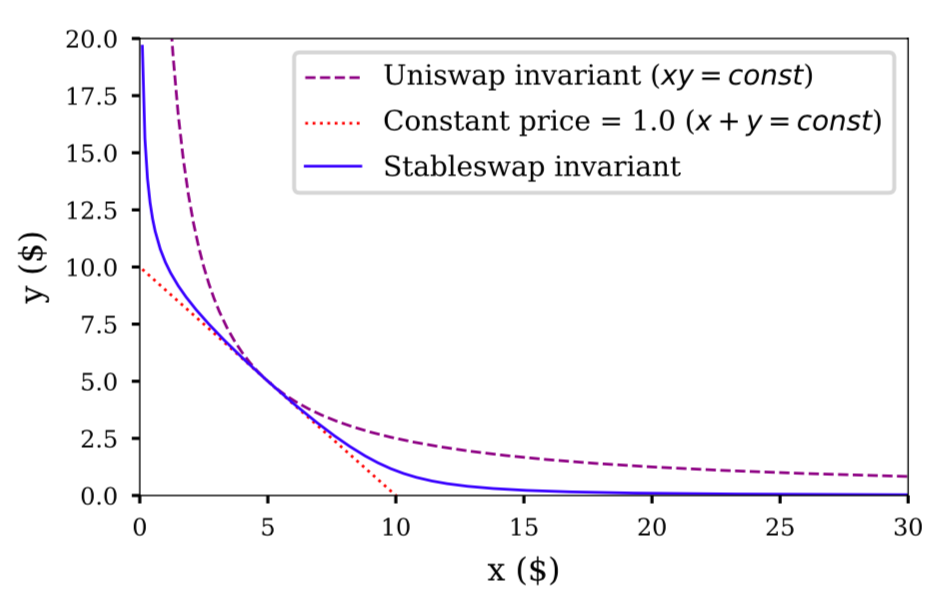

Curve (aka Stableswap) - 2020

- Main goal: low slippage, stablecoin-to-stablecoin trades

- Extremely capital efficient => very low slippage

- Multidimensional bonding surface, like Balancer

- Works very well for stablecoins, does not work well for non-stablecoins

- Relatively risky bonding curve

- The actual bonding curve formula is opaque (see my tweet on this here)

(Above) Bonding curves of Curve (aka StableSwap) vs. Uniswap

There are new AMM projects coming to Ethereum soon too:

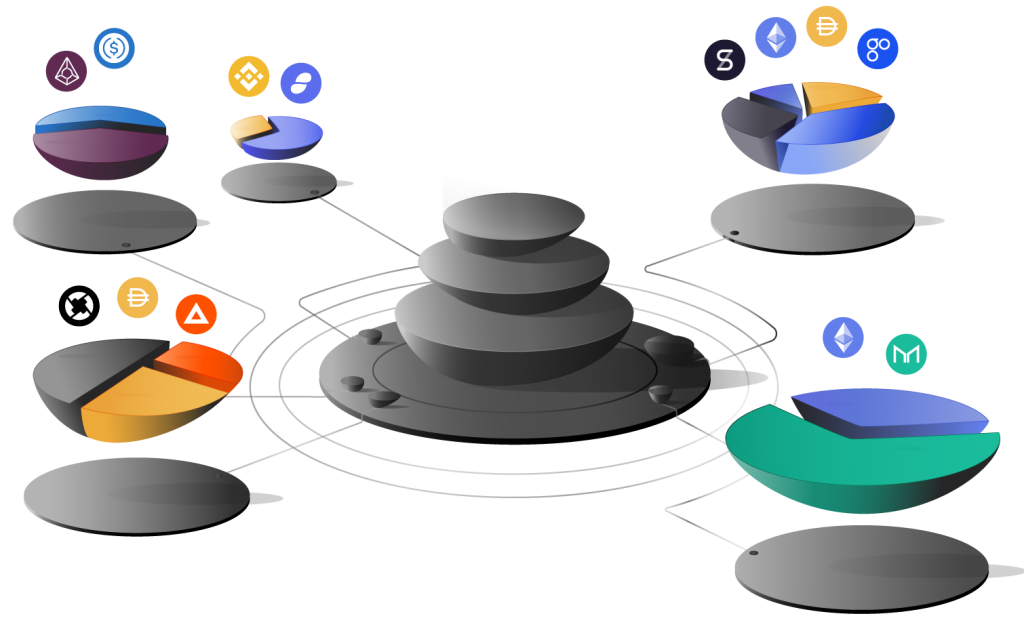

Balancer - ETA 2020 (article here)

- Main goal: decentralized Vanguard

- Generalizes Uniswap’s bonding curve to a multi-dimensional surface

- Enables token weights in the pool (e.g. Eth=50%, Dai=25%, MKR=25%)

- Portfolio model 2x more capital efficient than hub-spoke

- But portfolio model can fragment liquidity

- Having weights increases gas costs

(Above) Balancer can create liquidity pools comprised of multiple-tokens

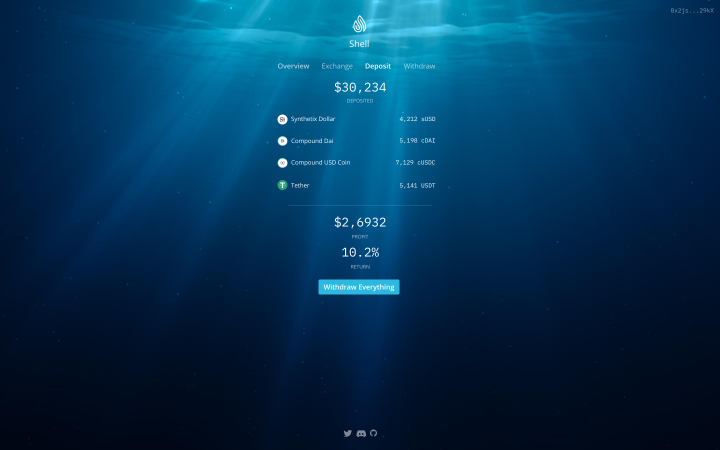

Shell Protocol - ETA 2020

- Low slippage trades

- High liquidity provider profits

- Weighted, multi-dimensional pools

- Support any flavor of stablecoin (e.g. Dai, cDai and Chai)

- Granular customization of AMM behavior

- Mitigate the cost of a broken stablecoin

- Transfer arbitrage profits to liquidity providers

(Above) Balancer can create liquidity pools comprised of multiple-tokens

Why they work better

I think Jacob said it well:

The thing that Uniswap brought to the market was the concept of *uncensorable token listing*. If you want to list a stock on the New York Stock Exchange, you need the permission of several financial institutions. It usually costs millions of dollars to do it.

If you want to list a token on Ethereum, you need to create a single transaction. It costs less than a dollar to do it.

Why they work on Ethereum

Traditional markets use order books because they can run at high speed. People can post orders and remove them in split seconds.

Ethereum processes blocks of transactions every 20 seconds. Automated Market Makers work well because in one turn of Ethereum you can poke a token in and get another token out.

What it lacks in price perfection, it makes up for in predictability.

Traditional economists look at this and see the slippage. Ethereum economists look at this and see the simplicity. It is a great circuit which can process lots of money.

The market is telling us that these systems are very valuable.

(Above) Steadily growing volume on Uniswap shows that AMMs are valuable

Final Thoughts

We’re seeing the rise of autonomous Automated Market Makers on Ethereum. These unstoppable robots are pitted in a fight for liquidity against each other and also against traditional orderbook exchanges.

They differ in subtle but profound ways: their primary currency pair, the design of their bonding curves, and reward structures for liquidity providers are different for each. Some are even adding the ability to create pools containing multiple assets—a sophistication which could bring ETF-like functionality to AMMs.

As they increase in liquidity, they decrease price slippage and become more efficient—better able to serve the needs of the DeFi economy. The best AMM experiments are likely to survive and create lasting network effects.

We get the pleasure of using the liquidity robots and watching them battle it out!

Action steps

- What are the core components of AMMs on Ethereum?

- Try it yourself—trade with a liquidity robot like Uniswap or Curve

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

New to the Bankless program? Start here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.