Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Ethereum is a gravity well for the world’s assets.

Today David explores how DeFi’s hunger for assets will lead it to places like tokenized real-estate. Along the way he shares how a brand new liquidity robot called Balancer opens up options for the long-tail of low liquidity assets on Ethereum.

Seems like we just unlocked another branch on the tech tree.

- RSA

P.S. Don’t forget to send a DAI to Bankless Transaction Grant today—we need your help!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WRITERS CORNER

By Bankless writer: David Hoffman, RealT, Bankless podcast & POV Crypto

DeFi Needs More Value

Ethereum’s financial applications are hungry for new assets. RealT, with its growing pool of real estate assets, and Balancer, a brand new DeFi protocol, may have an answer.

As illustrated in Ethereum is an Emergent Structure, Ethereum is the sum of its applications. The applications inside Ethereum compose themselves into a single unified financial ecosystem. We call that ecosystem ‘Ethereum’.

All applications on Ethereum are financial applications. They are powered by value. The assets that pass through Ethereum applications are the electrons that move through electrical wire, powering all connected applications. The more valuable the assets are, the more current they generate as they pass through DeFi.

This, of course, is another statement of Economic Bandwidth; the total market cap of the liquid flow of value throughout DeFi is the economic bandwidth of Ethereum.

The economic bandwidth of Ethereum is inherently a function of the value of Ether. Economic bandwidth goes up when the price of Ether rises, because there is more total value flowing through DeFi.

If native applications on Ethereum (especially those with native assets) want to become more valuable and useful, they need need the value of Ether to appreciate so that they can access a larger market. MakerDAO on Ethereum with a $20B ETH market-cap is a much better product than with a $20M ETH market-cap.

However...

This produces a chicken+egg problem:

- Apps on Ethereum need ETH to appreciate in price to access a larger market

- ETH appreciation depends on Ethereum adoption

- Ethereum applications only have ETH to leverage

(DAI is still just ETH, and USDC isn’t much different from DAI) - Ethereum can’t gain generalized adoption because it’s only useful to ETH holders

ETH + DAI = 95% of DeFi

Ether: A New Model for Money illustrated how Ether is the SOV for the DeFi economy, and that Ether is the only trustless asset. Also, DAI counts as ETH. This is great for ETH! It has a complete monopoly over DeFi!

This is a lousy deal for DeFi. DeFi is stuck providing its services to a single customer: ETH. The only asset of significance on Ethereum that adds additional value flows to DeFi is USDC…

…which is nice because it provides a boost to liquidity and collateral types,

…but it isn’t fundamentally different from DAI. It’s still a $1 stablecoin.

Financial applications on Ethereum are asset-agnostic. They are asking for new assets to play with.

Both MakerDAO and Uniswap have gone through protocol upgrades to specifically reduce dependence on ETH. As a result, Ethereum’s three largest applications, MakerDAO, Compound, and Uniswap are all asset-agnostic platforms. “DeFi runs on ETH” is great for the ETH value-capture narrative, but that is selling Ethereum applications short. They are not beholden to ETH, and they are dying for new assets inside of their applications.

Multi-Collateral DAI

“Multi-Collateral” Dai is Maker enabling alternative asset types and reducing dependence on ETH. Dai is a product for the Ethereum ecosystem, and that product is objectively better when there are more uncorrelated assets in MakerDAO vaults.

Dai is stability as a product, and you do not achieve stability by being 99% backed by one single collateral type: ETH.

We saw this weakness on Black Thursday, where the price of ETH lost 40+% in a single day. Because 99% of all outstanding DAI is backed by ETH, MakerDAO saw the collateral of DAI be cut in half. Liquidations ensued.

Meanwhile, the Dai price jumped to $1.05–08, as Vault-holders jumped to sell ETH and buy DAI in order to cover their positions, because their positions are in ETH.

If MakerDAO had access to an additional asset to leverage, one that was uncorrelated to ETH, the MakerDAO system would have a larger foundation to stand on. If DAI wasn’t 99% reliant on ETH, then DAI stability and liquidity would be shielded from ETH volatility. In a world where 50% of DAI is backed by ETH, and 50% is backed by something uncorrelated to ETH, then the squeeze on DAI would have been significantly mitigated.

Uniswap V2

Uniswap V2 was recently released, which most notably breaks the ETH monopoly as the trading pair for all Uniswap markets. Many markets on Uniswap will always best leverage ETH as a collateral; Ethereum native assets like MKR, DAI, REP especially.

However, other types of assets are far better suited to be traded vs stablecoins. Off-chain assets like real estate or gold are much more suited to be traded vs. the US Dollar; as that is how they are valued outside of Ethereum. RealT’s real estate properties in Uniswap trade vs. ETH, which is basically denominating property values in ETH. No one in the world measures the value of their real estate property in ETH terms. Other than Uniswap V1, of course.

Off-Chain Assets

In order to break the shackles of a completely self-referential system, Ethereum needs to build bridges to new sources of value. Accessing new sources of value will provide Ethereum the resources it needs to grow a healthy and robust economy. Both users and applications have more options in assets, which is mutually beneficial for all parties involved.

Real Estate, Obviously

Real estate, the world’s most valuable industry, is an obvious first choice for new collateral types in the Ethereum ecosystem.

- MakerDAO: new collateral type; highly uncorrelated to ETH (unlike BAT)

- Compound: new collateral type; RE collateralized loans

- Uniswap: New marketplaces

Real estate is a high-value, low-volatility asset class. As an asset class, its characteristics are opposite of ETH’s, which is low market-cap, high-volatility. Adding real estate to the portfolio of any application like MakerDAO or Compound makes the entire DeFi ecosystem more stable and more useful.

Black Thursday shook the entire DeFi structure, because the entire DeFi structure is built on ETH. It would have been nice to have a secondary foundation for DeFi to lean on during times of ETH volatility, and real estate is an obvious choice for a secondary pool of value for DeFi apps.

Stablecoins

Real estate is a capital asset. It generates a return to its owner in the form of cash. The total valuation of the real estate industry is bolstered by the sheer magnitude of cash it moves on a monthly basis.

After Ether, stablecoins are the most liquid and financialized assets on Ethereum, and offer a far better transaction experience between companies and customers. This makes Ethereum well-suited to offer novel products and services to those that receive their rental revenue payments in stablecoin.

RealT sends out rent on a 24-hr cycle; something only possible with a robust ecosystem of liquid stablecoins and fast block-times. It’s also nice that Ethereum actually has users, unlike other smart-contract protocols. RealT sends out $300 / day to users through the Ethereum ecosystem, and it’s growing rapidly. (That’s over $10,000k per month!)

Without DeFi, users would have no other option than to take their cash and run home with it. With DeFi, however, RealT users have options with their rental income. They can keep their cash on Ethereum, in the DSR, in Compound, Aave, dYdX, or any other DeFi app that offers you services for your DAI. On Ethereum, there are activities!

RealT’s Road to MakerDAO

RealT is the first company to put real estate assets on Ethereum. With $1M+ in total assets issued on the network, the pool of available collateral is growing. Larger and larger properties across different US cities are on the roadmap for future issuance on RealT’s platform.

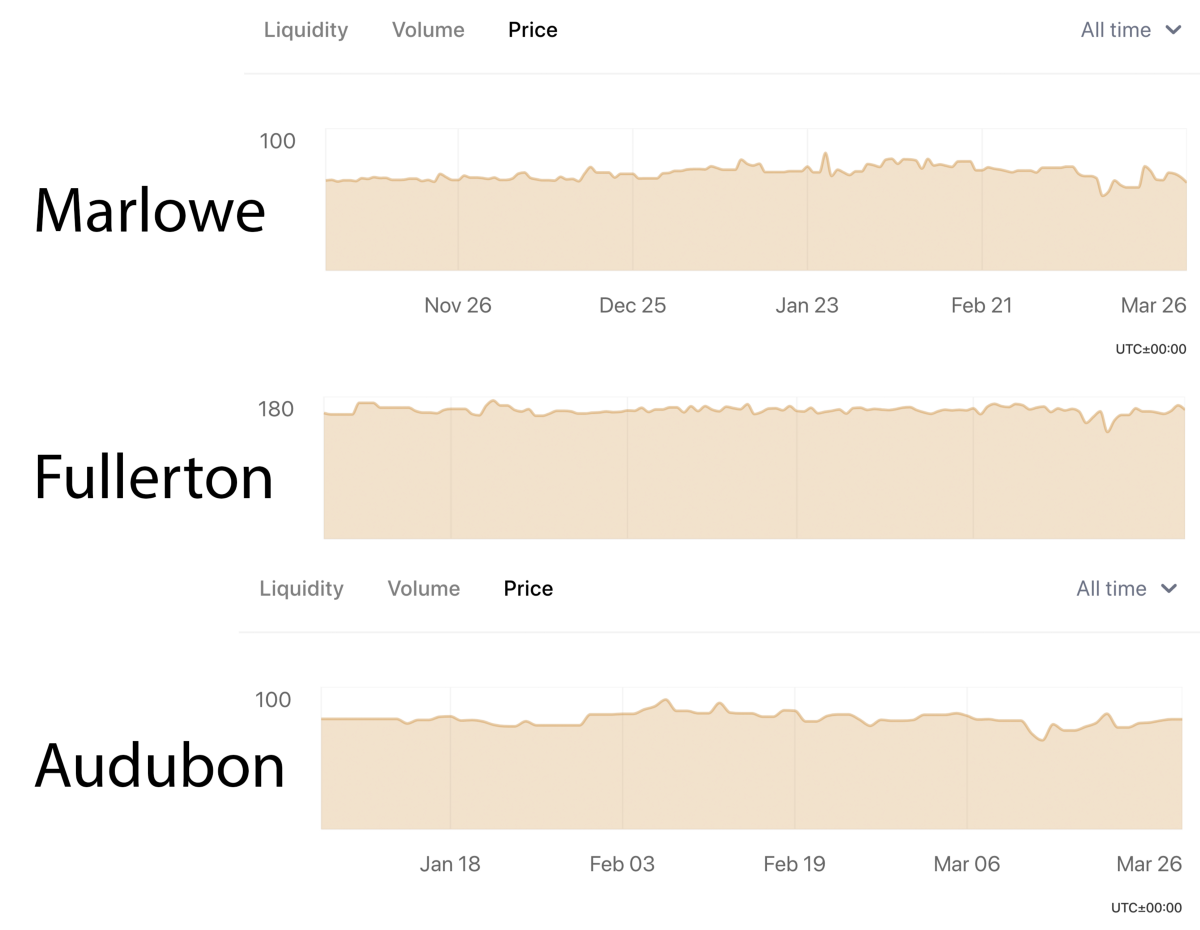

Currently, all RealT properties are available inside of Uniswap, and are traded vs. ETH. Historical pricing data of RealT assets in Uniswap illustrate their stability in price, even when priced vs ETH.

You can see the price chart of RealT’s first three properties in Uniswap for the last 6 months:

You can see black Thursday on all charts (Graphs at different time scales due to different Uniswap market genesis)

Two things are of note:

- RealT properties are perhaps the most volatile real estate assets in the world

- Even with #1 being true, RealT properties are the most stable assets on Ethereum.

Also important to remember that #1 is only true because RealT properties are ETH-denominated, not stablecoin denominated. Because the above price charts are RealT properties vs. ETH, you can see the volatility of ETH reflected in the value of the properties. You can see arbitrageurs step in and produce fair-market RealT properties, as ETH price volatility changes RealT asset valuation on Uniswap.

As a collateral type in MakerDAO, this is exactly what is needed to provide extra stability and liquidity to DAI.

The Big Hurdle: Fractured Liquidity

RealT has 6 properties in 6 different Uniswap exchanges.

- Marlowe: 56.7 ETH

- Fullerton: 67.0 ETH

- Audubon: 50.7 ETH

- Patton: 124.9 ETH

- Appoline: 157.0 ETH

- Lesure 64.0 ETH

There is 520 total ETH providing liquidity to 6 different RealT markets. Because of Uniswap’s 1:1 market design, the total liquidity of 520 ETH ($70,000+) is fractured into 6 different markets.

This represents the most significant hurdle for RealT assets inside of MakerDAO and other DeFi applications: Individual properties are too cumbersome and illiquid to be viable collateral.

Enter Balancer

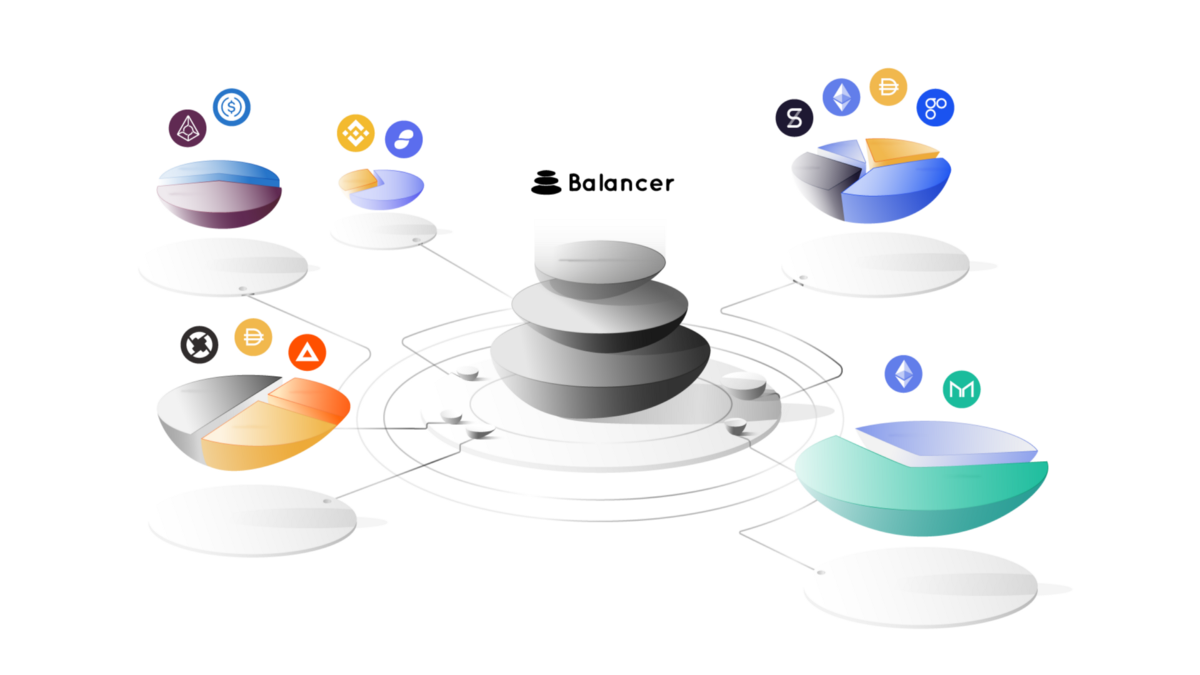

Balancer is like Uniswap, except instead of 1:1 markets, where one asset can only be traded for one other asset, Balancer is ‘N-Dimensional’, or, able to host any amount of tokens in a single pool. With Balancer, you can buy and sell any of the assets in the pool and be able to access the pooled liquidity of the total sum of the assets.

At genesis, Balancer is launching with 8-token pools and plans to scale up pool size with further R&D.

Balancer is an asset-aggregator and liquidity gadget. It allows for assets to be combined together into a generalized pool, and issues a secondary token that represents an index of assets. While doing this, it also aggregates the available liquidity of every asset inside a pool.

Being able to combine many assets into an index, and able to simultaneously access pooled liquidity, are powerful tools for satisfying the requirements of good collateral for DeFi apps.

RealT is actively exploring different possible architectures with an integration with Balancer. A few things still need to be fleshed out, such as maintaining legal compliance and the structure of the resulting offering, and we will keep the Ethereum community updates with our progress with these obstacles!

Once RealT overcomes these hurdles, Ethereum will have its first non-native asset that is ready for prime-time in DeFi.

When depositing RealT properties into the RealT Balancer pool, the depositor is returned a new token that is a claim on the pool of assets deposited. This is also how Uniswap works. The RealT-Balancer Pool Token is a credit for any asset inside the RealT-Balancer Pool. This means that the RealT-Balancer Pool Token can go out into the rest of the DeFi ecosystem and be collateral in MakerDAO, Compound, or any DeFi app that requires collateral.

Incentivizing Liquidity

The RealT Pool-token will have a market-cap of the total sum of assets inside RealT’s Balancer Pool. RealT properties can exist inside of Balancer, or out. For RealT property owners, Balancer is an opt-in integration on Ethereum. As a RealT property owner, you are never compelled to do anything you do not want to.

However, there are some pretty sweet perks for those that submit their RealT properties to the RealT Balancer pool. The main benefit is having exposure to the trading fees that the RealT-Balancer pool charges.

Balancer Trading Fees

Like Uniswap, Balancer charges fees to those that come to the protocol to swap assets. If you add your asset to the Balancer pool, you allow others to trade against the assets in the pool… for a fee. While the balance of assets in the pool may change, liquidity providers, in theory, receive more value than they put in due the trading fees.

Uniswap charges a flat 0.3% fee to all markets. With Balancer, specific pools can have their own unique exchange fees. At RealT, some research will be needed to model the best fee; however, my hunch is that it is significantly more than the Uniswap default of 0.3%. After all, buying or selling real estate IRL is 3% to both buyers and sellers: 6% total. Somewhere between 0.3% and 3% sounds about right, however more research is needed.

The purpose of the fee is to incentivize the depositing of assets into a pool. The more total assets that have been deposited, the more total liquidity is available. Having exposure to 0.3% — 3% exchange fees in a real estate marketplace is a compelling argument for adding collateral.

This incentive mechanism is what is needed on Ethereum to take real estate liquidity to the next level. Balancer’s customizable exchange fees allow for companies like RealT to set crucial parameters that are best suited for their particular needs. RealT, and real estate in general have very strong needs for liquidity. Balancers ability to pool assets and incentivize asset deposits are why I call Balancer a “liquidity gadget” for DeFi. Balancer is the place to deposit assets and achieve an improved level of liquidity.

The Road the MakerDAO

While this roadmap still needs blessing by legal, here is the general strategy for getting RealT properties inside MakerDAO:

- Migrate all real estate assets inside Uniswap into a single Balancer pool

- Increase the Balancer exchange fee to something more lucrative for liquidity providers, in order to incentivize further deposits from RealT property owners

- The total available market-cap of the RealT-Balancer Pool Token increases with further deposits

- RealT combines the liquidity of the 6 fractured Uniswap-RealT markets into a single RealT-Balancer Pool Token : DAI exchange

- RealT works with individual DeFi teams like MakerDAO/Compound to accept the RealT Pool-token as Collateral inside of DeFi

Before RealT properties become collateral inside MakerDAO, MKR holders have to vote-in and accept the RealT-Balancer Pool Token as collateral. However, there are levers and dials available that can help make the RealT-Balancer Pool Token a compelling collateral type for MakerDAO.

MakerDAO is designed to be able to accept any collateral type, no matter how terrible the collateral is. Terrible collaterals simply have very restrictive risk parameters: low-debt ceiling, high stability fees etc. This is what shields DAI from the downside risk of a collateral.

Good collaterals, however, are able to negotiate much better risk parameters from MKR governance. The more liquidity and market capitalization that the RealT-Balancer Pool Token can achieve, the better risk parameters it is able to negotiate with MKR holders. It is RealT’s job to create the best possible collateral characteristics for the RealT-Balancer Pool Token.

After all, real estate is already top-tier collateral in the legacy-finance world. Why not for DeFi too?

Action steps

- Try out the “liquidity gadget” Balancer

- Learn about RealT here and about real estate inside Uniswap here

Author Blurb

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his talk on how ETH accrues value and this accompanying post.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.