How to hire a money robot from Set

Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

It’s Tactics Tuesday! Every Tuesday we focus on one tactic to help you level up.

I’m not a trader. And short-term trading is not part of the Bankless program. Our focus is long-term crypto money accrual using simple buying strategies that help us avoid the psychological pitfalls that wreak so many in this crazy volatile market.

But money robots don’t have these pitfalls—they operate exactly as designed. Always. No emotion. No hangups. They’re better traders than us.

That’s why hiring them can be a valuable part of a crypto money portfolio.

Today we’re going to learn how we can leverage the money robots of the Set protocol to help us maximize our crypto wealth and level up our bankless skills.

- RSA

P.S. Get ready for Thursday’s thought piece by reading this in advance 🔥

TACTICS TUESDAY:

Tactic #3:

How to hire a money robot from Set

You can gain from the volatility of crypto without being a trader by using a money robot from Set. But there are some pitfalls! We’re going to learn how to pick the right strategy & use Sets to increase our crypto wealth.

- Goal: Learn how to use a Set to increase your crypto wealth

- Skill: Intermediate

- Effort: 1-2 hours

- ROI: In bear/neutral markets great ROI but negative ROI in bull markets

What is a Set?

A Set is like a robo-advisor for crypto, think WealthFront—it automates a pre-configured strategy. But unlike a robo-advisor, each strategy is represented by a token that itself can be traded, so each Set has a “ticker symbol” kind of like an ETF. And just like an ETF, you can add get exposure to a strategy simply by purchasing the tokens of a Set and adding it to your portfolio.

Here are the strategies that can be minted today.

The cool thing about Sets is that everything is open. Code, trades, holdings—everything verified on Ethereum. And automated too. These are like open, semi-trustless, automated ETFs. Or as I like to call them…money robots.

And while I think money robots like this will eventually eat the financial world maybe we can hire a few to help us increase our crypto wealth right now?

The money robots of Set

In the long-run, I expect many Set strategies will make sense for our crypto money portfolios. For now, there’s a shorter list of Sets available.

By category:

- Trend Trading—technical analysis strategies

- Range Bound Sets—buy low sell high strategies

- Buy and Hold Sets—buy and hold strategies with auto-rebalancing

And there’s also a short list of assets these Sets include:

- ETH—a crypto money

- DAI—a crypto money stablecoin

- USDC—a crypto bank stablecoin

- wBTC—tokenized BTC using BitGo for custody

Notice we have the essentials: crypto monies and a few simple strategies.

That’s all we need.

So what’s next?

How to choose a Set?

You can read more about each of the Sets here and decide which works best for you.

I’m going to walk you through the decision process I went through to select one.

First, I eliminated all the Sets with wBTC. You may feel differently, but I want to give wBTC more time to bake. At a market cap $5.8m (569 BTC), low liquidity, and third-party custody risks, wBTC has a different risk profile than native BTC, so not worth holding in a Set for me.

Next, I compared the Sets to an ETH holding strategy. Holding is accepted wisdom, yet I think it’s still underrated—it’s difficult to beat simply holding in a crypto bull market. A good Set shows how it can beat ETH holding and under what conditions.

And I considered slippage costs. Every time a Set rebalances there is slippage cost. Given the low levels of liquidity in the exchange markets that Sets use, these slippage costs could decrease profitability. I assume slippage costs are 1% per rebalance which does seems to be proving true so far but these costs could increase if Sets become larger proportional to liquidity. Something to watch.

Then, I looked at the AUM of each Set. Looking at this dashboard gave me a perspective on the size of each Set. The larger the Set the more likely it is to have liquidity on an exchange market when listed. Liquidity gives me more options to sell the Set later, which is valuable. Currently the ETH20SMACO is the largest at $1.9m only distantly followed by ETHLOVOL at $133k.

Finally, I considered tax ramifications. This was tricky as Set is unable to provide guidance due to liability—new territory. After speaking to professionals, I believe a solid approach is to treat the Set like an ETF. That is, when you put ETH into a Set, you no longer own that ETH, you own a new separate asset at a new originating cost basis. Under this assumption, you would only 1) incur gain/losses on the ETH you put into the Set at origination and 2) incur gains/losses on the Set when you sell or disband it. You would not incur gain/losses as the Set periodically auto-rebalances. (Note: This perspective is US jurisdiction. Also this is not tax advice, talk to your tax advisor.)

Btw, if you’re curious about Set fees, currently there are none. That could change.

Putting this all together

So nixing wBTC eliminated the Buy and Hold Sets. And after investigating, the highest performing Sets relative to holding seemed to be ETH20SMACO and the newer ETH12EMACO. Of the two the ETH20SMACO easily wins on size. So in the end, it was the most compelling Set for me though I’m keeping an eye on ETH12EMACO.

But how much of the ETH I’m holding could it make sense to put in here?

Some, not much. (At least right now.)

Why?

First, any asset I put into a smart-contract like Set carries some level of technical risk—hack, oracle snafu, evil employee. All of these have been mitigated by the Set designers, but these risks are non-zero compared to holding ETH and should be considered.

Second, these strategies don’t perform well in every market condition, they’re only better in the neutral/bearish markets we’ve been in lately. Let’s take an example, assuming you did the ETH12EMACO instead of ETH holding in these recent conditions:

- Last two years (mostly bearish mkt): 2.7x more ETH vs hold strategy ✅

- Last three years (bull & bear mkts): same amount of ETH vs hold strategy ✅

- The year 2017 on Dec 31 (bullish mkt): 75% less ETH vs hold strategy ‼️

Really good in bearish markets. Really, really bad in the hyper bullish markets of 2017. Not really any better than hold over the past three years if you combine both.

Check the numbers for yourself.

So the current roster of Trend strategies can be very good for horizons measured in months, but probably not much better than the simple hold for horizons measured in years. And of course, some trend level prediction is required.

In other words, you need to think like…

This: “we’ll be in a bearish/neutral sentiment for the next quarter or two, I should put some funds in the ETH20SMACO”

Not this: “I have no idea about short to medium term sentiment, but I do know ETH is great long-term so I’ll be putting all my ETH into the ETH20SMACO”

BONUS TAX TIP

Remember the tax stuff from earlier? Well, some of those considerations go away if you’re able to tax-shelter your ETH in an IRA before putting in a Set. Seems there’s already Bankless readers thinking this way. Good thing you already leveled up on this!

So how do I open a Set?

We’ve focused on the tactics of picking a Set which is essential, but if you want to get started you’ll still need to know how to open one. Fortunately my friend and our fellow Bankless member Nodar Janashia already wrote the go-to tutorial for us.

Final Words

The money robots of Set are a useful tool for crypto wealth accrual. You just need to hire the right ones and use them judiciously. Using them to take advantage of short/medium terms trends you can spot make senses, but do not expect them to outperform holding on an very long term basis.

Getting experience with Sets is another way to level up your open finance skills. The power of grouping assets and managing these assets by code is transformative. I expect to see Sets listed on exchanges like Uniswap and inside wallets like Argent in the near future.

And who knows?

Your next financial advisor might just be a money robot.

Action steps

- Determine if a Set makes sense for your crypto money portfolio

- Pick a Set and get started

- Send this article to someone who should learn about Sets

Continue leveling up. $12 per month. 20% off before Nov 1 plus Inner Circle access.

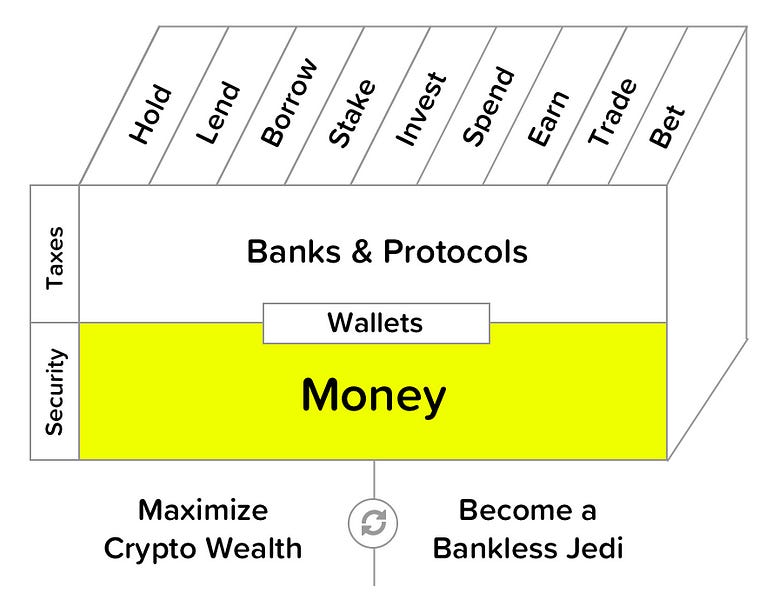

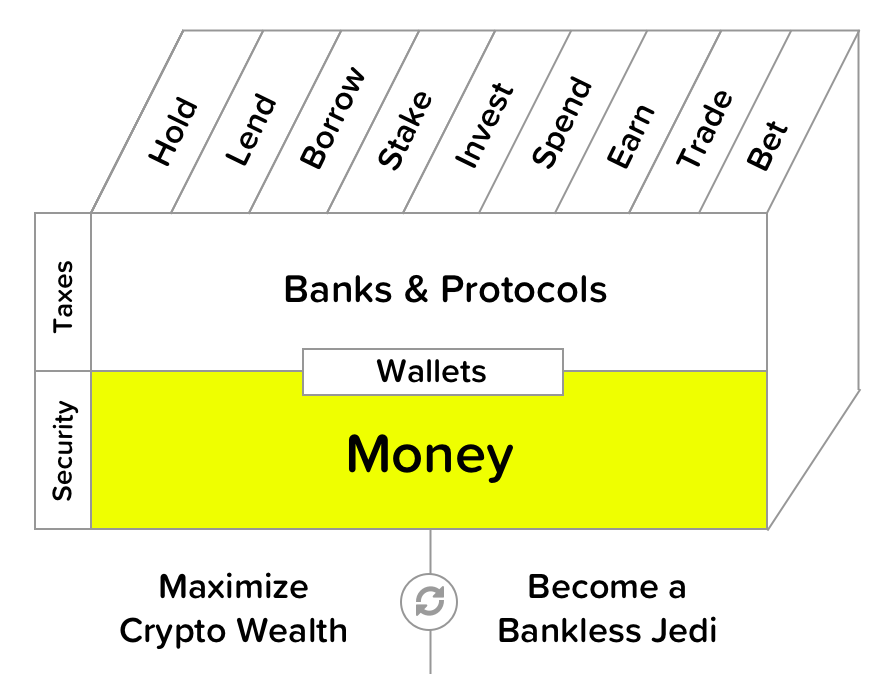

Filling out the skill cube

By addiing Set strategies to your skill list you’re leveling up in the Money layer of the skill cube. You don’t have to become a trader if a money robot can do it better.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.