How to get a DAI saving account

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

My Bank of America savings account earns 0.03% right now. I just checked.

But I can earn 7.5% on my DAI “dollars” right now—that’s 250x more.

Pretty tempting.

And it’s not hard. All it takes is some of the bankless skills you learn here every week.

So let’s do it. Let’s get a DAI savings account and level up!

-RSA

TACTICS TUESDAY:

Tactic #23: How to get a DAI saving account

Guest post collaboration: Marc Zeller, Ethereum France Co-Founder (follow him!)

DAI is the world’s first stablecoin that doesn’t require a bank. No central bank. No commercial bank. Purely crypto protocols. DAI is pegged to the value of the dollar (1 DAI = $1), but backed by crypto native assets like ETH. Right now you can earn 7.5% per year on your DAI by putting it in the DAI Savings Rate. Today we’ll learn how.

- Goal: Learn how to get DAI and start earning interest on it

- Skill: Beginner

- Effort: 1 hour

- ROI: 4-20% yield with minimal risks on USD-pegged tokens.

Why use a stablecoin?

You can use a stablecoin as:

- an instant hedge position in your crypto portfolio. In some jurisdictions (not the U.S.) this doesn’t trigger a tax-event.

- cash to acquire goods and services. Since there’s near zero volatility there’s no math to calculate an exchange rate, no regrets in 10 years when you paid 33 ETH your conference ticket (a true personal story about Devcon2)

- cash to receive for goods and services, collect crypto payment without having to handle the asset volatility (check Tactic #22 on how to receive crypto payments)

Since stablecoins exist on crypto networks like Ethereum, they inherit the properties of other Ethereum tokens. They’re global, borderless, peer-to-peer, and can be used inside the crypto banks and DeFi ecosystem.

There are two types of stablecoins:

- Bank stablecoins like USDT, USDC, GUSD, PAX are essentially tokenized IOU’s for dollars that their issuer keeps in a traditional bank account.

- Bankless stablecoins like DAI are backed by crypto collateral and settled completely onchain. DAI is the only bankless stablecoin of any meaningful size.

Note on risk. The technical, external, and economic failure risks described here exist in DAI but not in the bank stablecoins. This makes DAI higher risk. DAI is, however, fully transparent and onchain—we know exactly what’s backing it. USDT is not. In that way DAI is lower risk. Still, overall you should assume DAI carries higher risk than bank stablecoins like USDC.

The flavors of DAI

DAI by itself is already incredible. It can be used as a unit of account, a medium of exchange, and store of value. DAI is probably the closest thing to money crypto has produced so far.

If you just want to use DAI to transact, you can keep it as DAI. But if you want to build a DAI savings account you’ll want to learn about the flavors of DAI.

Since DAI is a money lego it can be wrapped and combined with interest protocols and money market protocols. You can turn your DAI into a savings account and there’s an entire universe of DAI flavors to choose from.

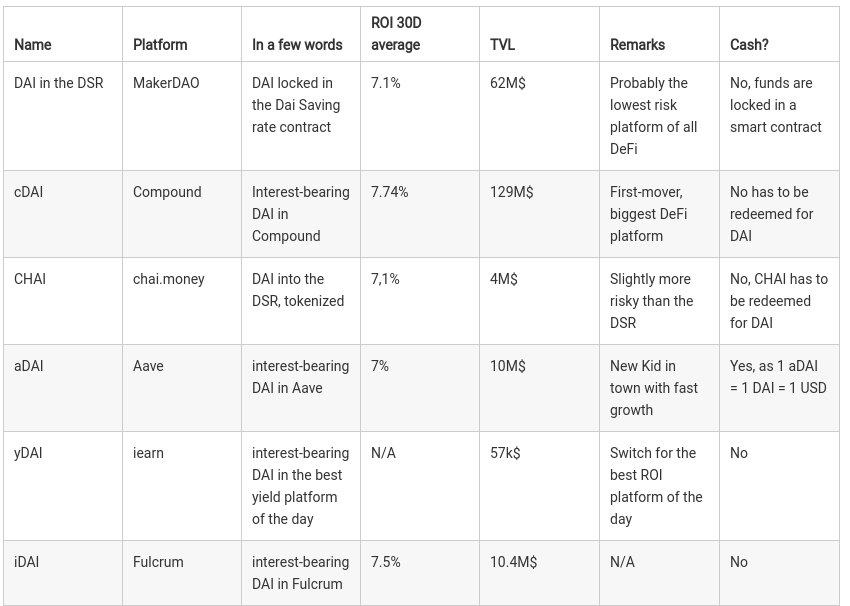

Here’s a cheat sheet to the most important flavors of DAI:

Which flavor should I choose?

For beginners, I recommend DAI in the DAI Savings Rate (DSR). This is the lowest risk way to earn interest on your DAI—no added risk beyond holding DaI. As of today the DSR is 7.5%. This means for every 100 DAI you’d receive $7.50 annually.

If you’re intermediate level, I recommend CHAI. CHAI is DAI wrapped in the DSR, but tokenized so it can be used in transactions while earning interest. There’s some slight additional risk vs. depositing DAI in DSR—but potentially tax benefits. Feels worth it. Instructions on how to convert DAI to CHAI in the weekly assignment here.

If you’re advanced, you can evaluate the risk/reward of other protocol savings accounts like cDAI from Compound and aDAI from Aave. These protocols acts as money markets—they add additional interest above the DSR but carry additional risk.

The three most common questions:

- Does the DAI savings rate change?

Yes, interest rates change regularly, sometimes weekly. The changes can be significant a 2-4% increase up or down is not uncommon. - Where does money from the DAI savings rate come from?

In short, it comes from borrows. The people who are using ETH as collateral to borrow DAI are paying a fee. A portion of this fee goes to the DSR. - How safe it this?

It’s not as safe as your traditional bank savings account. There’s no FDIC. The DAI code is among the most tested, but still could be hacked. It’s also more risky than lending USDC—weigh these risks against the returns before allocating.

Setup your DAI Savings Account

There are three steps to setup your DAI savings account.

Step 1, get DAI

DAI can be acquired with fiat currency (like dollars or euros) on many platforms. You’ll get the lowest fees on centralized exchanges.

From the US:

- Best deal is Coinbase Pro using the DAI/USDC trading pair

(it’s free to convert USD to USDC on Coinbase) - Transfer fees to Coinbase using ACH or wire transfer

- Fees 0.5% + wire transfer fee

Want an even lower cost way to go from USD to DAI? After you transfer USD to Coinbase and convert it to USDC, you can move it to your Ethereum wallet and trade USDC for DAI on Curve—(exchange rate 0.9980—1k in USDC gets you 998 DAI!)

From anywhere else:

- Kraken is a solid choice

- Transfer fees to Kraken using bank deposit or wire transfer

- Fees 0.25% + bank transfer fees + 0.5 DAI

Step 2, prepare crypto wallet

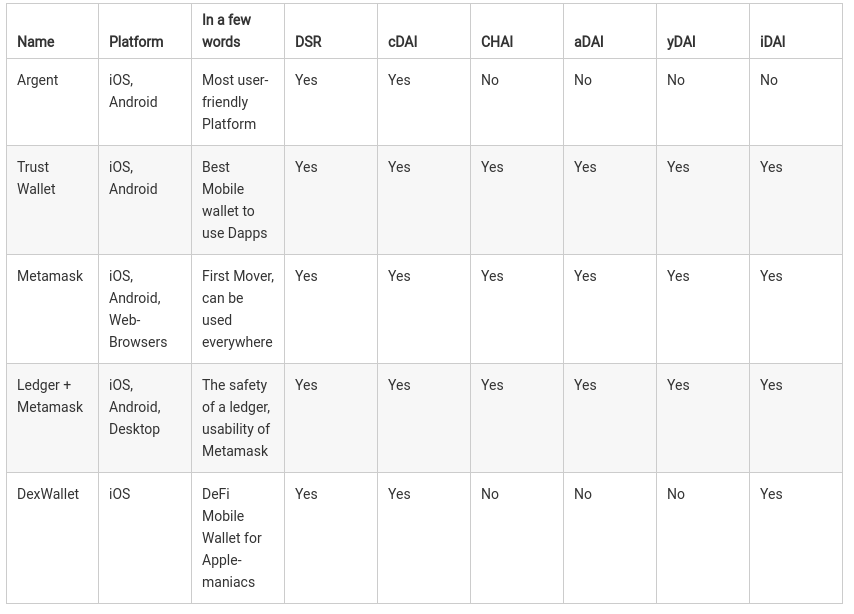

There are many crypto wallets to choose from. Here’s a curated cheat sheet to help:

For beginners, I recommend Argent. Easiest to use and supports DAI Savings Rate.

For the intermediate, I recommend Trust Wallet or MetaMask. More flexibility, though comes with the responsibility of seed phrase backup.

For the advanced, I recommend a Ledger with MetaMask. If you’ve properly configured your Ledger Wallet, this is also the safest way to store your crypto and is ideal for larger amounts.

The examples in the rest of this Tactic we will be using Trust Wallet on Android.

(If you’re using the Argent wallet click here for instructions instead)

Step 3, start earning money!

If you’re using the Trust Wallet and have some DAI, you can convert the DAI to one of the flavors discussed in the previous section to start earning interest.

Earn using the Dai Saving Rates

The Dai savings rate is powered by Maker and can be accessed directly on Oasis.

- Time needed: 5 min

- Skill: Beginner—Intermediate

- Current APR: 7.5%

Earn using Aave (aDAI flavor)

While still new Aave has already reached over $10m in just one month. Though it comes with some additional risk compared to the DSR, the aDAI interest rate will likely exceed the DSR in the long-run in part due to its Flash Loan capability.

- Time needed: 5 min

- Skill: Intermediate—Advanced

- Current APR: 7.9%

Earn using Fulcrum (iDAI flavor)

Though Fulcrum is more trader oriented, it’s still easy to use. It also comes with additional risk compared to the DAI Savings Rate. An estimation of the risk of various DAI interest platforms has been compiled by CodeFi here.

- Time needed: 5 min

- Skill: Intermediate—Advanced

- Current APR: 9.9%

A shortcut…

Rather than converting your DAI to one of the DAI flavors, you can trade it directly for one of the DAI flavors using a DEX Aggregator.

What is a DEX Aggregator? A platform that aggregates exchanges to provide the best rate for crypto asset swaps. Some of the best aggregators include:

This shortcut is pretty simple: as almost all DeFi platforms use some flavor of DAI, we just have to swap our plain vanilla DAI for a flavor of DAI that gives us interest.

Here’s an example of a DAI swap for aDAI:

Final Thoughts

Setting up a DAI savings account is a great way to level up and start earning interest on your DAI. Adding DAI to the DAI Savings Rate is no more risky than holding DAI, so if you already have DAI you may as well start earning interest.

If you’re planning to convert some fiat to take advantage of the high DAI interest rates first consider the risks—this is not as safe as dollars in a traditional bank account. That said, earning 7.5% or more interest on a synthetic dollar is an attractive proposition and can be worth it for a portion of your crypto money portfolio.

To see the latest DAI interest rates check out Loanscan or CoinmarketCap. To compare risk across platforms, see DeFiScore. See other DAI metrics here.

Action steps

- Convert some USD and setup a DAI Savings Account

- Choose the best flavor of DAI based on your experience level & risk tolerance

Author Blub

Marc Zeller is the co-Founder of Ethereum France and Chief Contrarian Officer at Coinhouse. He’s a passionate DeFi user, stablecoin guru, and writes regularly on the Aave blog.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

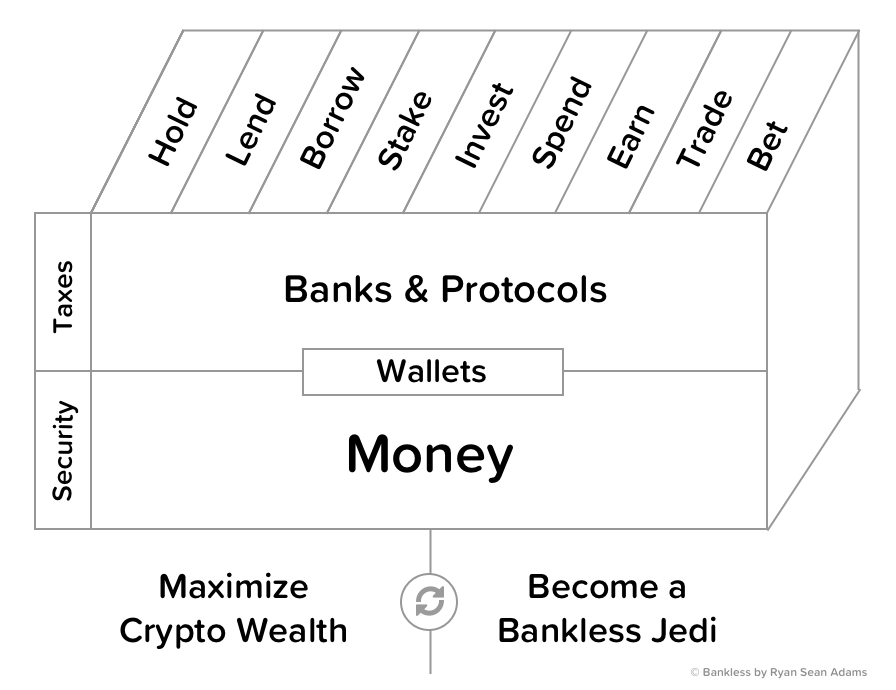

Filling out the skill cube

You just leveled up on DAI—the most decentralized stablecoin. Earning interest with DAI in a savings wrapper is a fundamental skill in the Bankless program. Well done!

👉Send a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.