How to use a Zap

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

I love simple tools that make everything else in the DeFi ecosystem better.

Zaps from DeFiZaps are one of those tools and it’s time we did a tactic on them.

Does anyone remember how painful it was to buy something on Amazon in when it looked like this? A ten-step process only suffered by the uber geeks brave enough to submit their credit card online.

Back then one-click eCommerce was considered a major innovation! Amazon had to license a one-click patent from Apple to even attempt it.

That’s where we are today in crypto. Simple transactions are still painful. And it’ll take a thousand tiny UX innovations like Zap to get us to mainstream.

I have hope. Because as we’re leveling up…so is DeFi.

Let’s learn about Zaps.

-RSA

TACTICS TUESDAY:

Tactic #25: How to use a Zap

Guest post: Nodar Janashia of DeFiZap with collaboration from RSA

DeFiZap is a system of smart contracts—Zaps—that deploys ETH (and soon DAI) across multiple DeFi protocols in one transaction. It’s the Amazon one-click of DeFi. Use Zaps to get instant access to DeFi opportunities directly from your Ethereum wallet including 💸Lending, 🦄Pooling, ⛽️Staking, and 🚀Leveraged Liquidity.

- Goal: Pick a Zap based on a DeFi position you want to take

- Skill: Beginner

- Effort: 30 minutes

- ROI: Hours of time & $100s in gas for frequent DeFi users

Why use a zap?

Zaps allow you get into a DeFi position in one transaction—it’s called zapping in.

Zapping in

Say you have ETH and want a position in the Uniswap ETH-DAI pool. This yielded 4% over the last 90 days but you think ETH to USD price will stay flat (important due to impermanent loss) and Uniswap fees will increase yield above the Dai Savings Rate.

Well, it’s a painful process to get into that position. You need to supply half ETH and half DAI. Takes 4 transactions. 10 minutes. Ugh. Ugly as eCommmerce in the 90s.

Zap allows you to do it in one click.

Zapping out

Now say you zapped into the Uniswap ETH-DAI position above. You made profit, now you want out. You can zap out the same way you zapped in. One transaction. Easy.

There are dozens of Zaps now. Each Zap is a recipe for getting into and getting out of a DeFi position—in one click.

Which Zap should I pick?

This is like asking which DeFi positions should I take? It depends what you’re trying to accomplish. DeFiZap has a simple survey you can take that recommends a few based on your tolerances. I expect we’ll see Zaps integrated directly in more wallets too.

Today Zaps provide more benefit to power users—people who already know the position they’re trying to take and the risks of each protocol and want to execute it with less time, effort, and money. Almost like an automated OTC desk.

Zaps are generally practical—they don’t shotgun your capital across the 'top 10 on coinmarketcap'—they inject into DeFi protocols built on Ethereum. Easy interactions in and out of protocols can supercharge user adoption. Though users should be aware of the risks of each underlying protocol.

Flavors of Zaps

There are many flavors of Zap today and more are added all the time. We’ll focus on Unipool Zaps for this tactic.

Unipool Zaps 🦄

Unipool Zaps allow anyone to earn trading fees by adding liquidity to Uniswap Pools using ETH (the ability to initiate Zaps with DAI is coming soon).

Unipool Zaps auto swaps half of your ETH into the entry ERC20 tokens required to match for the pool (decreasing your ETH exposure), effectively allowing you to start earning liquidity fees without having to go out of your way to supply both sides of the pool. This is especially useful to help liquidity providers measure their returns.

Some popular Unipool Zaps include:

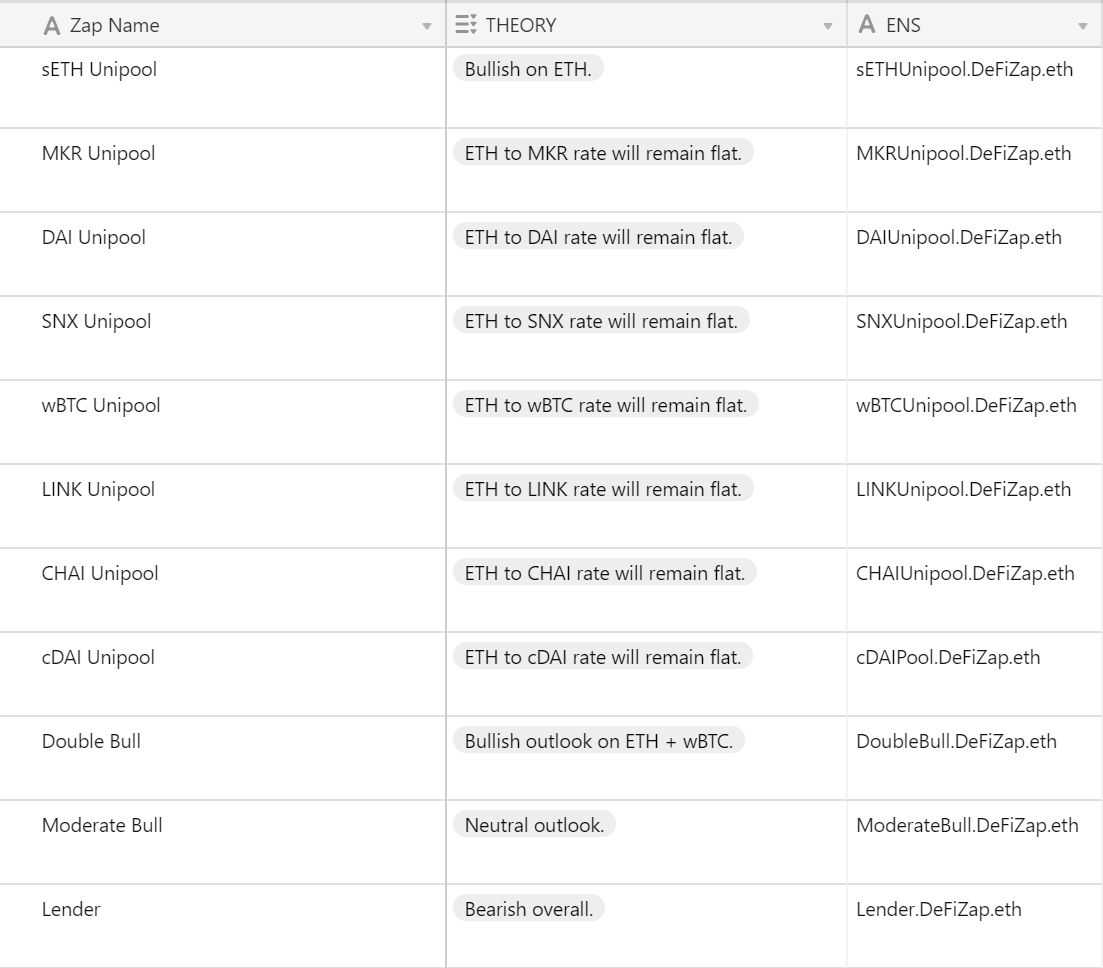

⚡️sETH Unipool: Bullish on ETH

⚡️MKR Unipool: Expect ETH to MKR rate to remain flat

⚡️DAI Unipool: Expect ETH to DAI rate to remain flat

⚡️CHAI Unipool: Expect ETH to CHAI rate to remain flat

⚡️General Unipool: Pick your own ETH-Token pool

The sETH pool keeps your ETH Exposure

If you want to keep your exposure in ETH the sETH Unipool Zap allows for one-click liquidity to sETH Pool on Uniswap using just ETH. This way you remain exposed to ETH price while generating fees from people trading ETH/sETH on Uniswap Pool plus extra SNX staking rewards. (⚠️RSA note—sETH does expose you to the risks of the Synthetix platform—make sure you understand those thoroughly before proceeding)

The cDAI and CHAI provide lending interest while you earn trading fees

You probably know a bit about DAI from our recent cDAI and CHAI articles. When holding cDAI users accrue interest based on the lending rate at any given time—8.5% as of today. CHAI works the same way, less risky than cDAI and earning 8% now.

The CHAI Unipool Zap and cDAI Unipool Zap allow you to enter these respective liquidity pools with just ETH—you earn Uniswap trading fees on top of the cDAI interest rate!

⚠️Before entering a Uniswap Pool make sure you understand the concept of impermanent loss which was covered here or here so you’ve have clear expectations on gain and loss potential.

Other Zaps for lending and leverage are also available. Though again, users should assess the risks of each lending and leverage protocol before using them. For example, some of the Zaps are configured to use the Fulcrum protocol which was recently attacked. (RSA—I’m looking forward to Zaps that automate insurance on these protocols!)

Zaps Cheatsheet

Here’s a quick cheatsheet on popular Zaps available and the positions they provide:

Example:

Zap into the sETH Unipool

Zap into the sETH Unipool in a two steps and one transaction.

Intermediate level: Zap in via website

- Connect MetaMask or Fortmatic wallet

- Go to the sETH Zap and click ⚡️ZAP IN

- Select your desired input amount and confirm

Advanced level: Zap in via ENS

You can also Zap in via ENS! Since the sETH Unipool Zap was registered with the Ethereum Name Service under sETHUnipool.DeFiZap.eth adding liquidity is as easy as sending an Ethereum transaction. (Note: make sure your gas limit is set to 1,500,000.)

(Above: adding liquidity to sETH Unipool by sendiing ETH to ENS name)

Final Thoughts

Zaps are an awesome tool to make it faster, easier, and cheaper to get into popular DeFi positions. You can zap into positions and zap out of them in one transaction.

While Zaps make it easier to enter and exit positions, it’s still up to you to assess the ROI and risks of the underlying positions you’re entering. These are powertools, not a short-cuts. Before zapping into a Unipool you need to know how Uniswap works, before zapping into sETH learn the risks of Snythetix. Don’t zap into positions without doing your due diligence. Level up first. That’s why we do the program.

Action steps

- Learn the flavors of Unipool Zaps and try one out!

Author Blub

Nodar Janashia is the co-founder of DeFiZap. He also makes DeFi Tutorials to highlight best use-cases & risks involved when using Open Finance tools.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet

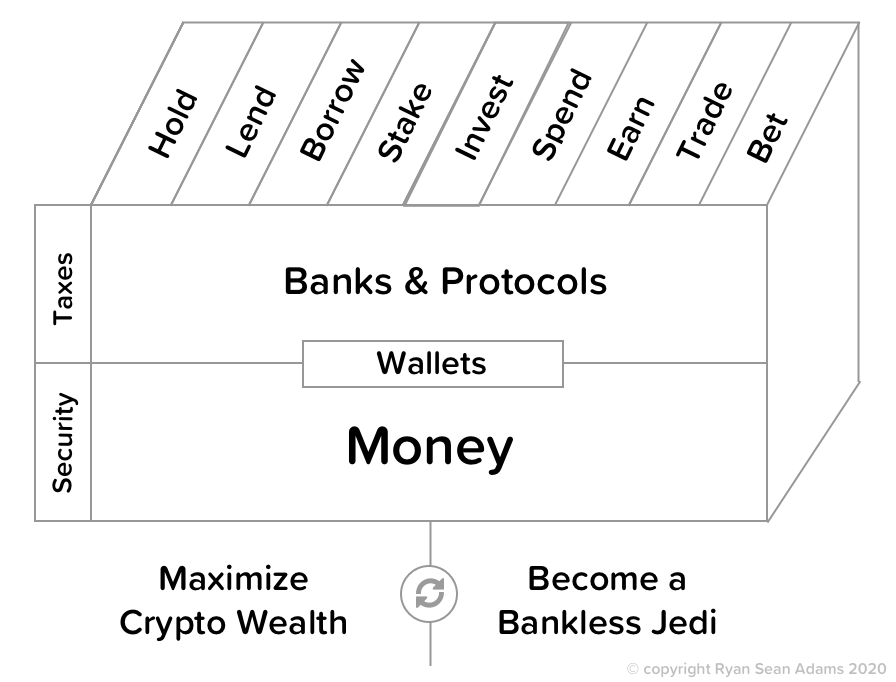

Filling out the skill cube

This week you leveled up on Zaps a tool that helps you take positions in DeFi protocols to lend and earn. Keep to the skill cube. Keep leveling up!

👉Send a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.