How to make money using OpenSea

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Remember when .com names were cheap? Every company, project, brand, and idea would need one if this internet thing took off. Only tech geeks knew about them.

ENS names are like .com’s for Ethereum accounts. They’re human-readable names for crypto bank accounts. Every company, project, brand, and merchant will need one if this Ethereum thing takes off. Only bankless geeks know about them.

In today’s tactic we show you how to flip them for profit on the eBay of ENS names.

You get good at this? It’s not just ENS names you can flip. Apply the techniques you learn here to other digitally scarce assets and front-run the multi-billion market that’s inevitably going to grow out of this stuff.

Best of all anyone can do this—just takes Metamask, ETH, and a bit of bankless hustle.

Oh, and mark your calendar for May 4th—thousands of ENS names are going to require renewal on that day. You can front-run those renewals too.

This is tactic #32. Let’s level up.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #32: How to make money using OpenSea

Lots of folks on OpenSea are in it for the yucks, not the bucks. In other words, users rely on OpenSea to buy and sell things they collect, play with, and enjoy. But money making opportunities abound! Here, we’ll take a look at how to earn money flipping ENS names on OpenSea. (You’ll need MetaMask and some ETH)

- Goal: Make money trading digital assets on OpenSea

- Skill: Beginner

- Effort: 1-2 hours

- ROI: 10%-1000%

What is OpenSea?

Guest post: Dan, wearer of many hats at OpenSea and owner of many NFTs.

In the early days, I’d tell people, “OpenSea is eBay for CryptoKitties.” That phrasing probably still does more to convey our fundamentals than any other 5 word permutation could. But the more time passes, the more it leaves out. Today, OpenSea is a marketplace for thousands of types of digital assets, including game items, collectibles, art, titles to virtual land, and more. Here, we’re zeroing in on one of the shining stars of that “more” category, ENS.

Why trade ENS names on OpenSea?

ENS, or the Ethereum Name Service, is a set of tools that turns 42-character Ethereum addresses into convenient, memorable, human-readable names like arachnid.eth. If you’re not familiar with ENS, check out this article and this FAQ. It’s an essential layer of web 3, roughly equivalent to DNS in the web 2 context.

ENS presents an ideal beachhead for rookie traders of nonfungible tokens because it allows you to leverage subject matter expertise from any area. To make money flipping Axies, you need to know a whole lot about Axie Infinity. I can’t tell a tank from a healer, let alone spot the best value DPS Axies. But to make money flipping ENS names, you just need to be able to identify a few important concepts from your own area of expertise and apply that advantage to the ENS market.

In broad brushstrokes, our strategy will be to identify undervalued ENS names, acquire them, list them for sale on OpenSea, and promote the listings to the most interested audience.

How do I identify undervalued ENS names?

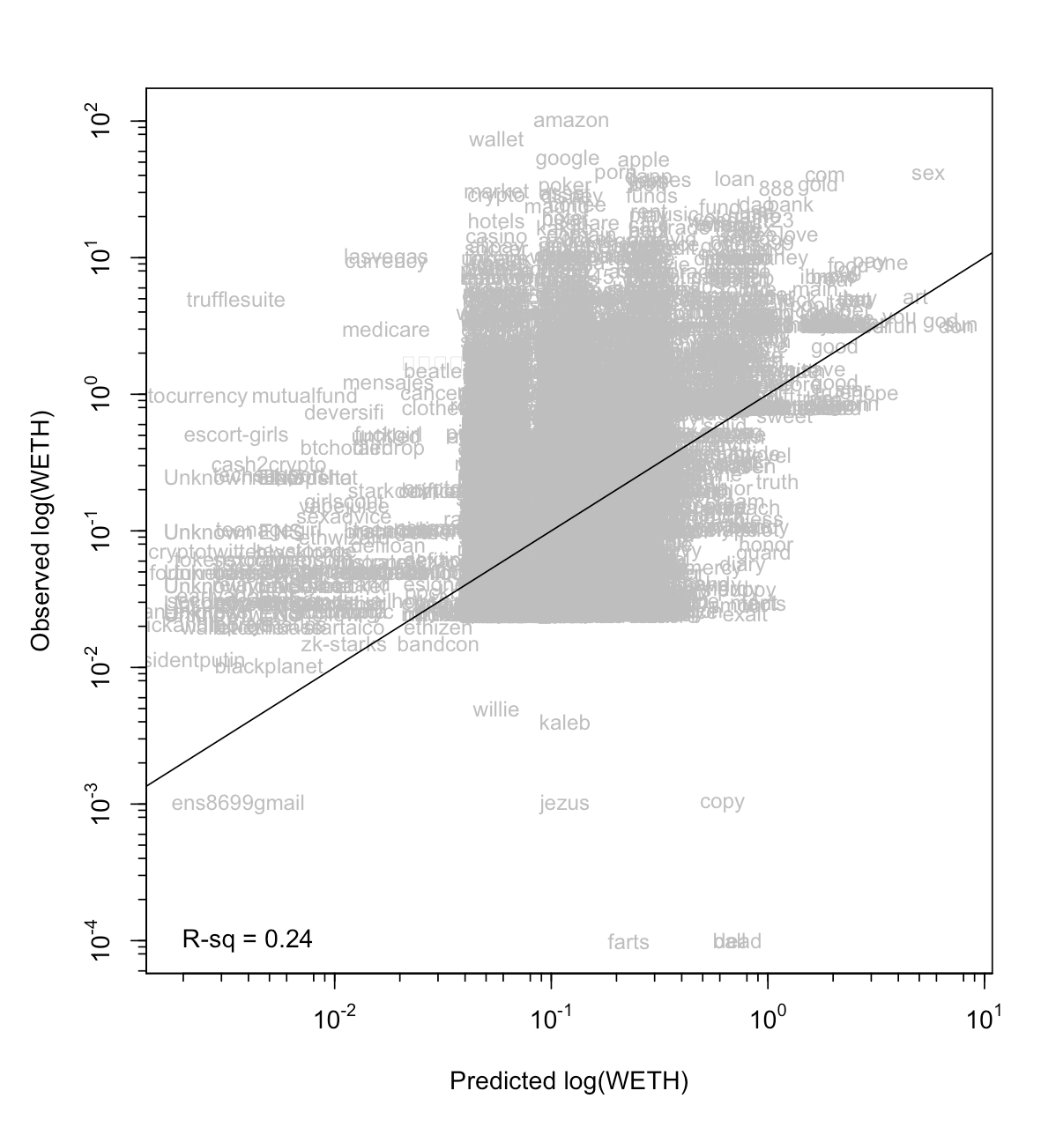

First and foremost, understand that size does matter. The shorter the ENS name, the higher the expected value, generally. Check out this tool by the anonymous data scientist Takens Theorem to get a sense of the relationship between length and price. A 3 letter name listed for 3 ETH is more expensive in absolute terms, but it might be a steal compared to a 6 letter name listed for 2 ETH. According to a blog post Takens Theorem wrote, name length can explain over 20% of the price variability.

That’s the baseline understanding of the market, anyways. But the economics of short names are undergoing a shift at this very moment. On May 4th 2020, thousands of names are going to require renewal. While most names will only cost you $5/year in rent, 4 character names will cost $160/year and 3 character names require a whopping $640 tribute if you wish to retain your ownership. If you see a short name going for a song, double check the expiration date or you might find yourself pinned between two bad options: losing your newly-acquired name and paying the substantial renewal fee.

Once you’ve groked those two ENS-specific factors, the process turns into a word game where your own subject matter expertise takes center stage. Let’s suppose for the sake of lexical comedy that, unlike the author of this article, you’re a philatelist. As you browse the pages of Philately Lately (didn’t bother verifying whether this exists because it simply must), you discover information that leads you to the conclusion that inverts are making a comeback in popularity.

First, you set aside your frustration with the philatelic community for having lost their way and forgotten the true value of inverts for so long (I’ll stop making up stamp stuff shortly, I promise). You realize that before long, some enterprising stamp dealer will create an online shop selling exclusively inverts and they’ll want to accept ETH. But they’re not going to request payment to a big ugly Ethereum address. They’re going to want a nice, snappy ENS name. So, I’m headed to OpenSea. Time to buy inverts.eth.

How do I buy an ENS name?

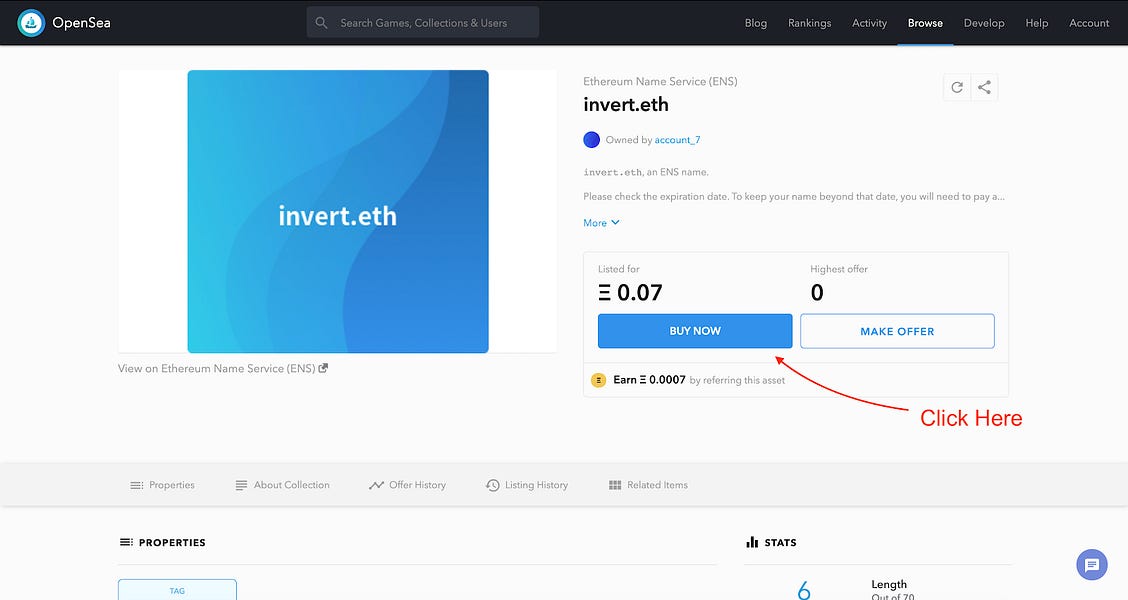

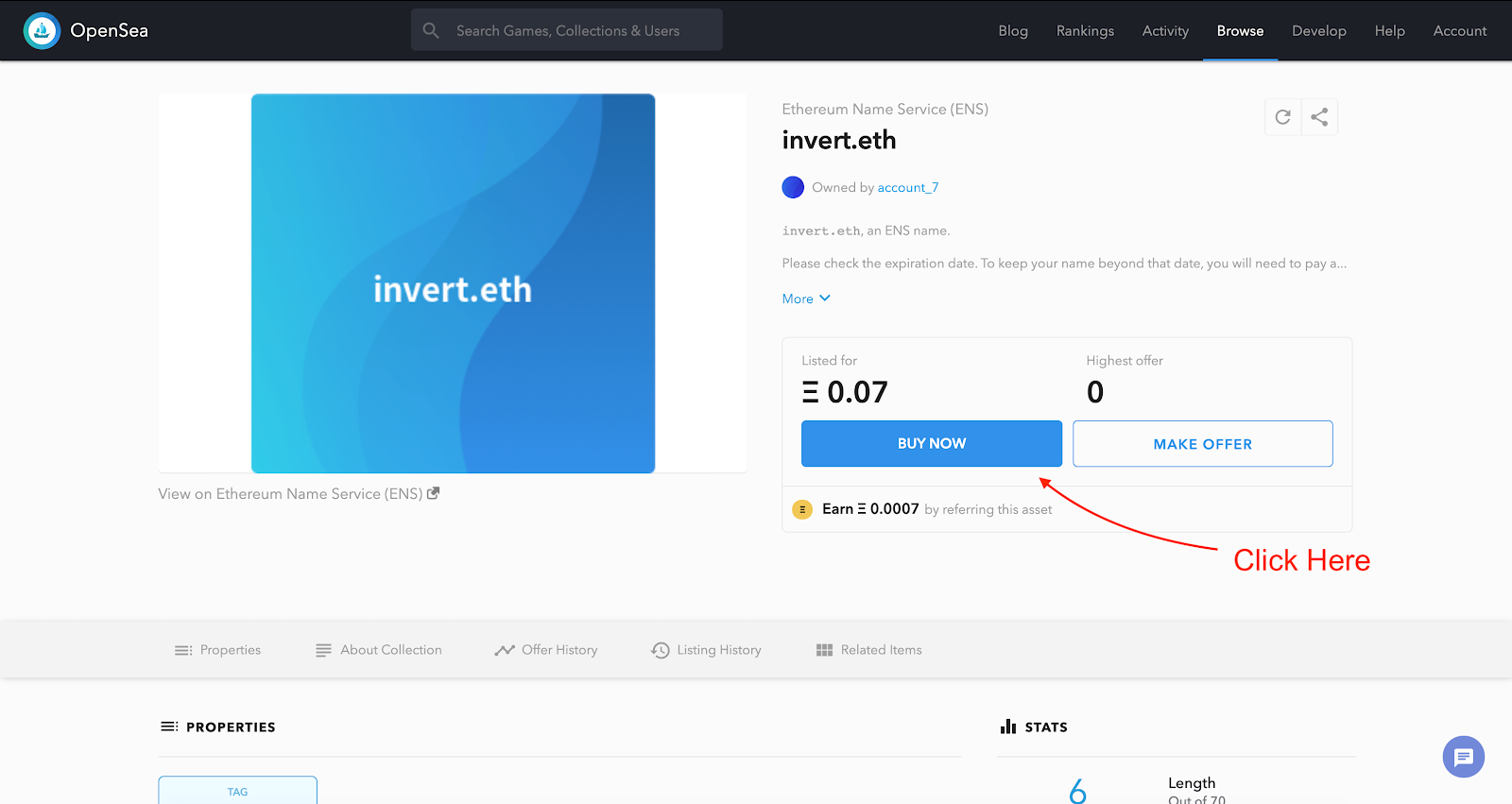

First, I’ll check if it’s already for sale on OpenSea. If it is, and I feel that it’s undervalued, I can just buy it. While inverts.eth is not for sale, I see that invert.eth is listed for sale for 0.07 ETH. That’s less than what I think the hypothetical Ethereum-friendly stamp vendor would reasonably pay for it, so I’m going to buy it, even though it wasn’t my original target.

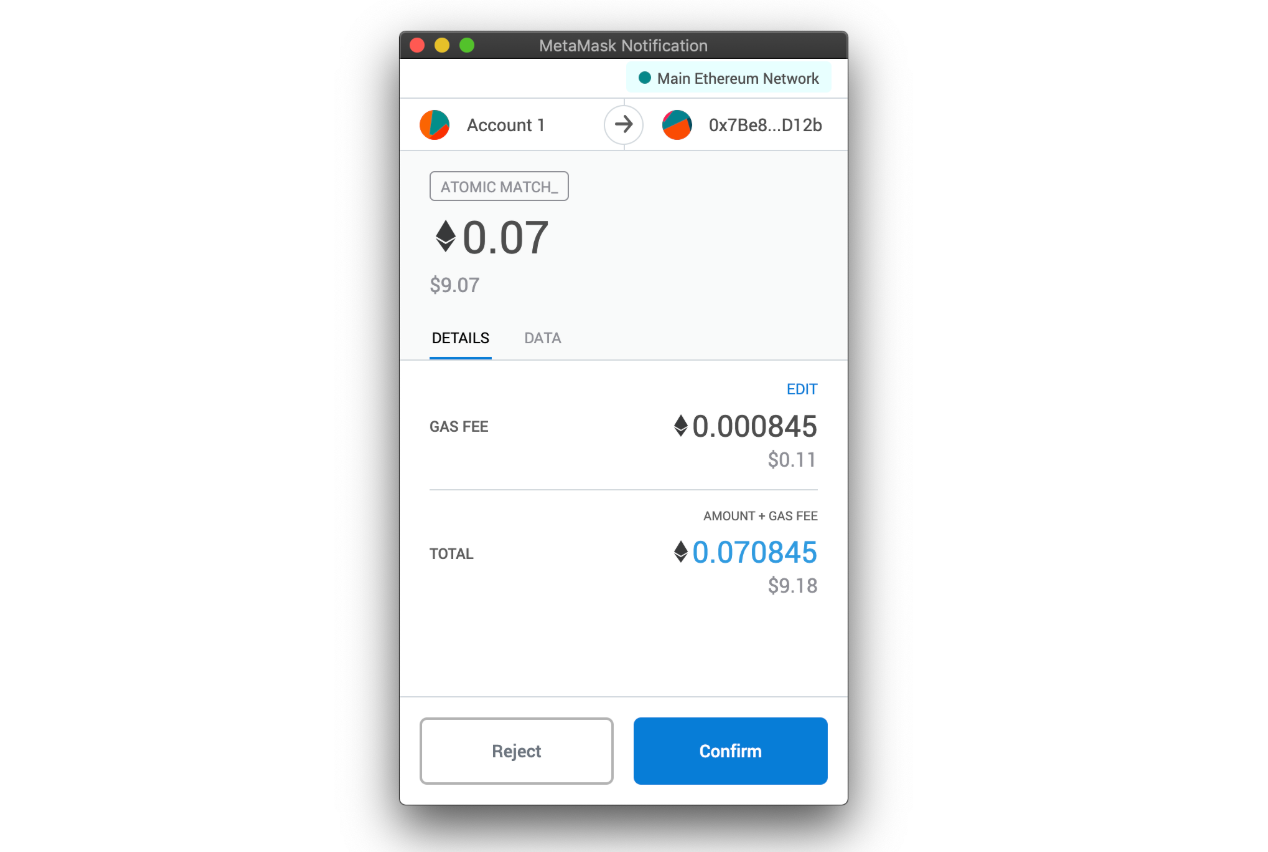

To purchase an item, click the “buy now” button. If it’s your first time transacting on OpenSea and the item is listed in a token other than ETH, you might have to do an initialization transaction approving the token for transfer before you can make the purchase. The popup for the actual purchase transaction looks like this:

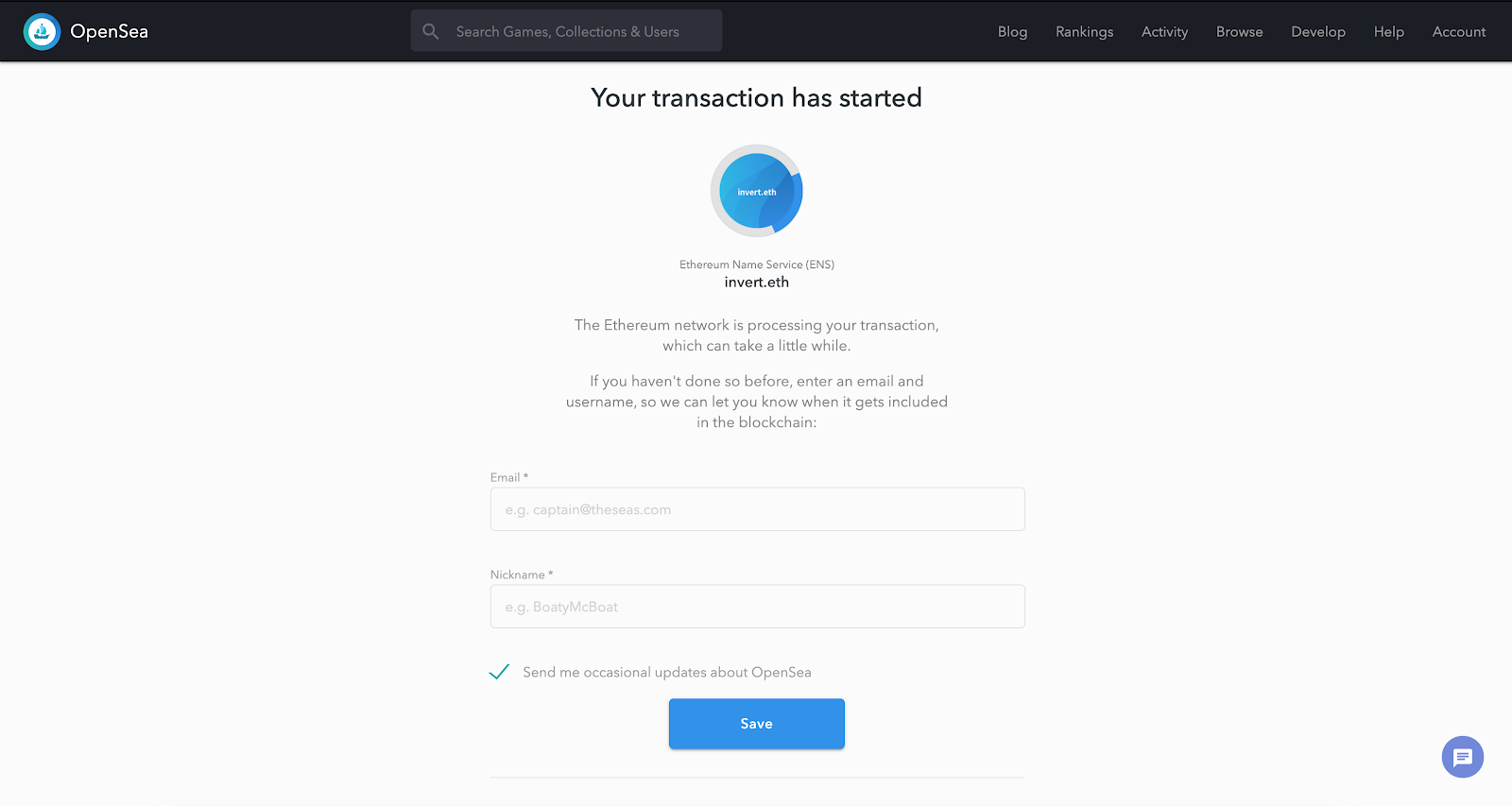

Confirm the transaction and wait for it to be mined. You should see a screen that looks like this as you wait:

Before long, you’ll see a confirmation. Success! In my case, I can now say with a slightly puzzling sense of pride that I’m the owner of invert.eth.

Now, let’s see about getting inverts.eth. At the time of drafting, it’s not for sale on OpenSea. It hasn’t even been registered yet. But by the time of publication, it will be, because I’m about to register and list it for sale.

If a name doesn’t appear on OpenSea, it’s almost certainly not yet registered. But if trust isn’t your scene, you can verify the registration status of an ENS name by searching for it on the ENS app. I’ll skip the details of the ENS registration process and refer you to Brantley’s article on the subject. Suffice it to say that I followed the process outlined in the article, locked down inverts.eth, and now I’m low key sizing up what it would take to start dabbling in stamp collecting. Perhaps my compulsive NFT buying has begun to affect my brain on some primitive level. Let’s list these names for sale before I succumb to the temptation of expanding into a new hobby.

How do I sell an ENS name?

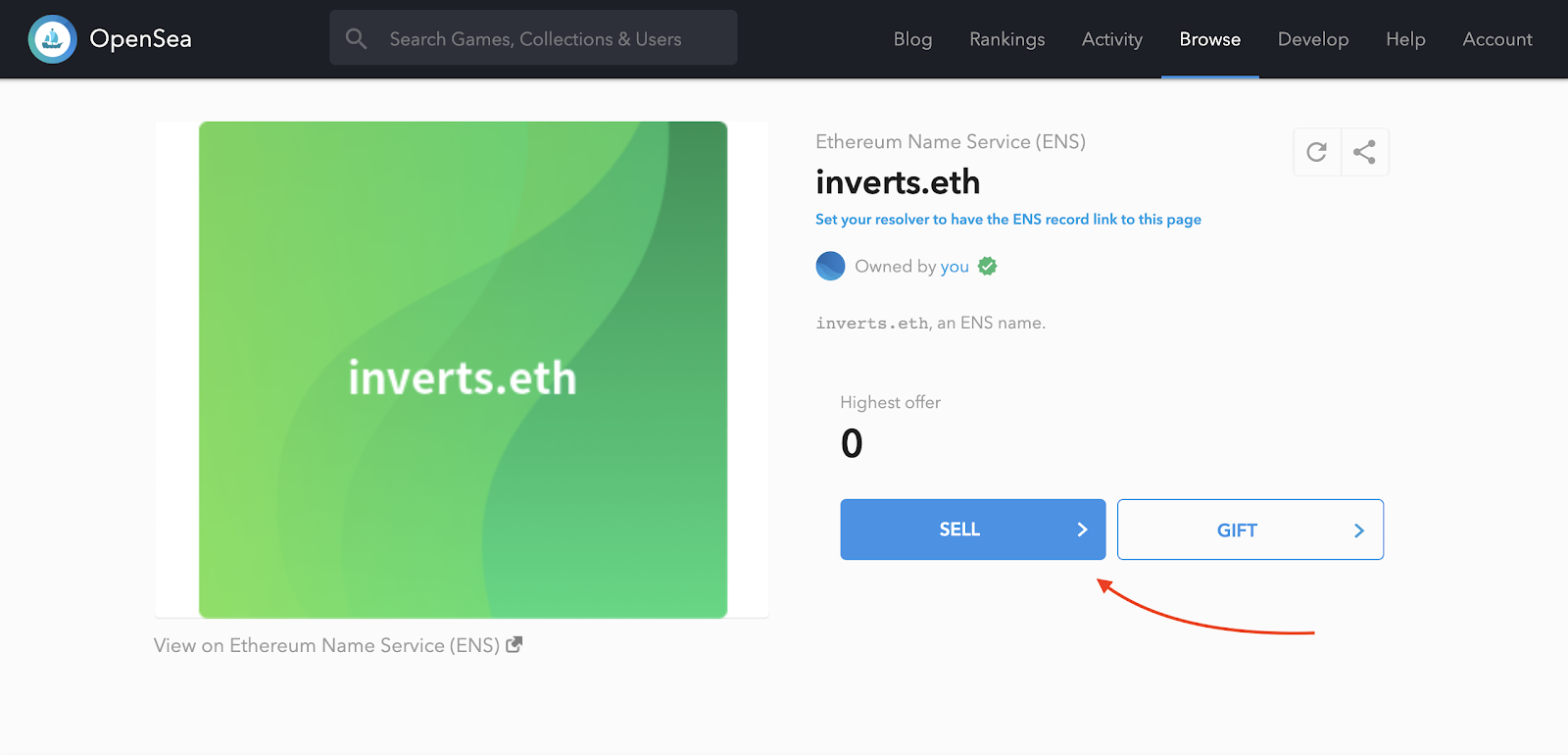

First, navigate to the name’s asset detail page. You can find it by navigating to your account page and searching for it by name. To set up your listing, click the “sell” button.

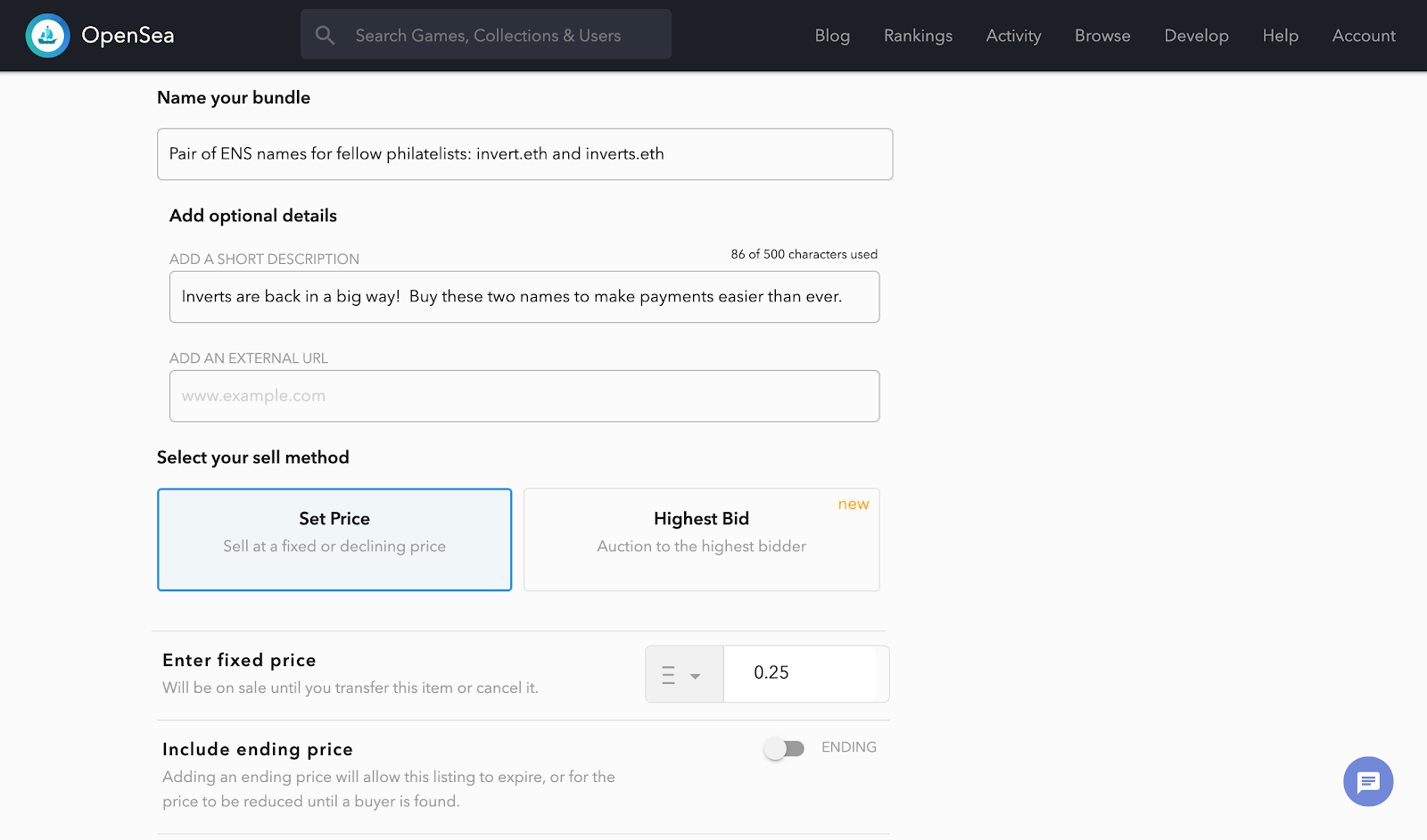

You’ll be redirected to a page where you can configure the sale. But, as Jim Barksdale asserts, there are “only two ways to make money in business: One is to bundle; the other is unbundle.” So, I’m going to list them for sale as a bundle.

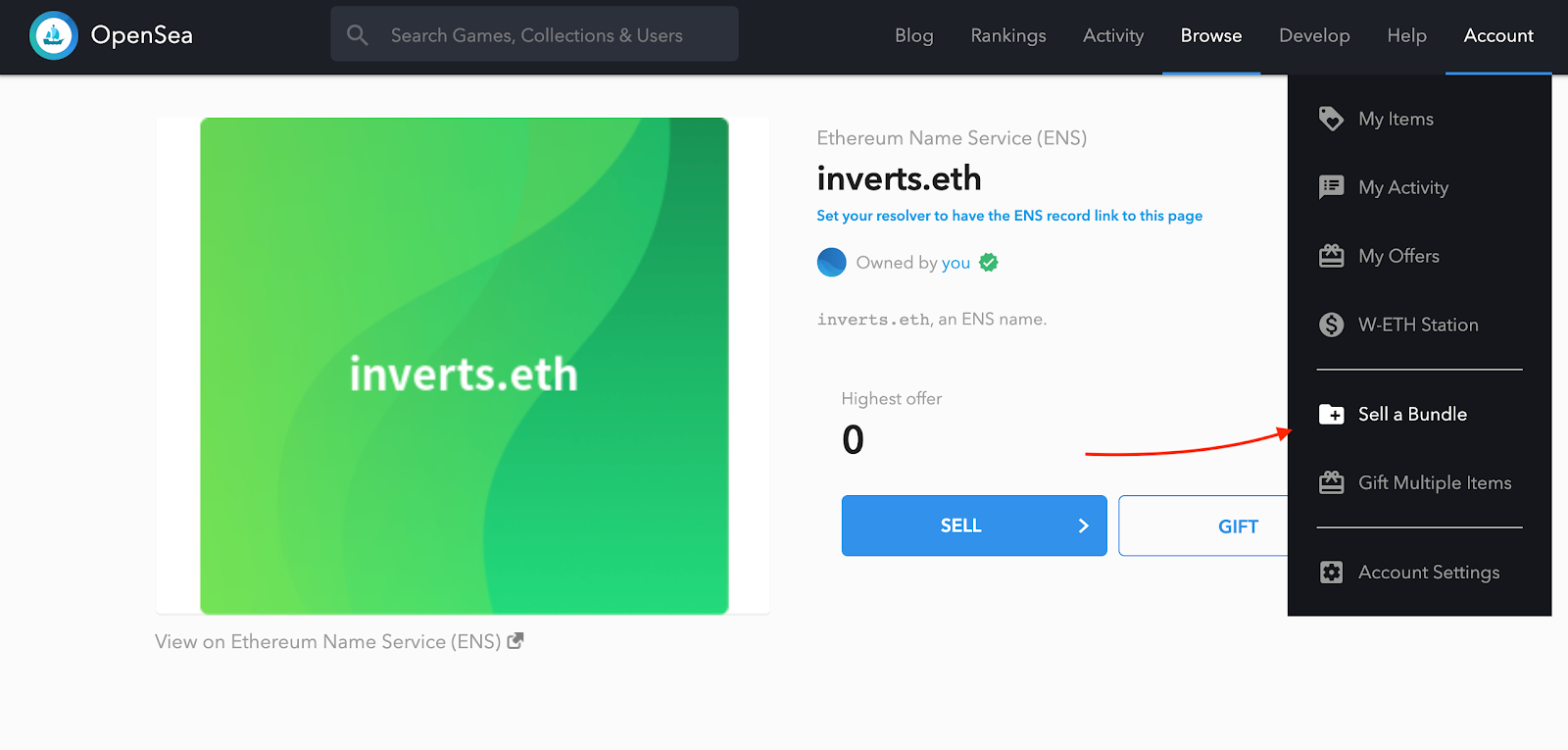

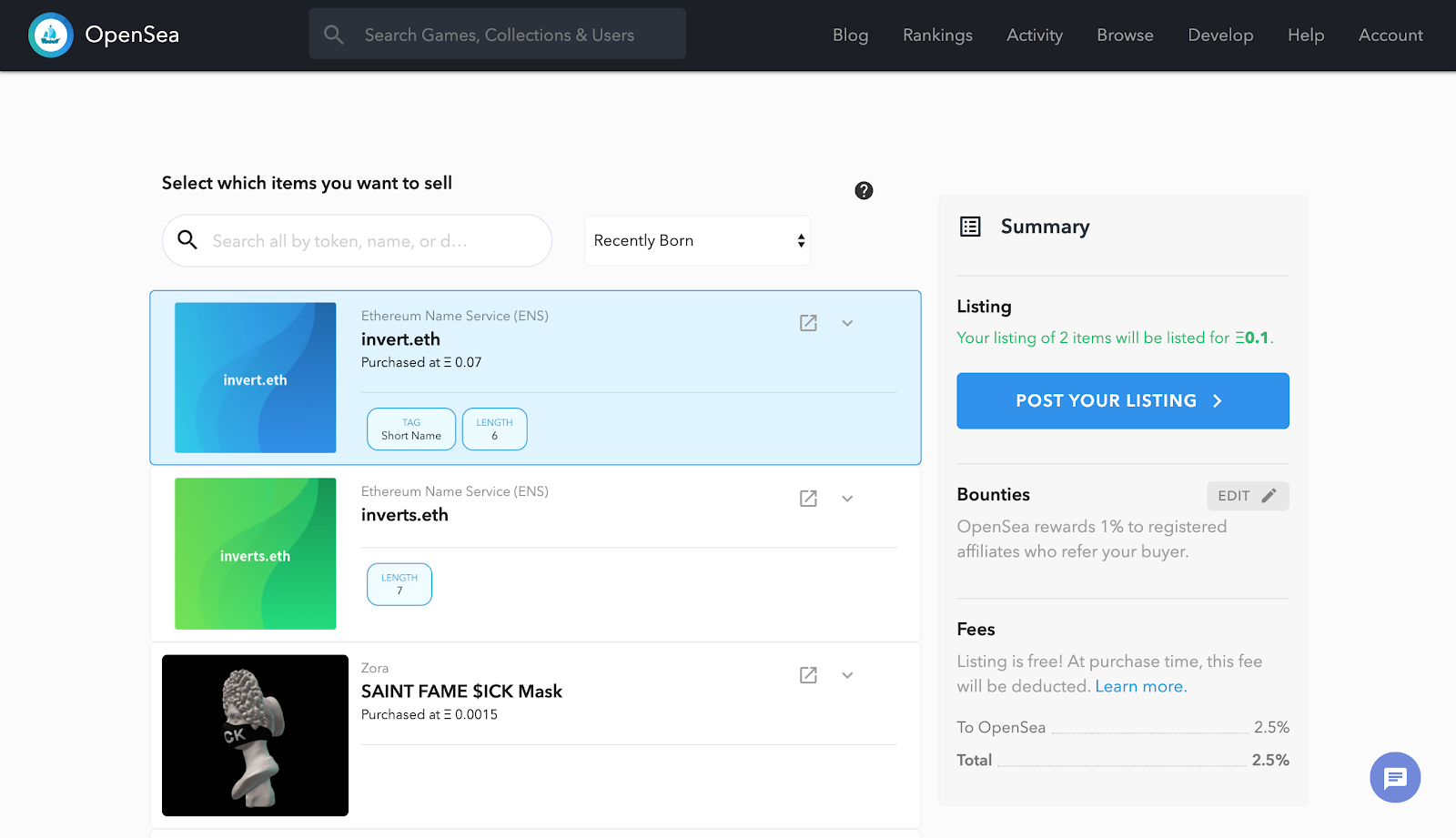

Hover over the “Account” option in the navigation menu, then select “Sell a Bundle” from the dropdown list. On the bundling page, I’ll select invert.eth and inverts.eth from the list of tokens I own.

Next, I’ll scroll down, add a descriptive title and description, then set the price for the bundle.

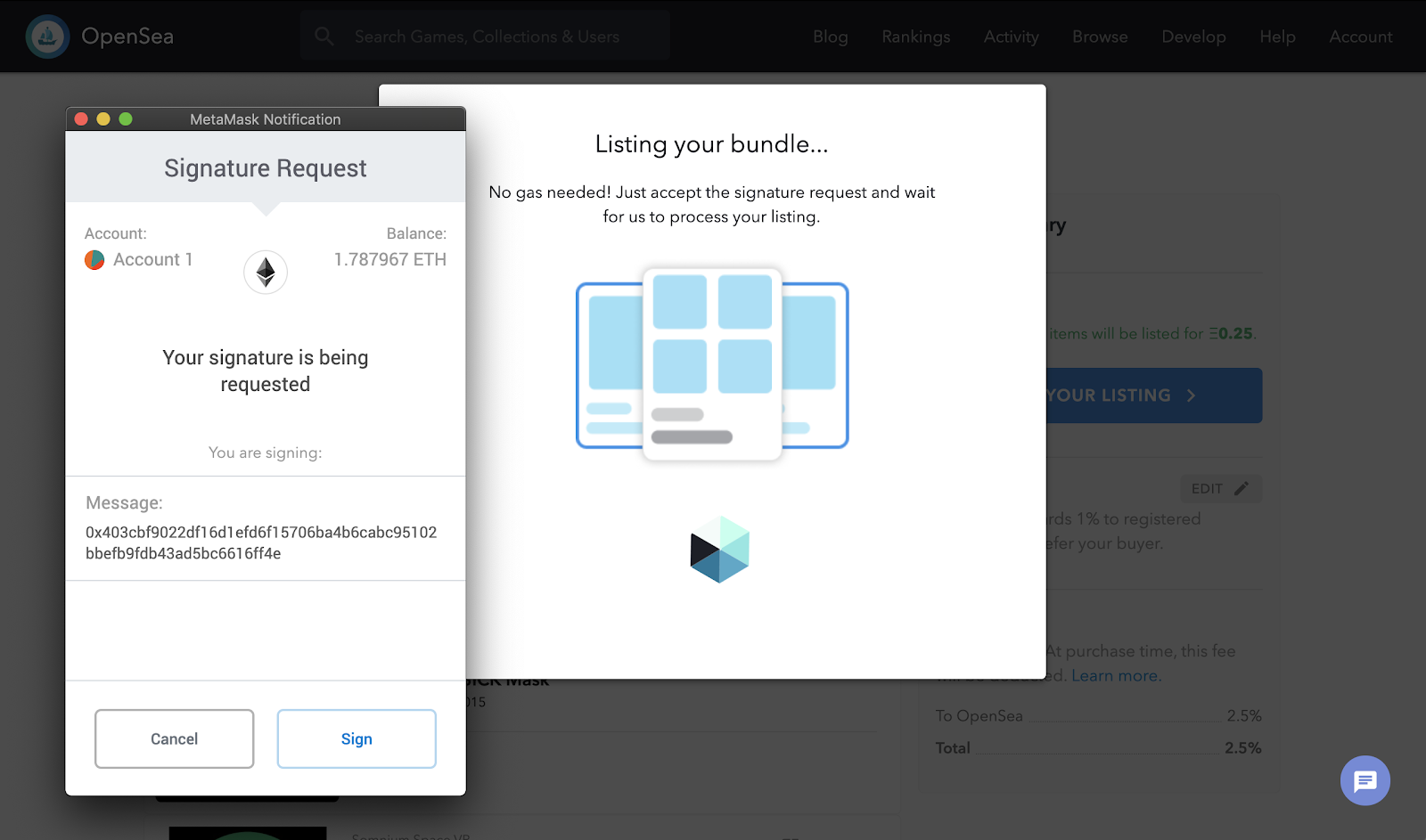

Finally, scroll back up to the summary, double check that everything looks right, and click “post your listing.” If it’s your first time selling something on OpenSea, you’ll get a few popups asking you to complete some initialization transactions. But if you’ve done this kind of thing before, you’ll only need to sign a single message.

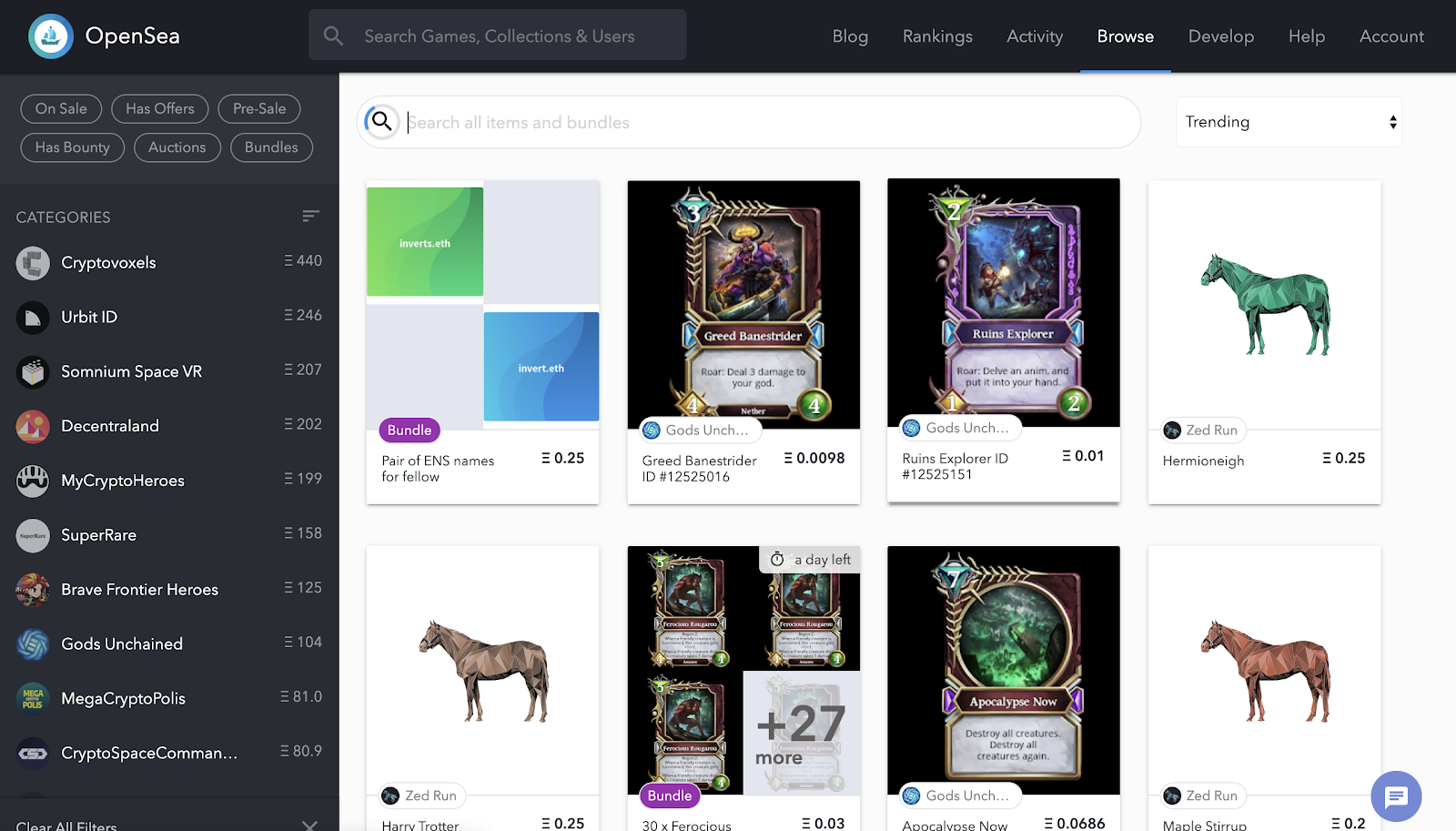

Once I’ve signed the message, I’ve got a bundle for sale. You can count on OpenSea to make buyers aware of your listing on the Browse page, but it never hurts to do a little extra promotion.

How should I promote my listing?

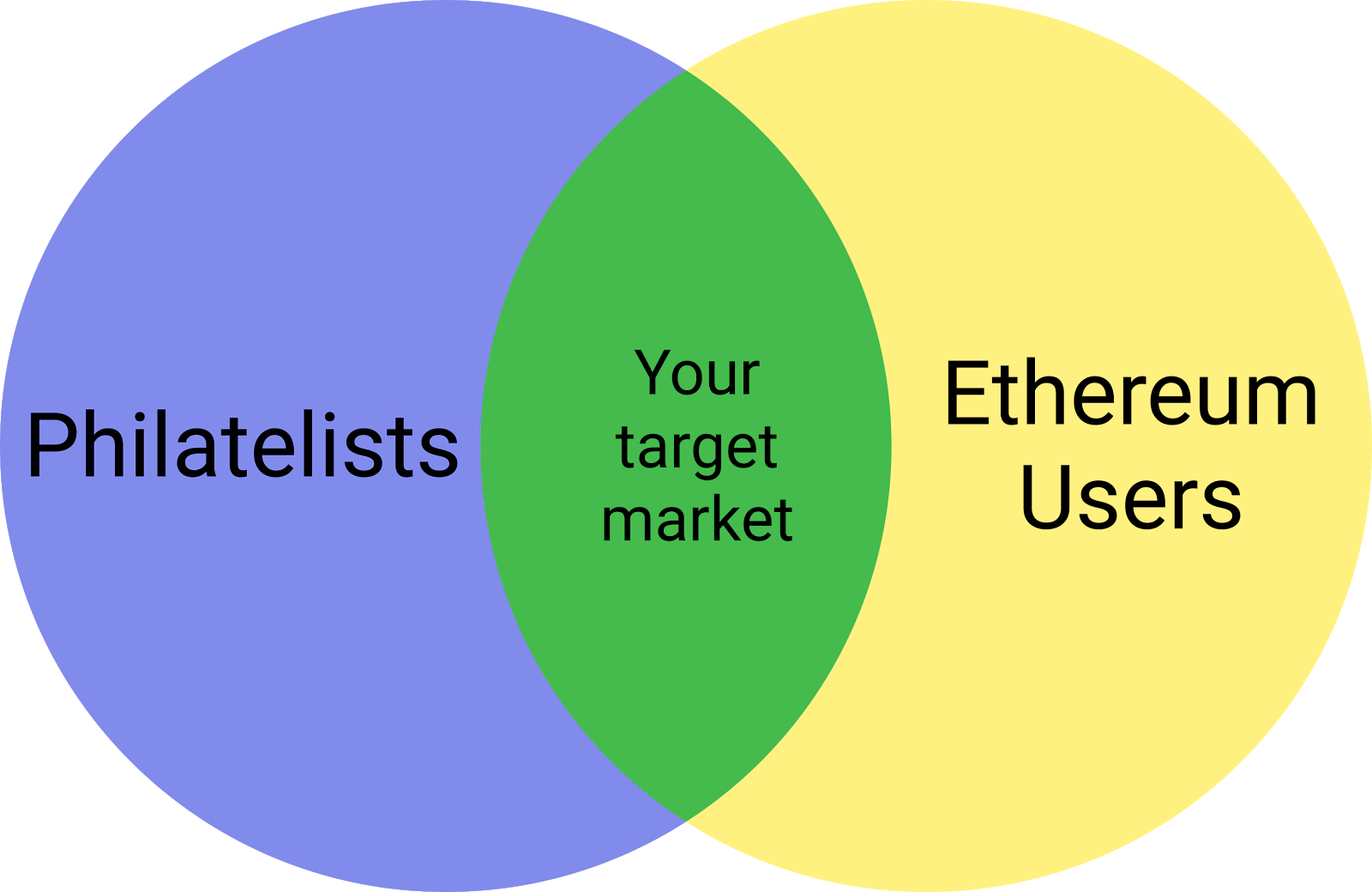

It’s a context-dependent matter, but here, our target audience is made up of those in the overlap between philatelists and Ethereum users:

Again, lean on your network and subject matter expertise. Hit the philatelist forums, email your techy stamp collector friends, and share the link in those fringey subreddits where diehards care more about the esoterica than the karma. Try tweeting at crypto-friendly stamp collectors. The more interested eyeballs on your listing, the better your chance of making the sale.

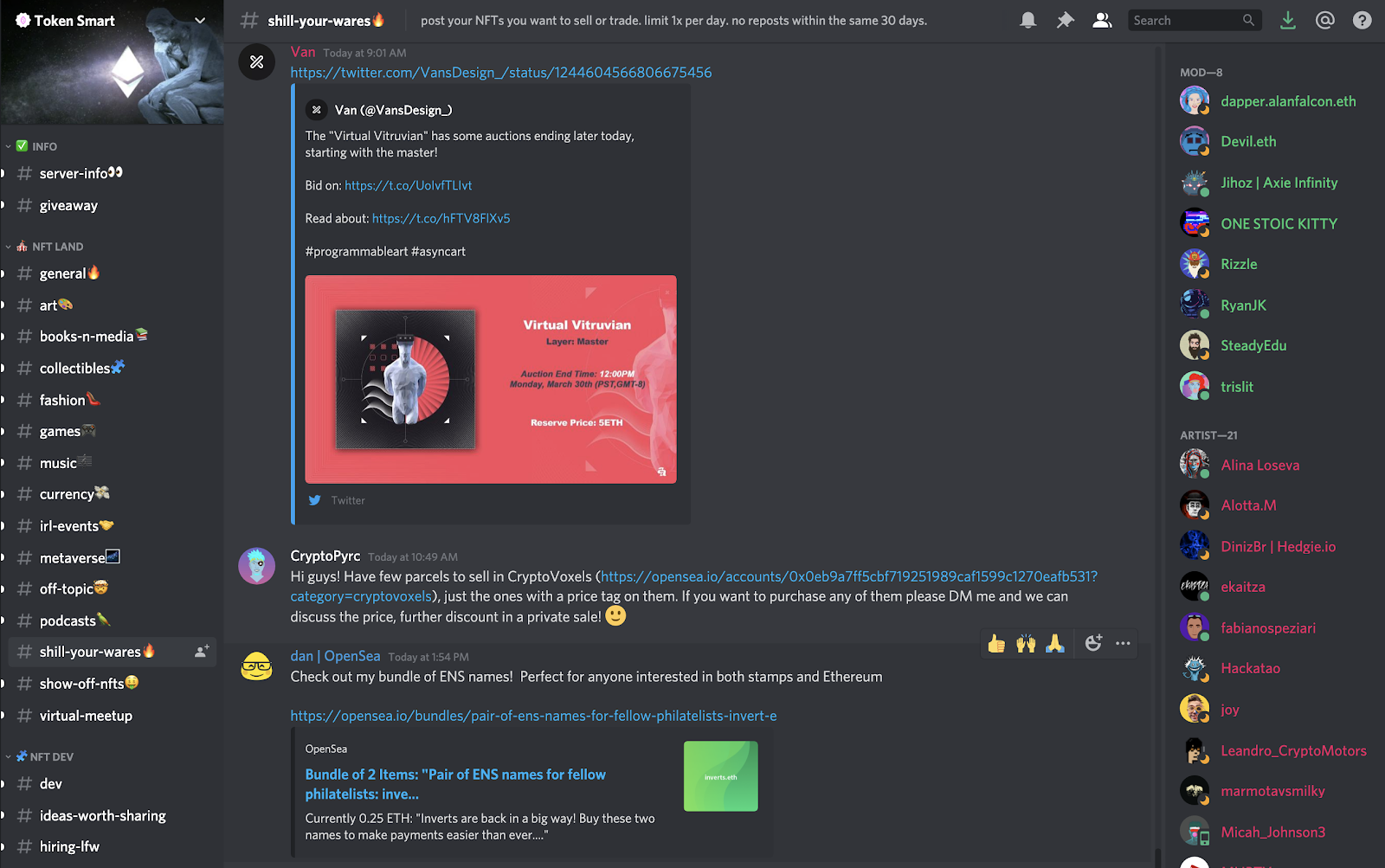

We’re fortunate in this specific case: thanks to the work of the Austrian Post, there’s already an existing community of people interested in the overlap between stamps and non-fungible tokens. Many of them can be found in the Token Smart Discord server, so that’s where I’ll start my own promotional efforts.

If I were feeling especially ambitious, I might also write up a quick article on Cent, a social media platform populated by some of the most devoted folks in the NFT space. I could also Peep about it on Peepeth, an Ethereum-powered social media platform that’s a lot like Twitter.

The goal is to find the philatelists hiding among the Ethereum users and the Ethereum users hiding among the philatelists. Somewhere in that overlap, there’s someone who can see the value of these ENS names, but lacked the time or information to secure them until I presented the bundle on a silver platter. When the right buyer sees my listing and purchases it, the names and the money will be exchanged instantly and atomically—either the whole deal happens or none of it does—with no further action required from me.

The example here is silly and low stakes, but the pattern can be applied almost anywhere. Take an example from defi: dydx.eth was purchased from ENS for 1.37 ETH during the ENS short name auction and subsequently resold for 8 ETH. As web 3 matures and Ethereum continues to absorb more of the financial world, the standard playbook for flipping domain names will grow increasingly useful in our own weird corner of the internet.

And of course, the pattern holds up outside of the ENS market, too. If you already know the factors that cause a neighborhood in CryptoVoxels to turn red hot, then buy up some tracts now and sell them when the masses arrive. If you can read the signs in the art market, then trade there. Whatever you’re good at, put your skills to work buying undervalued assets and promoting your listings to the target market. OpenSea is a generic NFT market and the most generic of all money making advice applies: buy low and sell high!

Author blurb

Dan wears a lot of hats at OpenSea & owns a lot of NFTs. Find him on Discord and Twitter.

Action steps

- Acquire an undervalued ENS name

- List the ENS name for sale on OpenSea

- Shill it—and sell it for profit!

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.