4 Mental Models You Should Know

Dear Bankless Nation,

The most bullish thing about Bitcoin and Ethereum is to be understood.

Investors tend to invest in things they understand. It’s the only way to maintain comfort and conviction in an investment.

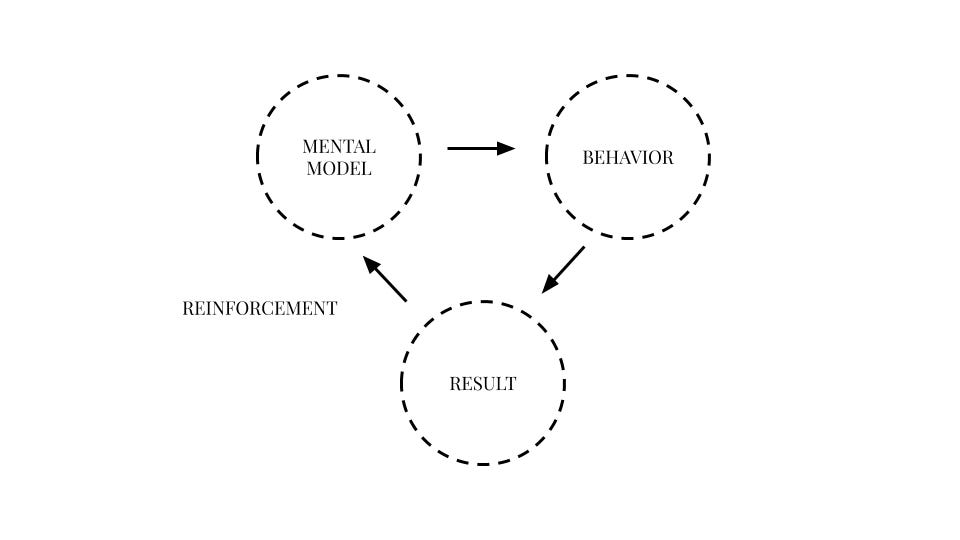

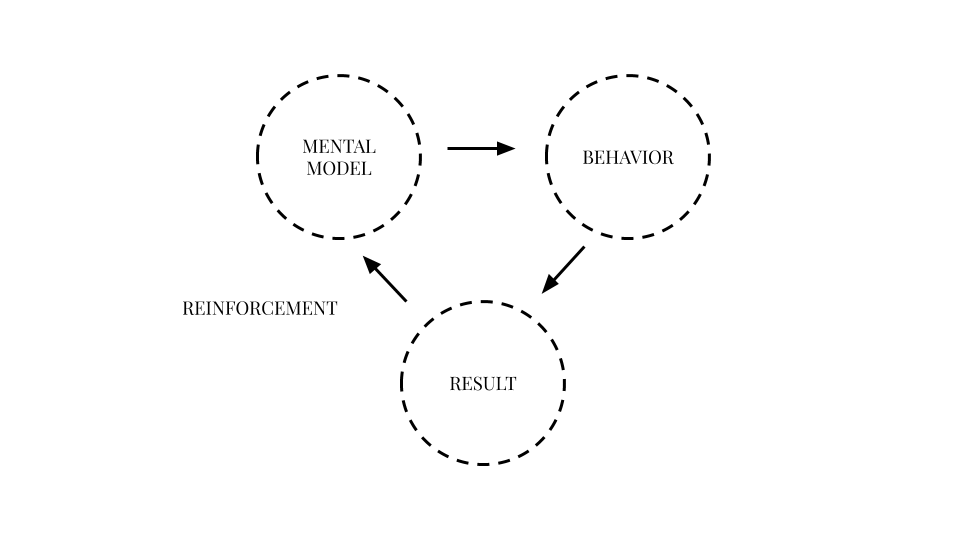

We’ve developed a number of paradigms that build a framework for the decentralized economy. We use these mental models to help investors understand and predict outcomes in this wild industry we call crypto.

We want you to start off 2021 with strong mental models for investing in this space. So today let’s recap the four Bankless paradigms popularized in 2020.

1. The Bankless Thesis

The Bankless Thesis extends Bitcoin’s decentralizing power to include all financial intermediaries—all the money verbs in money stack. Bitcoin is one mechanism for automating and codifying the role of a central bank, yet it’s not enough. To be completely bankless we also need to disintermediate commercial banks as well.

If you’re holding all of your Bitcoin on a crypto bank like Coinbase or BlockFi, your money is not completely bankless. This is a repeat of the system we already have.

Ethereum is a platform that offers not only bankless money, but bankless financial services as well. No intermediaries required, just open source code. We also call this trustless finance.

The people that leverage these powerful bankless tools are crypto natives, they’re members of the Bankless Nation. The Bankless Nation is the set of people that store their value in a self-sovereign way, and participate in open economic activity with no borders. 🏴

It’s a self-sovereign financial lifestyle for the future.

Learn more 👇

- The Bankless Skill Cube

- A Tale of Two Money Systems

- 📄A bankless nation (part 1)

- 📄A bankless nation (part 2)

- 📄The Three Nation Problem

- 📄The Digital Leviathan

- 🎙️A Bankless Nation Podcast

2. ETH: The Triple Point Asset

Ether is the world’s first asset that fits inside of all three asset superclasses: Store-of-Value Assets, Capital Assets, and Consumable Assets.

While there are assets that hold attributes of 2/3 superclasses, we have not yet seen what happens when an asset transcends all three boundaries. That’s why ETH could become so valuable.

The power of these synergies is still being discovered, and we are watching it happen in real time!

More on how ETH is a triple point asset:

- 📄ETH: A New Model for Money

- 📺 ETH: Triple Point Asset Presentation

- 🎙 ETH: Triple Point Asset Podcast

- 📄 The Fundemental Value Proposition of Ether

- 🎙Ether’s Value Mechanisms

3. Trustless Economic Bandwidth

DeFi is only as trustless as the collateral that fuels it. What’s the point of using trustless DeFi apps if the money you use is issued and confiscatable by a trusted third party?

In order to achieve full trustlessness, we need both trustless applications and trustless reserve assets—we need trustless collateral…trustless money.

Bitcoin and Ether are the only trustless monies this industry has come up with, and our ability to transact in a trustless fashion is limited by the market cap and liquidity of these assets—we’re limited by their economic bandwidth.

On Ethereum, where the majority of trustless finance occurs, we have yet to see fully trustless tokenized versions of BTC (but projects are working on it), which means that the only trustless money on Ethereum is ETH.

The market cap of ETH is the bandwidth of trustless money that DeFi has available, meaning the price of ETH matters. The price of ETH determines the scalability for DeFi!

Here’s more on economic bandwidth:

- 📄ETH and BTC are economic bandwidth

- 📄The trillion-dollar case for ETH

- 📄ETH is irreplaceable

- 🎙️Economic Bandwidth

4. The Protocol Sink Thesis

The cryptocurrency industry is about the intersection of money, value, and protocols. The unique contribution that cryptocurrency brings is not the currency side, but the cryptography side. Money from math, value from code.

Different applications on Ethereum have varying levels of dependencies on humans and code.

The Protocol Sink Thesis states that protocols that can remove humans the most from the equation become dependable, stable structures that others can safely build on, and thus ‘fall down the protocol sink’. They become reliable money lego in the decentralized financial stack.

The value in this industry is found at the bottom of the protocol sink. The concept of money lego only works when each lego has a stable foundation to build upon, and the thesis states that it’s far easier to trust math than it is to trust humans.

- 📄Global Public Goods and the Protocol Sink Thesis

- 🎙 The Protocol Sink Thesis

- 📄 Global Public Goods and the Protocol Sink (15 min read)

- 📄 The Great Protocol Sink (5 min read)

- 🎙️The Protocol Sink Thesis

- 📺Settlement Assurances & the Protocol Sink Thesis

We’re going to expand on these mental models and their predictive powers even more in 2021, so stay tuned.

- David

P.S. Crypto is in holiday mode! Links are light this week. Rest up, relax, and gear up for 2021.