Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

This will be the last time I address you as crypto natives.

We’ve become something greater.

We’ve become a community formed on the basis of common values, economies, and culture each opting in to the social contract of a common set of digital protocols.

We’ve become a digital nation.

From here on out I’ll be addressing this to the Bankless Nation.

David goes deep into our nation today in his second of two pieces.

He concludes with an action item.

If you’re part of the bankless nation…

Bear the banner.

Hoist the flag.

.

.

.

.

🏴

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WRITERS CORNER

By Bankless writer: David Hoffman, RealT, Bankless podcast & POV Crypto

A Bankless Nation - Part II 🏴

A Bankless Nation, Part I drew a line through the progression of different nation schemes that humans have discovered and used throughout history. Digital nations are where that line leads: the next iteration of human organizational infrastructure that will enable global coordination and commerce at scales larger than what the nation state is capable of. If humans are to ever generate a ‘Nation of Earth’, it’s going to be through the Bankless systems like Bitcoin or Ethereum; nation states have hit their limits to scale.

Part II of this article takes us into the future. We draw comparisons to the nations and nation-constituents of the past, and how the same pattern is found in the digital nations of the future. Further, we talk about how digital nations are exclusively ‘opt-in’ systems, and how this creates strong free-market forces that are extremely competitive, and ultimately benefits the users the most. Lastly, we discuss how this free-market competition generates products that are found universally, reducing the importance or significance of the borders and boundaries of the nation state, returning power and control to the individual, and sets the conditions needed to foster a single global nation of coordinated humans.

Let’s dive in.

Physical to Digital

Nations have come and gone throughout history, and types of nations have come and gone throughout history as well. Nations are subjects of the universe and like all things, answers to the survival of the fittest. Unfit nations die, and efficient ones live on. Nations are composed of people, and when people see greener hills, they will migrate over eventually, whether a Nation wants them to or not. There’s little a Nation can do in preventing its people from migrating to new pastures given enough time.

This is especially true with the to migration to digital nations. Tanks, planes, warships, and missiles mean nothing to Ethereum or Bitcoin. They simply exist in a different dimension. Additionally, they live in a dimension that individuals are perpetually connected to. There is no way to put the Internet back in the box it came it, and every day this becomes more and more true for the nations that reside on the Internet: Bitcoin, and Ethereum.

Same Components, Improved Efficiency

Humans respond to incentives. “Show me the incentives and I will show you the outcome” said Charlie Munger. This truth is why we can be confident in the perpetual growth of digital nations. They are objectively greener pastures.

When we compare physical nations to digital nations, they are not fair comparisons. They are about as accurate as comparing physical nations to organized religion, when religion dominated the human landscape. However, the whole point of these comparisons IS that they are apples to oranges. We’re moving from a depleted and exhausted landscape to a fertile one. There should be meaningful differences in these comparisons.

The greener pastures found with digital nation are a result of the digital nations doing the same job as physical nations, but with more efficient mechanisms. Because digital nations are born in the crucible of the free-market, these efficiencies are passed to the users, rather than being captured by the powerful few for the extortion of the many.

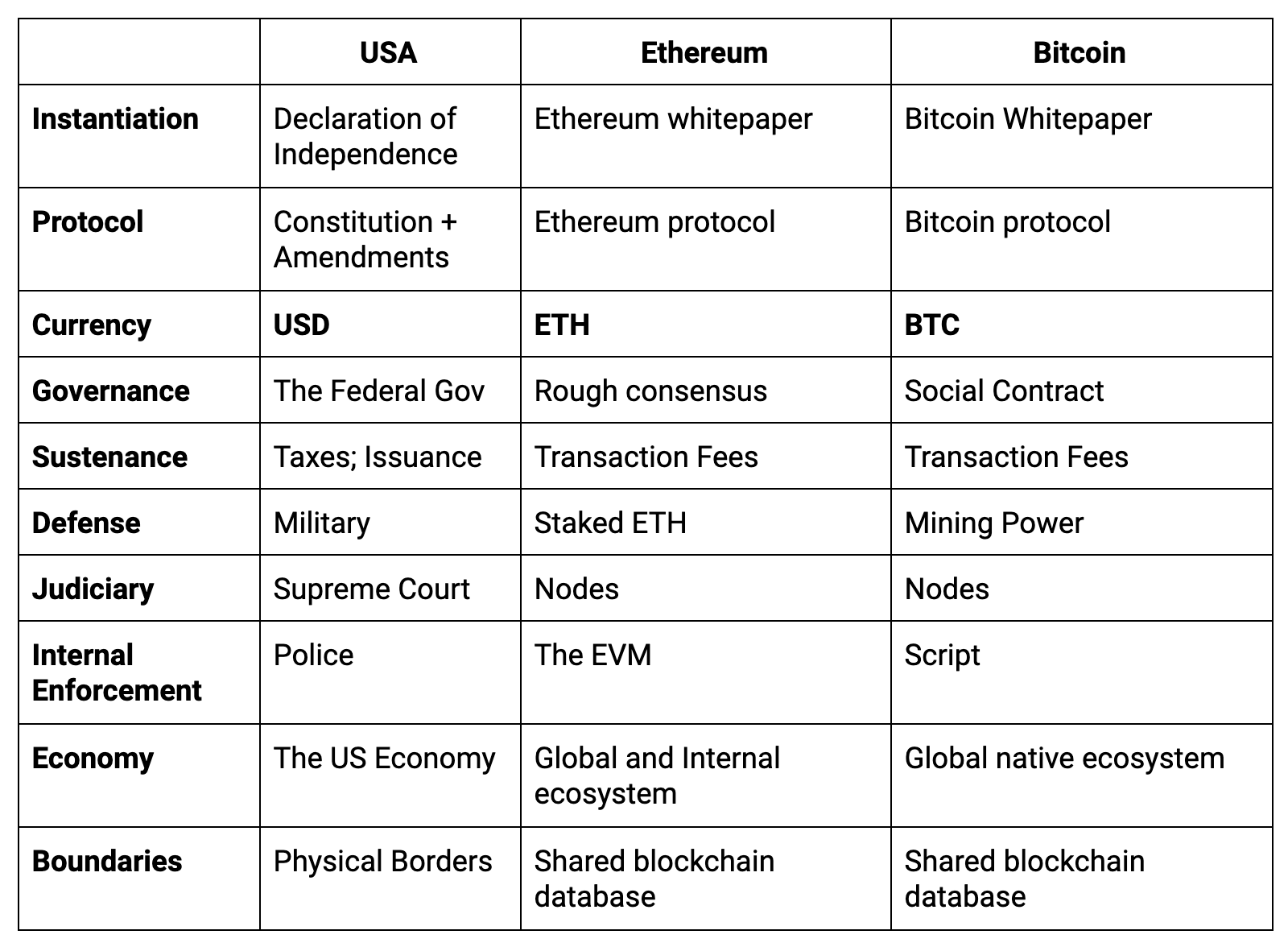

Many of the same functions found in nation states are also found in digital nations. We will discuss a few of these to illustrate how digital nations do the same job as physical nations, but better and with less costs.

Obviously, these are A-to-B comparisons; the EVM does not do the same job as the Police. If you have an intruder in your house, please do not call the EVM. However, they also are doing the same job: protecting private property. The police force of a nation’s fundamental role in a nation is to protect private property, and the EVM ensures that assets are managed in accordance with the protocol. It's the same thing, but contained in different nation paradigms.

Governance

The USA protocol requires governance; this is the main innovation that set it apart from the Religious nations that came before it; the nation state protocol can be updated so that it can retain fitness to the world around it.

Governance is costly. It requires the expenditure of energy and resources. It is difficult to decide what consensus actually is, and it takes a lot of deliberation and debate to make sure we are getting governance right. Ultimately, there are no assurances that nation state governance does actually arrive at the conclusion that matches the will of the people. The salaries of the governors are paid out of taxes regardless.

Since there is no ‘competitor government’ over a nation state, the external forces that keeps expenditure in check are weak. There is always the threat of being elected out of power, but the financial costs of a government are rarely of concern of the voting constituency. There is no ‘fiscal responsibility’ party inside of a fiat-money regime; the money printer renders this moot.

Digital Nation protocols like Bitcoin and Ethereum are designed to have minimal governance. The last time Bitcoin exerted any energy upon governance was during the Bitcoin-Bitcoin Cash hardfork. Ethereum retains governance-by-rough-consensus, which is partly volunteer work and partly funded by the initial issuance of the Ethereum native currency, but is destined to expire and follow in Bitcoin’s path of being a calcified system.

At maturity, these systems are only successful if they are ungovernable, and thus require no governance expenditure. Bitcoin has shown to already be there, and Ethereum is actively working to get to the same place. As a result, the citizens of these digital nations are under no obligation to be funding the governance of these systems.

Defense

All nations require defense expenditure. Without defenses, nations of all types are subject to attack and capture. As discussed in Part I, the value of a nation is a function of the economy that it produces, and the economy produced creates the incentive for its capture and coercion. Therefore, defense expenditure is required.

In the physical world, a Nation’s defense is also implicitly its offense. There’s nothing stopping the repurposing of defensive forces into offensive forces. This unfortunate reality is what generates the incentive for all nations to place extraordinary amounts of resources into bolstering their defenses; if a nation has an undeveloped defense, it can easily succumb to another’s defensive forces, because they are easily repurposed to an offensive force. An arms race ensues. All nations need to place an undue amount of proportion of their economic resources into defense, because these defense forces are switch-hitters.

Digital nations have no such arms race, nor do they need to defend against any physical-world attack. The hashpower that defends the Bitcoin Nation is not found in any one specific geographic spot, and while Bitcoin hashpower is a-part of the physical world, it is not committed to any one specific spot; it can easily pick up and move. Even more nebulous, the stake that protects the Ethereum nation doesn’t even physically exist. It is a purely digital abstraction that no physical attack can even touch. Complete separating from the physical world.

The $720B USA Military budget might as well be a fly-swatter against a digital nation.

The Bitcoin defense hashpower, and the Ethereum stake are also in their own respective domains. Ethereum is not validated by SHA256 and BTC the asset has nothing to do with validating Bitcoin the blockchain. There is no arms-race of defense expenditure in these systems; they simply need to suck up a sufficiently large portion of their respective validating commodity (SHA256 chips, ETH) to ensure that there isn’t enough on the free market to warrant an attack.

Digital Nations are minimally-extractive as a result of this. Additionally, there is no subjectivity around where the revenue comes from in order to fund defense. Defense spending comes from transaction fees. Transaction fees come from people who are making transactions. Making transactions adds to the bloat of the system, which is a real cost upon those operating a node. Those that merely store their wealth and make few to no transactions on the system are not taxed; only the constituents that add to the bloat. Nation states on the other hand have endless different rules about what is and are not taxed, and at what rate. The subjectivity of these taxes ultimately are inefficient, as they tax some people more than they should, and others less.

Judiciary

The Judicial branch of the USA offers finality for the laws of the USA protocol. Like the rest of the government, the operation of the Judicial branch has financial costs it bears upon tax-payers, as well as the centralization of decision-making into 9 justices of the Supreme Court. The Supreme Court of the USA is deliberately a slow-moving machine; it takes time to get things right. However, during that time when decisions have not yet been made, people’s lives and businesses hang in the balance. And, once again, there is no getting around subjectivity. Humans are fallible, and supreme court justices are no exception.

The ‘judiciary’ of digital nations are those that operate the nodes with the full history of the blockchain. These node operates do not take compensation, and thus impart no tax upon the system. Their operation is completely objectivity; either it follows the protocol, or it is a fork. Objectivity means that no costs are required to discover and follow the correct outcome.

Additionally, there is no gatekeeping to who can become part of a digital nation judiciary. In digital nations, we are all the judiciary, because only we decide what software we run.

Internal Enforcement

All Nations require internal regulation to ensure that no one is breaking the rules of the protocol. Physical nations have police forces that enforce and uphold the laws of the nation. This the component of the nation-state that keeps its internal operations in check.

Like all things in nation states, subjectivity and error are inevitable. The 2020 riots in the USA illustrated the misalignment between the police of the USA nation, and its constituent people. Protestors claim that the police are an unchecked force with undue political influence, and that the system of checks-and-balances have forgotten to check the police. Indeed, as the USA has become a safer place to live, nationwide police budgets have continued to increase. In 2015, taxpayers paid $250M to fund police-misconduct settlement payouts.

In digital nations, the enforcement of the laws of the protocol is trivial and objective. The Bitcoin script and Ethereum EVM are what ensure that all updates to the system follow the protocol. A transaction on Bitcoin or Ethereum is either valid, or invalid. There is no in-between. If there is ever an attempt to do something unlawful in these systems, it is rejected before it is ever included, which maintains efficiency and reduces expenditure. The costs of maintaining the rules of digital nations are bundled into the Defense costs, as they ultimately serve the same purpose: ensure that the system perpetually is able to make valid state updates, forever.

Summary of Comparisons

If there is an intruder in your home, do not call the EVM. Likewise, please continue to participate in your local democracy. Bitcoin and Ethereum do not fix this. However, they do enable cheaper and more secure places to store your money and wealth. They offer low-to-no tax safe havens for capital, in systems that provide maximum property rights and strong assurances of future access.

Digital nations do not fix the potholes in your street. They do, however, return power to the individual and control over his/her money & wealth.

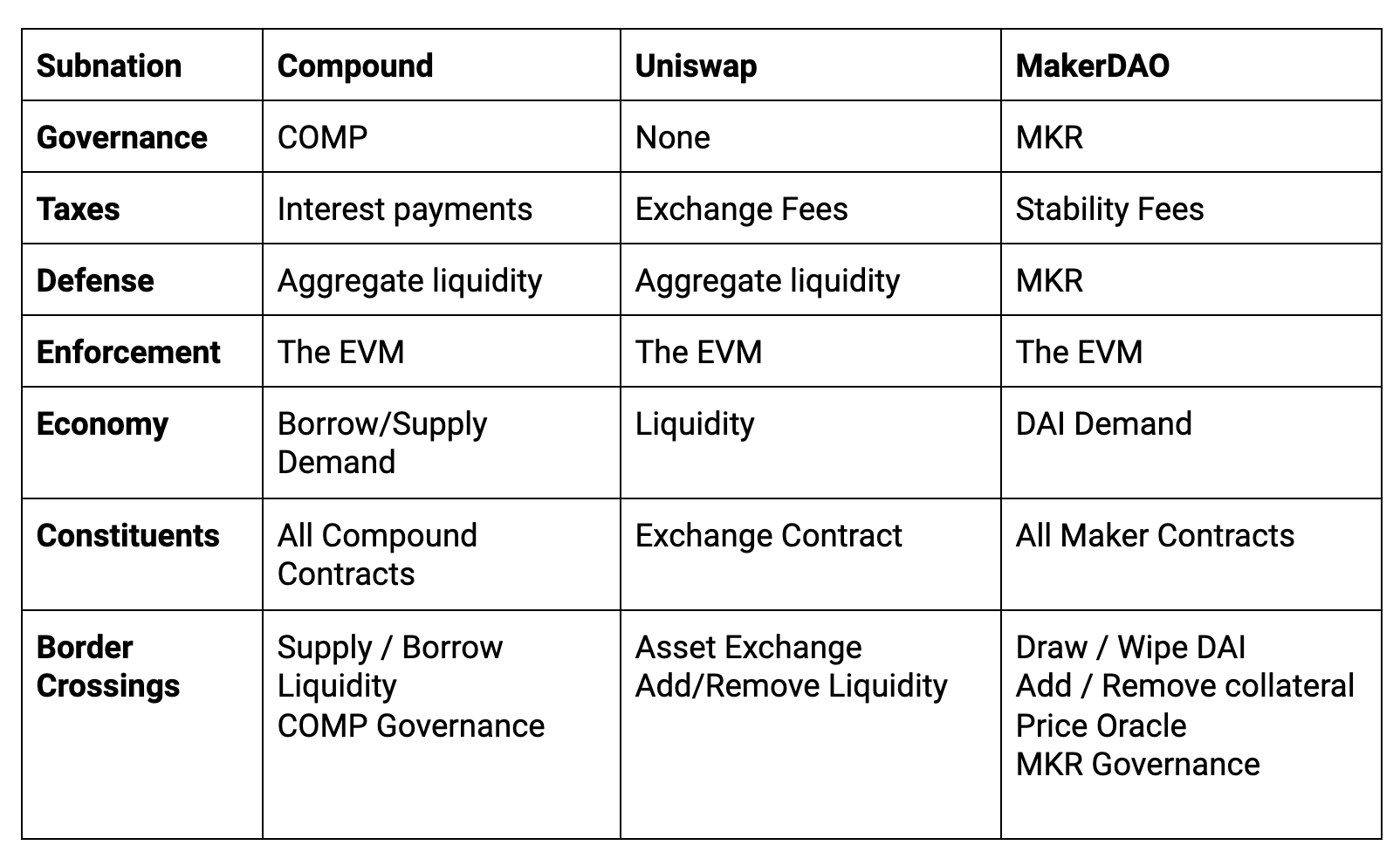

Subnations

The fundamental difference that sets Bitcoin and Ethereum apart is that Bitcoin is a protocol, and Ethereum is a protocol-of-protocols. In Part 1, we discussed how the USA scaled its nation further than any nation before it because it enabled sub-protocols under the main-protocol. The sub-protocols (the states) are enabled to set more finely-tuned rules for their particular domain, in order to make sure that the protocol fits for a wider array of environments. As a result, the aggregate USA protocol is a flexible and dynamic protocol-of-protocols that could morph to accurately fit into its environment.

Every contract on Ethereum is its own subnation of Ethereum. By default, a contract has complete sovereignty over its own realm. Other contracts on Ethereum can only influence another, if it is given explicit approval to do so.

All Ethereum subnations receive the full protection that the Ethereum blockchain can give it. So long as Ethereum can withstand attack, Ethereum subnations are guaranteed to live forever.

An Ethereum subnation is also a business that offers its services to others, designed to generate economic activity by some particular means. This is how Ethereum generates the taxes to fund the security budget as well. All subnations on Ethereum generate economic activity that pays transaction fees to the validators of the Ethereum nation.

Subnations like Uniswap, MakerDAO, Compound have their own internal fees that generate security for their own domain. The 0.3% exchange fee on Uniswap incentivizes liquidity to come to Uniswap, making the exchange manipulation-resistant. The MakerDAO Stability Fee establishes the market cap of MKR, which incentivizes buyers-of-last resort. Compound has its interest fees to borrowers, partly paid to suppliers, and in the future will likely be paid to the balance sheet of the COMP token owners, which has similar mechanisms to both Uniswap and MakerDAO.

These fees are the taxes upon the constituents of each subnation. Part 1 of this article illustrated how, over time, nations charge more and more taxes upon their constituency. In the beginning, a nation charges what it needs to offer decent protection. Once a monopoly is established, and the ability to exit is gone, fair taxes turn into extortion. Unlike physical nations, applications on Ethereum can never prevent ‘exit’ from their subnation. If any subnation begins to charge extortion-level taxes, it is likely that it will push the capital inside its system elsewhere, where the same services can be found at a lower tax rate. Ethereum is a digital nation of minimally-extractive subnations.

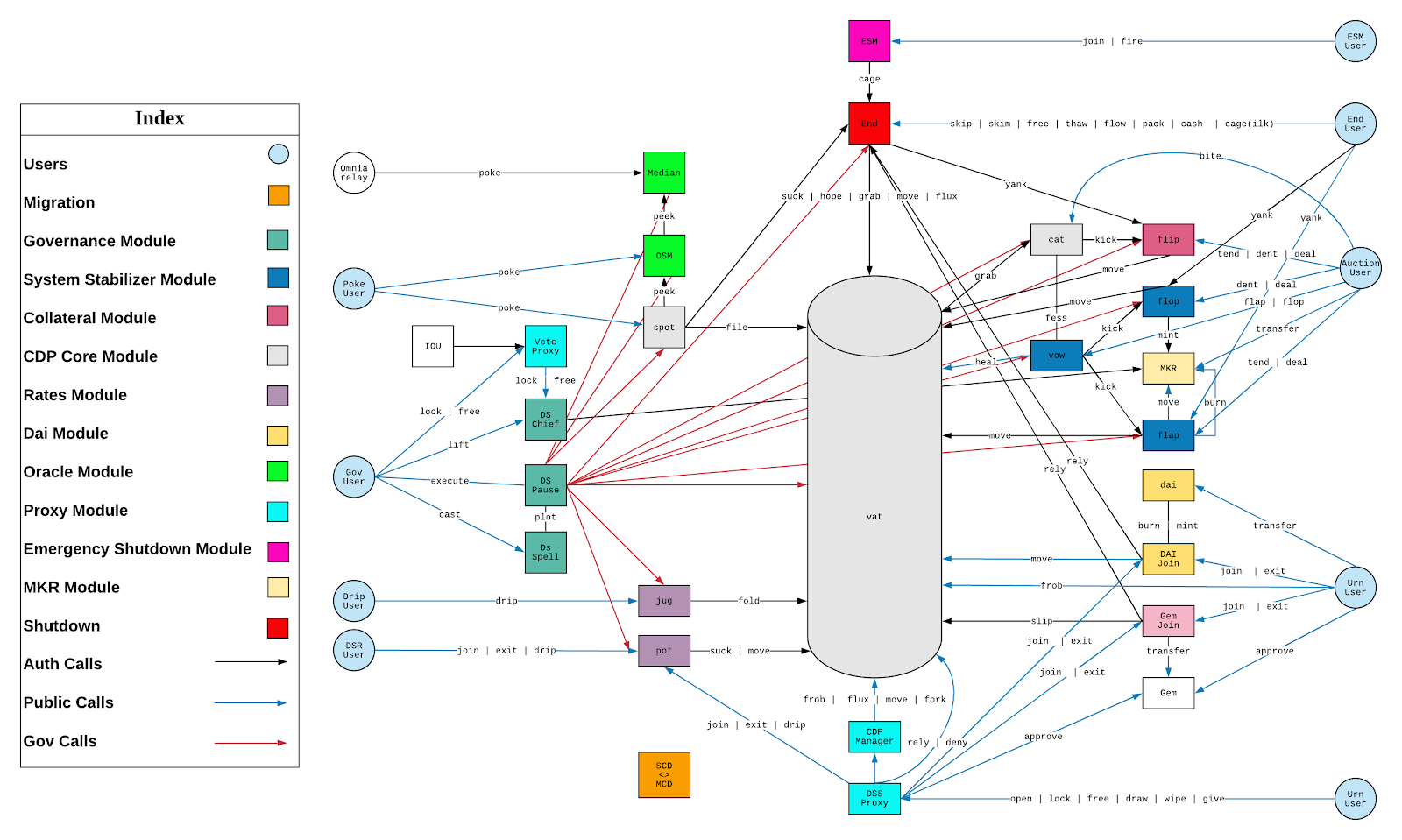

Subnations on Ethereum can either be a single contract with a single function, or a connected system of multiple contracts, with a network of if-this, then-that conditions that results in a holistic product.

Single-Contract Kingdoms

A single Uniswap exchange is a good example of a ‘single-contract Kingdom’. One single Uniswap market is wholly composed of one single contract address. All other Ethereum addresses are able to access and use the Uniswap contract, but no other address has the ability to change the protocol and manipulate the way it operates; the protocol is fixed.

Single-contract subnations are robust due to their simplicity. Having just one contract contain all the necessary functions reduces possible attack vectors by an order of magnitude. There is simply less to be concerned about. The real-world correlate for a single-contract subnation is a ‘city-state’, like Singapore or Monaco, and similarly, draw strength from their autonomy from the rest of the world.

Complete autonomy from the rest of the Ethereum ecosystem allows for these single-contract subnations to be relatively immune from the changes to the rest of the Ethereum ecosystem, and are only truly exposed to the size of the ecosystem at large. Other applications on Ethereum can come and go, but Uniswap and all its exchanges will remain indefinitely

Multi-Contract Coalitions

More ambitious goals require more flexibility than what a single-contract kingdom can offer. Different requirements of a larger system can be segregated into separate contracts. Each contract is only responsible for its functioning, and the outputs of that contract are the inputs for others in its coalition. This allows for each contract to specialize and focus on one particular task while relying on other contracts to do the same. If the builders of this subnation orchestrate these different contracts correctly, the holistic system of inputs/outputs of all contracts creates a resulting product of the multi-contract coalition.

The larger and more complex applications on Ethereum are unions of multiple contracts that work together to produce a whole that is greater than the sum of each part. These coalitions of contracts are composed systems of incentives, agents, and input/outputs. The goal of these subnation protocols is to produce a healthy economy that returns nourishment back to the protocol.

MakerDAO

MakerDAO is an Ethereum subnation. MakerDAO is a composition of many different interconnecting agents, with incentives, inputs and outputs. The Maker protocol is a system that is designed to produce a useful output (DAI), and receive nourishment for doing so (Stability Fees).

Compound

Compound is also an Ethereum subnation. It follows the same basic rules I’ve been describing.

Free Entrance, Free Exit

Governance is perhaps humanity's largest unsolved problem. The main reason why nations have come and gone throughout history is that we have not yet solved governance at its fundamental level. How do we decide how to fairly govern the systems that govern us? Further, the repercussions of poor governance in nations is significant, due to the fact that the constituents of a nation are typically unable to ‘opt-out’ of these systems. When religions were in their prime, ‘opting out’ was to choose either oppression or death. Nation states now blanket the Earth, and there is no place to go once you revoke citizenship. Revoking citizenship is simply not an advantageous thing to do anyway. You are trapped. Old nations are monopolies that are also able to dictate how to live your life.

Digital nations are exclusively opt-in systems. When you are born, you are claimed as a constituent of the nation you are born in, but you are not yet a citizen of Ethereum or Bitcoin. That is your choice to take when you chose it.

This difference cannot be understated. Because digital nations are opt-in, they must compete for your citizenship. They must give you good reason to join their domain. In order to attract constituents and capital, digital nations must deliver real products and valuable services in order to attract participation.

Digital nations are born in the crucible. They start with nothing, and the only way they grow in users and value is by providing real value for the world.

Legacy nations have never had to experience such a strong degree of free-market competition. Having monopolistic control over their constituents and their constituent’s capital has rendered them immune from free-market pressures. Even those with the resources and connections available to hide their assets off-shore (as shown in the Panama Papers) don’t have any ability to leverage their wealth; just to store it offshore.

Bitcoin and Ethereum allow people from inside nation states to migrate their capital to the digital domain, where it can be unshackled and highly fluid. As a result of this ability to exit, nation states will be forced to reduce the extortion of their constituents, or else risk incentivizing an exodus of capital.

The same is true for Ethereum subnations. I expect the capital on Ethereum to be fluid throughout its subnations from now until the end of time. Ethereum subnations are in direct competition with each other to attract capital and users. If someone builds a new subnation on Ethereum that offers the same or better products/services for the same or fewer cost, then we can expect capital and users to flow downstream into these new pools. If an application charges too much for its service, it risks being forked with a reduced fee or being replaced by a competitor offering a similar service. MakerDAO, Compound, and Aave all offer sufficiently comparable services so that the fees they charge keep the others in check.

The Sovereign Individual

Discussed in Part I, the Nation offers scaffolding to the individual, so that the individual can live their life with maximum freedom and autonomy. Nations that restrict freedom and autonomy from the individual (Religions, the USSR, China) tend to be replaced by ones that don’t. This is because there is no better way to organize an economy than to leave the people to their own devices so that the people can decide how to best provide value to the world, by leveraging a combination of what their skills are, and what they enjoy doing.

The opt-in nature of digital nations, along with the free-market competition of applications on-top of them, preserves the sovereignty of the individual by giving the users maximum autonomy and freedoms. In digital nations, all users are Admins.

In a world dominated by digital nations over nation states, the physical location of capital and value is gone. Money and assets live solely on the internet. Every single subnation on Ethereum is just one transaction away and lives inside a small device in your pocket. The power this gives to the individual cannot be overstated. You have the full force of the Ethereum digital nation at your fingertips, no matter what nation-state you are apart of, or cross into.

The purpose of a nation is to foster an economy. The economy of digital nations are contained inside the internet, but will also manifest itself in the physical world as well. When a customer pays for the products or services of a business using BTC, ETH, or DAI, a transaction was made where no nation state was relevant. The same business, service, or product could serve the same individual anywhere in the world, and the transaction would appear the same.

This is the path to a single, global community of humans. The protocolization of money and finance via digital nations are the tools needed to break through the limits of organizational scale that we have reached via the traditional nation state. The economy of the world will become a single, global economy when it operates under one single money and financial system, that treats all users equally.

Nation states, businesses, and individuals are all treated equally under the purview of the digital nation. Because no one is given privileges that others do not have, we can break through the glass ceiling of global coordination and generate a holistic economy of planet Earth.

Worldbuilding

Worldbuilding is the process of constructing an imaginary world, sometimes associated with a whole fictional universe. Developing an imaginary setting with coherent qualities such as history, geography, and ecology is a key task for many science fiction or fantasy writers. Worldbuilding often involves the creation of maps, a backstory, and people, including social customs and, in some cases, an invented language for the world.

Worldbuilding is the art of a fictitious universe, that is realistic and coherent enough to capture the mind of the audience. Using a more expansive definition, it reflects the current state of Ethereum.

Ethereum is the New World. It is a landscape of new opportunity, waiting for settlers to come and settle upon it. Riches await those who dare to enter uncharted territory and establish something of significance there. Those that venture forth into the unknown and cultivate the land they settle on, are rewarded by the future users of their land.

Unlike a fabricated world found in a fantasy novel or sci-fi movie, Ethereum still obeys the laws of the universe. It must generate a coherent setting where real-world problems are solved, and the current state of the outside world, as well as the rest of Ethereum, impact what should and should not be built. While Ethereum is a blank-slate, it also answers to Darwinian rules: only what is fit will survive.

“Cryptocurrency enthusiasts keep re-learning the lessons that regular finance learned decades ago, and that you can see a lot of financial history replaying itself, sped up, by observing cryptocurrency. … the story of cryptocurrency might [also] be the opposite, that it’s about traveling back in time to progressively forget the lessons of modern finance.” - Matt Levine

Ethereum is a blank slate. It is a blank slate that is quickly being populated with all kinds of financial and economic experiments. With Ethereum, we have the opportunity to ‘start fresh’, and construct a new financial paradigm from scratch. We have the privilege of picking out the lessons of history that have worked while being able to leave behind the ones that didn’t. It is likely that all successful financial mechanisms that humans have discovered will be replicated as applications on Ethereum. Similarly, the Ill-fated phenomenon of hyper-financialization that has caused the 2008 crisis and the 2020 ‘money-printer-go-brrr’ will likely not succeed on Ethereum. These things will not find themselves ‘fit’ when thrown into the free-market crucible that is Ethereum.

The ‘Single-Contract Kingdoms’ and ‘Multi-Contract Coalitions’ of Ethereum make up the Ethereum Nation. In my piece ‘Ethereum is an Emergent Structure’, I discussed how the DeFi apps on Ethereum coalesce over time into a single financial structure, and how that structure is ‘Ethereum’.

Ethereum will be built by pioneers and pilgrims as they move westward into the New World, settle on an empty plot of land, cultivate it, and incentivize others to join them in the fruits of their labor, by having exposure to the upset of the land they’ve built. This is how Ethereum will be built.

Bear the Banner

All nations have their own culture. They generate symbolic totems to symbolize their participation in something greater than themselves. Ernest Becker in his book ‘Denial of Death’ labels culture, religion, nations, or any ‘in-group’ such as sports teams, fraternities, social clubs, secret societies as ‘immortality projects’. Individuals are aware of their mortality and eventual death, and they harness this fear of death by being apart of a system that is greater than themselves.

The constituent members of these systems come and go, but the entity itself lives on. Sports teams replace old players with young talent, but the team continues to compete. Leaders of nation states come and go, but the nation itself persists. Fraternities gain an entirely new set of members every 4 years, yet the rituals, secrets, and stories are passed on. The cells that make up a human body are replaced once every ~7 years, yet the body, mind, and spirit of the individual are still alive.

Nations are immortal, so long as their constituents believe in their power and legitimacy. Digital nations are still in their infancy, and much of the culture and symbols of these systems are just now emerging. Bitcoiners wear the lightning bolt ‘⚡️’ to illustrate the lightning network, Ethereans wear the .eth name to signify their citizenship. Totems are a crucial component for the culture of a nation; they are symbols of meaning that the members of a nation can rally to and uphold together. They generate the symbolism that we can all share together as a community.

⚑

I have been wearing the black flag ⚑ as a symbol of a Bankless nation. An unmarked flag illustrates the neutrality of these systems. A flag with no marks and no colors reflects the removal of subjectivity from the Bankless nation. The colors, stripes, and shapes on a nation state flag reflect their subjective ‘this is good’ attitudes, and a black flag is the rejection of this attitude of governance. I do not accept to be governed by the whims of others and I and choose instead to participate in a system that has been cultivated by the free market. The black flag is a declaration of independence from the nations that come before it, yet it is also a nation. Badass.

If you are a part of the Bankless Nation, Bear the Banner!

Author bio

David Hoffman is the Chief of Operations at RealT, co-host of the Bankless podcast, and co-host at POV Crypto. He writes for Bankless on open finance and Ethereum topics. Check out his talk on how ETH accrues value and this accompanying post.

Action steps

- Bear the Banner! Add the black flag to your social media profiles ⚑

- Subscribe to Bankless podcast now so you don’t miss Monday’s episode where we talk in detail about the Bankless Nation (Listen to Part 1 here) 🔥

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.