Global Public Goods and The Protocol Sink Thesis

Dear Bankless Nation,

We’ve put out a podcast. I wrote an intro piece.

But we’ve never had a full article on the Protocol Sink Thesis.

Folks—this is that article. David explains the protocol sink and unlocks new mental models for global public goods along the way.

Spoiler alert: protocols win.

This explains why.

- RSA

Guest Post: David Hoffman, COO at RealT, Co-Host Bankless podcast & POV Crypto

Ethereum for Global Public Goods and The Protocol Sink Thesis

Ethereum is a platform for Global Public Goods in the realm of Money and Finance.

The Protocol Sink Thesis illustrates how applications move from being financial experiments to unstoppable global financial platforms, used by everyone. The more people use an application, the further down in the Protocol Sink it falls, and the more things collect at the bottom of the Protocol Sink, the stronger Ethereum’s gravitational grows.

The Protocol Sink

The Protocol Sink Thesis offers a model for how crypto-systems will manifest at maturity.

The thesis states that the more trustless, permissionless, and credibly neutral a protocol is, the further it can scale itself to a global platform, and as a consequence, absorb a larger amount of capital. Protocols that offer a platform to build upon become ‘dense’, and fall down to the bottom of the Protocol Sink from the collective weight of the people and companies building on them.

Web3 DeFi protocols like Uniswap, Compound, and Maker will survive in the long-term by removing attack-vectors and gaining anti-fragility, which will allow them to break through the limits on the scale of use that Web2 applications have reached.

Two key features predict where a protocol finds its resting-place in the Protocol Sink: Utility and Surface Area.

Utility

The Utility of a protocol is the value that the protocol brings to its users, and generates the incentive for adopting and leveraging the protocol. The utility of a protocol is the incentive it generates for depositing money or assets into its contracts. The total value of assets deposited into an application (think: ‘value locked in DeFi’). For protocols with a token, Utility can be measured by the tokens market cap or the total value deposited into its contracts.

Surface Area

The Attack Surface Area of a protocol is the weakness or resistance a protocol has to capture, coercion, corruption, and exploit. If a protocol has a large attack surface, it can become captured, coerced, or exploited to benefit some individuals over others, which invalidates the credible neutrality of the protocol. The elimination of attack surface area reduces the ways that a protocol favors one set of individuals over everyone else. If a protocol has minimal attack surfaces, the protocol is trustless, permissionless, and credibly neutral. These qualities are what enable it to scale to the maximum number of people. This increases the protocol’s potential for receiving more deposits from a wider set of users, and thus impacts its weight.

Protocol Density

To discover the projected density of a protocol or application on Ethereum, you simply take the utility of a protocol (how useful it is) and divide it by its attack surface area (how easy it is to capture). Things that are very useful and cannot be captured will find themselves at the bottom of the Protocol Sink. Dense protocols are at the bottom.

Density limits in Web2

We’ve seen early indications of the presence of the Protocol Sink from the large Web2 platforms like YouTube, Twitter, Facebook, in which almost all companies and businesses have profiles on these platforms.

Even further, platforms like the iOS App Store and Android Play Store are found in the deeper layers of the Protocol Sink, due to the mass of companies that build their products on top of them. The Web 2 gargantuans like Google, Amazon, Apple, Facebook, or Twitter are all found in the Protocol Sink.

These companies achieved their massive valuations because they built platforms for others to build on. Businesses, individuals, non-profits, social organizations all had free access to sign up and use their service, and the Web2 platforms became global infrastructure used by everyone. These companies have succeeded in scale by creating a global platform through a product with lots of utility, while also being relatively laissez-faire about what users can or cannot do on their platform.

The Web2 movement illustrates the presence of the same outcomes that the Protocol Sink Thesis predicts. Global, non-rivalrous, non-exclusionary platforms like Instagram, Facebook, Twitter, YouTube, Medium have seen incredible adoption and growth due to the density they amass from free user-generated content, and their ability to scale to the widest audience possible. However, being a product from a for-profit company that answers to nation-state regulators places a limit on the scale of these platforms. The incentive of the Company to extract as much as possible out of the User in order to generate revenue from the advertiser is inherently misaligning between all three parties; a limit on scale.

The Web2 movement is built upon the highly-dense protocols of the Web1 layer: TCP/IP, HTTP, FTP are some of the world’s most densely built/discovered protocols and represents the bottom-most layer of the Protocol Sink. We don’t talk about these much because of how invisible they are to us, and, unlike Web3 protocols, they aren’t things to invest or profit from. They have perfect credible neutrality.

Web3 protocols, applications found on Ethereum, should strive to achieve the same level of credible neutrality as the protocols of Web1.

Twitter, Facebook, Youtube are all free global services and they have provided much value to the world, but ultimately they are the private property of a single company. These products benefit a certain group of people above all others, and enable the influence and coercion of the people that use them. As these platforms have reached maturity, conversations have emerged about their monopoly status and their biased nature. As it turns out, the human subjectivity involved with monitoring content limits their neutrality and prevents them from being an unbiased protocol. Additionally, being a centralized company forces them to be subject to the rules and regulations of a nation-state government.

The free-signup and entrance into these platforms, as well as the value they provide, made these platforms incredibly useful, but the existence of a centralized for-profit company has placed limits on how far these platforms can scale, or the freedoms they have.

No matter how much utility these companies provide, they will never provide enough to sink to the bottom of the Protocol Sink. In order to fall down the Protocol Sink, you cannot be a for-profit company that answers to government regulation and subjective human desires. The bias, trust, and permission present in these platforms is the Achilles heel that paints a target on the back of the operators. In order to fall deeper down the Protocol Sink, you must be a self-regulating global protocol that doesn’t require a central operator to uphold the system. The protocol must be self-sovereign.

Prediction of the Protocol Sink Thesis

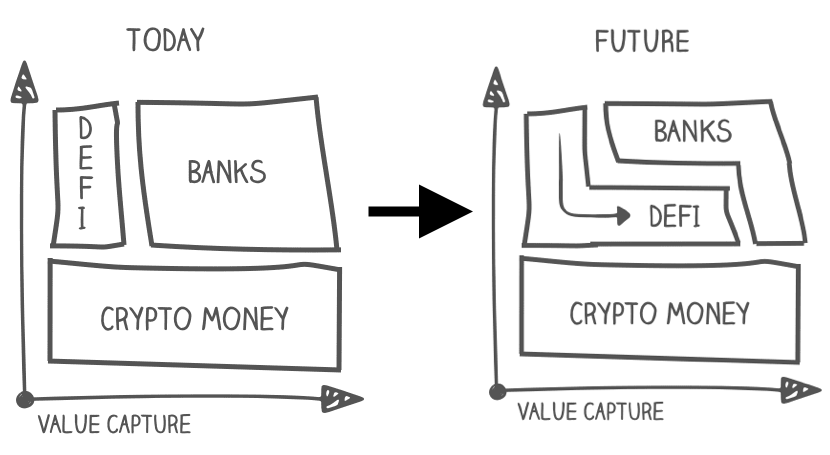

The core prediction of the Protocol Sink Thesis is that centralized businesses and companies will freely build on top of trustless, permissionless, and unbiased protocols, in order to offer superior services to their users.

As a result, crypto-economic protocols are destined to fall below centralized companies in the Protocol Sink. Simple game theory suggests that centralized companies like crypto banks (e.g. Coinbase and Gemini) will leverage the power of decentralized protocols beneath them, in order to increase their value to their customers.

Any crypto bank can improve its products and services by enabling users to access the Dai Savings Rate (DSR). Customers with DAI in their account can one-click into earning the APR offered by the DSR. While crypto banks compete with themselves, none of them compete with the DSR, and none of them have anything to lose by leveraging it. While Coinbase and Gemini are rivalrous, using the DSR is not. This allows the DSR to scale to any financial institution or individual who chooses to use it. You can repeat this same model for any protocol or application on Ethereum: Maker, Compound, PoolTogether, Augur…

Global Public Goods (GPGs) are the things that are found at the bottom of the Protocol Sink.

Useful protocols that have removed trust, bias, and permission will find themselves leveraged by companies, businesses, banks, and individuals from all over the world. Global Public Goods do not answer to (or even recognize) nation-state regulations. Air, water, knowledge, and internet protocols are the same all over the globe and do not change based on the regulations of jurisdiction. They are something that everyone can use, regardless of where they live.

Ethereum generates a platform for hosting Global Public Goods in money and finance.

Sinks, Attractors, Basins

The Sink in the Protocol Sink is not talking about your kitchen sink, although that is relevant. Rather, a Sink is a place of convergence. A sink is an environment that defines the borders and limits of a closed system, which influences the trajectory and outcomes of all the chaotic, nebulous set of individual units inside it.

A sink forces the convergence of independent, chaotic things into a singular ordered pattern of dependable predictable outcomes.

In mathematics, an attractor (sink) is a condition or set of conditions toward which a system tends to evolve, for a wide variety of starting conditions of the system. System values that get close enough to the attractor values remain close, even if disturbed. Over time, things converge upon a stable condition, regardless of their starting condition. The place that things converge upon (the attractor itself) is not actually a ‘thing’, but rather the emergent location that many independent things have shown to converge upon. Nothing central is actually attracting them there, but rather the collective emergent forces of the universe pushes them into a common order.

Another word for a Sink is a Basin. Below is a map of the river basins of the USA. Most notably, the Mississippi Basin in pink is one of the world’s largest basins. Any droplet of water that falls anywhere inside the pink region is assured to ultimately find itself at the point of convergence: where the Mississippi River meets the Atlantic Ocean.

The red circle is the bottom of the Mississippi Basin (sink)

The Mississippi River Basin is the Sink. Gravity is the force that generates the energy that creates convergence at the bottom.

Ethereum is a Basin. Ethereum apps are the creeks, streams, and rivers that reside within it. Money assets and capital is the water that flows downstream. There is an Attractor at the bottom of the Protocol Sink that pulls applications and assets downwards.

This Attractor is the collective universal demand for Global Public Goods.

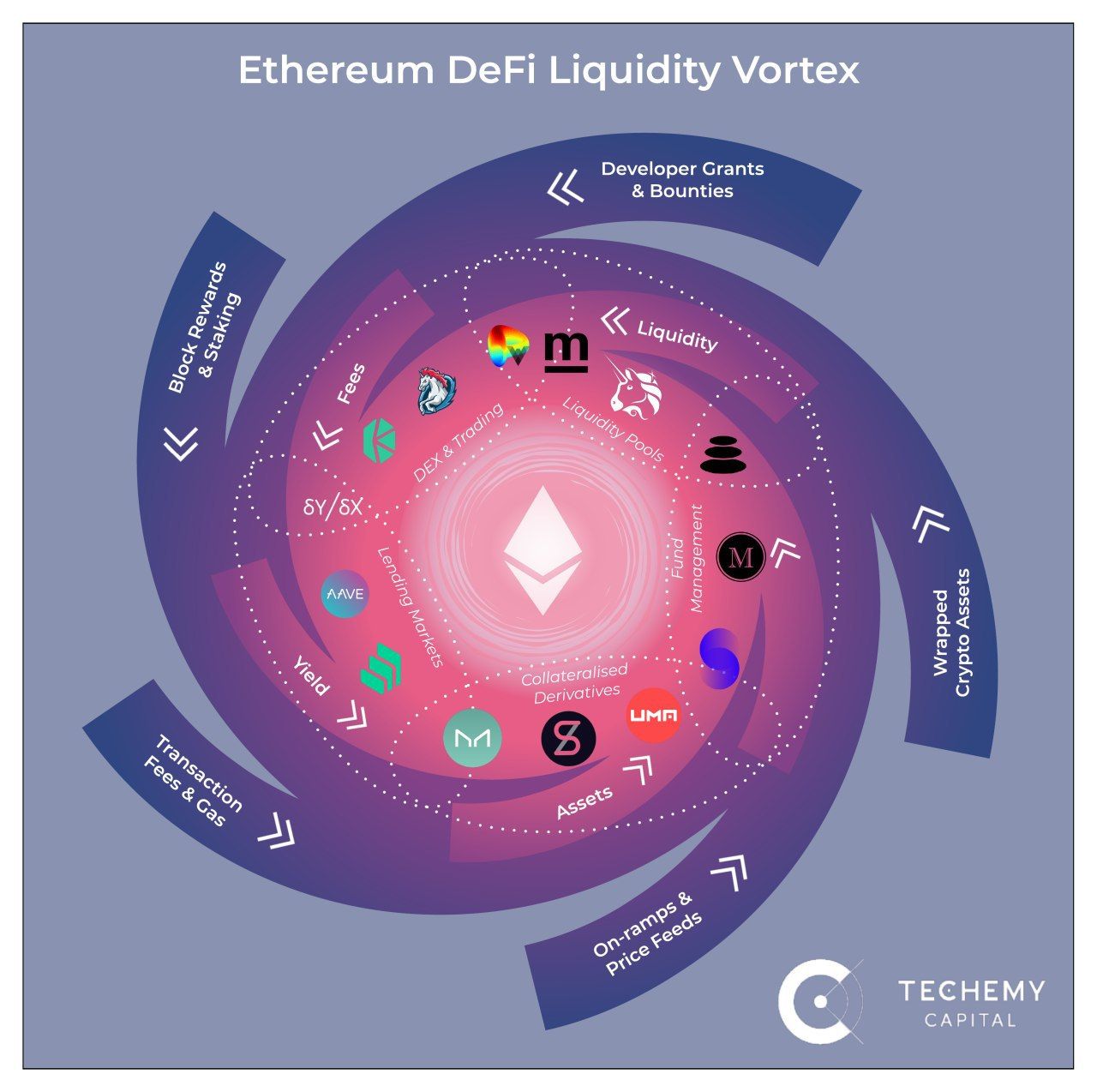

Source: Paul Salisbury, Techemy Capital

This graphic has been going around Twitter recently and perfectly represents the Protocol Sink. Things on Ethereum converge. They coalesce and collectively descend down the Protocol Sink. It also illustrates how Ethereum is not a bunch of separate apps, but instead one single cohered network of interconnecting applications.

The demand for global platforms with user-generated value is ubiquitous and generates a perpetual incentive to build applications on Ethereum. Ethereum is the Sink for ‘minimally extractive coordinators’: an internet basin that converges on permissionless, trustless, and unbiased applications in money and finance.

The fundamental innovation that Ethereum provides is a system that offers free security and protection to applications that aspire to be Global Public Goods.

The Protocol Sink

Global Public Goods are what is found at the bottom of the Protocol Sink. The crypto-economic revolution is built on the fundamental assumption that, in its final form, this revolution will have spawned an array of Global Public Goods in money and finance.

Global Public Goods are by definition the most scalable, useful, dependable, and persistent infrastructure we have available, and the qualities that make a good GPG are the same qualities that push a protocol down the Protocol Sink.

There are two characteristics that determine a protocols place in the Protocol Sink: Attack Surface and Utility.

Attack Surface

Attack Surface is a measure that illustrates a protocols weakness to capture/control. Simplistically, having a low Attack Surface simply means that there is no central point of a protocol. Trust, Permission, and Bias are the characteristics that can determine where the ‘center’ of a protocol is, and how easy or difficult it is to capture a protocol.

Trustlessness

When using the protocol, how much trust are users placing in others to do the right thing? With the selfish motives of others impact the outcomes upon other users? Is anyone extracting anything from a user against their will or knowledge? If trust is not an issue, the protocol will fall down lower in the Protocol Sink.

Permissionlessness

Can anyone use the protocol? Is there someone that can restrict or censor usage of the protocol? Are there any admin keys that give certain privileges to a special set of users? If everyone has equal access to use the protocol and no one can censor others, the protocol will fall down lower in the Protocol Sink

Credible Neutrality

Does the protocol benefit any particular user or entity above any other? Does one person or entity disproportionately benefit from the success of the protocol than what is fair? If the protocol is sufficiently fair or equitable, then it will fall down lower in the Protocol Sink.

Utility

Utility is simply the measure of value that a protocol provides to the world. The more useful a protocol is, the more people/companies/entities will build on top of it.

When a protocol has high utility, more value and capital will be deposited into the application. This generates mass, which adds to density. If the protocol has utility, it will fall down lower in the Protocol Sink.

The Protocol Sink Spectrum

Each characteristic above has its own spectrum. An application can be anywhere on a 0-100 scale for both Attack Surface and Utility. Further, the ‘total score’ of the characteristics illustrates the density of the protocol in relation to others. This scoring system is largely just for illustrative purposes—just to illustrate the metaphor. I’m going to call this the ‘GPG Score’ later in this article.

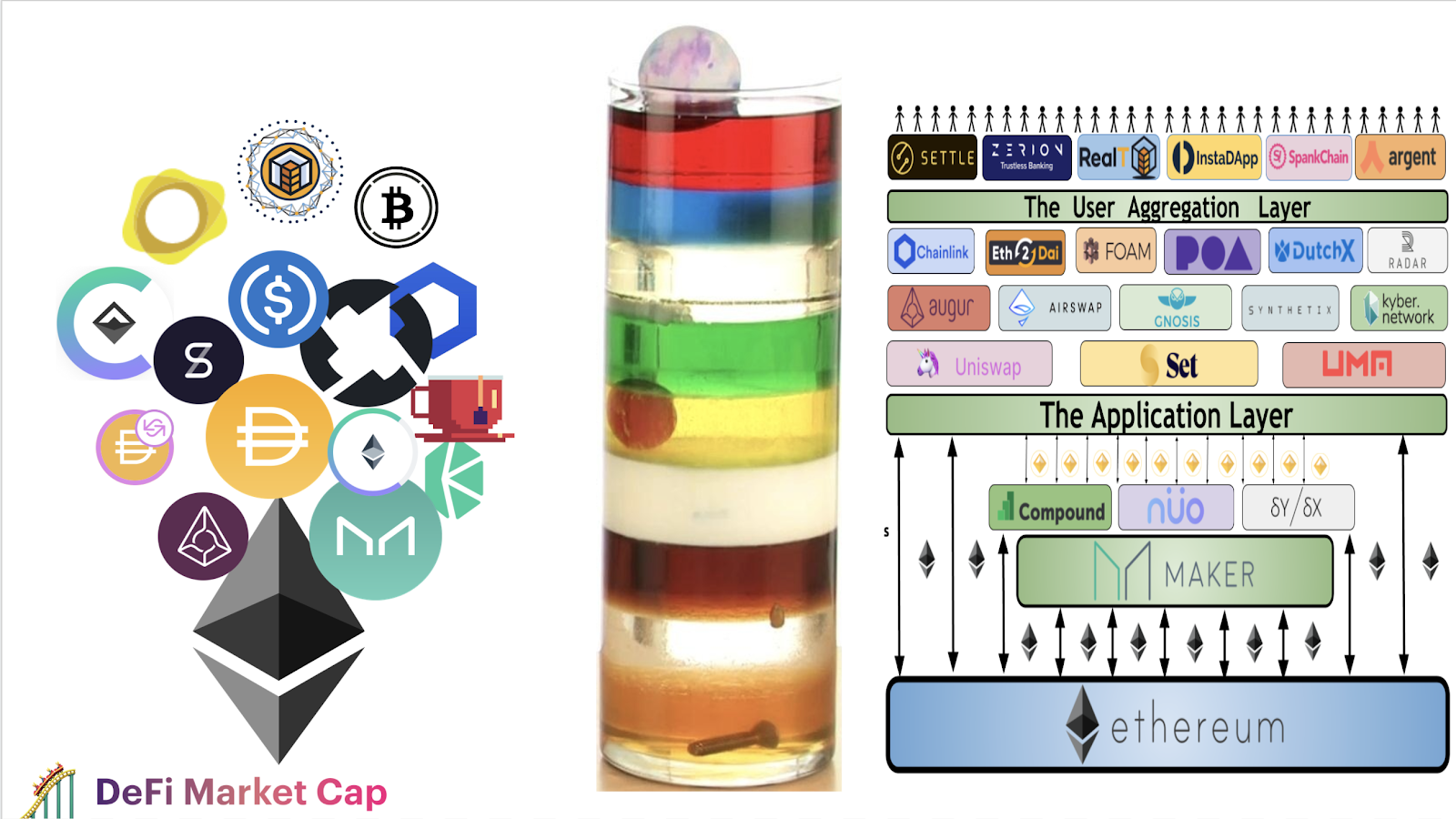

Assets and Applications

The Protocol Sink doesn’t only apply to Applications on Ethereum, but assets as well. On Ethereum assets are applications. Not all applications are tokens, but all tokens are applications. Applications on Ethereum are defined by a contract and its own address.

If it's a contract on Ethereum, it’s an app.

In the glass cylinder above, we have both liquids and solids of various densities. Like the liquids, the solids find their appropriate place in the Protocol Sink that corresponds with their native density. The GPG score applies to assets just as much as applications.

Public Goods

Wikipedia’s definition of a Public Good:

In economics, a public good is a good that is both non-excludable and non-rivalrous, in that individuals cannot be excluded from use or could benefit from without paying for it, and where use by one individual does not reduce availability to others or the good can be used simultaneously by more than one person. This is in contrast to a common good such as wild fish stocks in the ocean, which is non-excludable but is rivalrous to a certain degree, as if too many fish are harvested, the stocks will be depleted.

Non-Excludability

A good is excludable if it is possible to prevent people who have not paid for it from having access to it. A good or service is non-excludable if non-paying consumers cannot be prevented from accessing it.

Non-Rivalrous

A good is rivalrous if its consumption by one consumer prevents the consumption by another, or if consumption by one party reduces the ability of another party to consume it. A good is considered non-rivalrous if, for any level of production, the cost of providing it to a marginal individual is zero.

Public Goods do not get exhausted the more they are used. Air, water, sunlight are all public goods. Listening to a radio broadcast does not prevent others from also listening. Street lights illuminate the roads for everyone, equally.

As with all things, there is a spectrum involved. Streams and lakes are public goods; everyone can use them and they are very difficult to deplete. However, they can be depleted. While they are ‘depletion-resistant’, the scaling of the human species has shown that it has the capacity to deplete even the largest reservoirs of public goods. A river has a nearly endless supply of water, thanks to the cycles of the seasons that migrate precipitation higher in elevation, however, there is a rate-limit to which water migrates ‘upstream’.

If consumption-rate passes the supply-rate, scarcity takes over and a public good turns into a rivalrous one. Sunlight pours endlessly across the Earth, but there is finite space available to capture it. Physical space is endless and inexhaustible, except some spaces are more valuable than other spaces, which makes them rivalrous.

Global Public Goods

Which entity is a public good? Global Public Goods are Public Goods, but their benefits extend to all countries, people, and generations. GPGs have the ability to scale far beyond the typical public good.

The ability for some Public Goods to extend to a global and generational scale comes from how some Public Goods are antifragile in their nature. Two different goods can be public goods, but if one is antifragile, it will become a Global Public Good.

Antifragile

Antifragility is a property of systems that increase in capability to thrive as a result of stressors, shocks, volatility, noise, mistakes, faults, attacks, or failures. It is a concept developed by Nassim Nicholas Taleb in his book, Antifragile. As Taleb explains in his book, antifragility is fundamentally different from the concepts of resiliency (the ability to recover from failure) and robustness (the ability to resist failure).

Public Goods often have qualities of resilience and robustness (Earlier, I called this depletion-resistance), but Global Public Goods are antifragile; they get better/stronger as more people use them. The key feature behind Global Public Goods is that they benefit from the externalities of the users that consume them. The more a GPG is consumed/used/leveraged, the stronger it gets.

Ideas and knowledge are GPGs; when you share an idea, you also retain that idea, and you enable others to also use it and share it. A good idea can scale to the whole world, without subtracting anything from the idea originator, or the idea itself. Ideas transcend generations without any decay. Most importantly, an idea improves when more people think about it. Ideas are something to be iterated and expanded upon. These iterations are similarly as scalable and sharable as the original idea itself. Good ideas find themselves being shared, iterated, developed and adopted faster than bad ideas, which is how a small spark can turn into a revolution in such a short amount of time. Ideas are better if everyone has the same idea.

The Internet is a GPG. The use of the Internet does not inhibit others from also using it, and the more people use the Internet the more useful it becomes for others. If more things are on the Internet, the more utility the Internet provides for more people, which brings more users to the internet in the first place, which then generates a stronger incentive to build further things on the Internet.

The products of Web2 are antifragile at their core. Facebook, Instagram, Twitter all become better products when more of the world is using them. However, the companies that own these products are just as fragile as the rest of the world, and therein lies the problem of the scale of these products.

Free-Rider Problem

The free-rider problem is the burden on a shared resource that is created by its use or overuse by people who aren't paying their fair share. Street lights are public goods that require resources to build and consume energy for their operation; this requires taxes upon its users and anyone not paying taxes places a burden on the ability for this public good to scale and become more useful. This is why streetlights are not a GPG; their use does not make them more scalable.

GPGs are, by definition, Public Goods that are immune from the free-rider problem. In fact, it’s the opposite. GPGs have mechanisms that bake-in some minimum level of contribution to their usage. You, by definition, cannot use a GPG without returning some amount of value, and the amount of value provided is above the minimum threshold needed for keeping the GPG alive and healthy. Simply using the GPG is providing it with the nourishment it needs to sustain itself.

Rather than a Tragedy of the Commons, GPGs instead experience the ‘Festival of the Commons’, where the Commons is a place to come together and rejoice in our common usage of a shared utility that improves as the festival grows

Bitcoin is a GPG

Bitcoin lives on because of the strength of its antifragility. The value of BTC the asset comes from Bitcoin's antifragility. Bitcoin’s antifragility generates the strongest possible assurances for the future settlement of bitcoins at any time-frame, which in turn generates its utility and incentive for use in the first place.

Bitcoin succeeds, and is itself valued, because of its antifragility. Any other crypto-economic blockchain system that is born in this space must also exhibit antifragile qualities, or else it will eventually be forced to succumb to the rules and paradigms that keep legacy systems afloat: laws and regulations by nation states (cough XRP). Things that are antifragile don’t need laws or regulations to keep them afloat; they support themselves. Antifragility is independence from outside help and support.

Bitcoin is the first example of a GPG that offers a monetary or financial platform for the world that matches the current state of technology and needs by the citizens of planet Earth. Gold was once a GPG, but it slowly became obsolete and antiquated as new technologies subverted its utility.

Ethereum is a Protocol for GPGs

As discussed in A Bankless Nation, Part II, Ethereum is a protocol for protocols. Ethereum is a platform that does the heavy-lifting for producing an environment that is favorable for generating GPG applications. Ethereum is a platform that has security and protection baked in at the protocol, which allows for applications to be built that don’t need to concern themselves with their individual security and protection.

National Parks are Public Goods because they receive the protection of laws and regulations of the US government. If they did not have this protection, they would have either succumbed to the tragedy of the commons or divided into private property and unable to be used or appreciated by the public at large.

Imagine the Grand Canyon, but with houses, buildings, streets, plumbing, sewage systems throughout it. It wouldn’t be the Grand Canyon, it would be a tragedy.

In order to maintain the Public Goods status of the National Parks, the USA protects them via rules and regulations. It bottlenecks entry and restricts usage in order to preserve the ability for the Grand Canyon to be appreciated by everyone and all future generations. The USA uses tax dollars to support this public good. Without this protection, the National Parks wouldn’t exist; they don’t have the antifragility required to be self-sovereign, self-sustaining Public Goods. They require outside help. The USA protocol protects and maintains Public Goods, because of the belief that there are some things that should be Public Goods, but without protection would deteriorate into private property.

Ethereum follows a similar pattern, but instead of Local Public Goods like National Parks, it is a platform for the creation and protection of Global Public Goods, in the realm of Money and Finance.

Uniswap, MakerDAO, Compound are all financial applications that are better because they are unrestricted and unregulated. A Uniswap that is a for-profit company under the purview of the nation-state is not a Uniswap at all. Permissionless collateralized loans are simply more useful when they are not subject to Wall Street regulations. Borrowing and Lending are more efficient when the rules and regulations are baked into the protocol, not administered from a central government.

Ethereum is the protocol that offers protection to Public Goods, which enables them to become Global Public Goods.

Because of the security offered by Ethereum, applications can replace the rules and regulations of the nation-state with their own rules that protocol designers have deemed optimal for their particular application. Uniswap, Compound, Maker are given sovereignty by Ethereum; the only rules that Ethereum imparts upon its applications is that they abide by the laws of the EVM. Ethereum is a protocol that enables financial application self-sovereignty.

Uniswap

I recently wrote a piece titled Uniswap is Infrastructure that explores a few key points about the Uniswap application.

The point of this article was to illustrate Uniswap antifragility and its innate ability to scale to meet the demand of the whole globe, whatever demand that may be. However, I realize now that I was actually describing how Uniswap is a Global Public Good.

Uniswap keeps itself alive by baking-in its own nourishment into the protocol. The 0.3% exchange fee is what drives liquidity into the protocol and creates the environment for Uniswap to scale to a global platform. The exchange fee is how all Uniswap consumers are simultaneously Uniswap producers; there is no way to use Uniswap without ‘giving back’ to the protocol.

This is Uniswap’s antifragility and is the mechanism for how it rises to GPG status.

But Is It Decentralized??

We’ve heard this question endlessly from various different critics of Ethereum and the things being built upon it. What these critics are really asking is whether the project in question has the capacity to become antifragile, and gain GPG status. (Listen to the podcast episode on the DeFi Trust Spectrum)

It is impossible to be a GPG while also being under the control of admin keys. Admin keys illustrate power and control over something, which is antithetical to the role and purpose of a GPG. GPGs are public and require no external protection or support. Therefore, admin keys must be absent from a GPG.

The existence of Admin keys means there is potential to reduce the trustlessness, permissionlessness, or credible neutrality; if this potential exists, it cannot be a GPG.

COMP and the Governance Token Revolution

Compound recently debuted its COMP token, which has changed the game with how a protocol on Ethereum moves from being a Public Good protected by a centralized entity, to a Global Public Good with a decentralized set of keepers. While COMP is the most salient example of this, the underlying structure is independent from COMP, and is a model that many Ethereum applications can follow to elevate themselves to the status of GPG.

This model was illustrated by Gavin McDermott in his article Meet the SAFG.

The SAFG token model is how Ethereum applications elegantly and seamlessly migrate from being a Protected Public Good, to an Antifragile Global Public Good. This is the fundamental reason why the Ethereum and DeFi ecosystems are so excited about this new token model paradigm.

Protecting the Protector

Ether the asset is a Global Public Good, and most importantly it is the GPG that supports the health of the Ethereum ecosystem, which is an ecosystem of more GPGs. All the GPGs on Ethereum, current and future, depend on the value of ETH in order to function. The higher the ETH price, the stronger the protection Ethereum can provide to the GPGs that run on it. A rejection of the value of ETH is not just a disservice to those attempting to build something of value on Ethereum, it is a direct attack upon these efforts.

This is why I vehemently reject the notion that ‘shilling ETH’ is bad, and comes out of the mouth of someone that doesn’t understand this concept or how it is inextricably tied to any and all efforts surrounding Ethereum and its development. When the price of ETH grows, so do the walls that protect the GPGs on Ethereum.

Fortunately, Ether itself is a GPG; it is antifragile and doesn’t need the support of others to grow. I’ve illustrated ETH’s destiny in Ethereum in a few articles, which I summarize below through the lens of ETH’s destiny as the GPG that protects Ethereum.

Like applications on Ethereum, all my articles are composable and each one builds off the others, and makes the others better and more useful. In my opinion, this hits pretty hard and is a good finale for this article.

Ethereum is an Emergent Structure

- Applications on Ethereum are composable, and this composability makes applications meld together over time.

- Rather than being a platform of many individual apps, Ethereum is a single structure of melded applications that are all coalescing together.

- Ether, as the asset with the highest GPG score on Ethereum, is the point to which this structure gains its initial and strongest foundations.

- Other assets are welcome and are encouraged to aid in the support and foundation of this structure. In fact, other assets are required. You can’t build a structure on a single point.

- Ether, due to its privileged position as the native asset to Ethereum, will always be contributing greater support and foundation to the Ethereum/DeFi structure

- The weight of this structure is directly correlated to the price of the assets that support it on the secondary market.

The Fundamental Value Proposition of ETH

- Assuming that planned protocol updates are all included (PoS, EIP 1559), ETH is given direct exposure to the health and size of the Ethereum economy.

- The volume of the Ethereum economy will generate ETH scarcity in the form of EIP1559; the burning of ETH at a rate that follows the size of the Ethereum economy.

- The scarcity of ETH is directly related to its Utility Score in the GPG score criteria.

- The Utility of ETH IS its scarcity.

- Current and Future GPGs on Ethereum will all demand ETH as an asset, due to its high GPG score.

- Lots of GPGs on Ethereum will generate endless demand for ETH.

- GPGs on Ethereum improve as more people use them.

- Each GPG can act as infrastructure for other GPGs, making the creation of new and more useful GPGs easier over time.

- As new GPGs come onto Ethereum, they make the pre-existing GPGs more useful in turn.

- The more GPGs, and the more better GPGs on Ethereum, collectively push each other down the Protocol Sink.

- When there are many GPGs with high Utility at the bottom of the Ethereum Protocol Sink, the gravitational pull of the collective market cap of all GPG protocols will reach a sphere that is outside Ethereum.

- This produces a positive feedback loop in not just GPG numbers, but GPG utility, and therefore a dual feedback loop in incentive to come to use Ethereum in the first place.

Conclusion: Ethereum is an Attractor for Global Public Goods

In Ethereum, antifragility begets antifragility. The last two points in the above Uniswap is Infrastructure summary illustrates the future of Ethereum: a landscape of Antifragile Global Public Goods Infrastructure.

Currently, there are only a few applications that are found at the bottom of the Protocol Sink, with just a few hundred million dollars of density found there. Over time as more mass collects at the bottom, the stronger the influence of the gravitational pull will be. This influence will pull on things higher up in the Protocol Sink, and force them down into the realm of GPGs.

The growing mass at the bottom of the Protocol Sink exerts a gravitational pull that extends beyond the internal Ethereum ecosystem. In addition to the internal Ethereum economy, the capital and assets found in the outside world will also feel the presence of value found at the bottom of the Protocol Sink. Value is a nebulous thing; the barriers and restrictions of the nation state are not strong enough to prevent value from permeating into Ethereum. Over time, value will migrate into the world of antifragile GPGs.

“Show me the incentive and I’ll show you the outcome.”

This famous line from Charlie Munger illustrates why I have such strong convictions about the development of the Ethereum ecosystem at maturity. Global Public Goods offer incentives too strong to be ignored by the rest of the world. Chris Burniske’s piece Protocols as Minimally Extractive Coordinatorsillustrates the incentive to adopt Ethereum-based GPG platforms above any other alternative. He concludes his piece with the following two sentences:

Any unnecessary extraction from the process of exchange is a tax that will ultimately be weeded out by copy-paste competition in the world of open-source protocols. While this presents a brave new world for businesses, minimizing extraction should accrue to the benefit of all of us as consumers.

Ethereum is a free-market crucible, where competition is so active and harsh that the only things that can survive at the end of the race are antifragile GPG systems. Everything else finds their own appropriate place higher up in the Protocol Sink.

I look forward to the Web3 world that the Protocol Sink will bring. It will be 100x more useful than Web2, but with the same fairness and credible neutrality of Web1. Once it is here, humanity can truly resemble a single global community.

Action steps

Consider the long-term effects of the Protocol Sink Thesis

Evaluate the density of your favorite DeFi protocols

Listen to the Bankless podcast on The Protocol Sink Thesis

Read David’s previous pieces