Is tokenized BTC bullish for ETH?

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Another asset falls into the Ethereum gravity well. This time it’s Bitcoin.

It’s easy to port Bitcoin to Ethereum in a trusted way. wBTC is that—just trust BitGo and it’s issuers. But what if you want a trust-minimized BTC on Ethereum?

That’s a holy grail. Several projects attempting it and lots of buzz.

But are these efforts parasitic to ETH value accrual? Lucas explores these through the lens of economic bandwidth.

You might be surprised at his takeaways.

- RSA

P.S. Don’t forget to send a DAI to Bankless Transaction Grant today—extended deadline!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WRITERS CORNER

By Bankless writer: Lucas Campbell of Fitzner Blockchain Consulting & DeFi Rate

Is tokenized BTC bullish for ETH?

Prominent Bitcoiner Anthony Pompliano tweeted this out a few weeks ago.

While Pomp is not well-known for being an Ethereum bull, he did highlight an interesting point about the future of DeFi: either (1) DeFi will be built on Bitcoin or (2) Bitcoin will be ported over to Ethereum via something like tBTC.

DeFi won’t be built on Bitcoin

From my perspective, the first option is less likely to occur. The core argument for DeFi on Ethereum is this: any other network looking to popularize DeFi applications on their platform will have to compete with Ethereum’s composability. (RSA—also hard for Bitcoin since it’s not expressive)

For those unfamiliar, composability refers to the concept of being able to combine two or more components to make a unique combination or solution—almost like a bunch of legos.

Except in our case, they’re money legos.

Compound (permissionless lending) and MakerDAO (permissionless stablecoin) are money legos in their own respect. They allow developers to build and experiment with them to create entirely new financial applications.

Imagine trying to build PoolTogether, a no-loss lottery, on any other network. The network would require a permissionless stablecoin (i.e. a MakerDAO equivalent) and a permissionless lending protocol (a Compound equivalent) to successfully build the application.

This is just the beginning too. As Ethereum matures, so do its applications. They become more powerful (and complex) with the more money legos available. Look at Augur v2 for example.

The next version of Augur requires the following legos:

- two liquidity protocols

- two non-custodial wallets

- an identity solution

- a fiat on-ramp

- a permissionless stablecoin (i.e. DAI)

Ultimately, that’s the strongest argument solidifying the future of Ethereum and DeFi—its composability.

The more money legos available, the stronger the network effects and the deeper the moat. Until other networks have a diverse ecosystem of permissionless money legos for anyone to build with, Ethereum is likely here to stay as the de facto platform for open finance.

And it will take time (likely years) for other networks to reach this point. Even if Bitcoin had the expressivity to do it. Adding to the challenge, all of the money protocols must be liquid and empowered with billions (if not trillions) in capital.

All while Ethereum and DeFi keep on growing—and growing fast. Which means you not only have to catch up with the Ethereum of today, you have to catch up with the Ethereum of tomorrow.

With all of that in mind, the second option of bringing BTC to Ethereum seems to be the more viable choice, at least for now.

So what about Bitcoin on Ethereum?

Bitcoin is the most trustless form of digital economic bandwidth in existence today. It’s also the most liquid form of economic bandwidth. The combination of these two attributes provides us with one of the most attractive forms of bandwidth for Ethereum’s money protocols—trustless economic bandwidth.

Want an overview of economic bandwidth?

🎙️Listen to “Economic Bandwidth” Episode #3 of the Bankless Podcast

In order to preserve BTC’s trustless-ness in DeFi, the underlying mechanism for bringing BTC over to Ethereum must also be as trustless as possible, allowing the asset to proliferate as trustless economic bandwidth for Ethereum’s money protocols.

Let’s talk tBTC

This leads us to Keep Network’s upcoming launch of tBTC—a trust minimized version of Bitcoin on Ethereum. I say trust-minimized since there’s still oracle risk, technical risk, and economic incentive risk compared to vanilla BTC on Bitcoin.

tBTC will launch on Ethereum mainnet on April 27th, 2020. The launch will provide users with the ability to deposit BTC, mint and redeem tBTC, and use it in Ethereum DeFi apps.

With the introduction of tBTC it seems there’ll be an alternative form of sound money that could serve as relatively trustless economic bandwidth for DeFi. Lots of it too. Bitcoin’s market cap is $134B as of writing.

So does that mean BTC will replace ETH as the primary form of trustless economic bandwidth for DeFi, thus rendering ETH useless? Nope.

tBTC will not overtake Ether as trustless economic bandwidth on Ethereum, it will consume it.

tBTC is a net consumer of economic bandwidth

The design behind tBTC relies on over-collateralizing Ether to secure every tBTC on the network (a proposed 150%).

In other words, for every $100 of tBTC on Ethereum, it will require at least $150 in Ether locked away in a “tBTC Vault” netting at minimum negative $50 in economic bandwidth on Ethereum.

That means tBTC consumes trustless economic bandwidth rather than creating it.

At today’s BTC/ETH ratio, 1 tBTC consumes over 64 ETH.

So what would happen if tBTC became widely popular on Ethereum and its DeFi money protocols?

How much of Ether’s trustless economic bandwidth would tBTC consume?

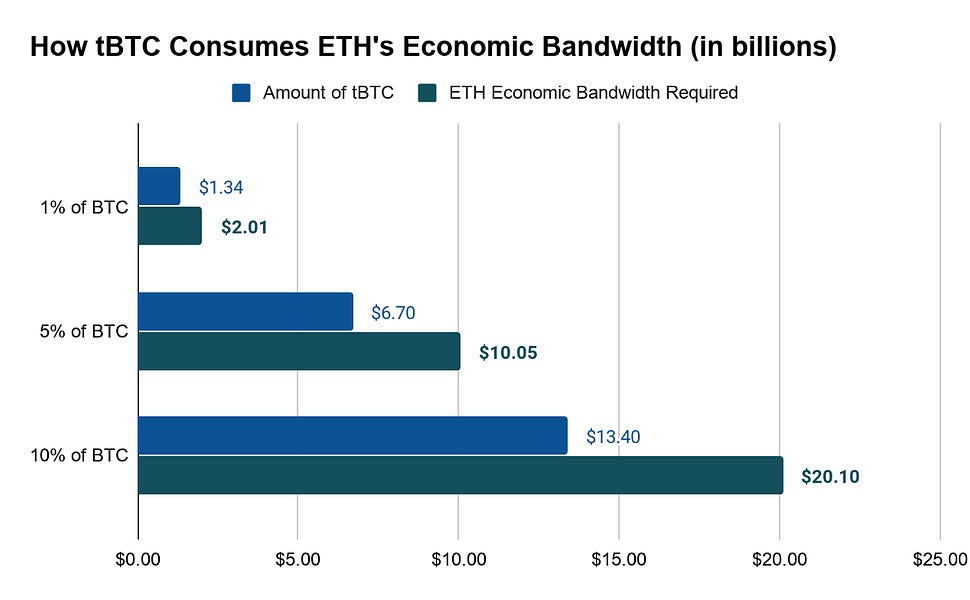

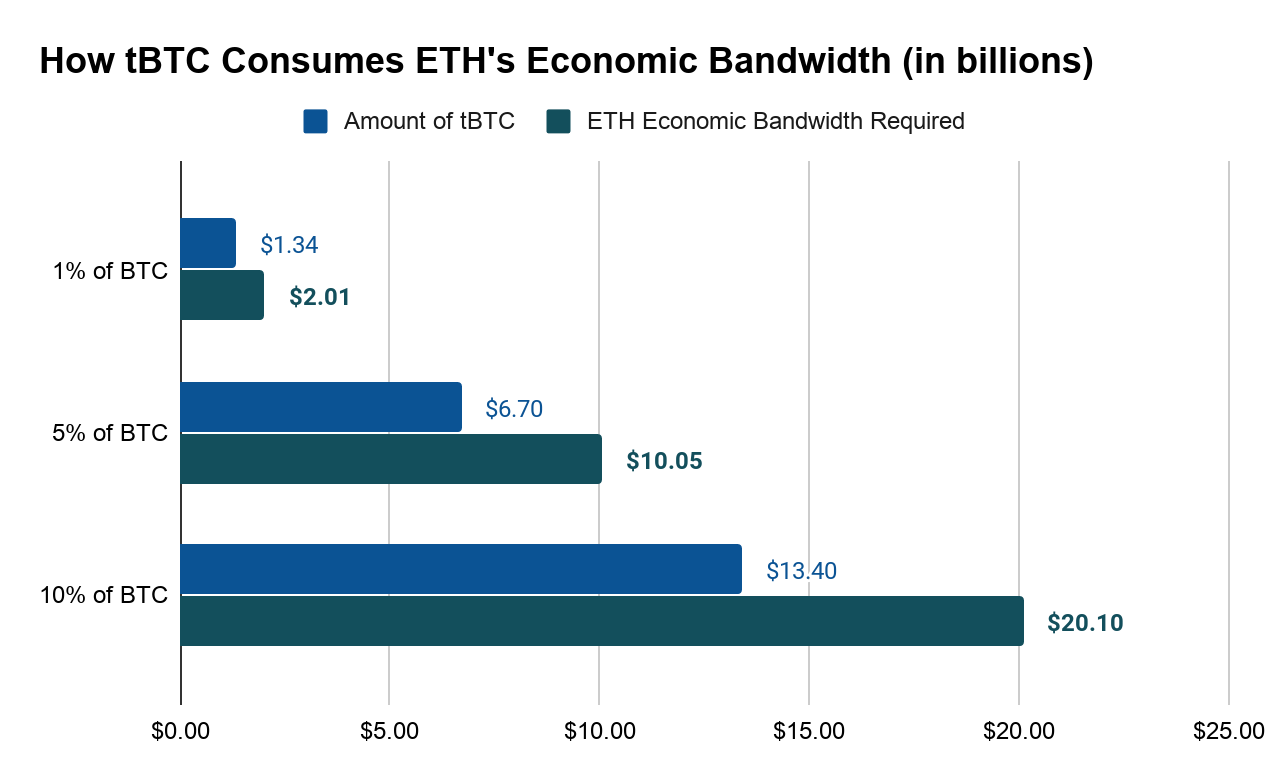

Looking at BTC’s liquid market cap (or total economic bandwidth) of $134B, tokenizing 1% of the outstanding supply would net $1.34B in tBTC. In turn, this would require at least $2.01B in Ether as trustless collateral to support the asset, consuming roughly 10% of current trustless economic bandwidth on Ethereum.

At 5% of the liquid supply? tBTC requires $10.5B of collateralized Ether or 56% of available economic bandwidth.

Finally, if 10% of Bitcoin’s currently liquid market cap was trustlessly tokenized via tBTC to fuel Ethereum’s money protocols, it would require all of Ether’s current economic bandwidth (and more) to do so.

The key takeaway here is that if tBTC does succeed on DeFi, the it’s likely to drive value to Ether given it requires over-collateralized ETH to mint tBTC.

Other forms of trustless Bitcoin don’t produce much bandwidth either

But what about other forms of trustless Bitcoin on Ethereum that don't require over-collateralized Ether? Ren Protocol is a potential candidate in this regard.

Rather than relying on collateralized ETH, Ren uses a “trustless custodian” (the RenVM) to maintain a ledger of the assets 1:1 across multiple networks.

The RenVM stores BTC in a network of decentralized nodes called Darknodes, where all Darknodes must be bonded with 3x the value in REN to ensure economic security. Instead of using ETH as a security deposit as tBTC does, Ren uses REN—its own token. REN’s value of course is directly related to the revenue Ren generates. REN is a capital asset, not a store-of-value commodity with a monetary premium, so in a rational market it’s value would be capped by the cash flow it generates.

Want an overview of capital assets vs commodities?

🎙️Listen to “Triple Point Asset” Episode #4 of the Bankless Podcast

While Ren’s design is intriguing, it runs into the same self-referential scaling problems as Synthetix and SNX. The amount of renBTC available for minting is entirely limited by the available economic bandwidth of REN—roughly $40M as of writing.

That’s not enough economic bandwidth to support the $134B in BTC circulating.

Here’s the takeaway from tBTC and Ren: it’s hard to create net new trustless economic bandwidth so most trustless tokenized BTC designs end up using ETH or producing very little new bandwidth.

What if a magic tokenized BTC came along?

Let’s say a magic design for tokenized trustless BTC came along that was scalable and didn’t require Ether in any respect, would this magicBTC replace ETH as economic bandwidth for Ethereum’s money protocols in the cast?

No. Ethereum still needs ETH.

Even if a magicBTC somehow won the battle for liquidity on Ethereum (a task comparable to beating USD in the U.S. economy) ETH still has an ace up its sleeve.

An Ethereum mechanism design called EIP 1559 establishes a market rate for block inclusion while the rest of the ETH paid in the transaction fee is burned. It turns every Ethereum transaction into a net consumer of economic bandwidth.

With EIP 1559, every time an asset on Ethereum is sent, deposited, borrowed and all other “money verbs”, a fraction of Ether will be burned, effectively distributing a universal dividend to token holders.

If Ethereum successfully tokenizes global financial assets like BTC and becomes the infrastructure for global finance, EIP 1559 solidifies ETH as the native asset to Ethereum and cements its need for the overarching success of the network.

So if magicBTC ever superseded ETH as the primary form of trustless economic bandwidth for DeFi, at the very least we can expect EIP 1559 to drive a net consumption of ETH’s economic bandwidth!

Note: Staking is another consumer of ETH as economic bandwidth—it converts economic bandwidth to security—will get into this in future articles.

Closing Thoughts

Due to growing network effects in Ethereum’s money legos and its composability, it’s becoming increasingly likely that Ethereum will remain as the infrastructure for open finance in the foreseeable future.

While the proliferation of BTC on Ethereum may sound threatening to ETH’s status as the primary reserve asset, some of the most promising designs for trustless BTC on Ethereum requires an over-collateralization of Ether—thus assets like tBTC often end up consuming more trustless economic bandwidth than they create leading to a net increase in ETH demand.

And importantly, the future implementation of mechanisms like EIP 1559 further entrench ETH as an essential asset to the network. From this vantage point, tokenized BTC is symbiotic to ETH value accrual, not parasitic.

If Ethereum succeeds as the infrastructure for open finance and tokenized assets, there will be a demand for ETH. It’s inevitable.

All roads lead to ETH on Ethereum.

Action steps

- Consider: do the trustless tokenized BTC designs produce or consume economic bandwidth on Ethereum?

Author Blurb

Lucas Campbell is an Analyst at Fitzner Blockchain Consulting & DeFi Rate. He fell down the crypto rabbit hold while studying economics at CU Boulder and ultimately became a board member for CU Blockchain. I discovered Lucas while reading his Token Tuesdays newsletter where he covers topics related to tokens and DeFi (recommended!)

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.