ETH & BTC are the only crypto money that matter

Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

Happy Thursday. On Thursday’s we zoom out and think strategically. We question assumptions, examine perspectives, and challenge ideas.

We calibrate our long-term strategy.

Today is about ETH & BTC and the crypto money portfolio. This is essential groundwork. You need to know for yourself which crypto monies are worth holding. Holding the right crypto money is first step to go bankless.

I’ve got some actions items for you at the end as usual. Tomorrow I’ll send you the weekly summary.

- RSA

THURSDAY THOUGHT

ETH & BTC are the only crypto money that matter

The Bitcoin forks and the Ethereum ICOs spawned many crypto assets. We’ll never go back to single token world. I expect every asset to be tokenized in some way, eventually.

But which assets will accrue value?

And importantly, where should you hold you crypto wealth?

The bankless model is simple: you hold the majority of your crypto wealth in crypto money. Specifically crypto commodity money. Today that means ETH and BTC.

What is commodity money?

Commodity money is a money whose value comes in part from its use as a commodity and in part from its use as a money. This is in contrast to representative money which has no intrinsic value or fiat money which is established by government decree.

Commodity money: gold, silver, copper, cigarettes, shells

Representative money: bank notes, checks, USD (when USD was gold-backed)

Fiat money: dollars, pounds, euros, yen, yuan

The thing that separates commodity money from a regular commodity is monetary premium. A pure commodity has value through utility alone. A commodity money has value both as a utility and as a money. Any value above a commodities’ utility value is monetary premium.

A commodities’ monetary premium is driven by the sum of all bets that a commodity will be used as a future store-of-value (SoV), medium-of-exchange (MoE), and/or Unit of Account (UofA) in some combination, in some economy. The economy served by the money can be small, like cigarettes in a prison, or it can be large, like gold for international trade during the Gilded Age.

A commodity money like gold is valuable partially due to its use in electronics, but mostly valuable due to use as a wealth hedge against fiat system failure. Gold’s value is simply the sum of many bets that many others will use it to store wealth.

It’s helpful to think of money as an adjective: moneyness. Gold has higher moneyness than silver today, just as silver has higher moneyness than copper. Every asset exists on a spectrum of moneyness. And moneyness itself is a social construct.

A lot to take in. But for now this is enough to understand crypto commodity monies: they are cryptocurrencies that have both utility value and monetary premium. And the best of these have the highest degrees of moneyness.

Note: Some people claim BTC is not a commodity because it has no utility. I disagree. BTC has utility—BTC is used to pay for transactions on the Bitcoin network. This is utility.

The crypto money portfolio

If you want exposure to the money potential of cryptoassets, I recommend a crypto money portfolio. The crypto money portfolio is composed of three types of assets:

- Money bets—assets with high potential to increase in moneyness—these are the reserve currencies of open finance (e.g. ETH, BTC)

- Bank bets—assets that provide exposure to the growth of the open finance banking layer, these are the crypto banks & money protocols (e.g. MKR, BNB)

- Stablecoin bets—stablecoins tethered to the value of fiat (e.g. DAI, USDT)—mainly to hedge risk and for direct use within the crypto ecosystem

The thesis of the crypto money portfolio is that one or several cryptocurrencies will become the base money of a parallel non-sovereign financial system worth trillions and that this money system will both enable and be enabled by a new class of crypto banks and money protocols.

The crypto money portfolio gets you exposure to the money layer and the banking layer of this parallel money system which are the layers with the highest potential for value accrual.

Crypto money is my primary thesis for the crypto space.

What percentages should you allocate to each of three asset types? That depends entirely on your circumstances. You first need to determine how much of your current net worth to invest in crypto and how much of your future earnings to invest. After that, you can decide how to allocate across the three crypto asset types. Both of these questions are beyond the scope of this article, but I’ll revisit them soon in the program.

Specific percentages aside, the crypto money portfolio places the bulk of your crypto exposure in money bets. Bank bets compose a smaller portion of the portfolio, and are only placed when expected to deliver alpha on the money bets. Stablecoin bets are like cash for use in the ecosystem and to hedge the risk of your other bets.

So what are the good crypto money bets today?

It’s actually not complicated.

Let’s try a simple exercise. Look at the top 15 cryptoassets by marketcap. Which of these has traction as a commodity money today?

Here’s what I get:

- BTC - Yes, reserve asset potential, currently used as money

- ETH - Yes, reserve asset potential, currently used as money

- XRP - No, centralized issuance, no usage as money

- BCH - Possibly

- LTC - No, redundant BTC fork

- USDT - No, stablecoin, not commodity money

- EOS - Possibly, looks too centralized to hold monetary premium

- BNB - It’s complicated, certainly a bank bet

- XLM - No, centralized issuance, little usage as money

- ALGO - No, unlaunched, no use as money

- ADA - No, unlaunched, no use as money

- XMR - Yes, but hard to see path to liquidity

- LINK - No, not commodity money

- LEO - No, but certainly a bank bet

- TRX - No, too centralized to hold monetary premium

BTC and ETH stand out as the only decentralized commodity monies. Only these have the liquidity, decentralization, and banking layers to give them a plausible path to status as reserve money for crypto finance. BTC is clearly in the process of being financialized primarily through crypto banks and ETH is clearly in the process of being financialized primarily through money protocols.

So for now, ETH and BTC are the only assets that meet my bar for good money bets in crypto. This may change, I reevaluate this thesis on a quarterly basis.

Of course, you may get different answers on the above. You may be willing to hold the more speculative crypto money bets in your portfolio. You may even disagree that ETH (or BTC!) will hold its monetary premiums. Ok. Allocate accordingly!

But realize the bulk of value appreciation in crypto is likely to come from commodity monies and the monetary premiums associated with them. This makes your money bets your most important bets in crypto. These are your long-termers. The base money from which you operate this program. Your first stop for going bankless.

Choose wisely.

My choice is ETH and BTC.

Actions

- Should you construct a crypto money portfolio?

- Which of the top 15 assets are good money bets?

Continue leveling up. $12 per month. 20% off if you subscribe before November 1.

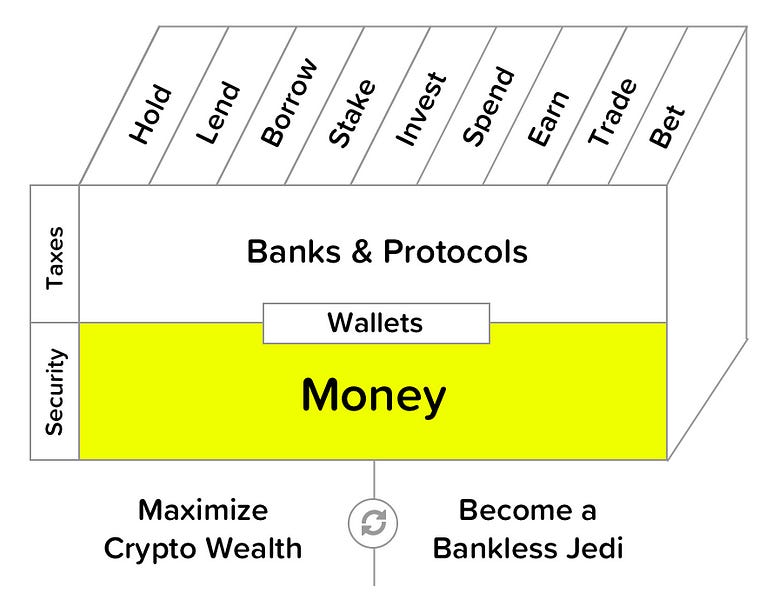

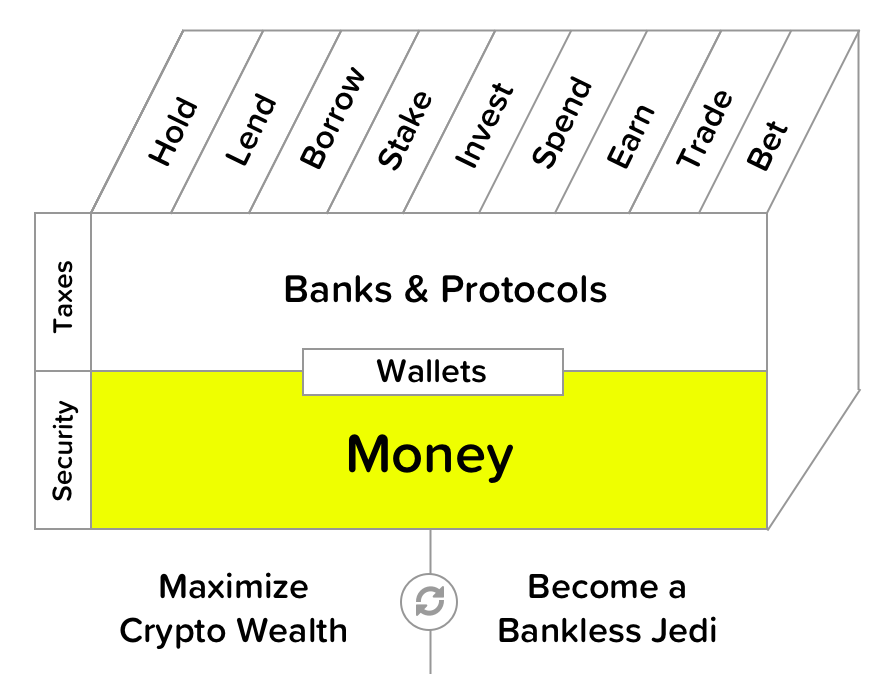

Filling out the skill cube

By constructing a crypto money portfolio you’re leveling up on the Money layer of the skill cube. We’ll do more here soon. Keep at it!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.