Why ETH Will Sustain a Monetary Premium

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Today is part 2 in our written debate on the topic: Is ETH Money?

Last week Checkmate laid out his arguments on Why ETH Won’t Sustain a Monetary Premium. And I asked if anyone wanted to challenge his position.

Apparently they did. I’ve included three of the best:

- A rebuttal of the No position by Vitalik Buterin

- A rebuttal of the No position by Foobazzler

- A full on bull case for ETH’s as money by David Hoffman (👈you are here)

Check out all three to get the full perspective. David’s bull case is below.

- RSA

THURSDAY THOUGHT

Why ETH Will Sustain a Monetary Premium:

- Read Vitalik’s rebuttal

- Read Foobazzler's rebuttal

- Read bull case for ETH’s monetary premium by David Hoffman (👈you are here)

Engineering ETH’s Monetary Premium

The EVM is how Ethereum builds itself into Money

Post by: David Hoffman, COO RealT & POV Crypto host

Monetary Premium = Liquidity

Liquidity is a big subject. The liquidity profile of an asset illustrates how easy it is to buy/sell that asset, from anywhere, at any time, without any loss from the sale. The assets that have these qualities are generally the assets that the world uses as money.

Bitcoin and Ethereum achieve liquidity in different ways, but both are inherently tied to the value of the asset. When the value of the respective asset goes up, the asset becomes more liquid.

The liquidity of a crypto-asset is a function of its price, which is a function of its demand. The liquidity/price/demand trio are really three different ways to talk about the same concept. The moneyness of an asset is ultimately a function of its total global liquidity, which is reflected by total market cap and the ability for the asset to be globally accessible.

In crypto, the fight for total market cap, and the fight for “being money” is the same fight

Simply put, whichever crypto-asset has the highest total liquid market cap is “crypto-money”.

Bitcoin achieves its value, and therefore its liquidity, and therefore its moneyness, from its finite supply. The promise of Bitcoin’s scarcity creates a strong incentive to buy-and-hold it, in the speculation that it does indeed become the next iteration of money. This is Bitcoin’s golden-egg. If this isn’t force enough to bootstrap Bitcoin into being money, theres nothing else for Bitcoin to rely on.

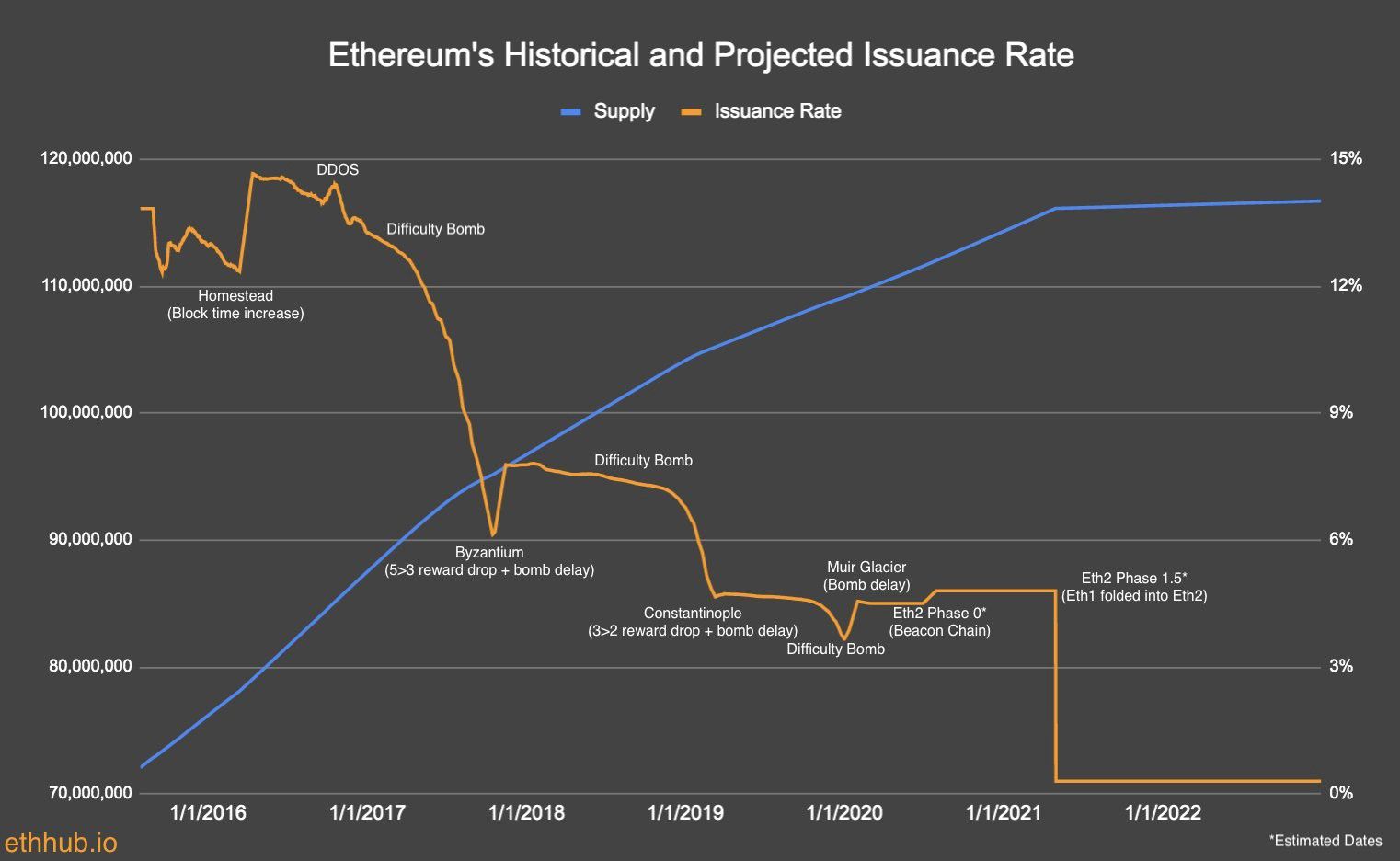

Ethereum gives Ether its liquidity by generating mechanisms that require ETH for their function. In ETH 2.0, there will be 3 pillars that engineer scarcity in ETH:

- ETH Locked in DeFi — increase ETH utility, increase ETH demand

- Staked ETH — Increase ETH scarcity, reduce ETH issuance

- ETH Burn Rate — Increase ETH scarcity, reduce ETH issuance

These three things are the functions that drive ETH scarcity, and is the yin to Bitcoins 21M yang. Importantly, the positive impact of each pillar is symbiotic with the positive impact of the others. Where Bitcoin has one single large pillar (21M), Ether has 3 smaller ones, that each compliment and strength each-other.

Scarcity is the precursor to Liquidity

Crypto-assets like Bitcoin or Ether are inherently fungible, divisible, and globally accessible. They have the necessary accounting system needed to act as money from day 1. The only obstacle between a cryptocurrency and being money, is being the most valuable/liquid cryptocurrency. For crypto-assets, the only important battle is the battle for value, because it is simultaneously the battle for liquidity, and therefore money.

Total Market Cap = Money

Checkmate’s article “Why ETH Won’t Sustain a Monetary Premium” goes through the common criticisms of Ethereum as a platform. The bulk of these criticisms are the age-old criticisms of Ethereum, and for the most-part, miss the real subject at hand: total value = monetary premium. Most Bitcoiner criticisms of Ethereum are actually moral criticisms as to why Ether won’t achieve money status. “Pre-mine = not money, due to unfair issuance” and “PoS = Cantillion Effect” are the most common.

To me, this reads “why Ether shouldn’t achieve monetary status”, or “why it would be unfair if Ether achieved monetary status”, and not “why Ether won’t achieve monetary status”. And at the end of the day, “why Ether shouldn’t…” is a subjective argument that can be right or wrong, where as “why Ether will” is something that we can actually investigate with data and trends.

This article is about why Ether will achieve money status, using data and trends.

Why Ether WILL Achieve Money Status

Ether is in process of engineering itself into money.

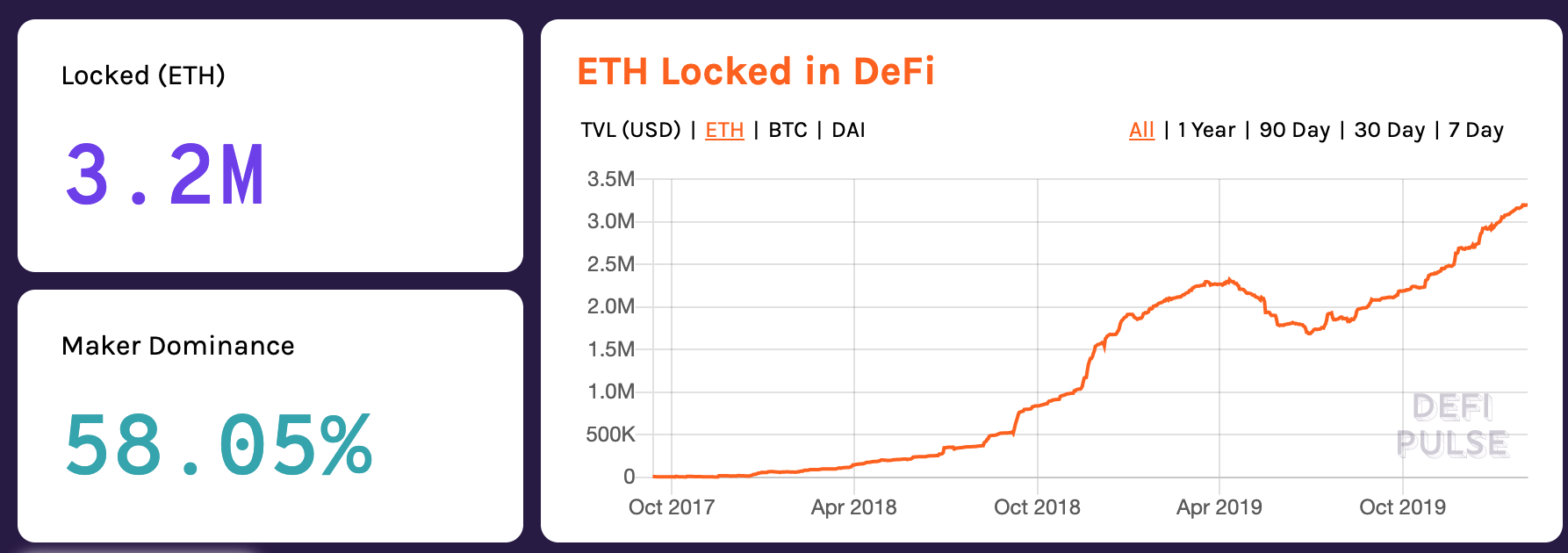

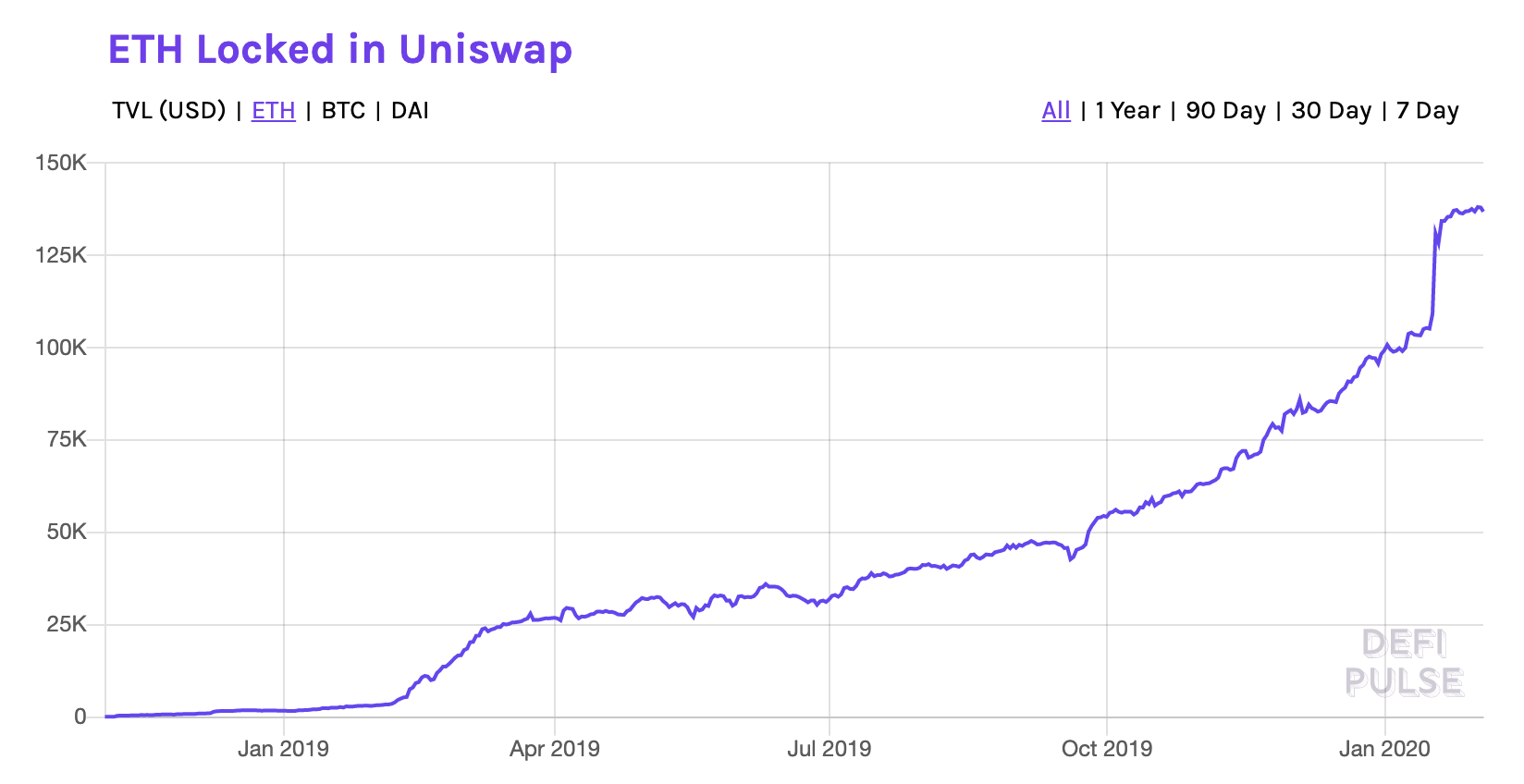

Ethereum as a platform struggled to find product-market fit until around 2018 where we saw applications that locked-up ETH start doing really well. The ETH-locked in DeFi metric caught fire, as the Ethereum community began to learn what ETH could be: the reserve asset for the permissionless financial system.

Efforts such as Proof of Stake and EIP1559 are also Ether demand+scarcity mechanisms, and the application layer to Ethereum is simultaneously acting as an Ether utility and liquidity mechanisms.

The main thesis of this article is that Ethereum applications all ultimately aid Ether to become organically (accidentally?) engineered into becoming money. In crypto, its not an oxymoron to accidentally engineer something into becoming something else: 2015–2018 Ethereum was about throwing as many Dapps at the wall and seeing which ones would stick. Turns out, the ones that stick are the ones that make ETH money.

1. Engineered Demand

Demand in the Application Layer: This corresponds to Checkmates section titled “Reliance on Application Layer for Value Accrual”

Ethereum’s application layer is the thing that will transform the worlds financial system. Financial primitives like MakerDAO, Uniswap, and Compound have the potential to serve the entire planet, and the growing usage of these applications all result in ETH-lockup.

ETH Locked in DeFi is the leaderboard for measuring the decree that Ethereum applications are removing ETH from the supply. Each-and-every Ethereum application generates ETH lockup incentives (I illustrated this in Ether is Equity). Basically, Ethereum’s application layer is a collection of Ether supply sinks (I illustrated this in Ethereum: Money-Game Landscape), which all contribute to ETH scarcity.

The equation of exchange is MV=PQ. (Read the wikipedia page for a full explanation of what MV=PQ is). For the purposes of this article, MV=PQ illustrates the relationship between money-velocity (how fast money changes hands) and the total value of the total supply of the money (market cap). When velocity goes down, market cap goes up.

Ethereum applications are Ether velocity sinks. This is why ETH Locked in DeFi is a metric that the Ethereum community is rallying behind. The more sinks there are that suck in more ETH, the more ETH achieves moneyness. The more ETH-sinks there are, the more each individual application is acting as a little federal reserve, with ETH as the reserve asset. With Bitcoin, you can be your own bank, but with Ethereum, both you and a bunch of NPC-computers can also be banks!

The crucial component of Ethereum’s application layer is that there is always room for more apps. There is never an upper-limit to the number of applications that generate ETH-lockup incentives, or pay fees to the stakers who are locking it up themselves. Therefore, the theoretical demand for ETH is infinite (something you hear Bitcoiners say about Bitcoin a lot, but Ether actually has a path to engineer this into reality).

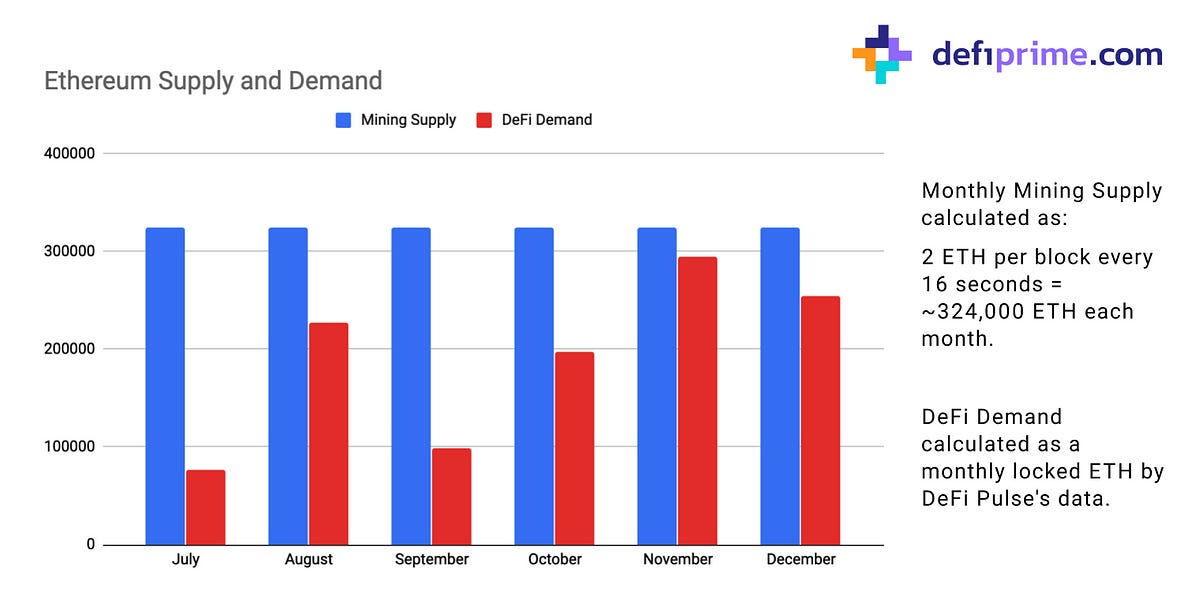

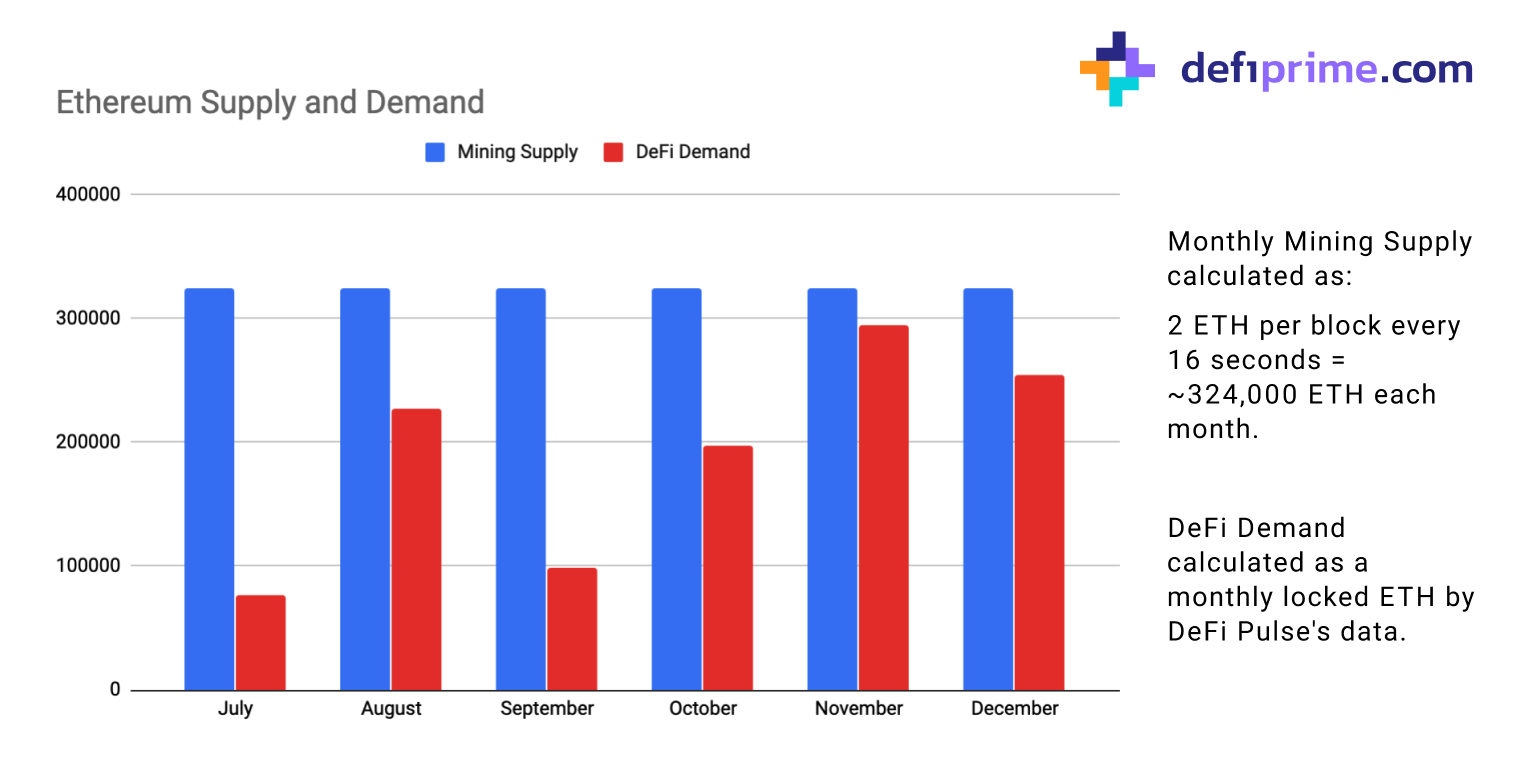

Graphs:

ETH locked in DeFi is going up ⬆️

ETH locked in DeFi compared to Ether issuance is flippening 🔀

Ethereum is still in its PoW state; transition to PoS reduces Ether issuance from ~4% yearly to ~0.4% issuance. With PoS transition, Ether issuance meaningfully falls below the rate at which ETH being locked in DeFi.

0.4% issuance in PoS Ethereum is the MAX issuance. Not included in this projection is the future burn-rate of ETH from EIP 1559. We won’t know how to project this burn rate until we are closer to ETH2, but it has been hypothesized that full utilization of all ETH 2.0s 64 shards would result in a negative-net issuance of Ether. I look forward to that yellow line dropping below 0.

2. Engineered Scarcity

Two innovations are coming to Ethereum that represent “engineered scarcity”.

Proof of Stake

- Generally assumed this will target 10%–30% of total ETH supply.

- Eric Wall in his recent piece Proof-of-Stake is Less Wasteful illustrated the idea that the set of stakers from a PoS system will converge upon the individuals who are perpetually bullish on ETH, as they are the individuals who will accept the lowest returns on ETH and still refuse to sell.

What this means:

1. Ethereum is able to issue to lowest amount of ETH possible needed for security

2. ETH-fees from blockspace buyers migrate into the hands of those that are perma-bulls on ETH. PoS rewards bullishness, and actually self-reinforces the value accrual of the asset. This is yet another great example of Ethereum engineering itself into moneyness, rather than depending on memes. - Further compliments the ETH supply sink effects

EIP1559

EIP 1559 generates an ETH-Burn force. While simultaneously making Ethereum easier to use (the initial purpose of the EIP), 1559 also burns ETH proportional to Ethereum congestion.

Checkmate seems to have a big problem with 1559 for a number of reasons.

- It represents monetary tinkering. In his eyes, and what seems to be shared by Bitcoiners at large, tinkering with monetary policy is a fundamental mistake, and that the inability to tinker generates the best monetary policy.

- It represents the Cantillion Effect, which is defined as: those that are in close-proximity to new-money-issuance are able to spend that money and buy things at a valuation that has not been adjusted to match the new supply of money. AKA: those who access newly-issued money are able to buy things cheaper than people 2, 3, 4+ hops away from that new money.

- EIP 1559 will make fees more expensive for users

My response:

Again, this is a moral argument for why ETH shouldn’t achieve monetary premium, not an argument that it wont.

I couldn’t disagree more with this. The Cantillon effect is real, and it is a valid critique of the fairness and equitability of ETH as an asset, but the Cantillon effect critique is only relevant to Proof of Stake as a security mechanism, and has nothing to do with EIP 1559. In-fact, the changes that EIP 1559 makes to PoS economics directly mitigates the Cantillion effect in PoS. If you are worried about the Cantillion effect, EIP1559 is your friend.

I’ve illustrated this in Ether is Equity and EIP 1559: The Final Puzzle-Piece to Ethereum’s Monetary Policy, but I’ll do it again here:Fee revenue in crypto-economic systems is volatile. This is an inherent truth. BTC fees in 2015 were below $0.01, and above $100 in Dec. 2017. Miners in Dec 2017 were making an absolute killing, and those miners that were operating with low or no profit in 2015 were basically given back-pay for their service.

EIP1559 ensures stable rewards for PoS Validators in ETH 2, allowing validators to be protected from the inherently volatile fee markets that all crypto-economic system have. EIP1559 does this by distributing all revenue to shareholders. It redistributes profits from stakers to all ETH holders equally.

When Ethereum receives less revenue (fees) than its expenses (security budget), it operates at a loss. Regardless of revenue, Ether is issued to compensate validators for security. This means that Ether validators are compensated even when revenue is low. If EIP1559 does actually increase the cost of fees, it will be because it increased the price of Ether. Checkmates argument here is that fee cost tracks Ether price, and if Ether price goes up, then fees will go up. Remember what we are arguing here: the moneyness of an asset is a function of its value. If the value of Ether is high, then its liquidity is high, and so is its moneyness. Checkmate seemingly accidentally admits that EIP1559 will work in helping Ether generate moneyness ¯\_(ツ)_/¯

3. Engineered Liquidity

Bitcoin is the worlds first internet-native asset. The big exchanges like Coinbase, Wyre, Gemini, Kraken, and services like LocalBitcoins is where Bitcoin’s liquidity is expressed. Exchanges like this are also where Ether finds its external liquidity.

External liquidity: Liquidity between an asset and the rest of the world. Basically all assets ever have only ever had external liquidity.

Internal liquidity: Liquidity between an asset and its own native ecosystem. Ethereum is the only ecosystem in existence to have an internal ecosystem.

There is nothing inherently different between Ether and Bitcoin from an external liquidity perspective. They both depend on the same infrastructure: on-ramps and exchanges. While Bitcoin is currently leading in this domain, it does not have access to its own internal liquidity domain like how Ethereum does.

Ether can generate its own internal liquidity. As someone who holds a significant amount of their crypto-wealth inside of a Maker CDP, I’ve experienced the benefits of internal liquidity first hand. Mint DAI in Maker, exchange for ETH on Uniswap in 1 minute. Never touch an entity that has the ability to censor you, or requires KYC for their services.

Being able to swap between ETH/DAI with good liquidity is the first step to generating a self-fulfilling economy where people do not have to leave. For me, there have been many instances where I want to buy ETH, but I don’t want to wait 5–7 days for my funds to clear. I can buy ETH with DAI from my CDP, and then sell-and-repay X-days later, thanks to Ethereum’s internal liquidity.

With this:

- I achieved what I needed

- I paid fees to Ethereum

- I paid fees to Uniswap.

Also, when users like me pay fees to Uniswap, it becomes more liquid.

Uniswap is Infrastructure illustrates the feedback loop this creates:

Uniswap scales with the economic world around it. The size of any given market is correlated with the volume of exchange that flows through it.

- The more volume a market has, the more fees that market collects (0.3% on every trade.

- The more fees a market collects, the more incentive there is for people to provide liquidity.

- The more people provide liquidity, the more liquid Uniswap is.

- The more liquid Uniswap is, the more it’s used by more participants making larger trades.

- When more participants make more, larger trades, the total fees in that exchange go up. Repeat bullet #2

Let’s not forget what this debate is about: Ether achieving monetary status, and that money is liquidity. Money is whatever the worlds most liquid asset is, and Uniswap represents an internal piece of infrastructure that makes Ether more liquid.

To further emphasize, liquidity is a function of total market cap. An asset with a market cap of $100 is inherently illiquid. An asset with a market cap of $100 Billion is extremely liquid. Price is a function of liquidity. Remember this:

- All Uniswap markets are ETH denominated. When ETH price goes up, all of Uniswap becomes more liquid.

- When ETH price goes up, ETH becomes more liquid.

- When ETH price goes up, the ETH/DAI market on Uniswap becomes more liquid by a factor of both of [1]x[2]. These effects are multiplicative, not additive. When ETH price goes up, ETH in Uniswap is exponentially more liquid.

And money is liquidity.

Ethereum will engineer its own liquidity, and therefore its own moneyness.

This chart represents ETH’s path towards being money.

4. Engineered Fairness

A common theme among Ethereum critics is the unfairness of its issuance and distribution. While a thorough analysis illustrates that the Ether ICO had a pretty ideal level of distribution/fairness, critics will say that an ICO is an inherently unfair way of distributing neo-money, and that a premine/ICO is automatically ruled-out for being money. To me, this is simply ignoring real-world data that we can actually use to measure “was the ETH ICO fair, or not fair?”.

I am a fan of metrics and data over is-ought comparisons, and when Ether’s gini-coefficient matches Bitcoins, that is satisfactory to me.

However, DAI represents the most fair currency of them all.

The deposit of an asset, and the corresponding issuance of credit backed by that deposit, has been a fundamental mechanism for the creation of money since the earliest emergence of modern financial systems. This truth is difficult to concisely illustrate, but David Graeber in his book Debt: The First 5,000 Years does a good job illustrating this.

David begins at how the institutions of “debt” and “credit” began as hunter-gatherers simply doing favors for each-other, and then the recipient of said favor would then be “in debt” to the issuer of the favor. In small hunter-gatherer tribes, those that received more favors than they issued were considered baggage, or “un-creditworthy”, and others would stop doing favors for them due to the assumption that their efforts would not be repaid from this individual.

MakerDAO is a globally-scalable system of enforcing debts and credits.

Those with ETH collateral can go to MakerDAO and issue a “promise-for-future-work”, aka DAI. Because MakerDAO is 150% collateralized, there is never any worry that any individual is “un-creditworthy”.

The existence of money is inherent to the institutions of debt and credit, and MakerDAO has generated a system of perfect money: money with creditor guarantees.

Have a problem with ETH fairness? Fine, use DAI. Also, it’s stable.

Addressing Checkmate’s concluding points

Lastly, I will directly address Checkmate’s conclusions directly.

As a concluding summary, the Ethereum project suffers from a combination of:

- A relatively centralized governance and an unsound monetary policy with signs this will only deteriorate in time.

This is an Is-Ought fallacy. First off, is Ethereum governance really all that centralized? To some decree, yes. Any consensus around changing/updating requires centralization. Ethereum monetary policy is being ‘centrally’ changed, but according to a social contract. If you believe Hasu, all crypto-economic systems are enforced by social contracts, including Bitcoin. The Ethereum social contract is minimum necessary issuance (MNI). All changes to Ether issuance fits inside this social contract. If this wasn’t the case, then I would be much more concerned with Ethereum’s monetary management, however there has never been a change to Ethereum’s monetary policy outside of MNI.

- The latest experiment of EIP1559 which seems to be at odds with the needs of all users except those who currently hold ETH. This makes for an unfair system and makes user transactions increasingly undesirable on-chain due to fee inflation.

I addressed this above. “…seems to be at odds with the needs of all users except those who currently hold ETH”. How is this any different from early holders of BTC? Early Bitcoin holders received disproportionate access to the upside of BTC scarcity. Sure, Bitcoin can have the warm-fuzzy feeling of equitably of issuance from the nature of its protocol, but if Ether can be favorably compared as equitably distributed via data and metrics (hint: it is), then I therefore think that this argument is not nearly as strong as the series of ‘engineered moneyness’ I’ve illustrated above.

- Order of magnitude greater attack surface compared to Bitcoin due to protocol complexity, Turing completeness, developer back-doors and centralised oracles.

If you accept the premises in Two Faces of Ethereum and Ether is Equity, then you agree that Ethereum perpetually trends towards solving these issues. If the worries illustrated in this critique are valid, then Ethereum apps will organically shift away from their current state, into a state on Ethereum’s application landscape that is more conducive to their survival.

- Persistent changes to narrative, project direction and experimental features which over time, are consolidating on the Bitcoin narrative of sound money anyway.

There is no proof that a sound narrative around monetary policy actually creates moneyness. This is a fabricated narrative that Bitcoiners have used to deadly effect from 2015-current, but IMO this narrative has reached the end of its days. What matters is facts and data, not narratives and memes. Data and facts are the kryptonite to memes and narratives.

- Over-reliance on third party applications, which can be stopped, to accrue value to the ETH token. The non-capped supply and fluidity of monetary policy require this mechanism.

Ignore Web-3 at your peril. DeFi owes no homage to Ethereum. DeFi as a concept is larger than Ethereum. However, there is so far no other platform for DeFi to exist on. Until some real competitor comes to eat Ethereum’s lunch, Ethereum has a monopoly on DeFi, and will fill the void that demand for DeFi creates. When Checkmate says “over-reliance on third-party applications”, I hear “Ethereum can engineer itself what it needs to become money, and no other protocol is positioned to do this.”

- Constant threat of any and all centralised pools of ETH (including custodial DeFi apps) becoming, or being transferred by hack, to an adverse PoS validator.

With finance comes risk. I will gladly take on this risk if it means my protocol-of-choice can have apps. Ethereum is a Hydra. We saw what happened with EtherDelta: centralization created weakness. However, EtherDelta was replaced by Uniswap, which has 0-centralization risk by design. To the decree that this is a legitimate concern, it is answered by the potential of all Ethereum apps to be replaced or subsumed into a new application that is simply better and more resistant to attack.

- Culmination of second system syndrome in the need for an entire rebuild of the base blockchain. This is an immense feat of rolling one chain into another and will take years.

Defined: The second-system syndrome is the tendency of small, elegant, and successful systems, to be succeeded by over-engineered, bloated systems, due to inflated expectations and overconfidence.

The idea is that Ethereum is trying to “be a better Bitcoin, via an over-engineered, expensive, high-maintenance system”.

The original illustration of second-system syndrome (SSS) came all the way back from 1975. To me, it’s easy to understand the lessons of SSS, and fix them before they become issues. Contrary to the false narrative peddled by some Bitcoiners, syncing and running an Ethereum full-node is trivial. Bitcoiners are right in that Ethereum 1.x needs changes in order to keep this being true. But rather than just updating 1.x, Ethereum plans on generating Ethereum 2.0, to introduce a whole set of new features and characteristics.

To Checkmate: Ethereum’s need to roll into ETH 2 is a result of its ever-growing technical debt

To Me: Ethereum is a financial system that updates and upgrades, based on research in crypto-economics and consumer demand. Moneyness in ETH is a product that can be iterated and improved upon!

“Why Ether Will” Conclusion

1+2+3+4 points illustrate reasons as to how Ether will engineer itself into money.

You might say: “David, you just listed bull-cases for why Ether will be valuable, not why Ether will achieve monetary status”… to which I say: that is the same thing.

Always remember the following:

- Moneyness is Liquidity

It does not matter how it came about, it just matters that it is. If something is the most liquid thing on Earth, it is money. - Liquidity is a function of value

High total value of an asset makes it more liquid - No other protocol can engineer itself into both liquidity and value

Uniswap = Engineered Liquidity. All DeFi apps = Engineered Value. Which do you prefer, engineered liquidity or memed liquidity? - The common Bitcoiner criticisms of “why Ether won’t be money” are is-ought arguments, and not is-will be arguments

The are two ways to generate money. Passive adoption, or engineered characteristics.

Bitcoiners generally believe that Bitcoin adoption will happen all by itself, and represents a system being passively adopted from Day-1.

Bitcoin is following a gold-model, that is simply not innovative or useful enough for todays information age. People want their problems solved, and a protocol that can engineer itself to solve problems will be able to discover product-market fit by simple iteration and testing. So far, Ethereum’s application layer has been a constant discovery process of finding product-market fit for Ether. Looking across Ethereum’s 5 year history, it is obvious to me that the apps that are finding product/market fit on Ethereum are the ones that are using ETH as money.

Good luck fighting against a system that upgrades itself to its needs, and the world needs a programmable store of value asset, that finds ways to make itself more useful.

Action steps

- What’s the case for ETH sustaining & growing its monetary premium?

- Which of points in this bull case have the most merit?

Author Blub

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his recent talk on how ETH accrues value and this accompanying post. (RSA note: this video one of two 4 x 🔥I’ve ever given—highly recommended)

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

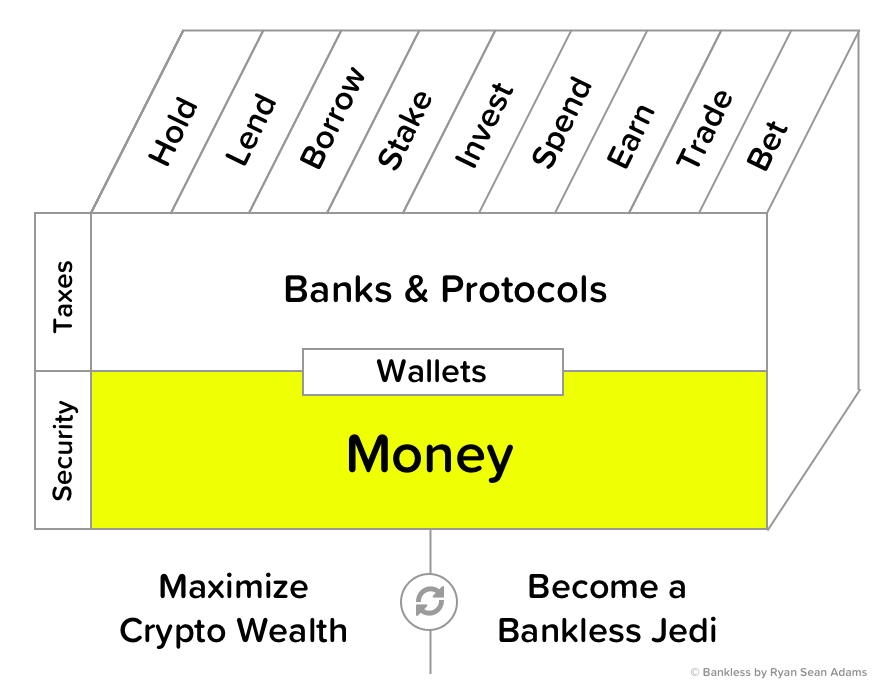

Filling out the skill cube

You’ve leveled up on the Money layer of the skill cube today. Making the right money bets is the single most important thing you can do for your crypto portfolio.

👉Send us a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.