Reminder: if you’re not a paid subscriber this is your last day on the full program! Subscribe now & get 20% off forever to keep leveling up.

Dear Crypto Natives,

Do you remember The Battle of 5 Armies from the Hobbit?

An army of dwarves from the Lonely Mountain vs the armies of humans and elves. Three armies on the field primed to fight—treasure and honor at stake. They were different tribes with different values, no chance at peace.

Then a new challenger appeared…two orc armies streaming down from the mountains. Claws, teeth, blades, wolves—they want to kill everyone.

So the dwarves, humans, and elves suddenly find common ground. They band together against a common foe. And The Battle of 5 Armies begins.

Above: orc armies facing off against elves, humans, and dwarves—or is this actually a depiction of crypto vs traditional finance?

This reminds me of crypto.

The crypto banks and money protocols fighting for the same treasure. They have similar services—credit, interest, stablecoins, exchange, assets—but with different approaches. One permissionless the other permissioned. Irreconcilable differences.

And they’re primed to fight.

Then a new challenger appears…the armies of traditional finance & central banks.

Does that paint a picture? Context for today’s thought piece.

- RSA

THURSDAY THOUGHT

Crypto banks vs Money Protocols

I think crypto banks and money protocols are destined to compete. They competing now. And the competition will continue to intensify.

Banks and protocols?

If you’ve been with me for a while you know I use the term crypto banks for centralized exchanges like Binance, BitMex, and Coinbase and lending providers like BlockFi and crypto.com.

Money protocols—these are Maker, Uniswap, Set, Compound, Synthetix. They provide similar services as the crypto banks, but they’re built as permissionless and programmable protocols on Ethereum.

Both use crypto as a money layer. They’re both part of the crypto finance system. But crypto banks are closed state and closed source—you need to ask permission to use them. Money protocols are open state and open source—no permission required.

Crypto banks have been around since the early days of crypto. But money protocols emerged on Ethereum. They need programmability to thrive.

The competition for capital

The banks and the protocols compete for capital.

- (Trading) Coinbase + Uniswap compete for liquidity and volume

- (Lending) BlockFi + Compound compete for lending capital

- (Stablecoins) USDT + DAI compete for stablecoin capital

- (Derivatives) BitMex + DyDx compete for derivatives

- (Investing) Bitwise + Set compete for index fund capital

The game is to capture as much value as possible. The currency of web 2 is data. Google, facebook—these are data aggregators. But the currency of crypto is capital. Like, actual money. So to be a successful bank or protocol in crypto you must be a capital aggregator.

Advantages and Advantages

Now it’s absolutely true that crypto banks dominate money protocols in users and capital. There’s a large gap. But keep in mind, money protocols are young. Maker is alpha. Compound is barely a year old. And yet already a combined capital pool of $500m? It’s incredible growth actually.

Crypto banks have had a few advantages:

- User experience (but wallets like Argent are narrowing the playing field)

- Liquidity (but protocols are global and don’t split liquidity with geofencing)

- Fiat-on ramp (but Wyre & others are making on-ramps available to protocols)

- Speed (but there are technologies in progress that may narrow this gap too)

And money protocols have advantages too:

- Global (instantly accessible to anyone in the world with an Ethereum address)

- Non-custodial (custody of the assets generally stays with the user)

- Programmable (able to be combined like money legos to create new products)

- Permissionless (build on them, fork them, use them—no permission required)

Some money protocols have even reached high degrees of decentralization. Uniswap is a purely trustless exchange—just you, some code, and the public ledger. This gives resilience against censorship and regulatory pressure. And afterall, to unstoppable money don’t you need unstoppable banking?

Remember the $20B ICO frenzy? Scams and silliness, yes. But also, an example of how a dumb, blind, neutral, money protocol can do something that the crypto banks can’t. With ERC20 anyone can launch a token. Just like anyone a launch a website. And as the internet taught us—permissionless is powerful.

So while there’s a gap between protocols and banks today, things in this space can change fast. Today’s kings become tomorrow’s dinosaurs.

Looking into the future

Crypto money at the base with banks and protocols on top—that’s everything. That’s the crypto money system. So it’s important ask ourselves, how will this banking layer pan out?

Here are some possibilities:

Blurred lines—as the banks and protocols complete for capital lines will blur. Banks will become more like protocols. Protocols will become more like banks. There’ll be hybrids. Binance launching its own chain? An attempt to become a protocol. Maker launching multi-collateral DAI—the risk assessment required to evaluate collateral move it a bit closer to the function of a bank, will they become more bank-like from here?

Banks will copy protocols—Binance is my favorite example of this strategy in action. They let the money protocols test ideas, then followup with permissioned versions of the good ones. Launchpad and IEOs? Their version of ICOs. Binance chain? Their version of Ethereum. BNB as a reserve asset for the Binance economy? Their version of ETH. How soon until we see a Binance version of Compound?

Banks will integrate protocols—this is actually my longer-term expectation. I think banks and protocols will work together. Banks will provide borrowing services using protocols like Maker. They’ll list Set tokens. You’ll have the ability lend on Compound directly from Coinbase. The Crypto banks will build on money protocols just as they’ve built on BTC, ETH, and ERC20s. And in the transition, I expect non-custodial money protocol aggregators like InstaDapp and Zerion to carve out a space.

Keep a close eye on the banking layer. It’s important. Your bank bets exist in this layer. And depending on what happens here, either the BTC path or the ETH path to money becomes more likely.

Crypto vs. the world

So if you zoom out, the battle isn’t really between money protocols and crypto banks. These will grow together, even while they compete, they’ll help each other.

No, it’s open finance vs traditional finance. Crypto vs fiat. A system fully reliant on banks vs a system that’s more reliant on protocols. More banks vs. more bankless.

Like the Battle of 5 Armies. At some point, the orcs are going to show up and it’ll just be crypto money vs. legacy finance.

Action steps

- Consider: how will crypto banks and money protocols compete & work together?

- How does this insight shape how you evaluate your “bank bets”?

Continue leveling up. $12 per month. 20% off if you subscribe before tomorrow!

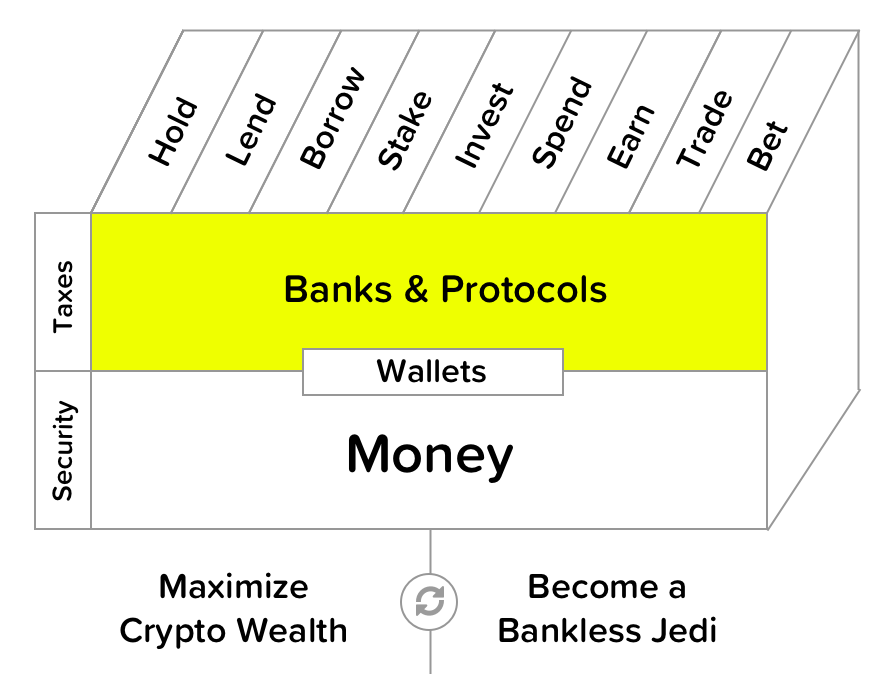

Filling out the skill cube

By understanding the dynamic between crypto banks & money protocols you’re leveling up on the banking layer of the skill cube. Keep at it!

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.