Rise of the Cryptodollar

Dear Crypto Natives,

You can get a Dai savings account at 7.5% interest—but will this rate go up or down?

For those who prefer bank stablecoins you can get USDC at 4.8% on Compound—but will this rate move with the DAI rate?

And what about this crypto bull market we’re entering. Will that affect rates?

So many questions.

This is the cryptodollar market. We’ve witnessed its rise to billions already—I fully expect trillions some day. We need to understand it. Thoroughly.

Josef Tětek just wrote the best piece I’ve ever read on this subject. It’s today’s thought piece. This answers your questions.

Level up on cryptodollars. We’re going bankless.

- RSA

Post by: Josef Tětek, analyst at TopMonks

Over the past two years we’ve witnessed the massive growth of DeFi services from a tiny niche to a slightly bigger niche (yes, it’s still quite small). While a lot has been written about various lending and derivatives services, there hasn’t been much of a discussion on the nature of the DeFi interest rates. In this article, I would like to open a discussion about the building stone that is integral to many current DeFi services - and will be even more important when/if DeFi outgrows its niche status.

What is a cryptodollar?

First, what is a cryptodollar? While the term itself is new (at least I haven’t seen it used before), it may be useful, because of the similarity of stablecoins with eurodollars. Here’s an eurodollar definition per Investopedia:

“The term eurodollar refers to U.S. dollar-denominated deposits at foreign banks or at the overseas branches of American banks. Because they are held outside the United States, eurodollars are not subject to regulation by the Federal Reserve Board (...) The fact that the eurodollar market is relatively free of regulation means such deposits can pay higher interest.“

Eurodollars are dollars held in foreign banks, thus not subject to various US regulations (though that has been changing in the past years with legislation such as FATCA). Cryptodollars can be thought of as further iteration of eurodollar—instead of dollar deposits being held in foreign banks, dollar-like deposits are held in crypto wallets and services. The underlying motivation is the same: to undertake financial operations denominated and settled in dollar value, without the heavy burden of US financial regulation. Such regulatory arbitrage seems to have worked so far, for Tether, USDC and DAI. All these are being used as a dollar surrogate within CeFi and DeFi services, usually without any KYC/AML.

MakerDAO and the Impossible Trinity

Now, what kind of cryptodollars do we have? The largest one seems to be USD Tether. Though Tether has been so far playing a successful hide and seek with the regulators, Tether is still relying on existing banking infrastructure, since its model is an IOU one. All the tokens in circulation are backed by dollars kept in a bank account. So Tether among with other IOU stablecoins are not real cryptodollars, the more appropriate term would be something like “tokenized eurodollar”.

The most important true cryptodollar is thus MakerDAO’s DAI. DAI is the largest crypto-collateralized stablecoin and doesn’t need lengthy introductions here. What’s interesting about DAI is that to keep its peg, an indirect mechanism is necessary - because DAI itself is not generally redeemable for the underlying collateral (with the exception of CDP owners). This indirect mechanism is the stability fee, which acts in the same manner as a loan interest rate (as it is defined as a per annum interest payment on the principal).

So how is the stability fee determined? Based on the deviations of DAI market price from the $1 peg. MakerDAO is sometimes called a central bank (here by Rune Christensen himself), but that’s actually not correct. MakerDAO is a currency board. What this means is the only real mandate of MakerDAO, similarly to real-world national currency boards, is to keep the exchange rate of its currency (DAI). Extrapolating on that, stability fee is simply a function of the DAI deviations from the peg:

- If DAI moves below the $1 peg, stability fee has to increase to shrink the supply

- If DAI moves above the $1 peg, stability fee has to decrease to inflate the supply

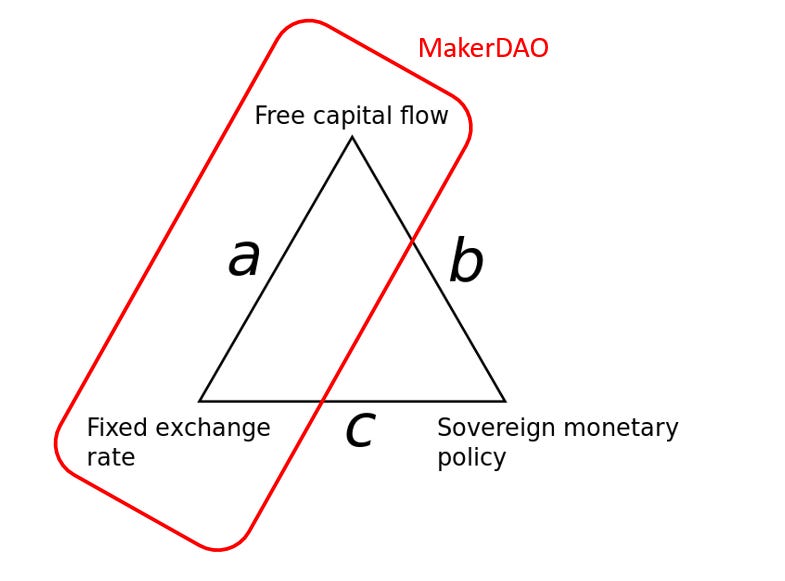

In macroeconomics, Impossible trinity is used to describe various monetary regimes. The trinity reflects that any regime can have only 2 out of 3 features: free capital flow, fixed exchange rate, sovereign monetary policy. Since MakerDAO is a currency board (keeping the exchange rate fixed at all times) and doesn’t restrict capital flows, it cannot have a sovereign monetary policy. The deviations from the peg simply dictate the monetary policy.

Image source: Wikipedia (author’s modification).

This lack of sovereign monetary policy can have some major implications for the whole DeFi space because, as we’ll next see, DAI stability fee is the driver of interest rates within DeFi.

Cryptodollar interest rate

DAI launched at the end of 2017 and became the first stablecoin adopted by various following DeFi projects. The most relevant DeFi projects from the interest rate standpoint are the money markets (MM), where users can deposit and borrow different Ethereum-based assets. By money markets, I mean Compound and dYdX, two largest money markets in existence.

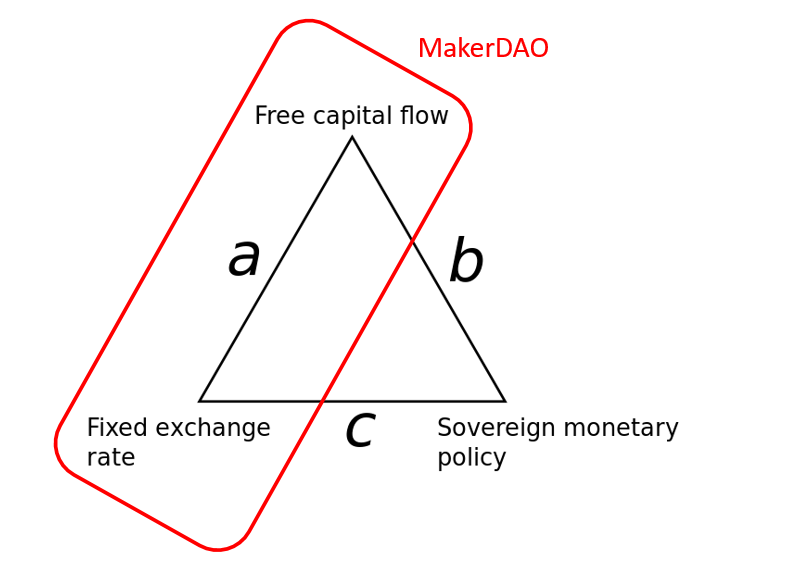

Let’s see how the first MM interest rate—DAI supply APR in Compound—behaved in the context of DAI stability fees:

(note on data: all the MM data in this section come from Loanscan API; all the MM rates are smoothed to 7day moving averages)

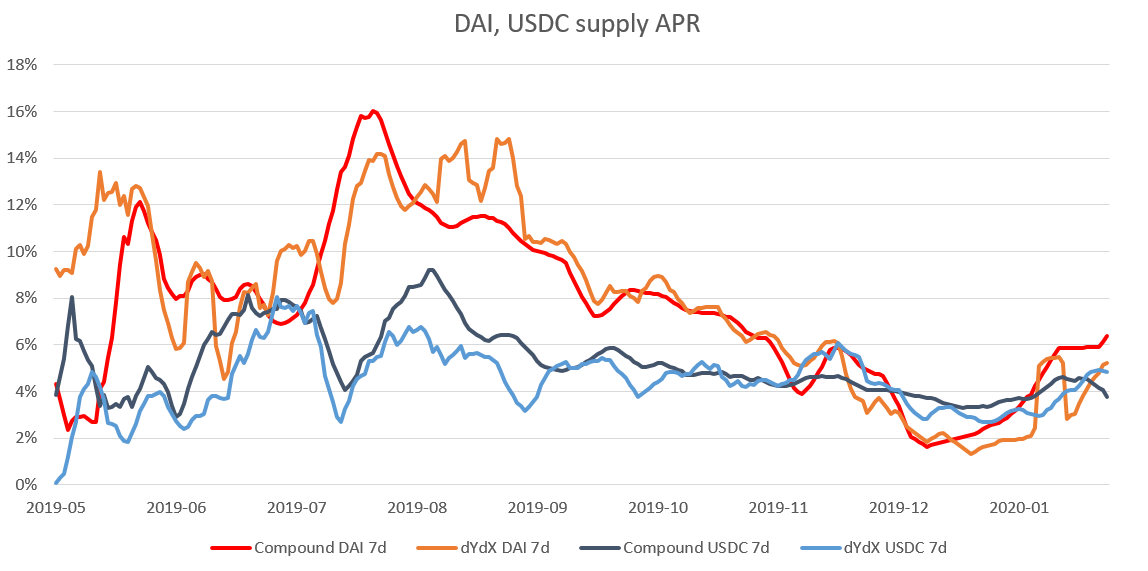

We can see the correlation between the stability fee and Compound supply rate, which grows stronger over time. The correlation coefficients are 0.71 since Compound launched and 0.90 in the past 6 months (you can find the overview of all the correlations at the end of this section). Why is that?

Simply put, all the DAI in existence come from CDPs, where someone has minted the DAI and is liable to pay the stability fees. CDP owners usually sell their DAI on exchanges (mostly to build up a leveraged long position on ETH), and from there some of the DAI finds its way to money markets. Supply rates (the rate that lenders earn) on the money markets have to be at the same level or lower than the stability fee. Otherwise, it would act as a free money printing press. Borrow rates stay more or less in line with the stability fee so that the cost to borrow DAI is similar for both the CDPs and the money markets.

And of course, since December, Compound confirmed the causality between stability fee and Compound rates by utilizing DAI savings rate for unborrowed deposits, thus directly pegging the rates to stability fees. Robert Leshner wrote that “MakerDAO will effectively control the interest rates of cDAI through the MKR voting process.”

Let’s see if there are other correlations—between DAI and USDC, and between both stablecoins at different money markets.

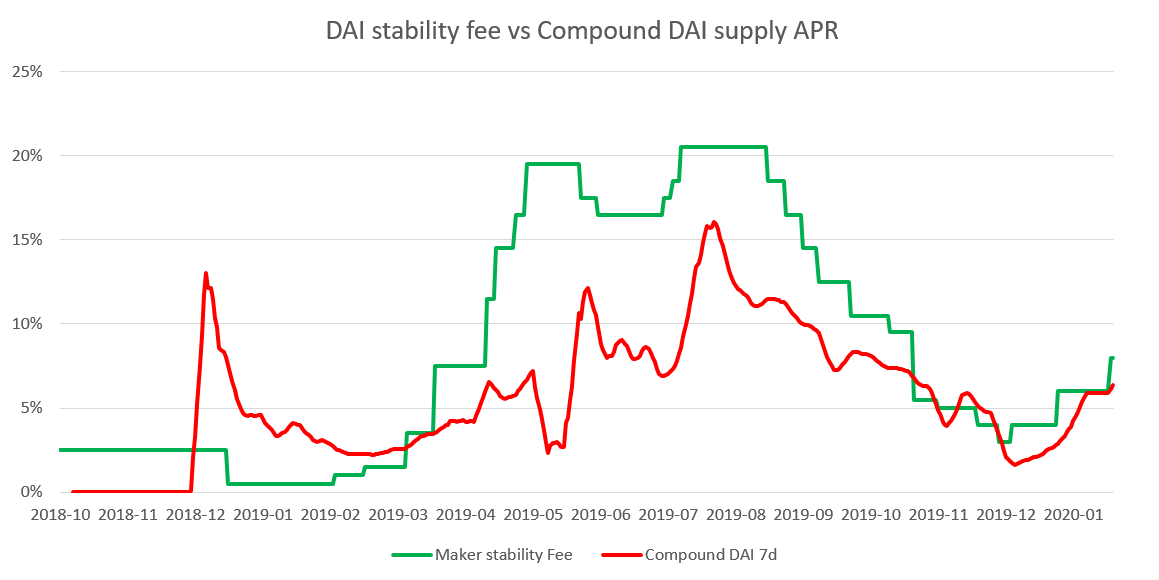

In the following chart, we have added USDC supply rate at Compound to the previous picture:

Although the USDC rate is consistently lower than the DAI rate, the correlation with the stability fee is still there: the correlation coefficient is 0.69 since the launch and 0.83 in the past six months.

Now let’s compare all the stablecoin rates on the two money markets (chart begins in May 2019, when the v2 protocols of respective money markets were launched):

While this chart may seem a bit messy at first, we can observe how the two money markets (Compound, dYdX) and the two stablecoins (DAI, USDC) gradually converge over time.

At first, the sync occurred for the same asset across money markets (DAI on dYdX & Compound), then across the assets (DAI and USDC). In short, as the money markets attracted more capital, the noise of various interest rates consolidated into a signal - the cryptodollar interest rate.

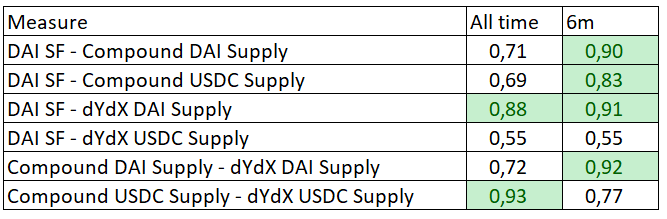

Here are all the correlation coefficients:

While not perfect, most of the supply rates in the past six months (Sep 19 to Jan 20) are heavily correlated with Maker’s stability fee, and also highly correlated among each other, across the money markets.

The takeaway from this section is this:

Interest rates across stablecoins and money markets are converging as the market matures, and are highly correlated with Maker’s stability fee. The stability fee is essentially the cryptodollar interest rate.

Drivers of the cryptodollar interest rate

Note: data in this section are sourced from Cryptocompare API. DAI prices in the charts are aggregated from hourly averages.

Let’s now explore what the drivers of stability fee fluctuations are. As we’ve explained above, MakerDAO doesn’t have a sovereign monetary policy; deviations from the peg are the triggers that force the Maker foundation & MKR holders to change the stability fee.

But what causes the peg deviations? Mostly speculation and overall market sentiment (relating to ETH, since it is the main source of DAI collateral, and will probably remain so for a long time):

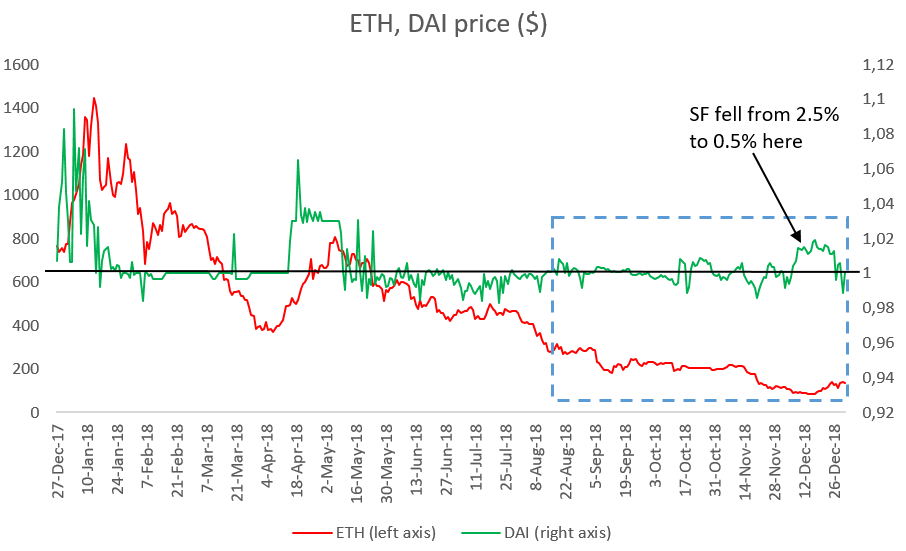

1) when the sentiment is predominantly bearish, there is a higher demand to hold stable assets such as DAI. Fewer speculators open CDPs to build leveraged long positions (on the contrary, they are more likely to close previously opened CDPs in order not to get liquidated due to the falling price of their collateral). In short, there is more demand to hold DAI and lower supply of DAI. DAI can be observed to rise above the peg and stability fees can be very low. We can see this happening especially by the end of 2018 (highlight in the blue box), during the final leg of ETH price dump:

Of the 141 days between Aug 13th and Dec 31st (highlighted in the blue box), DAI stayed above the peg for 84 days (60% of the time), while ETH price went from $318 to the low of $83. Stability fee was set between 0.5-2.5% all through this time. It was hiked to 2.5% in August, when DAI was below the peg (speculators were probably counting on the bear market being over and were selling DAI for ETH), only to be lowered again to 0.5% as ETH kept on dumping.

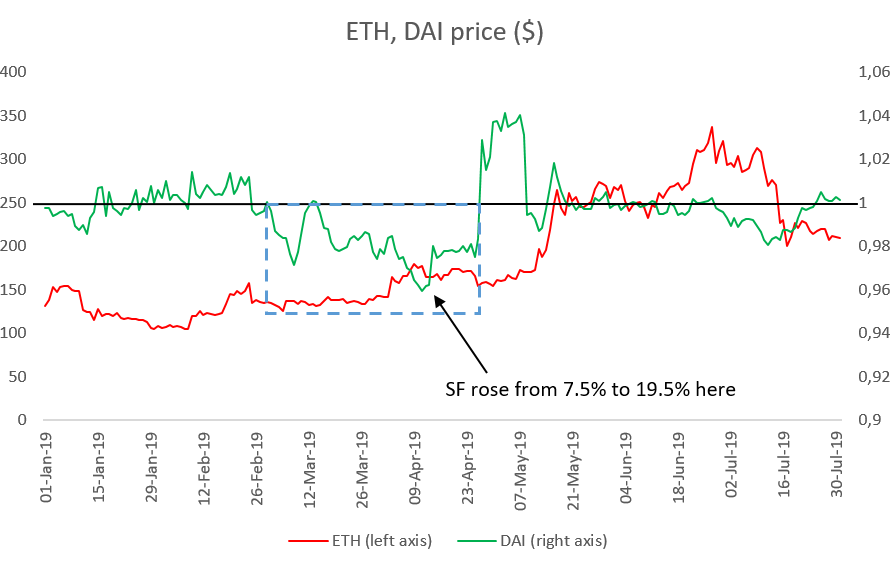

2) when the sentiment is predominantly bullish, the demand to hold stable assets such as DAI is weak. Speculators are prone to open more CDPs and mint more DAI, especially as ETH collateral keeps on rising and thus increasing its borrowing power. As crypto price rallies can be pretty massive, absorbing a stability fee in double-digit terms (per annum) isn’t such a concern for the speculators—ETH price rise can more than pay for it! We can observe the situation of ETH rallying and DAI falling below the peg during spring of 2019. Notice how DAI declined below the peg when ETH rallied (highlighted in the blue box):

Right after the rally started and DAI fell under the peg, the stability fee rose from 7.5% to 19.5% (in 20 days from Apr 14th to May 3rd). This massive hike in stability fees then stabilized DAI price, as we can see at the right part of the chart. Before the stability fee hike, DAI stayed below the peg for 54 days out of 57 total in the period (95% of the time), while ETH went up from $137 to $171.

The simple heuristic we can derive from the observations is this:

- when ETH rallies, expect stability fees (and consequently other cryptodollar interest rates) to rise and stay high—they have to rise to keep DAI from falling below the peg

- when ETH dumps, expect stability fees (and other rates) to fall and stay low—they have to fall so that DAI doesn’t remain above the peg

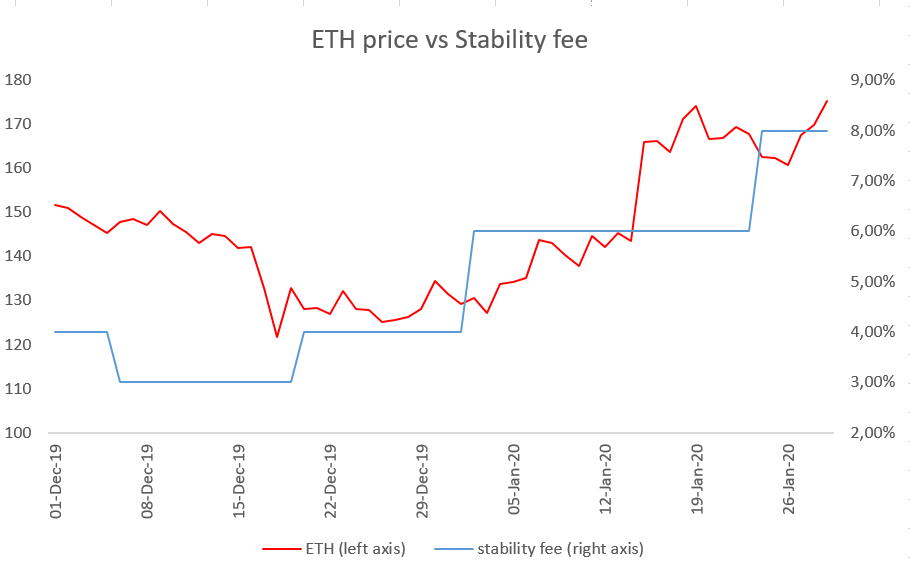

And of course, we can see this playing out already since the beginning of 2020—as ETH price rose from $120 to $170, so did the stability fees (from 4% to 8%). Here is the chart of ETH price vs stability fees since the beginning of December 2019:

DAI held the peg tightly over this period, probably owing to the stabilizing effect of newly introduced Dai Savings Rate (DSR), which is the interest rate paid to DAI holders, either in Maker’s Oasis app or on Compound or various wrappers like Chai.

Conclusion

In this article, I aimed to demonstrate the correlation between interest rates of the two stablecoins used on the two most used DeFi money markets, and the origination of the cryptodollar interest rate. I claim that the cryptodollar interest rate originates in stability fees; stability fees aim to minimize the deviations of DAI from the peg, while the deviations reflect ETH price sentiment.

The conclusion is that interest rates in current DeFi can be expected to rise massively in times of sustained ETH rallies, and collapse in times of ETH bear market. One of the implications is that borrowing in DeFi remains to be viable only for speculative purposes, as few other use cases can sustain the high borrowing costs in the times of bull markets. On the other hand, lending can become very lucrative, and high-interest rates may even offset the various risks of DeFi smart contracts. How high could the interest rates rise? During the last leg of the 2017 bubble, the funding rates on BitMex reached more than 1% daily on some days—indicating that speculators are willing to swallow interest rates of about 400% per annum when the market rallies.

We can expect the cryptodollar interest rates to stabilize when ETH itself becomes more price stable. In fact, the cryptodollar interest rate can be understood as a prediction market for yearly price appreciation of ETH—if speculators are for example willing to pay 20% stability fees per annum, they expect ETH to appreciate by at least 20% in a year. Once ETH stabilizes and the expectations get moderate, the cryptodollar interest rates will follow suit. One of the stabilizing elements can be the ETH 2.0 staking, which provides us with better estimations of ETH fair value, e.g. through discounted cash flow analysis. And on the other hand, as Tarun Chitra/Haseeb Qureshi have pointed out, the cryptodollar interest rate will play a huge part in staking economics.

Action steps

Test yourself:

What is a cryptodollar? (A: USD on crypto rails)

What sets the cryptodollar interest rate? (A: Maker stability fees)

When ETH rallies do cryptodollar interest rates go up or down? (A: Up!)