The Final Puzzle Piece to ETH’s Monetary Policy

Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

You probably know the broad strokes of Bitcoin’s monetary policy. But what about Ethereum’s?

Lots to publish on this. In short: I think ETH’s monetary policy is vastly underrated and massively misunderstood relative to BTC’s.

So I’ve asked David Hoffman to tell us more about a soon to be implemented Ethereum proposal that solidifies ETH’s place as a reserve asset and removes any lingering threats of economic abstraction—the final puzzle piece as he puts it.

David is one of the best I know at synthesizing details and presenting clear mental models for topics like this. So reading this is sure to give you a clearer picture on ETH’s path to money.

- RSA

P.S. All slots full for Wave 2 of the Inner Circle invite—congrats to all who got in!

THURSDAY THOUGHT

Ether Economics of EIP 1559

Guest post by: David Hoffman, Chief of Operations at RealT and host at POV Crypto

EIP 1559 is a Ethereum Improvement Proposal submitted by Eric Conner (follow on twitter). I recommend reading this short (4-min) article from Eric about EIP 1559, as a precursor to this article.

👉Read Eric’s EIP article (4 mins)

EIP 1559 does two main things:

- Establishes “the market rate” for block inclusion

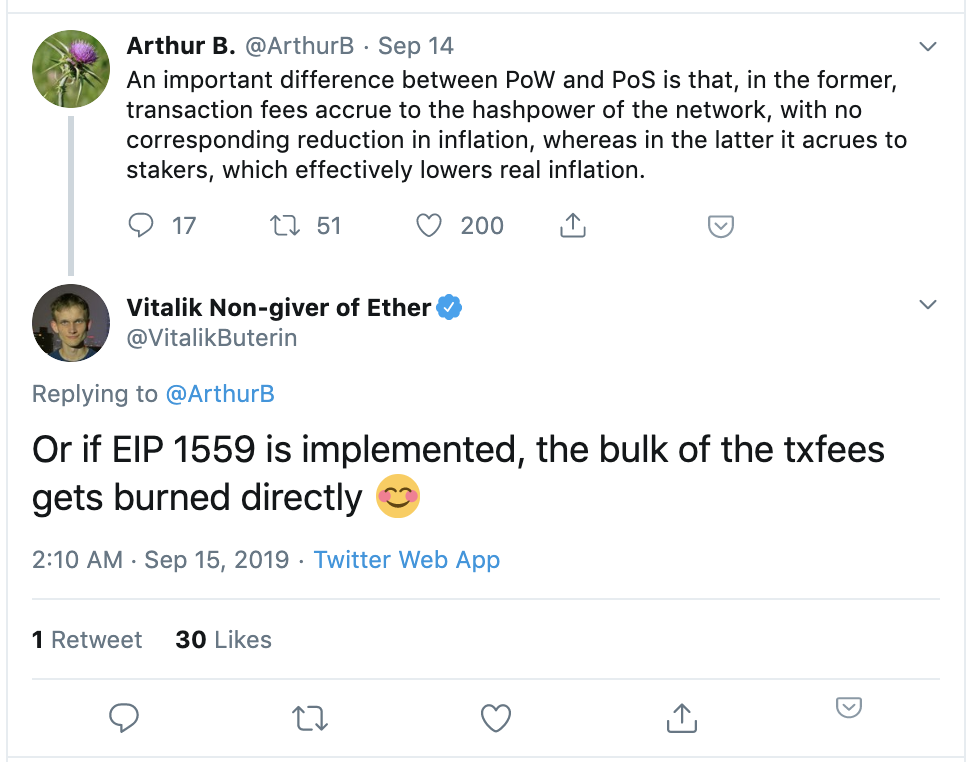

- Burns the majority of the ETH in the transaction fee

This change to Ethereum’s gas management has significant implications to the monetary system of Ethereum, which is explained in this article. EIP 1559 is the final piece of the puzzle in Ethereum’s monetary policy.

Burning the bulk of the ETH in transaction fee:

- Provides a deflationary mechanism to Ether’s supply, which adds to the scarcity of Ether and long-term security of Ethereum.

- Benefits all Ether holders equally, rather than exclusively benefiting validators.

The purpose of EIP 1559, according to Eric Conner, is to provide wallets and users a much needed improvement to the user-experience of gas management. Knowing how much to spend on gas in order to pay for one’s transaction is a UX issue that plagues Ethereum. Eric (rightfully) claims that the auction-style mechanism is highly inefficient and leads to gross-overpayment to validators. EIP 1559 and its BASEFEE mechanism was designed specifically to address this.

However, EIP 1559 is much bigger than that. The way that EIP 1559 solves the gas-management problem also improves Ethereum’s monetary management system. EIP 1559 ‘completes the circle’, ‘finishes’, or ‘syncs up’ Ethereum’s monetary policy to what it should be:

A recreation of a traditional nation-state economic system, but replacing the nation state with code.

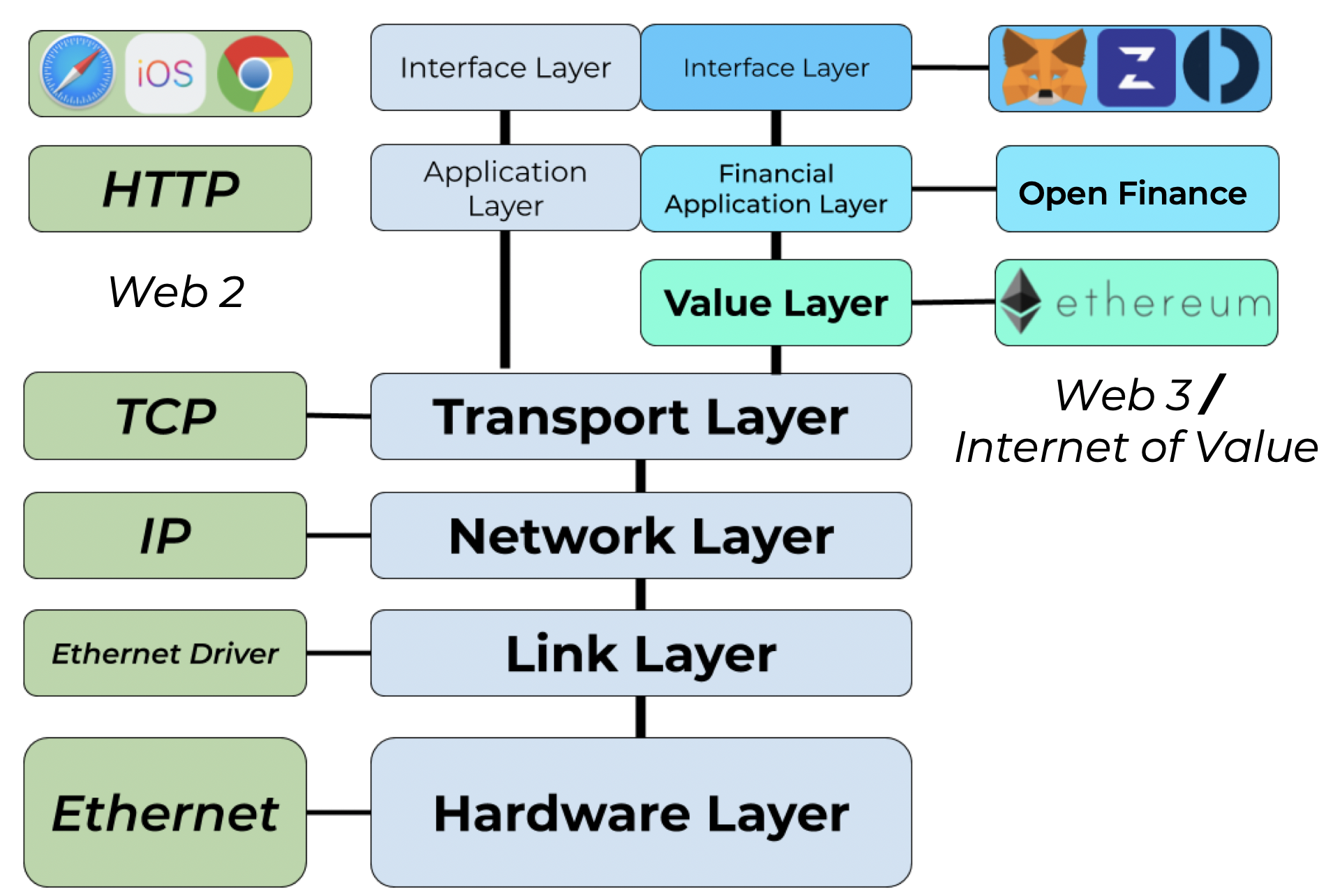

This has always been Ethereum’s primary goal; to create an alternative economic system on the internet. Using code, we can design for the same institutions found in the traditional world (banks, credit-markets, borrowing/lending institutions, exchanges) but on Ethereum. Importantly, we can design them without the need for human involvement, removing the need for bureaucracy, management, oversight, or rent-seeking.

What EIP 1559 actually does:

Algorithmic gas estimation: ‘The Market-Rate for Gas’

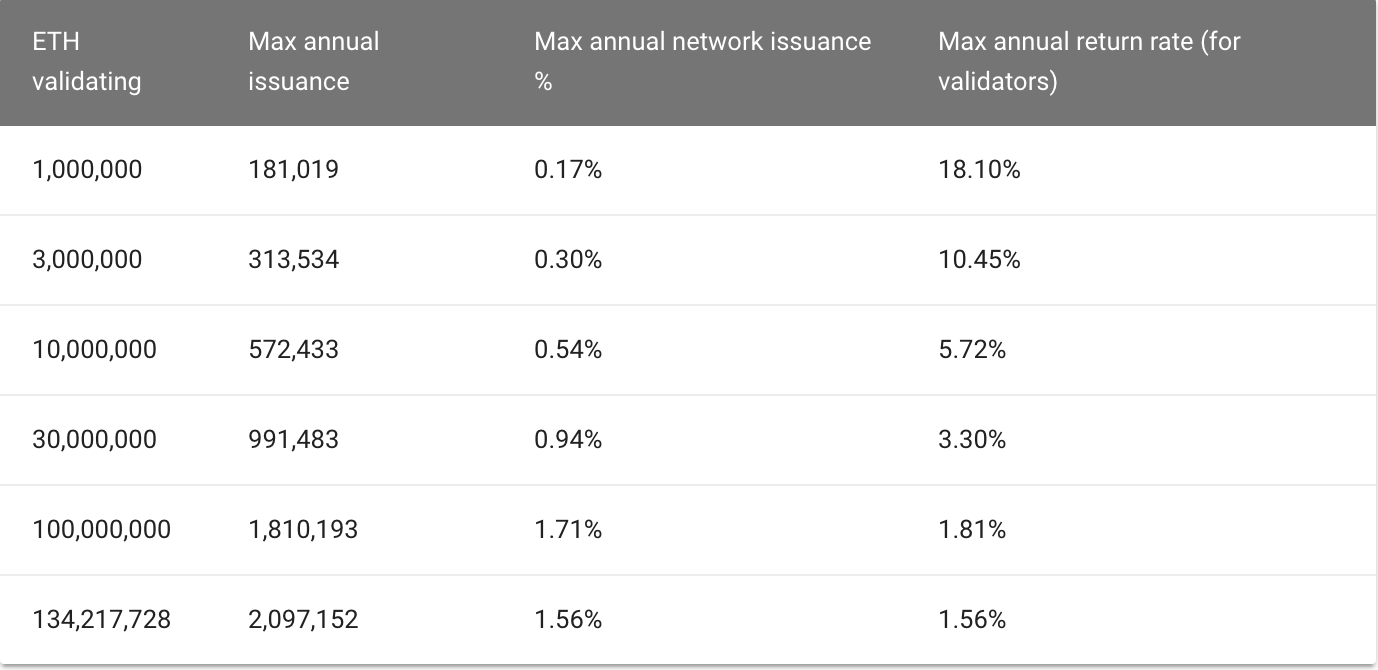

Using a system that is comparable to Bitcoin’s difficulty adjustment, EIP 1559 increases or decreases a number, a ‘BASEFEE’, based on the current levels of congestion on Ethereum. If Ethereum is greater than 50% utilized, BASEFEE automatically increases; if it is less than 50% utilized, BASEFEE decreases.

BASEFEE attempts to generate “the market rate” for gas prices, natively on Ethereum. While we can see the typical rates that are being paid on websites like EthGasStation.Info, or Etherscan’s Gas Price Tracker, these are 3rd party gas-market estimations. Additionally, they also do not illustrate the level of overpayment for gas fees. BASEFEE formalizes the “going market rate” for block-inclusion, removing the need for each and every wallets to generate their own individual gas estimation strategies. This will allow users to just press “Send Transaction”, and not have to be presented with ‘gas’.

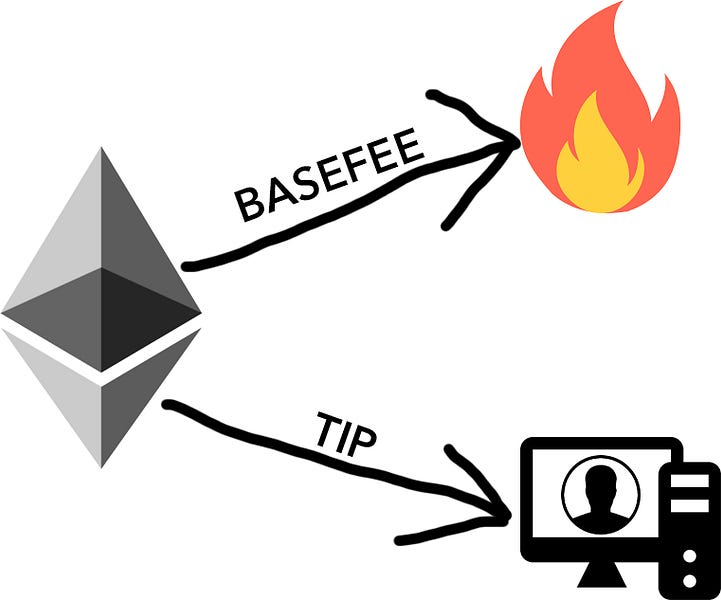

When it comes to getting your transaction through quickly, users can still “jump the line” by paying a ‘tip’ to the validators. This ‘tip’ serves the purpose that gas-auction does in today’s version of Ethereum; by ordering transaction inclusion based on tip size. Those that ‘tip’ higher get served first. The tip is what is paid to validators.

In times of high network usage, a user can ensure that their transaction is included sooner by including a larger tip along with the BASEFEE amount. Meanwhile, users who are not in a hurry can set a maximum fee that they’re willing to pay. The protocol will then wait for the BASEFEE to drop below this number before confirming their transaction.” — Eric Conner

Burning BASEFEE Burns ETH

BASEFEE is BURNT. No-one receives BASEFEE.

Burning this is important because it prevents miners from manipulating the fee in order to extract more fees from users.

It also ensures that only ETH can ever be used to pay for transactions on Ethereum, cementing the economic value of ETH within the Ethereum platform.

— Eric Conner

Burning BASEFEE removes the ability for validators to manipulate the fee market for their benefit. It also ‘locks-in’ Ether as the native currency of Ethereum, as it should be. No other currency on Ethereum can be used to pay for transactions. This is comparable to a nation-state demanding that only their native currency be legal tender.

Paying Fees to ‘Ethereum’

Burning ETH in transaction fees is a simple way to pay Ethereum for its blockspace. In the Ethereum 1.x/Bitcoin model, 100% of the fees are paid to the validators of the chain. This adds to the security of the chain, as there is more revenue that make mining/validating profitable. However, if the chain is overpaying for security, then those funds were much better used elsewhere.

Two Core Values

Ethereum has two core values that play off of each-other.

- Ethereum’s monetary policy is to prioritize security

- Minimal viable issuance to achieve security

Ethereum prioritizes security above all else. This is why Ethereum has chosen to fund security with block-rewards rather than fee market like Bitcoin. Funding security with block-rewards means that Ethereum’s security will never be 100% reliant on transaction fees for its security; Ethereum pays for its security ahead of time.

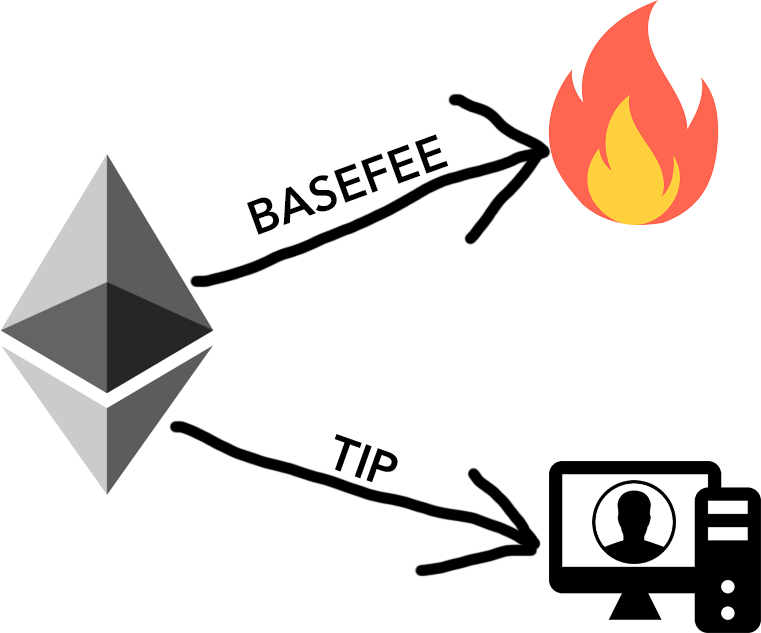

Here’s a chart, developed by Ethhub.io, that shows how much stakers will receive, based on how much total ETH is being staked (its a dynamic number: more total ETH staked, less paid per ETH. Less total ETH staked, more paid per ETH)

Ethereum doesn’t depend on fees for economic security. Ethereum guarantees a security budget to pay validators with block-rewards.

Because Ethereum pays validators by block rewards, also paying them BASEFEE would be overpaying for security. Validators are employees to Ethereum, and when Ethereum generates extra revenue, there is no reason as to why the employees should be paid this extra revenue. That revenue is paid to the business. The Employees are free to keep the tips that are placed in the tip-jar, for serving the highest paying customers first, but BASEFEE belongs to the network.

Burning ETH = Paying the Network

The title of this section has Ethereum in air-quotes for a reason. If we’re not paying BASEFEE to the validators, who should get it?

Burning BASEFEE pays everyone, equally. Whether you are Staking your ETH, or have it inside of MakerDAO, Uniswap, Augur, in your wallet, in a game, BASEFEE is paid to your ETH. If you hold ETH, you receive BASEFEE indirectly.

This is similar to how MKR holders receive the Stability Fee in MakerDAO; the SF burns MKR from the interest payments of those with debt to MakerDAO. If you hold MKR, your share of MKR is increasing due to the burning of MKR that isn’t yours.

By burning ETH, all Ethereum stakeholders benefit. EIP 1559 is solves a “tragedy of the commons” problem in Ethereum, by paying for one’s externalities by adding to the scarcity of Ether.

After staking, holding Ether and keeping it off the secondary market is the second-best way to add to the security of Ethereum. BASEFEE is the mechanism to which these Ethereum stakeholders benefit from the growth of Ethereum at large.

When the U.S. government pulls in more revenue from taxes, it spends more. When Ethereum pulls in more revenue from gas fees, it issues a stock-buyback.

Burning BASEFEE is Paying for Future Security

Every day that Ethereum runs, BASEFEE will remove more and more ETH from the supply. The BASEFEE amount that Ethereum could have paid directly to validators, instead is being paid to ‘Future Ethereum’.

The ability to attack Ethereum 2.0 will be a function of how much ETH is available for purchase on the secondary markets. If there is high ETH supply on the market, then buying enough to attack Ethereum is less expensive. If there is low ETH supply on the secondary market, then the price is higher, and attacking Ethereum requires much more capital.

By adding to the scarcity of Ethereum today, Ethereum’s security tomorrow is secured.

EIP 1559 puts constant downwards pressure on the supply of ETH. When Ethereum brings in little revenue, there is little downwards pressure, but when Ethereum is a fully-fledged economy, moving trillions of USD-value each day, and has the throughput of 1024x shards, the burn-rate of ETH could become significant.

Reducing Inflation, based on Aggregate Spending

EIP 1559 will introduce 2 new metrics to add to the list of the growing number of Ethereum economy metrics: The ETH-Burn Rate, and the ETH Burn:Issue Rate Ratio.

- ETH Stake Rate

- ETH Issuance Rate

- ETH Locked in Open Finance

- Dai Savings Rate

- Dai Average Borrow/Supply Rate

- ETH Burn Rate

- ETH Issue:Burn Ratio

The ETH Burn Rate tracks the scale of the Ethereum economy. As economic activity on Ethereum grows, the ETH Burn Rate will follow it. The ETH Issue:Burn Ratio is a metric that shows the trend of ETH scarcity. If the ratio is below 1, then ETH supply is decreasing.

How much could EIP 1559 burn relative to total issuance?

Modeling how much ETH could actually be burnt is a little premature. Having 1024x the transaction capacity makes the economics of Ethereum 2.0 wholly different than Ethereum 1.x

However, we can do some napkin math.

It’s a well-articulated goal for Ethereum 2.0 that 10M total ETH staking is desirable. At this number of total ETH staking, Ethereum is issuing 1550 ETH/Day.

Ethereum 2.0 will have 1024x shards, at 15 TPS each (current TPS of Ethereum 1.x). This is 22M transactions / day.

In order to burn 1550 ETH/Day to cancel out issuance, BASEFEE would need to be 0.00007045 ETH per transaction. To compare, a simple-ETH send costs 0.000021, at 1-Gwei gas price.

These calculations are extremely rough, and we will have much more data when Ethereum’s economic system is fully operational in Ethereum 2.0. Many variables go into this calculation, including changes to how gas is calculated and overall network congestion at scale.

EIP 1559 = Ethereum’s Taxation System

If there is one thing that the reader walks away from this article with, I hope it is this: EIP 1559 represents Ethereum’s taxation system.

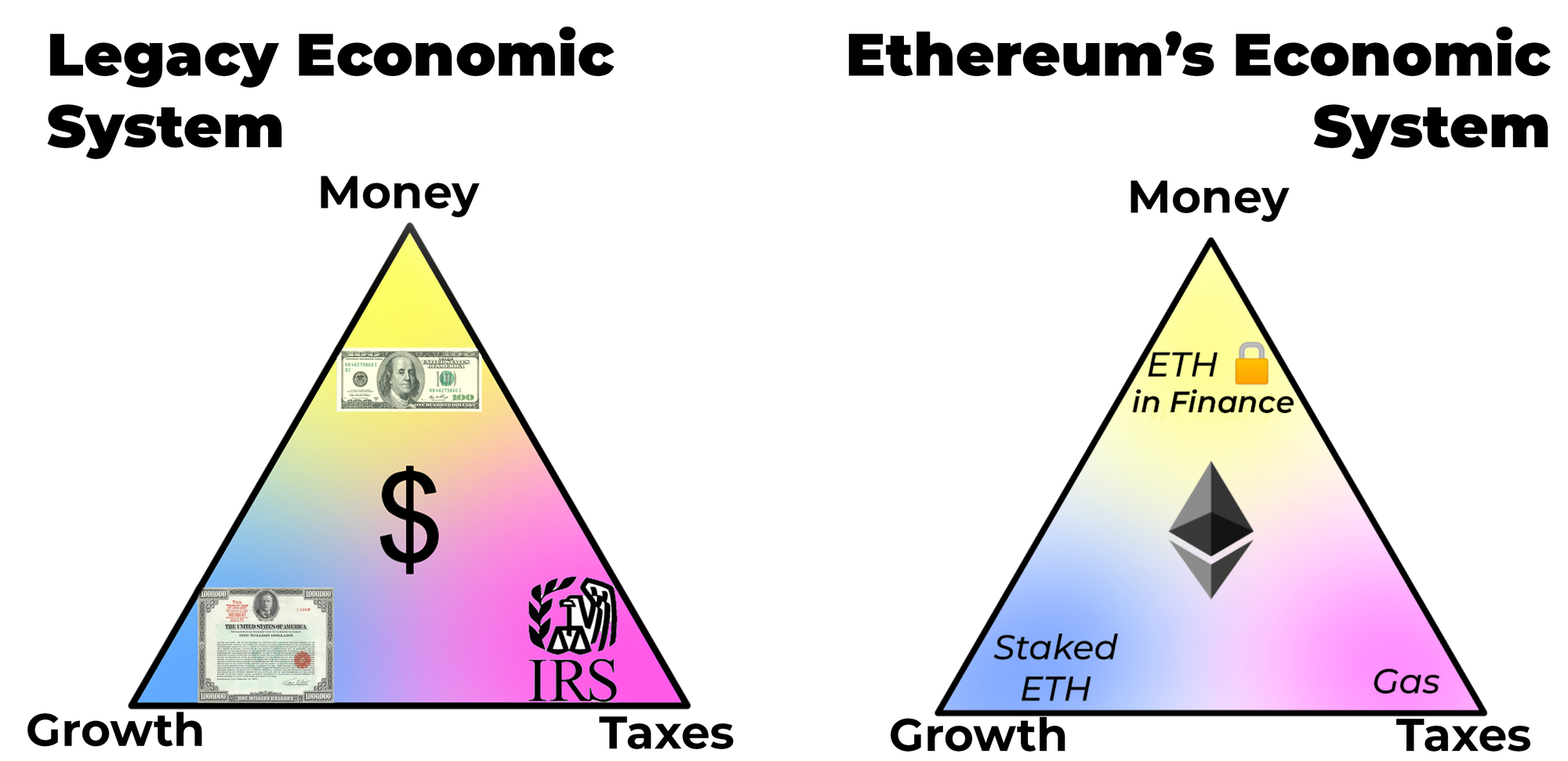

Ethereum is a permissionless cyber-economy. It is like a nation-state economy, except all human input/coordination/governance/politics has been replaced by code. The U.S. Dollar economy, the most successful economy ever on Earth, presents a model for how the ideal economy is structured. Ethereum takes that model, and commits it to code, enabling a digital value layer on-top of the internet.

The primary purpose of Ethereum is to establish a digitally native permissionless economy. Thousands of years of economic experimentation has lead to the U.S. economy proving to be the most successful economy humans have ever come up with.

Not without its flaws, however.

- The Dollar is determined by the Fed to lose 2+% every single year, making it a less-than-ideal money. The Fed will print whatever USD necessary to make USD lose 2% every year.

- The bond-market can change in a heartbeat, based on trust in the U.S. government. If the U.S. hints that it can’t/won’t pay its debts, the value of the bond market will change accordingly.

- The IRS collects taxes in order to support the economy. But thats a terribly bureaucratic system, and the rich all find ways to pay the minimum amount of taxes, leaving the working-class to pay far more than their fair share of taxes. Additionally, ‘who pays how much in taxes’ is a question with significant baggage. Everyone wants everyone else to pay them.

Each part of the Ethereum economic system takes the legacy system, and commits it to agnostic, apolitical, human-less code.

- The Economy = Applications. Applications like MakerDAO, Uniswap, Compound, Augur, dYdX etc have either mitigated or totally eliminated human engagement. The 2008 financial crises came from permissioned ledgers and false reporting. Ethereum applications have no such capacity.

- The bond market = the ETH-Stake Rate. There is never any doubt that the protocol cannot pay for its maintenance; it’s built into the code. Complete-assurance of the capacity to pay. Trust in the U.S. government is subjective; trust in Ethereum can be verified by viewing the code.

- The IRS = EIP 1559. No more “who should pay more/less in taxes?”. The rich can’t use their influence to change tax policy for their advantage. In Ethereum, users pay-per-use of the network, and all users are taxed equally. No individual will ever pay more or less in taxes than any other individual, per their use of the network.

EIP 1559 is the last piece of Ethereum’s economic system. The interesting thing is that it was generated with the purpose to make Ethereum’s gas-markets more efficient and user-friendly; the result, however, is an integral component of a functioning economic system. EIP 1559 is one of the many parts of Ethereum that is designed to be human and politically agnostic, as all money and monetary systems should be.

EIP 1559 does one thing very well: It ensures that all ETH holders capture the value of Ethereum, by default. Without EIP 1559, applications that don’t leverage Ether as a reserve asset (applications like Tether, Bancor, any off-chain asset etc.) still add to the value of ETH, by burning ETH to pay for their economic activity on Ethereum. EIP 1559 makes all usage of Ethereum directly add to the scarcity of Ether. No longer do you need to be an ETH-Staker in order to be exposed to the upside of the growth of the Ethereum economic system.

All you need to do is hold ETH.

ETH is the best model for money we have ever come up with.

Action steps

- Consider: what’s the effect of EIP 1559 on the scarcity & moneyness of ETH?

- Learn more about ETH’s monetary policy & issuance schedule at EthHub

Level up—no interruption. $12 per mo. Get 20% off as an Early Believer. Limited slots.

Author Blub

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his recent talk on how ETH accrues value and this accompanying post. (RSA note: this video is the first 4 x 🔥I’ve ever given—highly recommended)

EXTRA CONTENT: PodCast Episode w/ Ryan and David

If you enjoyed this thought-piece check out a conversation between David and I on POV Crypto where we cover ETH as a Triple-point asset.

👉Listen to ETH as a Triple Point Asset

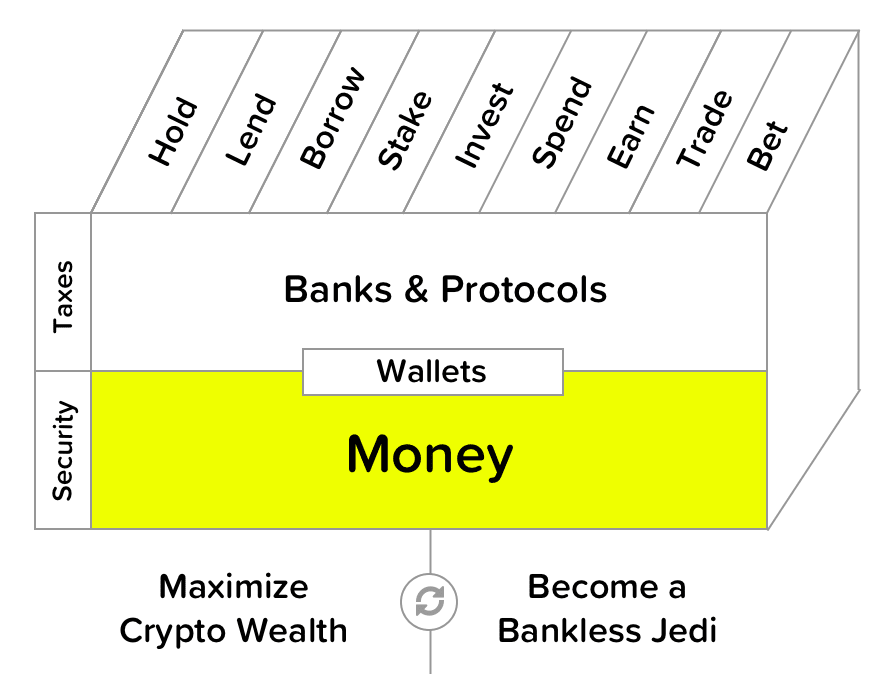

Filling out the skill cube

ETH is one of the two crypto money bets in a crypto money portfolio. Learning about the future of ETH’s monetary policy helps you better assess it as a reserve asset.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.