How to borrow and lend any token

Get full access to Market Monday, early access to podcasts, and exclusive debrief episodes!

Dear Bankless Nation,

DeFi is great because it’s permissionless.

Anyone, anywhere, at any time can create financial products and services.

We’ve seen the value of this with Uniswap, where anyone can create a liquidity pool for any token on Ethereum. Project no longer had to rely on centralized exchange listings where they usually had to fork out millions of dollars to get liquidity.

But there’s one part of DeFi that hasn’t gone fully permissionless: interest rate markets.

Both Compound and Aave have grown to billions of dollars in capital with their borrowing and lending markets.

But…they’re both permissioned.

Getting a token listed and creating a lending and borrowing market requires the permission of the DAO—the process of coin vote.

Advocates of this approach will say there’s a good reason to curate tokens. This is how you mitigate risk! Much can go wrong if the collateral fails. Hacks, oracle failures, illiquidity. People lose money on bad collateral.

And they’re not wrong.

But is there another way?

A way to segregate risk? A protocol for permissionless money markets?

That’s what Rari is trying. A couple weeks ago we asked if Rari was undervalued. Last week we talked to Rari’s co-founder as their protocol topped $1 billion.

This week we’ll show you how to use it.

Here’s how you can borrow or lend any token using Rari.

- RSA

P.S. PoolTogether v4 just launched! They’re giving away thousands of prizes to users from a special $1M prize pool. Dive in—the water feels great.

🙏 Sponsor: Lido—simplified and secure liquid staking for digital assets.

🎙️ WATCH LAYER ZERO: DANNY RYAN

Listen to podcast episode | iTunes | Spotify | YouTube | RSS Feed

Tactic Tuesday

Bankless Writer: William M. Peaster, Bankless contributor and Metaversal writer

How to borrow and lend any token

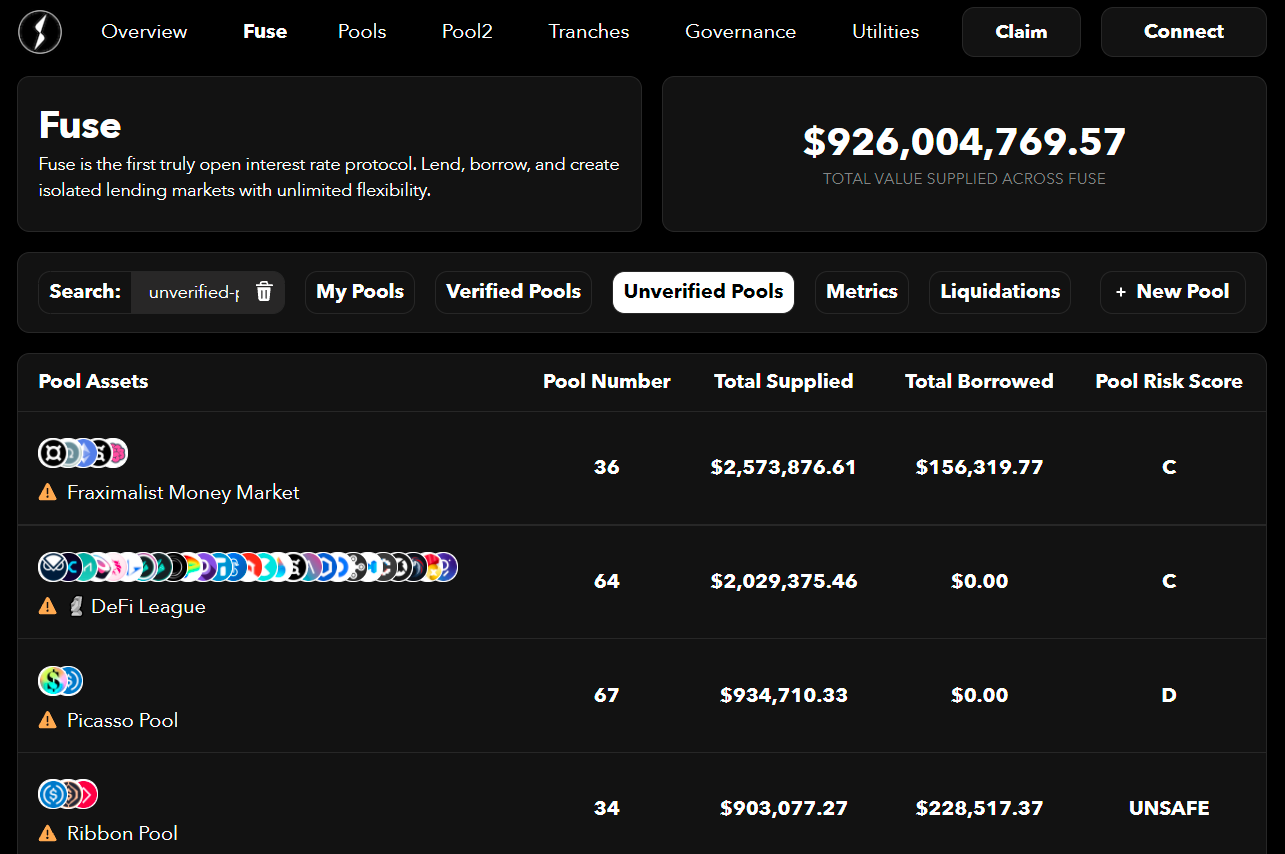

Rari Capital is a set of DeFi protocols allowing users borrow, lend, and earn yield on their tokens. The project recently just opened up Fuse, an open interest rate system, so that anyone can create permissionless lending pools through the platform.

This tactic will show you the why and how of these pools!

- Goal: Learn how to launch your own Fuse pool

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: Varies

🛑 Disclaimer! Creating your own money market may have legal implications depending on your jurisdiction. Please do your own research.

An Intro to Rari Capital

Rari Capital is a suite of DeFi protocols.

Launched last year, Rari burst out of the gate with a laser focus on helping users of all stripes earn yields on their idle DeFi capital. This focus remains Rari’s North Star, yet the project has evolved considerably since its earliest days.

While Rari began as a relatively straightforward yield aggregator for stablecoins, now the project counts among its foundation a handful of protocols. These include:

- A peer-to-peer (P2P) risk exchange system, Tranches, using the “Yield Aggregator DAI pool for customized risk and return profiles.”

- An “open interest rate protocol,” Fuse, through which people can create their own borrowing and lending pools.

And last week, the protocol reached $1B in value locked in its ecosystem, showcasing the power and demand for these protocols.

What is Fuse?

DeFi already has its heavyweight borrowing and lending protocols, like Aave and Compound. Yet these projects only support select DeFi tokens. They have strict governance processes and risk assessments that each token needs to go through in order to be supported on each protocol.

But where are you to go if you have a smaller token you want to borrow against?

Fuse. That’s because Fuse isn’t your ordinary DeFi lending protocol. The product supports more exotic (read: relatively unknown) tokens, meaning the assets that the bigger protocols can’t or won’t support so early on.

As such, the main idea with Fuse is that borrowers pay stablecoin depositors high premiums (compared to other DeFi money markets because of the added risks) in order to borrow against their smaller, riskier assets.

With that in mind, Fuse is a “higher risk, higher reward” DeFi lending protocol. That’s interesting in and of itself, but what’s really interesting is what happened last week.

During Fuse’s early days Rari maintained an admin whitelist of Ethereum addresses that could create new “verified” Fuse pools. However, as of last week Rari opened up Fuse so that anyone can create “unverified” Fuse pools around any tokens they want.

Permissionless lending pools have arrived. Just like anyone can create a liquidity pool for any token on Uniswap, anyone can now do the same with a lending and borrowing market.

Why use Fuse?

So we’ve already mentioned that borrowers can turn to Fuse when they have little to no DeFi options elsewhere token-wise. And we also mentioned how stablecoin lenders can turn to Fuse to earn more interest by taking on more risk.

These are important and fundamental considerations, but there’s a bigger picture, too. The person I’ve seen break down Fuse’s “big picture” best so far is Dan Elitzer, a co-founder of Nascent and Yam Finance.

In a Twitter thread last week, Elitzer explained how Fuse’s permissionless lending pools can, at their best, serve as “absolute godsend[s] for DAOs with treasuries.”

His grand point? A DAO can set up a Fuse pool around its own token. In doing so, the decentralized org could give its members “a place to borrow against their holdings without giving up governance rights or staking rewards” while also providing itself with a “high-yield source for compounding its treasury.”

Be sure to read Elitzer’s whole thread to get a better sense of the nuances, but the big idea is that Fuse pools can become a treasury management tool for DAOs and even beyond.

How to create your own Fuse pool

Now you know the what and the why of Fuse pools. How about creating your own lending pool on the protocol? If you’re ever so inclined, you can create your own lending pool around any tokens via these steps.

- Head to Rari’s Fuse dashboard and connect your wallet.

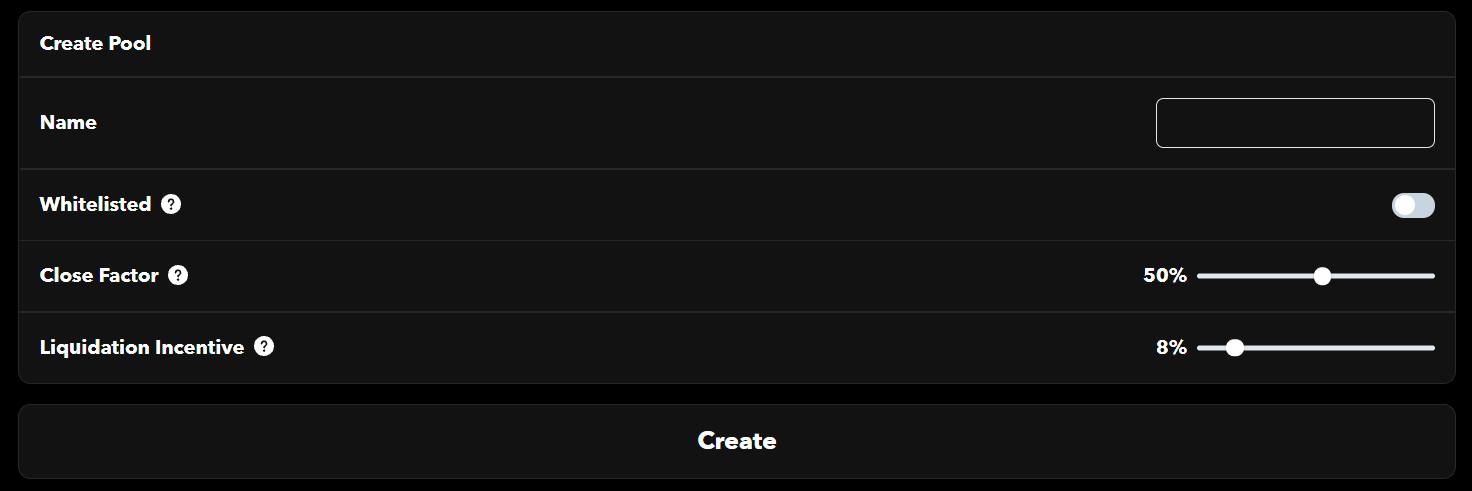

- Click on the “New Pool” button in the Fuse interface. This will bring you to the “New Pool” creation panel.

- Start by inputting your pool’s name. Be common sense about it and make it something thematic about your pool, so investors can quickly gauge what it’s about. Memes are fine, just make sure people can readily figure out your pool’s angle!

- After choosing your pool’s name, decide if you want to allow only whitelisted addresses to serve as liquidity providers (LPs). The default option is “No.”

- Now it’s time to figure out your Close Factor. As Rari notes in their docs, this is the percent between 0% and 100% that “a liquidatable account's borrow can be repaid in a single liquidate transaction.”

- Next, decide your liquidation incentive, which is the “additional collateral given to liquidators as an incentive to perform liquidation of underwater accounts.”

- If everything looks good, press “Create” and complete the creation transaction in your browser wallet.

- Once this is done, you can review your pool’s parameters on your provided pool dashboard! You can update your pool’s settings through this dashboard and add new assets.

Zooming out

DeFi now has permissionless lending pools. These pools can be useful for individuals and organizations looking for compelling yields. And it’s only getting started.

On the flip side, it’s important to understand that these pools have very unique risks. But if you’ve done your homework and have accepted that losses may come, Fuse can mark a new way forward!

Action steps

- 📺 Watch “The Rise of Rari Protocol | Jai Bhavnani” by Bankless

- 📰 Read “Is Rari Undervalued?” by Bankless

Author Bio

William M. Peaster is a professional writer and creator of Metaversal—a new Bankless newsletter focused on the emergence of NFTs in the cryptoeconomy. He’s also recently been contributing content to Bankless, DeFi Pulse, JPG, and beyond!

👩🏫️ Recent guides from Bankless:

- ⛓️ How to collect NFTs on Layer 2

- 🤝 The next big unlock for DAOs

- 👨🎓️ How to pay off your student loans with DeFi

Subscribe to Bankless. $22 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Lido

👉 Stake your crypto assets on Lido—now supports ETH, SOL, and LUNA

Lido lets users stake their assets and receive a tokenized derivative that automatically earns daily rewards. With Lido, your staked assets can be used across the DeFi ecosystem. You can lend, borrow, and more with your assets while maximizing your yield. Stake with Lido.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.