Dear Bankless Nation,

Rari is an emerging money markets protocol on Ethereum.

Unlike Aave or Compound, the protocol is significantly more aggressive with the tokens they support. That’s their niche—the long tail of crypto assets.

And this has been the key driver behind their growth in recent months. As of today, they’re currently the third largest money market on Ethereum with over $500M in value locked.

All of it without any token incentives. 🤯

But earlier today they made a huge improvement on their product. Their money markets are now permissionless, meaning you can now create a lending market for any ERC20 token on Ethereum—just like Uniswap and Sushiswap for liquidity. 👀

Pretty cool right?

And just like the majority of DeFi protocols these days, RARI has a governance token: it’s called RGT.

So with all the recent growth and the launch of its permissionless money markets, we had to ask the question.

Is RGT undervalued?

Ben gives his thoughts.

- RSA

P.S. Permissionless conference tickets are back on sale tonight at 12:00am EST! 250 available for $319. Bankless Premium members get 30% off. Join us for the hottest DeFi conference 🔥

RGT Token Analysis

DeFi is not a place to rest on one’s laurels. In a perpetual quest to iterate, innovate, and attract capital, new protocols are emerging to challenge year-old incumbents and take the lead in the endless race for liquidity.

One project that exemplifies this mentality is Rari Capital. Perhaps initially known for the youth of their core team ( Jai Bhavanni and Jack Lipstone are both under the legal drinking age in the U.S.), Rari has emerged as one of the most promising new projects in all of DeFi with their Fuse product—the “Uniswap of lending” which enables the creation of isolated money markets.

Rari has recently crossed $500 million in total value locked (TVL) and has quickly emerged as Ethereum’s third-largest money market. Moreover, the protocol is generating revenue for the protocol at an accelerating rate.

Is this the Compound or Aave killer?

Is RGT undervalued?

Let’s take a look under the hood of this project to find out.

Rari Product Overview

Product #1: Fuse

Fuse is a protocol for creating isolated money markets. Like Compound and Aave, users can deposit assets into Fuse pools and use them as collateral to borrow, with interest rates determined algorithmically based on utilization.

Incumbent money markets operate on a single-pool model where all assets deposited into the protocol are pooled together. While this helps minimize fragmentation of liquidity, it limits the assets that can be used as collateral, as depositors take on the risk of all tokens in the pool. In other words, if a token in the pool were to become illiquid, frozen, or go to zero, the protocol would be at risk of being undercollateralized.

In addition, the risk management of these markets is in the hands of the protocol's governance, where token holders have control over which assets are listed, which ones can be used as collateral, as well as risk parameters such as liquidation thresholds and reserve factors.

Fuse differentiates itself by isolating pools from one another. This means that rather than inheriting the risk of all assets held on the platform, Fuse depositors only inherit the risk of the pool they are depositing into.

With that design, Fuse allows for increased customization and management of pools, as administrators have complete control over parameters such as collateral factors, oracles, reserve factors, protocol fees, and the ability to whitelist addresses.

There are several fascinating implications of this.

For starters, it unlocks the long tail of assets as collateral for borrowing, as any asset with an oracle can have its own Fuse pool. Further, it allows DAOs whose assets may be deemed too risky to circumvent the listing process of traditional DeFi money markets. This means that the addressable market for Fuse is not only that of “safe” assets, but instead all assets within DeFi.

In addition, Fuse can potentially reduce systemic risk across DeFi due to the risk of a “run on the bank” scenario due to under collateralization being isolated to each individual pool.

🧠 Due to the variety and potentially elevated risk of depositing into a given Fuse Pool, the Rari Team developed a “Safety Score” framework to quantify and evaluate the risk of depositing into a given pool.

Fuse went live in March 2021 with a “guarded launch” during which the creation and management of pools is limited to the team and whitelisted operators. Despite this, the protocol has managed to realize its first use case as a way for smaller DAOs, and their token holders, to borrow against their holdings.

This has led to the creation of 32 total pools, with 19 having more than six figures in liquidity, and includes partnerships with a plethora of protocols such as Olympus DAO, Index Coop, Fei Protocol, Badger DAO, Vesper Finance, Pendle, Tokemak, BarnBridge, PoolTogether, and Yearn.

A major growth catalyst for Fuse is on the horizon in the form of permissionless pools. Within the next several days, the guarded launch will end and the protocol will, similar to Uniswap or SushiSwap, enable anyone to create and customize their own money market without needing approval. In addition, the team has stated in their Discord that they plan to deploy Fuse onto both Arbitrum and Optimism, which could potentially lead to Fuse becoming a preeminent money market on those networks.

Product #2: Yield

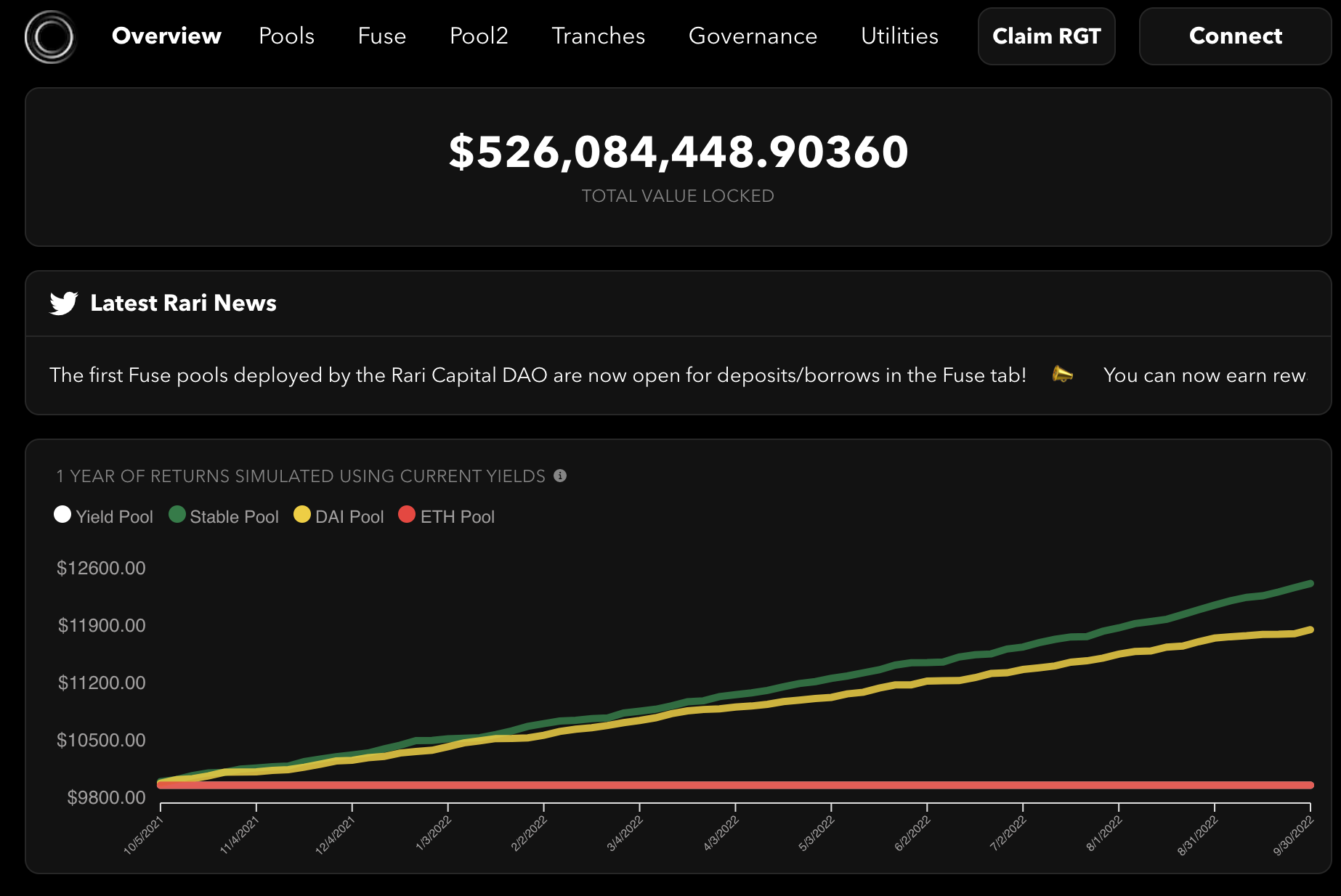

While Fuse has emerged as Rari’s flagship offering, the protocol's original offering was that of a yield aggregator. Like Yearn, depositors into Rari’s yield products will benefit from automated yield earning strategies.

There are currently two active yield pools, USDC and DAI, which have been used to bootstrap liquidity for Fuse, as deposits are run through the protocols pools.

It is of course worth mentioning that the yield product was also the source of one of Rari’s greatest setbacks, as the now inactive ETH pool was exploited for $10.6 million due to a malicious contract interaction with Alpha Finance.

📚 To read about Rari’s other products in development, Tranches and Nova, click here

Governance and Community

Now that we understand Rari’s product offerings, let’s dive deeper into the protocol’s governance and supporting ecosystem.

Rari is a prime example of the efficacy of progressive decentralization, as the protocol has successfully transitioned from a system of governance in which changes to the protocol were carried out by a team-operated multi-sig to one in which changes are voted on and executed on-chain via Compound’s Governor Bravo contracts. With regulators breathing down the neck of major DeFi protocols, this could potentially help to insulate the core team and project from this risk.

This new governance model has managed to lead to strong engagement, as the two proposals that were put to an on-chain vote saw an average turnout of 13.9% of the total supply. Furthermore, 22.37% of the total RGT supply has been delegated for use in governance, indicating that tokenholders have an interest in seeing their power exercised.

Along with furthering the decentralization of the protocol, Rari has managed to build out a robust ecosystem of stakeholders. This comes despite, as previously mentioned, the project raising no money from venture capitalists, and includes the backing of whales such as Tetranode, major funds such as Framework Ventures, and DeFi founders such as Joey Santoro of Fei Protocol.

In addition, through partnering with DAOs to launch Fuse pools, Rari has managed to foster key relationships with many prominent projects throughout the space. The attraction of this intellectual capital may serve as a signal that Rari’s offerings have product-market-fit, and should help to further integrate them within the DeFi stack.

Token Economics

RGT is a pure governance token, with no value currently being returned to tokenholders. This makes it most comparable to non-dividend paying equity as holders don’t have rights over the direction of cash flows that may accrue to the protocol, as well as the DAO treasury.

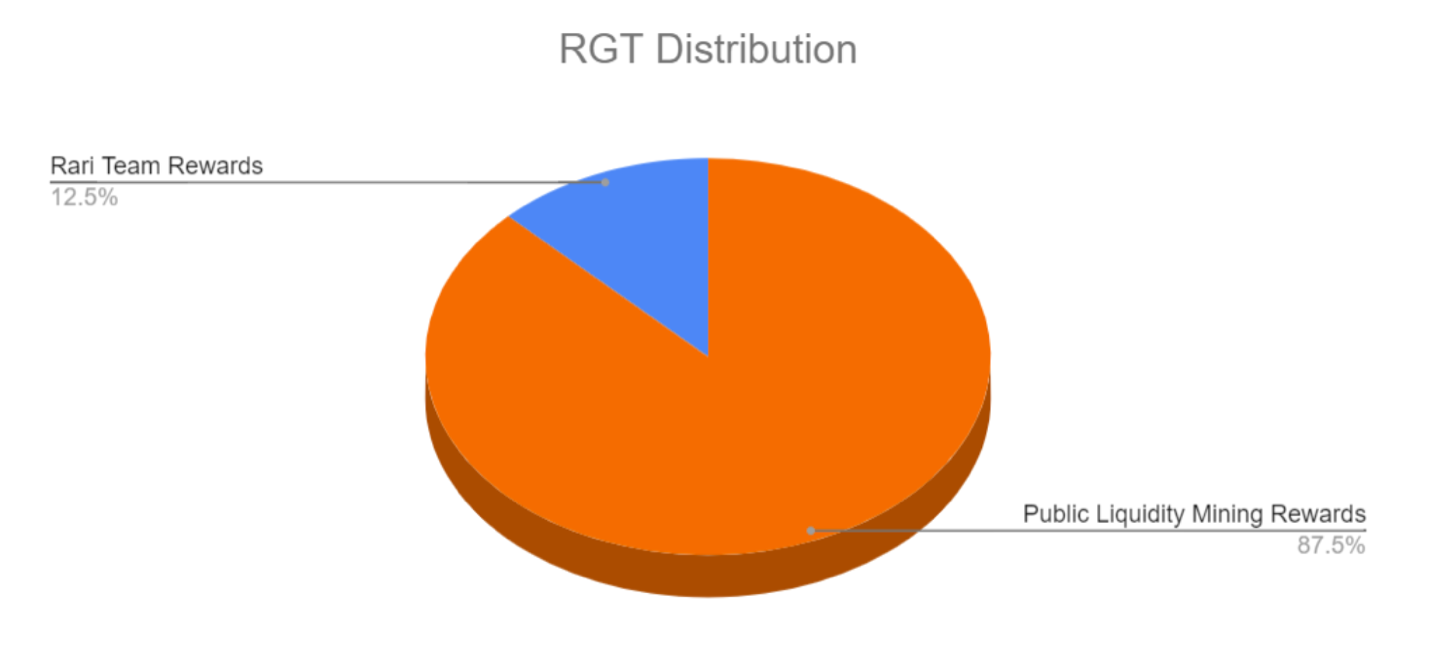

The token had a unique, community-driven distribution in which 87.5% of the 10 million RGT supply was distributed to yield pool depositors via a 60-day liquidity mining program, with the remaining 12.5% allocated towards the team over a two-year vesting period.

Recently, the community voted to mint, over the course of several months, an additional 10 million RGT. Of this, 2.5 million RGT was immediately minted to the DAO treasury, with the intent that it is used to retain the core team and attract new contributors. The remaining 7.5 million RGT will be minted linearly over the course of three years to the DAO treasury to be used in liquidity mining and other protocol initiatives.

While this does represent a 100% inflation of the total supply, this will not necessarily translate to immediate sell pressure, as the direct minting into the treasury keeps these new tokens off the open market. In addition, it may further incentivize the tokenholder base to vote in profit sharing or mechanism to keep supply off the market, as holders such as Tetranode have proposed on governance forums that RGT incorporating a vote-escrowed token model like Curve.

Performance & Financial Metrics

Now that we understand Rari’s product offering, governance model, and token economics, let’s dive into the protocol’s performance and financial metrics.

Fuse Deposits & Borrows

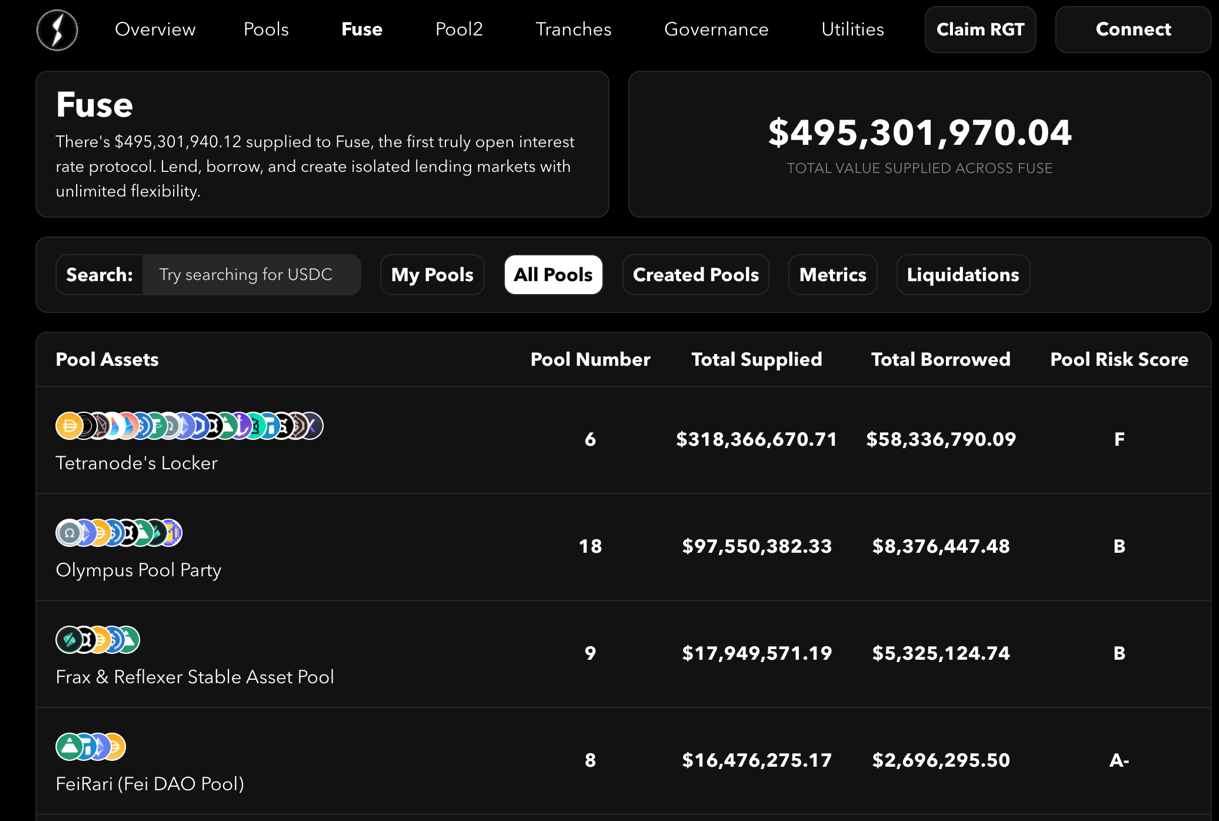

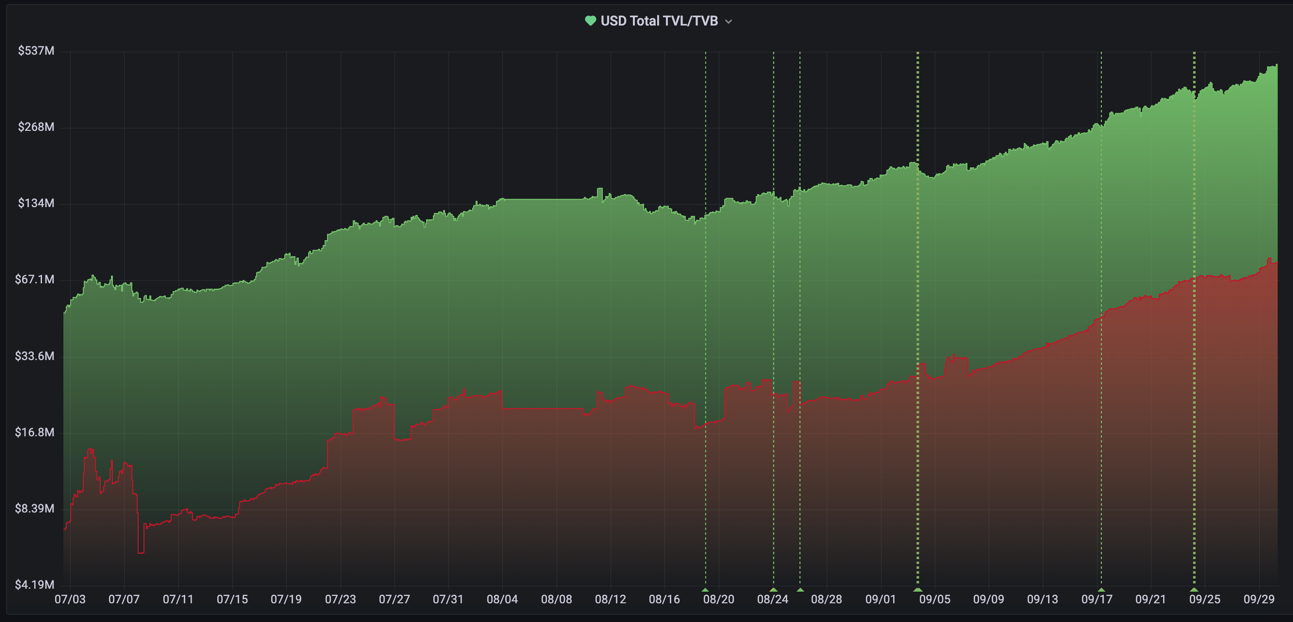

Since the launch of Fuse in March 2021, Rari has experienced an incredible amount of growth. The protocol currently holds more than $505 million in assets under management, with Fuse deposits accounting for $476 million (94%) of all value locked.

Increased adoption of Fuse has been the primary driver of growth for the protocol as they’ve increased by 850% from $50 million on July 2. This growth has accelerated in recent weeks as deposits have risen 179% from $170 million on September 4.

Along with deposits, there has also been substantial growth in outstanding debt, which has risen 1028% from $7 million on July 2 to $79 million today. Similarly, growth in borrows has accelerated as of late, increasing by 192% since September 4.

This growth is indicative of the insatiable demand to borrow against the long tail of assets on Ethereum and may signal that Fuse is achieving a strong product-market fit. Further, it’s even more impressive considering that it has come completely unincentivized, as Fuse does not currently support liquidity mining capabilities for pools.

AUM has also largely been concentrated, with two pools accounting for 84% of total deposits. The largest, Tetranode’s Locker, which is operated by the namesake whale, supports deposits of 19 assets, borrows of 6 stablecoins, and accounts for $310 million (65%) of AUM. The second Pool 18, “Olympus Pool Party” which holds $94 million in deposits of (you guessed it) staked OHM along with ETH and 6 stablecoins which accounts for an additional 19%.

Protocol Revenue & Reserves

Protocol revenues have experienced similarly explosive growth as streams are tied directly to platform usage. (Fuse charges a 10% platform fee on interest earned by depositors which can be changed by Pool Administrations).

With that, Fuse has generated $252,000 in cumulative fees since launch with $104,000 of it (41%) accruing in the month of September. According to estimates from team-created dashboards, based on current rates of utilization across all pools, this works out to $2.30 million in annualized revenue.

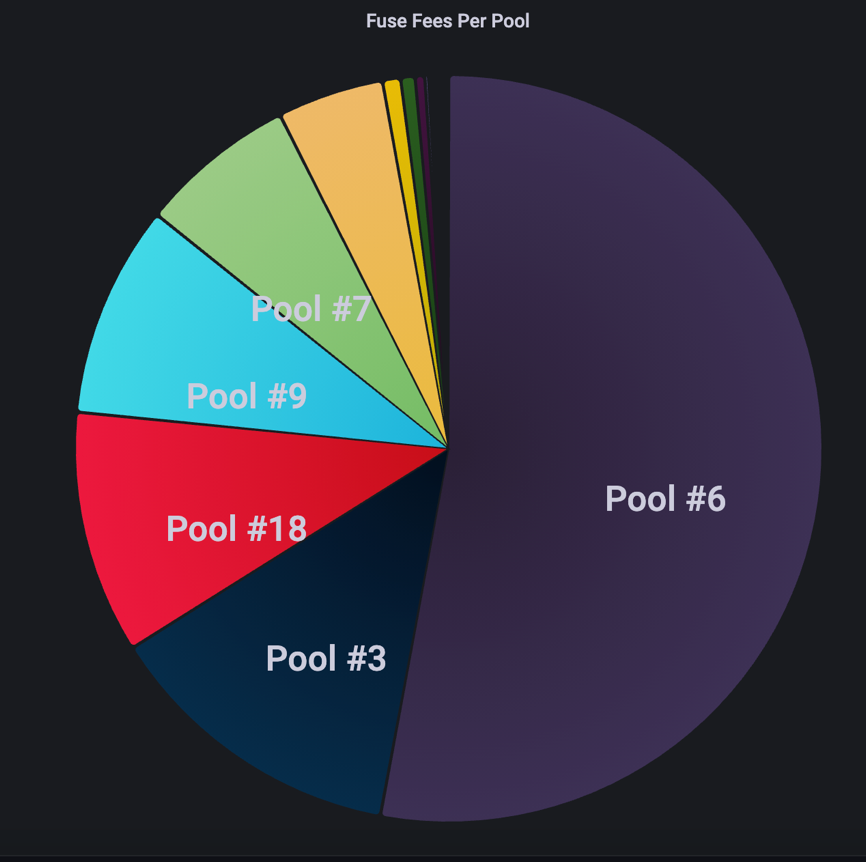

Diving into the composition of this revenue, we can see that Pool 6, (Tetranode’s Locker) has been the primary driver of revenue, generating $135,000 (53%) in fees for the protocol. An additional five pools make up most of the remaining revenue, with Pools 3, 18, 9, 7, and 8 accounting for an additional $112,000, (44%). This suggests that the concentration of TVL does not necessarily correlate to the concentration of revenue, which is likely attributable to the differences in utilization across the various pools. Furthermore, it reinforces the Fuse value proposition in that there is strong demand to utilize a variety of assets as collateral.

Fuse fees can also serve to help diversify the DAO treasury, as 91% of revenue is denominated in stablecoins.

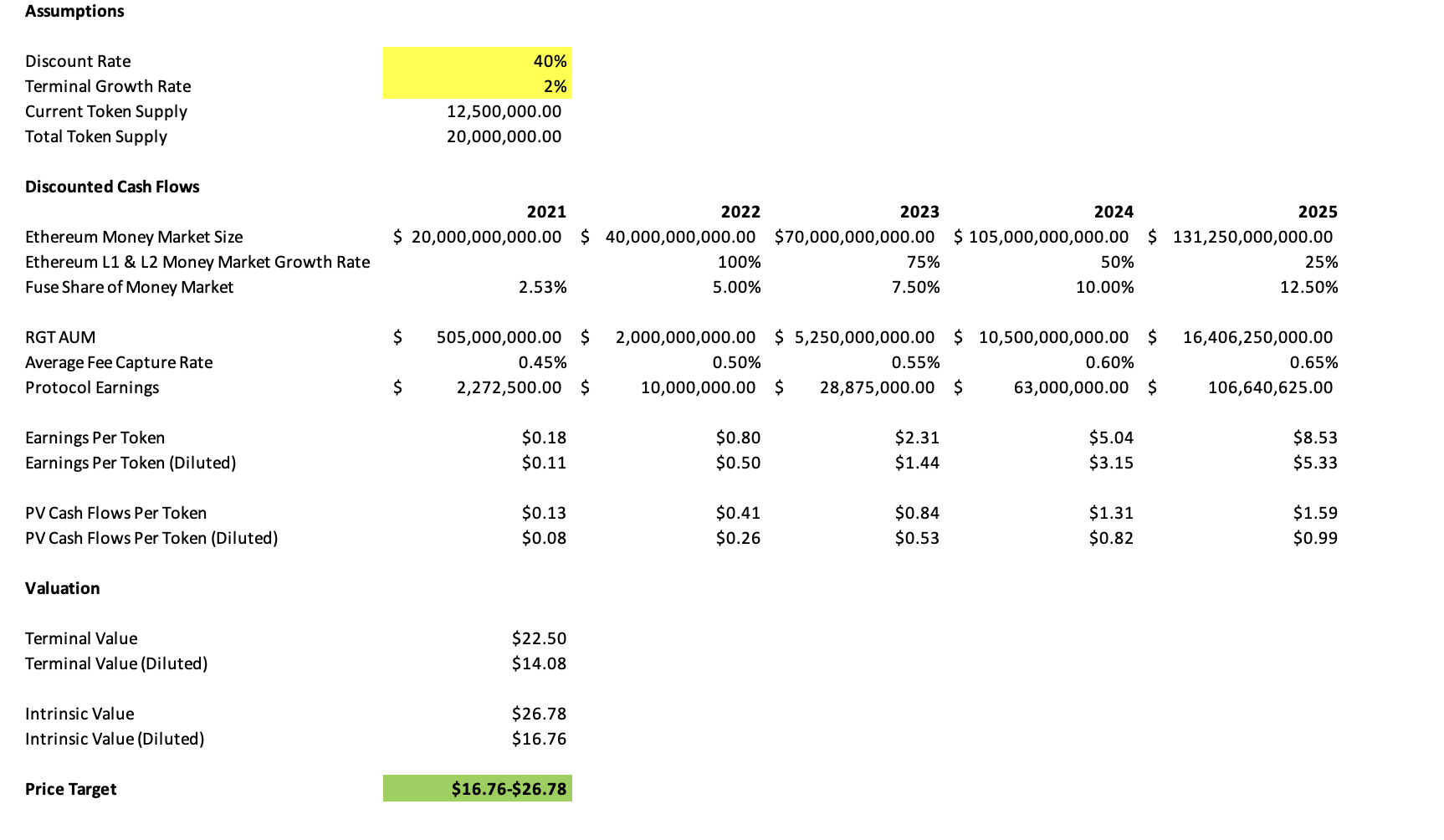

RGT Discounted Cash Flow Model (DCF)

Now that we have a better picture of Rari’s financials, we can attempt to intrinsically value the token using a DCF model.

Due to the breadth of assets supported by Fuse, along with the rates of utilization and fees that can vary dramatically by the pool, modeling out Rari’s cash flows is incredibly difficult. Because of this, we’ve based projects for Rari’s AUM on the share of the total value locked in all Ethereum L1 money markets, which we expect to incrementally increase over time. This does not account for any growth as a result of L2 deployments, or the protocol’s other product offerings.

In addition, we’ve based the protocols “take rate” by dividing the fees generated by Fuse by that of the protocol. The model assumes that Rari will gradually increase this take rate over time.

We’ve also assumed a discount rate of 40%, and a terminal growth rate of 3%, in line with industry standards for higher-risk, venture investments, and global GDP growth.

As we can see, Rari’s RGT has a fair value of $26.78 per token based on the model. RGT currently trades at $24.35, which suggests that the token may be currently undervalued by about 10%.

However, it’s worth again stressing that the model makes major assumptions to reach this conclusion.

Risk Factors

As an early-stage protocol in the midst of launching its flagship product, there are considerable risks.

Let’s touch on a few key ones referenced throughout the piece.

Security

As previously mentioned, Rari was the victim of a $10.6 million exploit. While the protocol has since recovered and rebuilt trust with users, a second incident could have devastating ramifications on the project’s brand and adoption.

Competition

Although barriers to entry are high for new money markets, Rari is facing stiff competition in the form of incumbents such as Compound and Aave, along with competitors with similar isolated models such as Beta Finance.

Undercollateralization Events

While isolated pools significantly minimize the systemic risk faced by the protocol, there still exists an outside possibility of a black swan event in which bad debt across pools is unable to be liquidated.

Regulation

With an SEC probe of Uniswap and protocols increasingly taking measures to deny service to users in the United States, DeFi is squarely in the crosshairs of regulators. While Rari has taken steps to decentralize the protocol, with a public team it stands to reason that they may be more susceptible to legal pressures.

Conclusion

With a highly innovative product, robust and engaged set of stakeholders, equitable token distribution, increasing adoption, and strengthening financials Rari is an incredibly promising protocol just beginning to scratch the surface of its potential.

With the impending opening of the floodgates in the form of permissionless Fuse pool creation, Rari seems to be revving up the engines as it seeks to emerge as a breakout DeFi protocol.

While there are considerable risks facing the project, and the token may be trading at close to fair value, Rari seems to be on the track to DeFi stardom.

**Disclosure: The author holds RGT tokens.**

Action Steps

- 🤓 Evalute the RGT token

- 🔥 Lend and borrow assets on Rari Fuse