The next big unlock for DAOs

Get full access to Market Monday, early access to podcasts, and exclusive debrief episodes!

Dear Bankless Nation,

We’ve made the case that DAOs are the future of work.

We firmly believe that.

But it’s still really early for DAOs. Tools and infrastructure are sparse. Most DAOs are still fairly centralized. And they’re definitely not autonomous.

The good news is that we’re making progress. We’re learning how to DAO together.

And if you can imagine, there’s a lot of work to do—communities need to migrate to on-chain governance, find better alternatives to token-weighted voting, and more.

But there’s one thing that’s not really talked about: decentralizing capital flows.

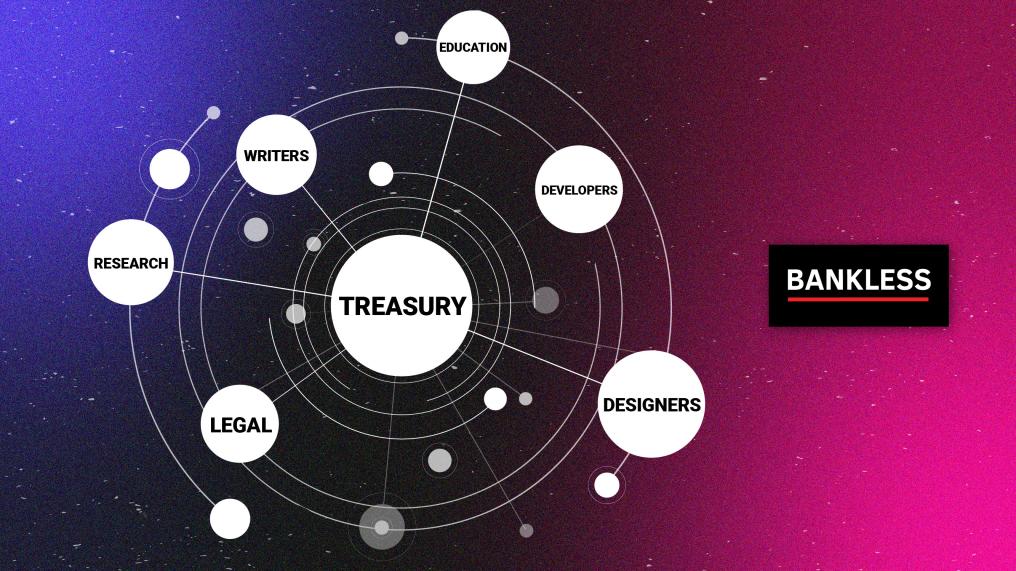

Most of today’s DAOs rely on a centralized Grants Committee to distribute funding to their projects. These committees are made up of a few members, making the flow of capital contingent on them. Put simply, it’s centralized.

As such, we need to find better ways to decentralized capital flows for DAOs.

By doing this, DAOs can create more resilient economies. They can multiply the value created with the capital they use. And they can empower their contributors to build more sustainable work.

Our newest addition to the Bankless team, core contributor of Bankless DAO, and resident anon, frogmonkee, explains why.

This is a must-read for all DAO contributors.

- RSA

P.S. Zerion recently launched some killer NFT features. Just plug in your wallet and start flexing your jpegs!

🙏 Sponsor: Aave—Experience DeFi: Deposit, Earn, & Borrow with Aave

📺 Watch State of the Nation: Rari’s March to $1B

🎙️ Listen to Podcast Episode | 📺 Watch the Episode

WRITER WEDNESDAY

Guest Writer: Frogmonkee, Core Contributor at Bankless DAO & Editor at Bankless

DAOs as Economics Engines

Stick around the DAO space long enough, you’ll begin the hear the same conversations:

We need to move social consensus on-chain!

We need to stop using token-weighted voting!

We need to distribute power away from core founders!

We need to [insert decentralization tactic here]!

While all valid points, one thing I don’t hear enough is distributing capital flows.

How can DAOs efficiently allocate and distribute capital without burdening the system with bottlenecks and bureaucracy?

The answer is perhaps to make these decisions at the peripheries, not the center.

Decentralized Capital Flow

Capital is leverage. When applied properly, it provides us with the right incentives and purchasing power to build.

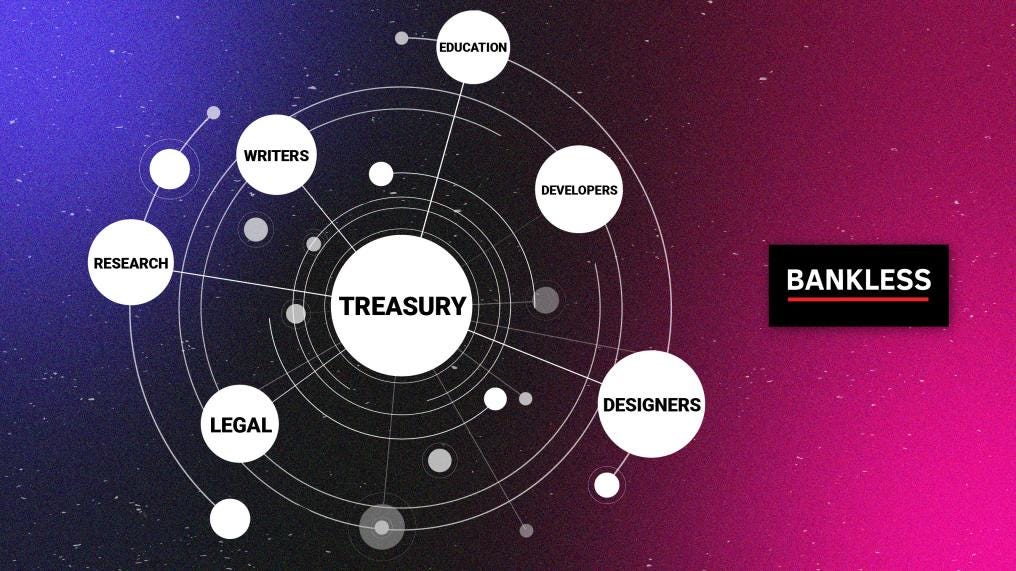

In our current phase of evolution, capital often comes from centralized sources within a DAO—its treasury. If you look at any major DAO, each has its own grants program for funding projects and other initiatives that are valuable for the DAO. It’s a useful primitive for allocating capital, but it’s centralized around a core committee.

As with anything centralized, committees like these face scaling challenges. They have limited staff, a clogged pipeline of projects to fund, mandates from the community, and other bottlenecks that can hamper how quickly initiatives can get up and running.

The next phase in our evolution is to move capital flows to the edges and enable discrete groups to create their own standard operating procedures for circulating capital. DAOs will evolve into complex structures where each node in the network interacts with the others to receive and distribute capital in the form of grants, revenue splits, bounties, paid positions, and more.

Not only will this unlock multiple sources of funding, each uniquely curated to address a particular capital requirement, but it will also form a resilient and scalable economic structure that can only be attained through organic and decentralized governance.

Evolving Capital Flow at Bankless DAO

Bankless DAO is slowly moving towards the decentralized economic engine pictured above.

We still have a grants committee with seven members, but we’re beginning to see some innovative examples of coordination at the edges forming their own methods of acquiring and distributing capital.

Let’s explore some of these methods.

Guild Budgets

Bankless DAO is organized into 13 guilds. These guilds are talent pools and represent different competencies available for other members of the DAO to join or tap into—writers, developers, analytics, design, legal, etc.

Each guild has its own budget to allocate as they see fit.

As expected, many of these guilds have bootstrapped and funded projects that fall within their domain, effectively creating 14 total sources of funding in addition to the singular grants committee. These guilds are limited in their budget, amounting to a fraction of what the grants committee can allocate, which makes guilds perfect for micro-grants that can roll up into larger grants after demonstrating some Proof of Concept (PoC) or MVP.

Guilds quickly grasped the advantage of having their own capital pools instead of relying on a central flow from the grants committee and have begun to find ways to bring capital flows into their multisigs.

For example, the Developers Guild negotiated a 10% revenue split for their involvement in the DAOpunks project while the Writer Guild takes 10% of all paid external client work.

An expanded guild treasury means more elected roles, bounties, micro-grants, and efficient capital allocation for initiatives that are guild-specific.

Standard Operating Procedures

At Bankless DAO, guilds often interact with one another, tapping into the varying skill sets of each guild, like asking the AV guild to produce videos, requesting a Twitter campaign from the marketing guild, or commissioning a newsletter graphic from the design guild.

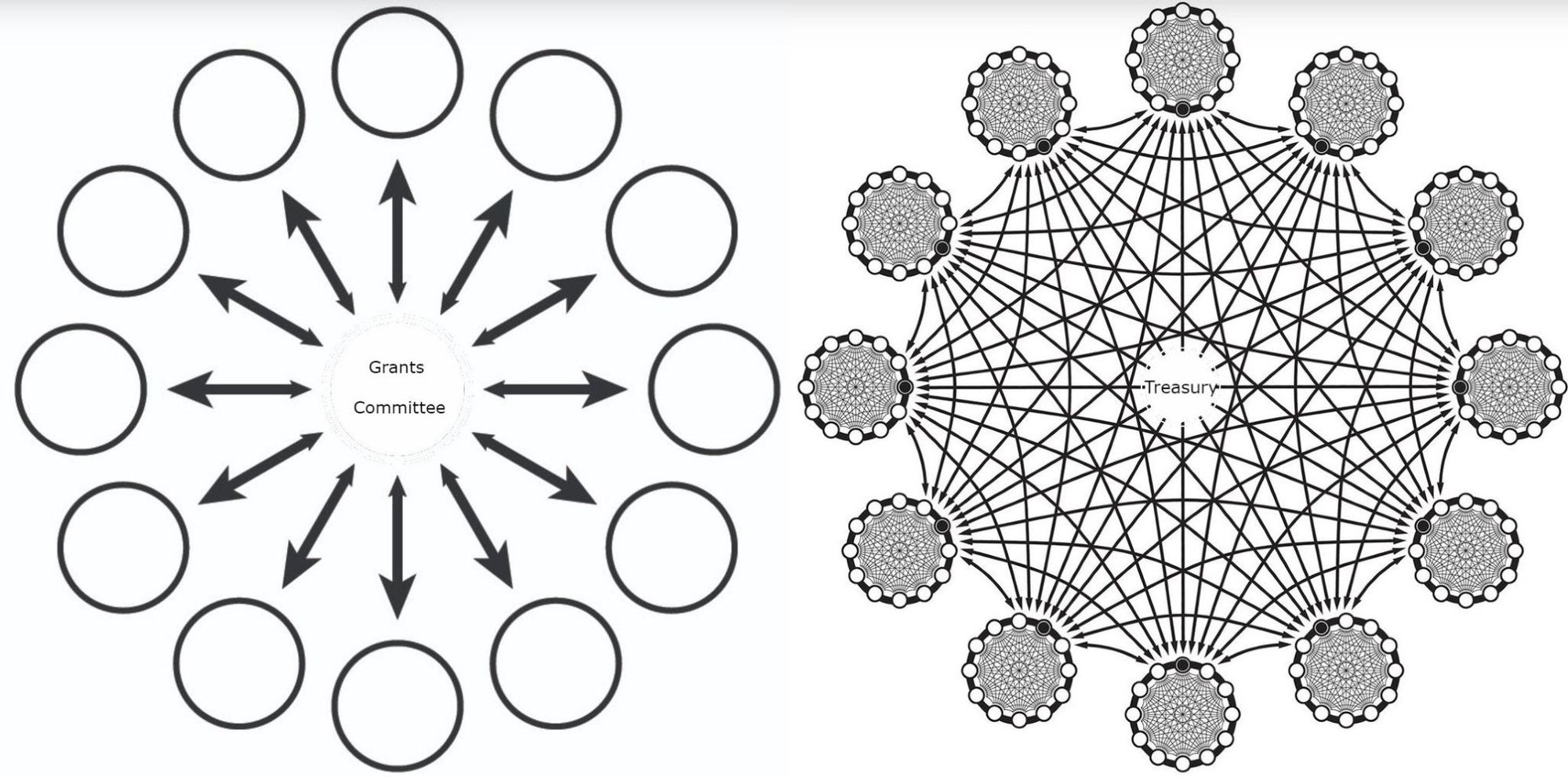

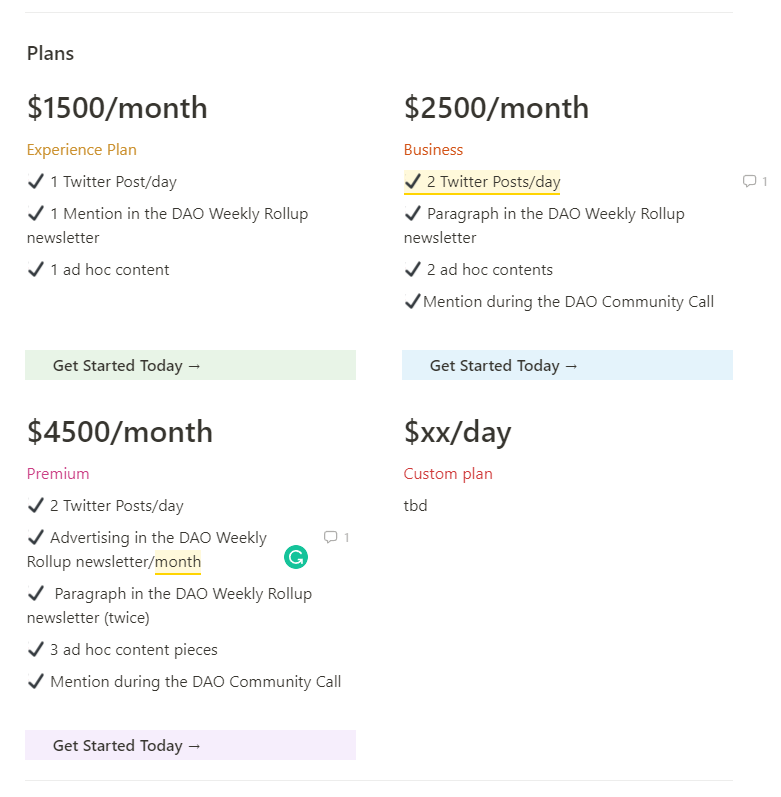

Thus far, these deliverables have been priced on-demand, which has been great for price discovery, but inevitably produces bottlenecks. To this end, we’re seeing the very beginnings of standardized deliverables.

So far, we’ve already seen the marketing guild standardize pricing for Twitter campaigns.

The marketing guild is the first of many to standardize their offerings, just like companies and services do within a broader economy. Transparent pricing and deliverables will make it easier for other guilds and projects to budget for future expenses and make for more efficient capital usage.

Rethinking Cost Centers

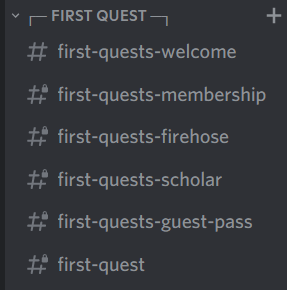

Thinking further along here, DAOs as economic engines are a useful framing for rethinking cost centers with an organization. Take, for example, First Quest. First Quest is Bankless DAO’s onboarding project.

Members drop into the Discord server and go through a series of “quests” that briefly contextualizes Bankless DAO’s mission, culture, tools, and operations.

Eventually, going through First Quest will lead directly to a guild workstream. Like a funnel with multiple outlets, new members can find a guild they most resonate with and jump directly into a guild-specific first quest. For example, the writers guild's first quest would be to complete an editing or writing task to gauge competency and familiarize new members with how the writers guild operates.

These tasks, like most tasks, have an associated bounty. When framing a DAO as an economy, I could foresee the First Quest team taking a cut of the writers guild first quest bounty (or any guild’s first quest) for each new member referred to the guild. In this way, First Quest has incoming capital flows instead of acting as a pure cost center.

Benefits of Distributed Capital Flows

The examples above are only an inkling of what a functioning DAO economy could look like, where each working group/guild/project/initiative/committee operates as a discrete economic component and engages in commerce with the rest of the DAO for goods and services.

At first glance, an interconnected economic web seems convoluted relative to a central capital pipeline (see Figure 1)—and indeed, a distributed economy is infinitely more complex.

But there are a myriad of benefits that are worth prioritizing.

Decentralization and Resilience

The main benefit of moving from centralized to decentralized capital flows is… decentralization! Creating an economic engine will ultimately reduce reliance on centralized intermediaries, like a grants committee.

Transitioning to distributed capital flows also creates a resilient economic structure, not reliant on a centralized source of funding, susceptible to corruption, bottlenecks, and inefficient practices.

As an added benefit, each instance of distributing capital to smaller pools, such as to each of the 13 guilds, creates experiments that run in parallel. Each guild has evolved to use their capital pools in their own ways and the best practices have cross-pollinated, which further increases resiliency across the DAO.

Velocity of Money

A DAO economy with distributed capital flows would increase the velocity of money transacted within.

In economics, the velocity of money refers to the number of times a single unit of currency changes hands—the more transactions, the higher the velocity. Velocity is a useful heuristic for understanding how much value a single unit of currency can create. A single USDC from a central treasury is only worth 1 USDC, but it can have a larger economic impact if that single USDC is exchanged five times a week.

For example, Bankless DAO has recently funded the writers guild. Let’s say that 600 $BANK will go to compensating a new member who has completed the writers guild first quest. A third of that payment gets redirected to the First Quest team, who then use the 200 $BANK to pay a designer to create a new graphic. That 200 $BANK has now changed hands three times despite being the same 200 $BANK.

In this way, a DAO can increase the impact of its native token by fostering an internal economy where tokens change hands more often.

Future of Work

What excites me the most about DAOs as economic engines is the potential for self-sustaining work.

We’re still in the early stages of DAO evolution, but I firmly believe that DAOs are the future of work. Each initiative, acting as a unit within a larger economy, has multiple ways towards revenue generation and becoming a self-sustaining group (see again the section Rethinking Cost Centers).

As the DAO economy becomes more advanced, we’ll see economic models emerge that will uniquely suit the goals of their creators. DAOs as an economy will frame each initiative as having a modular set of tools to generate capital inflows and outflows that will eventually sustain the underlying team as a source of income.

The Road Ahead

DAOs still have a long way to go before actualizing their idealized form. We’re barely decentralized and hardly autonomous, but we’re getting there. The roadmap for progressive decentralization must include methods to decentralize capital flows.

In our current state, most DAOs distribute capital to recipients from a centralized source.

The next phase of our evolution will mean that DAOs look more like economies, where discrete units have their own operating procedures and methods for capturing inflows and distributing outflows. DAOs will inevitably evolve into complex ecosystems, where each edge can engage in commerce with others.

Doing so will create resilient economic systems, multiply the economic impact of capital, and empower creators to build self-sustaining initiatives that can properly compensate for their work.

Action steps

- 🗞️ Subscribe to the State of the DAOs newsletter

- ☕ Read David’s musing on the Future of Work

- 🤿 Dive right in and join a DAO.

Author Bio

Frogmonkee is a core contributor at Bankless DAO where’s actively involved in governance, operations, the Writers Guild, and macro-level thinking. He recently joined Bankless HQ as an editor for the newsletter.

Go Bankless. $22 / mo. Includes archive access, Inner Circle & Badge—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

👉 Experience DeFi: Deposit, Earn, & Borrow with Aave

Aave is a decentralised, open source and non-custodial liquidity protocol enabling users to earn interest on deposits and borrow assets. Aave Protocol is unique in that it tokenizes deposits as aTokens, which accrue interest in real time. It also pioneered Flash Loans and Credit Delegation as innovative DeFi building blocks. The Aave Protocol V2 makes the DeFi experience more seamless with features that allow you to swap your assets for the best yields on the market, and more. Check it out here.

Want to get featured on Bankless? Send your article to submissions@banklesshq.com

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.