How to buy tokenized gold

Reminder: if you’re not a paid subscriber this is your last Tactic on the program! Free trial stops Thursday! 😲 Don’t miss out. Subscribe now & get 20% off forever!

Dear Crypto Natives,

No matter how bullish you are you shouldn’t keep all your wealth in crypto money. Even an aggressive version of the crypto barbell strategy means diversification into some low-risk & non-crypto assets.

But this doesn’t mean you have to use a legacy brokerage to buy these assets. At some point, all traditional assets will be tokenized on public blockchains—treasuries, corporate bonds, stocks, precious metals.

Want to diversify into gold? Cool. You can own gold on the blockchain today.

And we’re going to cover how do to it. I’ve evaluated a few tokenized gold options for us and have included some thoughts on the easy button.

One note—it’s still early for tokenized gold. I expect this tactic will need updating soon. Still, there are a couple of products mature enough to make gold on the blockchain more compelling than their legacy finance counterparts even today.

- RSA

TACTICS TUESDAY:

Tactic #9:

How to buy tokenized gold

You can buy gold represented as an Ethereum token rather than buying a gold ETF from your brokerage. Benefits include: compatibility with crypto finance, storage in crypto wallets, lower annual fees, and access to gold products that have traditionally been reserved only for large purchasers.

- Goal: Learn how to buy tokenized gold

- Skill: Intermediate

- Effort: 1 hour

- ROI: Gold ETFs cost 0.25% annually—tokenized gold can cost 0% annually

A word on gold

There are many who make the case for gold better than I. For me, the most persuasive case is made by Ray Dalio in his paradigm shifts article. He thinks the world is over-leveraged in due to the cash pumping policies of central banks. In the next paradigm shift, he says, sovereign assets like treasuries may not protect you—so adding gold to your portfolio may be “risk-reducing and return-enhancing”.

It’s funny. I personally believe Dalio is spot-on. Long non-sovereign value stores! Though his prescription completely misses crypto money as a potential solution. I understand his perspective—crypto is unproven, tiny, illiquid compared to gold (is crypto money a risk-on or risk-off asset—do we even know?)

Truthfully, I think Dalio along with many in his generation will be surprised by the long-term strength of crypto as an asset class—maybe he has more to learn here. But let’s stay humble—we have much to learn from Dalio. Gold been a flight to safety in the face of sovereign debt crises and currency inflation for centuries. It’s crypto for baby boomers. And since they hold a decent chunk of the world’s wealth, where do you think they’ll store it in a future crisis?

Yep. Dalio’s right. Holding some gold could make sense.

The crypto native way to buy gold

But this doesn’t mean we have to buy gold the way previous generations did. We can use open finance rather than legacy rails. We can buy tokenized gold.

What is tokenized gold?

Of course, we can’t put physical gold on the blockchain. So tokenized gold is a token (generally an ERC20 asset registered on Ethereum) that’s redeemable for physical gold. Each gold token represents some unit of physical gold in a vault somewhere. The gold tokens themselves are minted by issuers—so you have trust the vault, the issuer, and the process for redeeming gold.

Tokenized gold projects

There have been many tokenized gold projects marketed to crypto natives over the past couple of years. Some of these scams no doubt. There are only couple tokenized gold projects I’d trust enough to write about here, though you’re welcome to do your own due diligence—maybe I’m missing a diamond in the rough.

The three tokenized gold products I like:

- DigixGold (DGX) - launched May 2018

- PAX Gold (PAXG) - launched September 2019

- PerthMint (TBD) - not yet launched

Let’s talk about each.

DGX—DigixGold: The First Gold Token

Ticker: DGX

Digix did an Ethereum ICO before ICOs were cool—they raised $5.5m worth of ETH in March 2016 to deliver their tokenized gold project. They shipped their gold backed token on May 2018.

Costs:

- No fees for creating / redeeming (though 1% fee if redeeming for physical)

- 0.13% per transfer transaction on Ethereum

- 0.60% annual (currently turned off)

What I like:

- Redeemable for physical gold (but you have to fly to Singapore)

- Has been live over a year—many of the bugs have been worked out

- Can buy using BTC or ETH BitFinex and Kyber exchanges

- Transparent provenance & audit trail of each gold bar on Ethereum

What I don’t like:

- 18 mons after launch & there’s still poor liquidity

- Only $5.5m worth of DGX and just $1.5m added this year—slow growth

- There’s a governance token that seems unnecessary

- Unclear management accountability & organizational structure

I like that DGX is available on exchanges like BitFinex. I like the transparent audit trail they provide. I like that the asset has been live for 12 months. I like that they’re starting to be adopted by crypto payment companies like Monolith. But overall, I’m struck by the feeling that they could be doing much better. DGX had the first mover advantage, but they don’t seem to be moving fast enough with exchange listings, liquidity, and growth.

One theory for this: their “decentralized” governance structure is stunting growth. The market may offer a clue. Digix still holds 335k ETH of the amount raised. This ETH has appreciated since 2016, now worth $64m. Meanwhile, their governance token trades at 60% discount to the ETH they hold, worth only $25m. The market seems confident that either Digix won’t grow or the token has no rights to this growth or both. If an equity was valued so far below its book value, investors would demand the underly cash assets and dissolve the entity. Or install new management.

I’ve own DGX, but the feeling of missed potential has kept me eyes wide open for alternatives.

PAXG—PAX Gold: The Regulated Gold Token

Ticker: PAXG

PAX gold is product from Paxos—a digital asset financial institution—or a crypto bank as I call them. Paxos has a pretty successful stablecoin called PAX, third in size to USDC at $250m in market cap. They also have an exchange called itBit that doesn’t get much volume as far as I can tell. They released their PAXG product in September.

Costs:

Creating / redeeming PAXG using Paxos incurs a fee:

Minimum fee is about $30 per creation / redemption of PAXG

Creation / redemption >$3k worth of PAXG fees range from 1% to .125%

0.02% per transfer transaction on Ethereum

No annual fees

What I like:

- Regulated by the NYDFS—audited monthly attestations published on website

- Trust company structure means you still get gold in case of Paxos bankruptcy

- Redeemable for physical gold held in Brinks vaults in London

- Also redeemable for unallocated goal—highly liquid in traditional markets

- Just listed on Kraken—buy with BTC, ETH, EUR, USD

What I don’t like:

- PAXG asset hasn’t been live for long

- 1% for creation feels high—but no need to do this if buying from exchange

- Low liquidity so far—but it’s only been a month & already on Kraken

- Only $3.8m worth of PAXG—but that’s only $1.7m less than DGX

This offering is young, but it’s already showing strong potential. The redemption to either unallocated or physical gold is a plus. Given its listing with Kraken and relationships with major exchanges through its stablecoin, I think PAXG liquidity will easily surpass DGX by year end. The trust structure, public attestations, and strict regulatory compliance driven by the NYDFS give peace of mind.

They also appear to be managed by a team that’s organized, experienced, and intent on growing fast. There’s no governance token or “decentralized” governance structure getting in the way of execution. Their marketing is impressive. That said, the asset is still young, so maybe we’ll see some hiccups along the way.

PerthMint—the Government-Backed Gold Token

Ticker: (Not yet available)

The PerthMint Gold Token (PMGT) is not yet available, but will be an exciting new entrant. They are in the process of lining up exchanges and liquidity providers and will be launching in the coming week.

PMGT will be issued as an ERC20 token like DGX and PAXG, so compatible with Ethereum wallets. Unlike the others, there are purportedly no management fee, no creation / redemption fees, and no transfer transaction fees. I’m not clear on all the details, but this fee advantage seems to be due to the program’s direct relationship with the Perth Mint.

And apparently, the Australian government backs Perth Mint assets so it seems this will be the first tokenized gold offering with a sovereign state backing it up. There’s certainly enough here to make it unique so I’m looking forward to PMGT as a 3rd option.

How do I actually buy DGX or PAXG?

You can buy DGX and PAXG directly from their issuers or via exchanges.

Buy directly from issuers:

- Buy DGX directly from Digix here (AML/KYC and ETH address required)

- Buy PAXG directly from Paxos here (AML/KYC required)

Buy on exchanges:

You can get paid for creating PAXG? 🔥

Paxos is running an early bird promo on the first $10m of PAXG issued. If you create PAXG directly from Paxos they’ll give you back 2% in USD. Assuming the PAXG costs 1% to create (may be more or less depending on size) that means you make 1% in USD for your trouble.

How does tokenized gold compare to gold ETFs?

In many ways tokenized gold is already a better product than gold ETFs. Why?

- Runs on crypto rails—available in wallets, money protocols & crypto banks

- Makes buying gold with crypto much easier

- No annual fees—gold ETF’s range between .25 to .40% annually

- Redeemable for physical gold—ETFs are securities, no physical gold redemption

- 24/7 trading, transfer, and settlement—no intermediary

This comparison table from the Perth Mint is actually pretty accurate.

And bonus—remember when you learned how to break your IRA out of brokerage jail? Well, if you implemented that tactic you can put the tokenized gold you buy in a retirement structure and your gold gains will be tax free. Wow! See how knowledge in Bankless program compounds so quickly! 🔥🔥

Final Thoughts

Decide if gold makes sense for your asset portfolio. If it does, there’s good reason to consider tokenized gold over ETFs. Not just because you’re crypto native. But because you can save money and get access to a better product.

Both DGX and PAXG are good options for tokenized good—PAXG is still young, but I think is fast becoming the best option overall. Though I’m excited for new tokenized gold offerings from groups like PGMT. Increased competition works in our favor.

Action steps

- Decide if gold make sense for your asset portfolio

- Consider buying either DGX or PAXG tokenized gold

Level up—no interruption. $12 per mo. 20% off includes Inner Circle & Deal Sheet. If you haven’t signed up by this week you’ll miss out on future tactics.

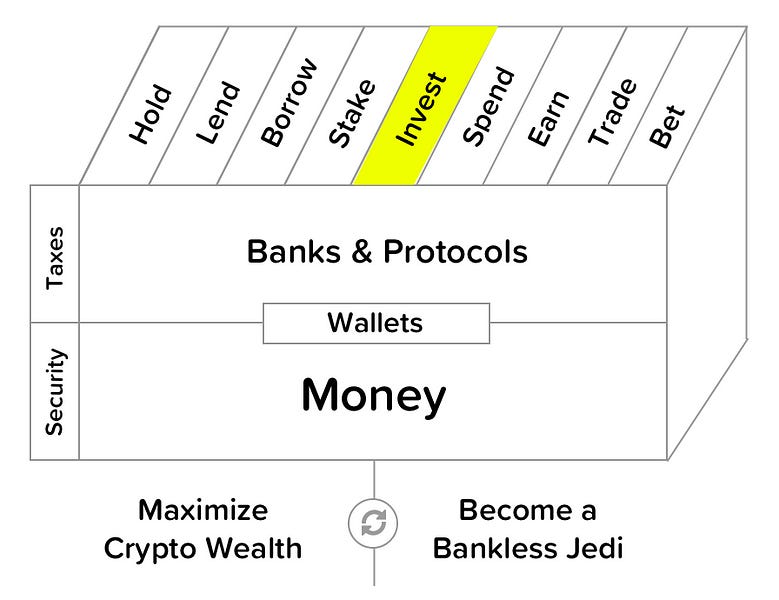

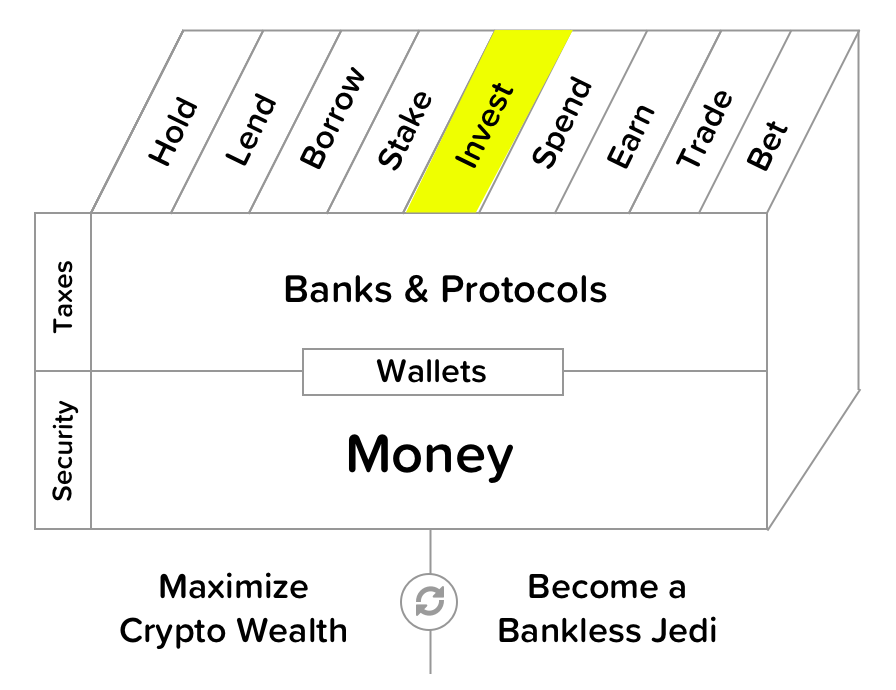

Filling out the skill cube

This week you leveled up on “Invest” area of the skill cube! Tokenized gold can save you fees and give you access to a better gold investments than in traditional finance.

👉Send Bankless a DAI tip for today’s issue

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.