Ethereum is an Emergent Structure

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

David explores Ethereum as a living structure. 🤯🤯🤯

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WRITERS CORNER

By Bankless writer: David Hoffman, RealT, Bankless host, & POV Crypto host

Emergence

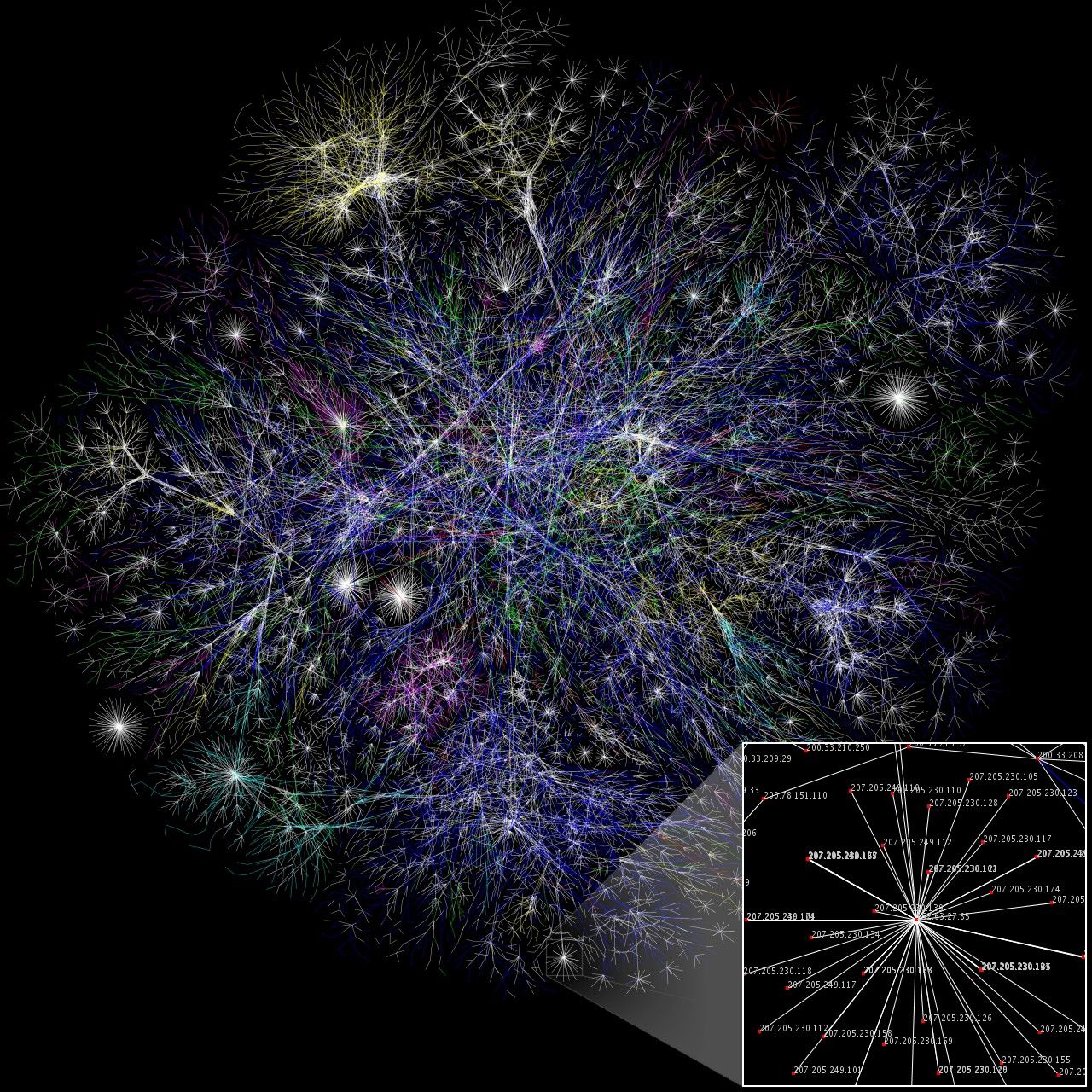

Emergence occurs when a system of interconnected parts is observed to have properties that its component-parts do not have on their own. Emergent properties are the result of the interactions of individual parts, but also the result of the interactions of the interactions of individual parts.

Emergent properties result from the combinations of interactions from the many components of a composed system.

The discrete parts of a system create permutations of combinations with all other parts. The larger the number of individual components in an interconnected system, the more powerful the emergent result is.

The Brain

Consciousness in the brain is a great example of emergence. Gestalt Psychology refers to the brain as “an organized whole, that is more than the sum of its parts”. You can compartmentalize the brain into different areas and label their function:

- Occipital lobe: Inputs and processes visual stimulus

- Temporal lobe: Inputs environmental stimulus and outputs meaning/significance

- Parietal lobe: Orients the body in space-time

- Pre-Frontal Cortex: produces goal-oriented behavior from the signals from the rest of the brain

However, you cannot find the brains ‘consciousness center’. Consciousness is an emergent phenomenon that is created when you combine the separate functioning structures of the brain together. Consciousness is a bi-product of the combinations of the discrete parts, yet it also represents the most significant characteristic of the human brain as a whole.

Markets

Markets are emergent phenomenons. No-one invented ‘the market’; rather it emerged as a result of the demand for the exchange of goods. Producers need an efficient place to exchange in order to access goods they don’t produce. As a result of the need for exchange, markets become more useful the more they are used. Larger markets have wider selections of goods available for trade and in higher quantities, and allow for more overall participants. As a market grows larger, more goods are available and more possible opportunities there are. The market becomes a better place to trade as it grows.

Markets are one of the unique things in this universe that get better when more people use them. This positive feedback loop creates the emergent product of markets: money.

For an illustration on how Uniswap reflects this phenomenon, read Uniswap is Infrastructure.

Money

Money is the emergent phenomenon from markets. The need to exchange goods creates the demand for a single good that everyone uses to act as substrate for exchange. Wheat, oil, coffee, steel all have desirable properties that make them valuable commodities. The equivalent desirable property for money is that it is able to be exchanged for anything of equal value, without loss.

Money’s good is as a substrate, and money becomes more useful when more people use it. Good money has good network effects, and the best money has the best network effects. The most used a money is, the less lossy it becomes during exchange.

Side note:

Money as an emergent phenomenon illustrates why the competition to be internet money is so strong, and why crypto-communities become so tribal. There is only one jurisdiction on the internet, and therefore only one space for money to compete. Liquidity begets liquidity, and moneyness begets moneyness. Fiat monies like the Euro, Yuan, or Peso can all coexist with the USD, because of the authority of each respective government to enforce the usage of their money in their region. On the internet, there is only one region. There is one place for internet money to exist, and thus the competition for the label of internet money is fierce.

Ethereum is a Platform for Emergence

The intrinsic characteristics of Ethereum set Ethereum up to be a platform that fosters emergence.

- It is a permissionless platform. Anyone can build.

- It is a turing-complete platform. Anything can be built.

- It is a composable platform. Anything built can interoperate with anything else.

These are the ingredients for emergence.

The rise of the Internet follows this same model. The Internet is an emergent system of interconnected users, websites, and traffic. Anyone can build anything on the internet, and anyone can access it. The rise of the internet was specifically enabled by the lack of obstacles to developing on it; no-one needs approval to built something on the internet.

As the internet developed, it began to develop faster. As it grew in users, the incentive for building on it grew, while the obstacles shrank. As time passed, more and more users came to the Internet, which ultimately forced the hand of every single company into establishing internet presence. Additionally, the tools for building on the internet became more robust and easier to use, reducing the costs of building something meaningful and allowing a greater set of people to become builders. A positive feedback loop set in; the incentives for being on the internet grew larger, while the obstacles for building on it got smaller.

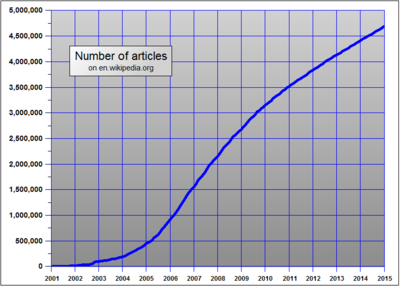

Wikipedia the Emergent Platform for Knowledge

The Wikipedia vs Encyclopedia Britannica story is a great example of the success and power of open-source and permissionless value-creation. The ability for any and everyone to write content for Wikipedia turned it from being a website that competes with Encyclopedia Brittanica, to a database of all recorded human knowledge.

Growth of Wikipedia articles over time

Unlike the coordinated and centralized effort of Encyclopedia Brittanica, the chaotic and decentralized content creation of Wikipedia ultimately created something far more valuable. Simultaneously, Wikipedia created a superior product without paying for labor. Thousands and thousands of authors contributed endless hours of labor to produce free content for the platform.

Further, those that contributed the content are often experts in their field, intrinsically driven to share the knowledge they have gathered, allowing Wikipedia to organically access expert knowledge for every possible domain. If an article is inaccurate, it tends to automatically get reviewed and corrected by those more knowledgeable. As human knowledge progresses, Wikipedia automatically updates.

All of this happens organically.

Articles :: Websites :: Apps

The Internet, Wikipedia, and Ethereum all represent open technologies with similar paths:

- Anyone can come to the platform and create something valuable

- When someone builds something valuable, it makes the platform itself more valuable

- The things that are built on the platform exhibit evolutionary qualities; they improve, iterate, or are replaced.

- The things that are built on the platform make all other things more useful and easier to build

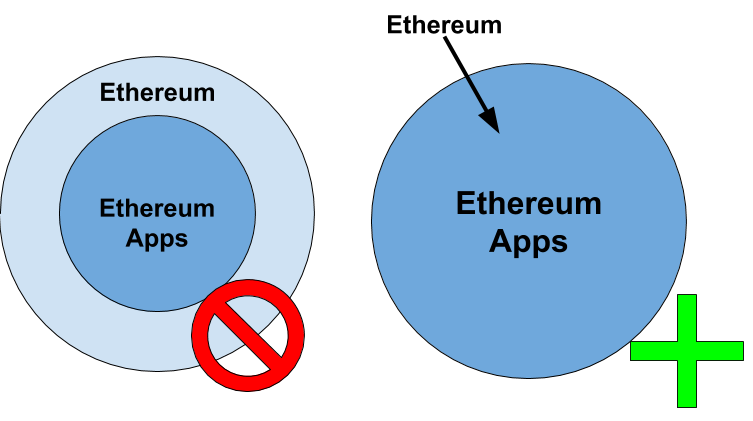

Ethereum is a Story of its Applications

Without applications Ethereum is nothing. Ethereum needs applications to be useful. Ethereum, and therefore Ether, derive utility and value from the applications on-top it.

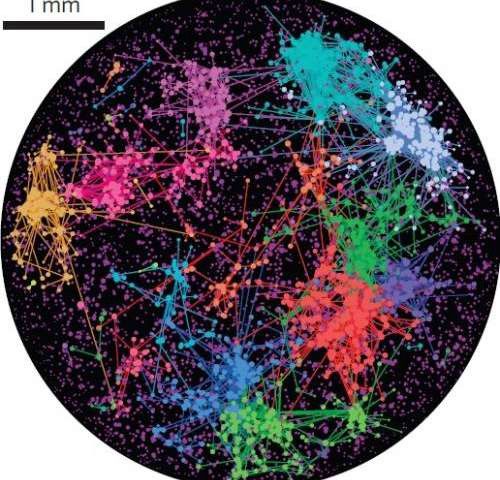

All Applications are Adjacent to Each Other

When you build your application on Ethereum, you are building in the same space as all other applications. All apps have surface area with all other apps. This is Ethereum’s core feature. The integration of a virtual machine inside Ethereum was a revolutionary improvement in the development of crypto-economic systems, but the ability for apps to be composed together is perhaps an even greater feature.

This feature is known as composability, and composability fosters emergence.

Surface Area

In the Ethereum ecosystem, businesses are apps, and when an application is deployed, it generates products and services for people and other applications.

The creation of a product/service generates surface area. An application’s surface area is the external-facing components on an application that other apps can hook into and build off of.

Composability on Ethereum creates surface area. When an application is built it creates a product. This product represents the surface area of the applications

(Above) trees, leaves, veins & arteries, lung bronchi, lightning, broccoli, pinecones, snowflakes, rivers, supply chains, neural networks, social networks… the universe?

MakerDAO’s Surface Area:

- DAI

- The DSR

- Vaults

- Keepers

- MKR Governance

- MKR Auctions

These are the external-facing features of the MakerDAO application. It has a lot of surface area. Applications like Compound and Uniswap also have large surface areas

Side note: the cool thing about Uniswap is that it only has surface area. The correct definition for what a “DAO”: an application that only has surface area. Code on the inside, humans on the outside.

Each application on Ethereum generates surface area for others to latch onto and leverage. But when applications built each other, they create new surface area as well! This is how the Ethereum structure grows: different components building off of other components. Money Legos! The collective surface area of every composed app is the outline of the Ethereum structure in its entirety. Applications build on-and-around each-other, and the structure grows.

Like barnacles on a turtles back, each app increases the surface area, and generates new surface for others. Unlike Barnacles however, applications increase the well-being of the apps below it. Applications that built off each-other are inherently symbiotic; each provides services/customers/value for each-other.

Where the Emergence Emerges

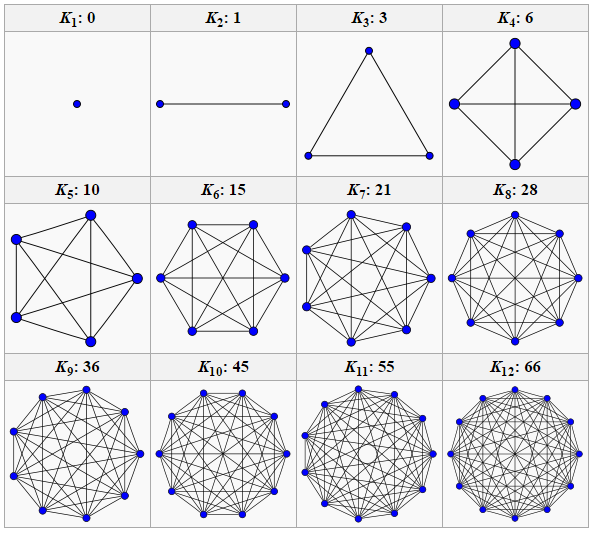

Linear growth of applications produces quadratic growth of surface area.

Every new application on Ethereum generates larger permutations of possibilities than the applications previous. In the image above, K3 generated 2 possible connections, but K12 generated 11 possible connections. The more applications on Ethereum, the more potential there is for new applications. Growing the economic pie!

Imagine Ethereum at the genesis block, depicted by K1 in the diagram above. No contracts, no apps; the only thing that existed was the native asset Ether: a single 1D point in an empty universe. How do you build something like PoolTogether or DeFiZap in this early universe? You cannot; you first need more fundamental primitives to provide foundation and structure for higher-level apps. (RSA-tech tree!)

MakerDAO is the leader in the ETH Lockup Leaderboard is because of the magnitude of the surface area that it creates. The existence of DAI, the only stable cryptocurrency, creates such a wide new landscape for Ethereum applications to be built. The size of MakerDAOs surface area is illustrated by the never-ending list of DAI-derivatives (Chai, cDAI, aDAI, rDAI, LSDai, PLDai), as well as Vault services like CDPSaver, and most importantly, the growing list of DAI markets (dYdX, Uniswap, Oasis, Fulcrum, Curve, Compound).

Good applications create large surface areas. The ETH Locked in DeFi leaderboard can be viewed as a measure of each applications surface-area for other applications. Compound and Uniswap also have large surface area for other applications to be leverage.

Read Uniswap is Infrastructure: an exploration of the different faces of Uniswap that other apps can latch onto.

PoolTogether uses Dai inside of Compound, plus their own app, to produce a no-loss lottery. The PoolTogether app is built atop the surface area of MakerDAO and Compound. PoolTogether also produces PL-Dai, which other apps can leverage. PL-Dai is PoolTogether’s surface area for other apps. Now that PL-Dai exists, it can be made easily accessible by Uniswap, making it easy for other apps to build on PoolTogether!

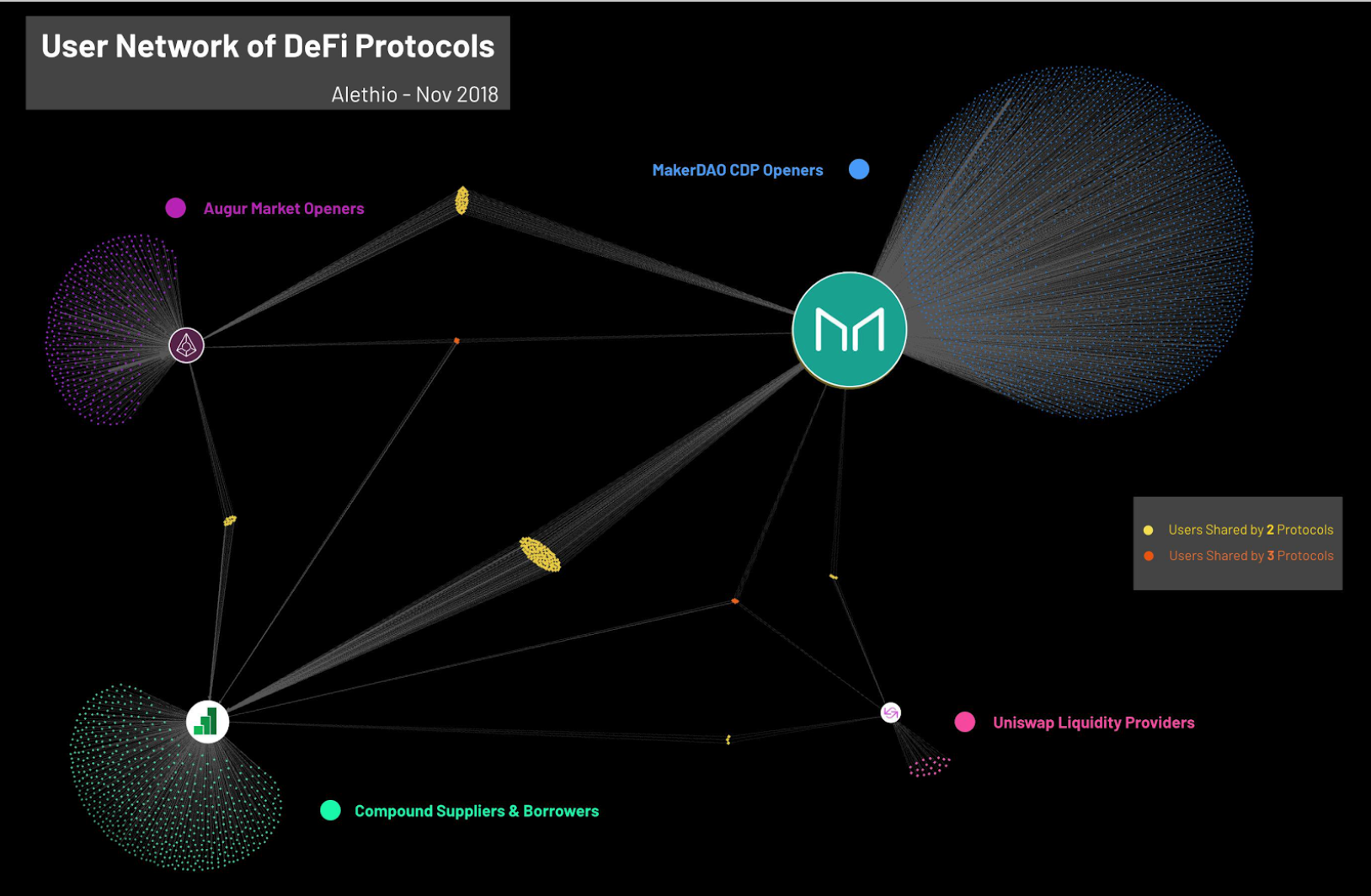

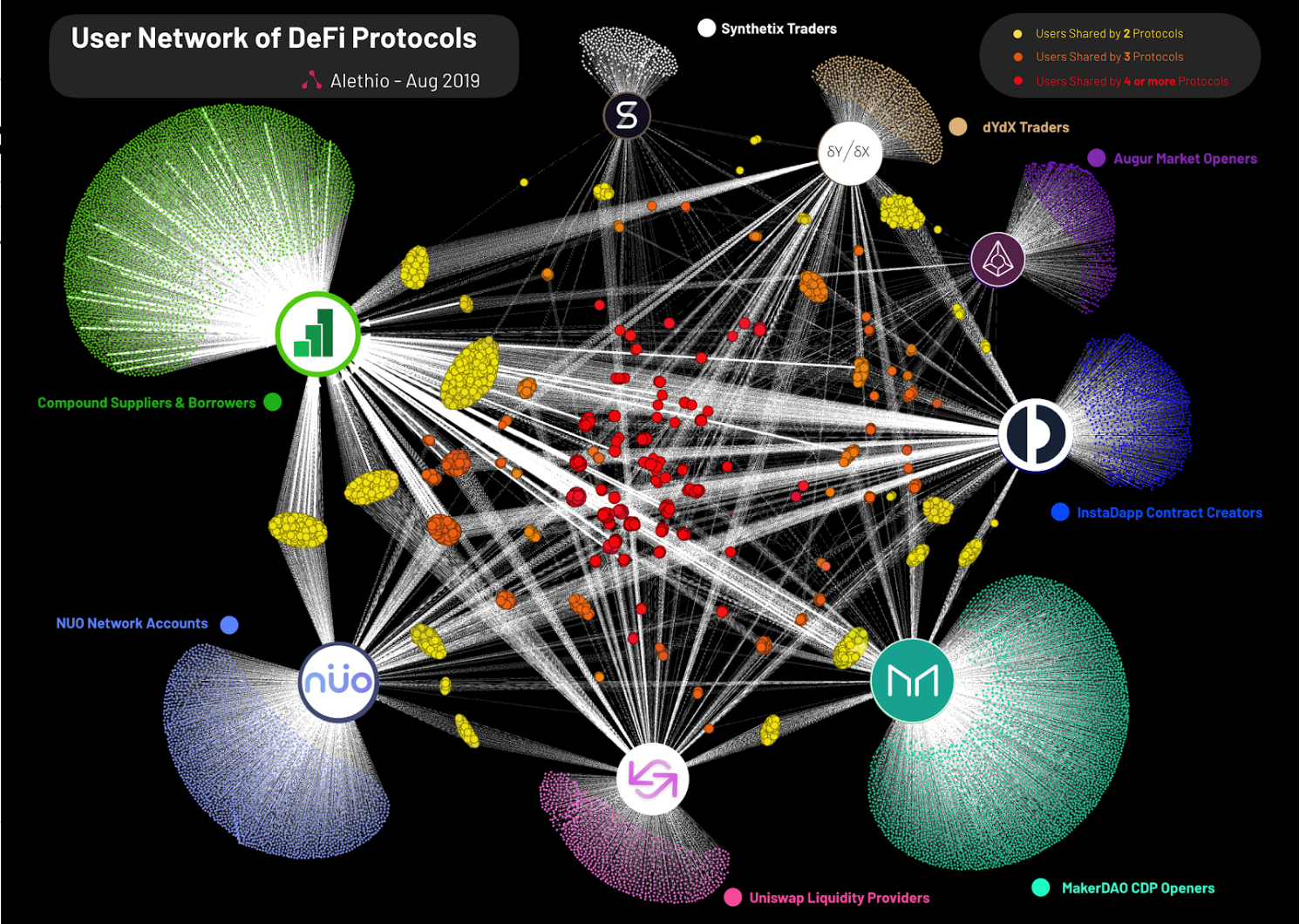

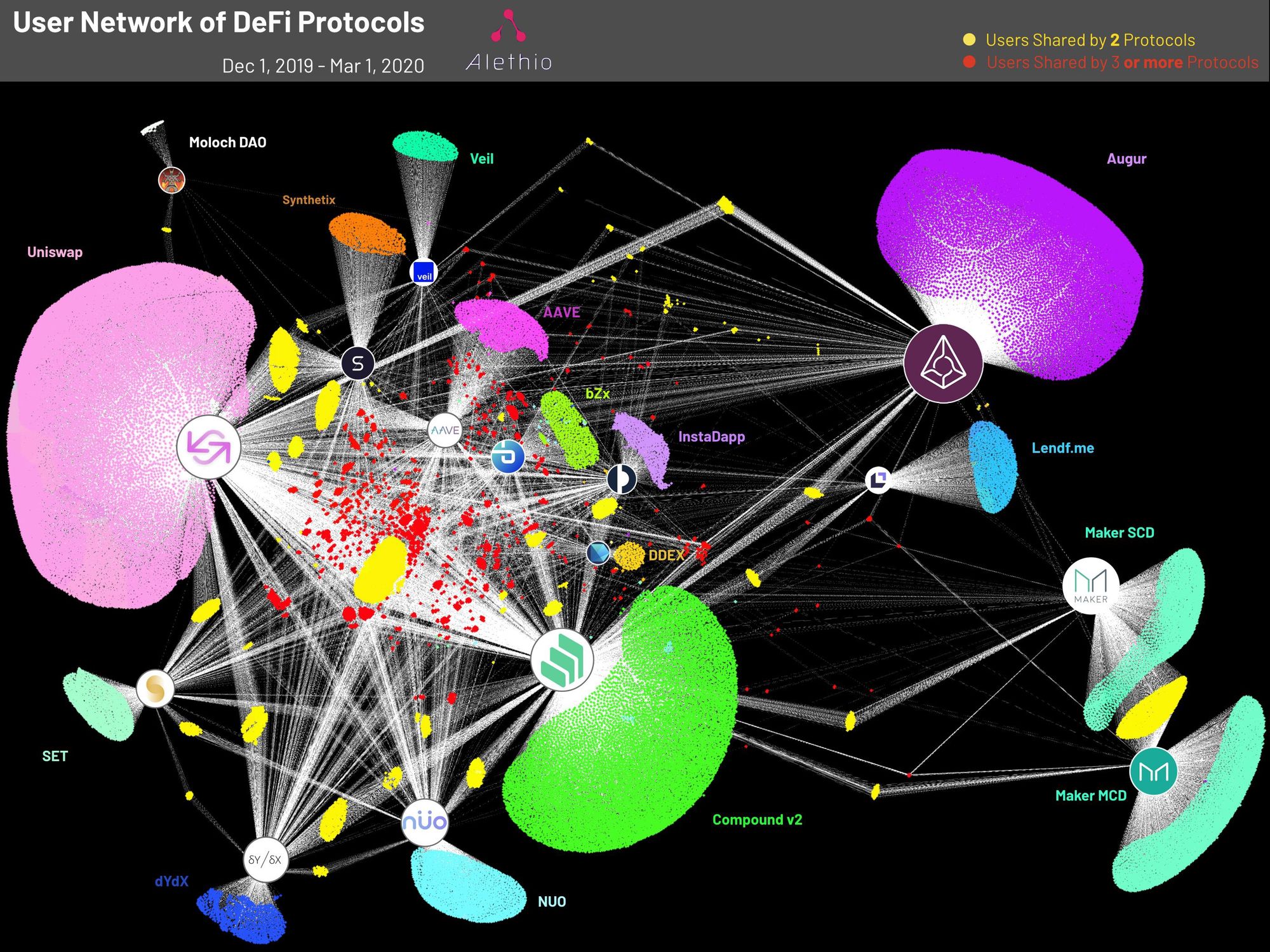

(Below) 16 months ago…

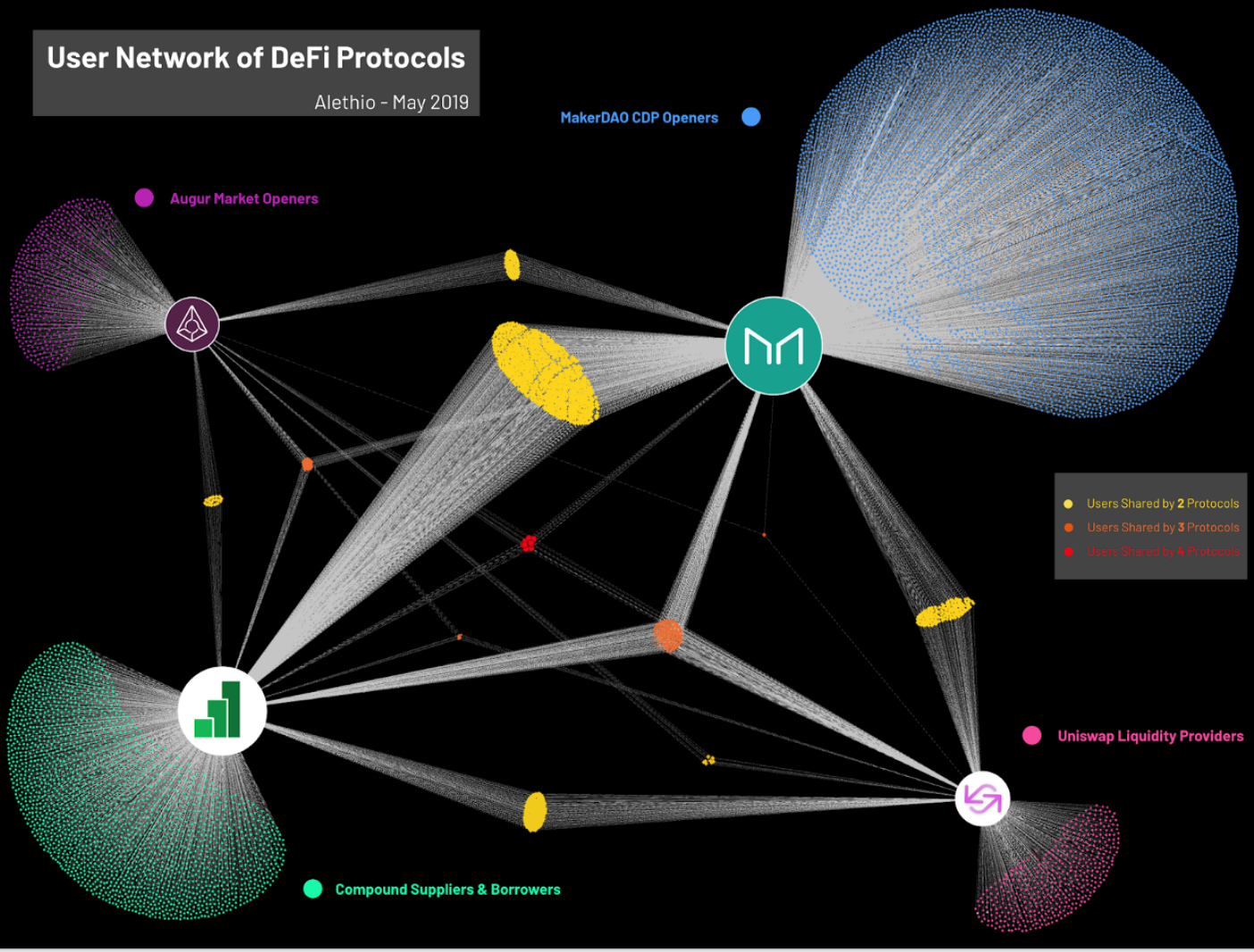

(Below) 10 months ago…

(Below) 7 months ago…

(Below) Today

(Above) If this were able to be represented in 3D, everything would be standing on top of MakerDAO. Maker is smaller due it being split into SCD and MCD, as well as low velocity between DAI and Vaults.

Ethereum is an Organic Structure

The collection of applications on Ethereum compose Ethereum. Applications are not a subset of Ethereum, they are Ethereum. There is nothing that “is Ethereum”, other than the apps that live inside it.

As applications are built, deployed, and composed, the Ethereum structure grows. I’ve frequently illustrated Ethereum as a landscape. A physical plane of existence where things are built. Ethereum is the ground for builders to build structures on. Each application on Ethereum is a structure, which each contribute to the development of the Ethereum landscape.

(Above) Ethereum builder Austin Griffith ^

Perhaps this gives to meaning to the term “Buidler” when it comes to Ethereum devs. Those who construct and deploy code are building physical structures on Ethereum. Software engineers are called engineers for a reason; they are responsible for building stable structures for others to use.

A Composed Structure

Structures on Ethereum converge upon each other. The ETH deposited inside an application is a measure of the mass of the app. The more ETH an application has, the more mass it has, and the greater the gravitational pull it exerts on others.

ETH deposited into an app is a measure of how useful that application is, both to users and other apps. “Being useful” simply represents how many other users and apps need that product/service. “Being useful” is the incentive for others to use your application, and represents the strength of the gravitational pull that each app produces.

Everyone needs stability in their economic lives. Also, everyone needs to use the same currency that everyone else uses. It is 1000x easier to just use DAI than to create your own stablecoin. Since everyone is already using DAI, why try and solve all the problems that MakerDAO has already solved? Just use DAI. The gravitational pull that Maker has on the rest of the ecosystem is difficult to escape. Just give in. One stablecoin to rule them all.

The next biggest ETH-lockup applications are Compound and Uniswap, and along with Maker, these represent 75% of all the ETH locked in DeFi. Consequently, the majority of all Ethereum apps leverage these platforms because the surface area they’ve created is so large.

The gravitational pull that ETH-holding apps exhibit doesn’t only pull on a few apps; they pull on ALL apps. The gravity of ETH creates the convergence of applications from being many disparate individual structures, into one single superstructure. The growth of this superstructure is the growth of Ethereum. Ethereum is the sum of its apps.

This gravity is not confined to the internal ecosystem on Ethereum. The rules of money and economics transcend crypto. If there are users with economic activity, there is incentive to join the economy and capture some of that value that is being transacted. The gravitational pull generated from the economic activity inside Ethereum creates the incentive for legacy finance to migrate to Ethereum. Eventually, the incentive to either use, or be apart of, the Ethereum superstructure will pull in everyone. The larger the Ethereum structure grows, the stronger the influence it pulls on the outside world.

Ethereum is a City

Cities exist because they are epicenters of economic activity. Living in a city increases ones exposure to the economic activity inside it. Cities are places of opportunity and growth; ever since the industrial revolution humans have converged upon cities in order to access the opportunities available. The economic activity that cities generate creates the same gravitational pull illustrated above.

Cities are Efficient Structures

It’s easier to coordinate and distribute resources when everyone is living in the same spot. The public, and goods distributors, can converge on the same spot in order to access the same markets. Distributing food is easier when everyone can access the same supermarkets. Distributers have fewer destinations to go to, and are able to distribute more goods, faster. When lots of people all use public transportation, the costs of building and maintaining transportation reduce on a per-unit basis. It would be idiotic to build a subway in North Dakota. Indeed, the efficiency of cities increase with scale: bigger cities are more efficient than smaller ones (liquidity begets liquidity).

Cities are Emergent Structures

No one coordinates the development of a city; they are constructed from the incentives of thousands of different individuals. Even things like city governments or city counsels only have so much control over the direction and evolution of the city. The development and growth of cities is through chaordic organization: organization through chaos. Chaordic organization is the description of the resultant product of emergent systems: auto-organization of separate-but-composed units.

The demand to live inside a city generates the demand for both housing and workspace, creating to incentive for developers to build structures to house humans and human labor. With the growth of housing and bazaars comes growth in population, and increased demand for secondary and tertiary services. Over time and iteration, human meeting-places turn into skyscrapers and 1,000-unit apartments. Supermarkets and restaurants feed everyone; offices coordinate labor; bars and music venues entertain; daycares and schools. Hospitals. Hotels. Gyms. Casinos. Parks. Clubs. Skateparks.

What began as a handful of individuals needing to secure a livelihood emerged into a complex and integrated system of efficient resource allocation and exchange.

Ethereum exhibits these same qualities. Every application on Ethereum represents opportunity for others. Every new application built on Ethereum brings opportunity for new users and further applications. When new users and new apps arrive on Ethereum, further opportunities are created for the next wave of users to come and take advantage.

The structure build itself.

The Structure Builds Itself

Illustrated above, things like cities and Ethereum have positive feedback-loops that create self-fulfilling prophecies for their own existence. Just as markets, money, and cities become more useful and efficient as more people use them, Ethereum becomes a better place to build when others are already building there.

Following this same pattern, it’s easy to see why Ethereum as a platform has seen the success that no other platform has: large structures have already been built on Ethereum that offer large surface area for other applications. There are already products and services on Ethereum to make building your product/service easier. Everyone already lives in Ethereum; on the Internet there are no borders preventing migration from rural to urban.

However, Ethereum has an additional feature that cities, markets, and monies do not have when it comes to bootstrapping themselves into existence.

That feature is ETH.

Apps that Leverage ETH Are Adopted

At the genesis block, Ethereum was devoid of life, with Ether being the only object in its universe. From the point-of-view inside of Ethereum, Ether is looking for things to do. It is BORED and it needs ACTIVITIES. Applications on Ethereum represent attractions and places-of-interest for Ether to go.

Imagine you participated in the Ethereum presale and you are the owner of 10,000 ETH. How does an application like Peepeth (decentralized Twitter) benefit you? At the cost of 0.00001 ETH per tweet, you can tweet 100,000 tweets and still have 9,999.9 ETH leftover. Peepeth doesn’t solve the problem of how to effectively leverage your ETH.

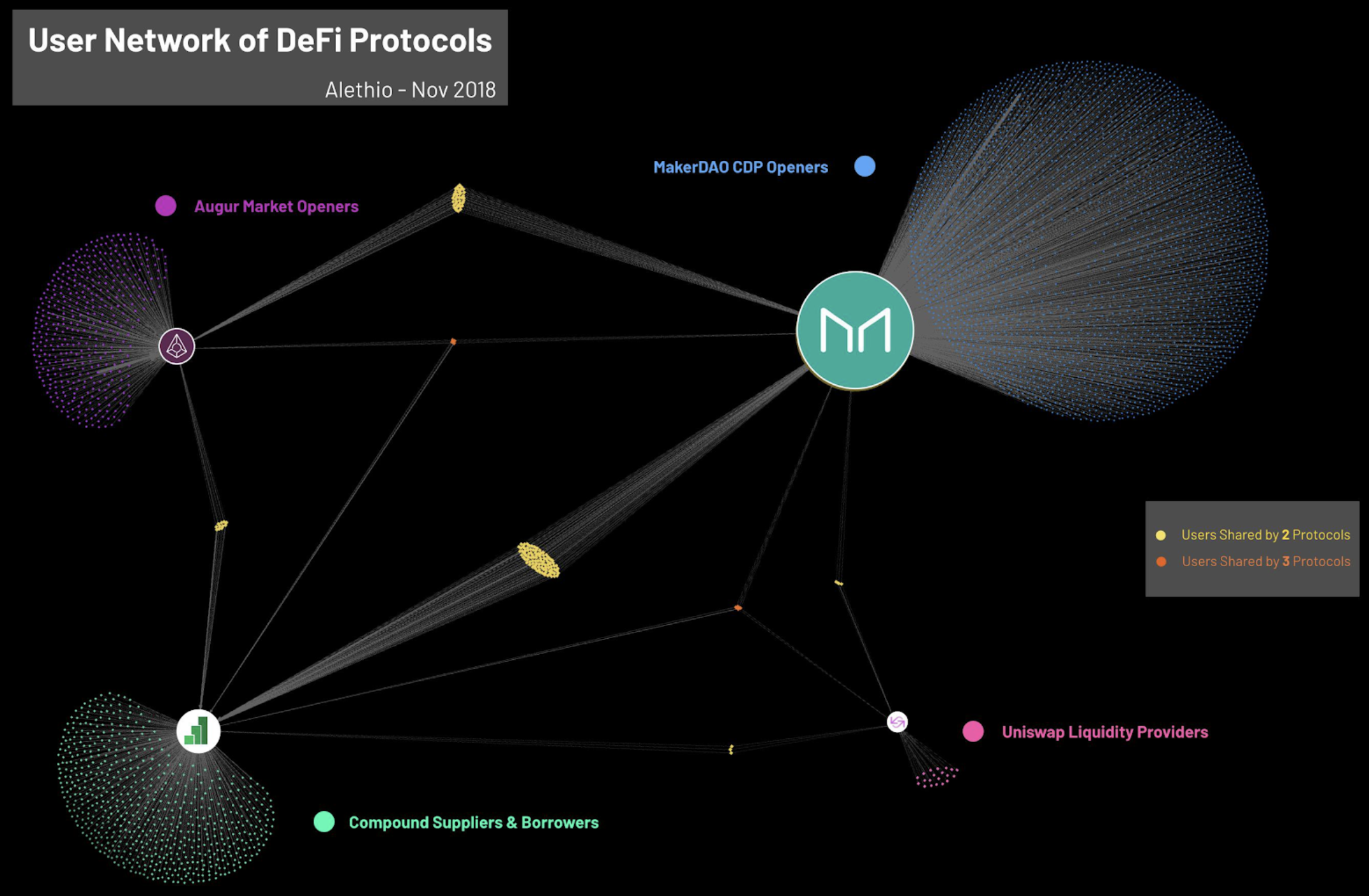

(Above) The early days of DeFi. Maker’s early dominance as the first platform that allows you to leverage ETH as a valuable asset is clearly depicted.

Applications that leverage ETH as a valuable asset offer solutions to what you should do with your ETH.

In addition to the large surface area that MakerDAO creates, there is an additional thesis as to why MakerDAO saw such early success: it was the first application that allowed you to leverage the value of your ETH.

Applications that allow Ether to be leveraged as a valuable asset are automatically chosen by Ether-holders to use.

Because what else are they going to do… send 10 billion tweets on decentralized Twitter? It’s far more likely that Ether users put $10 billion into financial applications that allow users to find ways to leverage the capital inside their ETH for a productive output.

Applications that allow the productive use of Ether are automatically adopted.

All Ethereum users have at least one thing in common: they hold ETH. Since ETH is required to execute a transaction on Ethereum, this is basically guaranteed across the entire set of Ethereum users; they probably hold at least some amount of ETH.

Applications that create utility for ETH are generating incentives for depositing ETH into their app. When an application generates this incentive, they are generating the incentive to purchase and hold ETH in the first place. They are providing utility-value to ETH.

When “DeFi” is a collection of thousands of different applications that all generate incentives to deposit ETH, ETH becomes a generalized asset that is accepted everywhere on Ethereum as the main collateral of choice. In other words, ETH is Money for DeFi.

There is 2.8% of all ETH locked in DeFi. We are just in the early days of Ethereum applications being built to offer services to ETH holders. Yet, we have still seen a clear pattern of how future applications are going to be built.

- Build an application that uses ETH as collateral

- ETH is deposited into this application, proving that this app is useful to ETH-Holders

- The growth of ETH deposits proves to VC funds that they have found product/market fit for their app

- The app receives VC funding

- The team uses the funding to improve their product, in order generate more ETH-deposits.

At the genesis block, Ether is BORED. Applications on Ethereum automatically receive adoption when they provide services that offer ways to leverage the value of ETH.

PeePeth: “What if we can make Ethereum useful to those that haven’t adopted it yet?”

MakerDAO: “What if we can make Ether more useful?”

Twitter users don’t care about PeePeth, but ETH-holders chose MakerDAO to succeed. MakerDAO gave ETH a path to utility. MakerDAO allows Ether holders to access a return on their capital. The same goes for Compound, Uniswap, and every application with ETH deposits. The ETH-locked in DeFi metric is a measure of each applications usefulness to Ether and Ether-holders.

Simultaneously, they generate the mechanism as to how ETH becomes valuable. When more DeFi applications leverage ETH as money, it makes ETH into money. If Ethereum and DeFi host the majority of the economic activity of crypto systems, then ETH is internet money. If they host the majority of economic activity of the entire globe, then ETH is money for the world.

This bootstrapping mechanism is how the Ethereum superstructure builds itself. The incentive to build products and services on Ethereum is built into the protocol itself. This is why DeFi as a use-case has taken off, while most other Ethereum apps have seen lackluster adoption. DeFi paves roads for ETH to be valuable, and ETH holders are incentived to take this path, because it’s the path that increases the value of their asset. ETH will build itself into internet money.

The Epicenter of Ethereum is Ether

The foundation of Ethereum’s city is Ether. The economic activity of Ethereum requires a currency, and the native currency of Ethereum is Ether. All roads in Ethereum lead to Ether. The gravitational pull from Ethereum apps is generated by the Ether that is deposited in it.

The genesis block of Ethereum was a 1-Dimensional structure. Ether was all that existed. The structure being built is being built on top of this single point. The collective weight of every application falls upon Ether. This weight is reflected in the market-price of ETH. The number on the scale that Ethereum stands on is the market-price of ETH.

The Ethereum economy generates demand for Ether. MakerDAO requires it, Uniswap requires it, Compound, dYdX, Augur, Aave, Set all require ETH. Applications like PoolTogether require DAI instead, but 1 DAI requires at least $1.5 of ETH in MakerDAO!

All roads on Ethereum lead to Ether. If Ethereum is a nation, then Ether is its capital.

The Superstructure is an Organism

Organisms are emergent beings. You, the reader, are a system of interconnecting components, which are themselves comprised of interconnecting components. Down to the trillions of individual cells, the superstructure of the human body is an orchestration of components across different scales.

The Cells

The cells are the smallest units of the organized whole. Each cell only knows about its adjacent ecosystem, and only acts in its self-interest to live long and prosper.

In the global economic system, cells are individual economic agents; individuals who have localized knowledge about the economy in their specific environment.

In Ethereum, the cells are the agents that engage with each application. Every market participant is acting in its own self-interest, with valence to the applications that they are familiar with and understand.

The Organs

Organs are themselves a structure of the cells that comprise them. An organ is something that is created out of the demand from the larger body. The need to pump blood, the need to filter toxins, the need to sense surroundings are all roles of individual organs, which are themselves comprised of cells.

Applications are organs. They are comprised of individuals that use the application to achieve their own goals, and as a result make the application larger and more useful. Each application on Ethereum produces an output for the rest of the structure to leverage; MakerDAO’s output is DAI, Compound’s output is cTokens, etc. Every organ in Ethereum fills a specific role inside of the greater structure.

The aggregate output of all the individual agents that engage with an Ethereum app are how Ethereum apps relate and orient themselves in reference to other applications.

The liver, the organ that is responsible for removing toxins, is located next to digestive tract, the place where toxins arrive in the body. The heart is located in the center, where it can most efficiently distribute nutrients. These organs exhibit chaordic organization. This is how Ethereum apps auto-organize. Complementary applications will naturally converge upon each-others in order to effectively leverage each other’s surface area.

The Body

The body is the final product of chaordic organization. After millions of recursive iterations by natural selection and evolution, the body is a streamlined and efficient system, produced by internal fights over scarce resources inside a single ecosystem. The body is like a city; many individual components that organically orchestrate to produce an emergent result.

Ethereum is a body. All the applications on Ethereum represent the individual organs that compose the greater whole. The outputs of every application are combined and converged by the body to achieve a single, prime objective: to live long and prosper. The emergent goal of the Ethereum ecosystem is to grow. Ethereum’s main goal is to survive. Once this goal is achieved, it can focus on its secondary goal; to thrive. All organisms have these two goals:

- Survive (defense)

- Thrive (offense)

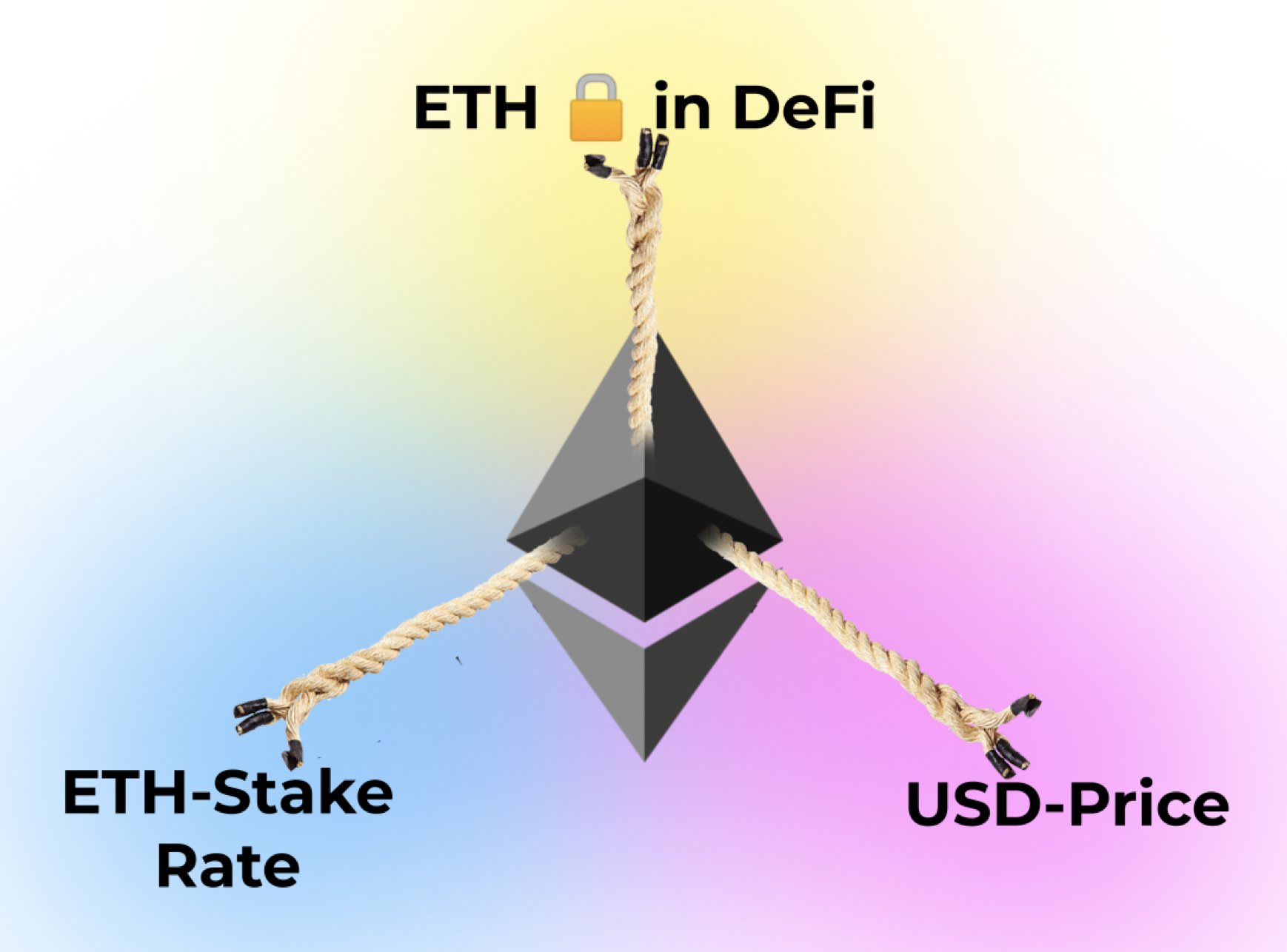

Ethereum’s defense comes from its consensus algorithm: The amount of staked ETH. This is that wall that must be overcome in order to bring-down Ethereum. These are the scales that protect the body. The more ETH staked, the denser the scales.

(Above) Ethereum dgafing about its larger, legacy finance alternatives. This is a Pangolin, BTW

Ethereum’s offense comes from the utility and value that Ethereum applications provide, which we can measure as ETH Locked in DeFi. Ethereum applications are the teeth and claws of Ethereum: the weapons for the hunt. These applications are tools for ETH holders, and threats to any competitor outside of Ethereum.

Each head is an Ethereum app; the size of each corresponds to the amount of ETH locked inside

The Gravity of The Superstructure is the Monetary Premium of ETH

All the apps that compose the superstructure have mass that weighs upon Ether. The weight that Ether bears in supporting the superstructure is reflected in the U.S. dollar price (the Normal Force on ETH). The higher the weight of the structure, the more load it bears on Ether. This reads like a stressful scenario, but I assure you, its actually awesome 😎

The collective weight of the Ethereum superstructure is a measure its demand for Ether. A superstructure that has 0 ETH locked in it is weightless and meaningless. A superstructure that has 3.2M ETH in it is a system that pulls 3.2M ETH off the secondary market, and drives 3.2M ETH worth of scarcity and demand. Currently, the Ethereum superstructure weights 3.2M ETH.

In order to support the weight of the Ethereum superstructure, the Ether price must increase. The superstructure represents gravitational pull on the supply of ETH: the collective incentive for people to deposit ETH inside of it.

The superstructure is a general structure. Ether, as the native asset of this superstructure, is accepted as currency everywhere in this superstructure.

Money is the good that is the most sale-able: the asset that is accepted anywhere and everywhere, for the least amount of slippage. Inside this super-structure, ETH is money. Because all roads lead to ETH, there will never be any other asset that is the most sale-able and liquid asset in Ethereum. As the native asset of Ethereum, it is destined to be the money for the ecosystem.

The weight of the superstructure on the market-price of ETH is what creates the monetary premium of ETH. The superstructure is a general structure, and the collective weight of Ethereum apps create a generalized positive price pressure on ETH.

“Generalized positive price pressure” is a synonym for “monetary premium”.

Summary

Ethereum is a superstructure of composed financial applications. All applications on Ethereum create surface-area for new applications to build off of, which in turn creates further surface area. Rather than leeching value, applications that build together are value-generative. Applications that built on others act as funnels for the applications below them. Applications that produce large surface areas create their own landscape for other applications to leverage. The larger the surface area, the more room there is to use.

The internal financial ecosystem of Ethereum exhibits chaordic organization. The gravitational pull generated from each application is the mechanism for how disparate discrete components organize in efficient and effective manners, and generate a single, efficient superstructure.

Each application in this structure has mass, and weighs upon the applications below it. The lower applications are foundational to the ones above them. They bear the load, and also receive their share.

ETH is the fundamental particle of the Ethereum universe: the native asset that produces the mass of Ethereum. The market cap of ETH is the weight of its mass: it’s influence upon the world outside it. The ETH Locked in DeFi is the measure of the total mass of the Ethereum superstructure.

At the beginning of this article, we discussed how money is the emergent product of markets. Markets are places of exchange, and exchange is more efficient with money. Markets create the money.

Ethereum is a platform for markets. All significant DeFi applications: Maker, Compound, Uniswap, Augur, dYdX, are all market-applications. These market-generating applications all need a money to function. Ether, as the native currency of Ethereum is the most obvious choice. It’s holders want applications that use it as money, so that the holders… can use it as money. This creates a perpetual energy out of the ongoing incentive to use Ether as money.

The structure constructs itself

Follow me on Twitter: @trustlessstate

Thanks for reading!

The conversation continues inside the Bankless discord channel.

Also, subscribe to the Bankless Podcast on iTunes or Spotify, where David and Ryan discuss these concepts in-depth, and peel back the layers of Ethereum and its superstructure.

Author Blub

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his talk on how ETH accrues value and this accompanying post.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.