Ether: The Triple Point Asset

Level up your open finance game three times a week. Subscribe to the Bankless program below.

This article explores Ether’s role as an asset in Ethereum. Using data from the last ~2 years of the Ethereum economy, I propose a novel definition for understanding Ether, the asset: bandwidth for permissionlessness inside of Ethereum.

This article, summarized in two paragraphs:

Ethereum is a foundation for building an alternative internet-based financial system. This financial system has the capacity to be completely open and trustless. This new financial system needs a native money to operate. Financial applications in this new landscape need a trustless form of collateral for their operation, and the only truly trustless asset on Ethereum is Ether.

As a result of this demand, Ether has become an economic-trifecta; a “triple-point” asset, satisfying all the requirements that a new economy needs, all at once. As a result of this, Ether has become the best model for money that the world has come up with.

This article, as a talk at Ethereal Tel Aviv:

There are two assumptions in this analysis of Ether and Ethereum:

- Ethereum 2.0 has enabled ETH staking ✅

- EIP-1559 has been implemented, which burns ETH in transactions✅

Part 1: Defining Ethereum

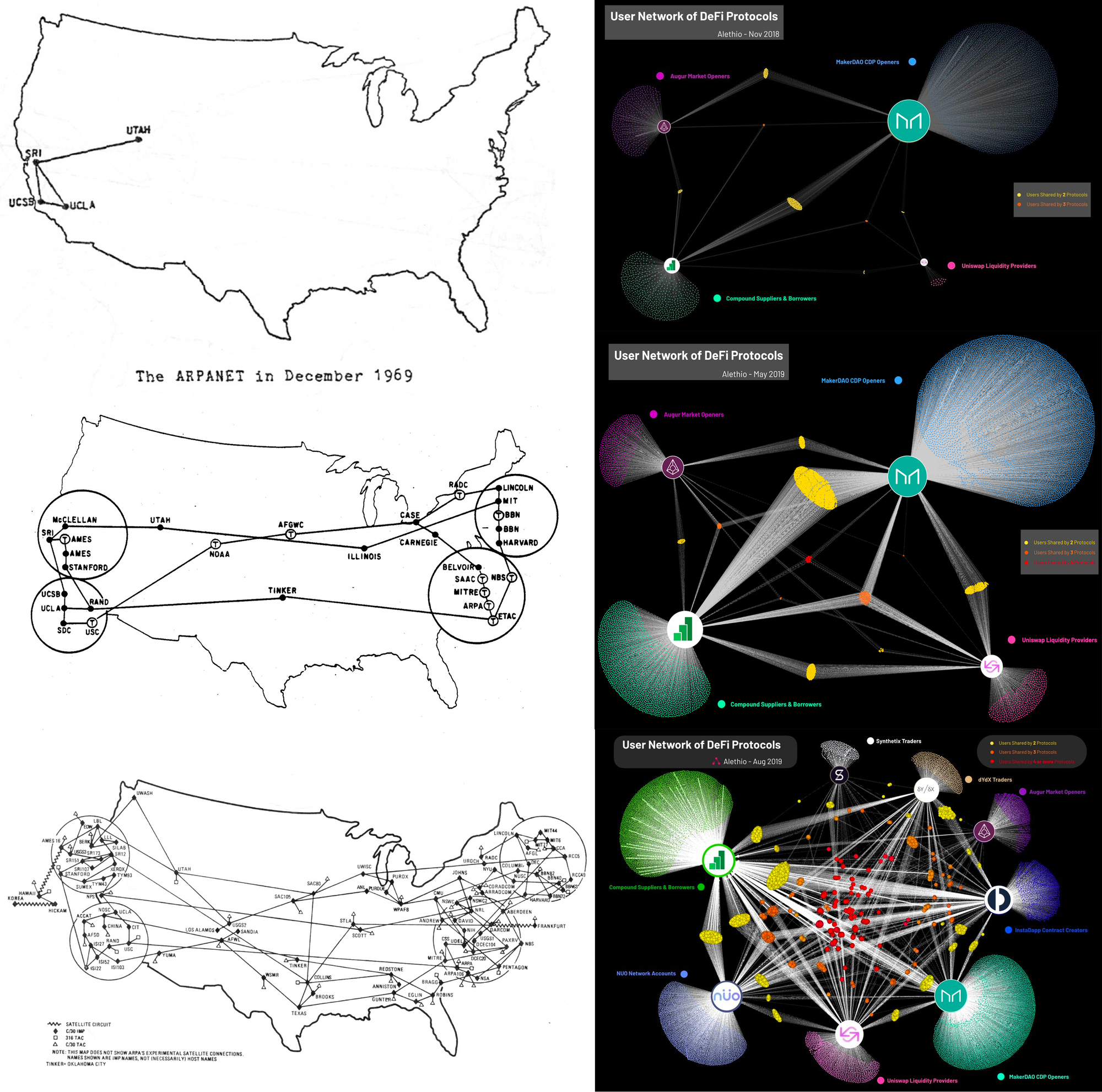

Before we define Ether, we need to define Ethereum. Ether will be defined by how Ethereum is used. Defining Ethereum has also been difficult. Attempting to define Ethereum feels a bit like defining the Internet in the 80’s: no-one really knows what is coming. The cool thing about open-source technology is that the use and application of the technology evolves and emerges, as the community builds and discovers its use-case.

Applications define the Internet

If you ask google to define the internet, you will get this answer:

- A global computer network

- providing a variety of information and communication facilities

- consisting of interconnected networks

- using standardized communication protocol

Personally, I don’t think this definition is helpful. It is technically right, but it’s a definition meant for the technically minded. If you were to ask “howis the internet?”, or “how does the internet impact humanity”, we need to look at what we are doing on the internet 99% of the time. Which brings us to these:

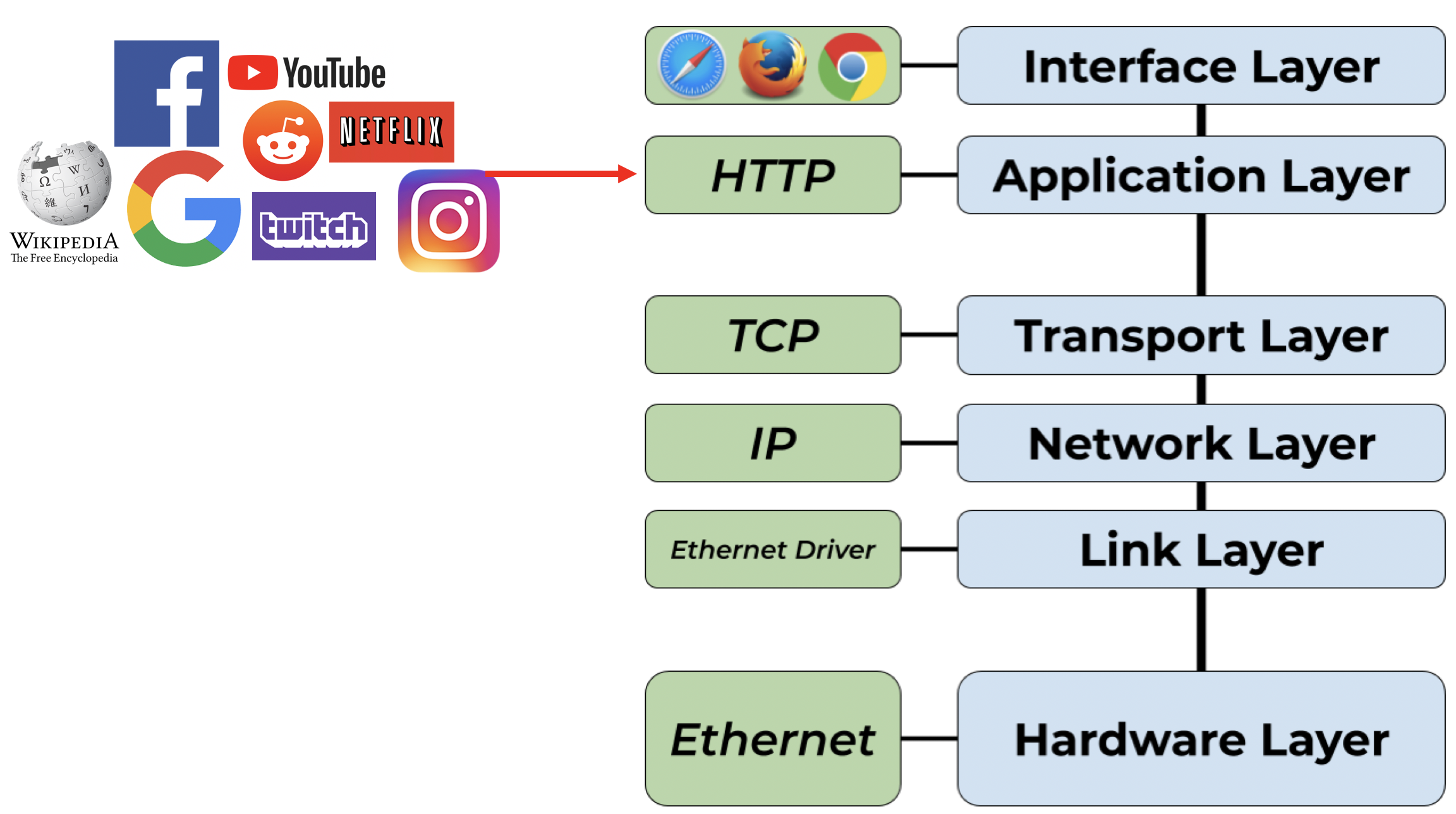

The internet is a stack of different technologies, with the applications at the top. While “the internet” cannot exist without any one part of the stack, it is the application layer of the internet that defines how the internet meaningfully impacts our lives. All the layers below the application layer are a means to an end: to provide products and services to the people.

The Missing Layer: Value

The innovation behind the internet was to make data cheap, available, and infinitely copiable. This innovation opened up the world to abundant and cheap information, and humanity is better because of it. However, cheap, available, and copiable is the opposite of what money and value are. Money and value are by definition scarce, expensive, and difficult to access.

When Bitcoin solved the internet’s double-spend problem, it achieved creating internet scarcity. For the first time ever, when you sent something on the internet, you could no longer keep it yourself. However, with Bitcoin, this is only true if you are sending bitcoins; the Bitcoin protocol only provides scarcity to bitcoins, nothing else.

This is where Ethereum comes in: a platform for providing digital scarcity for any digital asset. Ethereum gives the power of digital scarcity to more than just its own native currency. Because of Ethereum, digital scarcity can be made for any asset found on its platform. “Tokenization”, and the ERC20 standard, is the printing-press for digital scarcity. As a result, Ethereum has become the asset-agnostic settlement layer for the internet. Because of its permissionlessness and openness, any asset can come to Ethereum and use it for management of its scarcity and settlement between parties.

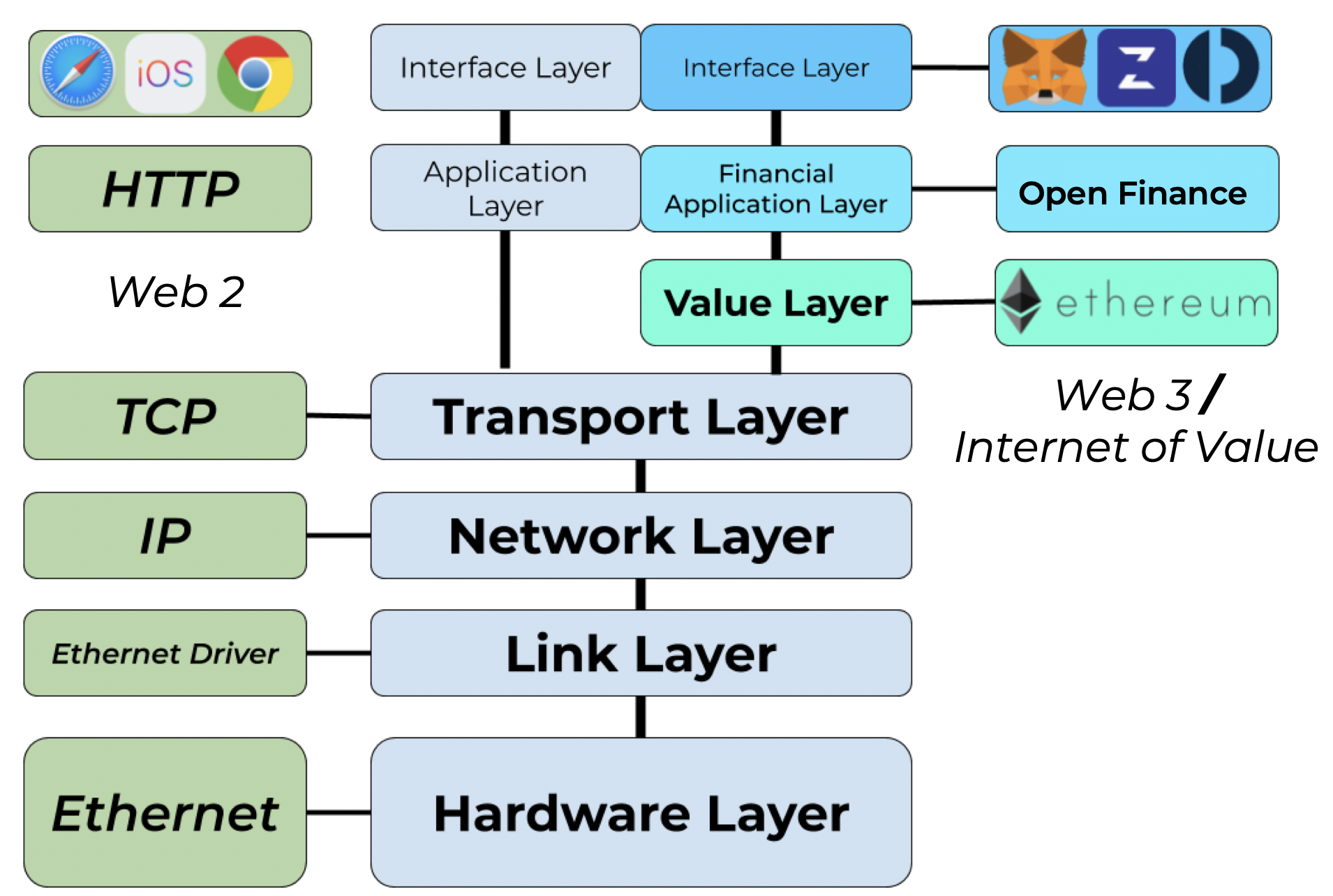

Ethereum exists as a new layer on the internet. It uses the communication protocols below it to create a new network that defines how digital value is managed. Ethereum is the value-layer of the internet.

If you go to Ethereum.org, you will find the following definition for Ethereum:

- Ethereum is a global, open-source platform for decentralized applications

- On Ethereum, you can write code that controls digital value, runs exactly as programmed, and is accessible anywhere in the world.

The applications on the internet defined what the internet is. Likewise, the applications on Ethereum will define what Ethereum is.

Ethereum’s Application Layer

The revolution of Ethereum is the establishment of a new application layer on the internet. The internet of Web 2 is the internet of centralized databases and centralized data. Facebook, Google, Amazon, and their products, represent the big applications of Web 2.

Ethereum provides an alternative. A new layer, a value layer, that allows for new applications. While the internet of Web 2 is saturated, and dominated by gargantuans, Web 3 provides an unclaimed landscape of potential value-applications.

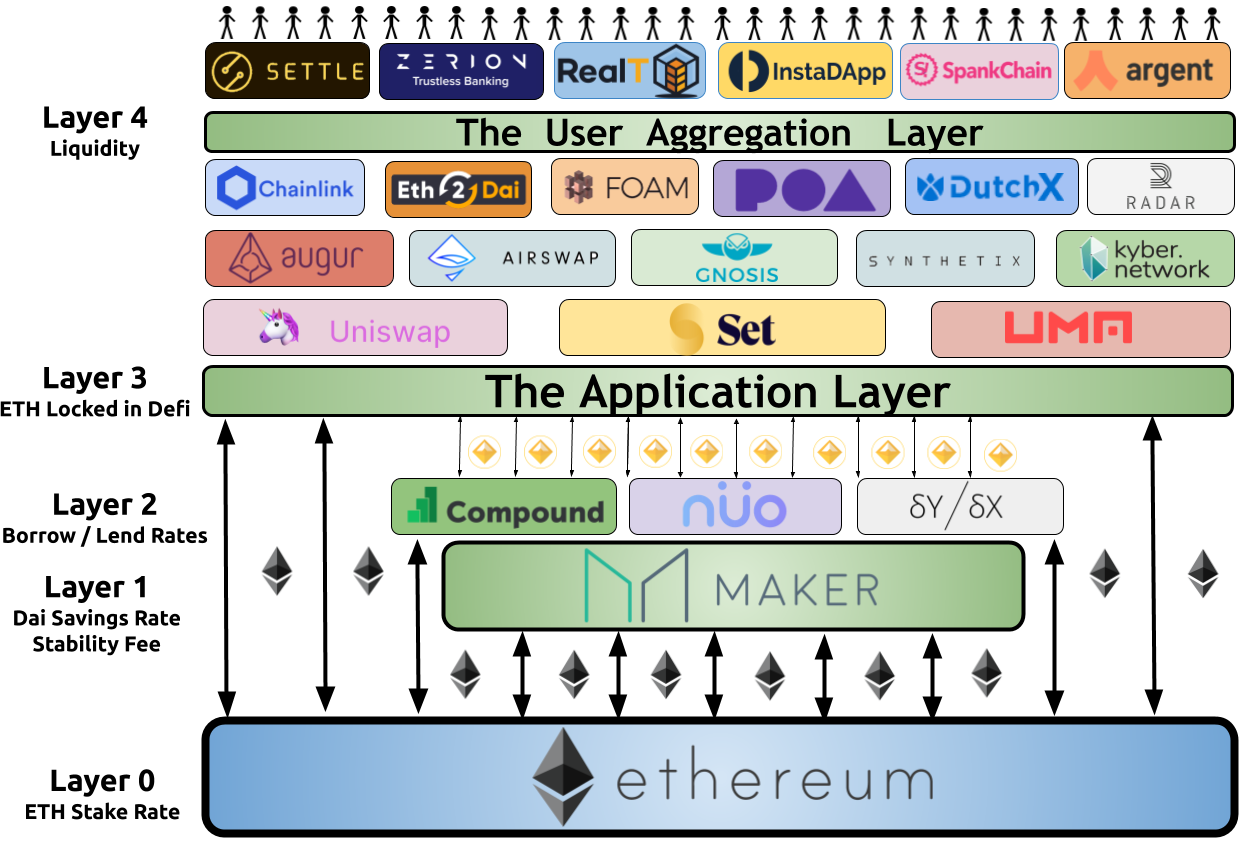

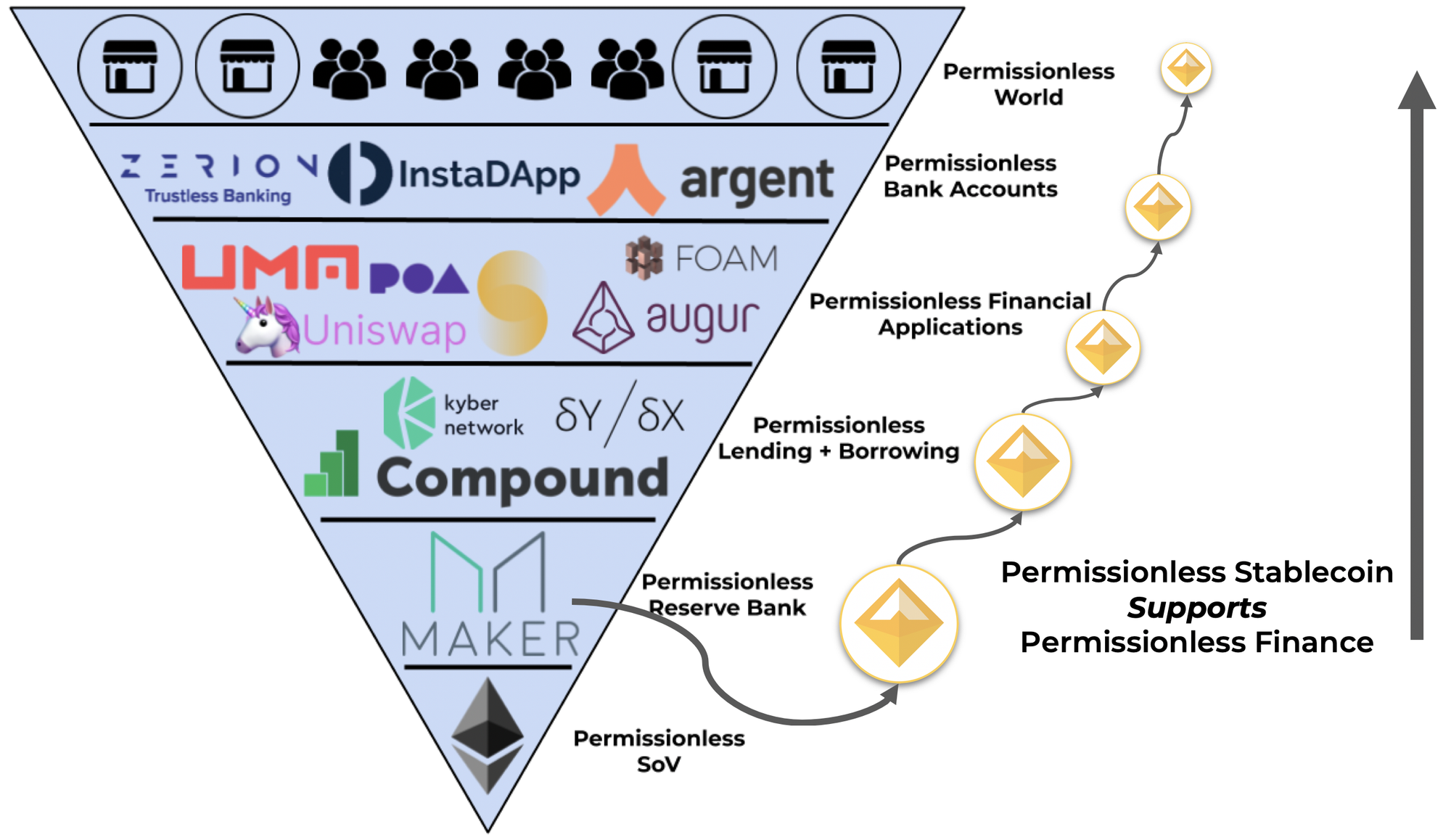

The financial applications found on top of Ethereum have begun to dominate its application landscape. Led by MakerDAO, and the establishment of permissionless stability by Dai, Ethereum’s permissionless financial network has exploded. Open Finance on Ethereum has begun to lock-in Ethereum as a global value settlement platform. The open finance movement that started as a curiosity in 2018 has erupted into what is perhaps Ethereum’s main purpose: A network for permissionless financial applications and services.

Ethereum’s Open Finance landscape spawns horizontally across its internet of value. Each application is able to be composable with others, generating endless permutations of transactions between each app. However, Ethereum is not a flat landscape. Financial systems and economies are inherently stratified, and Ethereum is no exception.

With the base blockchain at the bottom, Ethereum’s applications have stratified themselves in a way that maps onto the legacy financial system.

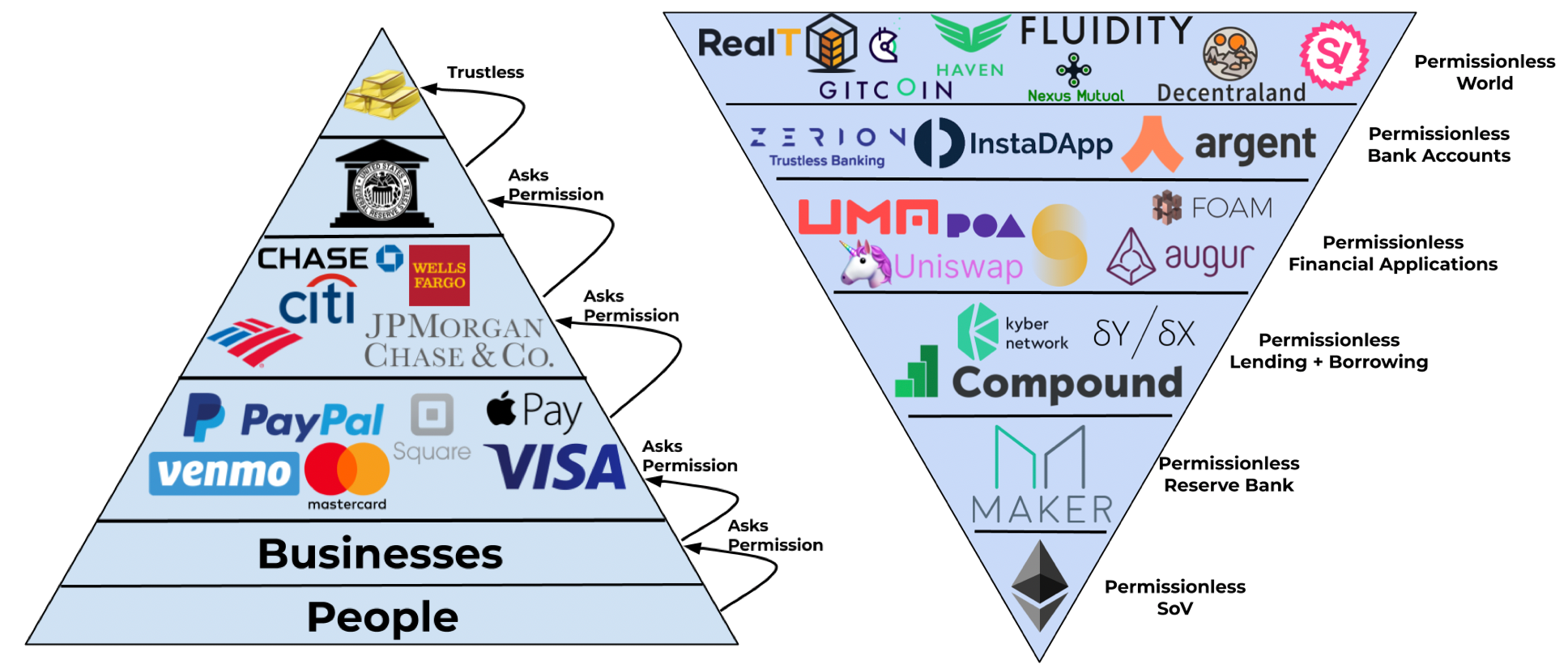

The money is always at the base of every financial system. Gold is a great permissionless Store-of-Value money, except that it is heavy, tangible and capturable. 90% of the worlds gold supply has been captured by central banks, and the financial products and services below these central banks have all been relegated to fiat money. Because of the capturability of gold, each financial layer under the federal reserve must ask permission to the layer above it, because it’s the layer above it that has the money.

This hopefully illustrates the role of a permissionless, programmable Store-of-Value money at the bottom of a new alternative financial stack. Gold is permissionless, and so is Bitcoin, but if the systems that leverage the value of these assets aren’t permissionless, then over time they can capture the asset and generate a permissioned system, in which rent-seeking is enabled.

Stitching it Together

If you believe in my illustration of Ethereum thus far, here’s how I define it:

- Ethereum is the internet of value.

- The internet-native global settlement layer for digital assets

- A landscape of permissionless financial applications, which together support a permissionless economy

Part 2: Defining Ether

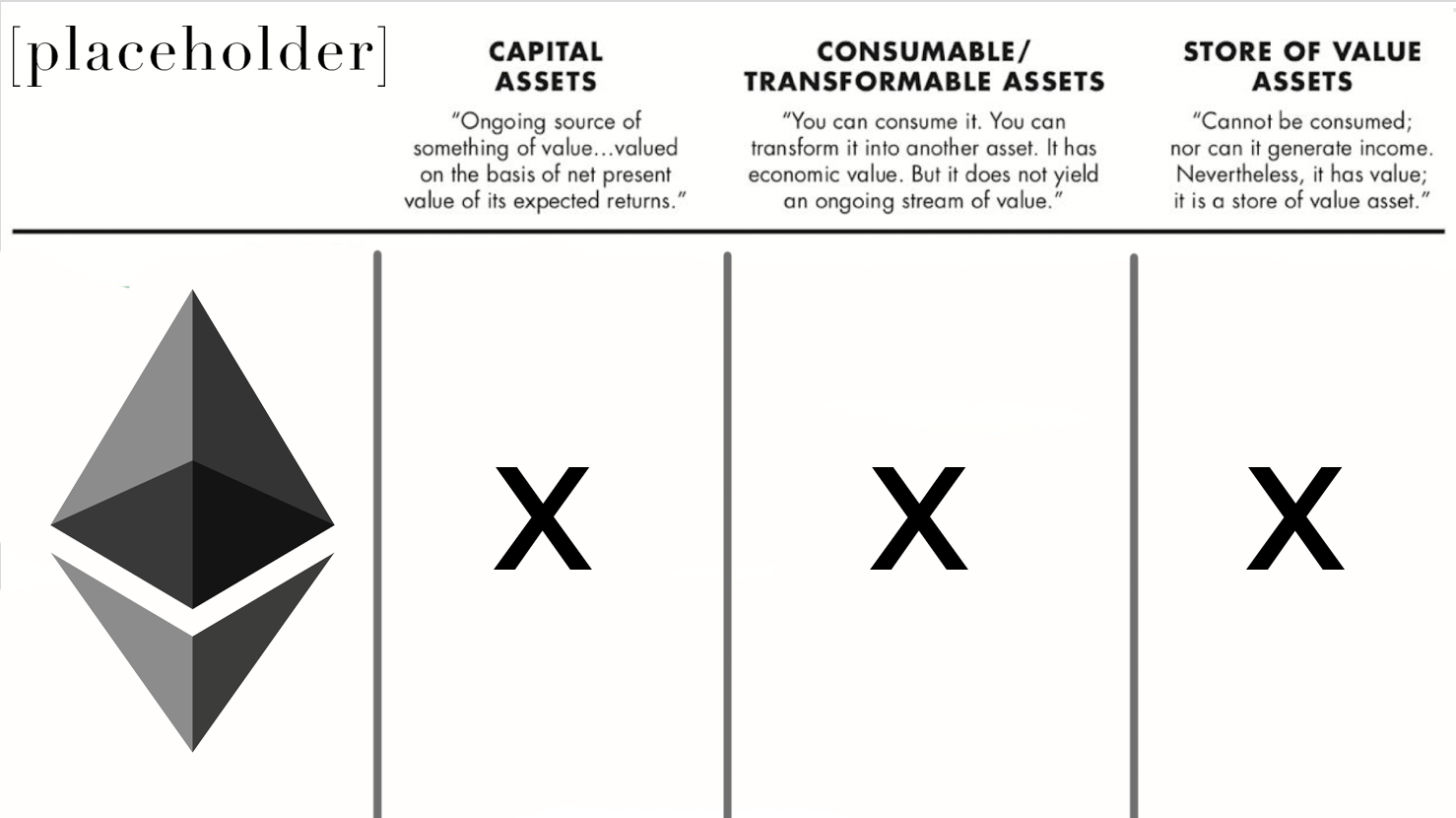

Ether as an asset has been difficult to pin down. The maximal flexibility offered by a turing-complete blockchain (Ethereum) means that Ether can truly do anything. This makes defining it inside the scope of other asset classes difficult.

In order to define Ether as an asset, we need to understand what asset classes are.

Defining Asset Classes

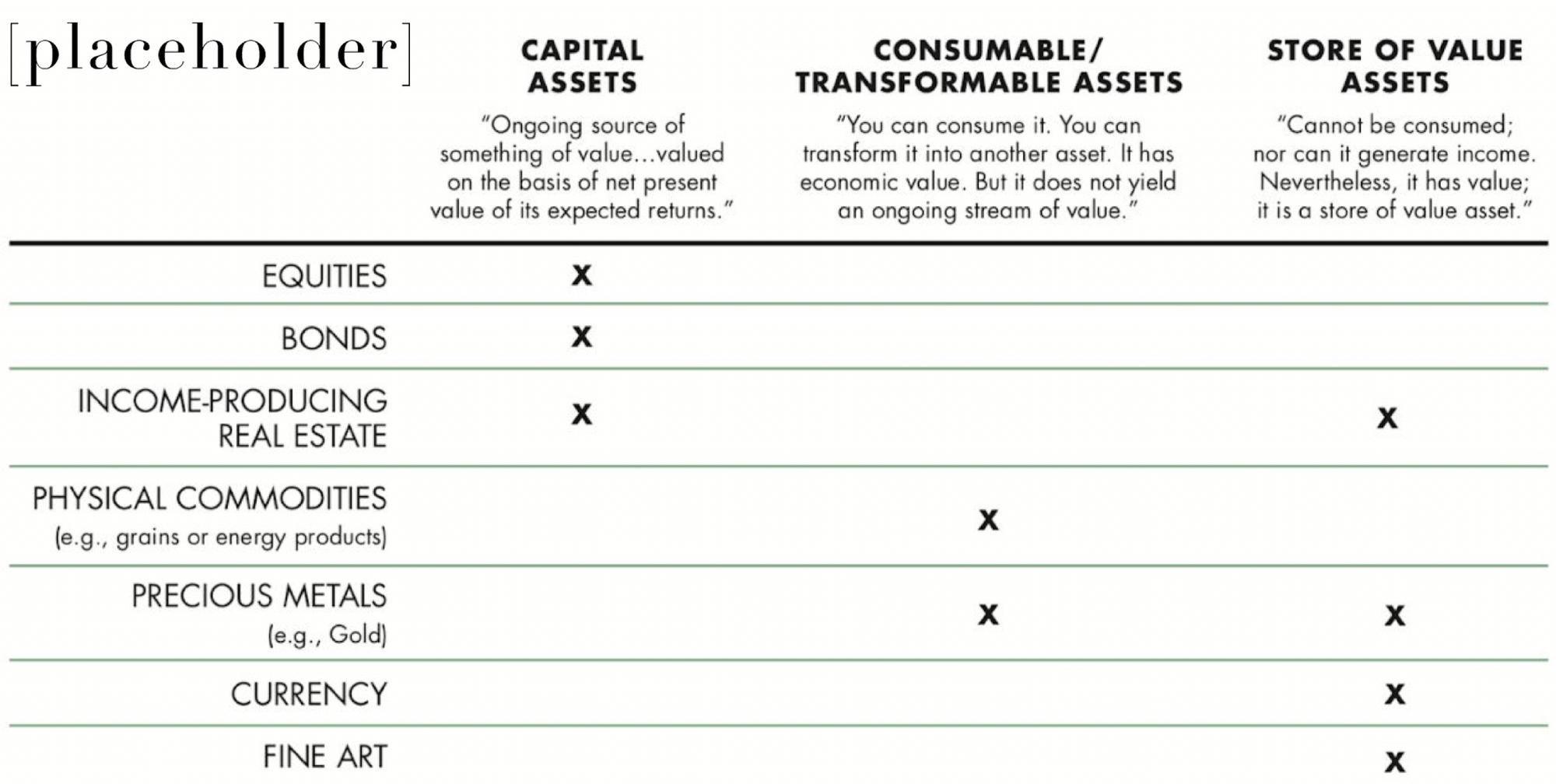

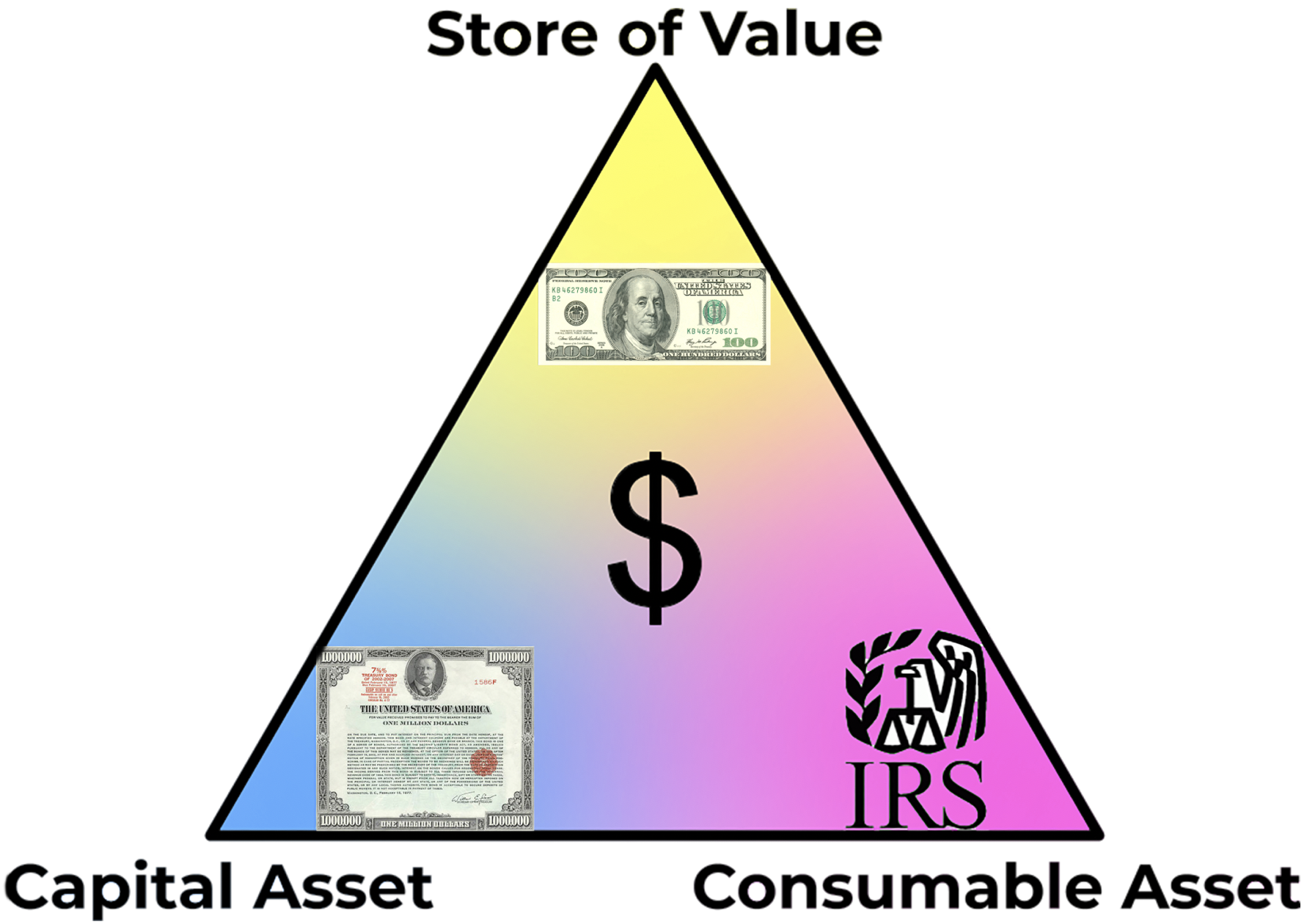

Popularized by Chris Burniske (at least, in the crypto-sphere), Robert Greer’s 1997 paper What is an Asset Class Anyways? proposes three asset superclasses:

Capital Assets

- Assets that are productive

- Produce an ongoing source of value

- Generate value/money/cash-flow

Examples include equities, bonds, rentable real estate, or taxi medallions. Assets that, in some way, enable cash flow for the owner.

Transformable/Consumable Assets

- You can consume/burn it — one time use

- You can transform it into another asset

- Its consumption produces economic yield

Examples include gold, oil, commodities (wheat, coffee), or energy. These types of assets are generally used in industry to produce some sort of outcome that is economically beneficial. Think about the gold plating in electronics, the gasoline in a car, or the coffee beans in a coffee machine.

Store-of-Value Assets

- Cannot be consumed

- Value persists across time / space

- Scarce

Examples include gold, currencies, real estate, art, or bitcoins.

This is the most simple asset class, but perhaps the most important. These types of assets must be scarce, and hard to produce/duplicate/copy. They should be desired/desirable ubiquitously across the globe. They are the assets that benefit from global trust in the perceived value of the asset.

When we discuss “monetary premium”, we are discussing SoV assets.

You may have noticed that some assets fall into more than one category. Real estate properties are great Stores-of-Value, and you can also rent them to generate cash flows.

Likewise, gold is an important component in industry products due to its ability to carry electrical signals and resistance to decay. It’s also been the greatest store-of-value asset humanity as ever seen.

Until now.

Ether: All Three Asset Classes

Ether fits perfectly into all three asset classes. Depending on the context, Ether can be operating as any three of the above asset classes, and even all three at once!

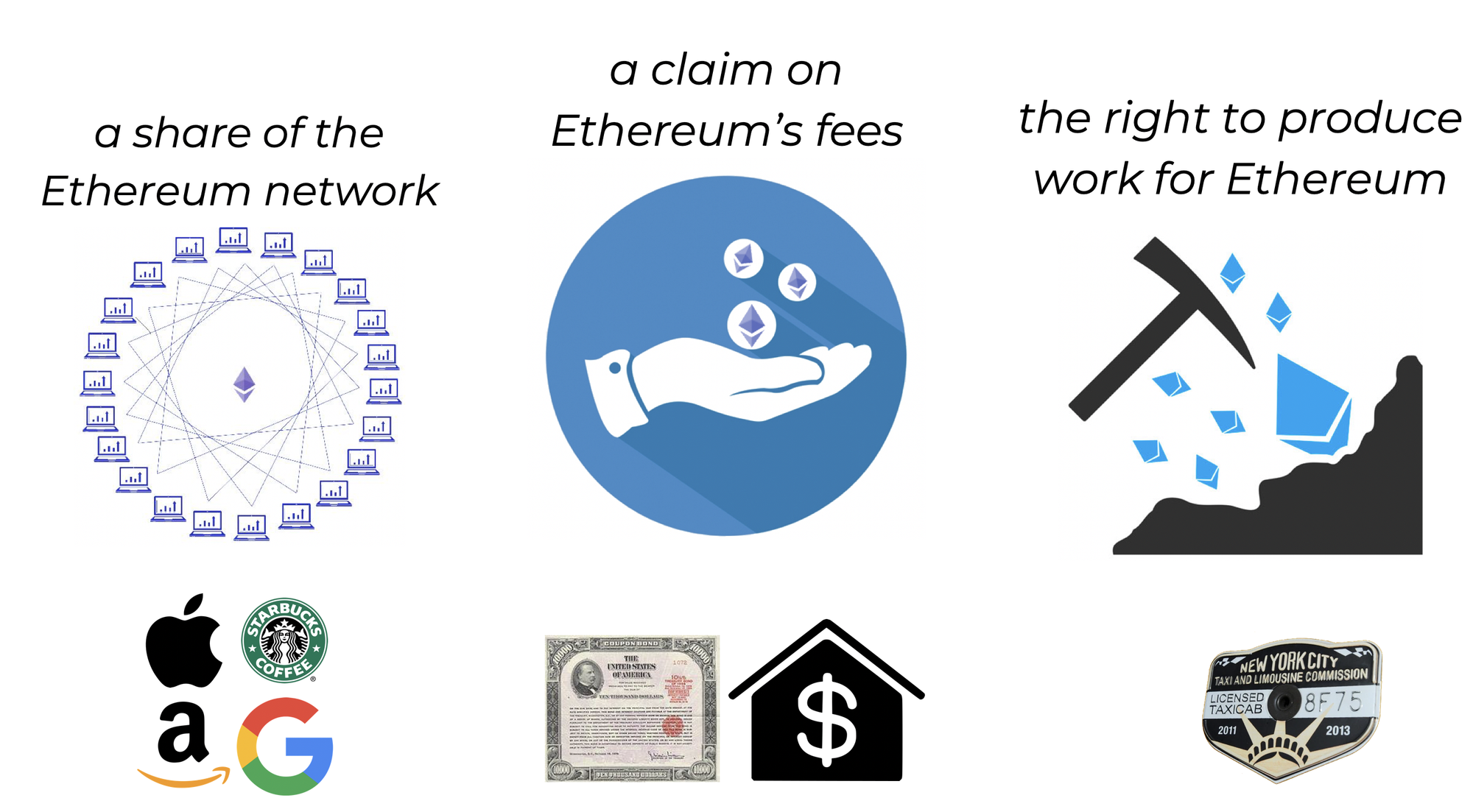

Ether is a Capital Asset

In its capital-asset form, Ether is:

- A share in the Ethereum Network

- A claim on Ethereum’s fees

- The right to produce work for Ethereum

A Share in Ethereum

The Ethereum network is a decentralized institution. The Ethereum network produces products and services for its Internet of Value, in an attempt to grow its network, grow its users, and capture more value. The better products and services it creates (MakerDAO, Compound, dYdX, Augur), the more customers there are for Ethereum. Ethereum’s customers are both the applications found on top of it, as well as the users of those applications.

A Claim on Ethereum’s Fees

In order to keep the network running, Ethereum needs to pay its workers. These workers come in the form of validators, those that make sure that all user-customers are playing by the terms-of-service of Ethereum (Ethereum’s ToS: Follow the rules of the EVM; don’t double-spend). These fees are paid to the workers for their labor, but also act as a wall that protects Ethereum. The height of the wall is highly correlated with the total fees produced by the network. The height of the wall is the cost of attacking Ethereum.

The Right to Produce Work

Owning Ether is owning the right to produce work, and collect the fees of Ethereum. Ether is the mechanism for ensuring incentive alignment between the Ethereum network and its workers. All workers must own ETH in order to provide work for Ethereum. If you want to be an employee of the Ethereum network, and be paid for your services, you must own ETH to make sure that you are aligned with the network.

These are the components of Ether that make it a capital asset. When staked, ETH is a productive asset for its owner. Ether produces more of itself for the owner that stakes it and does work for Ethereum.

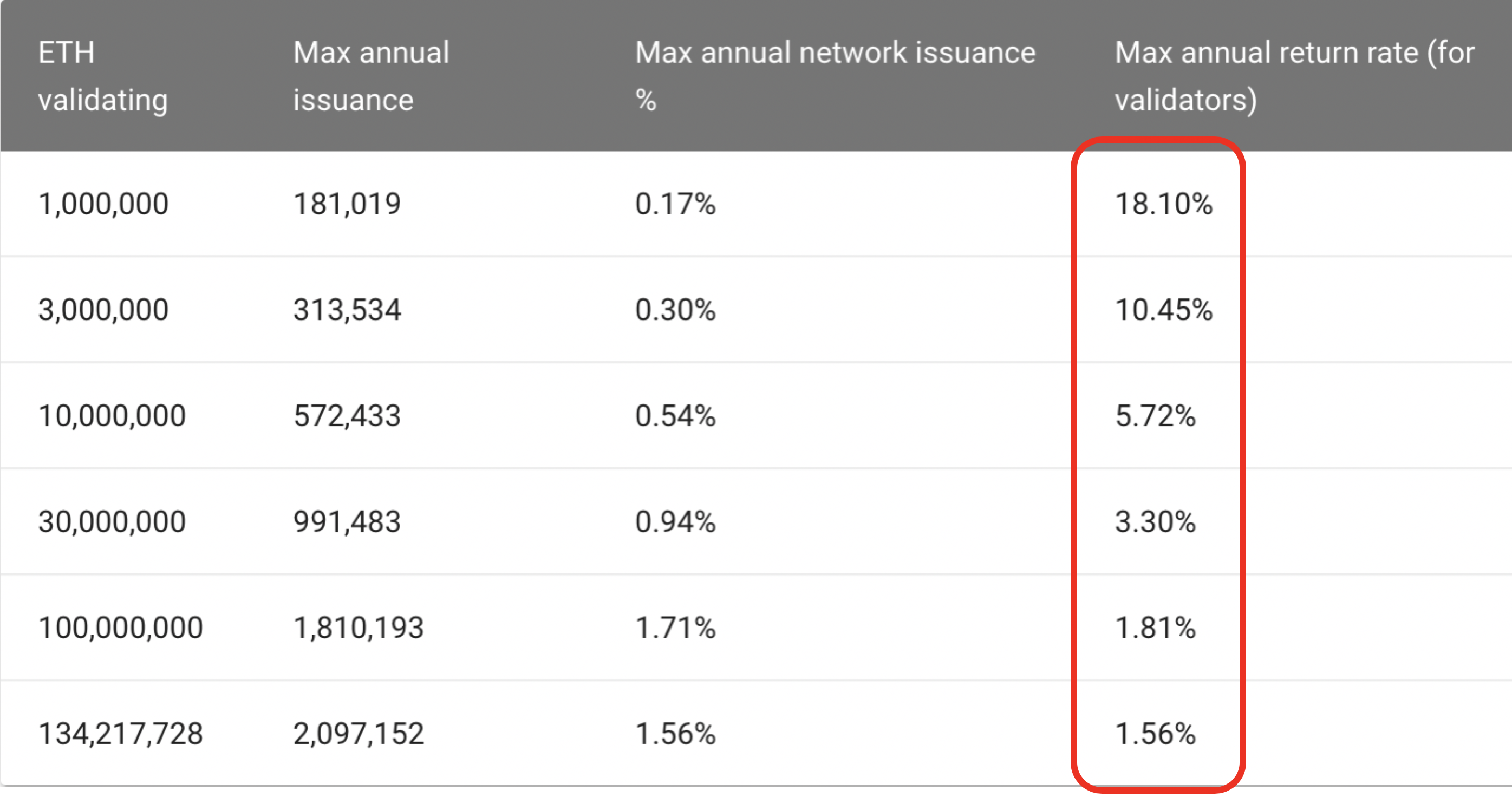

The current ETH 2.0 spec has an issuance schedule that is dynamic. Fewer total ETH-stakers mean that the ETH-stakers are paid comparatively more. This is to incentivize more ETH-stakers to come and provide work/security to Ethereum. When more ETH-stakers stake their ETH, Ethereum pays each staker less, as more total security is being provided, and therefore further security is not as needed.

Here is the Capital-Asset return rate based on different numbers of ETH being staked. At the sought-after 10M staking rate, ETH-stakers will receive 5.72% yearly return on their ETH.

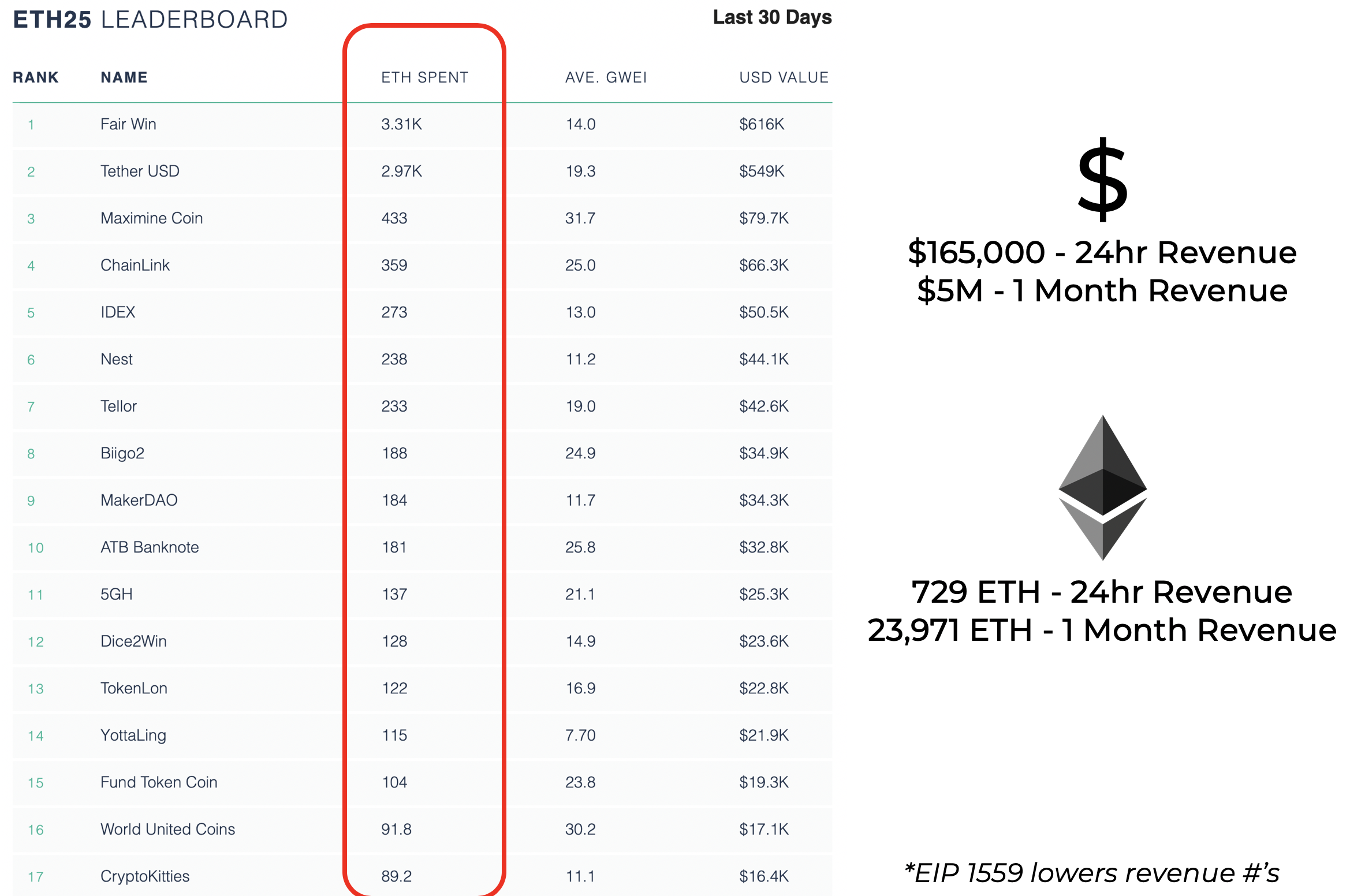

However, that’s not the only way that ETH-stakers are paid. The above return-rate is just for new Ether-issuance. ETH-stakers also receive a portion of the fees paid to the network.

Here are Ethereum’s top-paying user-customers (on Sept 18). The fees collected are added on top of network issuance, and paid to the workers of Ethereum.

Ether is a Consumable/Transformable Asset

Consumable/Transformable assets come in many forms. The most apparent asset in this class isn’t one particular asset itself, but rather a number assets that produce this thing. That thing is Energy.

Energy is a consumable asset that we all use to transform things into the world around us. Energy is how raw earth ore turns into the steel inside of a skyscraper or the frame of a car. Energy is how elevators move people to their office and how we transact and do business on our computers/phones. It is the power behind cargo-ships, creating worldwide commerce. It is the heat in our ovens that turns raw food into edible meals.

Imagine a world without energy…

Energy makes the world go-round. Without energy, we would not be able to turn useless things into useful things. This demand for an energy substrate is what gives oil its global value, why electric cars are hot topics, and why batteries are so god damn expensive.

Energy is the economic substrate that powers the world economy.

Ether is the Economic Substrate for the Internet

Ether’s original definition, “gas for Ethereum”, illustrates this well. The consumption of Ether is the cost of turning the economic wheels inside of Ethereum. Any time any activity is done, Ether is consumed.

Anytime…

- An asset is moved

- A loan is generated

- An exchange is made

- A purchase is executed

- A DAO is started

Ether is consumed.

Ether is a Store-of-Value Asset

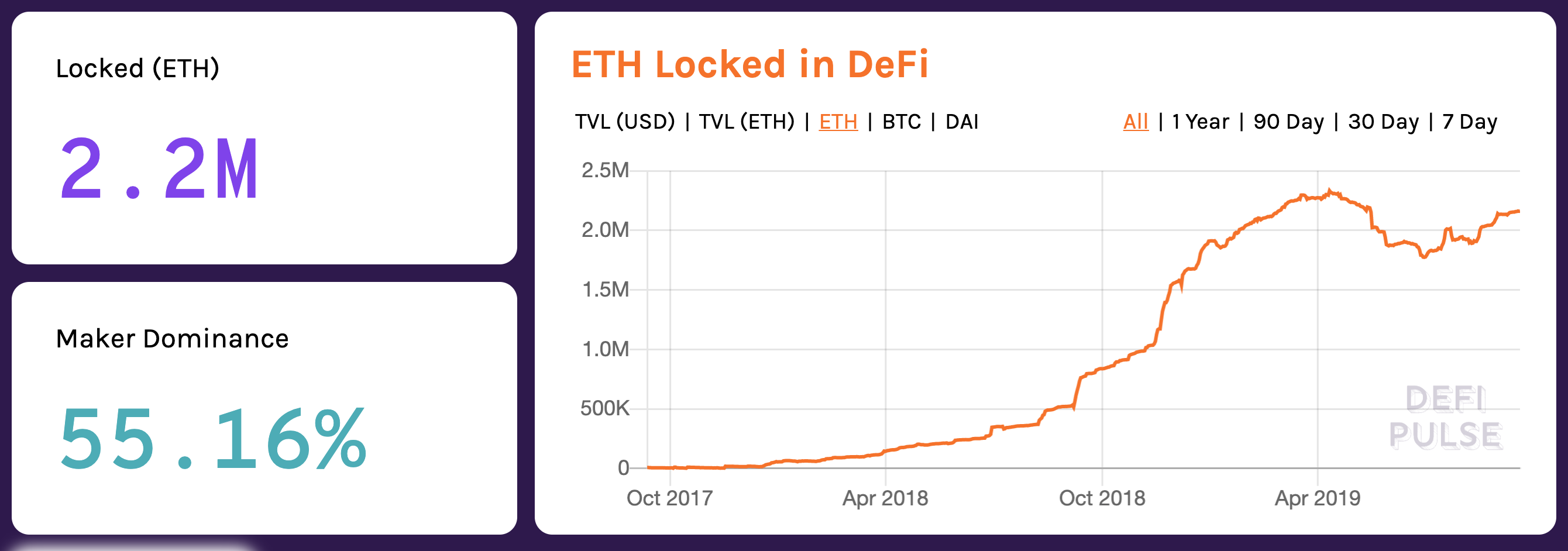

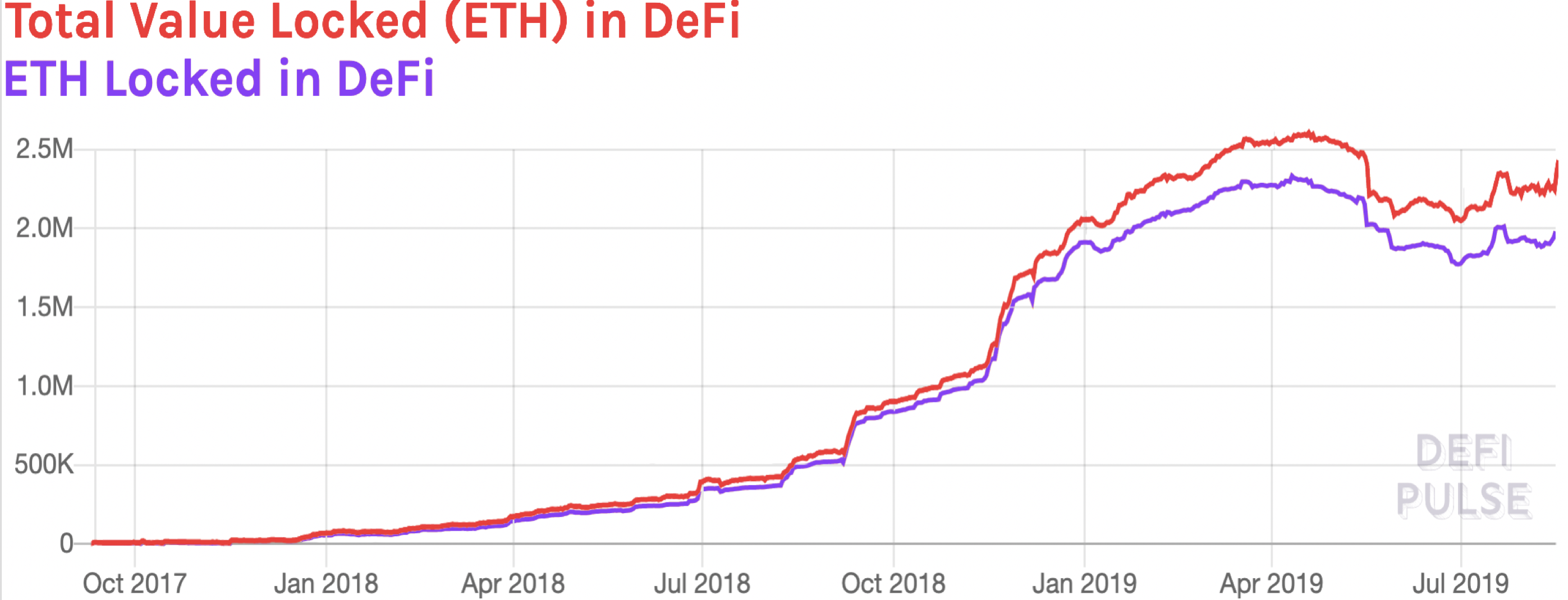

If you’ve ever payed attention to the “ETH locked in DeFi” metric, you’re paying attention to Ether’s as a Store-of-Value asset. Being “locked” is referring to how it is being used as collateral for something. It wouldn’t be “locked” if it didn’t have a commitment to act as the value that backs some sort of agreement/contract/asset on Ethereum.

Ether, as a permissionless global asset, is the vehicle for generating permissionless financial insitutions on Ethereum. We’ve called these permissionless financial institutions “DApps”, and the economic network they create “DeFi”, or “Open Finance”.

If Ether wasn’t permissionless, or if these Open Finance applications on Ethereum ran on permissioned collateral, such as centralized stablecoins, or tokenized gold, then they wouldn’t be fully permissionless systems. We would have to trust in the centralized institutions that issue the on-chain assets, that they’re off-chain assets are legit, and that they will honor all redeemability.

Thankfully, Ether is permissionless, so we don’t have this problem, if we use Ether as collateral inside of DeFi/Open Finance. (Hint: we do).

Ethereum’s First DApp: MakerDAO

Not first, as in first in time. First as in, the first order of operations.

MakerDAO is crucial to the development of Open-Finance on Ethereum. Stability is crucial for finance, and without a stable-reference point to Ether, many of the financial applications on Ethereum simply wouldn’t be able to operate. Platforms like Compound, DyDx, or Set all require a stable currency in order for their application to function.

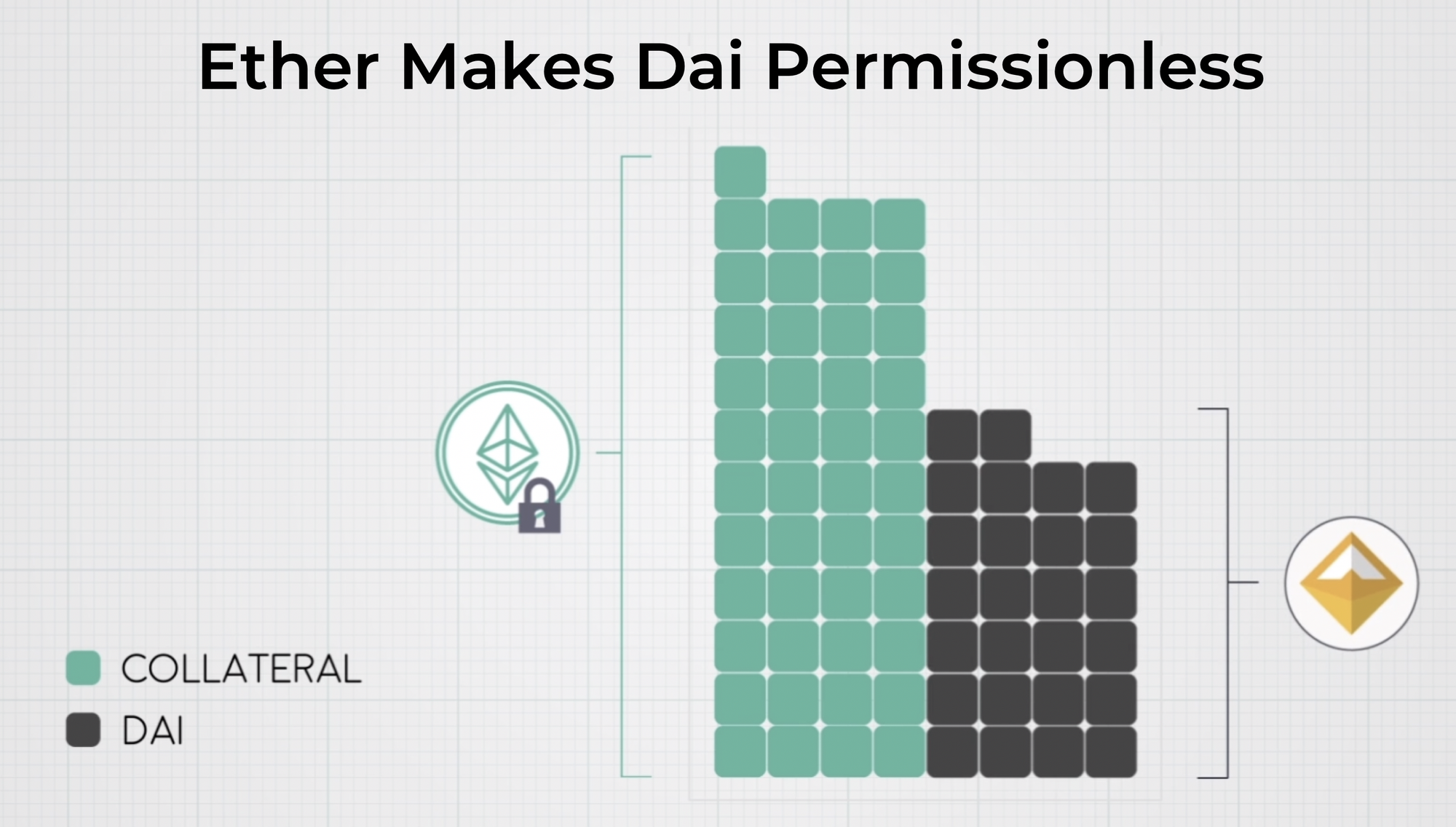

There are plenty of stablecoins on Ethereum, but there is only one permisionless one. Dai is only native stablecoin on Ethereum and it achieves that nativity by being backed by the only trustless asset on Ethereum, Ether.

Dai achieves its value by the Store-of-Value function of Ether, as well as achieves its permissionlessness from its overcollateralization.

Permissionless Stability Enables Permissionless Finance

Having a permissionless Stablecoin is really important. In addition to providing a stable foundation to build finance upon, if you want the financial structures on top of that foundation to be permissionless, you need that foundation to be permissionless.

If DeFi all ran on USDC, we would all be trusting Circle with their management of our funds. DAI is the only stablecoin that cannot be removed/revoked/burned from a users wallet via a central authority. This is why Open Finance applications can get assurances when building their application with Dai: If Dai runs in their application, no central party can disrupt the application or its assets.

^ New money for the new economy

All this is based off Ether as a Permissionless, Programamble, Store-of-Value asset

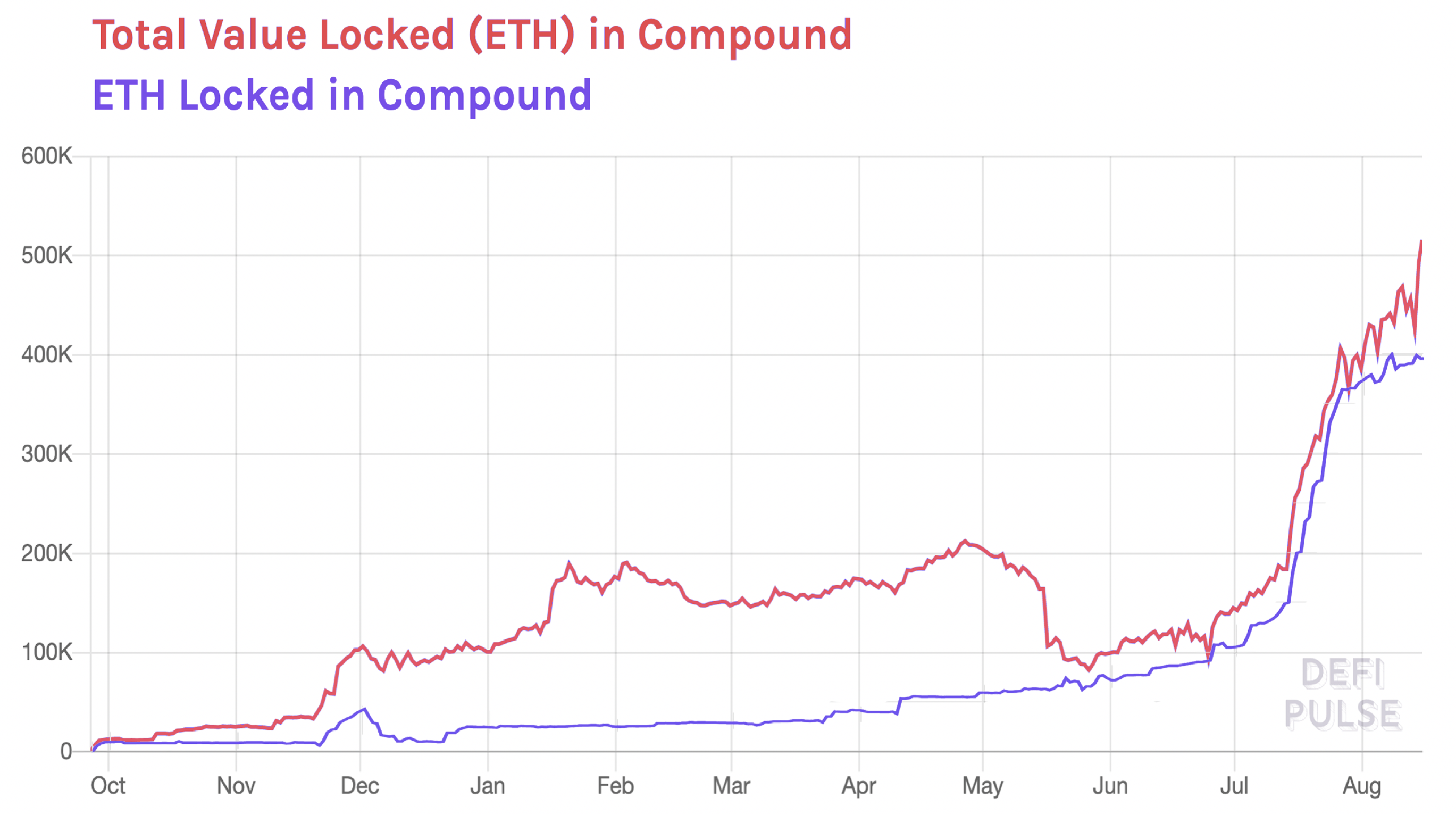

Compound

Compound.Finance is the borrowing/lending application for Ethereum. It’s a financial primitive, and a crucial component in the financial stack of Ethereum.

Compound is an application that pools borrowers and lenders together, and matches the demand/supply of each party with a variable interest rate. This produces the Dai Borrow Rate and Dai Supply Rate, or, the costs of borrowing Dai and the interest received from lending Dai. You can check rates at LoanScan.io

Compound is trustless because of collateral.

Collateral is what makes Compound a permissionless platform. Borrowers must over-collateralize their loan, in order for lenders to be given assurances that there is always money in the bank for them to withdraw (in other words: trustlessness).

Below is a chart that has two lines. In Red, the total value of all collateral locked in Compound, denominated in ETH. In Purple, the total number of ETH locked as collateral.

The descrepency between ETH locked and total value locked is a bunch of REP being used as collateral.

The vast majority of collateral in Compound is Ether. Borrowers are locking up ETH to be the collateral for their loan. In this scenario, Ether is being used as a Store-of-Value asset, an asset that is perceived by the market to hold its value across time, as the collateral for a permissionless loan. This permissionless collateral is what powers the lending side of Compound, as the Compound application ensures over-collateralization, and auto-liquidation, of the collateral from borrowers. Lenders don’t have to trust borrowers: the Compound application removes trust from the equation.

Compound does this by

- Using Ether as a Store-of-Value

- Using Ether’s programmability to enable trust-removed borrowing/lending

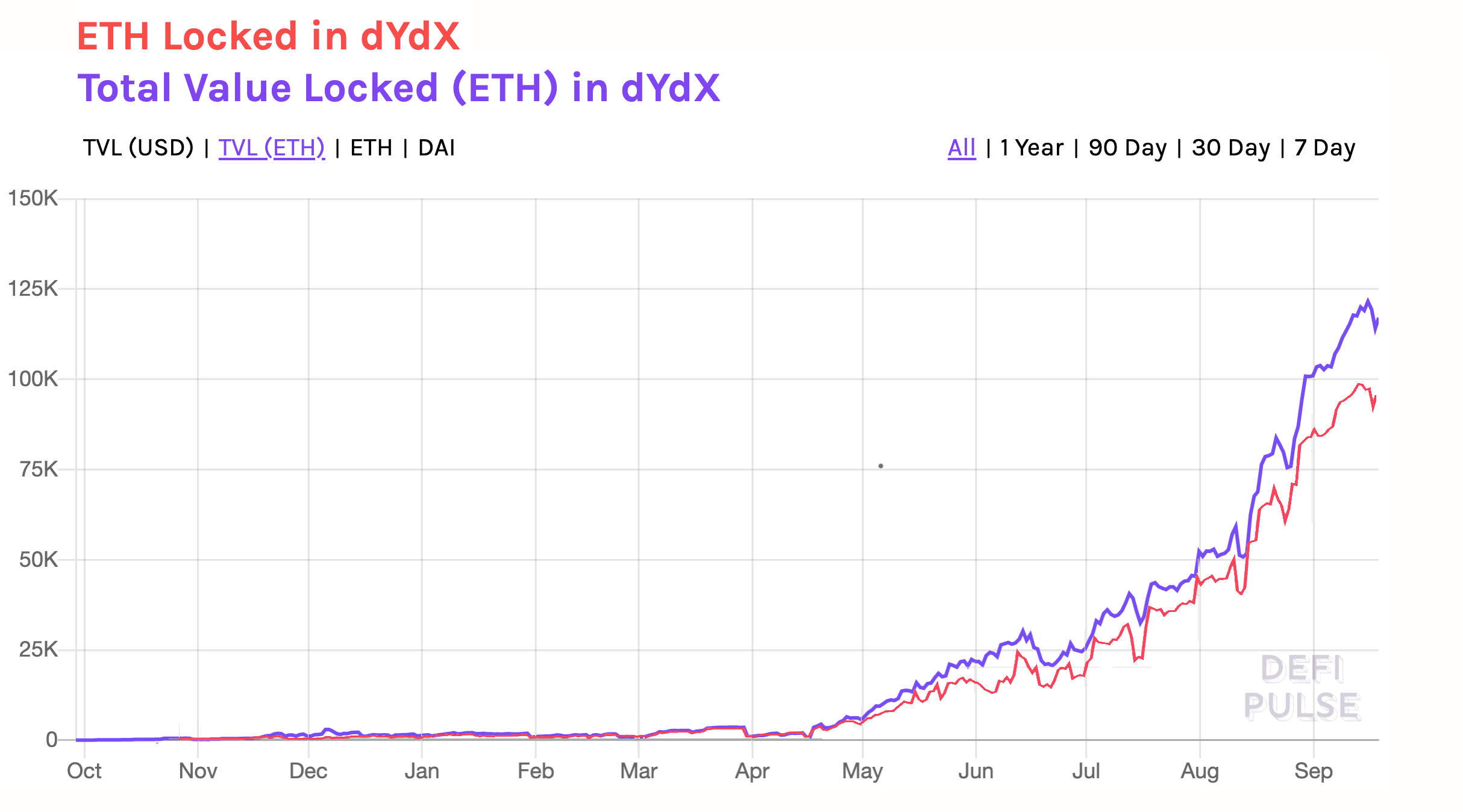

dYdX

dYdX is a platform for margin trading, lending, and borrowing. dYdX runs on smart contracts on the Ethereum, and allows users to trade with no intermediaries.

DyDx provides its services to users by requiring a Store-of-Value collateral in order to borrow or trade on margin. The collateral could theoretically be anything, and DyDx has enabled USDC as collateral. However, as you can see in the chart below, the vast majority of collateral inside dYdX is Ether.

Ether is the primary Store-of-Value collateral that’s used in dYdX. The combination of dYdX’s smart contracts, and a permissionless SoV programmable asset like Eth, enable dYdX’s permissionlessness and trustlessness as a financial application.

You can see that demand inside of dYdX is 94% Ether or Dai. And remember, Dai is just a token that represents collateralized Ether.

Store-of-Value Ether makes dYdX permissionless and trustless

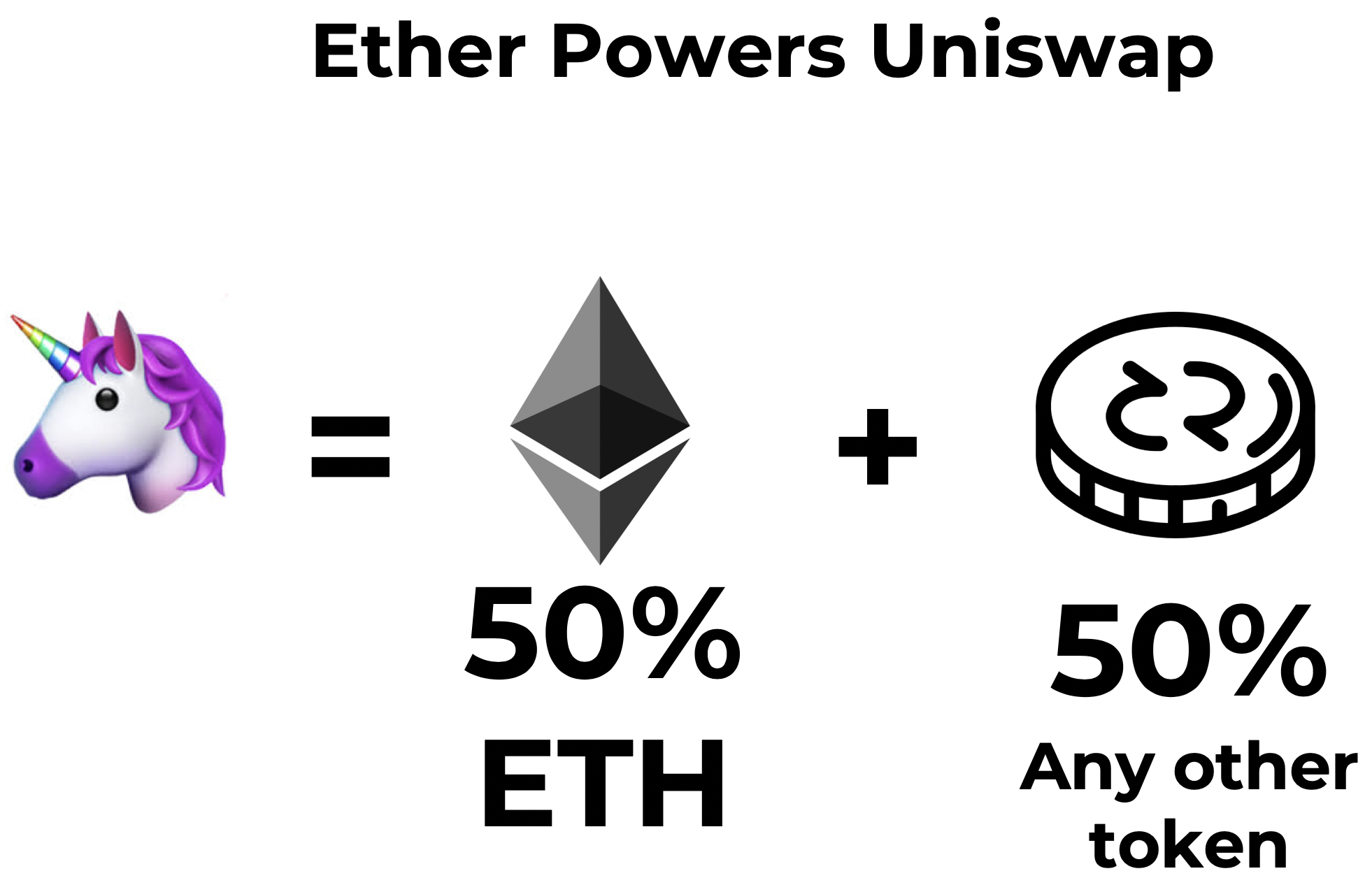

Uniswap

The same pattern holds true for Uniswap.Exchange. Uniswap Exchange operates by having two pools of collateral for any token pair.

In V1 of Uniswap, all token pairs trade against Store-of-Value Ether. It’s Ether’s role as a SoV that makes it such a great collateral for all token trading pairs to trade against.

In V2 of Uniswap (maybe by end of 2019), Uniswap will enable any-token to any-token trading pairs, and I’m willing to be the next-most used collateral will be Dai, Ether’s stable form.

Ether is the Store of Value for Open Finance

10 years after their inception, only one use-case for blockchains has been discovered: The permissionless management of value across the internet.

Open Finance is a new fertile landscape for new financial institutions. In the Open Finance landscape, institutions are autonomous, humanless, contracts on Ethereum. And, from what we can see so far in DeFi, is that they use Ether as the underlying Store-of-Value asset for their application.

It’s all ETH!

While I expect further assets to be able to come to Open Finance and act as collateral (centralized stablecoins, gold in vaults, securities and treasuries etc), I expect Ether and Dai will remain the significant majority of collateral for Open Finance applications. Open Finance applications that leverage Ether and Dai are retaining full-permissionlessness. If Open Finance applications use off-chain, trusted assets, then they are acting as a hybrid Open Finance application, with trusted assets.

Which is fine! But it’s not as cool as fully trustless, fully permissionless applications that leverage trustless ETH and DAI.

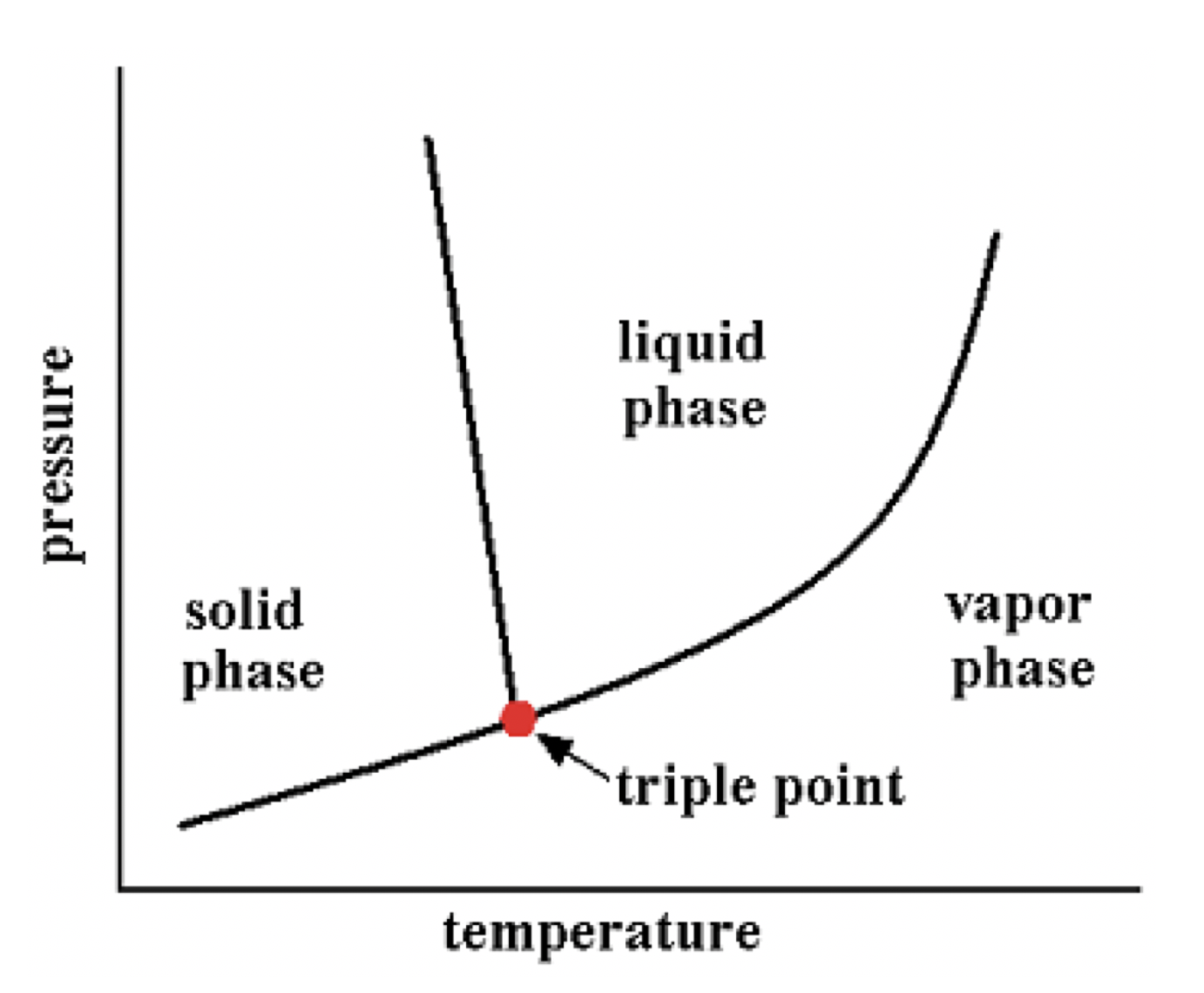

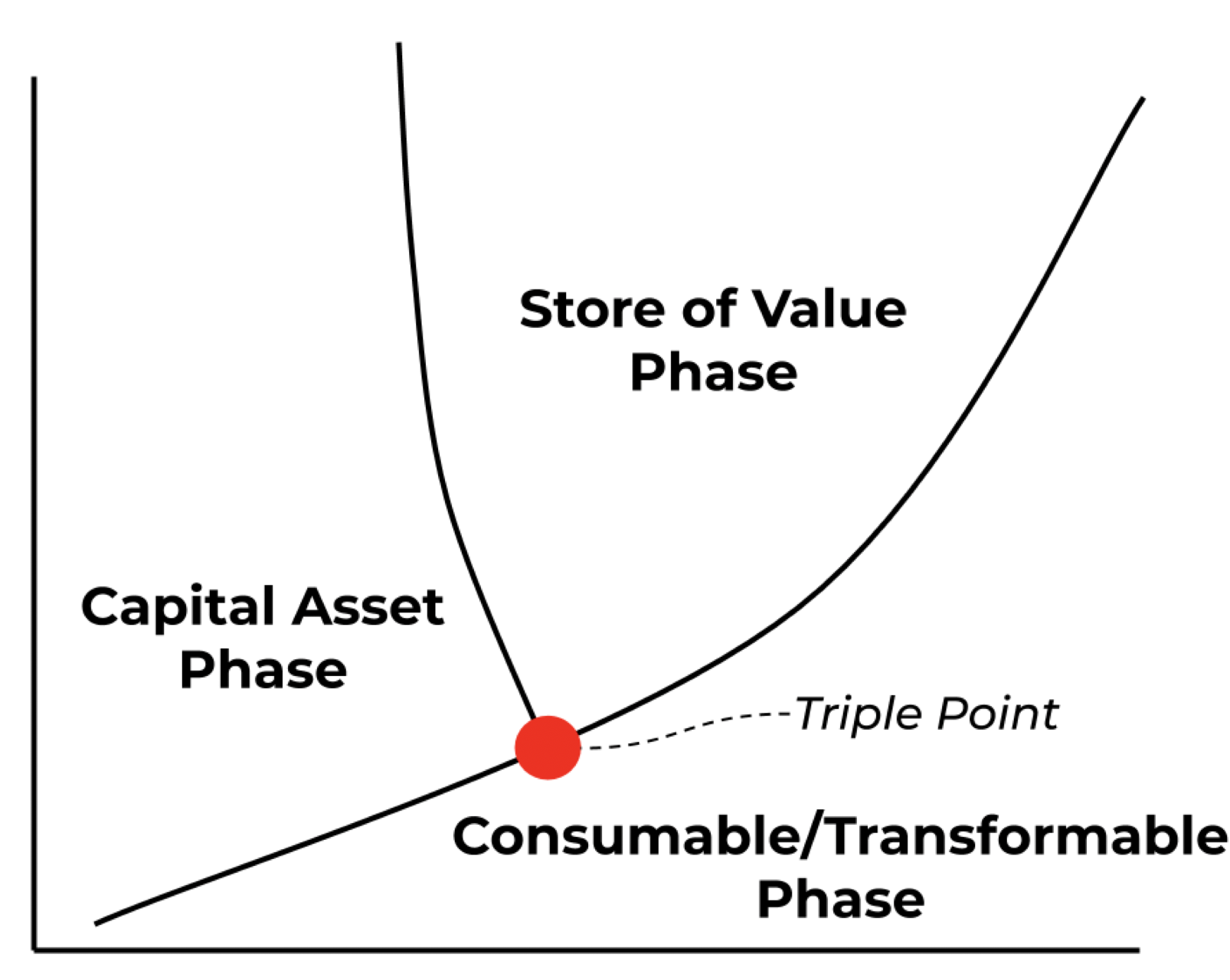

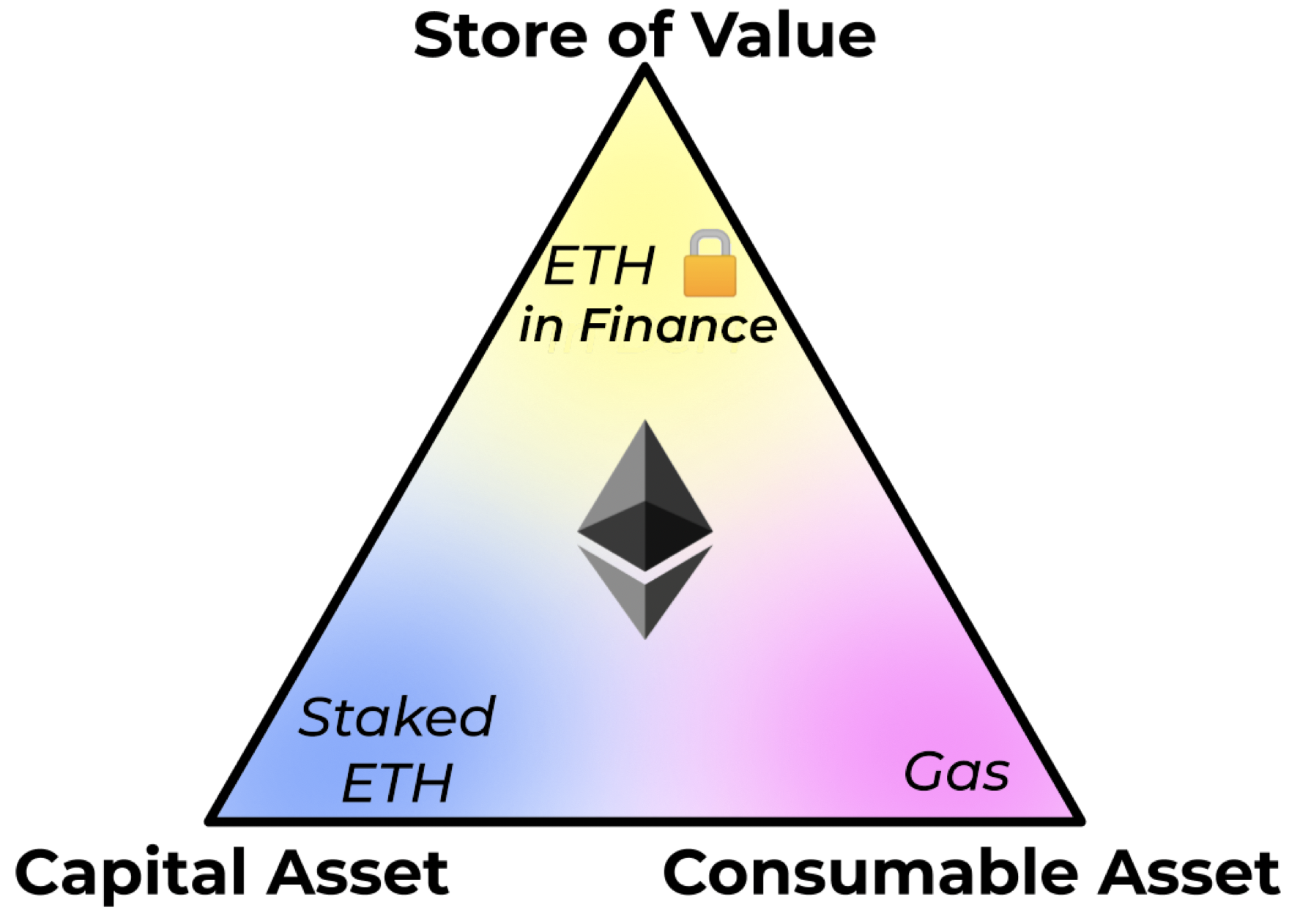

Ether: The Triple-Point Asset

Depending on the context, Ether acts as any of the three major asset superclasses.

- Staked ETH = Capital Asset

- Consumed ETH = Consumable/Transformable Asset

- ETH Locked in DeFi = Store-of-Value ETH

Ether is the first asset to ever transcend all three asset classes (that I know of). This is great for Ether; money is something that is by definition flexible. Money is what you need it to be, when you need it to be that thing, and Ether fits into all three major frameworks for what a valuable asset should be.

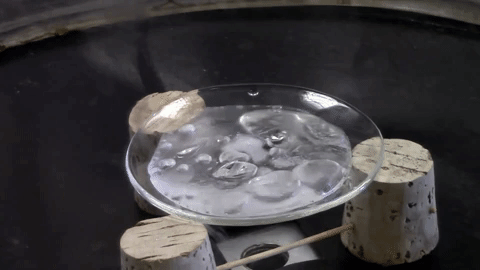

The story doesn’t end here, however. The “triple-point” is a reference to thermodynamics. In thermodynamics, the triple point of a substance is the temperature and pressure at which the three phases and solid of that substance coexist in thermodynamic equilibrium.

Phases of matter are usually distinct; either you’re a solid, liquid, or gas.

However, if things are balanced just right, you can enter the triple-point, where all three phases exist all at once.

The above tweet was Dan Elitzer’s inspiration for his article SuperFluid Collateral in Open Finance.

Superfluid Collateral in Open Finance

What happens when collateral becomes liquid?

tokeneconomy.co

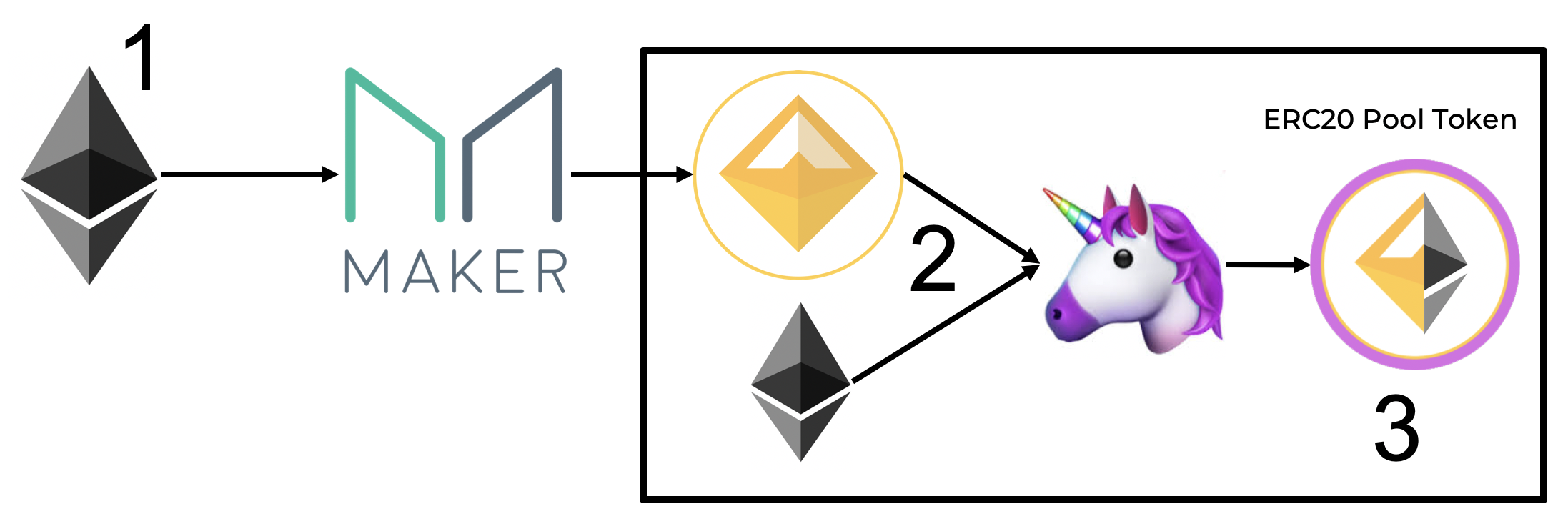

This article illustrates the fluidity of collateral inside of Open Finance applications on Ethereum. Here’s what Dan was talking about:

- Ether is used as a Store of Value inside MakerDAO to produce Dai

- Ether and Dai are used as collateral in Uniswap…

- …to produce the Uniswap Pool Share Token (how this works here).

4. This new ERC20 has the value of 1-part Ether and 1-part Dai, which are the native SoV assets in Ethereum

5. Use this new SoV token inside Compound as collateral for a loan.

The main point that Dan was making in his article: the Ether locked inside of Uniswap, generates a new token that represents its value, which is then re-locked inside of Compound. The same Ether that is collateral for Uniswap is used as collateral for Compound.

Lets put this into the asset definitions we defined above.

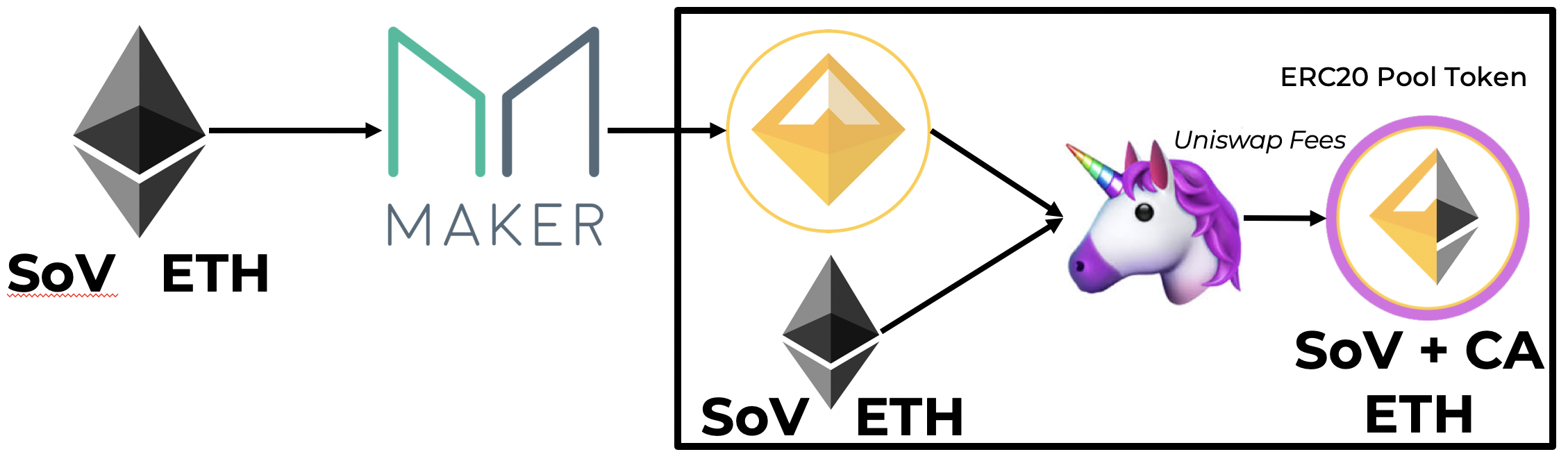

- Store-of-Value ETH was put inside Maker to produce Dai

- Store-of-Value Dai + ETH were put inside Uniswap to produce the Uniswap Pool Share Token.

- The Uniswap Pool Share Token is an asset that is both a Store-of-Value, and a capital asset. Uniswap Pool Share Token are collateralized by the assets that back them, but they also receive fees from the volume of the exchange they back. Uniswap exchanges charge 0.3% fees. This means that the Uniswap Pool Share Token increases in value, as it collects fees from Uniswap.

Uniswap Pool Share Tokens are therefore both Store-of-Value Assets, and Capital Assets, at the same time.

Lets keep it going!

4. The new token, which is both a SoV and a Capital Asset, is deposited into Compound as collateral for a loan. It’s now acting as the SoV asset that backs the loan.

So, it’s a SoV (ETH+DAI) that backs the Uniswap Pool Share Token [SoV+CA] that backs the Compound loan [[SoV+CA]*SoV].

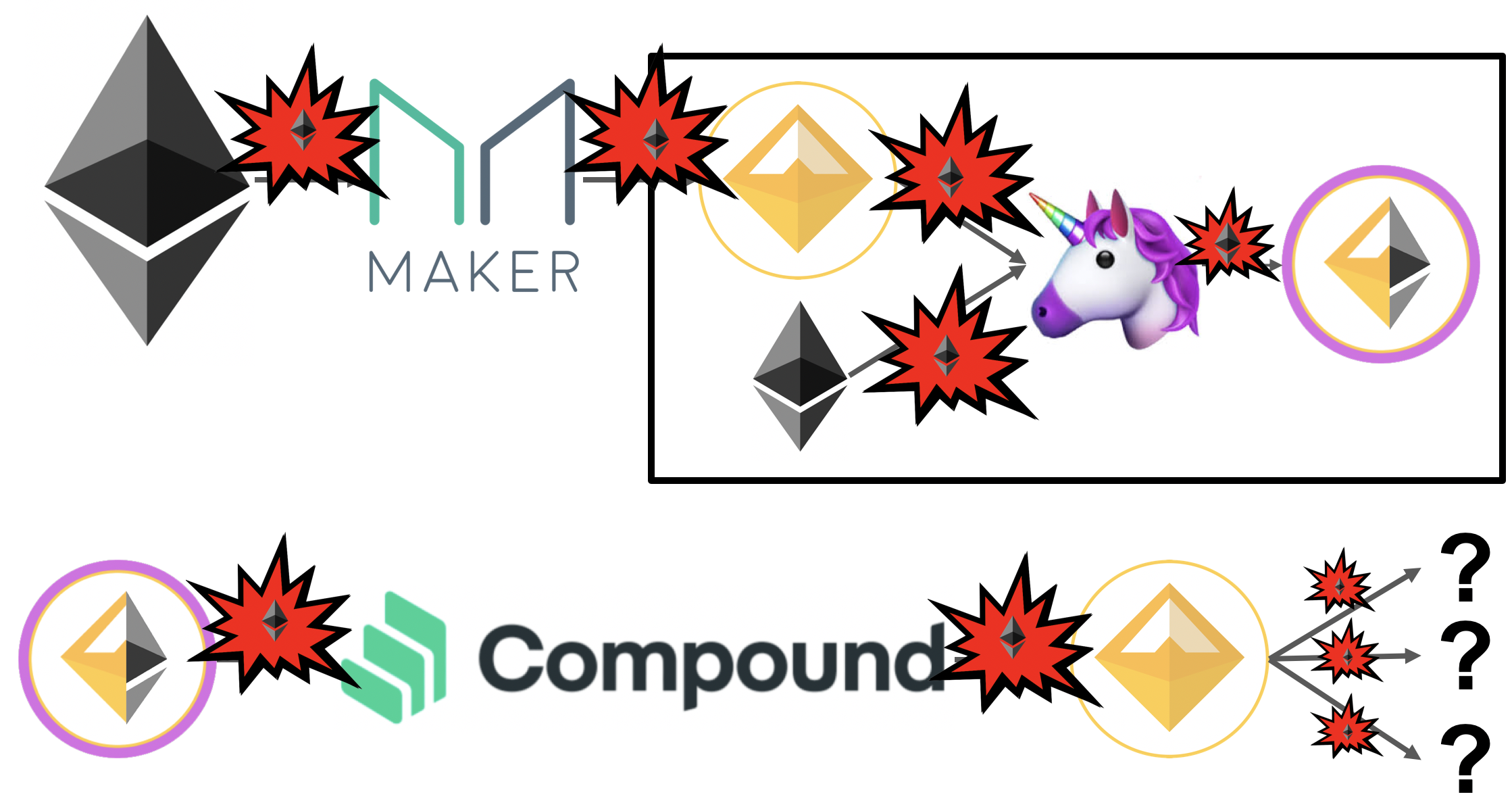

Theoretically, this could also be done as lending tool in Compound, rather than a borrowing tool.

If you replace step 4 with a new step, you get

4. Allow your Uniswap Pool Share Token to be borrowed in Compound, and receive interest payments, denominated in Uniswap Pool Share Tokens from the Borrowers.

So we now have a [SoV+Capital Asset] that is being lent out and collecting fees, making it as [[SoV+Capital Asset]*Capital Asset].

This whole process requires 8 total transactions. Every time economic activity occurs on Ethereum, Ether is consumed. While Ether was being transformed into some permutation of a Capital+Store-of-Value Asset, Ether is being consumed as the economic substrate of Ethereum.

In order words, Ether is operating as this hybrid SoV/Capital Asset, while Ether is also being consumed to pay for the transformation of plain-old ETH, into the “Compound loan that’s collateralized by a Uniswap Pool Share Token”.

Ether acts as a triple-point asset because it has the capacity to be all three assets at once.

Why is this significant?

Ether is the first asset in history to operate as all three asset types at once. Why this is neat? What does this mean?

This model secures the U.S. Economy

- Store of Value — The U.S. Dollar

- Capital Asset — U.S. Treasury Bills

- Consumable Asset — Taxes

Currencies are great Store-of-Value assets. Nation-state currencies are designed to hold wealth across time (although, they could be better at this. Perhaps significantly better). Currencies are the trust-vehicle for communicating and transacting value across space and time. The U.S. dollar has been the most successful currency of all time, and is the SoV asset that dominates the world economy.

U.S. Treasury Bills are the foundation to the U.S. bond market. The bond market is perhaps one of the greatest economic forces in the world, as it enables the market to express its trust/distrust of a government’s ability to repay its debts. Bond market yields are the fundamental risk-free rates by providing the U.S. government with your SoV asset (the US dollar), with the promise to return your US-dollars, with an extra % interest. The U.S. government then uses that value to secure the U.S. economy.

Taxes are how the U.S. government pays its debts, and funds new endeavors. The IRS represents the entity that collects fees, based on economic activity, to support the U.S. economy. The taxes collected (partly) go to the holders of U.S. Treasury bills, as the revenue mechanism for paying the interest owed by T-Bill holders (in theory, the U.S. government also pays off T-Bill holders via inflation of the U.S. dollar, reducing the Dollars strength as a Store-of-Value asset).

Ether and Ethereum Follow This Same Model

This same structure of an economy is found in Ethereum as well. This time, it’s Ether at the center of it all, and its Ethereum as the economic system.

- Store of Value —ETH Locked in DeFi

- Capital Asset — Staked-ETH

- Consumable Asset — Gas

Ether is used as a Store-of-Value asset powering Open Finance applications.

Ether is staked to Ethereum, to fund economic security and receive risk-free interest.

Ether is used to pay gas, the fees for using the Ethereum economy, as the taxes to pay for the security of the network.

Bringing it all together

At the heart of Ethereum is the infrastructure needed for generating an entirely new economy. This time, the financial services inside this economy are

- Entirely run by code*

- Trustless / Permissionless

- Is on the Internet

Now that we have this new economy, we need a new money to run inside of it. If we want to retain the trustlessness and permissionlessness of the Ethereum economy, we need a trustless and permissionless currency.

The only trustless and permissionless asset in Ethereum is Ether.

Ether’s role in Ethereum

Ether is bandwidth for Permissionlessness

The demand for, and use of, Ether inside of Ethereum is a function of its demand as a permissionless money inside financial applications.

There is finite Ether in Ethereum, meaning that when Ether is locked inside an application, the application is using up a part of the total sum of Ether. Applications compete for Ether collectively use a portion of all Ether in Ethereum. This is what we call the “ETH locked in DeFi”.

Bandwidth is referring to “ETH Locked in DeFi”, or, “How much ETH does this application need to serve the needs of its users?”

Right now, bandwidth usage is pretty low. There’s a lot of room for application growth and ETH capture.

- If more DAI wants to come into existence, its going to need to lockup more ETH to generate that permissionlessness. Each Dai needs 1.5x its value of ETH to support it.

- If demand for Compound loans increase, Compound will require more ETH collateral to back the loans. Same for dYdX.

- If Uniswap grows in volume and liquidity, it will need more ETH or Dai to grow these liquidity pools.

All of these things require a portion of total ETH, representing the usage of Ether’s bandwidth as a permissionless currency.

Growing Bandwidth

Ether has plenty of bandwidth for the current state of Ethereum. The market cap of Ether is ~$20B at the time of writing, while total value locked in Open-Finance is $600M. We currently have the bandwidth we need to achieve the current needs of the users.

However, Ethereum as an economy leaves much to be desired. If we want Ethereum to be

- The global financial platform for the internet

- the internet of value

- The global settlement layer for all digital assets

and we want this to be fully permissionless/trustless, then we need Ether to scale to larger numbers.

Trusted finance and permissioned assets are welcomed on Ethereum. They have their role and function in Ethereum all the same. But the real revolution is totally permissionless financial applications, that operate using totally permissionless money. Anything else is a compromise.

There are 1.7 Trillion USD in circulation. If we want Ethereum to match that demand, the price of Ether will have to grow by 85x.

There are $73 T in stock market assets. If we want to generate permissionless synthetics of these assets on Ethereum, they need to be collateralized by Ether, and will require Ether price to increase by 3650x. The same is true for the global money supply.

If we want a permissionless world, where humans communicate value through a trustless platform, the value of Ether needs to scale to meet this demand. Right now, Ether and Ethereum serve the needs of a small niche population of dedicated believers and the value of Ether is high enough to do so.

However, If we want to onboard the next 1-Million, or 1-Billion, users to Ethereum, Ether will have to increase in price to support the economic activity required by permissionless/trustless financial applications.

How will Ether scale?

We need the price of Ether to increase, so we can have more capital available for more financial platforms. How does this happen?

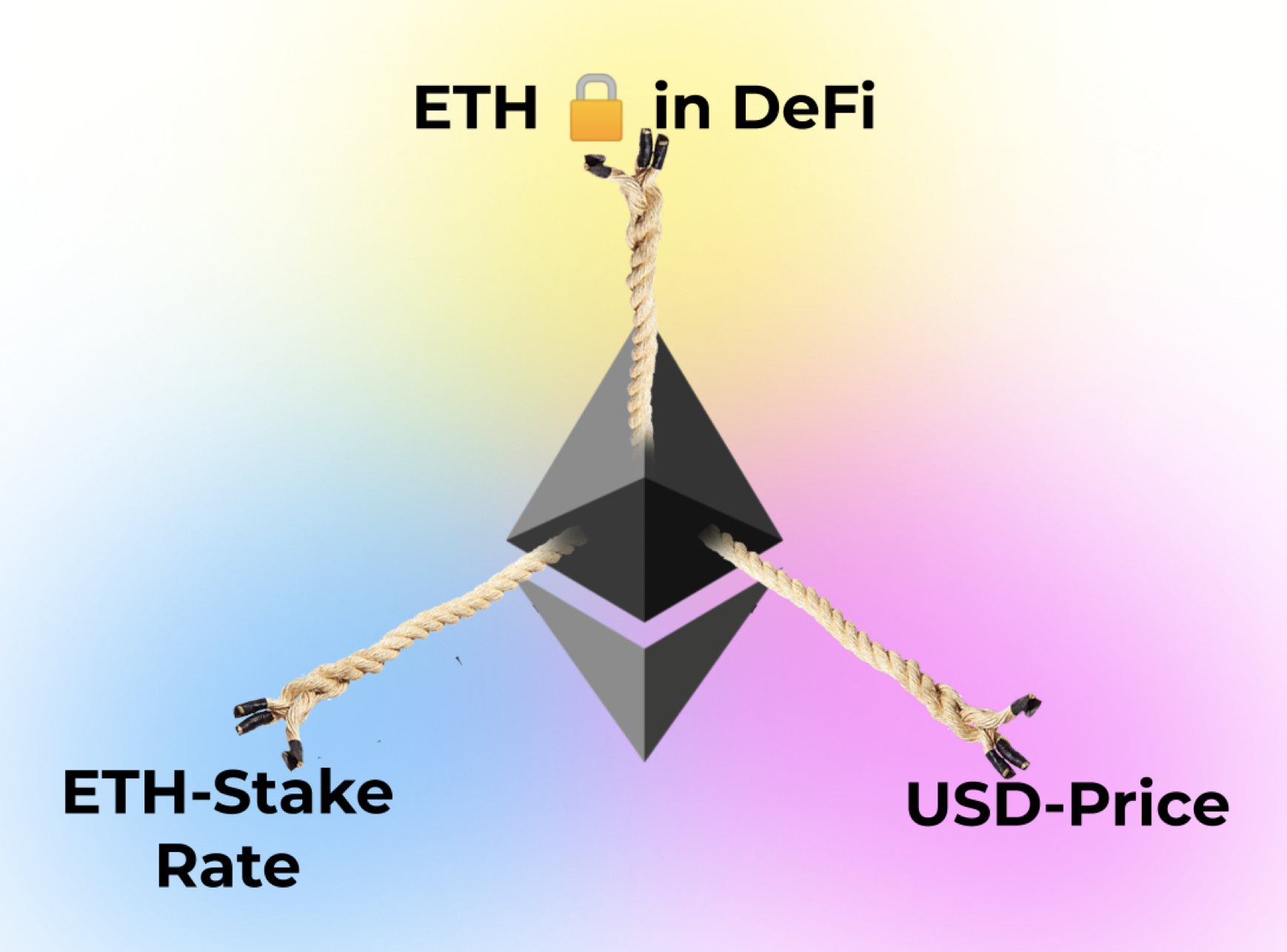

The Three-Way Tug-of-War

Here is my model for understanding how Ether will appreciate. This is the fundamental value proposition for Ether.

- Open Finance attracts ETH. Open Finance applications provide products and services that require Ether lockup. Collateralization powers trustlessness, and Ether powers trustless DeFi. DeFi applications will create valuable services for Ether-holders, that convince them to lock-up their Ether inside their application, to access the service/product. MakerDAO, Compound, dYdX, Uniswap…. More useful applications, more reasons to lockup ETH.

- The ETH-Stake Rate. The alternative to locking your ETH in DeFi is to stake your ETH. The ETH-Stake rate offers the “risk-free rate” for Ether holders. If you believe that you can receive a better return on your ETH by staking it, than you can by locking it in DeFi, then the ETH-Stake rate is your incentive to stake. ETH locked in DeFi and ETH-staking will constantly be fighting over ETH. Notably, the more ETH is locked in DeFi, the better the ETH stake rate is. If DeFi generates great products, then ETH will migrate to DeFi, leaving higher returns for those who are still staking.

- The US-Dollar Price. Both of these two forces pull on the US-Dollar price. If DeFi is fighting for ETH, and the ETH-Stake rate is fighting for ETH, then there’s less ETH available for purchase. The only mechanism that the US-Dollar has to generate it’s equal-and-opposite pull on the above two forces, is to increase in price. The US-Dollar value of ETH is a representation of the cumulative forces pulled by the ETH-Stake rate, and the products of DeFi.

Which is fantastic, because it means as Open-Finance becomes more useful, the price of Ether should scale up alongside it to match the demand. The higher demand Open-Finance generates for ETH, the better the ETH stake rate. Collectively, both of these forces pull on the price of ETH, to increase the bandwidth of Ether in Open-Finance, and the security mechanism that supports the Open-Finance economy.

The US-Dollar price doesn’t stand a chance, so long as DeFi continues to generate more financial applications on top of it.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.