Dear Crypto Natives,

I loved turn-based strategy games like Civilization as a kid. Ever play one?

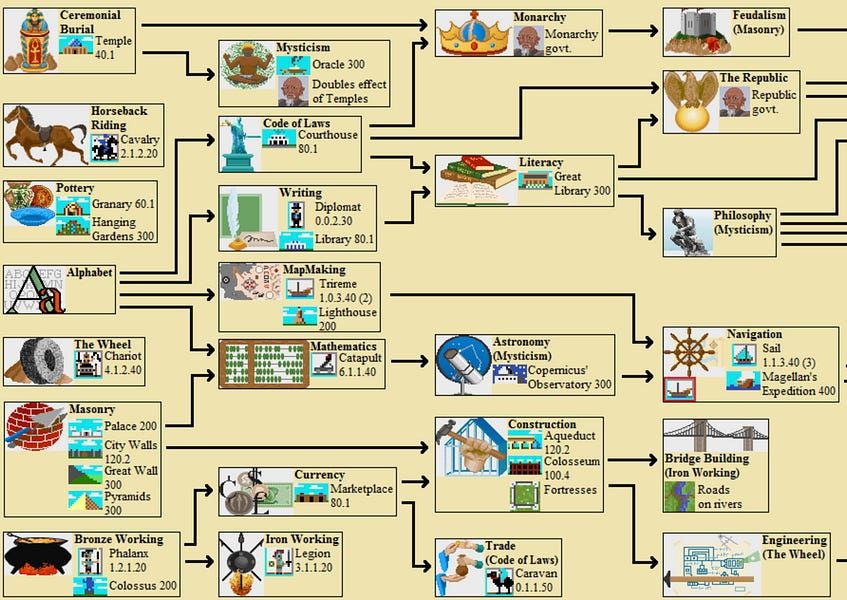

You’d start as a hunter-gather society in the stone age. Your goal is to use resources and time to level up your society according to a tech tree like this:

Learning the Alphabet helps you unlock Writing, Mathematics, and Law. With Law and Writing, you can unlock Literacy which opens up Philosophy and eventually, a new form of government—a Republic and so on.

Your civilization can’t jump straight to flight and nuclear fission! You know how many technologies are required to get there? Epochs worth! It’ll be 20 turns until the Renaissance for the rebirth of science and another 10 for the Industrial Revolution to get the necessary machinery—and you’re not even in the bronze age yet!

These technologies are like branches on a tree, each branch dependent on dozens of others. Some branches appear as dead ends, but really they’re just waiting on the right combo of technologies to keep growing. Sometimes time is all that’s needed. Sometimes it takes an investment catalyst.

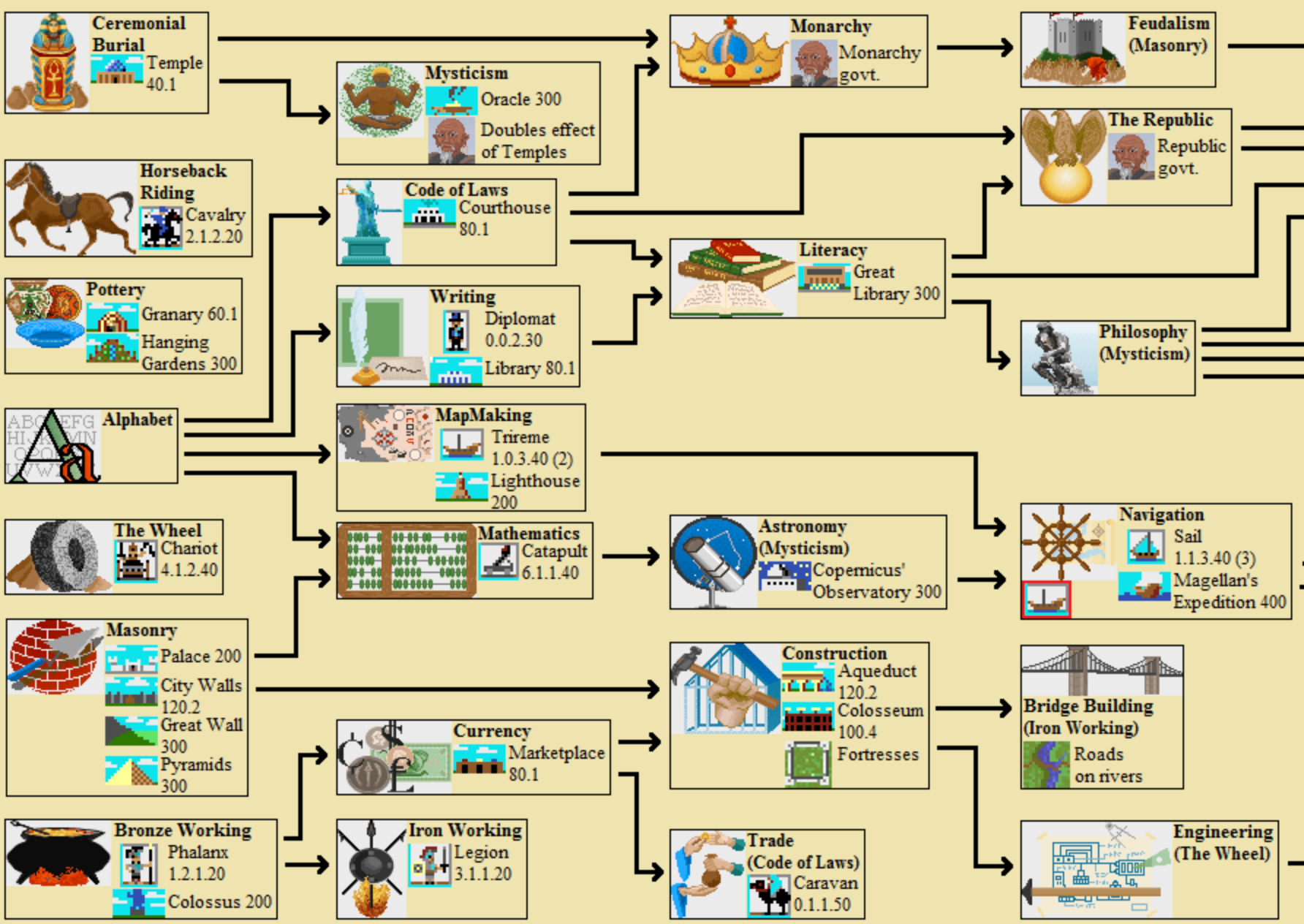

Have you noticed the Ethereum economy operates like tech tree?

We started off with Ethereum—an economic network in the stone age. Not a lot to do besides transmitting ETH or speculating on it.

A few turns pass by. Oh, what’s this? We’ve unlocked tokens—the ERC20 standard—that’s +30 to Funding. Tokens have the positive byproduct of adding to the moneyness of ETH but also come with a negative byproduct—a +25 to scams.

A few more turns pass by. Turns out ICOs aren’t the only tech ERC20 tokens have unlocked. When combined with ETH as a reserve asset tokens allow us to unlock Maker, a protocol which gives us +20 lending and produces DAI. Our first big win! We’ve unlocked the world’s first permissionless stablecoin! Not possible without ETH and tokens.

Now that we have DAI (a stable form of ETH) what’s possible? We can unlock the DAI Savings Rate (DSR). That’s a +25 to the Savings protocols of our economy. The DSR opens the door for feature rich smart-contract wallets like Argent (+20 usability). DAI fuels liquidity in Compound (+20 Lending) and DyDx (+15 Margin), and helps set the DeFi lending rates for Bank Stablecoins.

Are you seeing how Ethereum’s Economic tech tree works?

You can’t get a highly liquid Synthetix without Uniswap. And you’ll never have Uniswap without ETH liquidity pairs.

Do you want to unlock…

- a tokenized BTC like tBTC? You first need ETH + ERC20

- a synthetics minter? You first need ETH + ERC20 + Uniswap

- a private stablecoin? You first need ETH + ERC20 + DAI + AZTEC

Sometimes we get lucky and unlock a major economic breakthrough like Uniswap—something destined to become a root branch for our tree—like the Alphabet or the Wheel it’s a prerequisite for hundreds of other branches. Other times the tech appears to be a stagnant as as Augur appears to be now—but maybe Augur’s just dormant waiting on a stablecoin to flourish. (DAI will be added to Augur in months.)

We don't know Ethereum’s tech tree in advance. It’s full of surprises. Even the very best crypto investors might only see a branch or two ahead. But that’s fine. Why bet on the individual branches when you can buy ETH and bet on the entire tree?

But you’d be be dead wrong to dismiss ETH & DeFi as “not institutional grade” or “too primitive” or “completely self-referential” based on its current state.

Who could have expected a bunch of cavemen to send a man to the moon?

Who could think a low throughput network of magic internet money would some day become an open financial system for the world?

Us.

Maybe that’s because we know the compounding power of tech trees.

And maybe Wall Street & the banks should fire up a game of CivIII before they miss it.

- RSA