The Two Faces of Ethereum

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Awesome news…moving forward all of David’s articles will be released to all Bankless subscribers—whether you’re a full paying subscriber or not! This will ensure they get the widest distribution possible.

So if you’re a full subscriber you’ll get David’s articles in addition to the Market Monday, Tuesday Tactic, and Thursday Thought-piece you receive each week on the program.

If you’re a free subscriber you’ll get David’s articles in addition to the occasional updates you get on the Lite version of the program.

Everybody wins! I’m so pumped.

- RSA

p.s. I’ve included a note from David below—support his writing directly if you’re enjoying it!

Ryan and I want to maximize distribution of my articles, so moving forward all of my articles will be released to all Bankless subscribers both free and paid.

If you would like to support me and my articles, you can donate to davidhoffman.eth!

This will help me dedicate more time and attention to writing more articles as well as help me commission @Freddmannen for more illustrations.

- David

THURSDAY THOUGHT

The Two Faces of Ethereum

By Bankless contributor: David Hoffman COO RealT & POV Crypto host

“We always think in a sci-fi movie that something you thought was human, would then rip off its mask to reveal itself to be a computer…. and this is the-reverse! The computer face is ripped off, revealing humans behind it all…”

— Eric Weinstein, a metaphor for explaining the DAO fork

There is a debate in crypto

about whether these crypto-economic systems (blockchains; Bitcoin + Ethereum) are functions of social contracts or functions of autonomous/humanless code.

Who runs these things? Humans or computers? The Bitcoin thesis is that we ought to remove humans wherever possible. The thought is that human-to-human trust systems aren’t as scalable as human-to-computer ones. Therefore, any amount of human involvement in crypto-economic blockchain protocols (wtf do we call these things?) is to be met with caution and skepticism. Humans f**k things up; computers run as programmed.

In my opinion, the Ethereum world does not pay enough attention to this concept. This is the fundamental concern of Ethereum’s #DeFi ecosystem. It’s not totally De. There are humans at the helm.

The Two Sides of Crypto

Kill all Humans

A core thesis of blockchain and cryptocurrencies is that we can relegate financial tasks and transactions to fully autonomous code. We no longer need humans to manage our value; the computers can do it just fine. Better, actually.

But how much human involvement can we actually strip out of these systems? Is it even possible to strip out 100% of human involvement?

@Hasufl thinks not. Bitcoin is the embodiment of a fully computerized system, where all human input has been totally stripped out, but according to Hasu, that does not mean the social contract isn’t still an important component of these systems.

Bitcoiners will argue that the social contract itself is something to be removed. The incentive structure of PoW and fixed supply assets create strong enough incentives to turn humans into brainless, satoshi-addicted zombies that serve the chain forever.

Full Human Control

That might resemble something like my company, RealT. We issue tokenized real estate assets that payout rent on a daily basis, and just takes minutes to sign up and register! Buy RealTokens today, receive rent tomorrow! Oh yeah, also no U.S. citizens. Also, we can revoke your tokens. Centralized AF 😎

The cool thing about Ethereum is that it enables companies like RealT to exist. We don’t need a blockchain to provide our product, but we do need Ethereum and its DeFi ecosystem to have a competitive advantage vs our paper+ink competitors.

Which brings me to the core thesis of this piece:

Between RealT and Bitcoin is a huge landscape of possible human-to-computer protocols.

MakerDAO

MakerDAO is criticized for its concentrated MKR distribution. The token that represents governance over a system needs to be well-spread to have that governance be ‘decentralized’. However, there are three points to bring up:

- MakerDAO isn’t a blockchain, it doesn’t need maximal decentralization

- There are 16,351 MKR-holding addresses. Compare that to voting-members of a company, that’s orders of magnitude more decentralized (and more importantly, permissionless)

- Like all tokens, MKR exhibits entropy. Time creates decentralization.

99% of the activity on MakerDAO requires no human oversight or input. MakerDAO is a protocol. It is autonomous in the sense that there is no human processing of all consumer-facing transactions (unlike RealT, like Bitcoin). The only human involvement is with protocol changes/upgrades. A software update, if you will.

Bitcoin creates an incentive system to turn humans into brainless, satoshi-addicted zombies. The Maker system is comparable: rational economic agents make economic decisions that will converge on choices that are good for the system. Here’s how MakerDAO creates incentives for MKR-addicted zombies.

There are differences here too: Bitcoin is a plug-and-play system that doesn’t require human choice (after deciding to plug-and-play…). Maker requires subjective choices by individual economic agents, and hopes the same mass-psychology that produces the Efficient Market Hypothesis also produces the Secure MakerDAO System.

The same rules apply: The more MKR distribution and voting activity, the more brainless MKR-addicted zombies there are working to maintain MakerDAO. The distribution and voting activity of MKR, along with the engineering security of the MakerDAO protocol will allow for MakerDAO to tap into the same energy that powers Bitcoin; anti-fragile autonomous software with minimized human involvement. (On MakerDAO’s antifragility)

However, MakerDAO will always have comparatively more human involvement in its maintenance than Bitcoin, because it requires human action.

The Big Questions

- Has MakerDAO stripped out enough human requirement to be socially scalable?

- Is it always better to strip as much human involvement as possible? Or is there just a threshold that needs to be achieved?

- How does the decree of human involvement contribute to long-tail risk? How much more likely is MakerDAO to experience a black-swan event than Bitcoin, specifically due to the human governance? What’s the ratio of the benefits of MakerDAO vs. the costs of its black swan susceptibility?

Uniswap

Uniswap is another good example to look at. Vitalik Buterin frequently cites Uniswap as one of his favorite Ethereum applications because of its simplicity and compete stripping of all human involvement. Remember, Vitalik is a Bitcoiner!

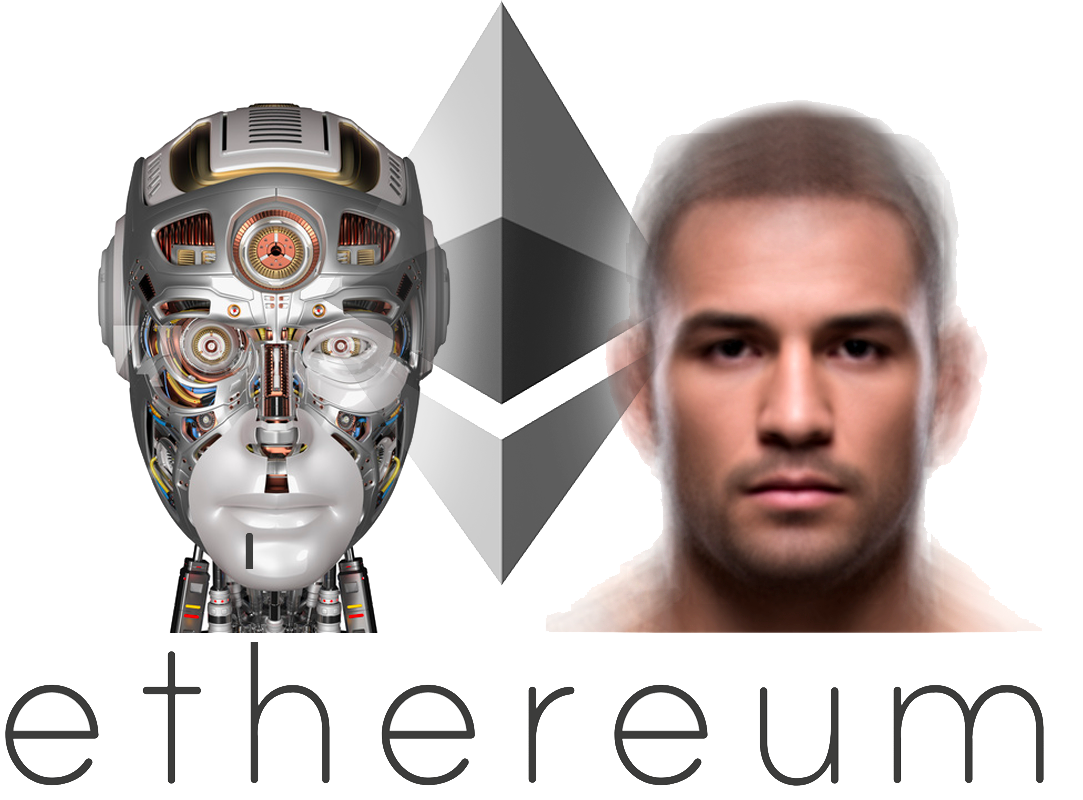

I recently put out a tweet that suggested a hypothetical future scenario where the Uniswap exchange takes their Liquidity Provider tokens (tokens that are a claim on the assets in a Uniswap pool) and turn them into governance tokens. This way, they could govern over the fees taken by their particular exchange. We could let Uniswap LP Token Holders govern their particular exchange the same way MKR governs over MakerDAO.

Hayden Adams, the creator of Uniswap, came into talk about why Uniswap is going to take the fully-autonomous, human-stripped path:

My thesis: The LP Token holders would pick the right fee for their particular exchange, by matching supply/demand to best suit both parties.

Hayden’s thesis: If a protocol is able to fully function with entirely autonomous code, then it should.

The core thesis of blockchain and cryptocurrencies is that we can relegate financial tasks and transactions to fully autonomous code.

Hayden claimed that if you allow a token to govern over a protocol, you are allowing for two separate sets of incentives to be created. These sets of incentives may or may not be aligned.

The risk of a black swan event for MakerDAO is a function of how misaligned MKR holders are from DAI holders. If you think this risk is too great, you might be a Bitcoiner. If you think this risk is manageable, you might be an Etherean.

If you’re a developer building an app on Ethereum, it’s okay if your app requires humans. The Bitcoiners are going to yell at you and be mean, but you can ignore them. Ethereum has space for you. But, if your app can operate without humans, perhaps default to that, because the Bitcoiners are saying these things for a reason.

A Landscape of Autonomous Code

Ethereum’s whitepaper was able to strike people’s imagination because of the combination of unstoppable code and a turing-complete coding language. When early stakeholders envisioned the future of Ethereum, they didn’t imagine RealT. They imagined Uniswap.

Ethereum’s future can be many things. One of them is a landscape of fully-autonomous unstoppable applications. With Uniswap, we’ve got one in the bag (Augur possibly fits too).

Others apps come close, but don’t have the complete checklist that Uniswap has. And again, that’s the power of Ethereum: it doesn’t matter. We have a wide variety of applications on Ethereum that span the Human-Computer spectrum, and so far so good. Most are still standing, and new ones are cropping up every day.

The Ethereum apps that have human skin exposed have so far been sufficiently protected from nature’s weather. However, as many Bitcoiners fear, winter is coming.

Or maybe not. I don’t know. Maybe Ethereum skips into the future with limited nation-state friction and little regulatory resistance. Maybe Ethereum is welcomed by open-arms by the powers-that-be. Maybe Andrew Yang gets elected and puts together a pro-crypto task force (Yang 2020!).

Maybe Joe Biden gets elected and thinks that Bitcoin is for DRUGS.

I don’t think we will be able to make accurate predictions to what degree the powers-that-be will attempt to thwart these systems.

All The Faces

Ethereum is a Hydra. It has many faces. When EtherDelta was taken down by the SEC, it’s because it was too far human. It was an easy target.

Ironically, the first Ethereum application to fall was quickly replaced by its first completely autonomous alternative, Uniswap. Also, it requires just 1 transaction to trade on Uniswap, vs the 8 it would require in EtherDelta, making Uniswap highly user-friendly and easily composable.

When the EtherDelta-head was chopped of Ethereum’s body, a new Uniswap-head replaced it, this time with no humans and objectively a better product.

Ethereum the Hydra

While I said it is pointless to guess to what degree the world's authorities will take offense to the activities found on Ethereum, there is an important point to bring up.

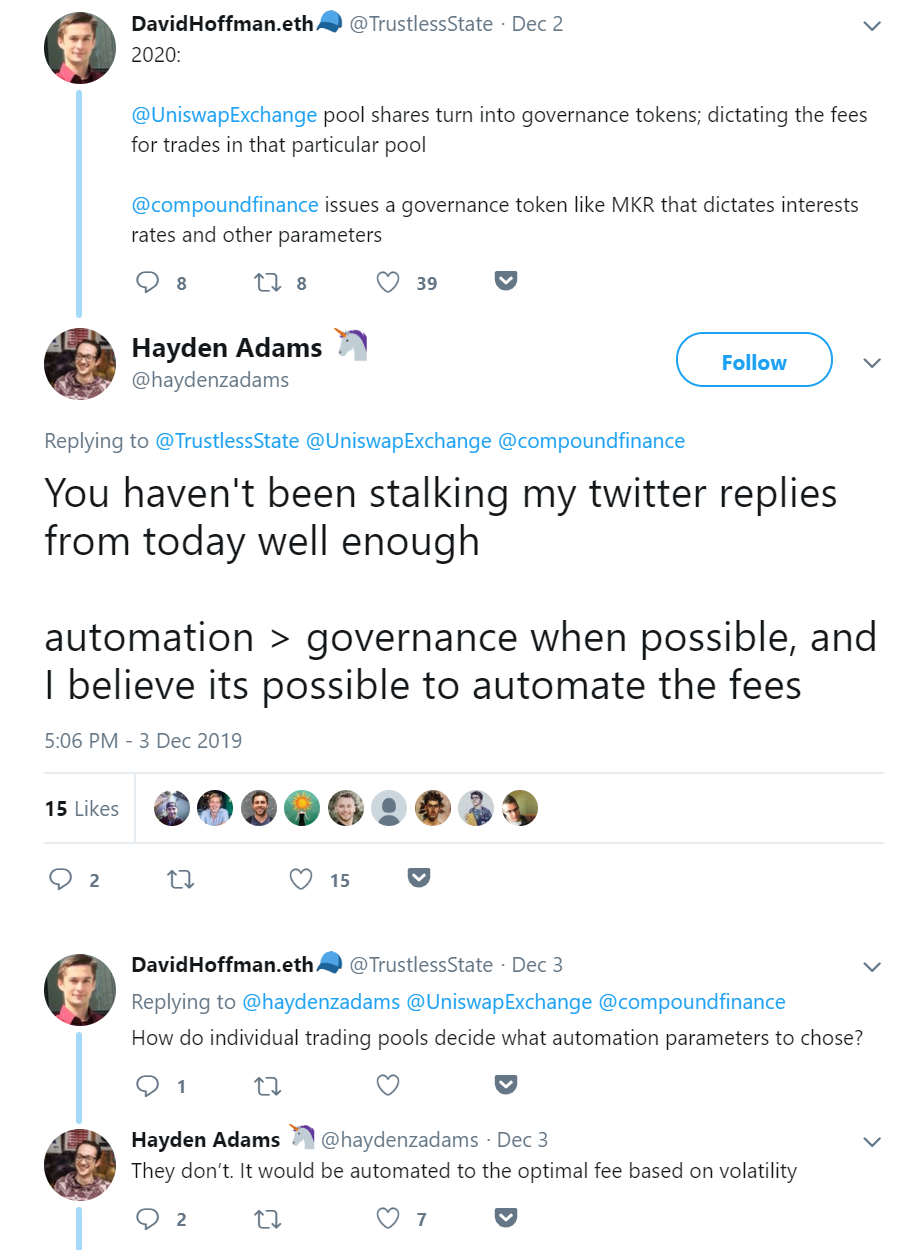

Imagine there are a bunch of Ethereum applications that are doing illegal things from the perspective of the world’s powers. According to Hasu, that’s the main purpose of cryptocurrency, anyway.

My thesis is: Hasu is right, for now. Future growth of crypto will add many compliant businesses. For now, uncompliant and illegal applications come first, because they have no outside competition.

Here’s a thought experiment

Imagine a world where over half of Ethereum applications were doing illegal things, and the powers of the world coordinated together to stop the illegal activity.

In this world, who do the powers target: Ethereum, or the applications that are doing the illegal things?

I don’t think targeting ‘Ethereum’ is realistic, especially when it’s the application doing the illegal thing, not Ethereum itself.

Ethereum will be the air we breath. (Illustration by ultraviol.eth @Freddmannen)

Attacking Ethereum costs money. The greatest deterrent.

Attacking Ethereum applications either…

- Costs the same as attacking Ethereum (Uniswap, Augur)

- Costs less than attacking Ethereum, due to central parties managing applications (MakerDAO, Compound)

It’s worth noting that some applications like PoolTogether have human components to them, but could be easily patched if necessary. Writing a version of PoolTogether on Ethereum that removes the humans is trivial. PoolTogether and applications like it don’t do this because of the huge benefits of being able to maintain, iterate, and expand these systems.

Darwinian Battleground

Ethereum’s core feature is its Turing-completeness. Turing-complete code is what enables Ethereum to host human-controlled crypto-applications that otherwise could not have been built.

This freedom is what has enabled Ethereum to have its 2018/19 Cambrian explosion of interoperable apps. The freedom of Turing complete code is the freedom for all possible applications, products, and services to be able to be built on Ethereum.

This is a double-edged sword. With great potential comes great risk. We have seen applications come to Ethereum, explode (The DAO), be stopped by authorities (EtherDELTA), or witness levels of growth that the Silicon Valley startups dream of.

Apps like MakerDAO and Uniswap are clearly ‘fit’ apps on Ethereum.

I frequently call Ethereum a “Landscape”. Inside of Ethereum’s EVM is a 3D-landscape of digital value applications. Across Ethereum’s limitlessness is space for all possible applications to be built on Ethereum. Applications can fill any niche in Ethereum’s landscape, across an infinite variety of spectrums. One of the most critical spectrums in Ethereum is the human-to-computer spectrum.

Code = DNA

Every application on Ethereum has its own DNA. Each app is unique and fills its own niche inside of Ethereum. Each app has its own nutrient requirements (users, value), and some apps are more successful than others. While there is room to build all possible applications on Ethereum, there is not necessarily enough room to host them all. Ethereum applications are subject to the survival of the fittest.

Ethereum is two things:

- The landscape for all possible applications

- The set of all applications living on this landscape

This landscape will be the battleground for Ethereum applications. Battles will be between apps and other apps over users, value, and liquidity. Other battles will be between apps and the outside world, probably also over users, value, and liquidity. Both will be battles of territory.

EtherDELTA was clearly not fit to live. It took advantage of an extremely lush market cycle, and had zero competitors, but EtherDELTA was not long for this world. Even if the SEC hadn’t killed EtherDELTA, Uniswap’s far superior UX would have killed it long ago.

Growth of Ethereum Will Fill a Vacuum

The applications that see product/market fit on Ethereum will naturally come to fill a vacuum.

The shape of this vacuum is determined by

- The wants/demands of the users — how fertile the landscape is

- The capacity/incentive for outside influence to interfere — how hostile the landscape is

Application growth for the next 10 years will follow this pattern:

- Provide a product that answers to user demands

- See if it can withstand hostile environments

Over time generations of apps will be deployed and tried on Ethereum. The survival of the fittest will shape the set of Ethereum applications to fill the most fertile parts of the Ethereum landscape.

Naturally over time Ethereum applications will find a balance between:

- how much pie there is

- how much competition there is for that pie

- how exposed the application is while eating the pie

Shoutout to @idecentralized for the metaphor. Illustration by ultraviol.eth @Freddmannen

Ethereum the Hydra

As Ethereum ages, it will eventually represent a landscape of applications that were able to pass Darwins trials.

One of my favorite metaphors came from Kenny Rowe, where he labeled these crypto-economic blockchain protocols, aka Bitcoin and Ethereum, as young organisms going through their growth phases.

Kenny illustrated Bitcoin as a street-toughened teenager who could probably survive on its own. He said Ethereum is perhaps too young to be able to survive without help.

As Ethereum goes through the trials of nature, we will see weaker apps be killed, eaten, or starved and be replaced by tougher, efficient and more robust ones.

Naturally, over time, Ethereum will come to fill as much space as possible. Each app on Ethereum that passes Darwins trials acts as infrastructure for further apps to build off of. Not only does composability help increase the number of possible apps on Ethereum, but it also helps other apps pass Darwins trials.

Each autonomous unstoppable application on Ethereum lays foundation for further autonomous unstoppable applications, and makes Ethereum just a little bit more anti-fragile.

Thanks for Reading!

Actions

- Consider: human, cyborg, machine—which apps will win their niche?

- Consider: how does this Darwinian battleground make Ethereum anti-fragile?

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

Author Blub

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his recent talk on how ETH accrues value and this accompanying post. (RSA note: this video one of two 4 x 🔥I’ve ever given—highly recommended)

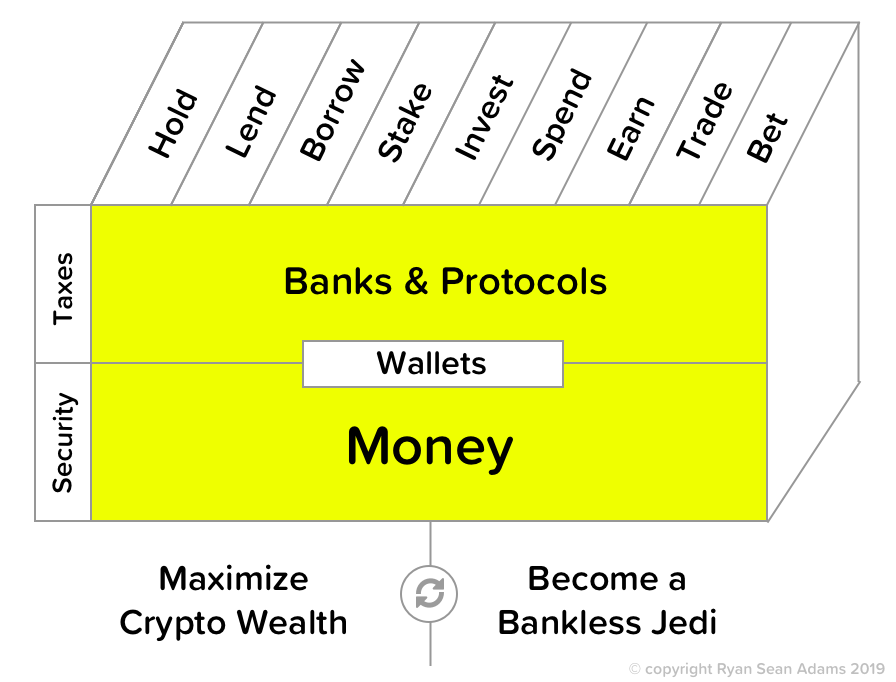

Filling out the skill cube

By learning how human and autonomous protocols compete and interact on Ethereum you’re leveling up on the Money and Protocols layers of the skill cube.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.