Uncollaterized loans are coming to DeFi

If you’re a full subscriber, join the discord for a live video AMA with Kain Warwick of Synthetix today at 6pm EST! If you’re not a full subscriber…subscribe and we’ll send a link!

Dear Bankless Nation,

A big issue with borrowing in DeFi is the need to over-collateralize the loan. This is how mortgages work in the real world, but it’s not how most people think of a loan.

If I already have the money why in the world would I need a loan?

Maker, Compound, Aave—all of these protocols have required users to lock up more capital than they can actually borrow.

That’s why unsecured DeFi lending is a massive opportunity. But there’s a problem. How do you do this without requiring KYC, credit scores, and all the cruft and inefficiency of traditional finance?

The race is on for unsecured lending solutions in DeFi and we’ll be covering them all as they emerge.

First up is Aave with their credit delegation feature.

Here’s how it works.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

We just released episode 9 (Part 2) of SOTN—PROPAGATING feat. Vitalik!

📺 Watch SOTN#9 (Part 2): PROPAGATING w/ Special Guest: VITALIK BUTERIN

ETH SUPPLY GATE & CURRENT GAS FEES with the Founder of Ethereum

THURSDAY THOUGHT

Guest Post: Stani Kulechov, Founder of Aave & Marc Zeller, Tech Evangelist of Aave

Unsecured loans are coming to DeFi

An unsecured loan by credit delegation is a little-to-no collateral loan that leverages unused borrowing power from DeFi liquidity providers.

For liquidity providers, unsecured loans provide a way to increase passive income by earning a premium on the borrow rate. Borrower accept this higher rate, and in return can take out a loan without supplying collateral.

Unsecured loans comprise the majority of lending activity in traditional finance.

Now they’re coming to DeFi.

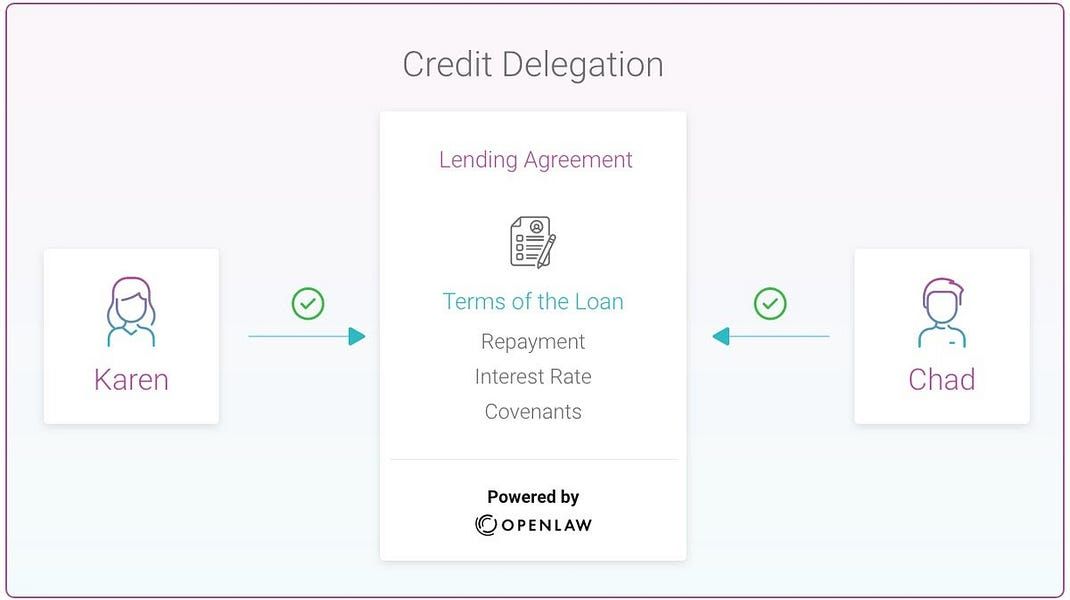

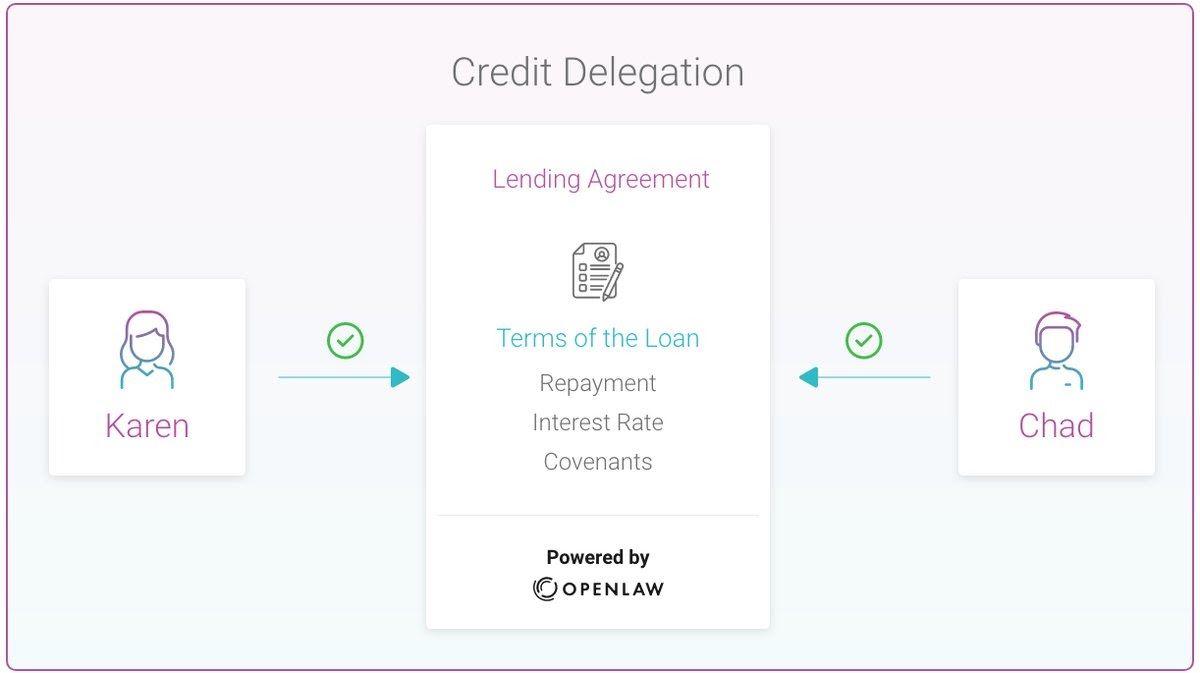

In July Aave announced the addition of credit lending to the protocol with a Karen and Chad delegated loan example—the first meaningful unsecured lending attempt in DeFi so far.

Before we talk about it further, let’s talk about why DeFi needs this.

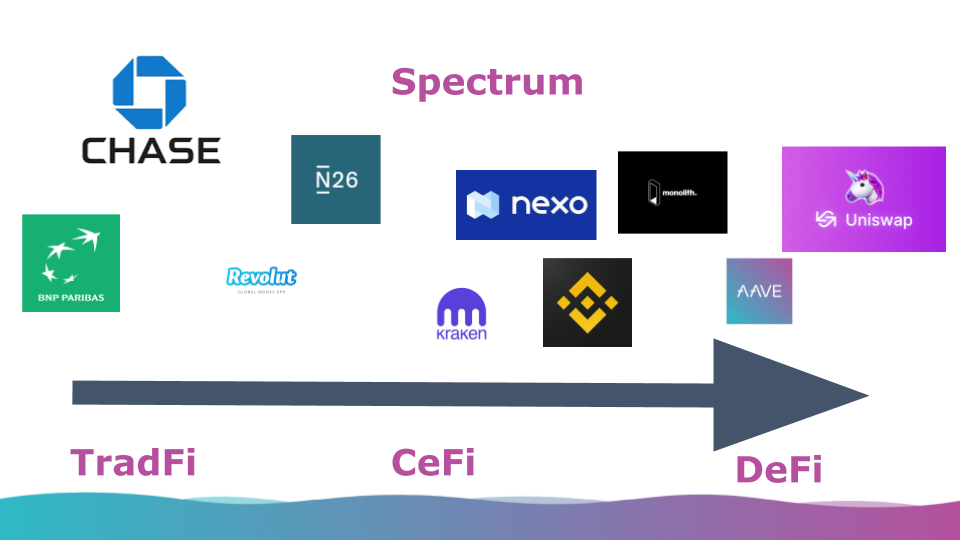

DeFi is a Spectrum

The decentralized finance ethos is pretty clear, build a better financial ecosystem. One that’s accessible by anyone in the world.

There’s clear consensus on the core values of DeFi: no KYC, no whitelist, the rules are the same for everyone, no geo-lock, no credit score, and no paperwork.

Additionally, DeFi should be open source and non-custodial: you’re the owner of your money and you’re free to use it as you want, when you want.

Lending in DeFi: Credit makes DeFi capital more efficient

Traditionally in DeFi users deposit stablecoins or other assets to earn interest. In these early years of DeFi we’ve seen interest rates for crypto dollars such as Dai provide significantly higher yields than traditional banks.

But many of the deposits go into lending protocols where after depositing, the depositors do not have the intention to borrow against them. This produces a vast amount of value locked within these protocols without any utilization. In other word, there’s a significant amount of unused borrowing power in most lending protocols today—they’re capital inefficient.

That’s where credit delegation comes in.

To improve capital efficiency, Aave introduced Credit Delegation, where a depositor with unused borrowing power can delegate a credit line to someone whom they trust to earn additional interest.

Let’s dive deeper into how it works.

How do DeFi loans (credit delegation) work in Aave

Credit delegation uses a combination of smart contract functionality and peer-to-peer trust. The trust is introduced when credit delegation is used to source liquidity from DeFi beyond delegating credit to smart contracts. What’s important in credit is confidence the loan will be repaid.

⚠️HOLD ON! BUT ISN’T TRUST IS BAD???

Trust minimization at base layers is awesome, but at higher levels trust can be a positive attribute and that leads to greater capital efficiency!

Using OpenLaw to ensure credit-based loans are repaid

In the Karen and Chad example, to ensure that Chad repays the loan, OpenLaw is used as a legal wrapper to ensure that the transaction is legally binding. (RSA-remember we used OpenLaw to create a DAO in tactic #31).

OpenLaw is an interesting tool as it allows Karen and Chad to conclude the agreement and also execute the smart contract code directly with through their Ethereum wallets.

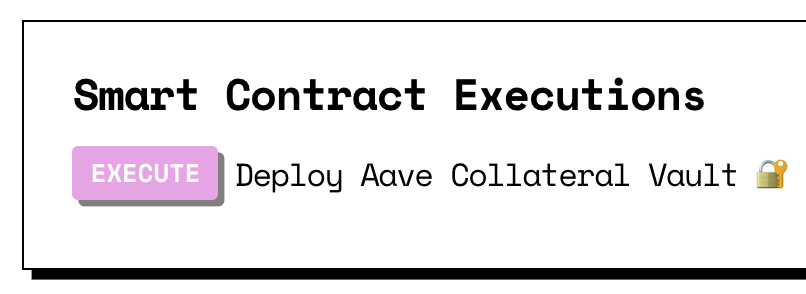

A smart contract based Credit Delegation Vault is created with each credit delegation.

This vault is a debt wrapper built on top of Aave. Each vault allows users to set different delegation parameters including which currency the borrower can draw, interest rate formulas, and most importantly, the credit limit.

With OpenLaw all of these parameters are selected through the programable legal agreement that Karen and Chad set up, leaving Chad free to simply draw the funds.

The Credit Delegation Vault acts as the “credit card”. In the background, Karen has a deposit in Aave. When Chad draws the credit line, the Vault draws Karen’s credit line from Aave against Karen deposits, which act as a collateral for Chad’s borrows.

This way Chad does not need collateral and is happy to pay additional interest for that reason to Karen. Win win!

Peer-to-peer and Peer-to-Protocol

Liquidity for credit delegation is sourced in two ways:

- Peer-to-peer trust. Credit delegation can be used to delegate credit to anyone the depositor trusts. This could be a business partner, friend, a trader, or a maybe even a fellow Bankless badge holder.

- Smart-contract trust. Credit can also be delegated to a smart contract with predefined functionality that programmatically enforces certain limits.

Example: smart-contract credit delegation using yearn

Smart contract-based credit delegation is in the works with yEarn which intends to leverage yVaults. yEarn allows LEND depositors in Aave to delegate Dai into these yVaults with predetermined functions. This can programmatically limit credit risk to certain behaviors such as farming governance tokens.

🎙️Listen to our yEarn episode for learn more about this protocol

Credit delegation for CeFi

Credit delegation is a great way to source liquidity not just in DeFi but into CeFi or traditional finance.

Aave performed its first credit delegation by allowing DeversiFi, a decentralized trading venue, to draw credit from Aave via the credit delegation mechanism.

DeversiFi was able to source liquidity from DeFi which ended up being cheaper than what CeFi OTC lending desks were offering. Similarly, we could see in the future that traditional finance could obtain credit at a cheaper rate from DeFi as rates are going down overtime, making DeFi a competitive source for capital. (RSA—does this sound like protocol sink guys?)

We could imagine that credit scoring project such as Tellor or Union, which is trying to achieve borrowing against social reputation could use DeFi protocols like Aave’s Credit Delegation to source liquidity.

What this means

Aave’s credit delegation is a money lego that allows DeFi depositors to delegate credit lines to earn more. It can be used as a building block in other DeFi protocols such as OpenLaw, Tellor, and Union or even by crypto banks like Coinbase to create credit lines with healthy lending activity and scale DeFi liquidity into all parts of finance.

Uncollateralized loans are coming to DeFi.

Get ready.

Action steps

- Explore unsecured lending solutions: Aave, Teller, and Union

- Consider who you might delegate a line of credit to (the Bankless Nation perhaps?)

Author Bio

Stani Kulechov & Marc Zeller are Aave core team members—an open source and non-custodial protocol enabling the creation of money markets (and a friend of Bankless!). They’re also active contributors to the DeFi ecosystem leading meetups like Ethereum France and crypto co-working space The Block Cafe.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.