How to create a bankless DAO

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Organizations are a collection of contracts.

Modern organizations like corporations and non-profits settle in the legal system.

The legal system is maintained by the state. Nation-states are expensive, they’re prone to corruption, they’re geographically limited, they’re non-digital, and they require monopoly of violence to enforce.

Still, nation-state legal systems are a useful settlement layer for humanity—as long as they avoid dysfunction and corruption. The U.S. for example has strong property laws, corporate laws, and is stable enough to assume its laws will be enforced with reasonable neutrality.

But there’s a new settlement layer in town. It’s called Ethereum. It comes with a property rights system, a settlement layer, and a money system—it’s a new social coordination tool for the world.

While it isn’t nearly as flexible as the nation-state legal system (it can’t make decisions that require human judgement for example) it has other advantages—it’s digital, programmable, jurisdiction-less, and accessible to all internet citizens. Rules are transparent too. And it’s efficient—no armies, banks, or bureaucrats required.

And what if we combined the best of the legal settlement system with the best of digital settlement system? Can we create organizations that span both worlds?

That’s what we’re doing in today’s tactic.

We’re going to create a DAO that spans both worlds.

We’re going to summon a programmable, extensible, and globally accessible digital entity with legal docs, bank accounts, and capital coordination tools for $4.

This will blow you away.

-RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY:

Tactic #31: How to create a bankless DAO

Today we’re going use an OpenLaw Smart Agreement to create a DAO on Ethereum without a bank. This DAO includes a basic legal wrapper making it useful for the planning phase of a new venture with co-founders. It includes a way to designate founders, to pool capital in ETH or stablecoins, and to vote for future actions as DAO shareholders.

- Goal: Deploy a DAO using a Founders Agreement to Ethereum

- Skill: Intermediate

- Effort: 30 mins

- ROI: $4 in transaction fees for globally accessible digital company—not bad

How to create a bankless DAO with OpenLaw

Guest post: The OpenLaw team, creators of the OpenLaw public library

Ethereum is challenging common assumptions on how money works, emerging as a leading platform to launch digital, financial products (and even systems) operated entirely by code.

Similarly, it is also becoming a launchpad for digital organizations, or “DAOs”, that stand to benefit from this emergent soup of financial products. Traditional notions about how to best organize ourselves in an increasingly digital market is being challenged by these new organizations.

But what exactly are DAOs, and how do they relate to bankless financial products?

Organizations are contracts (so are DAOs)

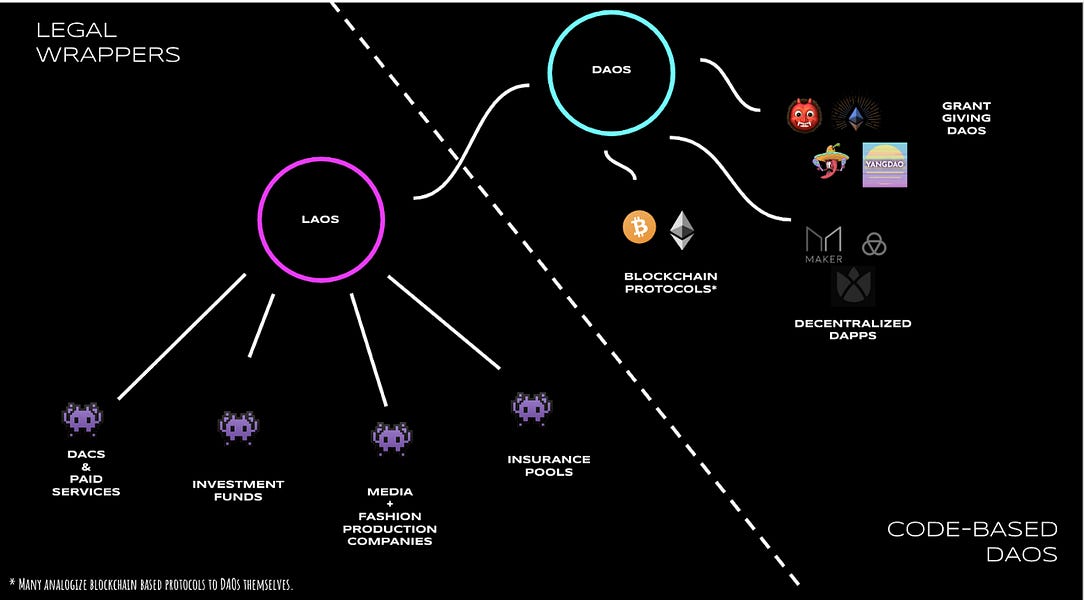

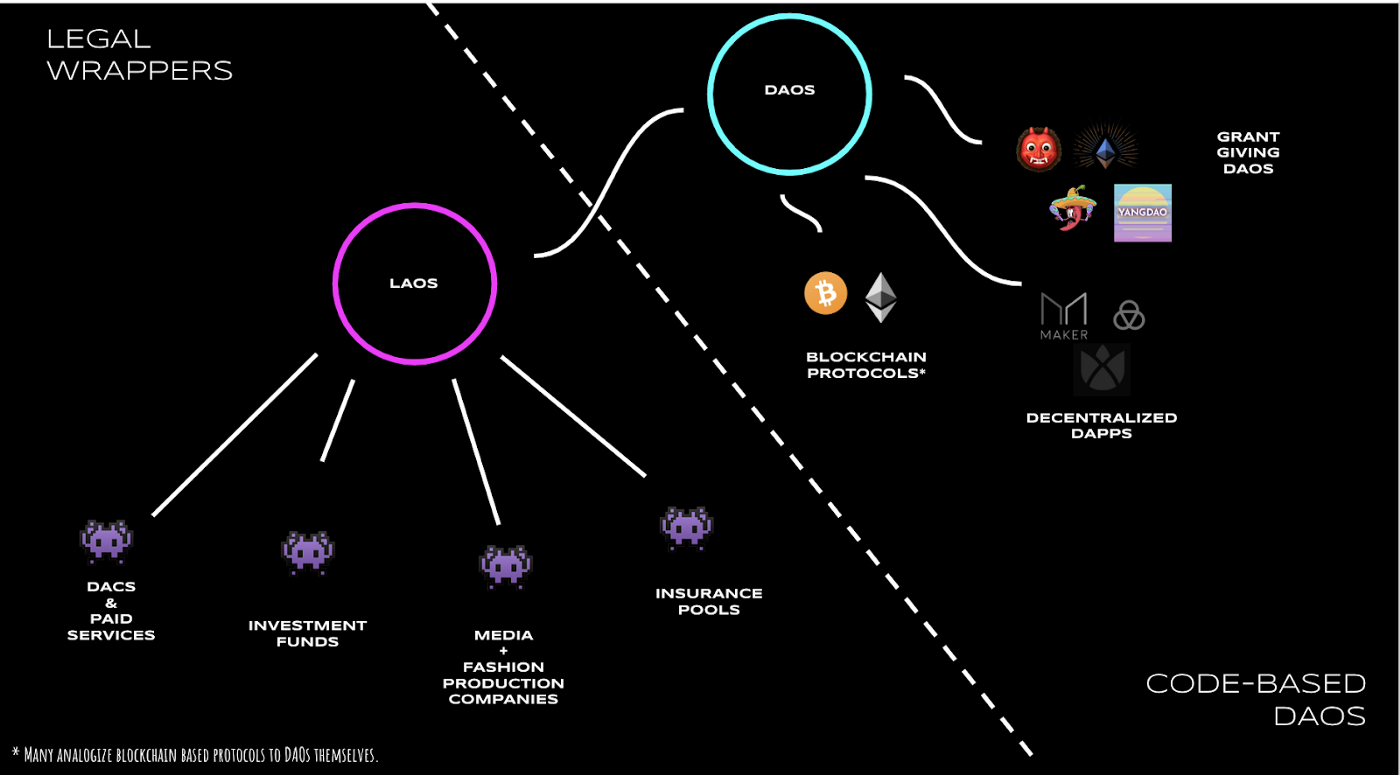

To repeat a well worn idea: organizations are contracts. By extension, DAOs are also a collection of contracts; this time both traditional and digital ones. These contracts are designed to enable online communities to coordinate and exchange digital monies and assets to accelerate social or commercial activity (such as DeFi charged savings often covered here on Bankless).

If you’re familiar with public equity markets, you might have come across links on company websites to “Organizational Documents,” which true to their name, spell out the rules of a company and its financial operations. From this core, a company might grow out layers of legal commitments, resulting in the web or “nexus of contracts” that comes to define it.

Therefore, by looking over a set of legal agreements, one can quickly grasp the existence of an organization and how it is programmed to operate into the future. For legal engineers, this may not come as any surprise, but this whole “nexus” theory begs for programming languages like Solidity (the programming language of Ethereum), which can reflect legal agreements as computable conditions that move money and update other legal states without banks. Legal agreements expressed in Solidity that define permissions and other rights among digital accounts are quite relevant to the field of DAOs.

DAO legal wrappers

With recent upgrades on the OpenLaw public library, which is free to use with an email account, we have made it easier than ever to dive into the world of Ethereum, financial programming, and DAOs, allowing anyone to easily upgrade their orgs. and other legal interests into self-executing smart contract code. We call these smart agreements. (RSA—we used OpenLaw smart agreements to tokenize ourselves in Tactic #19)

At their most fundamental, smart agreements serve as the bridge between the potentially autonomous code of smart contracts and the people that interact with it, fusing together code and law.

For example, a payment invoice in the traditional, web2 sense, is just a string of text that instructs an employer to instruct their bank to likely instruct another bank to update a ledger account of how much money you have. A smart invoice, on the other hand, would simply ping an employer to sign a payment from their browser wallet in the sum of say, USDC or DAI stablecoins, which would then create digital records and settle in minutes rather than potentially days of daisy-chained-bank-instructions.

Intrigued? Now imagine this speed and predictability applying to all payments for all legal contracts without banks, as well as all the other organization ops that could be similarly streamlined.

Let’s create a DAO

To give more folks access to smart legal agreements that plug into operational primitives on Ethereum, such as “DAOs” and other experimental digital associations, the OpenLaw team has synthesized a quick set of lo-code/lo-legal forms for the Bankless community to test out and get started—so let’s create a DAO!

Use Case

We’re going to start your DAO where most entities start: at the planning stage.

Say you have a group of founders who want to contribute capital to start a venture—an app, a consulting service, a game clan, a podcast, a capital pool—this smart agreement can be the genesis that allows you to collectively pool capital and conduct capital-weighted voting on next steps—without a bank!

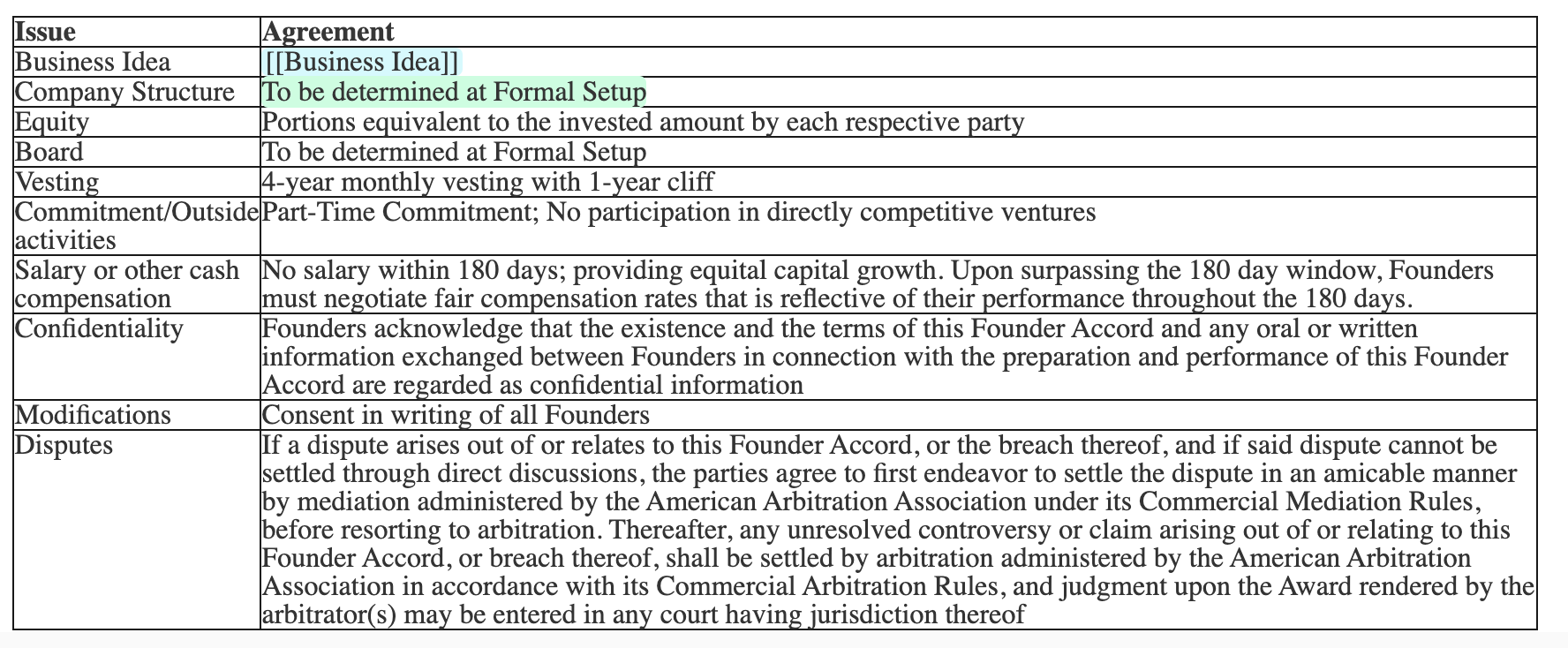

Here’s what the “Smart Founder Agreement” sets up for your proto-company:

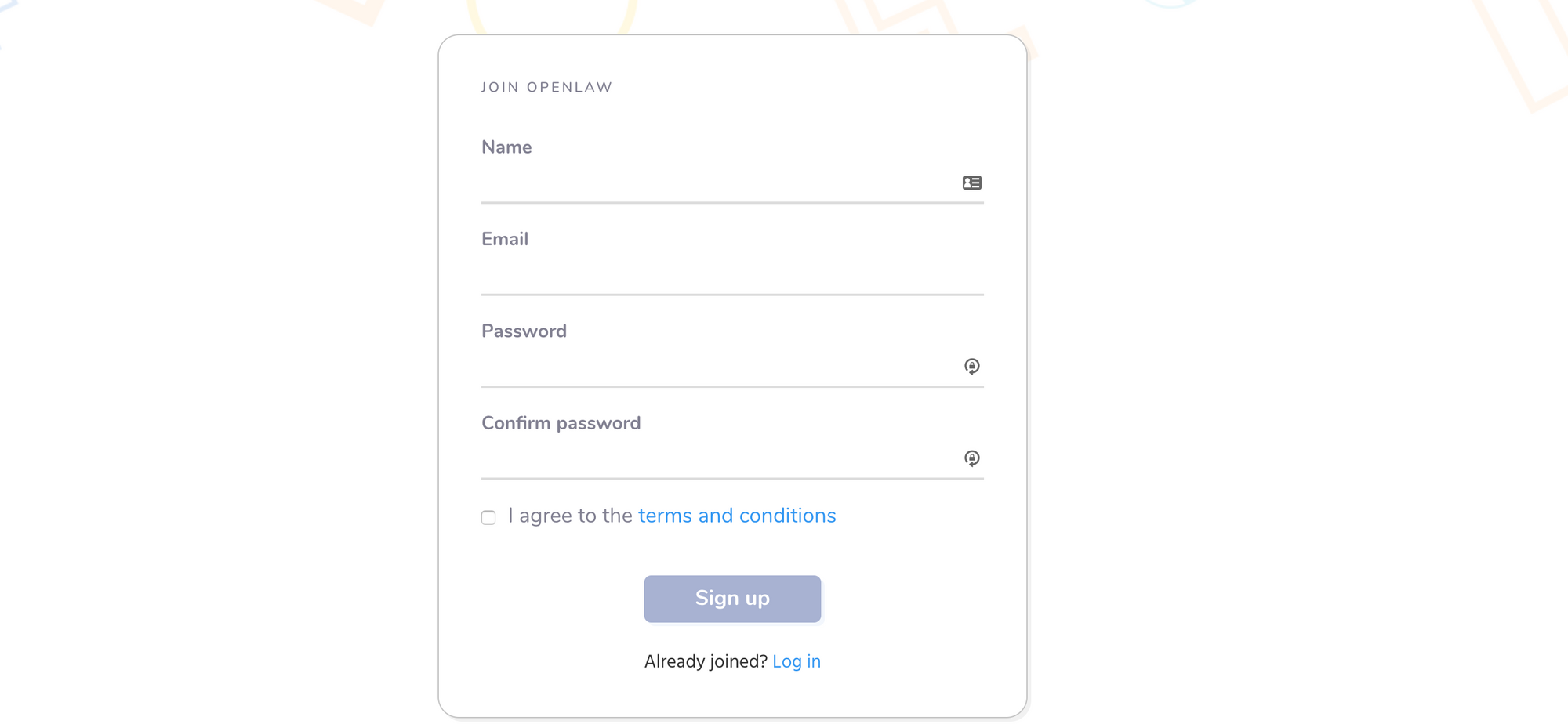

Step 1: create an OpenLaw account

Create an OpenLaw account and login. (RSA—use a private email if you wish!)

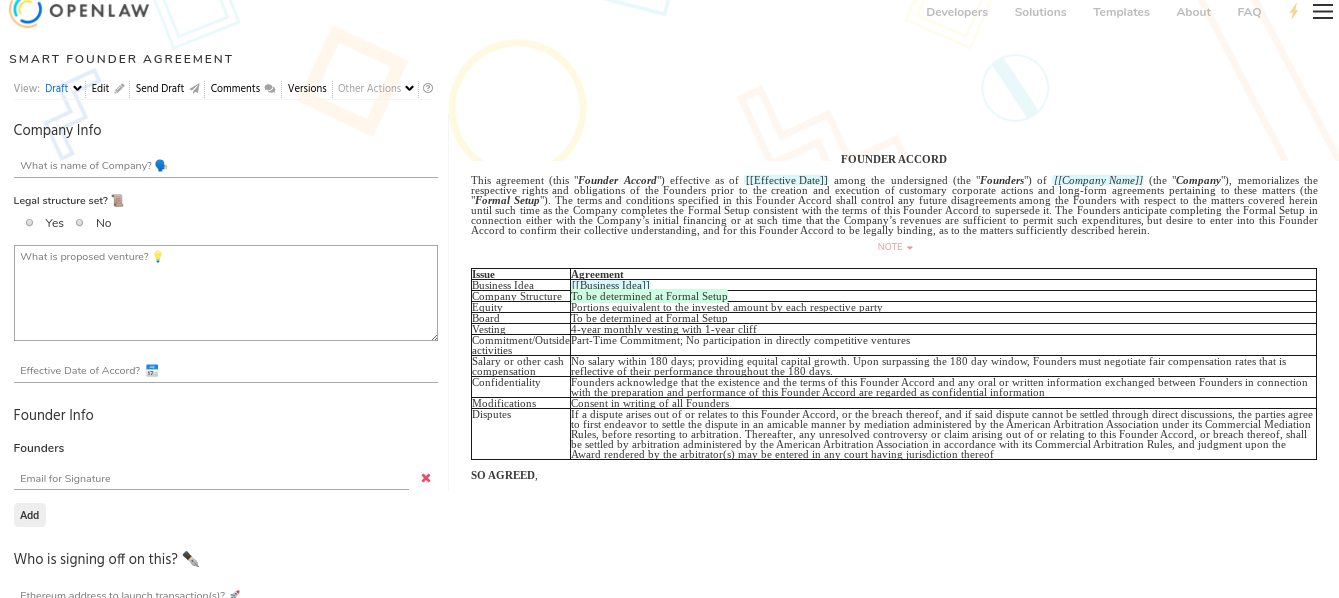

Step 2: Fill out Founder Agreement details & send to co-founders

Navigate to the Smart Founder Agreement here and fill out details.

Any org. setting up a new business on Ethereum can benefit from basic templates to record their plan among founders, and deploy code to hold money as they figure out business goals. To this end anyone can fill out the Smart Founder template on the OpenLaw library to execute a basic founders' agreements to hash out terms for a new business venture, and deploy a related Moloch DAO (some examples) to carry on financial ops in Dai (default) or any other ERC-20 token.

Fill out details like:

- Company Name (name of entity)

- Legal structure set (mark “no” to determine later otherwise select a type)

- Proposed venture (describe the business in general terms)

- Effective Date of Accord (agreement date)

- Founders (all founder emails—they’ll all need OpenLaw logins + ETH address)

- Who is signing off for this? (enter your ETH address to hold this contract)

Click “Send Contract” on the top menu. This will route the contract to founder email addresses for signature with their ETH address. Once all parties have signed you can deploy the DAO to the Ethereum mainnet.

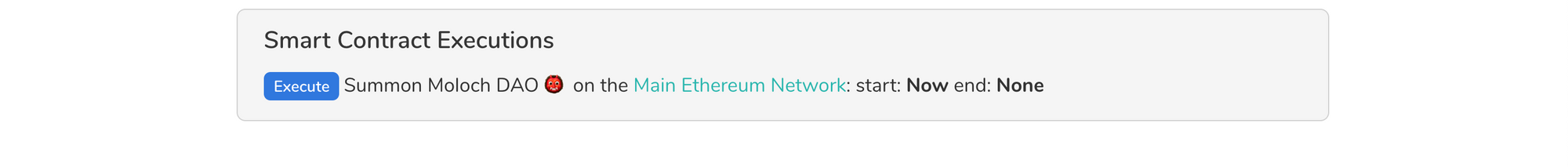

Step 3: Deploy DAO to Ethereum mainnet

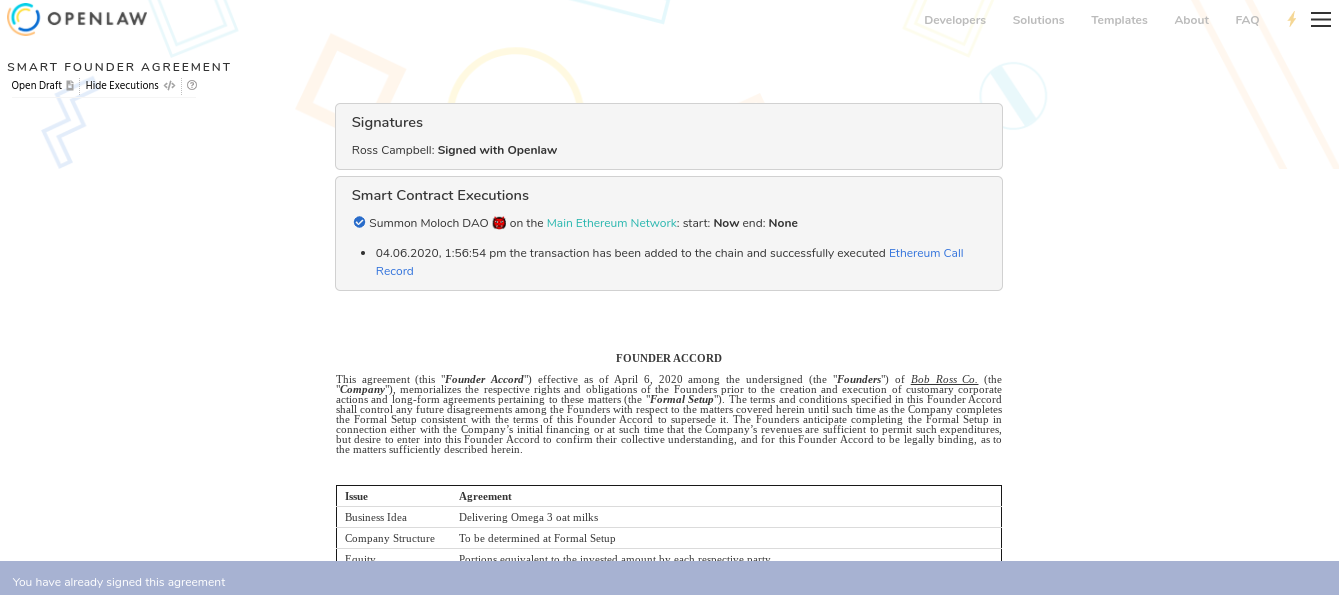

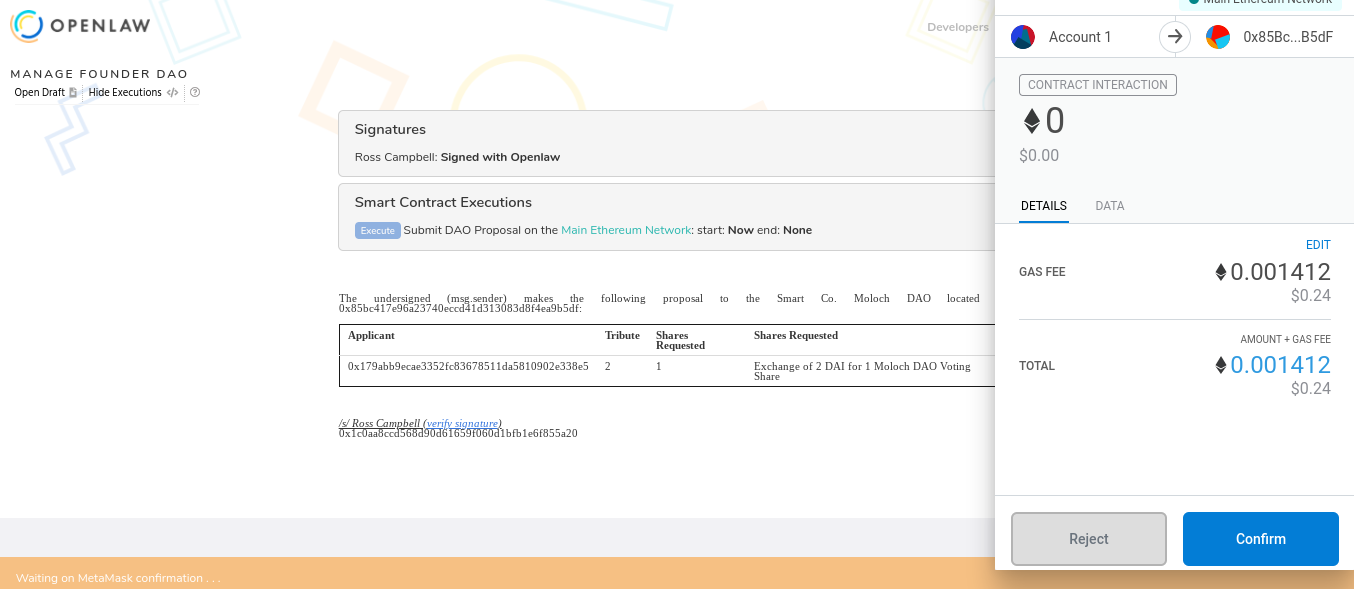

After you and your co-founders sign you’ll be able execute the smart contract and deploy to mainnet. Click “Execute” to deploy the contract and summon the DAO.

To summon a DAO is an expensive operation as far ETH contracts go, costing 6.5m gas, which is about $4 at standard gas rates of 3.5 gwei. But consider you just summoned a globally accessible digital company complete with legal documents, bank accounts, and capital coordination tools!

👉Here’s how your deployed organization will look in code

Step 4: Vote on proposals & add contracts

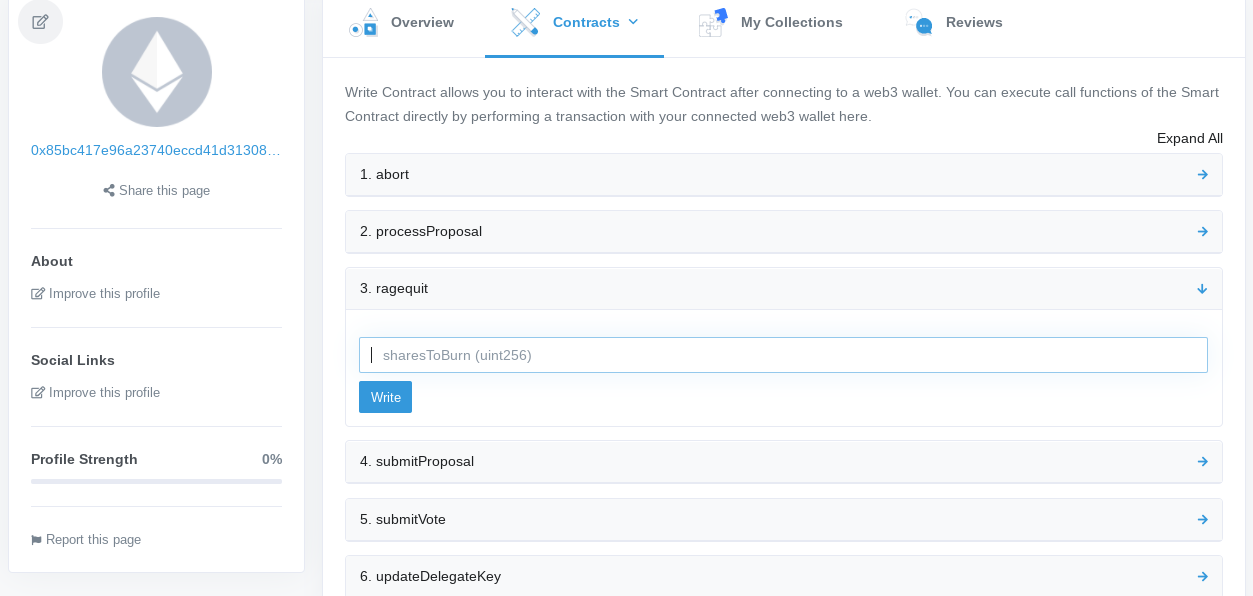

The resulting Moloch DAO has a basic dapp interface to vote and make proposals on its verified smart contract to move money among founders and business partners, as seen in this deployment on the etherscan ‘explorer’, and can make transactions among DAO members using Ethereum. (The OpenLaw team will soon offer dashboards and similar interfaces to make it even easier to anchor these companies on Ethereum.)

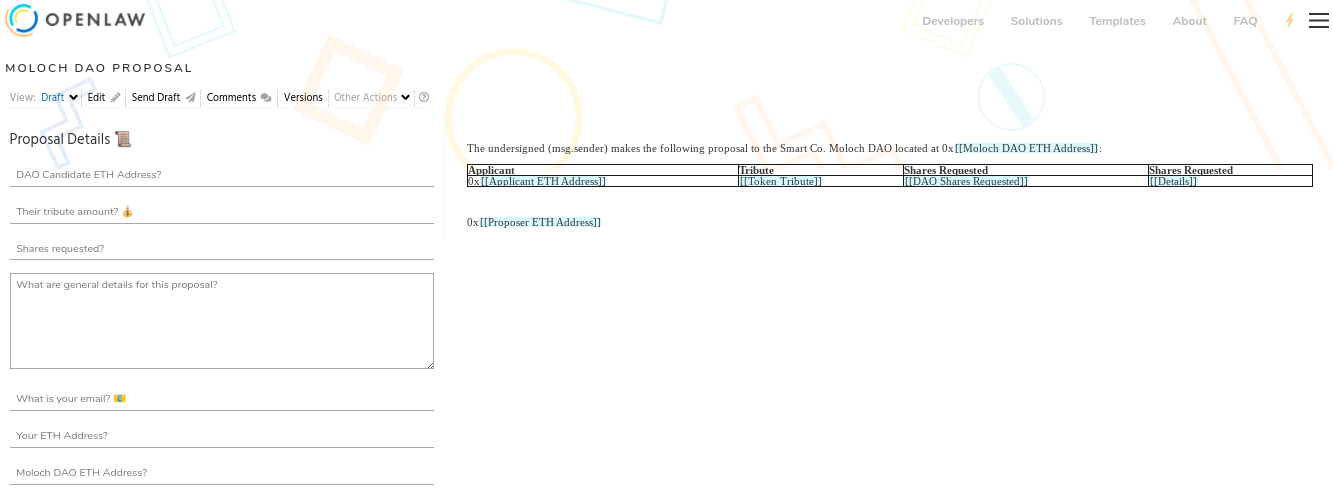

OpenLaw markup language can also quickly spin legal wrappers to Moloch DAO functions, and pretty much any DAO or Ethereum actions for that matter, as seen in the following simple form to submit a voting proposal with e-signed statements (resulting Ethereum transaction here):

👉Here’s a form to submit a capital funding request from the DAO

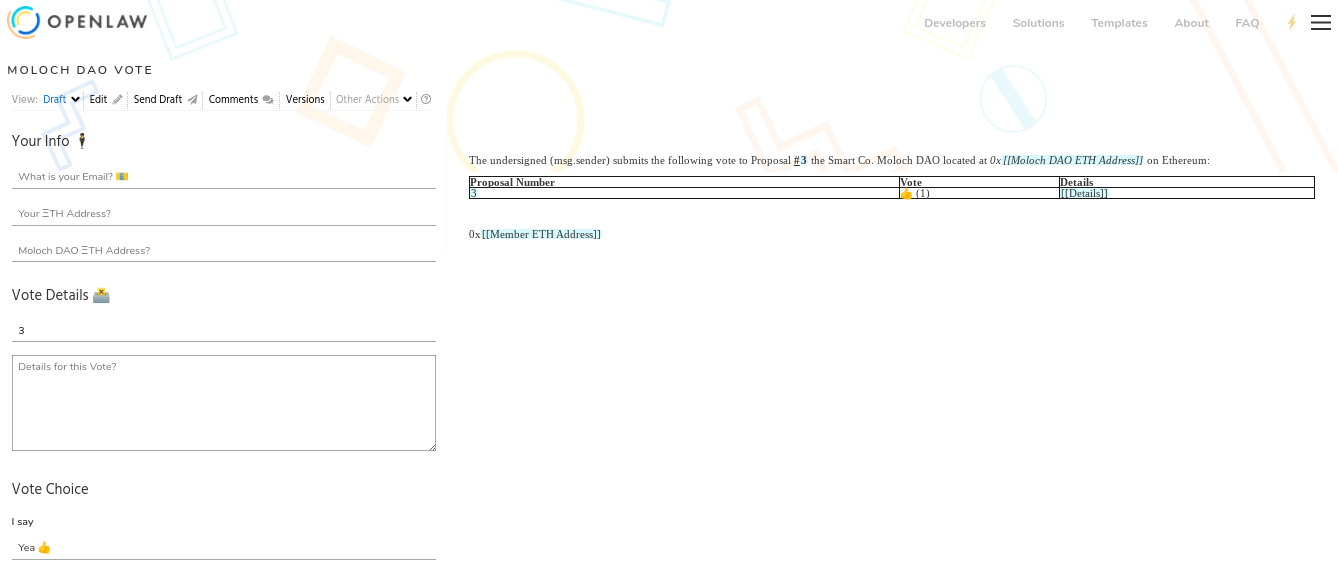

Further, founder decisions can be programmed from OpenLaw forms where legal descriptions, records of e-signatures, and approvals from stakeholders is desirable before a vote is stamped onto Ethereum:

👉Here’s a form to submit a vote on the capital funding request

Founders can vote for the proposal by signing with their ETH account.

With these starter tools for bankless orgs on Ethereum, members of a new venture or group of developers seeking grants can very easily make collective decisions on the root, or nexus, of a simple Moloch DAO program and Founders Agreement stored on OpenLaw (resulting DAOs also bears a matching stamp from OpenLaw database). From there, more sophisticated legal and digital programs might be useful, and Openlaw and The LAO team are forging ahead to build legal templates and money rails to fund these orgs that live and thrive on smart contracts.

How cool was that?

You’ve unlocked a new skill. You now have the ability to summon a globally accessible digital capital coordination tool. The bankless organization is a new money lego to add to your set. And it’s just getting started.

Yep. DeFi gives your superpowers.

Action steps

- Start an idea, grab some founders, and launch a DAO!

- Dig deeper into this DAOs at the LAO telegram & OpenLaw public library

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.