Dear Bankless Nation,

I’ve missed something big until now.

A reason why DeFi tokens on Ethereum are more valuable that I thought.

They have a hidden premium I didn’t previously account for —something so big it could propel the next crypto frenzy…for good and bad.

A farming premium.

What I missed

DeFi tokens are capital assets. That means they’re valued based on future cash flows. In a rational market, the value of a capital asset like a stock, or house, or bond is based on the future cash flows a buyer thinks it will generate.

Same is true of a DeFi token.

Above—assets categorized in the asset superclasses. DeFi tokens as capital assets. We consider ETH a triple-point asset once staking arrives. (🎙️Chris Burniske episode for more)

Growth expectations may be right or wrong for particular capital asset, but over time its base valuation should revert to the cash it’s able to generate in the future.

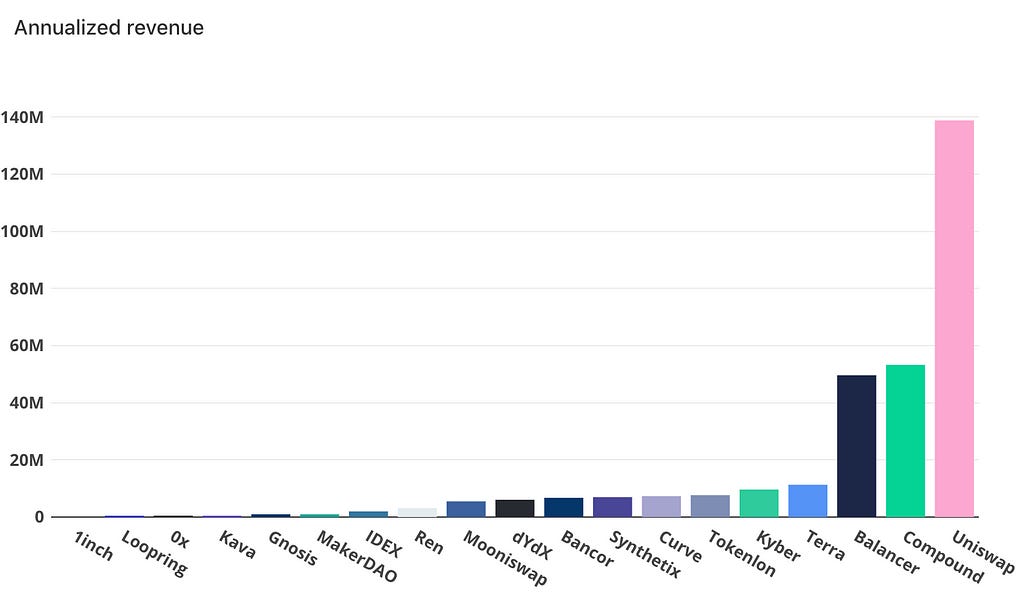

For a DeFi token, cash flows are generated by protocol revenue.

We’ve talked about this. We’ve written about this extensively. As an industry, we’ve made great progress on valuation charts and standardized metrics.

But what if we’re missing something hiding in plain sight?

What if we’re missing a massive source of future cash flows for these DeFi tokens?

Stocks on steroids

An AAPL share entitles you to a portion of Apple Inc’s future earnings.

Over the last year, 1 APPL share entitled you to about $13 in earnings. Some of these are paid as dividends, most are re-invested into Apple. Buying 1 share of APPL at $500 means you’re paying about $38 for $1 in annualized earnings—that’s P/E.

But what if you could take your 1 share of APPL, lock it in a brokerage account, and start generating TSLA shares?

Your $500 APPL share wouldn’t just be worth $13 in annualized APPL earnings, it’d be worth that PLUS all the TSLA earnings.

What’s the value of 1 share of APPL if it gave you the ability to get 1 tenth of a TSLA share over a 12 month period of time?

- $13 (Apple earnings)

- $210 (1/10th value of TSLA share)

- Earnings per APPL share = $223

Buying APPL at $500 would give you $223 in annualized returns! You’d be paying $2.2 for every $1 in annualized profits! Then imagine if TSLA doubled… 🤯

Stocks on steroids…crazy scenario right?

This is exactly what’s happening with DeFi Tokens

DeFi tokens generate protocol revenue, yes. But with yield farming, they have the power to generate assets too! That’s a MASSIVE additional revenue source!

What’s the value of SNX?

Well…it’s generating about $7m annualized today. Buy 1 SNX today and you’re paying about $166 for every $1 in earnings—close to AMZN P/E ratio—not crazy.

But what if you could suddenly lock up your SNX up and start earning 2 YAM per month? And what if those YAMs become worth $100 each? That’s an extra $1,200 per year!

Would you buy 1 SNX at $6 for at least $1,200 in annualized earnings? I think yes.

Of course…markets are more dynamic than this simple example. As more SNX is locked in a YAM farm, YAM returns per SNX decrease. And as farming opportunities for SNX arise, the price of SNX increases.

This is exactly what we’ve observed. The market got efficient and repriced up all the DeFi tokens used to farm YAMs. Look at the price increase of these 6 farming tokens on August 13th during peak YAM.

DeFi tokens aren’t just valued by protocol revenue. You have to add yield revenue too.

There’s a farming token premium!

What are the implications of the farming token premium?

I’ll leave you with three implications:

- Yield farming may greatly boost the price of certain DeFi tokens this cycle—tokens with highly sought-after communities will benefit most from this yield farming premium. 💪

- Anything tokenized on Ethereum becomes a candidate for a yield farming premium, even monetary assets like ETH and tokenized BTC—this makes Ethereum-based higher value, which draws more assets to Ethereum. 🧑🌾

- Notice the departure from DeFi asset valuations based on cash flows to asset valuations based on the farming of highly speculative meme-backed assets like YAMs—this could be the recipe for a 2017-like bubble. 🤑

Update your models.

If you think yield farming is a fleeting fad, this may not matter.

But if you think yield farming is just getting started and will become a fixture of this current bull cycle—like ICOs in 2017—then the farming token premium might drive prices more than any fundamental you think you understand.

It’s not clear to me if all of this is good. But it may be our reality.

Buckle up and be careful.

- RSA