Bankless Q2 Token Report

Level up your open finance game five times a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

This is the best report on DeFi tokens I’ve read this quarter. Lucas nails it (follow him!)

Why?

It gets the model right. DeFi tokens are protocol shares. They’re capital assets. We can value them based on expectations of future value flows.

You know what this means?

It means all the institutions—the analysts, the investors, the financiers in their suits can value DeFi protocol tokens the way they value stocks.

And they will value them this way…eventually.

Not yet though. As always Bankless is keeping you a few steps ahead.

And I think it’s our job to help folks in traditional finance understand this stuff—so send your non-crypto investor friends this report. Catch them up to speed.

We even made an institutional friendly .pdf just for them. 😉

- RSA

P.S. Robert Leshner from Compound is joining Bankless members for an exclusive AMA tomorrow at 12pm EST (4pm UTC)—don’t miss it! (Details here)

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Writer’s Corner

Bankless Writer: Lucas Campbell, Analyst at Bankless and Growth at DeFi Rate

Bankless Q2 Token Report

The birth of the crypto capital asset has sparked an emergence of compelling token valuation models.

With protocols able to track earnings in real-time, and with tangible value flowing through them, we can take traditional valuation methods like PE ratios, DCFs, and other models to measure how these tokens stack up to their peers in an attempt to find fair valuations.

We’ve covered this topic a handful of times before, but if you’re just starting to learn about crypto capital assets, here are a few Bankless resources that will be valuable for your journey:

- How to think about crypto PE - January 2020

- Are DeFi tokens worth buying? - February 2020 (the answer was yes)

- How to value crypto capital assets - May 2020

Since we last covered crypto capital assets in May, DeFi has seen a wave of new tokens breaking out in the space, most notably Compound’s native governance token - COMP - which is now the most valuable DeFi asset by market cap.

With the SAFG model, protocols can compliantly distribute tokens in virtually any jurisdiction to its users for providing value-added services to the protocol. This could be something as simple as just using the application, providing liquidity, or participating in governance. The caveat with the SAFG token model is that the tokens represent no economic rights at the start. Instead, the protocol will have to sufficiently decentralize itself with governance eventually electing to imbue the asset with economic rights over the value flowing through the protocol.

This trend won’t go away anytime soon. In fact, it’s probably just getting started.

The crypto capital asset is here ladies and gents. And there’s some interesting stuff going on.

So let’s dive in.

Meet the Money Protocols

Below is a quick synopsis on the DeFi protocols included in this article and their respective earnings mechanisms.

- 0x - Liquidity protocol - Market fees are distributed to ZRX tokenholders/liquidity providers.

- Aave - Lending protocol - A portion of the interest accrued is distributed to LEND tokenholders via burns.

- Augur - Derivatives protocol - Fees from prediction markets are distributed to REP tokenholders for participation.

- Bancor - Liquidity protocol - A portion of trading fees are distributed to BNT liquidity providers.

- Compound - Lending protocol - Accrued interest is distributed to an insurance reserve.

- Kyber - Liquidity protocol - A portion of trading fees are distributed to KNC tokenholders via token burns or dividends for governance participation (Katalyst Upgrade).

- Maker - Lending protocol - Interest accrued on outstanding Dai is distributed to MKR holders in the form of token burns.

- Synthetix - Derivatives protocol - Trading fees are distributed to SNX stakers for minting Synths.

- Ren - DEX - cross-chain swap fees are distributed to Ren Darknodes

- Loopring - liquidity protocol - A portion of trading fees are distributed to LRC tokenholders.

- Gnosis - DEX - no value accrual yet but possibly trading fees in future

- Balancer - liquidity protocol - trading fees are distributed to Balancer liquidity providers

Quarterly Earnings

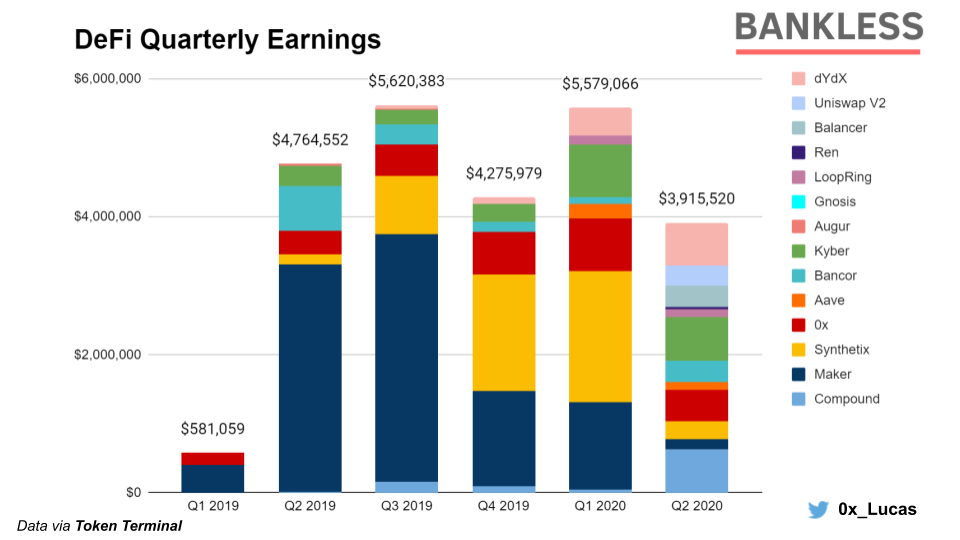

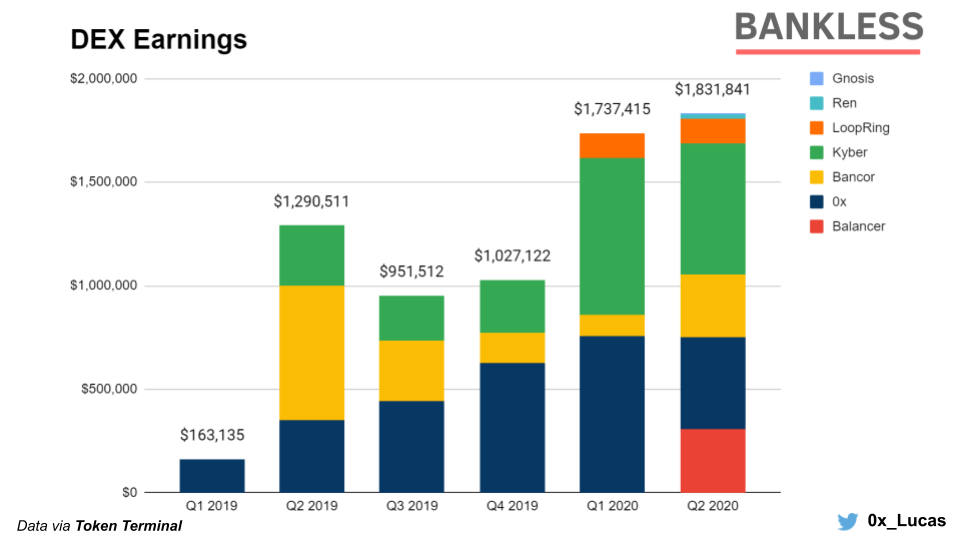

(Above) DeFi Quarterly Earnings calculated from average annualized earnings (as reported by Token Terminal) during Q2 and divided by 4.

In Q2, DeFi protocols took a downturn in revenue as earnings fell by -42% from the last quarter.

This was largely due to MakerDAO shifting towards 0% SF and DSR environments as the protocol scrambled to return DAI’s peg back to its rightful place amid Black Thursday volatility in late March. As a result, earnings for Maker fell to ~$152,000 between April and June compared to $1.2M over an identical timeframe in Q1.

The other major contributor to the decrease in DeFi earnings was Synthetix which, as we mentioned in earlier pieces, was suffering from front-running attacks that disproportionately reported earnings for the derivatives protocol. Since fixing the issues, Synthetix is reporting roughly $267,000 in quarterly earnings or ~$1M on an annual basis.

The highest earners in Q2 were Kyber, Compound, and dYdX. Kyber’s liquidity protocol raked in $634K in the quarter while Compound and dYdX brought in slightly lower amounts at $624.7K and $624.3K, respectively. The other notable earner in Q2 was 0x which generated $445,000 in quarterly revenue for ZRX holders.

While DeFi incumbents remained at the top of the earnings leaderboards, Q2 saw an explosion of new entrants along with major protocol upgrades. While DeFi’s favorite liquidity protocol - Uniswap - launched V2 in May, we also saw new additions to the field including Balancer, Ren, Gnosis, and Loopring, all of which went live with major upgrades or new product launches, bringing in new interest to the protocols (as well as earnings).

As such, we’re beginning to see an increasingly diverse ecosystem for DeFi protocols as they begin to compete for a slice of the market share.

Price Performance & PE Ratios

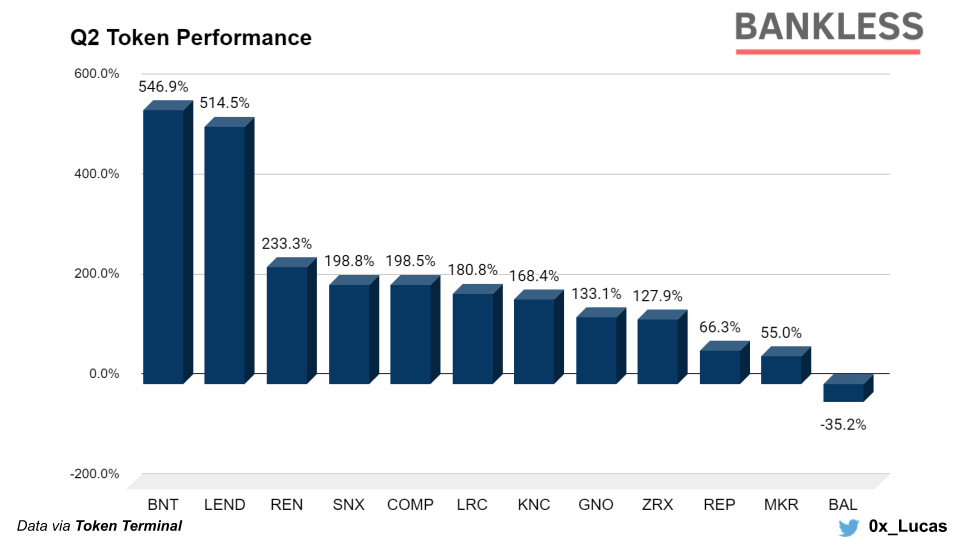

Despite the downturn in earnings, DeFi tokens performed very well in Q2. The driving force behind the strong performance was the introduction of yield farming -- Ethereum and DeFi’s new narrative.

On average, DeFi assets in Q2 increased by 199%, substantially outperforming both ETH and BTC which increased by 70% and 43%, respectively.

The best performing DeFi asset in the quarter was Bancor’s BNT as the token surged 546% following the announcement of the liquidity protocol’s V2 upgrade. The other notable performance in Q2 was Aave’s LEND which is having the strongest year out of any DeFi token to date. In Q2 alone, LEND rose by 514% while the money markets protocol simultaneously increased its value locked from $30M to over $120M by the end of June.

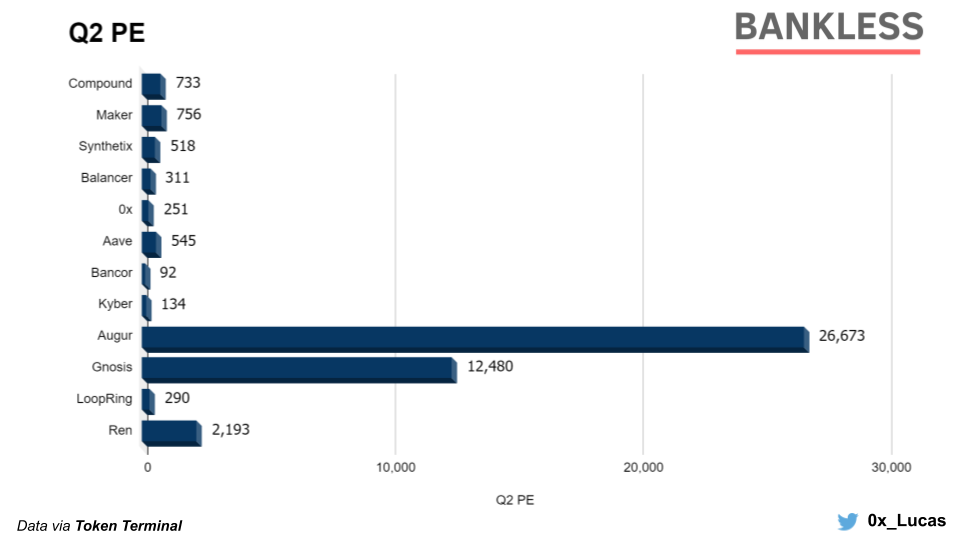

The combination of a decrease in earnings along with a surge in asset prices has generally led to an increase in PE ratios for DeFi tokens across the board. To provide some color on this, Kyber’s PE ratio in May was reportedly ~80, Bancor’s was ~56, and Aave’s at ~74. Now, these tokens have increased their PE ratios to 134, 92, and 545, respectively.

While Augur continues to hold onto its astronomical PE ratio of 26,673, its usual partner - 0x - has decreased its PE ratio down to a more sustainable number of 251 (from 6,571 as reported in May) as the liquidity protocol steadily increased earnings in recent months. On the other hand, Bancor continues to hold onto the lowest PE ratio which is the only DeFi protocol to generate a double digit ratio in the second quarter.

(Above) Q2 PE Ratios calculated by Q2 annualized earnings divided by market cap as of July 7th, 2020

Sector Overview

DEXs

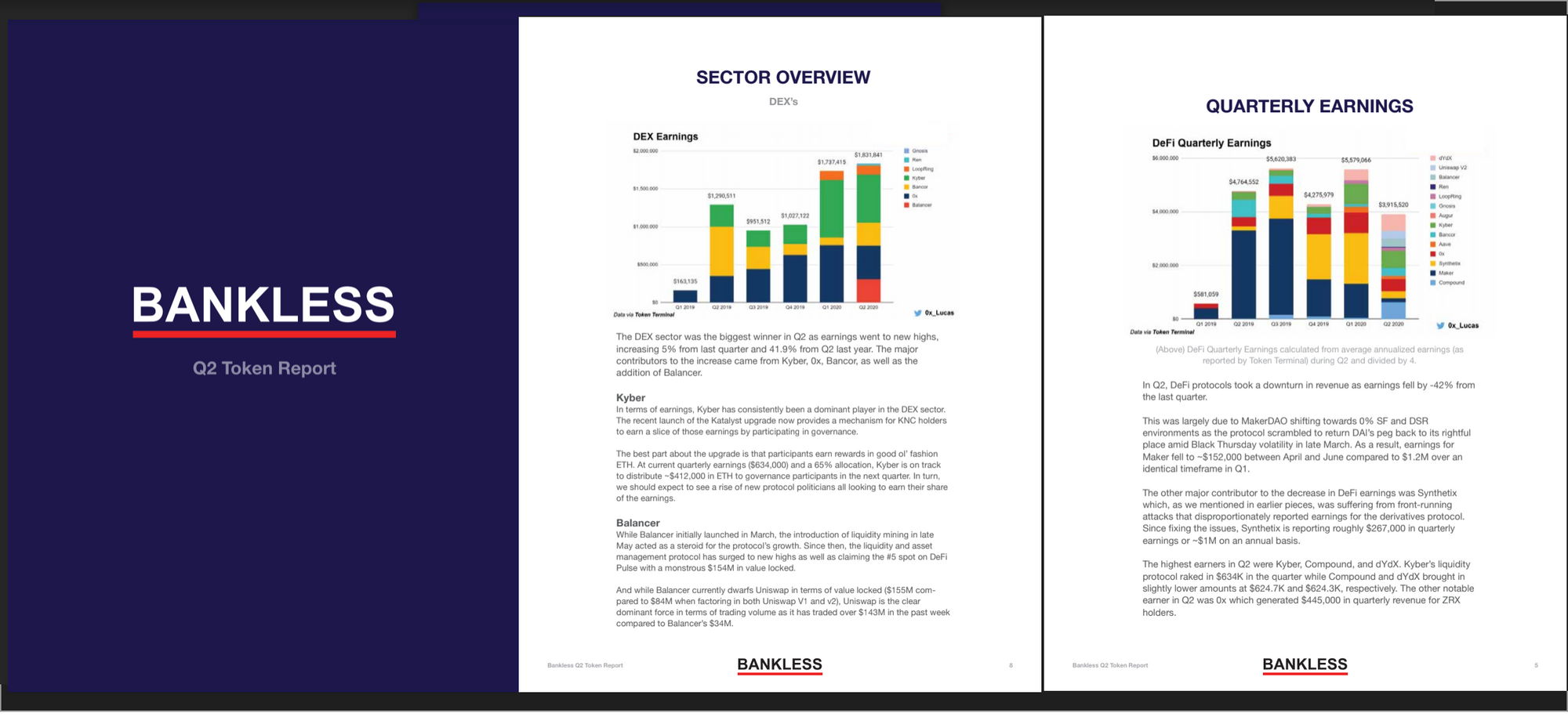

The DEX sector was the biggest winner in Q2 as earnings went to new highs, increasing 5% from last quarter and 41.9% from Q2 last year. The major contributors to the increase came from Kyber, 0x, Bancor, as well as the addition of Balancer.

Kyber

In terms of earnings, Kyber has consistently been a dominant player in the DEX sector. The recent launch of the Katalyst upgrade now provides a mechanism for KNC holders to earn a slice of those earnings by participating in governance.

The best part about the upgrade is that participants earn rewards in good ol’ fashion ETH. At current quarterly earnings ($634,000) and a 65% allocation, Kyber is on track to distribute ~$412,000 in ETH to governance participants in the next quarter. In turn, we should expect to see a rise of new protocol politicians all looking to earn their share of the earnings.

Balancer

While Balancer initially launched in March, the introduction of liquidity mining in late May acted as a steroid for the protocol’s growth. Since then, the liquidity and asset management protocol has surged to new highs as well as claiming the #5 spot on DeFi Pulse with a monstrous $154M in value locked.

And while Balancer currently dwarfs Uniswap in terms of value locked ($155M compared to $84M when factoring in both Uniswap V1 and v2), Uniswap is the clear dominant force in terms of trading volume as it has traded over $143M in the past week compared to Balancer’s $34M.

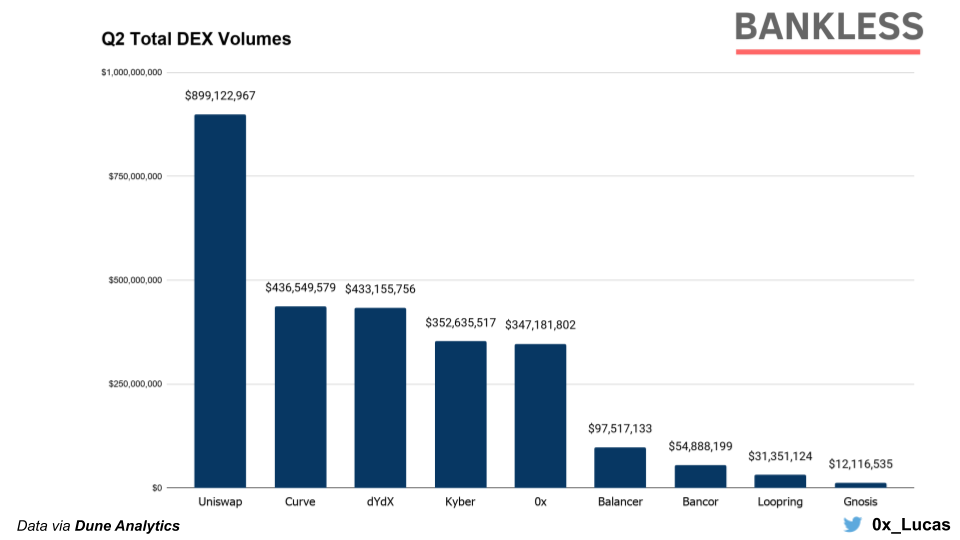

DEX Volumes

The DEX sector in Q2 experienced new records in terms of volumes. Uniswap dominated the market as the untokenized liquidity protocol was just shy from reaching $1B in Q2 volume. The next two players, Curve and dYdX, also saw substantial volumes as Curve’s AMM took the #2 spot, aggregating $436M in volume between April and June while dYdX’s margin trading platform was right behind with $433M.

What’s interesting to note is that the top 3 DEXs by volume are all untokenized, indicating that while tokenized incentives act as a catalyst for growth, they are not the end-all be-all. Instead, it’s all about product market fit and an intuitive UI that anyone can easily understand.

With that in mind, the top tokenized DEXs in terms of quarterly volume were Kyber and 0x as they accumulated $352M and $347M in Q2 volume, respectively.

With DEXs continuing to soak up more and more volume, tokenized DEXs offer one of the more attractive investments in the DeFi space given their ability to reliably generate tangible earnings day-in and day-out.

New DEX tokens to look out for 🧐

Curve (CRV) - Curve is one of the rising stars in the DEX space as the AMM is aggregating significant volumes, sitting second in the field with $436M in volume in Q2. With the launch of the CRV governance token expected to happen in the coming weeks/months and the distribution occurring retroactively to anyone who’s provided liquidity to the protocol since genesis, it’s something worth keeping an eye on.

If you’re interested in learning more about CRV, you can read up on a concise summary here.

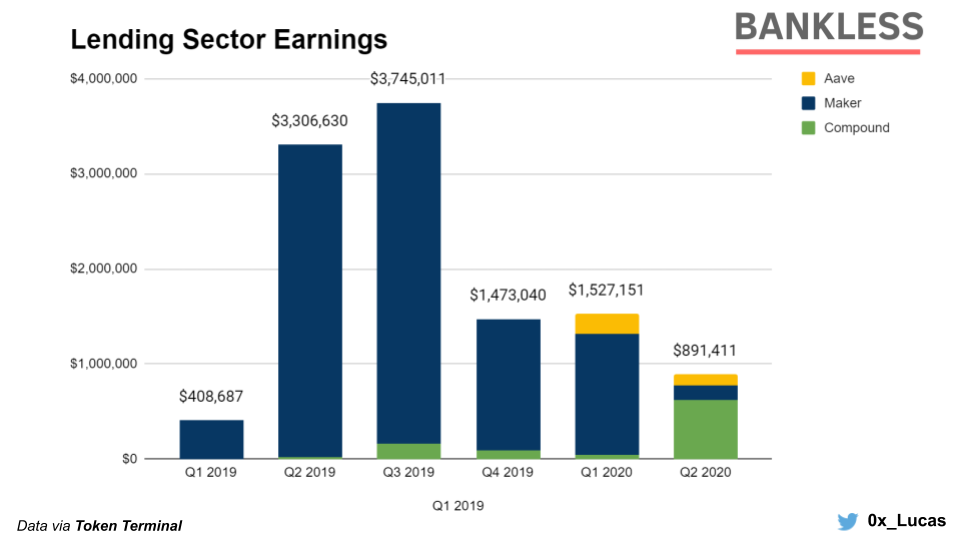

Lending

Despite the lending sector being the major player in 2019, the sector as a whole has seen a significant downturn, almost entirely due to the loss in earnings from Maker.

In Q2 2019, Maker effectively represented over 99% of earnings in the lending sector. Fast forward a year later and Maker’s 0% SF environment opened up the opportunity for new players.

Compound now dominates the space as the protocol elected to increase the reserve factor on major tokenized assets to 50% (namely BAT, ZRX, and REP) and USDT to 20%. As such, Compound in Q2 took the lead in the lending sector for the first time, bringing in $624K in quarterly earnings compared to the $152K from Maker and the $114K from Aave.

Maker

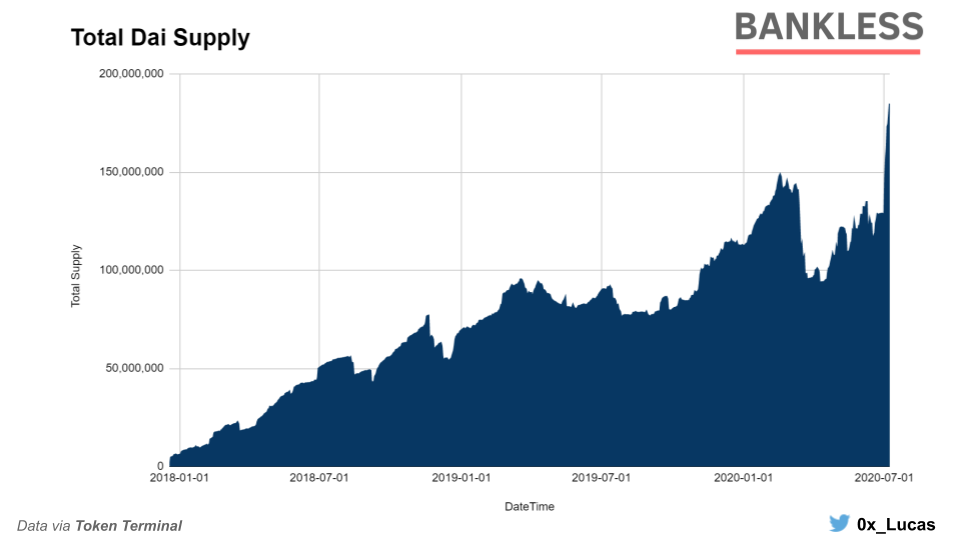

The silver lining with Maker’s 0% stability fee is that the outstanding supply of Dai is reaching new highs. In Q2 alone, Dai’s supply increased by 90% to 184.9M in circulation. The recent spike in supply ironically comes as Compound’s recent change to the COMP distribution resulted in a “crop rotation” in favor of Dai.

As such, users are flocking to mint new Dai so they can deposit it into Compound and maximize their COMP earnings.

With Dai’s supply reaching new highs, there’s massive earnings potential for the Maker protocol. However, with Dai’s peg sitting above $1, it’s hard to imagine that adjustment coming anytime soon as Maker governance is still exploring new mechanisms to help stabilize the peg for DeFi’s favorite stablecoin.

Lending tokens to look out for 🧐

BZRX — After the flash loan mishap in February 2020, bZx is getting back into the swing of things with the launch of the BZRX token. The token model features governance rights along with liquidity mining incentives so it’ll be interesting to see how the lending protocol performs following the launch of its native token and the reboot in August.

Aave Upgrade — The rising lending protocol has also been teasing a token & governance upgrade. Given Aave’s fundamental growth in 2020 along with its recent announcement of credit delegation, expect big things from the Aave camp in the coming weeks.

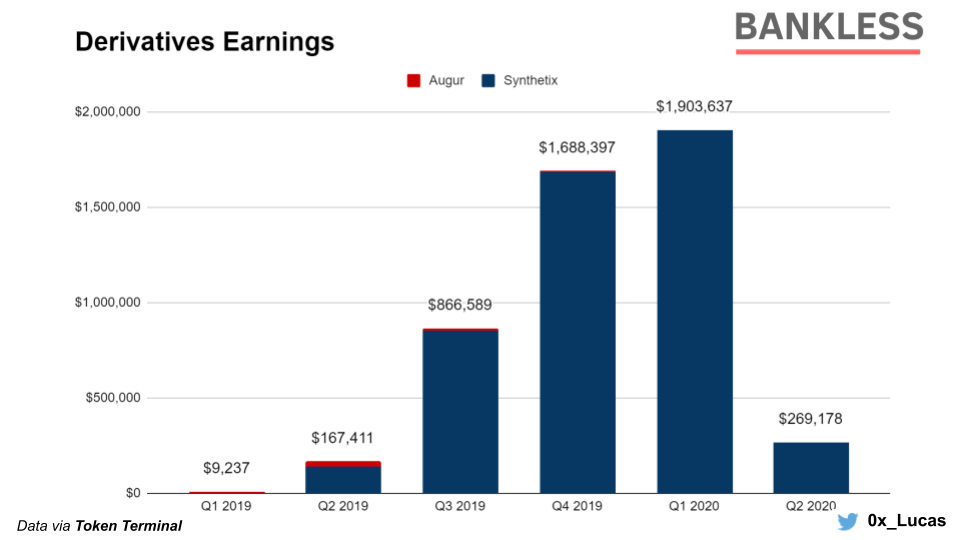

Derivatives

To date, Synthetix is still the only major player in the derivatives space. And while Synthetix was seemingly playing its role as the de-factor derivatives protocol (due to disproportionate earnings), the recent fix has brought down protocol revenues substantially.

Fortunately, Synthetix has been iterating and releasing new products at breakneck speeds. The DeFi derivatives protocol recently launched binary options, allowing users to bet on the future price of any supported asset on the protocol within a predefined time period. The team is also set to launch futures contracts later this year. Given the immediate success of binary options along with the virtually unlimited market potential for futures contracts on Ethereum, we can expect to see a good amount of traction coming to the Synthetix camp.

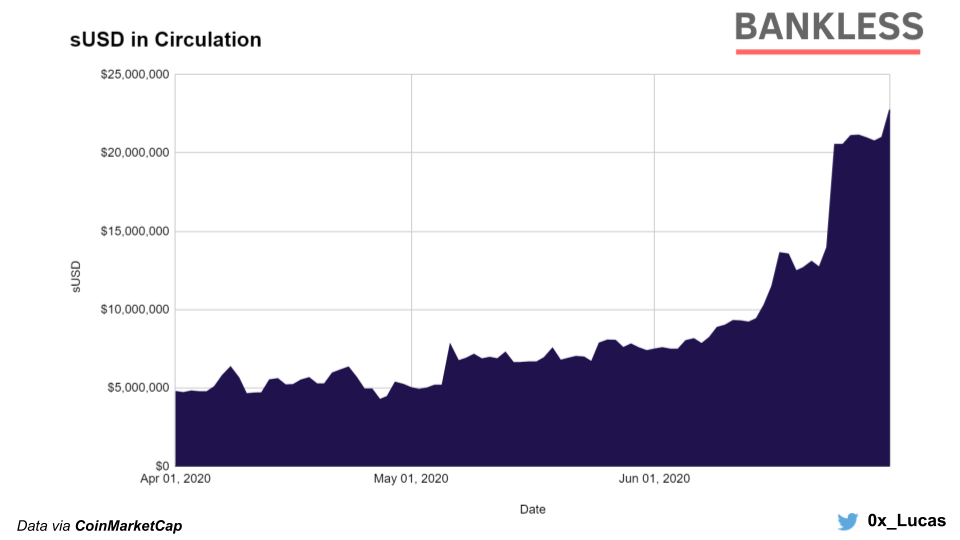

Equally as important, the amount of outstanding sUSD is hitting new ATHs as Synthetix’s native crypto dollar has increased its circulating supply by 379% in Q2 to reach $22.7M in total.

While sUSD still has some ways to go before competing with other stablecoins in terms of market cap, the growth in Q2 is a positive sign for what’s to come (especially if Synthetix follows through with lowering the c-ratio and adding ETH collateral).

Similarly, Augur’s lack of tangible usage has brought the prediction market protocol earnings to a near halt - bringing in a mere $2.1K in quarterly earnings. However, the upcoming launch of Augur V2 should (hopefully) bring a resurgence to one of Ethereum’s OG money protocols. Interestingly enough, while Augur was busy building V2, we’ve also seen notable new entrants in the prediction markets including Gnosis’ Omen and Polymarket - two prediction market platforms offering competitive platforms to Augur V2.

The one trick Augur has up its sleeve is that the protocol could implement yield farming, creating a strong incentive for market participants to actively use and bootstrap the new protocol. While no details have been shared on that front, we’ll see if that ends up coming into play.

Derivative tokens to look out for 🧐

UMA — UMA Protocol has a strong case for becoming a contender in the derivatives space as it offers a compelling and modular design. In short, anyone will be able to create any synthetic asset conceivable collateralized by ETH or DAI using UMA. The protocol has also strongly hinted at a liquidity mining mechanism which will offer an enticing incentive for users to mint synthetic assets on the protocol.

Here’s the most recent documentation there is on the upcoming distribution.

Conclusion

While earnings have taken a downturn this quarter, DeFi tokens are surging to new highs on the back of yield farming.

Even with PE ratios reaching in the 100s, that’s actually not high, relatively speaking. Comparing this to traditional capital markets, Tesla doesn’t even post positive earnings while other major tech companies like Netflix are also boasting PE ratios in the low hundreds.

That’s because the PE ratio is all about future growth potential.

Tesla has the best in class electric cars. It is a clean energy company building for the future. And the future is clean energy. As a result, investors value that potential to the tune of $286 billion dollars undeterred by the fact that the company has never made any money.

DeFi is on a similar path. The future is not heading in the direction of more banks. It’s less banks. These are early-stage digital technologies for a completely open financial system accessible by anyone in the world. There’s no shortage of future growth potential.

Ethereum’s money protocols are poised to disrupt trillion-dollar financial markets. But despite the massive potential, we’ve only seen 1 DeFi unicorn to date (congrats Compound!).

So with many prominent DeFi protocols valued at less than half a billion dollars and PE ratios largely in the low hundreds, we’re only scratching the surface on what’s to come.

Action steps

Evaluate how your favorite DeFi tokens stack up to their peers

Read previous Bankless pieces on crypto capital assets and PE ratios

How to think about crypto PE - January 2020

Are DeFi tokens worth buying? - February 2020

How to value crypto capital assets - May 2020

Author Bio

Lucas Campbell is an Analyst for Bankless and leads Growth at DeFi Rate. He’s also an active contributor to other major newsletters like The Defiant as well as engaging in token economic & DAO advisory via Raid Guild.

Introducing the newest Bankless Youtube show—Meet the Nation!

A series focused on short interviews with new projects within Ethereum and DeFi.

📺Let’s Meet RAI—The Trustless Stability coin (a better DAI?) with CEO Stefan Ionescu

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.