Ren's Trillion Dollar Opportunity

Dear Bankless Nation,

There’s almost a trillion dollars worth of BTC sitting idle on the Bitcoin network.

That’s a significant amount of economic bandwidth that could be used on Ethereum to fuel DeFi applications. Imagine how much total value locked in DeFi may increase if hundreds of billions of BTC had a mechanism to easily port over to Ethereum.

Tokenized Bitcoin isn’t new…but the main contender WBTC is custodied by BitGo (a crypto bank) and permissioned. Yet it boasts over $7.5B in liquidity. Is it possible for us to create a more decentralized and more permissionless version of BTC?

That’s where REN comes in.

REN is a cross-chain liquidity protocol for crypto that claims to design a more permissionless and trustless tokenized BTC alternative. Similar to tBTC…but secured by the value of REN token instead of by ETH.

Today, Lucas dives into the protocol and how they’re attempting to bridge liquidity across the ecosystem.

Let’s get started.

- RSA

P.S. As usual, this week’s project coverage was voted on by Badge holders. Need a badge to vote on the next round? Get one.

TOKEN THURSDAY

Bankless Writer: Lucas Campbell, Editor & Analyst for Bankless

Ren is a cross-chain liquidity protocol. With Ren, anyone can port any crypto asset to any other blockchain in a trust-minimized fashion. The protocol is underpinned by the REN token which acts as a bond for node operators in the protocol called Darknodes.

We’ll dive into this more below.

- Project: Ren Protocol

- Asset: REN

- Fully Diluted Valuation: $1.06B

- Market Cap: $941M

- Total Value Locked: $738M

- Price-to-Sales Ratio: ~74

Ren: The Cross-Chain Liquidity Bridge

The future of crypto is shaping up to be multi-chain.

With thousands of crypto assets and hundreds of public blockchains, it’s becoming harder and harder to deny this fact. We’re already seeing this come into fruition with an increase in traction from Binance Smart Chain, Polkadot, Terra, as well as Ethereum sidechains and Layer 2s.

So what does this mean? Interoperability between chains may be a key factor to the growth in crypto. Being able to seamlessly transfer assets across different chains will allow the crypto ecosystem to create a universal fabric for any asset to live on any chain—frictionless liquidity for the whole ecosystem.

Ren is building the technology to enable permissionless transfer of value between any blockchain. Today, this use case is a simple implementation where anyone can port BTC, ZEC, BCH, DOGE, FIL and more over to Ethereum or Binance Smart Chain and vice versa.

But the future may hold much more than that.

The RenVM ultimately acts as an interoperable liquidity building block, allowing developers to integrate cross-chain capabilities into any application they build. This means that any DeFi application, like a DEX or lending protocol, could integrate RenVM’s capabilities and enable cross-chain liquidity into their application.

By achieving interoperability, we can bring significantly more liquidity (we sometimes call it economic bandwidth) to DeFi. Bitcoin is now a trillion dollar asset. All of that liquidity and economic bandwidth could be used as value in DeFi—as collateral to mint DAI, used to borrow USDC on Aave, provide liquidity on Uniswap, etc.

How does Ren Work?

Ren leverages the tokenized representation model widely used in similar products like wBTC, imBTC, tBTC etc. The normal model has users lock up an asset with some sort of custodian, and the custodian mints a one-to-one backed token for the user on another chain. This token can then be burned, and the custodian releases the respective amount of the locked asset back to the user. The problem is that for the majority of the existing version of wrapped tokens, they rely on a centralized custodian. That’s where Ren comes in.

Ren Protocol enables this concept in a decentralized fashion via two key components: the RenVM and Darknodes.

The RenVM is a decentralized virtual machine which replaces the centralized custodian in other tokenized representation models with a non-custodial, programmable custodian.

This virtual machine is replicated over thousands of machines that work together to power it, contributing their network bandwidth, their computational power, and their storage capacity. These independent machines are known as Darknodes—the backbone of the RenVM.

However, it’s important to note that due to the nascency of the RenVM, the protocol’s Darknodes are currently operated by the Ren Core team. That said, decentralizing this functionality is on the roadmap in the near future—we’ll touch on this more in the “what’s hot section”.

Role of the REN Token

The REN token is used as a bond for Darknodes to ensure incentive alignment and deter malicious actors. Each Darknode is required to have a bond of 100,000 REN.

In return for running a Darknode, operators earn protocol fees in the underlying asset from cross-chain asset transfers via the RenVM. As an example, if the protocol facilitates a BTC to Ethereum transfer, all Darknodes earn an equal slice of the BTC fee since all bonds are the same (100,000).

This is one of the more attractive pieces of the REN token as it represents economic rights over the protocol in an exogenous asset—not REN. This allows operators to earn incomes in BTC for all BTC transfers, DAI for all DAI transfers, and so on.

While most DeFi tokens represent on-chain governance rights, as of today, Ren is still in the early stages of their governance system with plans to further evolve their processes in the near term. To highlight this, the community is currently on track to gain control over a community-governed treasury soon and on-chain voting will start in the coming weeks.

Protocol Fundamentals

BTC on Ethereum

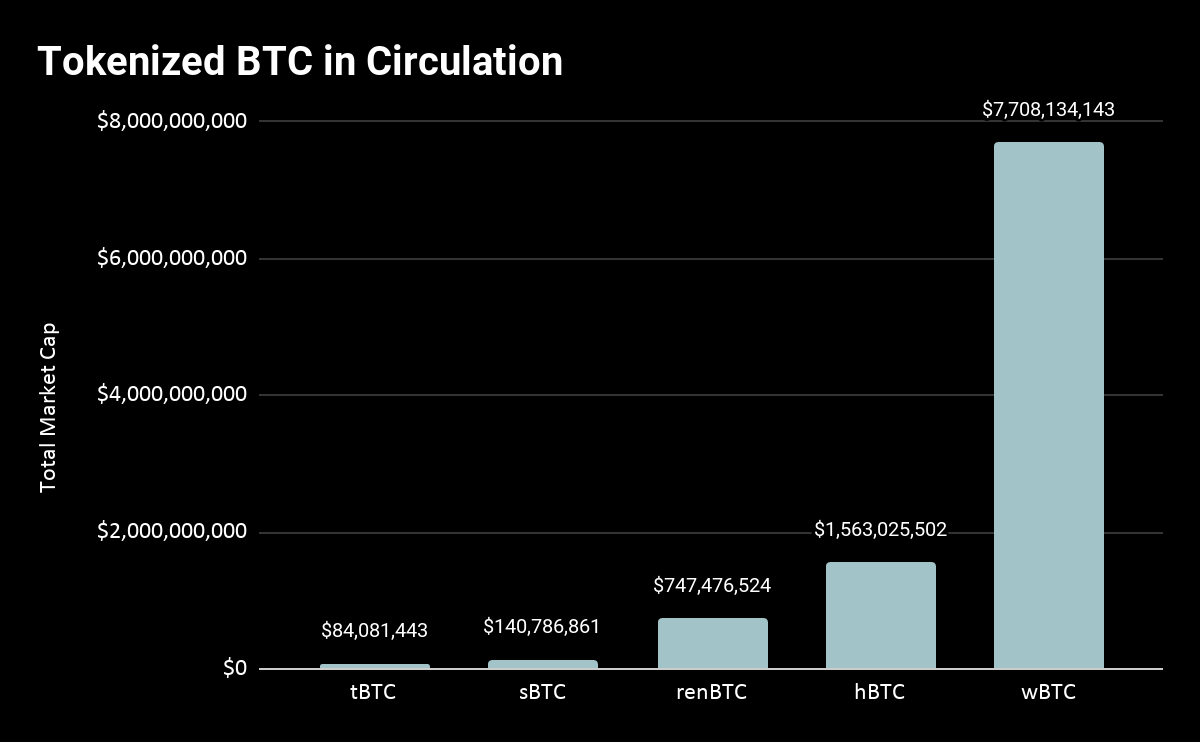

With renBTC as their flagship product, it’s crucial to understand where it stands in the market of tokenized BTC. Therfore, the key questions are: how much value in renBTC is circulating, and how does it compare in relation to other tokenized BTC products?

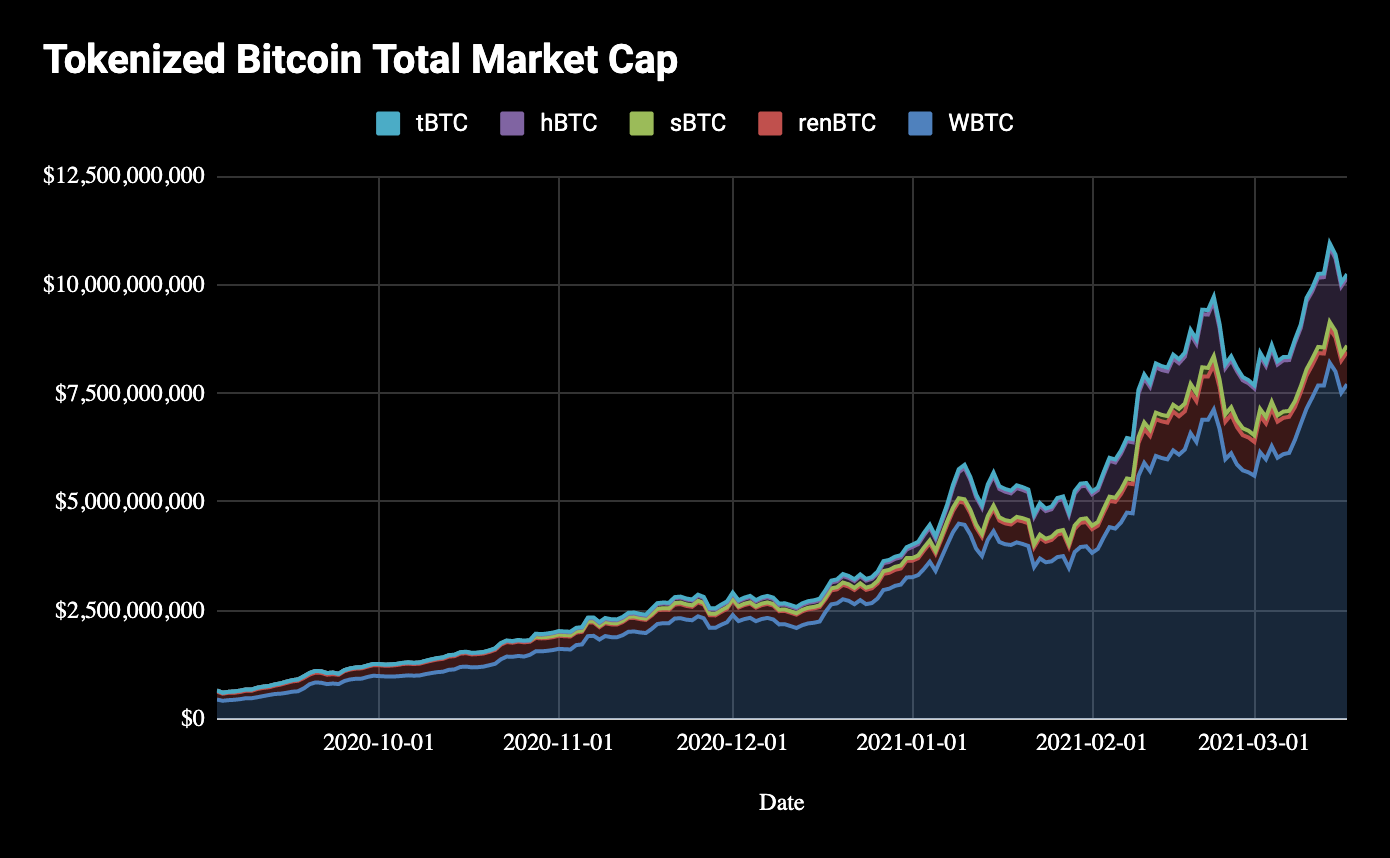

Fortunately, this past year has seen an explosion in growth of tokenized BTC. As it stands, there’s now over $10B in tokenized BTC (roughly ~1% of all BTC) circulating other blockchains, mostly Ethereum.

Of the $10.2B in circulation, renBTC currently accounts for $747M – or 7.3% of all tokenized BTC. Ren’s biggest competitor, WBTC, is by far the dominant force in the realm of tokenized BTC as it still represents over 75% of the market—meaning there’s plenty of room for growth ahead for both Ren and the tokenized BTC market as a whole.

What’s equally important is that the trend of wrapping BTC on Ethereum and other blockchains is growing—meaning that Ren’s current addressable market continues to grow alongside the protocol.

The introduction of yield farming on Ethereum really set this trend into motion as it became apparent that BTC holders on the Bitcoin network no longer wanted to hold onto an idle asset, so they instead elected to put it to work via any of the income-generating opportunities available in DeFi.

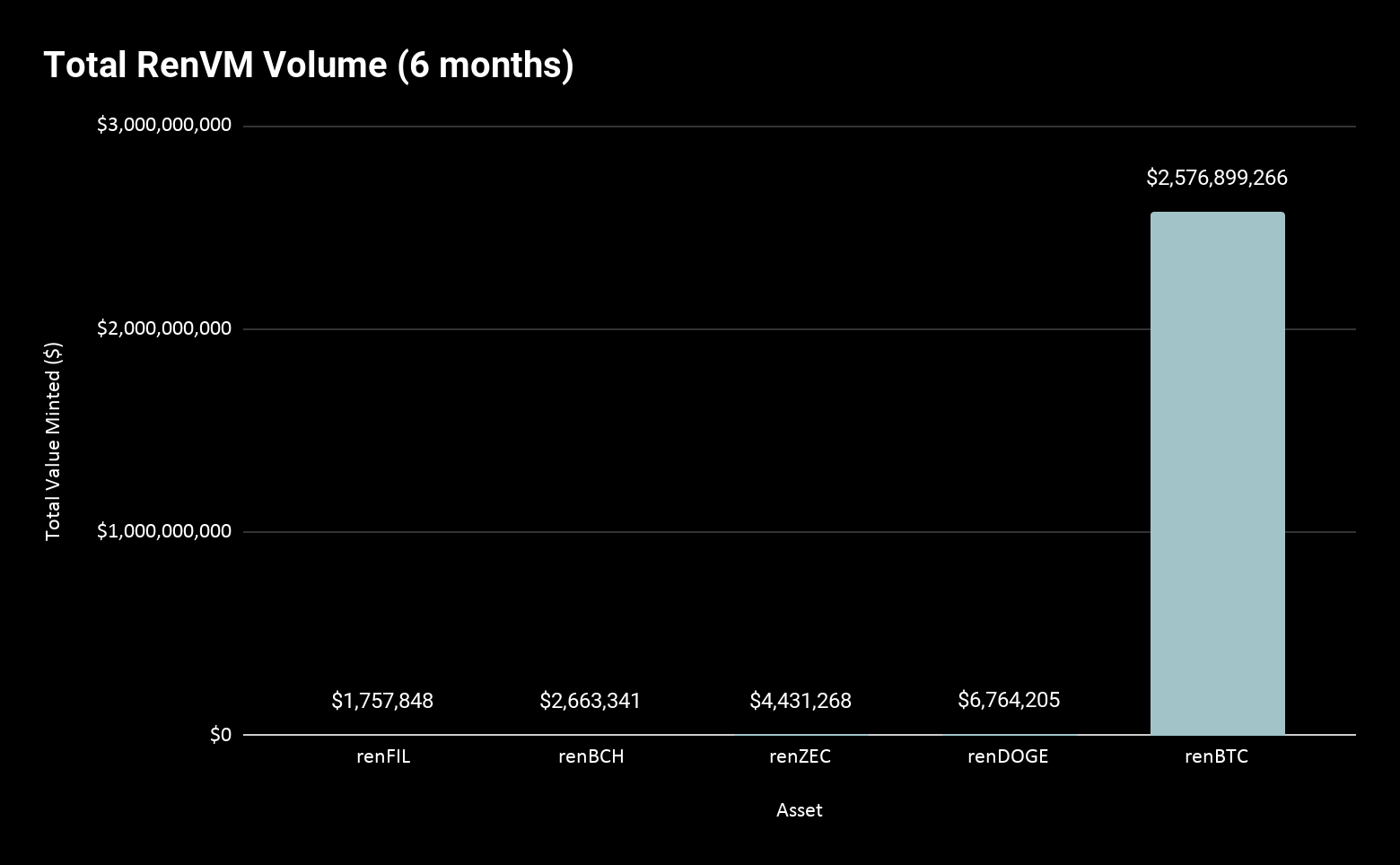

After launching the initial version of the RenVM less than a year ago, the protocol has facilitated over $3B in volume. Notably, over 99% of that value derives from renBTC. As a result, the other assets supported by Ren haven’t seen nearly the amount of demand or volume compared to BTC. For reference, the next leader is renDOGE at $6.7M in value minted and renZEC at $4.4M.

The key takeaway here? Despite these other assets boasting multi-billion dollar valuations, there’s negligible demand for any other asset besides BTC. Today no one really cares to have DOGE or BCH on Ethereum. One of the drivers behind this is that there’s likely few (if any) earning opportunities for other non-native assets on Ethereum or any other chain, so there’s no significant reason for them to be there yet.

Revenue

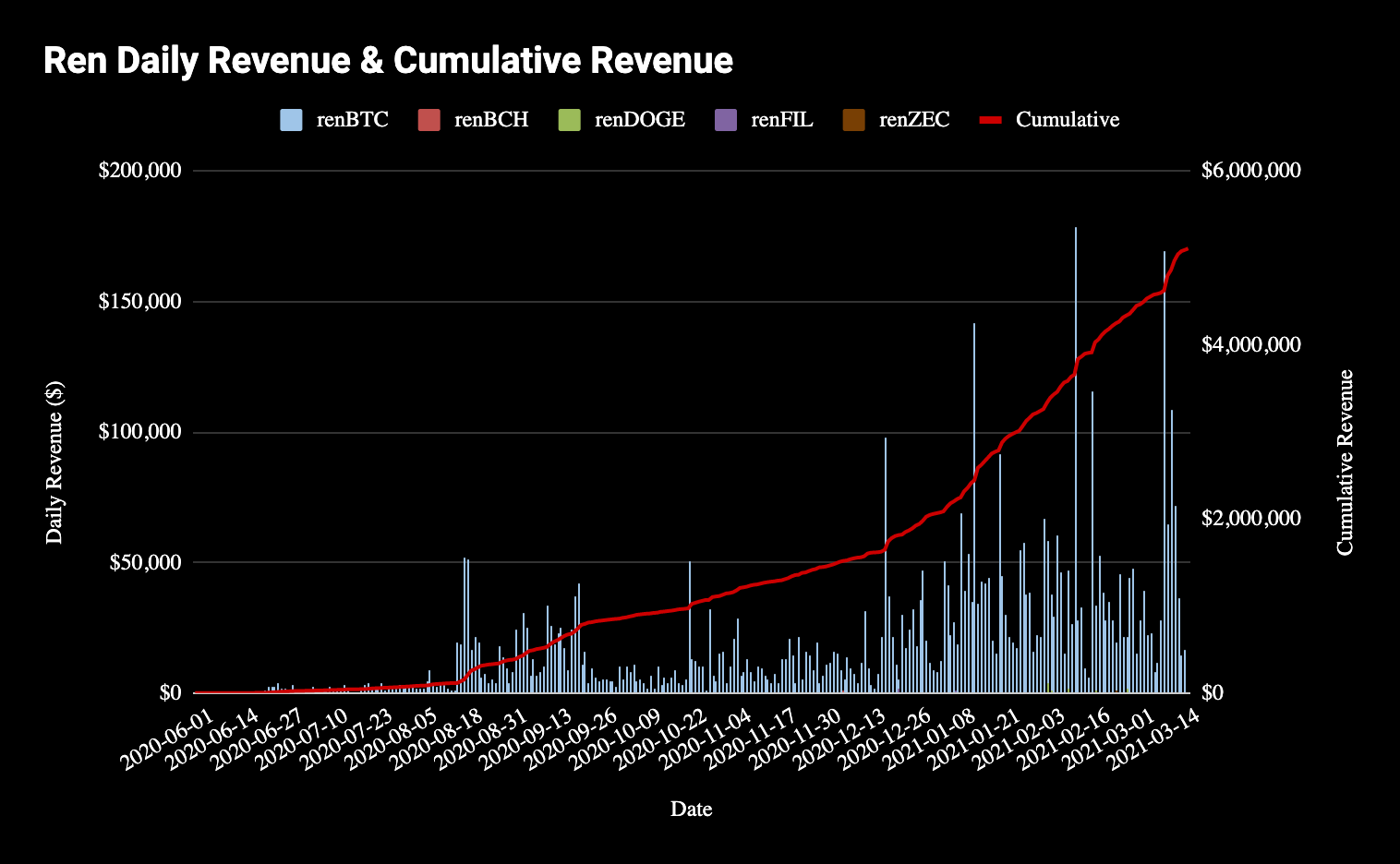

Naturally, with 99% of the demand coming from renBTC, Ren’s version of wrapped Bitcoin dominates its revenue distribution. Since launching less than a year ago, the protocol has generated over $5M in earnings to Darknode operators, with all of it except $31K coming from renBTC.

Better yet, this trend is accelerating. In the past 30 days, Ren has been on pace to nearly triple their annualized revenue to over $14.5M.

Price to Sales

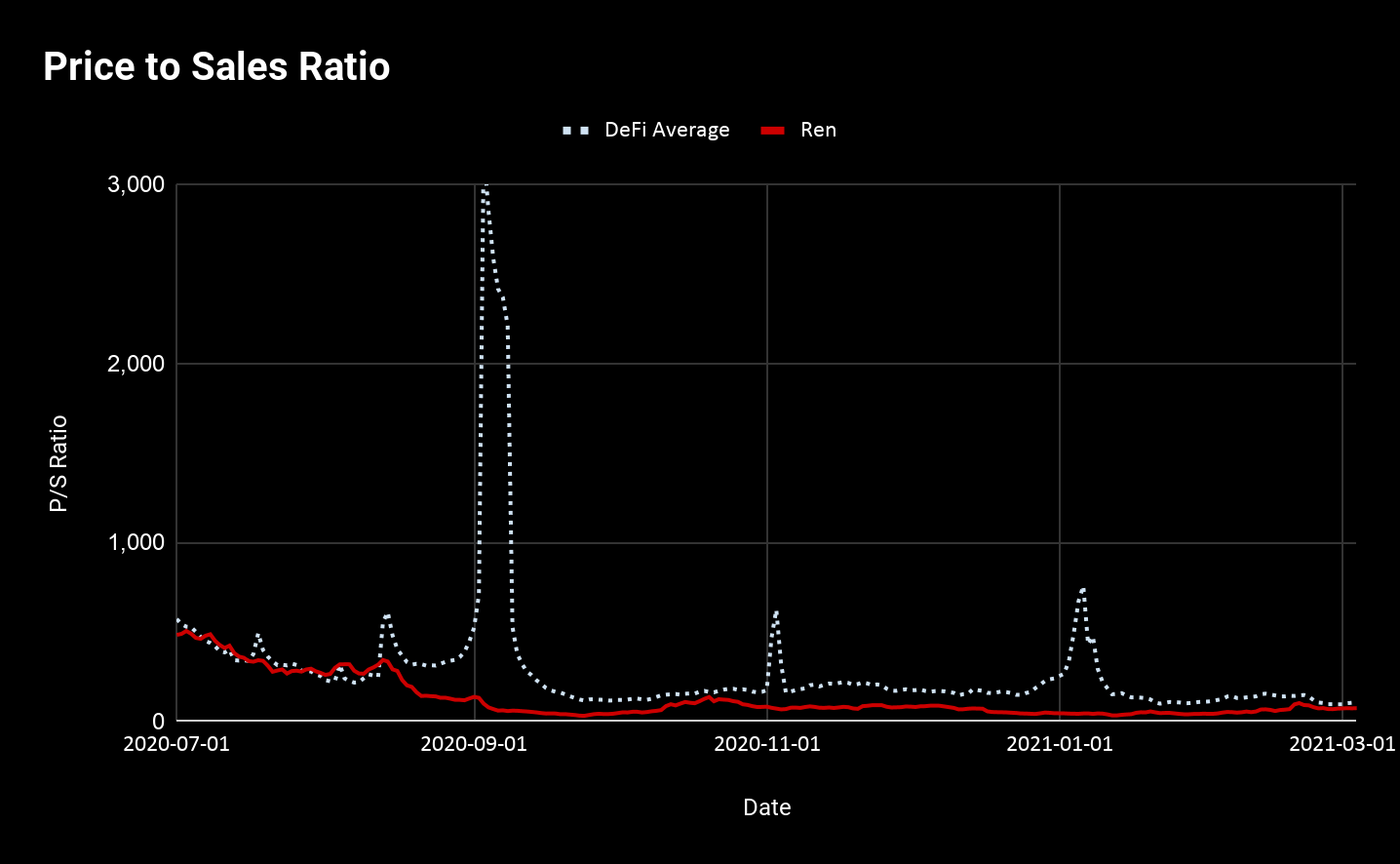

As a result of the climbing revenue, Ren’s Price to Sales ratio is coming in at 74—slightly lower than DeFi’s average of 105. If you’re a recurring reader, we’ve put this into simple terms before.

In the lens of Ren Protocol, which generates revenue from cross-chain transfer fees, the Price to Sales ratio literally translates to tokenholders paying $74 for every $1 that the protocol is able to generate from cross-chain swap fees.

While that seems relatively expensive, rest assured that it’s still lower than the DeFi average. These high revenue multiples are a natural by-product of the high growth potential for DeFi as well as the natural inefficiencies in crypto markets when it comes to valuing these nascent assets. Again, whether or not this is good or bad, is up to you – the reader – to determine :)

Price Performance

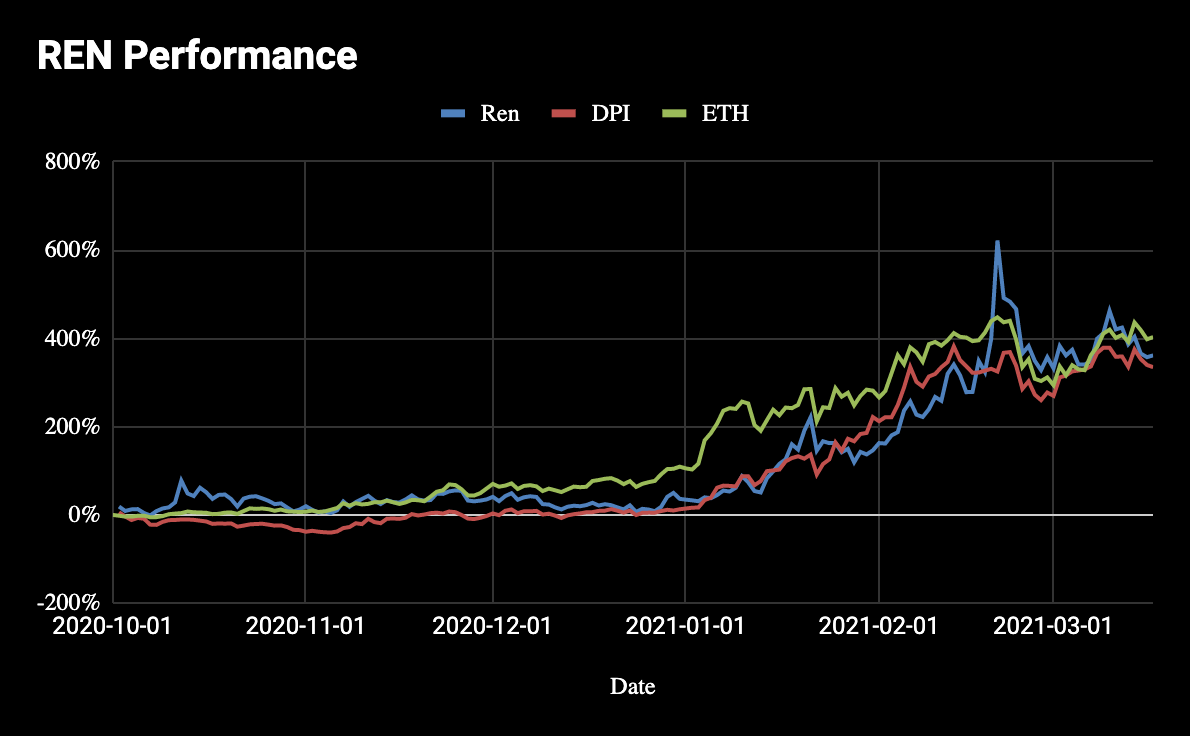

Finally, let’s see how REN has performed against our two key benchmarks: ETH and the DPI. We use these two assets as our benchmark as our goal as crypto investors is to (1) outperform the broader DeFi market and (2) ensure you wouldn’t be better off just holding ETH.

What’s interesting is that all of these assets have performed rather similarly since the start of Q4 (which is when we start having data on the DPI). As of March 17th, REN increased by 362%, outperforming the DPI at 335% while slightly underperforming against ETH at a 403% increase.

What’s Hot 🔥

Here’s what you should keep an eye out for:

- New Layer 1 support coming in Q2 including Solana, Fantom, and Moonbeam. Supporting these new chains will only increase Ren’s addressable market for bringing new assets over to Ethereum.

- RenVM to support Generic ERC-20s: RenVM to support the movement of ERC20s to and from other blockchains. As a quick example, this would enable sending USDC or DAI on Ethereum to Binance Smart Chain, Solana and others.

- RenBridge 2 Released: The new version of the RenBridge released in February supports a range of new assets like DOGE and LUNA, as well as an integration with BSC.

- RenVM added support for Binance Smart Chain: With Binance Smart Chain entering the crypto landscape, Ren now supports Binance’s competitor to the Ethereum, which leverages some similarities with Ethereum Network.

- RenVM added support for DigiByte ($DGB): DigiByte is a billion dollar asset which has been around in the crypto space for years. Users can now port DGB over to Ethereum and Binance Smart Chain via Ren.

- RenVM Greycore on Testnet in Q2: Decentralizing control over darknodes is one of the biggest pieces left for Ren to fulfill its envision of a non-custodial, cross-chain liquidity protocol.

- Upcoming RenVM Integrations: BadgerDAO & Zapper.fi

Wrapping Up

The concept of seamless, interoperable liquidity protocol within crypto has always been attractive—this was actually one of the bullish concepts from the 2017 ICO bubble. Projects like Icon, Aion, and Wanchain came together to create the Interoperability Alliance, driving their respective valuations to sky-high levels amid the bubble.

And while these projects have faded into the background, their intentions may have been on-target. The industry is trending towards a multi-chain future, and seamless cross-chain liquidity will likely be a key piece to connecting these ecosystems. With it, we can seam together fragmented liquidity and economic bandwidth in crypto to fuel DeFi applications to new heights.

Years later, Ren is now tackling these concepts. And they’re proving that there’s demand for it. In less than a year, the protocol has facilitated over $3B in volume—a notable feat for this growing sector.

What’s more interesting is that the RenVM’s capabilities go well-beyond basic cross-chain asset transfers. Developers can use this money lego to build and empower their DeFi application with cross-chain capabilities, like lending and DEXs.

But it’s still early. Ren has some work ahead in decentralizing control over Darknodes, along with proving out demand for other applications beyond cross-chain BTC transfers.

We’re still in the early innings, so keep an eye out!

Action steps

Explore Ren Protocol and the potential for cross-chain liqudity

Read up on our past Token Thursday projects

Keep an eye on Discord for the next round of Token Thursday coverage