KeeperDAO: ROOK takes Knight

Dear Bankless Nation,

Liquidations, rebalances, and arbitrage happen all time. Here’s $1.6b worth of liquidations from one day last wk.)

But who are these mysterious collateral-hunters?

Well…one of them is KeeperDAO. This is a protocol focused on using bots to hunt and execute these liquidation strategies in order to return the profits to the users. KeeperDAO has been around for a while…but things are starting to ramp up fast.

The protocol is now deploying over $20M per day to different opportunities. 🤯

You know what’s cool about this week’s Token Thursday?

We weren’t actually too familiar with KeeperDAO—we probably wouldn’t have covered it. But Bankless Badge holders voted for us to write this article.

So here we are leveling up on KeeperDAO today.

I think you’ll be as blown away as we were.

Let’s get started.

- RSA

TOKEN THURSDAY

Guest Writer: Lucas Campbell, Editor & Analyst for Bankless

KeeperDAO is a liquidity underwriter focused on executing liquidations, rebalances, and arbitrages opportunities in DeFi. The protocol features ROOK, a governance token, which was launched in November 2020.

- Project: KeeperDAO

- Asset: ROOK

- Fully Diluted Valuation: $668m

- Market Cap: $209m

- Total Value Locked: $145m*

- Price-to-Sales Ratio: 6

*Source from Dune Analytics. DeFi Llama reporting differently.

ROOK Takes Knight | KeeperDAO

If you’ve ever been liquidated on Compound, Aave, dYdX or anywhere else in DeFi, you may have been liquidated by a KeeperDAO bot.

KeeperDAO is a liquidity underwriter in DeFi. Anyone can deposit capital and earn a profit in return for allowing the protocol to borrow that capital to execute liquidations, rebalances, and arbitrage opportunities in the DeFi ecosystem.

All profits from these opportunities are split amongst the protocol’s liquidity providers and Keepers—the actors who initiate the transactions. The protocol currently allows deposits for a range of supported assets including ETH, WETH, USDC, renBTC, and DAI.

Keepers are on-chain profit seekers that use the protocol’s capital to execute arbitrage and liquidation opportunities. And similar to LPs, Keepers can be anyone, albeit it’s a bit more complicated as you need to design and program a strategy that can earn a profit in a single transaction—like monitoring an arbitrage opp between Kyber and Uniswap between a specific pair.

In theory, KeeperDAO can execute any on-chain opportunity on Ethereum. Examples include liquidating positions on Compound or Aave, taking over Maker Vaults, or capitalizing on arbitrage opportunities between DEXs like Uniswap and Balancer. It’s ultimately up to people to design Keeper bots to execute the opportunity at hand.

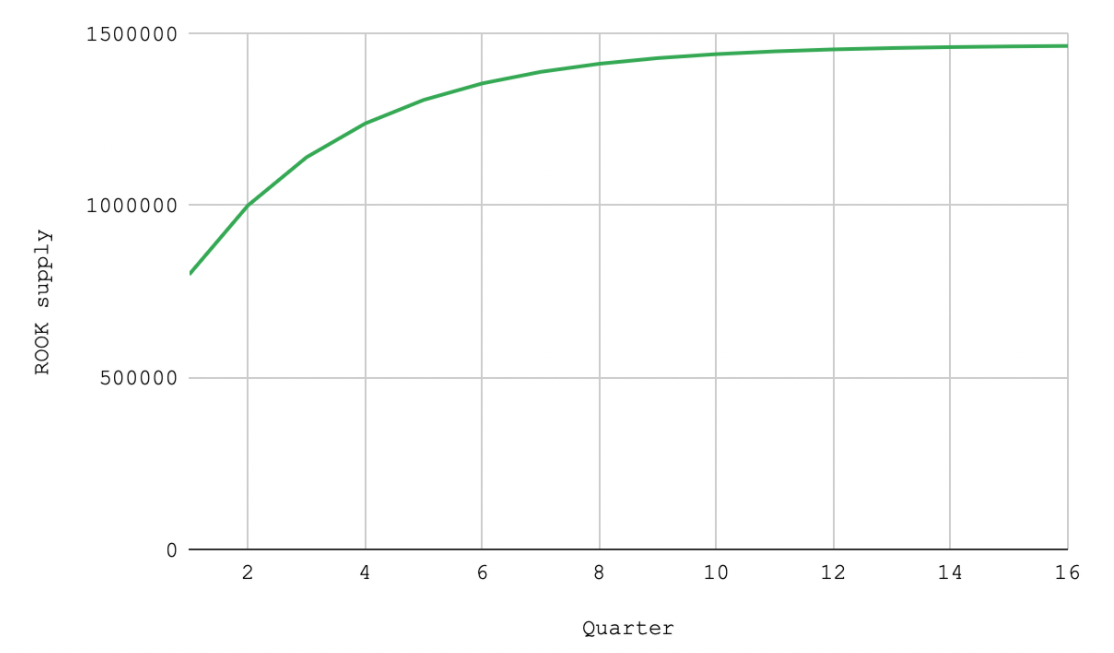

Token Economics: ROOK

KeeperDAO features ROOK, the protocol’s native token used for two key roles: governance and incentives.

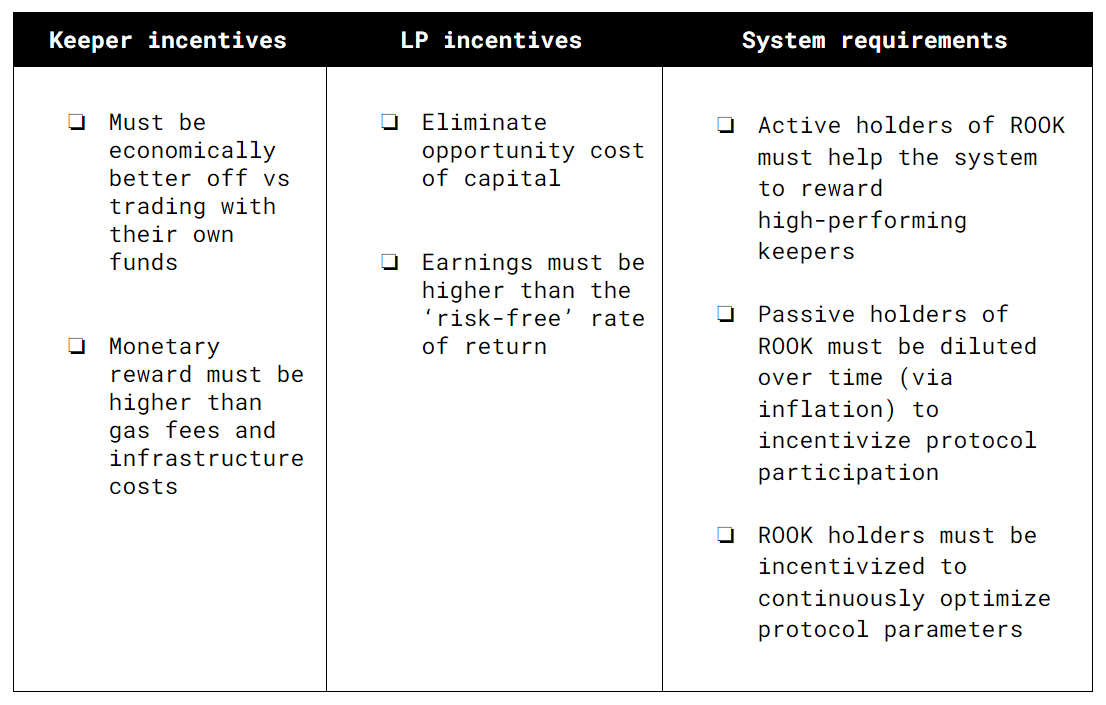

Naturally, like most DeFi tokens today, ROOK will be used to propose and vote on protocol upgrades. Token holders also have the ability to determine the profit share between Liquidity Providers (LPs) and Keepers (arbitrage bots).

👉Note: KeeperDAO governance isn’t live yet and is slated to be released next quarter.

In terms of incentives, LPs can earn ROOK by depositing any of the supported assets to the protocol. By depositing capital into KeeperDAO, depositors earn a portion of the profits from strategies plus a subsidy in ROOK.

Those who elect run Keepers also had the opportunity to “arbitrage mine” which distributed ROOK based on the total profits returned to a pool from each Keeper. However, arbitrage mining was recently phased out in favor of incentivizing the Hiding Game (more on this in the “What’s hot” section).

ROOK currently represents no economic rights over the protocol. However, with governance going live in the next few months, it’s not out of the question for the community to propose & pass a proposal to implement fee rights for token holders.

A potential avenue for ROOK economic rights may be redirecting the existing deposit fee (or at least a portion of it), which currently goes to existing LPs to create “sitcky deposits”, to ROOK token holders. Other options include implementing a similar program to YFI’s BABY where the treasury buys-back the protocol token on the open market and reserves it for rewarding contributors or other initiatives in the future.

Nothing concrete as of yet though!

Fundamental Metrics

Gross Merchandise Volume (GMV)

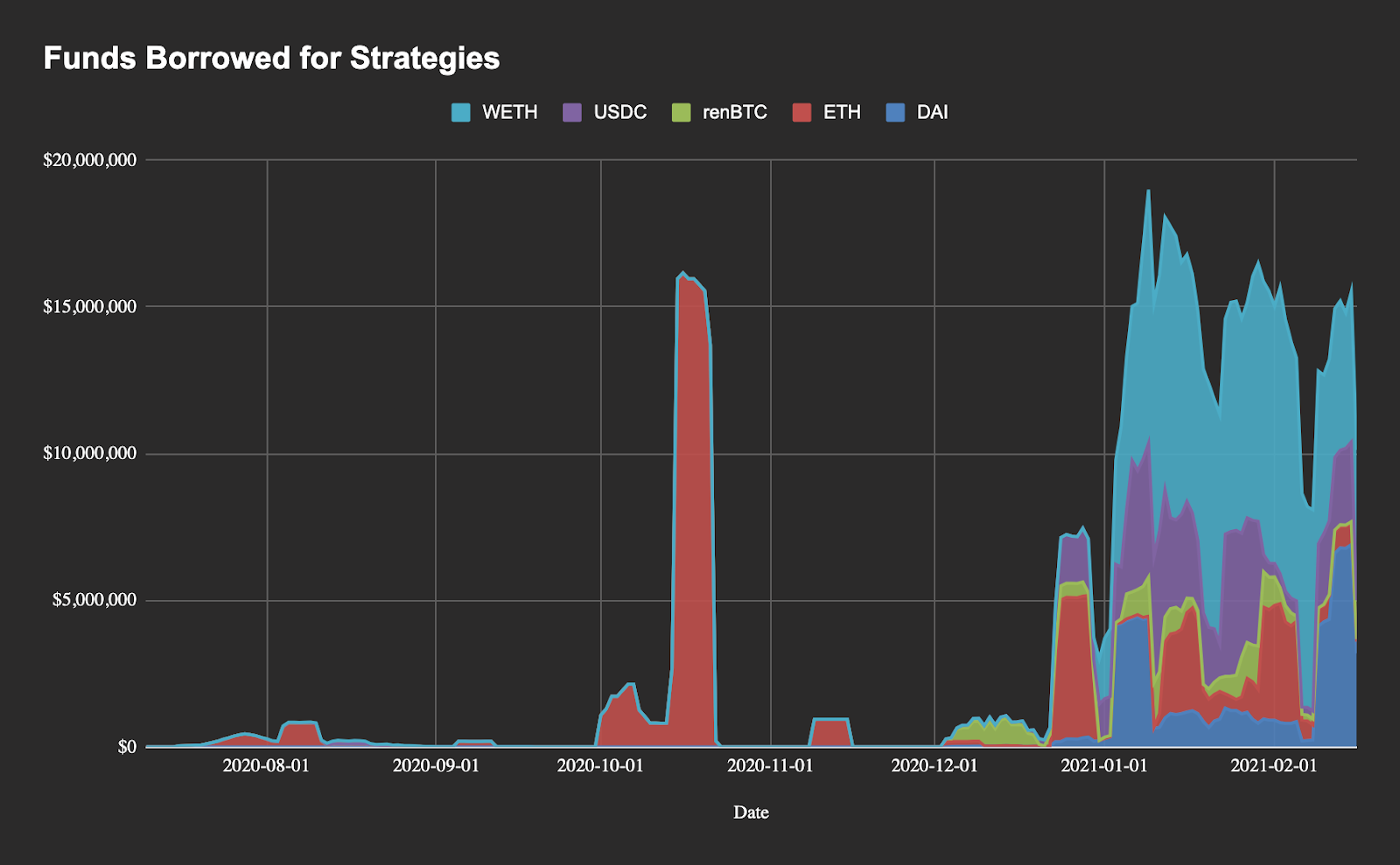

KeeperDAO’s Gross Merchandise Volume (GMV), which represents the amount of capital borrowed from the pool to execute arbitrage and liquidation strategies, has maintained new records in 2021.

According to Token Terminal, KeeperDAO has been deploying over $20M per day over the past week across different strategies for the existing 22 Keepers running on mainnet today. WETH is currently the dominant player in terms of borrowing volume as it’s used in excess of $5M per day.

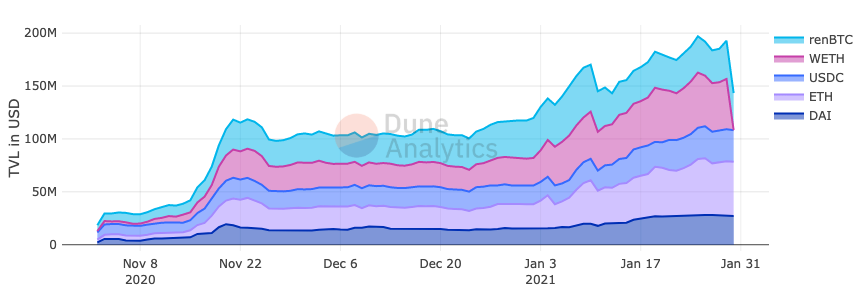

Total Value Locked

While KeeperDAO has yet to be listed on DeFi Pulse, the protocol is currently boasting over $140M in value locked from liquidity providers, according to Dune Analytics. The pool distribution is fairly equal across all assets, with ETH representing the largest pool at $51M while DAI represents the largest pool at $27M.

Even though KeeperDAO’s underwriting strategies can be profitable, it’s likely that the majority of liquidity held today is being used to farm ROOK. For reference, the total yield for ETH on KeeperDAO is 25% APY with only 1% coming from Keepers and the remaining 24% derives from the ROOK subsidy.

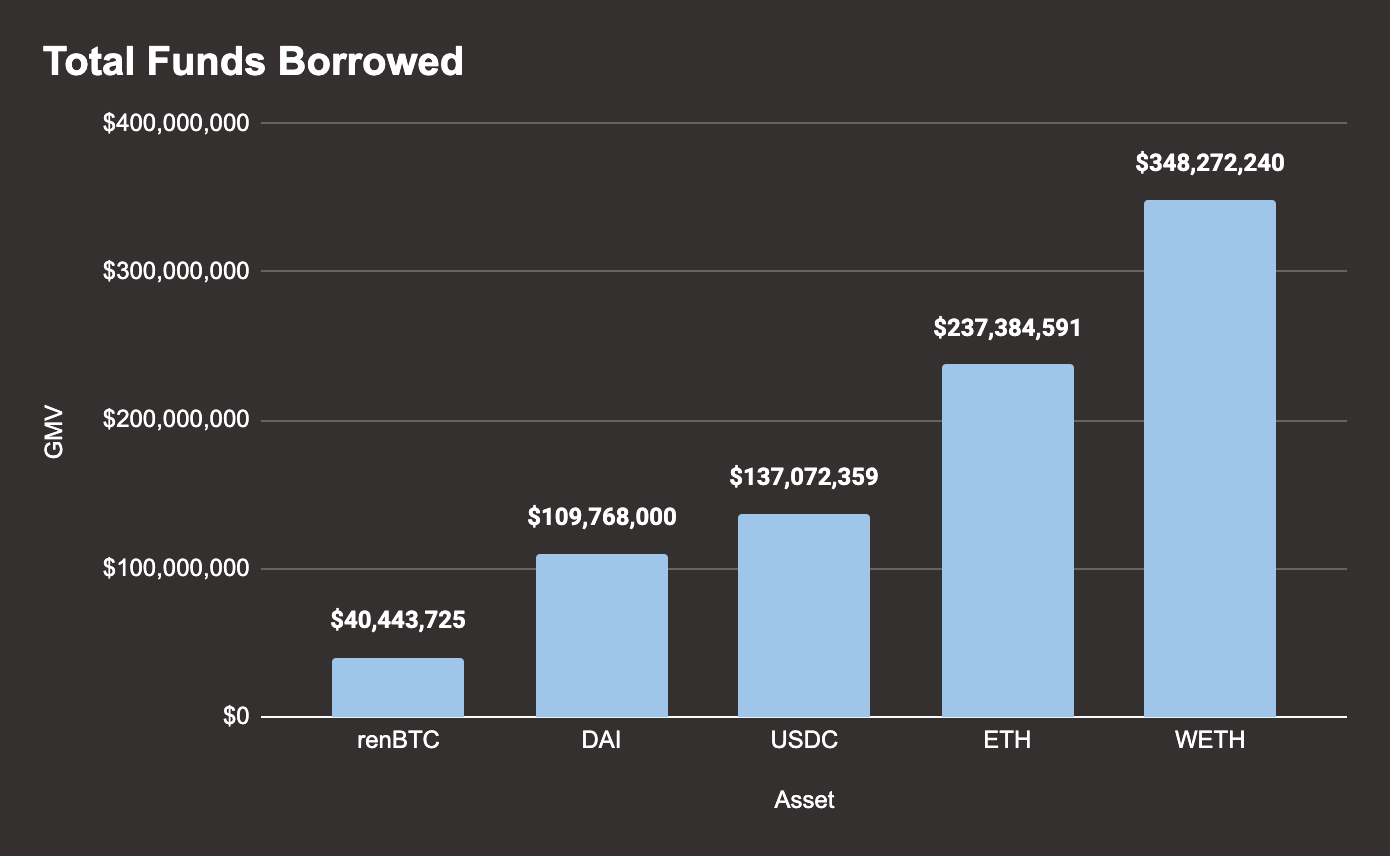

Even though liquidity is relatively even across supported assets, the majority of actual usage for Keepers is coming from ETH. Combined together, ETH-denominated collateral represents 67% of all capital borrowed by the protocol’s Keepers. USDC is the next closest asset in terms of capital used, with the total coming out to over $137M.

The least used asset as it stands is renBTC. This seems somewhat natural given how early in the life cycle it is for Ren’s cross-chain BTC (been around for <1 year) as it’s only just starting to gain ground in terms of adoption in DeFi as trust-minimized collateral.

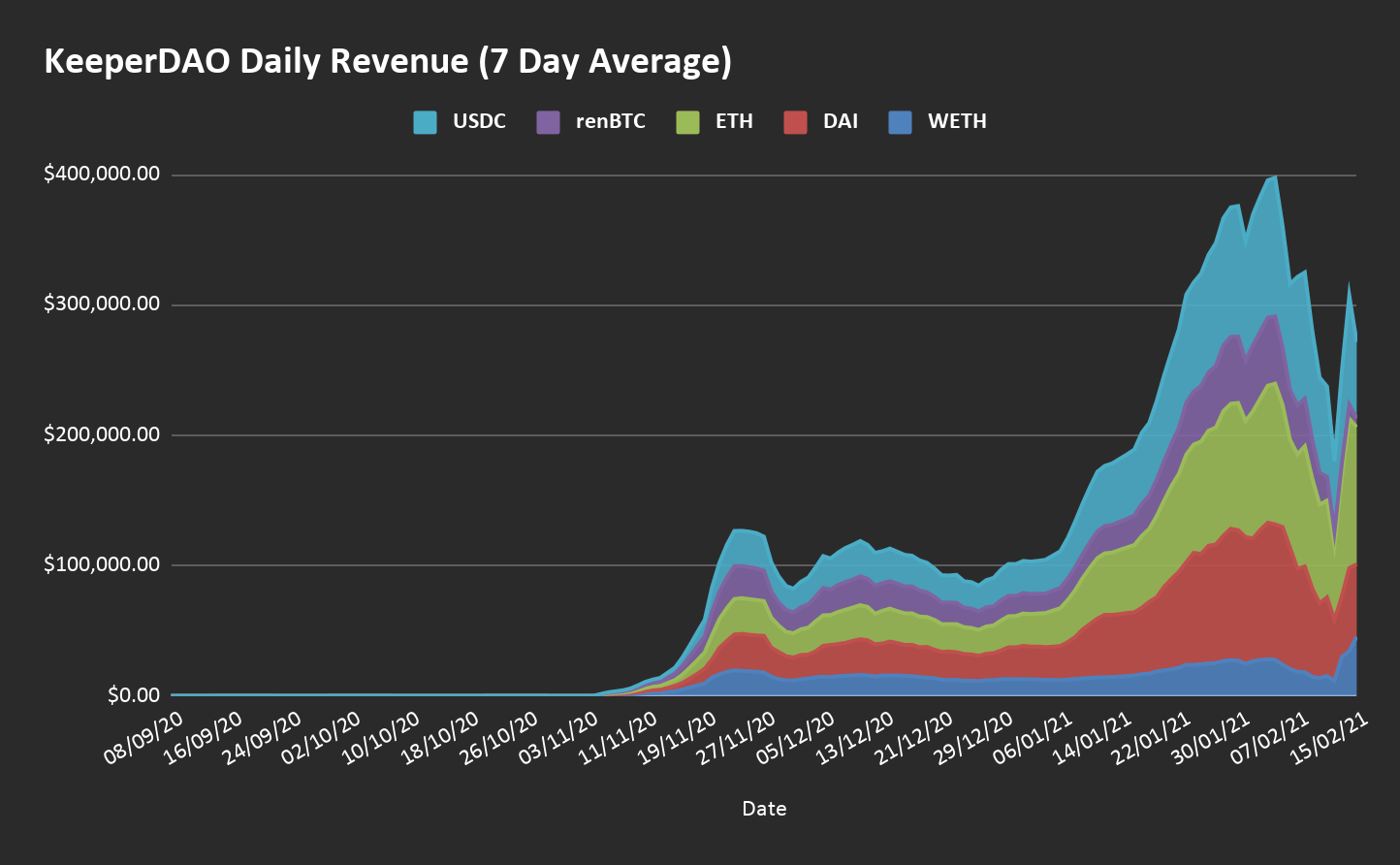

Revenue

While ETH dominates in terms of capital deployed, that doesn’t necessarily hold true for revenue. For KeeperDAO, revenue is the profit earned from executing the underlying strategies.

As it stands today, the protocol is returning an average of nearly $500,000 per day to LPs and Keepers via each respective strategy. While WETH dominates usage, it’s actually the least profitable after only returning a total of $1.5M since inception. Comparatively, ETH, DAI, and USDC have all generated over $4M each in income for the protocol’s users.

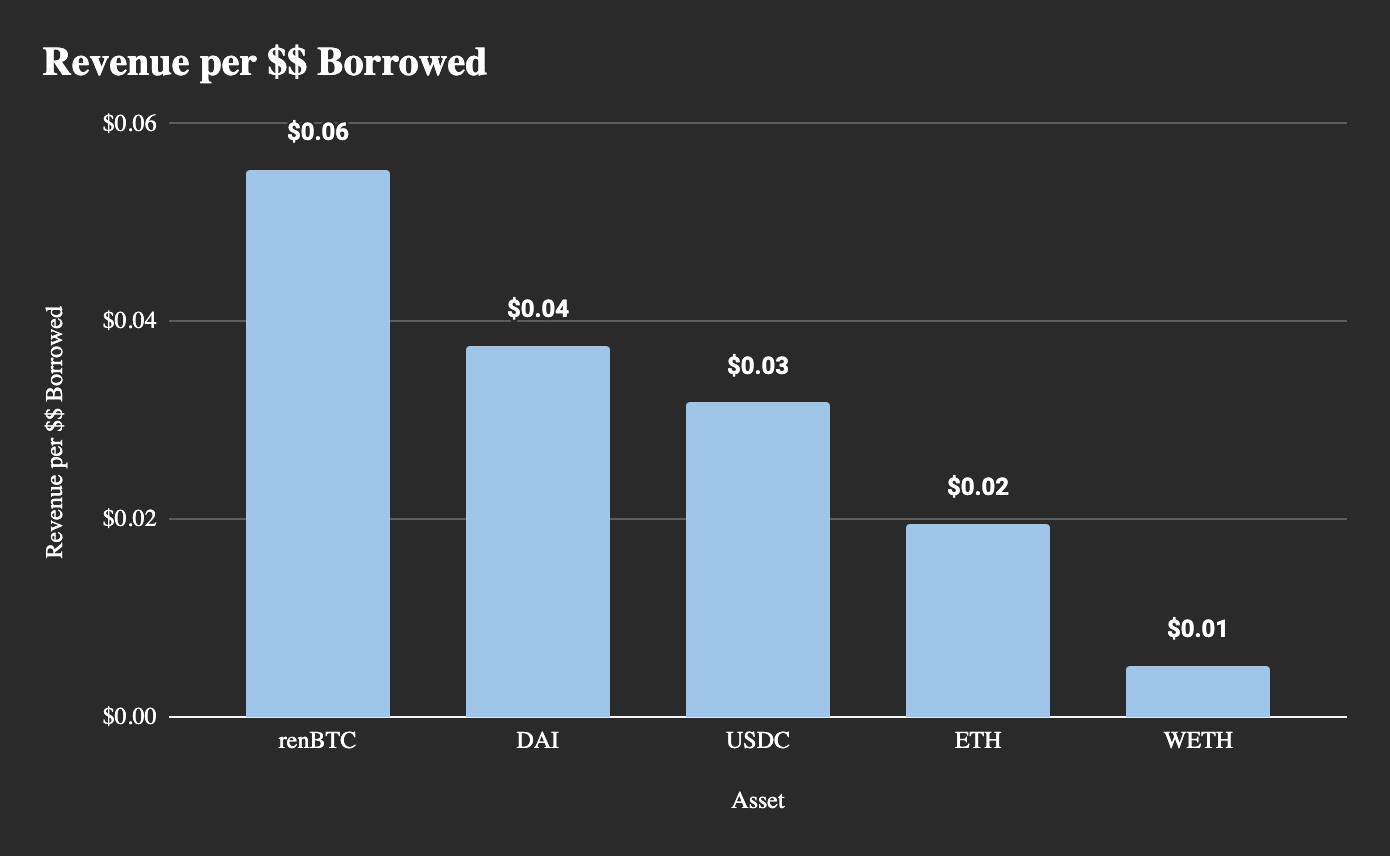

The last key metrics for KeeperDAO is comparing the amount of capital borrowed (GMV) with the profit generated (revenue). At its core, this metric represents the profit margin for each asset when they’re deployed for any of the Keeper strategies.

As we can see, despite being the least used asset, renBTC is currently returning the highest profit margin as it generates $0.06 for every dollar deployed in Keeper strategies. On the other end, ETH and WETH are the least profitable in terms of margins as the asset is only generating $0.01-0.02 for every dollar deployed.

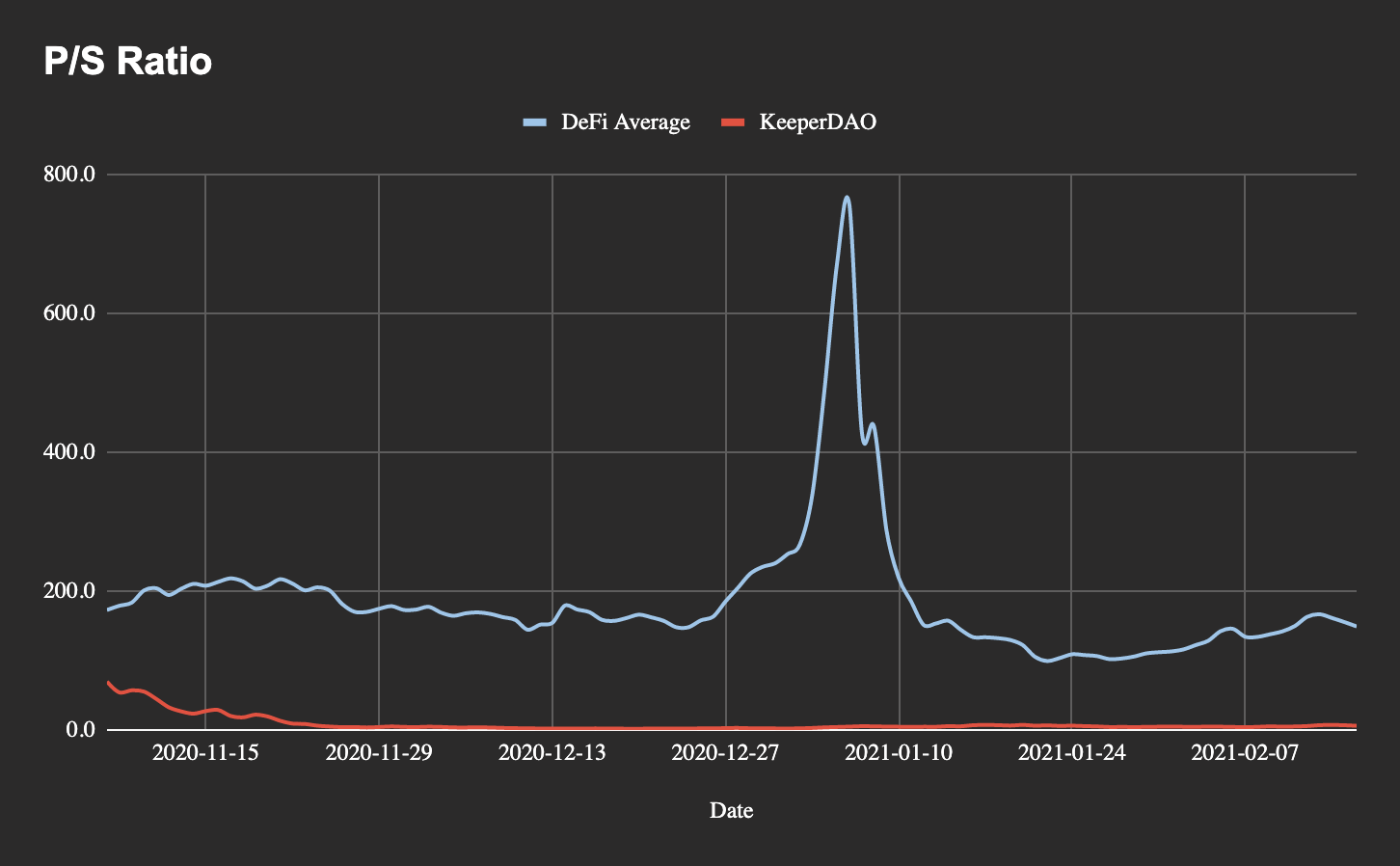

Price to Sales

Finally, the price to sales ratio. KeeperDAO’s P/S ratio is substantially lower than the average in DeFi right now. (Lower can mean better value)

Whether this means that the market is undervaluing it or indicating that KeeperDAO has lower future growth expectations than other DeFi protocols is ultimately up to you, the reader, to decide. Regardless, with DeFi tokens experiencing a recent bull run, the average P/S ratio in the sector currently stands at a lofty ~150.

Meanwhile, KeeperDAO barely shows up on the radar with a P/S ratio of ~6.

To put this stat in simple terms, the market is currently paying $6 for every $1 KeeperDAO can generate in profit from arbitrage and liquidation opportunities.

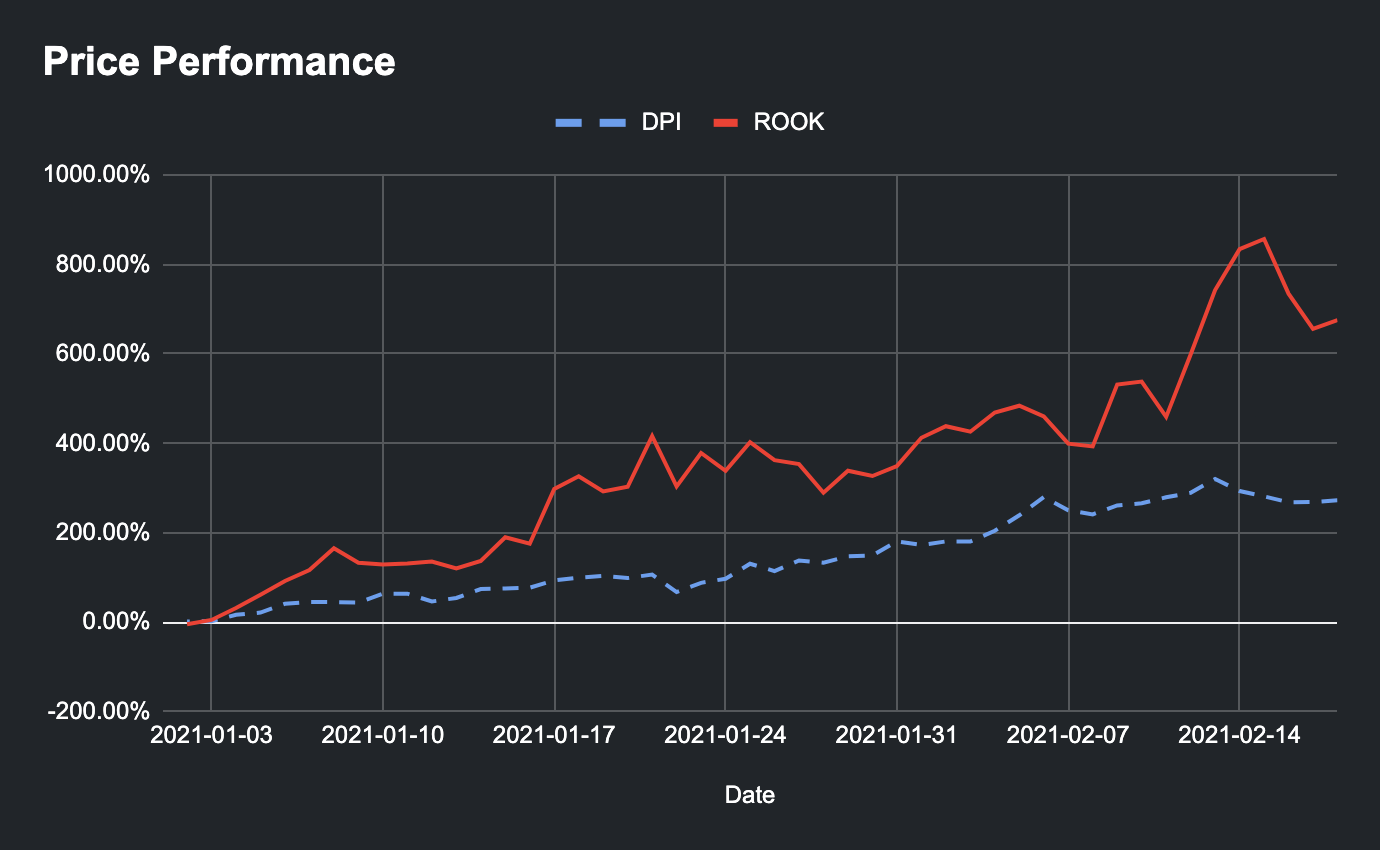

Price Performance

It’s no secret that DeFi tokens have been mooning.

The new year has treated DeFi investors well with DeFi assets experiencing parabolic rises across the board. Our measuring stick, the DPI, is up 272% since the start of the year. While this is a notable performance that any investor would be happy with, ROOK is outpacing the index by a fair margin. KeeperDAO’s native token is up over 675% YTD—outperforming the DPI by nearly 2.5x.

You could say ROOK token holders are feeling good about their investment ;)

What’s Hot 🔥

There’s definitely some stuff happening on a fundamental level for KeeperDAO. The protocol is currently deploying over $20M per day towards profitable opportunities, generating half a million per day in profits to users, all with the goal of increasing yields for protocol participants.

But it’s still early for this liquidity underwriter. Here’s what you should keep an eye out for:

- The Hiding Game: This is a cooperative game between users and keepers to hide MEV (on-chain profit) by wrapping trades and debt in specialized on-chain contracts. If you’re familiar with the Dark Forest (here’s our episode on this), you’re familiar with the concept that Ethereum’s mempool is riddled with apex predators (bots) watching for profitable transactions to front-run. This is KeeperDAO’s entire business—finding profitable on-chain opportunities. Therefore, you can imagine that the dark forest presents some inefficiencies for KeeperDAO.

The Hiding Game solves this issue as it allows the protocol cover up these transactions with the HidingBook—virtual mempool enabling users and keepers to coordinate, capture, and distribute MEV. What’s interesting about this is that the Hiding Game allows anyone to execute trades via the orderbook and receive ROOK in return—meaning if you’re going to swap tokens on a DEX, you may want to look into KeeperDAO as you’ll receive a cashback in ROOK! The Hiding Game is a more advanced concept, but for those interested in learning more about it, you can read about it here. - New Emission Schedule: In the first quarter of ROOK, 30% of emissions were distributed to LPs and 70% to Keepers. Now, there’s a new update to run in tandem with the launch of the hiding game. In this quarter, instead of 70% going to LPs, that allocation is now directed to traders who submit orders through the HidingBook.

- On-Chain Governance: There’s currently no on-chain governance for KeeperDAO. However, this update is slated for the coming months and will serve as a foundational piece in the protocol’s evolution in the future.

Closing Thoughts

There’s plenty of volatility in crypto markets—meaning there’s always an opportunity for KeeperDAO to profit. While still early, the protocol is on-pace with some eyebrow-raising numbers, like its $20M daily average in capital deployed along with generating $500K in daily profits to LPs.

And while there are plenty of positive signs in usage—to put it bluntly—the token economics could use some work. ROOK is currently only used as an incentive mechanism for Keepers, LPs, and traders in the Hiding Game. However, the upcoming governance launch should open up the doors for the community to propose new token designs. Keep an eye out.

To learn more about KeeperDAO, check it out here. For those with more questions or want to stay up to date, you can hop in the Discord or follow the official Twitter account.

Action steps

Dig into KeeperDAO and its protocol token, ROOK

Read up on our past Token Thursday projects

Keep an eye on Discord for the next round of Token Thursday coverage