The Good, The Bad, and The Ugly of Binance Smart Chain

Dear Bankless Nation,

What exactly is Binance Chain?

Fiskantes gives us an level-head take on the state of Binance Smart Chain now that the passions have settled.

Will it help or harm Ethereum?

Is it decentralized?

Is it here to stay?

This is the good, the bad, and the ugly of Binance Smart Chain.

- RSA

WRITER WEDNESDAY

Guest Writer: Fiskantes, Partner at Zee Prime Capital & CIO at Sigil Fund

Binance Smart Chain: The Good, The Bad, and The Ugly

Author’s Note

This article is an expansion of my popular tweet storm about BSC. It serves as an attempt to view Binance Smart Chain objectively, however it's still just an op-ed piece and not a full summary nor a deep data driven research. If you find any factual mistakes in the article, please reach out for correction.

Disclaimer: I am a heavy user of Ethereum and an occasional user of Binance Smart Chain.

A Primer on the Binance Ecosystem

A lot has been said with regards to Binance Smart Chain. Just three weeks ago it was the main topic in crypto. Since emotions have already subsided and all seems quiet on the western front, we can now zoom out and look at things calmly—without all the noise.

Before we start, let's make a distinction between Binance, Binance Chain and Binance Smart Chain:

Binance

One of the largest centralized exchanges—no need to go much deeper here. However, it's worth noting that Binance is also an umbrella brand for the overall Binance ecosystem—a true behemoth in the crypto world, containing a venture fund, project launchpads, an incubator lab, a charity fund...you get the idea.

Binance Chain

This is the first blockchain network under the Binance brand. It uses Tendermint and thus it can be seen as part of the Cosmos ecosystem.

It was launched in 2019 and it was deliberately designed to not support smart contracts. With that, the main use case was trading via Binance DEX—a ‘decentralized’ exchange used to bootstrap liquidity of multiple non-ETH projects, including Thorchain. Thorchain also currently uses it (BEPswap resides on Binance Chain). I couldn't find the details about validation. The FAQ says:

“Binance Chain uses BFT and PoS (upcoming) based consensus mechanism to produce blocks among a series of qualified Validators...The process for setting up validators among different entities on Binance Chain is currently being defined.”

It's safe to assume that the validator set of the Binance Chain is centralized.

Binance Smart Chain

Binance leadership was not satisfied with lagging adoption of Binance Chain. While alternative ecosystems were busy building the basic rails, the wave of innovation with DeFi was concentrated on Ethereum. Acknowledging this, Binance forked Ethereum EVM and bootstrapped a second blockchain—Binance Smart Chain, with support of smart contracts.

It's essentially an Ethereum copycat with increased throughput and a centralized validator set of 21 validators handpicked by the leadership (kinda like EOS). They call it PoSA = Proof of Staked Authority.

Having two blockchains under one brand is pretty confusing and I am not sure why they didn't name it differently. However both blockchains now reside on the main Binance domain and form what Binance calls a “dual-chain architecture”.

(If this sounds confusing to you, imagine being a newbie who just started trading on Binance and having the option to withdraw your coins to Ethereum, Binance Chain and Binance Smart Chain).

While we could go in many directions from here now that we have a basic understanding of the Binance ecosystem, the rest of the article will focus on The Good, The Bad and The Ugly of Binance Smart Chain.

The Good, The Bad and The Ugly

The Good

Does it make sense to use BSC? Was it a wise decision for Binance to build it? Is it good for the overall crypto ecosystem? Let's look at the positives:

1. Low fees

There is no way around it, Ethereum mainnet is currently severely congested as transactions cost hundreds of dollars and contract deployment costs thousands. No matter how bad you want decentralization, if you are priced out of Manhattan, you want the next best alternative. And thanks to Binance Smart Chain, you can taste the DeFi experience with composability, high yield and smooth UX in a low fee environment.

That being said, many alternative chains boasted with low fees and high TPS and went nowhere. Surely, BSC needs to offer more than just that! For some reason many users and devs picked this particular suburban area over other cheaper alternatives.

2. Developer experience

One of my strongly held opinions in crypto is that developer experience is one of the most crucial aspects for adoption. If your protocol doesn't offer dev experience—an environment that makes it easy for independent devs to tinker with and build on, to quickly deploy and iterate—nothing else matters for adoptions. Not your token price, not influencers, no shiny logo and flashy website, nor partnership announcements.

I work with a couple of projects that build on alternative layer ones and even though some offer various advantages over Ethereum, one thing is always painfully clear.

Ethereum and the EVM have years of a head start when it comes to developer experience. The solution was here earlier and many companies (spearheaded by Consensys) spent years and tens of million of dollars to build out developer infrastructure to support the Ethereum ecosystem.

Binance Smart Chain cleverly bypasses this need by simply adopting EVM. With it they can easily roll out their fork of Etherscan, Metamask support, and a range of other products and tools popular on Ethereum.

If you are a developer who just wants to experiment quickly and cheaply on a live network that has most of the tooling of Ethereum, liquidity and users, BSC is probably a good way to go.

Whatever you build there can be later on ported to Ethereum main net.

3. Liquidity and composability

In summer 2020, a whole new level of crypto experimentation emerged. It needed two key ingredients:

- Liquidity: Thanks to token incentives, lending protocols and decentralized exchanges attracted enough liquidity to be viable alternatives to their centralized counterparts.

- Composability: When base DeFi protocols (mostly lending platforms and AMMs) became liquid enough, other derivative DeFi products, such as yield aggregators could be built and used at scale.

What followed was a Cambrian explosion in DeFi. And while it happened on Ethereum, note that decentralization (while very important) was not a necessary ingredient to this!

Binance realized that they don't need decentralization to ride the wave. They just need the two key ingredients mentioned above. They already have enough liquidity. Binance boasts probably the biggest retail user base in crypto, and huge capital reserves to be deployed at their will.

Composability was solved by forking EVM and incentivizing builders to copy the most popular DeFi projects. Thus CeDeFi was born. A pretty cringey term, but it somewhat reflects the reality of BSC.

I believe liquidity is one of the key differentiators between BSC and other lowcost EVM ecosystems such as xDAI. We are building finance, surely having a lot of money helps!

🧠 Author’s Note: There are some accusations of BSC being dominated by fake volume. While Binance probably uses a lot of its idle capital to bootstrap liquidity, Rewkang in his recent tweetstorm debunks the notion that BSC is not used by actual users.

Data show that there is indeed a lot of genuine activity, at least on PancakeSwap, a major DEX for BSC.

4. Competition

Let's not forget that the free market is driven by profit and competition. The crypto exchange business is very lucrative but also extremely competitive, and big players such as Binance need to take any advantages they can get so they can fend off competition.

If Binance can use their resources to create a semi-open DeFi ecosystem centered around their brand and exchange, if they can capture their users within their ecosystem and drive value of their token and equity, they should do it.

If they can fork a free open source code and use it to capture value within their business, they should.

Copying is also a viable business strategy and no amount of angry finger pointing changes that. In the world of business pragmatism rules. While Ethereum researchers and devs painstakingly move the space forward, they generate public goods in the form of freely available open source software.

Where alternative layer ones are trying to re-build blockchain primitives from scratch, Binance just plucked low hanging fruit of readily available open source to its full benefit.

Thanks to BSC, in the short to mid term, Binance is forming a powerful crypto-financial ecosystem with their CEX in the middle and BSC surrounding it. I have no doubt that they will be able to capture a lot of users but at the same time will serve as an on-ramp and learning ground for newbies to enter crypto ecosystem “on rails”.

Thus, such competition is also useful for native Ethereum and DeFi ecosystem. Competition in the form of Binance gives us a reality check and pushes us to innovate. Some DeFi apps are extending to BSC to capture the business value there, others are pushing to innovate on L2s and scale other ways. The only thing that is not an option is remaining complacent in the status quo. End users will be the one benefitting the most.

5. Decompressor

While we can argue that BSC is sucking out some liquidity out of Ethereum, I don't think we should be worried.

Some users certainly are leaving to take advantage of cheaper fees, but most of them were priced out from Ethereum anyway. Eventually a natural equilibrium will form until other scaling solutions are available.

In the short term, BSC acts as an emergency valve to lead the pressure away. What I also noticed is that the majority of short term oriented DeFi projects and money grabs also moved to BSC, thus improving the quality of the average DeFi Ethereum project.

The Bad

Now that we’ve highlighted the good aspects of BSC, I will try to argue from the opposite direction, dissecting the biggest weaknesses and negative externalities of BSC.

1. Decentralization theater

There is nothing bad with centralized services; however, it stinks if they try to act as if they have the same guarantees as decentralized. It's one thing to be attracted to BSC because of low fees, but it's another to rely on it with your money thinking you are on a permissionless, decentralized and credibly neutral settlement layer.

While Binance Smart Chain is open (anyone can build on it), it's hard to argue it's decentralized, given the permissioned validator set, arguably under direct control of Binance leadership.

However, quoting 1inch’s founder, Sergej Kunz:

“We don't know for sure if the BSC is centralized as we don't know who are the validators of their network. But 1inch plans to run its own validator on BSC.”

Source: CoinTelegraph

It's very unclear how one can join these mythical 21 validators. The 21 validator system sounds similar to EOS, but even there you could delegate tokens and vote.

There is no such mechanism with BNB.

2. Lacking Credible Neutrality

Binance has a tight control over it's border. Not only can they stop withdrawals to particular networks from their CEX at will. They can even shut down the bridge between BSC and other networks.

Of course this doesn't happen often in practice, but the mere possibility of this happening sheds away in trace of credible neutrality.

I personally find credible neutrality very valuable and for this reason I am holding majority of my capital within a credibly neutral ecosystem, while paying a higher fee for it. I advise anyone to consider the BSC ecosystem as a more open and composable extension to their centralized exchange, rather than a decentralized ecosystem.

This means that BSC is more akin to permissioned Ethereum sidechain (I’ll refer you to this awesome article to understand the nuance of sidechain definition).

So in practice, you should regard your capital on BSC being under the same regime and rules as having them deposited on Binance CEX. When you bridge your assets from Ethereum into BSC, you get IOUs.

There is of course nothing wrong with having your capital on custodial exchange. It is also highly improbable Binance would want to steal from you. I would even argue it's safer to trust Binance than some smaller sidechains, where the validators do not command a huge and valuable business brand with reputation at stake. Just do not conflate it with self custody of funds in a permissionless ecosystem such as Ethereum.

🧠 Author’s Note: While Ethereum’s L1 is credibly neutral, you should be careful while using smart contracts and DeFi apps built on top of it, many are in fact akin to custodial, since they have admin keys or other ways to control your capital locked within them. However the difference still is whether they are built on a permissionless credible neutral layer, or another custodial, trust-based layer.

3. Target market

In the short term, BSC can capture the demand for “CeDeFi”—arguably a big market of users who don't care about credible neutrality and/or want low fees while enjoying yield farming and DeFi experimentation.

Control over the network also enables Binance to more efficiently fight against hacks and rug pulls, and there is a wide group of users that certainly appreciate that.

However, Ethereum thanks to it's credible neutrality enables so much more. Apart from yield farms and liquidity pools, it fosters a wide range of financial and non-financial innovation, such as alternative governance structures, decentralized autonomous organizations, experiments with funding of public goods, privacy technologies. Arguably, these vectors of innovations are not viable on a centralized layer.

Even though you can technically build it, you always run a tail risk of Binance leadership deciding (or being coerced) to shut you down.

Thus, while it may be advisable for some DeFi projects to expand into BSC or experiment there in a low cost environment, I also think no serious and long term thinking crypto project should choose BSC as the home of their “headquarters”.

It is akin to building your business in a dictatorship instead of a democracy. While the dictatorship may be benevolent, you can't rely on it being benevolent years into the future. While I can imagine BSC evolving into a decentralized ecosystem (mostly changing their validator policy), I find it very unrealistic.

4. Technical challenges

Binance tries to market BSC as some sort of tech innovation in scalability vs “slow and expensive” Ethereum.

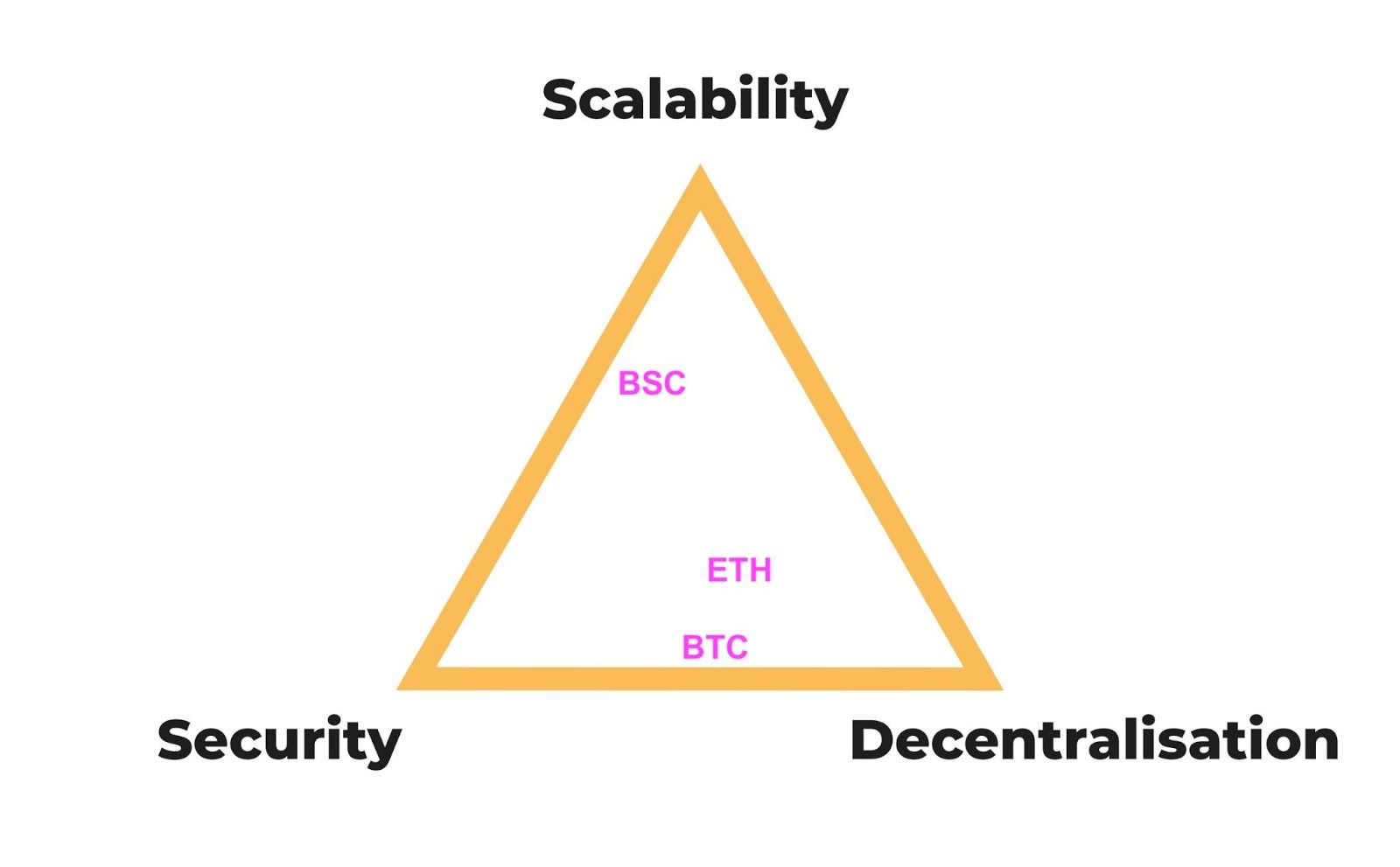

Let's make it clear once and for all, that BSC is not any sort of technological innovation. Only thing it does is move the spot on the Blockchain trilemma triangle from decentralization towards scalability, while changing very little technically.

I believe in the long run, BSC validators will find it harder and harder to store all the state, since the bloat will become unbearable. E.g. within the generalized smart contract and feature rich DeFi ecosystem with many DEXes, lending platforms, trading venues, there will be an increasing amount of arbitrage opportunities.

This is something that bothers Ethereum as well—too many DEXes on one generalized chain start to cannibalize the network. However, Ethereum has two ways to fight it:

- In the short term, the fee market makes fees increase and thus creates new equilibrium.

- In the long term, the majority of trading activity may be pushed to other layers, Zkrollups or Optimistic Rollups and scale heterogeneously.

BSC can't really let the fees rise too much, since their value prop is to be cheap—not decentralized. BSC can scale with Ethereum, but without the world class researchers and developers that work on Ethereum they are destined to wait for Ethereum to innovate and fork the innovation. This can become a chore by itself, since Ethereum network is pretty much a work-in-progress.

This doesn't mean Binance ecosystem won't remain powerful. Binance has money, users, marketing power and business acumen...but it is not a technical innovator by any means.

I believe Binance will have to quickly follow the innovation while also trying to not be stretched too thin. With such a large and diverse ecosystem, it may prove more and more difficult to keep up.

The Ugly

I tried to summarize both good and bad, pros and cons of BSC above. What is left is the ugly. The vitriol between communities and influencers. The marketing war and attacks.

Crypto is a world where financial incentives clash with ideals, differences in values and technical nuances grow into tribalism and are amplified by bags being held. I don't want to pick sides here, vicious attacks are flying both ways.

There are cheek in tongue jabs by CZ hinting on Ethereum being unusable or 1inch (extending to BSC, while comparing Ethereum) to hellish scorched earth

But there are also blocked withdrawals to the Ethereum network from Binance. These are attributed to high gas fees, regardless of the fact that many users would happily pay high gas fees to withdraw in order to cover their CDPs and other endangered DeFi positions.

We also see interesting attacks on BSC, ranging from technical, such as the Gastoken spam, to cultural and political like Tanks of Tiananmen and Slave Finance aiming to provoke a response—preferably a heavy hand of censorship.

While the projects above are so far left uncensored, we have already seen another interesting case veiled in opacity.

What looked like a $31m scam from Meerkat, a “CeDeFi” app on BSC, turned into a returned funds and lead dev apologizing and explaining it was “just a test”.

I leave the readers to form their own opinion on what really happened.

Tribalism and verbal fights are nothing new in crypto but withdrawal blocks and political attacks are still unprecedented, and we may see it escalating further between various competing entities and communities.

I just hope it won't escalate too much and turn into a negative sum game for everyone involved.

Closing remarks

BSC is most likely here to stay at least for the mid term.

I don't find the ecosystem particularly interesting, since I have already been through food coin craze and DeFi summer.

If you are a serious crypto user and focus too much on it, you may miss more important developments happening elsewhere. However, for many users and developers it will remain a viable short term option, centralized but cheap and simple to use, with a lot of liquidity and retail users to target.

We should just accept it and put an emphasis on unbiased education of new users while waiting for better scaling solutions.

Action steps

- Explore the good, the bad, and the ugly for Binance Smart Chain

- Read Fiskantes previous piece “Crypto Advice from a Poker Player”

Author Bio

Fiskantes is a is partner at Zee Prime Capital, CIO at Sigil Fund and co-founder of Crypkit.