How to trade synthetic stocks

Dear Bankless Nation,

Let’s democratize access to financial assets and services for everyone.

It shouldn’t matter where you live or how much money you make, everyone should have equal access to opportunity. Someone living in South East Asia should have the same opportunities as someone in the United States—including the opportunity to get upside exposure in Apple stock!

That’s what’s interesting about Mirror Protocol. They’re building a synthetic asset protocol that supports major U.S. equities like AMZN, AAPL, and TSLA.

But here’s another reason I found it worth exploring: it’s built on the Terra chain…and yet you can also use it on Ethereum.

I have my thoughts on the hazards of dPoS chains like Terra as a base settlement layer, but I also see them playing some role in our multi-chain future. As I’ve argued before we’re already in a multi-chain world—after all…what else are crypto banks if not sidechains for Ethereum and Bitcoin?

So what role will chains like Terra play?

Maybe they’ll occupy some niche between a crypto bank and Ethereum on the decentralization spectrum?

I think the best way to answer this question is to see for ourselves.

Ultimately…if the protocol sink thesis holds true then the most credibly neutral protocols will win in the end. Centralized systems are forced to build on decentralized protocols. That means all these chains and experiments are much more synergistic than competitive. There is no fixed pie.

Let’s learn more.

- RSA

Tactic Tuesday

Guest Writer: Brian Curran, Head of Comms at Terra

How to trade synthetic stocks with Mirror Protocol

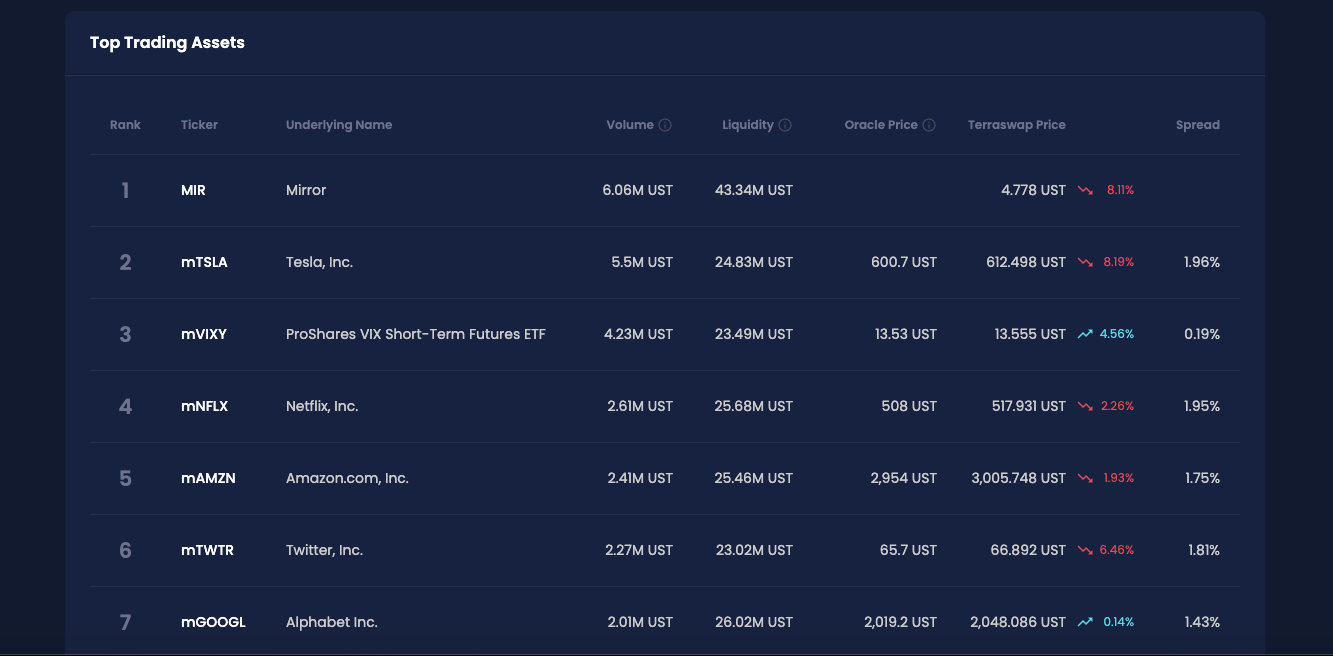

Mirror is a synthetic asset protocol, allowing crypto traders to gain exposure to the price movement of real-world assets, including equities, indexes, commodities, crypto assets, and more. Interestingly, Mirror’s synthetic assets are available on multiple blockchains including Terra, Ethereum, and Binance Smart Chain.

This tactic will show you how Mirror works, how you can trade synthetic stocks 24/7, and highlight some of the earning opportunities available with the protocol today.

- Goal: Trade synthetic stocks on Mirror

- Skill: Intermediate

- Effort: 10 - 20 mins

- ROI: Depends on your trading while farming opps yield over 100% APY

Introduction to Mirror Protocol

Mirror is a synthetic asset protocol powered by smart contracts on the Terra blockchain. It allows for on-chain exposure to the market price of real-world assets, including equities, indexes, commodities, crypto assets, and more. Called mAssets, these synthetic assets can be traded on Terra, Ethereum, Binance Chain, and soon several others.

The protocol launched in early December 2020 and has since accumulated more than $800 million in value locked and $300 million in total liquidity.

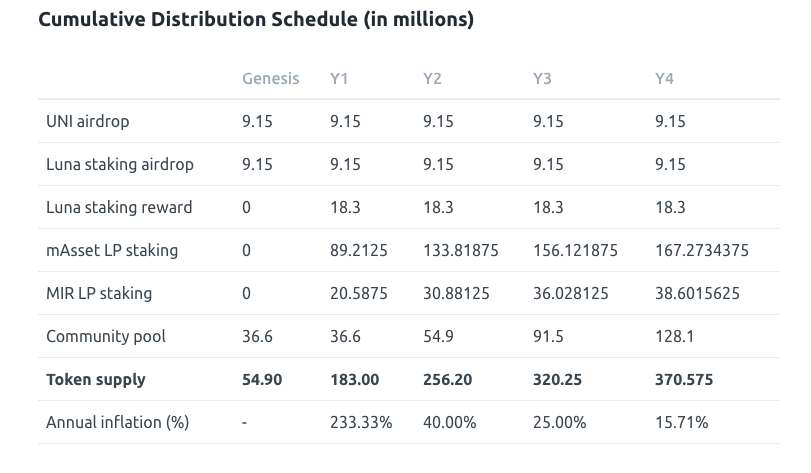

Mirror is community-governed using the protocol’s native MIR token, which had no pre-mine and emitted via a cemented supply schedule over the next 4 years. The distribution is heavily weighted towards the first year to encourage liquidity provision by users on trading pairs on TerraSwap and Uniswap.

At its core, Mirror grants global access to synthetic asset exposure. It is designed to provide an avenue for financially disenfranchised users around the world. These demographics may include users in countries with stringent capital controls, Internet censorship, or onerous capital gains fees on foreign equities.

How Does Mirror Work?

Conceptually, a cool way to think about Mirror is a reverse MakerDAO + Uniswap/Sushiswap for synthetic assets.

Mirror utilizes a siloed collateralized debt position (CDP) model where minters of mAssets lock-up UST (one of Terra’s native fiat-pegged stablecoins) to issue the mAssets at the corresponding collateral ratio for that particular asset—as determined by community governance.

Minting mAssets collateralized by UST means that minters are effectively taking a short position on the mAsset. However, in Mirror V2, users can mint short tokens (e.g., inverse) to take long positions on minted mAssets.

The siloed collateralization model of Mirror is critical for the capital efficiency of the platform. For example, the liquidation threshold for most mAssets on Mirror is 150% which is superior to models that co-mingle the debt of minters into a single pool.

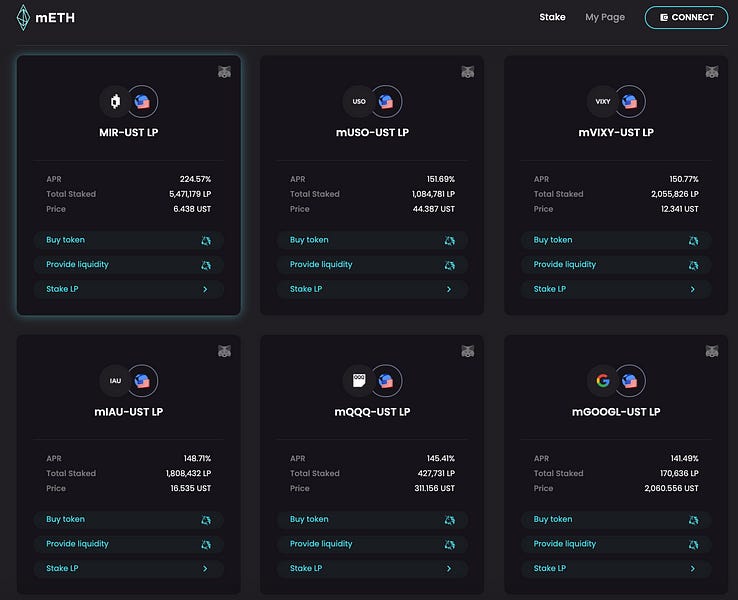

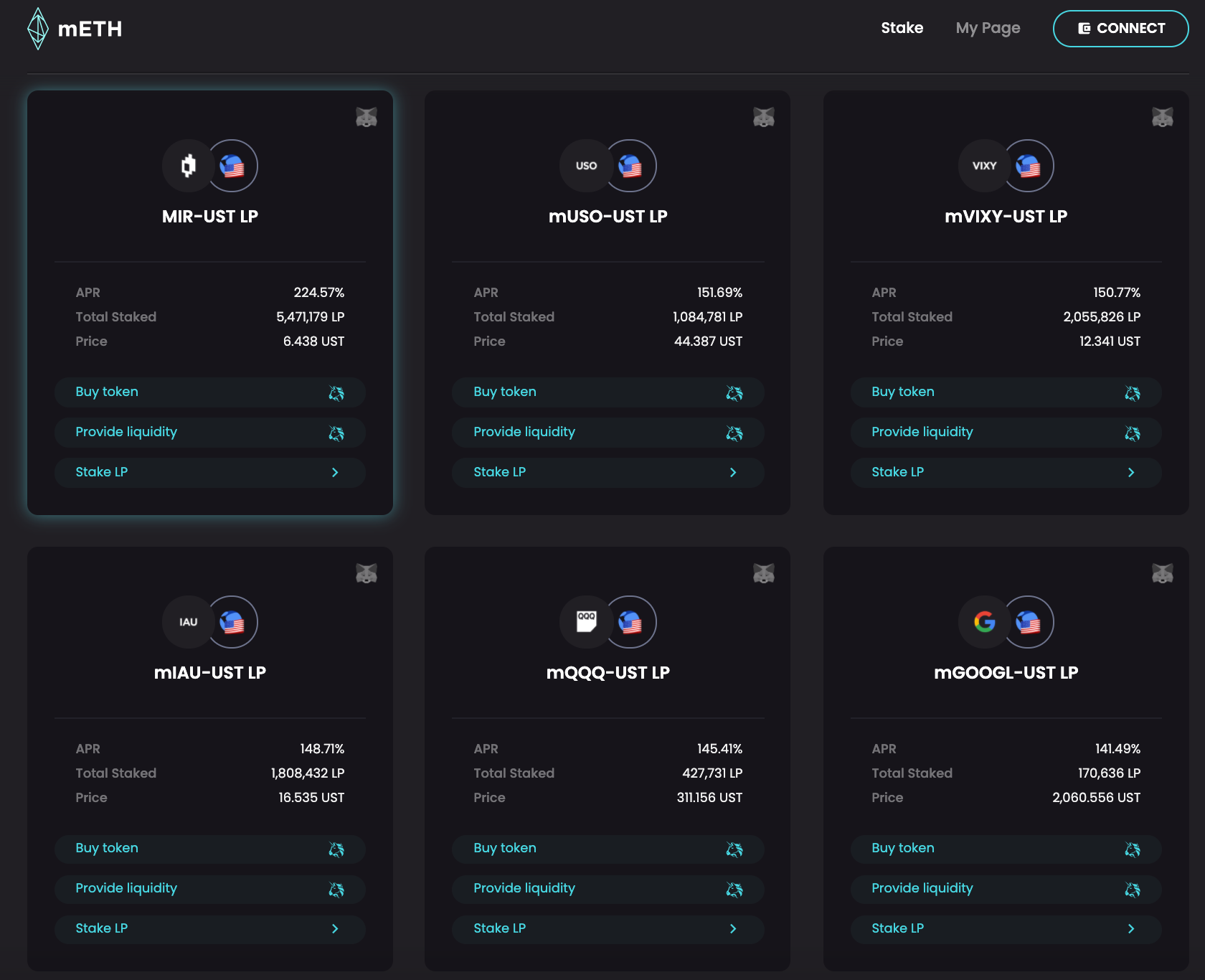

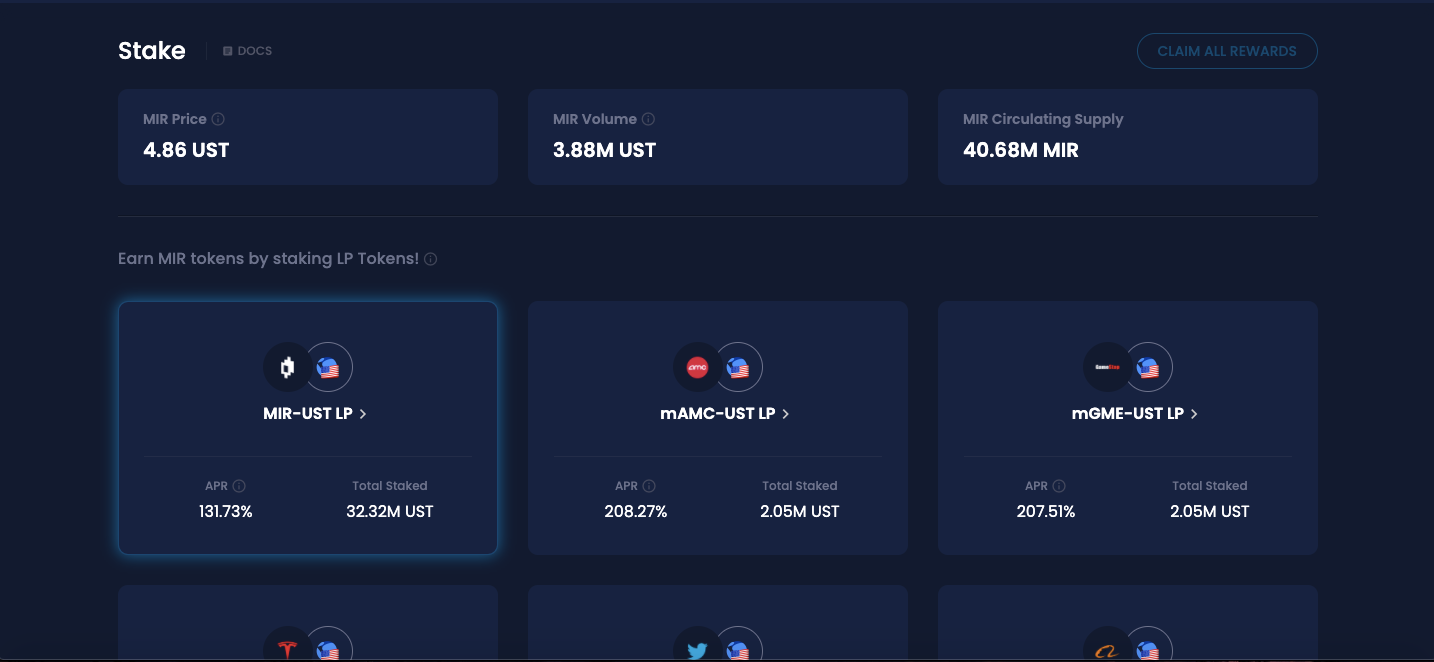

As mentioned, mAssets can be traded on Mirror-compatible networks like Terra, Ethereum, and Binance Chain. Liquidity providers of UST-mAsset pairs are rewarded handsomely in MIR tokens for liquidity provision on both Terra and Ethereum, with real-time APRs for staking LP tokens available for Ethereum here and Terra here.

Terra’s Shuttle Bridge to Ethereum enables the seamless porting of mAssets and UST between the two blockchains.

The community can make governance proposals on Mirror by staking MIR, which enables them to propose or vote on protocol parameter changes (e.g., collateral ratios), allocate funding from the community pool, and whitelist new assets.

So far several projects, such as Mirror Wallet (mobile) and Flipside Crypto have received funding from Mirror’s community treasury to build out a mobile trading interface and on-chain metrics dashboard, respectively.

⚠️ If you’d like to build something on Mirror, read up on our Community Funding Framework.

Who’s Behind It?

Mirror was launched by Terraform Labs, the company behind the Terra Network and Chai payments app. Mirror launched on December 3rd, 2020. You can find the cumulative distribution schedule for the MIR token here.

Yield Farming Opportunities

You can find yield farming for mAssets in the links below:

- Terra LP Tokens (contains UST/mAsset TerraSwap pairs too)

- Ethereum LP Tokens (contains UST/mAsset Uniswap pairs too)

- Binance LP Tokens (contains UST/mAsset PancakeSwap pairs too)

The distribution of the MIR token (including liquidity provision allocations) is in the screenshot below.

How to trade synthetic stocks on Ethereum

While Mirror is natively built on the Terra blockchain, it’s easy for any Ethereum user to get exposure to any mAsset supported by the protocol.

All you need to do is head over to Uniswap, type the desired mAsset/UST pair (let’s say mAMZN) and you’re ready to go—just execute any normal Uniswap transaction!

As you can see, there’s plenty of liquidity for you to trade with on Ethereum due to the liquidity mining program for LPs :)

How to trade synthetic stocks on Terra

For those interested in exploring other chains (and savings on gas fees!), you can trade synthetic stocks on Terra Network.

If you’re already setup on Terra, all you need to do is simply head to the Terra Mirror Web App, scroll down, and type in the corresponding mAsset (e.g., mGOOGL).

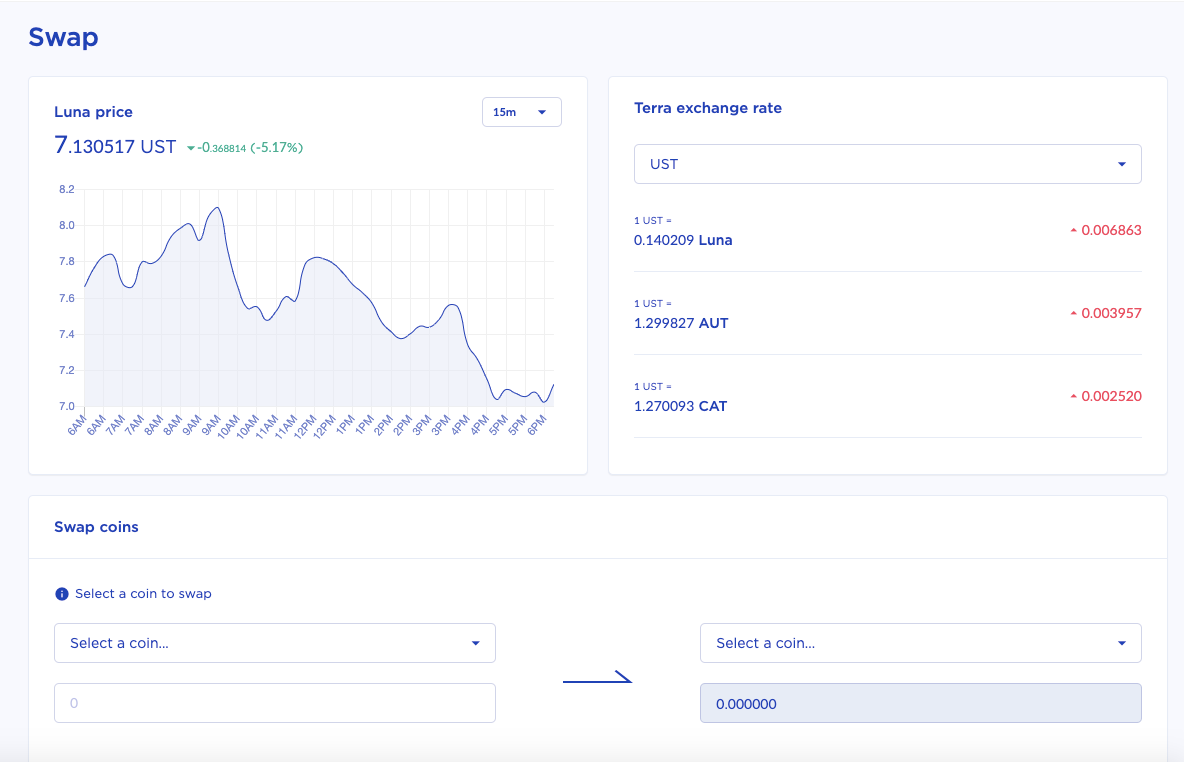

For those new Terra users, you’ll need to get setup on Terra Station, Terra’s desktop and mobile app. In order to get UST, you’ll need to purchase LUNA—Terra’s native token—on major exchanges and deposit it into your Terra Station Wallet.

Once you do so, you can easily swap your LUNA for UST. For more information on getting started with Terra Station, check out this guide here.

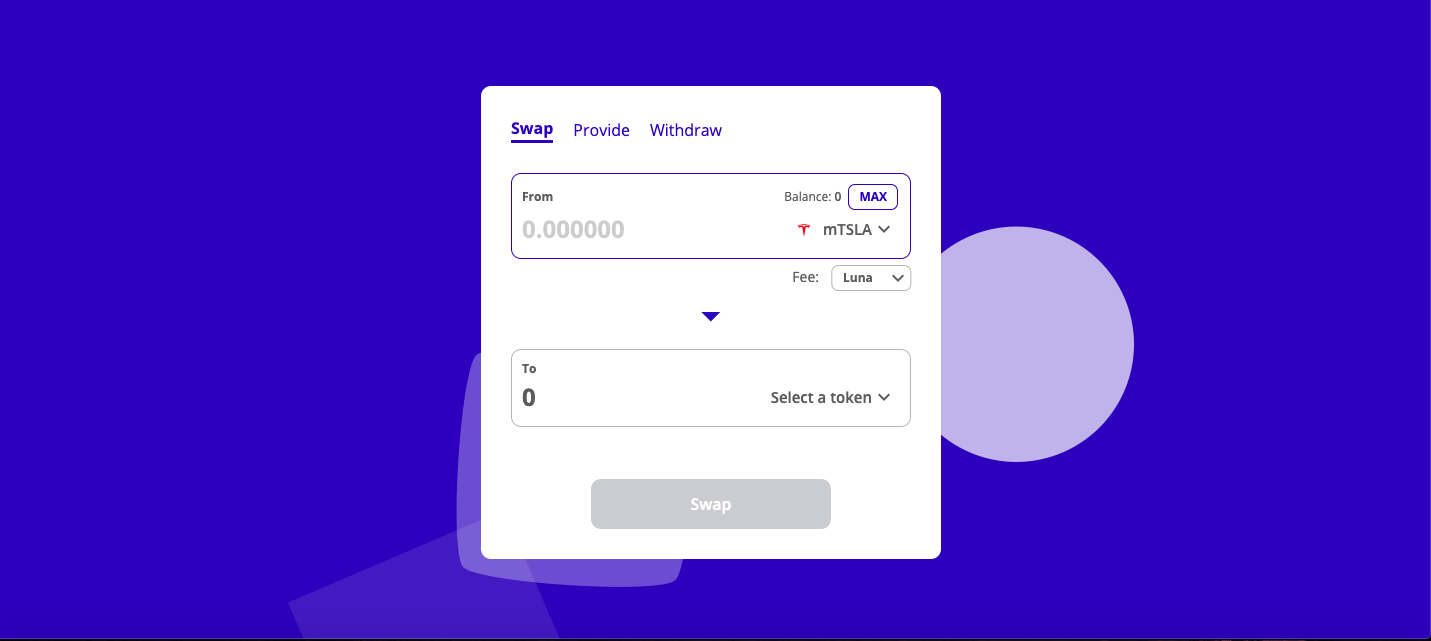

With the wallet, you’ll be able to swap UST for an mAsset directly from the swap interface for the desktop or mobile app.

Finally, you can swap UST for mAssets on the TerraSwap web app with a few clicks directly from your Terra Station wallet.

How to yield farm by providing liquidity for synthetic stocks

To provide liquidity on Mirror, you can follow three paths:

- Terra

- Ethereum

- Binance Chain (not included in this tactic!)

Ethereum

If you’re interested in providing synthetic asset liquidity on Ethereum, you can participate by clicking on the “Provide Liquidity” option for each UST/mAsset pair, which will take you to the respective Uniswap LP page.

⚡ Editor’s Note: If you’re looking for the easiest way to get into the pool, try Zapper or Zerion!

Both wallet management apps support all of Mirror’s synthetic asset pools on Ethereum, allowing you to use ETH and other major assets to easily jump into the pool while minimizing the hassle of getting equal weights of both assets in your wallet!

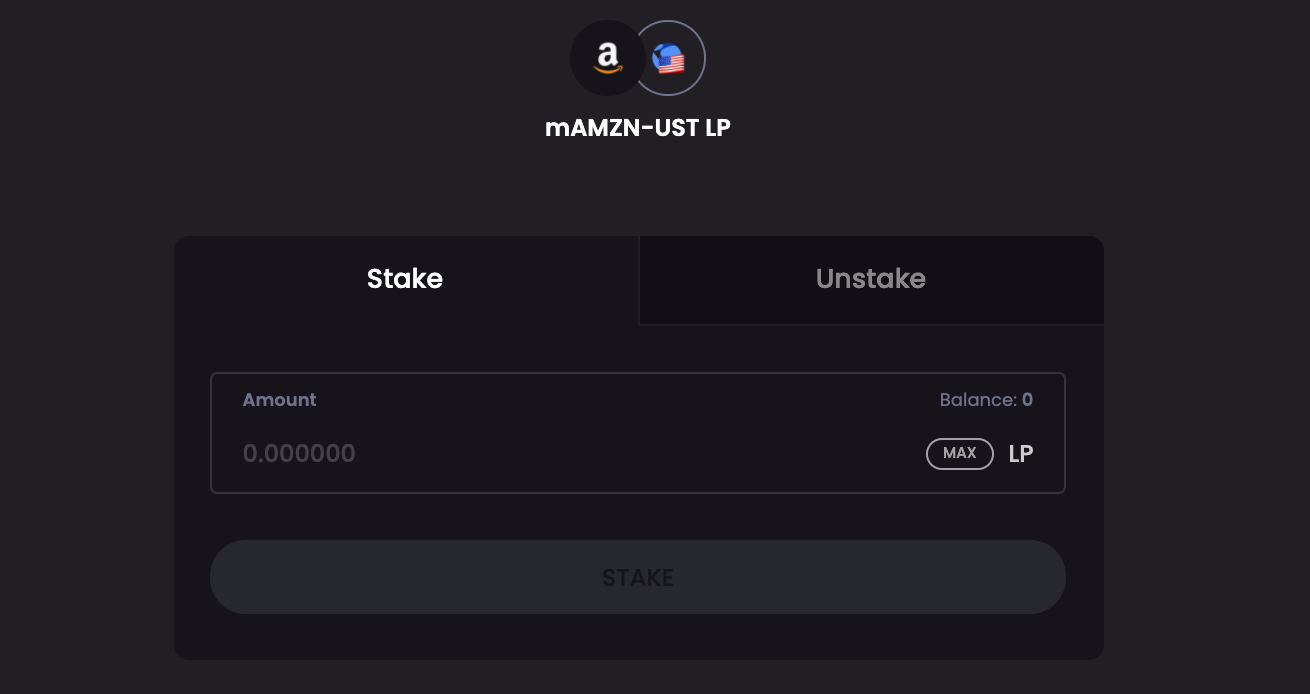

Once you have your LP tokens, select the “Stake LP” option on the same tab and stake your Uniswap LP tokens.

Just confirm the transactions (approvals and stake), and after a few minutes, you’re earning attractive returns on real-world assets! Rewards accrue in real time and are claimable at any point!

Terra

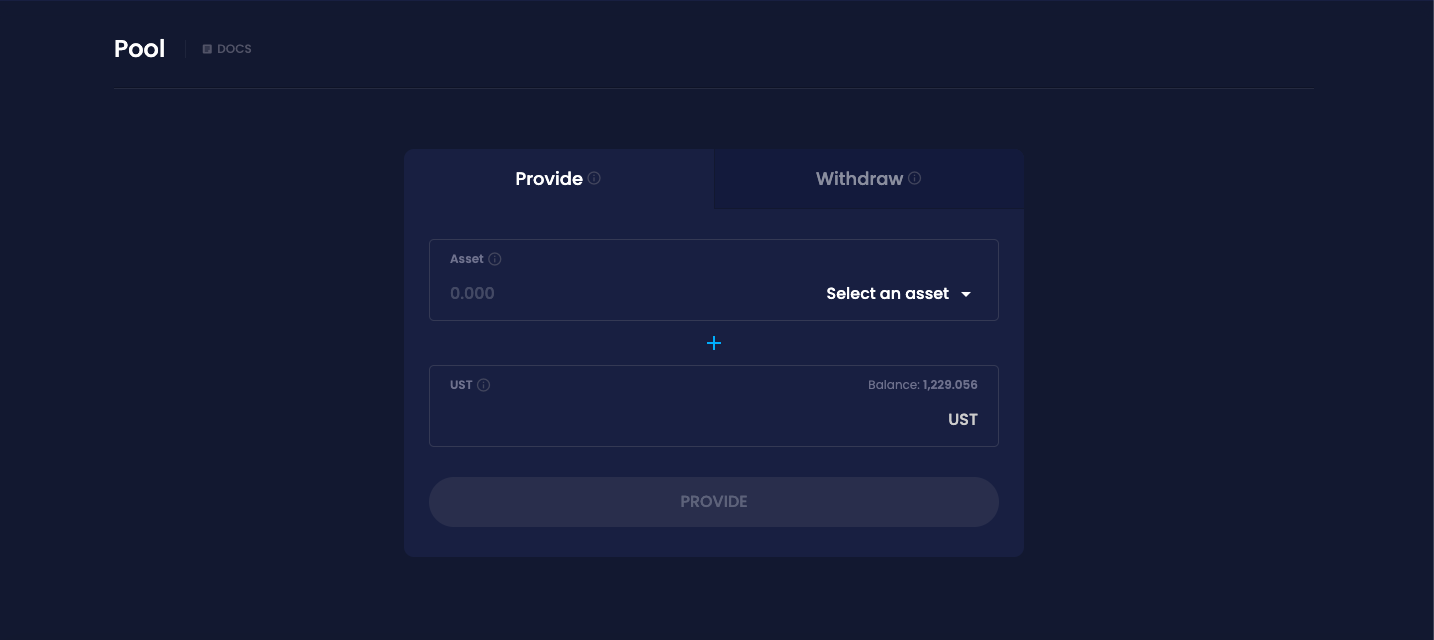

On Terra, go to the “Pool” page and deposit the corresponding amount of UST/mAssets to earn LP tokens.

Next, stake your LP tokens by simply selecting the LP token pair on the “Stake” page. Now, you’re earning attractive APRs on real-world assets!

Conclusion

Mirror Protocol aims to allow anyone, anywhere, at anytime, to get exposure to the price of any major asset in the world. This is another way to democratize access to financial assets for anyone by using public blockchains.

The Fair Launch of the protocol’s native governance token extends this thesis—the protocol is owned and controlled by the token holders. And as it matures, Mirror hopes to support the long tail of real world assets so that anyone, anywhere can have equal financial opportunity.

Action steps

- Get exposure to synthetic stocks with Mirror from anywhere in the world

- Provide liquidity to your favorite trading pair and make bank in MIR!

Author Bio

Brian Curran works as the Head of Communications at Terra, a cross-chain blockchain network focused on building stablecoins and other financial products in crypto.