How to make bank with Balancer liquidity mining

Level up your crypto finance game five times a week. Subscribe to the Bankless Program below.

Dear Bankless Nation,

Balancer is one of the promising liquidity protocols on Ethereum.

Even though Balancer launched liquidity mining prior to Compound, and even though it was a massive success at the time, it’s largely been overshadowed by the craze that’s consumed the DeFi ecosystem for months.

During this time, the Balancer community has been quietly fine-tuning the mining mechanism while the protocol has grown to over $750M in value locked and boasts $320M in weekly volume.

So we want to show you how to leverage its capabilities.

But Balancer liquidity mining is only the tip of the iceberg. This new AMM can support all sorts of wild and innovative liquidity products. Stuff like smart pools, liquidity bootstrapping pools (LBPs), and more.

All of this is coming to Balancer in the coming months—so keep an eye out.

Today Lucas dives into Balancer liquidity mining showing you the best returns and how to earn them. Like his last tactic, this one shows yields by the three types of crypto money in your Bankless portfolio—ETH, BTC, and USD.

Let’s see which pools rank the highest!

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

How to buy the DeFi Pulse Index (DPI) TokenSet. This is a great way to gain exposure to the upside of DeFi without all the time and effort of buying, selling, and reallocating tokens into a portfolio. With high gas prices, this also saves on lots of expensive transaction when it comes to rebalancing your portfolio!

👉Check out Bankless YouTube for & tactics by DeFiDad!

TACTICS TUESDAY

Tactic #55: How to earn 100% APY with Balancer

Bankless Writer: Lucas Campbell, Analyst for Bankless & Growth at DeFi Rate

With Uniswap currently lacking a yield farming mechanism for liquidity providers, Balancer is a great alternative for earning a high yield via BAL subsidies.

This tactic will show you how you can provide liquidity to Balancer and highlights a few of the highest returning Balancer pools on the market today.

- Goal: Provide liquidity to Balancer & start earning BAL tokens

- Skill: Intermediate

- Effort: 10 - 30 mins

- ROI: upwards of 155% APY on certain pools

Background on Balancer

Balancer is an automated portfolio manager and liquidity protocol with unique features to rival popular Automated Market Makers (AMMs). Unlike Uniswap, Balancer isn’t restricted by a single pair (like ETH-DAI) but instead can support up to 8 different assets within any given pool. (See tactic #33 for more)

What results is a non-custodial index fund that automatically rebalances your assets based on the predefined parameters. And unlike in traditional finance where investors pay fees to gain exposure to an index fund, Balancer pays you.

Those who become liquidity providers not only accrue trading fees from token swaps but also earn a sizable subsidy in BAL tokens as 145,000 BAL are distributed to liquidity providers every week (~7.5M per year).

Four Factors any Balancer Farmer Should Know

Balancer rewards are constantly being tuned via an on-going decentralized governance process. Since inception, the core team and the community have implemented a handful of different “factors” to help effectively allocate BAL rewards based on the value the pools provide to the protocol.

With that, here are a few of the factors that you should keep in mind when you’re hunting for the best yield on Balancer:

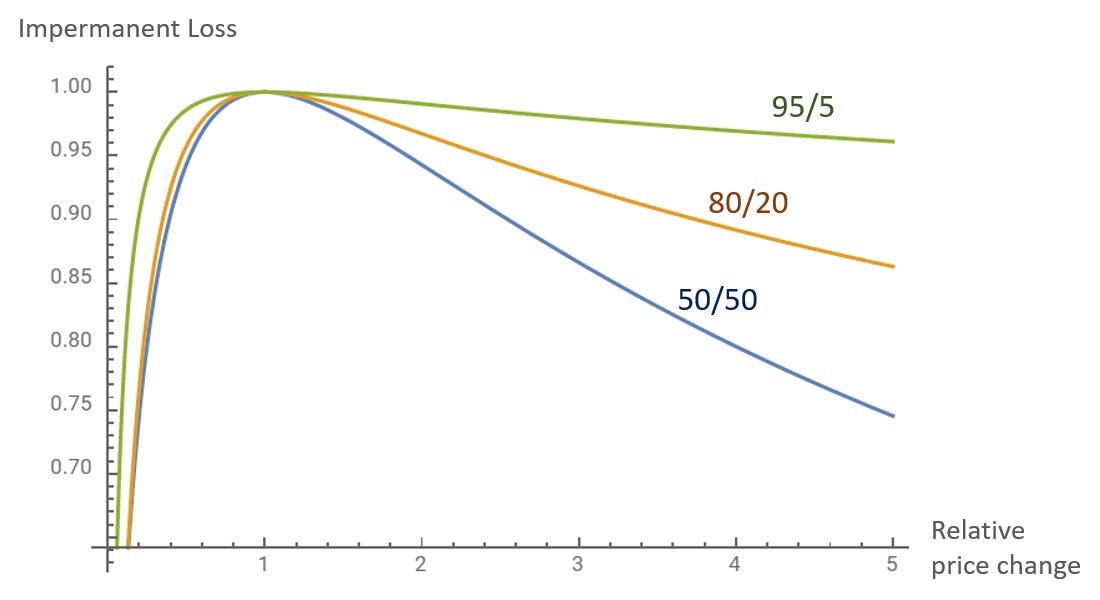

- ratioFactor = Since Balancer LPs can provide liquidity to pools with different weights, like an 80/20 or 95/5 (rather than strictly 50/50), combined with the fact that these types of pools tend to support lower trading volumes, the ratioFactor reduces BAL rewards for highly imbalanced pools. The larger the pool skews towards one asset, the higher the ratioFactor, and the lower the BAL rewards.

- feeFactor = The feeFactor allocates rewards based on the pool’s swap fee. The lower the pool’s swap fees, the higher the BAL rewards (and vice versa). So if you’re looking at two identical pools, make sure to pick the one with the lower fees!

- wrapFactor = Since pools with pegged token pairs don’t contribute as much to trading volumes, these liquidity pools have been given a wrapFactor. Hard-pegged assets like sETH + WETH have a wrapFactor of 0.1, resulting in 10x lower rewards vs normal pairs whereas soft pegged asset pools like DAI & USDC have a wrapFactor of 0.7, making the reward penalty significantly less harsh. With that said, having pegged token pairs minimizes your chance to incur impermanent loss!

- balFactor = The balFactor was the most recent factor to be implemented into the liquidity protocol. In order to help bootstrap and incentivize liquidity for BAL, all Balancer pools featuring the native asset receive a 1.5x multiplier on rewards. For those that are bullish on BAL, the balFactor is indispensable for stacking BAL week-in & week-out.

⚠️Maximize rewards by selecting pools with equal asset ratios, low fees, and a BAL pair

Note on Impermanent Loss

Remember—impermanent loss is a liquidity providers (LPs) worst enemy.

What’s nice about Balancer is that users can choose to mitigate impermanent loss by providing liquidity to higher weighted pairs at the cost of lower BAL rewards (via the ratioFactor).

Here’s a quick synopsis on how pool weights affect impermanent loss with Balancer:

⚠️For those looking for more reading on impermanent loss & why it exists with AMMs, Bancor has a nice write up here! We’ve also talked about it in Tactic #15.

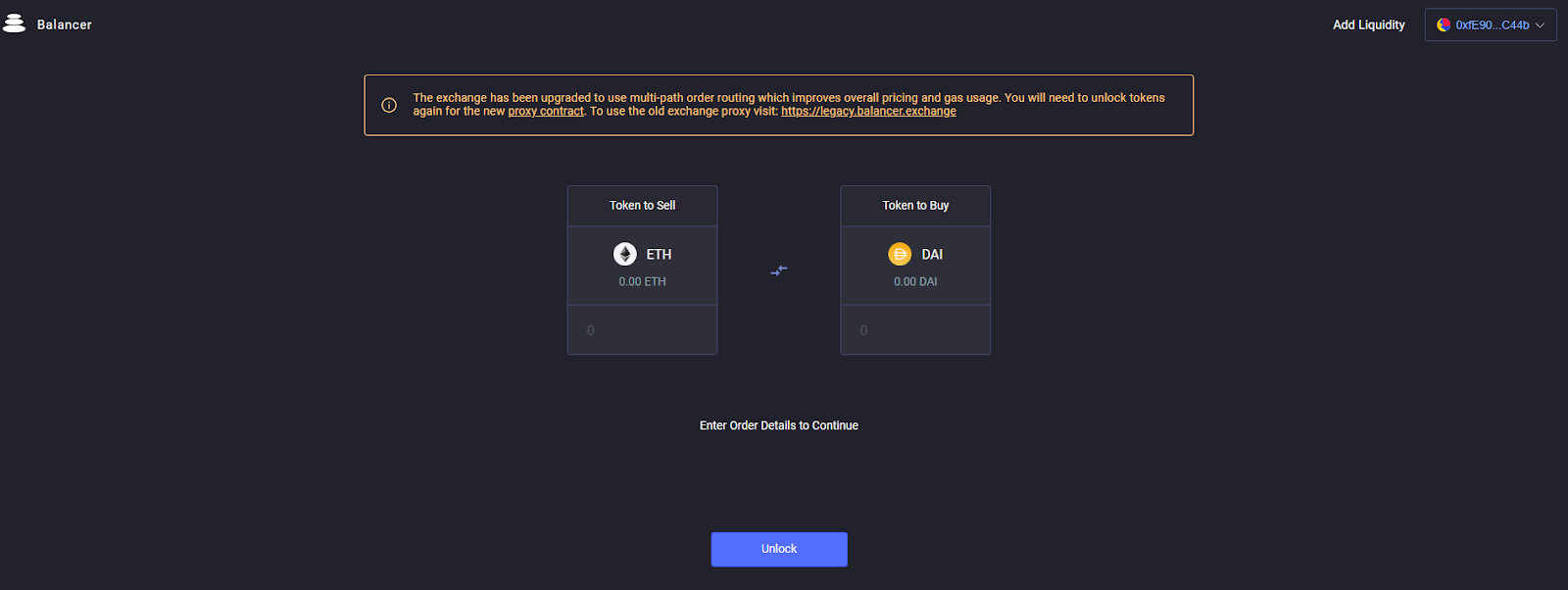

Best Pools on Balancer

Naturally, with the balFactor adding a substantial multiplier to rewards, the top 3 highest yielding pools are all BAL-based.

However, all three pools offer a different paired asset that you can ascribe to based on your outlook on each asset’s future performance. When thinking about which pool to provide liquidity to, you may want to consider which two assets you're equally as bullish on in order to minimize the potential for impermanent loss.

If one asset drastically outperforms the other, especially with 50/50 pools, the impermanent loss can put a serious dent on your overall returns. That said, current BAL subsidies should eat away most of the losses, ideally leaving you with a positive return in the long run — but it’s not guaranteed.

Let’s dive into our rankings!

1) ETH Pools

There’s a handful of BAL/WETH pools that you can provide liquidity to depending on your outlook. How to decide?

If you believe BAL will outperform ETH, you’ll want to lean towards a BAL-heavier pool. On the other hand, if you think ETH will outperform BAL, you’ll want to lean towards an ETH-heavier pool.

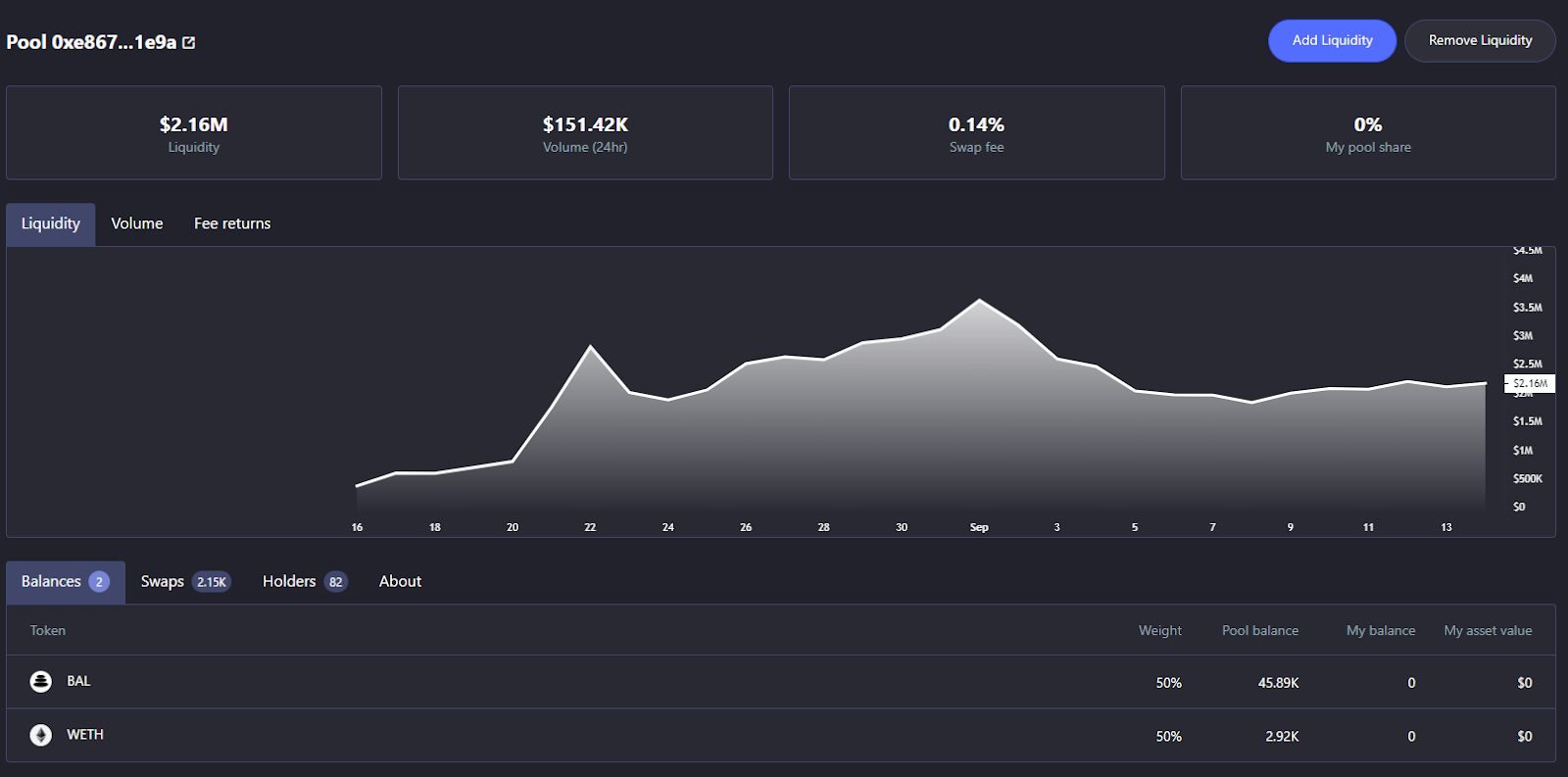

🥇First Place—50%/50% BAL + WETH

- Estimated Return on Liquidity (ROL): 117%

- Outlook: Equally bullish on BAL & ETH

🥈Second Place—40%/60% BAL + WETH

- Estimated ROL: 112%

- Outlook: More bullish on ETH

🥉Third Place—80%/20% BAL + WETH

- Estimated ROL: 75%

- Outlook: More bullish on BAL

2) BTC Pools

Balancer also offers a way to earn substantial returns by providing BAL & BTC liquidity. Before jumping in, make sure you understand the centralized and trusted nature of Wrapped Bitcoin (WBTC) as the asset pair.

As with ETH, your pool choice depends on your outlook on BTC relative to BAL.

🥇First Place—50%/50% BAL + WBTC

- Estimated ROL: 112%

- Outlook: Equally bullish on BAL & BTC

3) USD Pools

The last set of BAL pools on the list include BAL + crypto dollar pairs. The USD pools serve as a nice way to earn an income for those that are neutral on BAL, ETH, or BTC in the short term and are looking for ways to increase their holdings over the long run.

🥇First Place—50%/50% BAL + USDC

- Estimated ROL: 117%

- Outlook: Neutral on BAL

🥈Second Place—50%/50% BAL + DAI

- Estimated ROL: 110%

- Outlook: Neutral on BAL

🥉Third Place—80%/20% BAL + USDC

- Estimated ROL: 75%

- Outlook: Bullish on BAL

Honorable Mentions

Here are some other attractive pools that I also think are worth considering:

🏅50%/50% USDC + yUSD-Oct20

- Estimated ROL: 185% APY in UMA + 56.29% in BAL

- Outlook: Bullish on UMA + BAL

This pool does not feature BAL and therefore takes a hit in terms of native protocol rewards. However, the pool is subsidized by UMA as it features yUSD-Oct20, a synthetic yield dollar built on the derivatives protocol. When factoring in both subsidies, the combined return on liquidity goes as high as 241% APY, making it the highest yielding liquidity pool on Balancer to date.

If you’re looking to leverage this pool, be aware that yUSD expires on October 1st and you’ll have to sell or redeem your yUSD before the expiration date.

🏅40%/30%/30% WBTC + BAL + WETH

- Estimated ROL: 115% APY

- Outlook: Bullish on BTC, ETH, BAL

This pool offers an interesting exposure profile for those that may be uneasy about future performance. Prospective LPs get relatively equal exposure to BTC & ETH while also leveraging the bonus rewards by having BAL in the pool.

⚠️For more Balancer reward calculations and returns on other asset pools, you can check out Prediction Exchange to find the best yields!

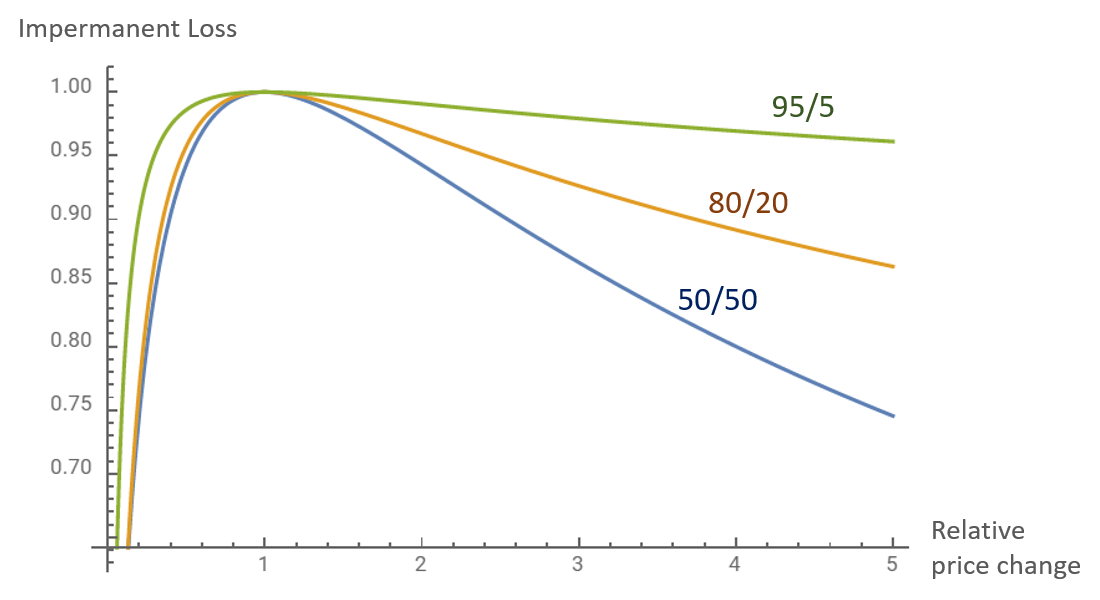

Swapping Tokens on Balancer

For those interested in trading on Balancer, you can head on over to balancer.exchange to trade a long tail of Ethereum-based assets.

If you’ve ever traded on Uniswap before, this process should feel pretty similar. There’s not much to it!

How to Provide Liquidity to Balancer

Hint: You can use Zapper.fi to skip a lot of the steps listed below & minimize the hassle of getting all the required assets in your wallet. Zapper lets you provide liquidity to any Balancer pool in a few clicks with ETH, USDC, DAI, and others.⚡

If you’re looking to start providing liquidity to any of the Balancer pools mentioned above or any other pools supported by the protocol, here’s what you need to do:

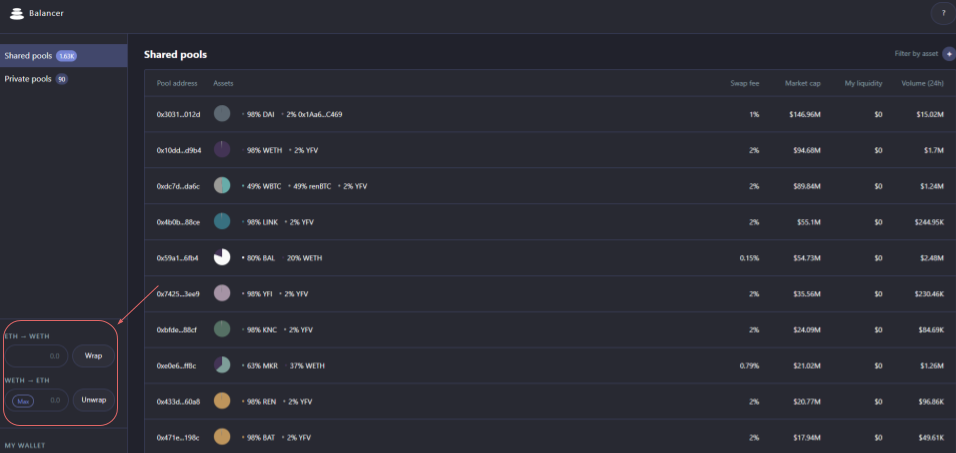

- Head on over to pools.balancer.exchange. You’ll be able to see a long list of available pools. Any liquidity mining pools mentioned above are linked and should take you directly to the pool’s overview.

- Connect your Ethereum Wallet. Balancer currently supports MetaMask, WalletConnect, Portis, Coinbase Wallet, and Fortmatic.

Note: You’ll need to get Wrapped ETH for any of the ETH-denominated pools. Fortunately, Balancer allows your to wrap your ETH directly through the liquidity pool dashboard!

- Select your desired Pool. For this example, we’ll select the 50% BAL + 50% WETH pool. Here you can see total liquidity, volume, trading fees, and your percentage of the pool if you’re already an LP.

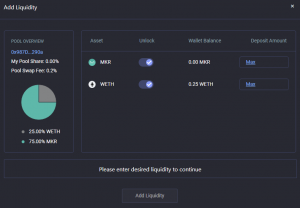

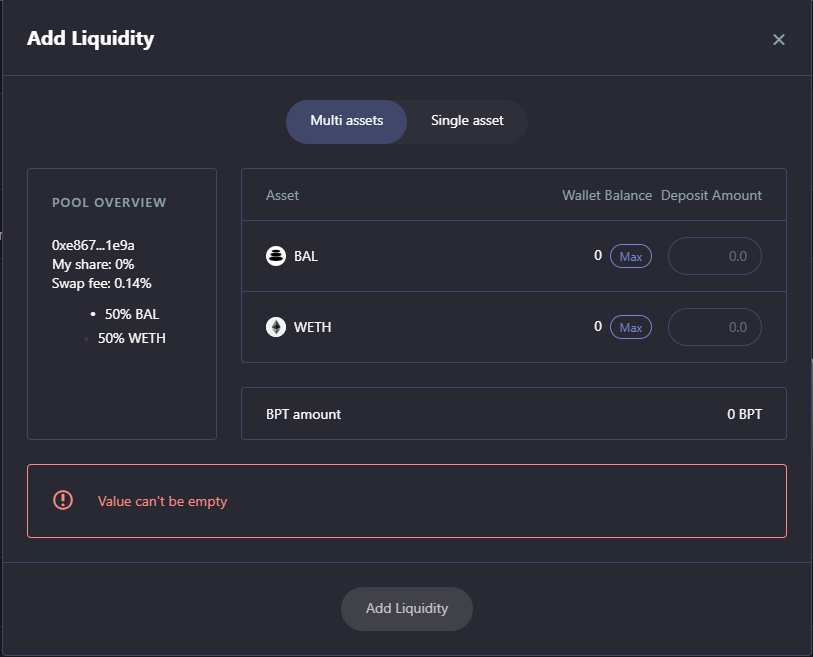

- Click on “Add Liquidity” in the top right. From there you can add the pool’s assets either via multi-asset deposits or single asset deposits. For multi-asset, you have to deposit the proper weight of each asset based on the pool’s parameters. For single asset deposits, you can deposit one of the assets in the pool but in return, you’ll receive a lower amount of BPT tokens.

- Once you’ve entered the appropriate amount, just click on “Add liquidity” at the bottom and confirm those transactions via your Ethereum wallet. If it’s your first time using the token on Balancer, you’ll have to approve spending first.

Once the transactions are verified on Ethereum, you’re all done!

You’re now providing liquidity to the Balancer pool and earning BAL rewards along with trading fees. Balancer rewards are automatically distributed to your wallet 1x per week at around 23:00 UTC on Tuesday (later today!) — no need to claim tokens! 🤑

You can track your earnings with some Bankless favorites: Zerion and Zapper.

Both asset management platforms offer an intuitive interface for easily tracking all of your farms. The entire Bankless team uses both of these trackers virtually every day.

Author Bio

Lucas Campbell is an Analyst for Bankless and leads growth at DeFi Rate. He also engages in token economic & DAO advisory with 🔥_🔥

Action steps:

Provide liquidity to the Balancer pool of your choice

Complete the weekly assignment: How to buy the DeFi Pulse Index TokenSet

Read past Bankless content on Balancer

We just released episode 14 of SOTN—FUNding

📺 Watch State of the Nation #14: — FUNding with Kevin Owocki

Gitcoin Grants Round 7, Andre’s new protocol StableCredit USD, CeDeFi = Fake DeFi

We’re now live streaming State of the Nation—join us at 2pm EST every Tuesday!

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.